Key Insights

The Asia Pacific Venture Capital market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 10.8%. This growth is propelled by a dynamic startup ecosystem, robust government initiatives supporting innovation, and increasing digital adoption across the region. Key drivers include a surge in tech-savvy entrepreneurs, favorable policies in leading markets like India and China, and rising disposable incomes fueling demand for new products and services. Despite potential regulatory hurdles and economic uncertainties, the inherent economic dynamism of the Asia Pacific ensures a positive long-term outlook for venture capital.

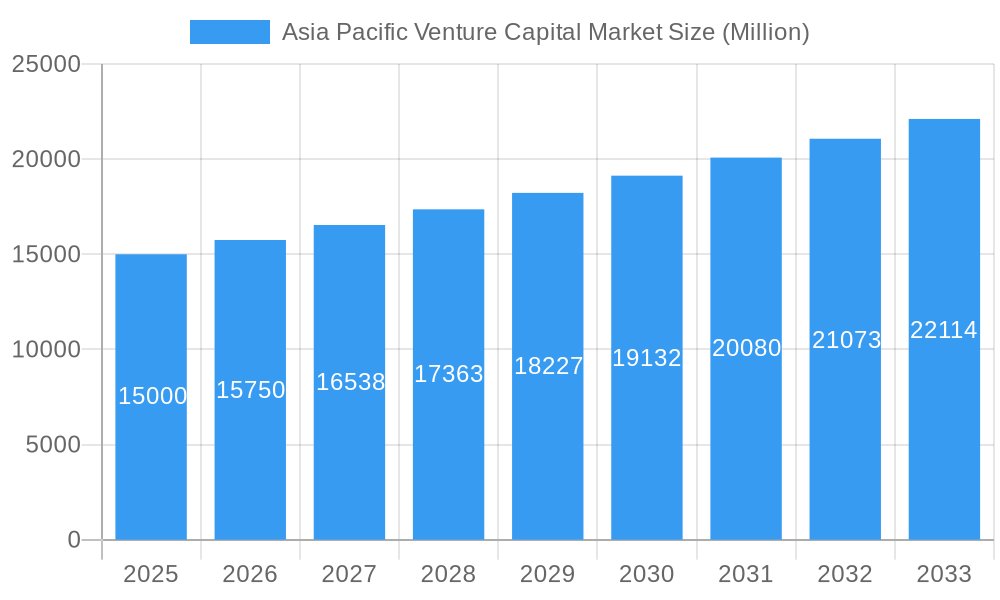

Asia Pacific Venture Capital Market Market Size (In Billion)

The market is expected to reach approximately 352.4 billion by 2024. While detailed segmentation requires further analysis, key sectors likely include fintech, e-commerce, health tech, and renewable energy. The presence of leading venture capital firms such as East Ventures, Sequoia Capital, and SG Innovate highlights the substantial investment potential. This market size estimation for 2024 is based on current growth trajectories and strong investor participation. Continued technological advancements and favorable economic conditions are expected to sustain this growth trend through 2033.

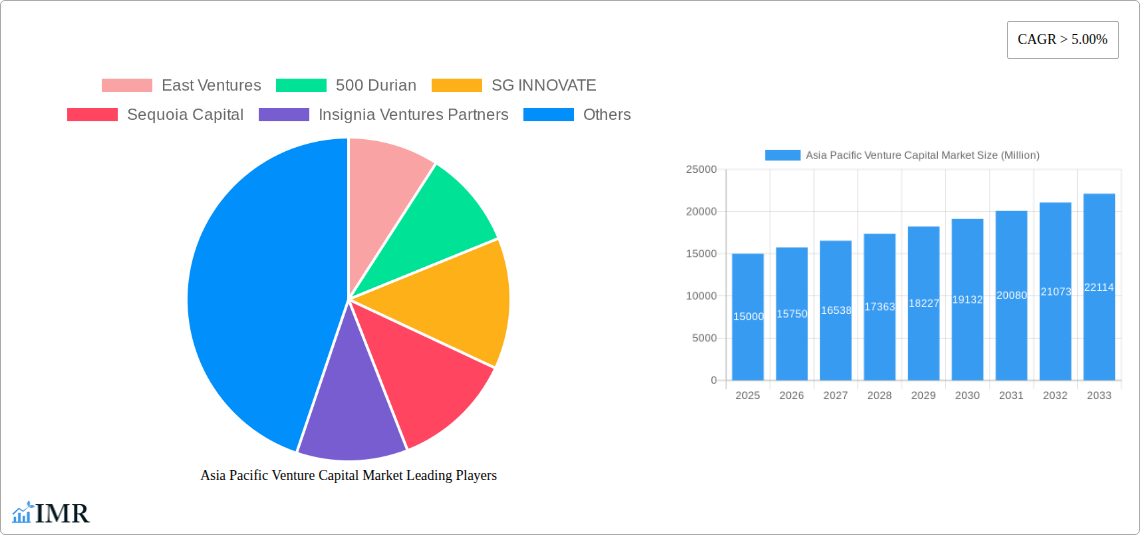

Asia Pacific Venture Capital Market Company Market Share

Asia Pacific Venture Capital Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Venture Capital market, covering market dynamics, growth trends, dominant players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for venture capitalists, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes the parent market of Private Equity and Venture Capital and the child market of Venture Capital. Market values are presented in millions.

Asia Pacific Venture Capital Market Dynamics & Structure

This section analyzes the intricate structure and dynamics of the Asia Pacific venture capital market, encompassing market concentration, technological innovation, regulatory landscapes, competitive dynamics, end-user demographics, and mergers and acquisitions (M&A) trends. The market's high fragmentation is revealed, with numerous firms competing for investments, leading to a dynamic, yet potentially volatile, landscape.

- Market Concentration: The Asia Pacific venture capital market exhibits moderate concentration, with a few dominant players and a large number of smaller firms. The top 10 firms account for approximately xx% of the market share (2024).

- Technological Innovation: Rapid technological advancements, particularly in fintech, AI, and e-commerce, are key drivers, attracting significant venture capital investment. However, challenges remain in navigating differing regulatory environments across the region.

- Regulatory Frameworks: Varying regulatory frameworks across different countries within the Asia Pacific region create both opportunities and challenges for venture capital investments. Some countries have implemented supportive regulations to encourage investment, while others have stricter norms. Navigating these differences is crucial for success.

- Competitive Product Substitutes: While venture capital is unique in its early-stage investment focus, alternative financing methods like angel investors and crowdfunding pose some degree of competitive pressure. This competitive landscape is constantly evolving.

- End-User Demographics: The increasing number of tech-savvy entrepreneurs and the expanding startup ecosystem within the Asia Pacific region is a significant driver of venture capital investment. The growing middle class in many Asian countries further fuels demand.

- M&A Trends: The Asia Pacific region has witnessed a significant increase in M&A activity in the venture capital space in recent years, reflecting industry consolidation and the pursuit of strategic advantages. The total M&A deal volume in 2024 was approximately xx deals.

Asia Pacific Venture Capital Market Growth Trends & Insights

This section presents a comprehensive analysis of the Asia Pacific venture capital market's growth trajectory, utilizing both quantitative and qualitative data to provide an in-depth understanding of its evolution. This includes an analysis of market size, adoption rates, technological disruptions, and shifting consumer preferences.

The Asia Pacific venture capital market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing entrepreneurial activity, government initiatives promoting innovation, and the availability of substantial funding from both domestic and international investors. The market size grew from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This strong growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of xx%. Market penetration is expected to reach xx% by 2033, driven by continuous technological advancements and increased demand for venture capital funding in various sectors.

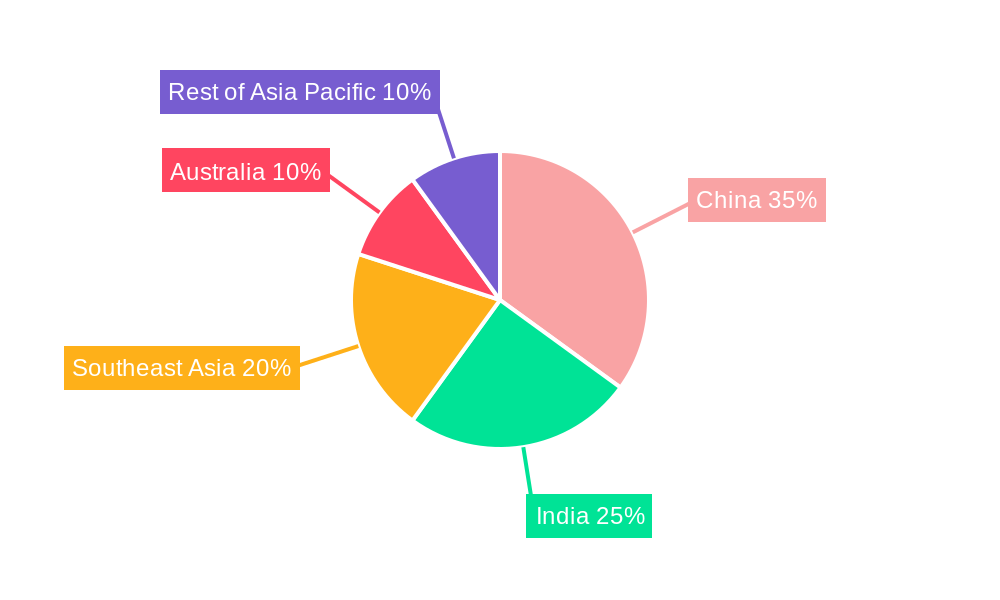

Dominant Regions, Countries, or Segments in Asia Pacific Venture Capital Market

This section identifies the leading regions, countries, and segments within the Asia Pacific venture capital market. The report examines the factors that have contributed to the dominance of these specific areas, considering economic policies, infrastructure, and market size. While India and China have historically been dominant, other nations are exhibiting increased potential.

China: China remains a dominant force, attracting significant investment due to its large market size, expanding technological capabilities, and supportive government policies. This is reflected in a xx% market share in 2024. Key drivers include the availability of skilled talent and the strong support of the government for technological innovation.

India: India follows closely, experiencing substantial growth in recent years due to a burgeoning startup ecosystem, a large pool of engineering talent, and a growing digital economy. India holds a xx% market share in 2024.

Southeast Asia: Southeast Asia demonstrates remarkable growth potential. Countries such as Singapore, Indonesia, and Vietnam are attracting significant venture capital investment, fueled by strong economic growth and a rapidly expanding digital landscape. Factors like supportive government policies and a young, tech-savvy population are contributing to the market's rise.

Asia Pacific Venture Capital Market Product Landscape

The Asia Pacific venture capital market offers a diverse range of products and services tailored to various investment stages and sector-specific needs. These include seed funding, Series A, B, and beyond, and the products are primarily categorized by investment stage and industry focus. A strong focus on technological advancements in fund management, due diligence, and portfolio monitoring is a defining feature.

Key Drivers, Barriers & Challenges in Asia Pacific Venture Capital Market

Key Drivers:

- Technological Advancements: Rapid innovation in areas like AI, Fintech, and e-commerce is fueling demand for venture capital.

- Government Support: Several governments in the region actively promote innovation through funding and policy initiatives.

- Growing Startup Ecosystem: The number of startups in the region is increasing dramatically, creating numerous investment opportunities.

Key Barriers & Challenges:

- Regulatory Uncertainty: Inconsistent regulations across different jurisdictions pose a challenge to investors.

- Geopolitical Risks: Regional geopolitical instability can impact investor confidence.

- Talent Acquisition: Competition for skilled talent can be fierce, increasing operational costs for startups.

Emerging Opportunities in Asia Pacific Venture Capital Market

The Asia Pacific venture capital market presents a range of exciting emerging opportunities. Untapped markets in smaller economies offer substantial growth potential. The increasing adoption of technology in various sectors creates opportunities for investment in innovative solutions. Evolving consumer preferences are reshaping the market, presenting opportunities for investment in businesses catering to these changes. Focus on sustainable and impact investing also presents a lucrative opportunity.

Growth Accelerators in the Asia Pacific Venture Capital Market Industry

Long-term growth in the Asia Pacific venture capital market will be propelled by several key factors. Technological breakthroughs in various sectors will continue to attract investment. Strategic partnerships between venture capitalists, corporations, and governments will facilitate investment and market expansion. The expansion of the startup ecosystem into underserved regions of the Asia Pacific will contribute to the overall growth.

Key Players Shaping the Asia Pacific Venture Capital Market Market

Notable Milestones in Asia Pacific Venture Capital Market Sector

- December 2021: Razorpay Software Private Limited (India) raised USD 375 million, valued at USD 7.5 billion.

- March 2022: XPeng (China) led a USD 200 million investment in Rockets Capital, focusing on frontier technology and EVs.

In-Depth Asia Pacific Venture Capital Market Market Outlook

The Asia Pacific venture capital market is poised for continued growth, driven by technological advancements, supportive government policies, and a thriving startup ecosystem. Strategic investments in emerging technologies and untapped markets will offer substantial returns. The market's future potential is significant, and proactive investors are well-positioned to benefit from the region's dynamic growth trajectory.

Asia Pacific Venture Capital Market Segmentation

-

1. Industry/ Sector

- 1.1. Fintech

- 1.2. Logistics and Logitech

- 1.3. Healthcare

- 1.4. IT

- 1.5. Education and Edtech

- 1.6. Others

-

2. stage

- 2.1. Early Stage

- 2.2. Growth and Expansion

- 2.3. Late Stage

Asia Pacific Venture Capital Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Venture Capital Market Regional Market Share

Geographic Coverage of Asia Pacific Venture Capital Market

Asia Pacific Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia’s booming Internet & Fintech economy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 5.1.1. Fintech

- 5.1.2. Logistics and Logitech

- 5.1.3. Healthcare

- 5.1.4. IT

- 5.1.5. Education and Edtech

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by stage

- 5.2.1. Early Stage

- 5.2.2. Growth and Expansion

- 5.2.3. Late Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 East Ventures

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 500 Durian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SG INNOVATE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sequoia Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insignia Ventures Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wavemaker Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Founders Capital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SEEDS Capital**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 East Ventures

List of Figures

- Figure 1: Asia Pacific Venture Capital Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Venture Capital Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 2: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 3: Asia Pacific Venture Capital Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 5: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 6: Asia Pacific Venture Capital Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Venture Capital Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the Asia Pacific Venture Capital Market?

Key companies in the market include East Ventures, 500 Durian, SG INNOVATE, Sequoia Capital, Insignia Ventures Partners, Wavemaker Partners, Global Founders Capital, SEEDS Capital**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Venture Capital Market?

The market segments include Industry/ Sector, stage.

4. Can you provide details about the market size?

The market size is estimated to be USD 352.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia’s booming Internet & Fintech economy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022, the China-based XPeng led an investment into a new fund of around USD 200 million. The fund is focused on backing up frontier technology startups and electric vehicle production. The fund is named as Rockets Capital and includes capital investors such as eGarden, IDG Capital, 5Y Capital, Sequioa China, and GGV Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Venture Capital Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence