Key Insights

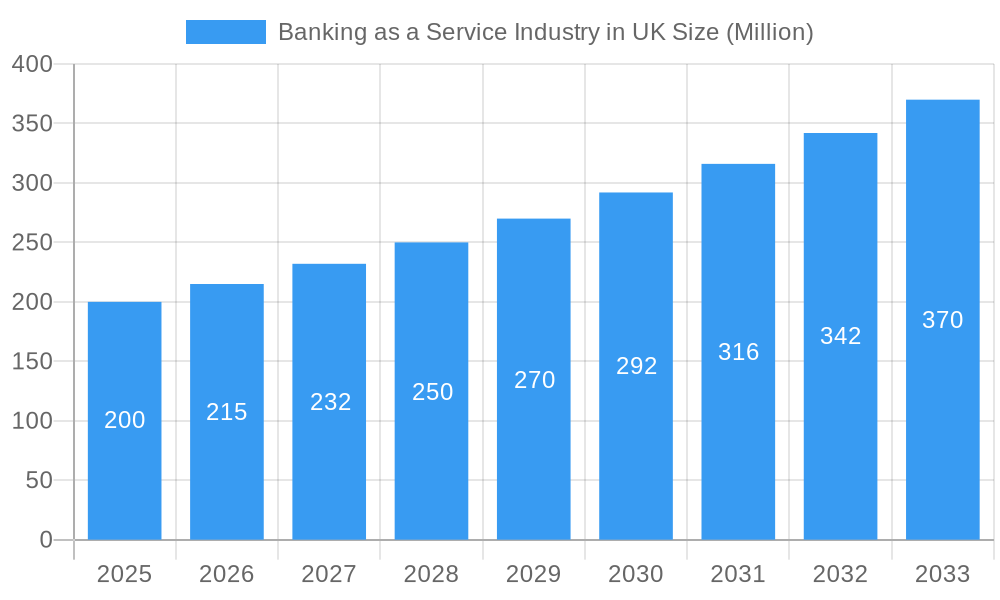

The UK Banking as a Service (BaaS) market is experiencing significant expansion, driven by accelerating digitalization, the proliferation of fintech innovations, and robust demand for advanced financial solutions. The market, estimated at £1.1 billion in the base year of 2024, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 12.6% through 2033. Key growth drivers include established banks adopting BaaS to enhance service delivery and expand their reach, particularly within embedded finance and open banking frameworks. Concurrently, the thriving fintech sector leverages BaaS to access essential banking infrastructure and regulatory compliance without substantial capital outlay. This dynamic fosters competition, innovation, and diversified, customer-centric financial offerings. Growing emphasis on data privacy and security is also spurring demand for secure and compliant BaaS solutions, encouraging both established providers and new entrants to focus on resilient, scalable, and flexible platforms.

Banking as a Service Industry in UK Market Size (In Billion)

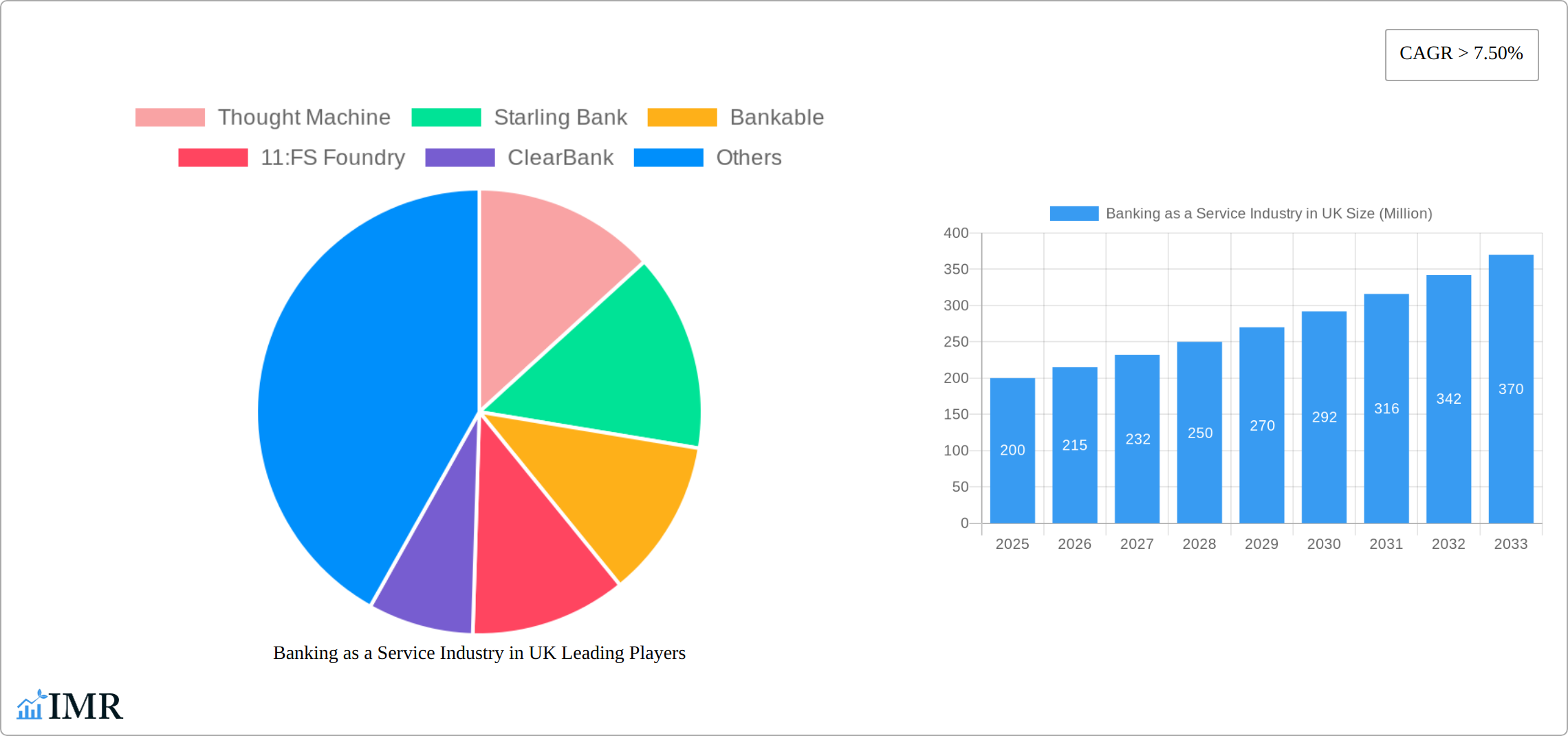

Despite the positive trajectory, market participants face challenges including regulatory intricacies and stringent security requirements, which can elevate operational costs. Integrating BaaS into existing legacy systems presents technical hurdles for incumbent financial institutions. Nevertheless, the UK BaaS market's long-term outlook remains optimistic, propelled by ongoing technological advancements, escalating consumer demand for personalized financial experiences, and the continued evolution of open banking regulations. Leading entities such as Thought Machine, Starling Bank, and ClearBank are instrumental in shaping this evolving market. Future segmentation is anticipated, with a growing focus on specialized areas like embedded finance, payments, and lending.

Banking as a Service Industry in UK Company Market Share

Banking as a Service (BaaS) Industry in the UK: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the UK's rapidly evolving Banking as a Service (BaaS) industry, offering invaluable insights for industry professionals, investors, and strategists. The report covers the period 2019-2033, with a focus on the estimated year 2025, and leverages extensive market data to provide a detailed forecast for 2025-2033. The study encompasses key market segments, dominant players, and future growth trajectories, enabling informed decision-making in this dynamic sector. The UK BaaS market, a crucial subset of the broader Fintech industry, is projected to reach £xx Million by 2033, driven by technological innovation and increasing regulatory support.

Banking as a Service Industry in UK Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the UK BaaS market. The market is characterized by a mix of established players and emerging fintechs, leading to a dynamic competitive environment.

- Market Concentration: The UK BaaS market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller players compete for niche segments. Market concentration is estimated at xx% in 2025, indicating a relatively competitive environment.

- Technological Innovation Drivers: Cloud computing, API-driven architectures, and advancements in AI and machine learning are key drivers of innovation. Open banking initiatives further propel BaaS adoption.

- Regulatory Frameworks: The UK's regulatory framework, including the Open Banking initiative and the FCA's guidelines, significantly impacts BaaS market development. Regulatory clarity and consistent enforcement are crucial for sustained growth.

- Competitive Product Substitutes: Traditional banking services pose the primary competitive threat. However, BaaS providers are differentiating themselves through superior customer experience, specialized services, and technological advantages.

- End-User Demographics: The target audience is diverse, encompassing fintech startups, established financial institutions, and technology companies seeking to embed financial services into their platforms. SMBs and large enterprises represent key customer segments.

- M&A Trends: The BaaS sector has witnessed an increasing number of mergers and acquisitions (M&A) deals. In 2024, approximately xx M&A deals were recorded, driven by strategic expansion and consolidation.

Banking as a Service Industry in UK Growth Trends & Insights

The UK BaaS market has experienced substantial growth over the historical period (2019-2024). The market size is estimated at £xx million in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is attributed to several factors, including increased adoption of open banking, growing demand for embedded finance solutions, and the rise of innovative fintech startups. Consumer behavior shifts towards digital banking solutions and a preference for personalized financial experiences further fuel this expansion. Technological disruptions, particularly the development of robust APIs and cloud-based infrastructure, have significantly lowered barriers to entry and enabled rapid innovation. Market penetration is expected to increase from xx% in 2025 to xx% in 2033. Further analysis of market size evolution and adoption rates from 2019 to 2024 provides a clear picture of market momentum.

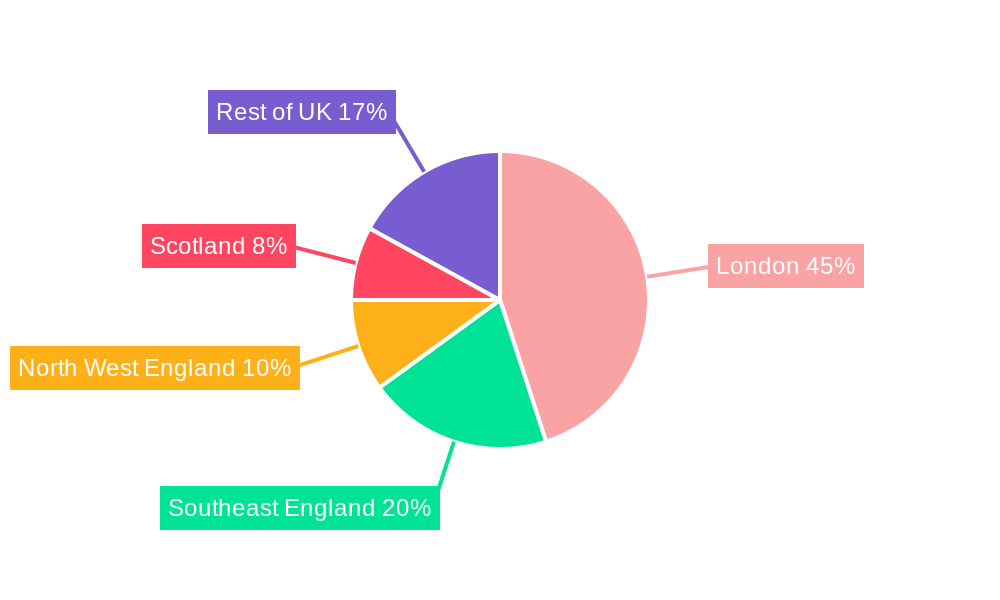

Dominant Regions, Countries, or Segments in Banking as a Service Industry in UK

London and other major UK cities are the leading regions driving BaaS market growth, benefiting from a high concentration of fintech companies, established financial institutions, and technological infrastructure.

- Key Drivers:

- Thriving fintech ecosystem.

- Supportive regulatory environment.

- Access to skilled talent.

- Developed technological infrastructure.

- Dominance Factors: London's position as a global financial hub and its concentration of Fintech companies give it a significant advantage. The city's strong regulatory framework and skilled workforce provide a fertile ground for BaaS innovation and adoption.

Growth potential exists in other regions of the UK, as adoption of embedded finance expands across various industries and geographical areas. Market share in London is estimated at xx% in 2025, with strong growth potential in other major urban centres.

Banking as a Service Industry in UK Product Landscape

The UK's Banking as a Service (BaaS) landscape is a dynamic and evolving ecosystem, offering a spectrum of solutions that empower non-financial entities to embed financial functionalities seamlessly. From fundamental account management and payment processing to highly bespoke, end-to-end BaaS platforms, these offerings allow businesses to extend their product suites with crucial financial services like lending, deposits, and payments, all without the overhead of obtaining a full banking license. The innovation is heavily driven by advanced API integrations, robust security protocols, and a sharp focus on crafting personalized customer journeys. A core tenet of today's BaaS products is their modularity and scalability, enabling clients to select and integrate specific services that align perfectly with their unique business models and strategic objectives, thereby fostering heightened market agility and a distinct competitive edge.

Key Drivers, Barriers & Challenges in Banking as a Service Industry in UK

Key Drivers:

- Open Banking Initiatives: The UK's proactive regulatory framework, particularly its commitment to Open Banking, acts as a potent catalyst. It fosters a fertile ground for innovation, democratizes access to financial data, and intensifies competition, creating significant opportunities for BaaS providers.

- Growing Demand for Embedded Finance: Across a multitude of sectors – from retail and e-commerce to SaaS and specialized industries – there's an escalating desire to integrate financial services directly into existing customer journeys. BaaS is the foundational technology enabling this seamless embedding.

- Technological Advancements: The maturation and widespread adoption of cloud computing, sophisticated API architectures, and artificial intelligence are dramatically lowering the barriers to entry for new BaaS providers and enabling existing ones to enhance efficiency, personalize offerings, and innovate at an unprecedented pace.

- Fintech Innovation: The vibrant UK fintech scene consistently pushes the boundaries of what's possible, driving the development of new BaaS use cases and demanding more sophisticated and flexible financial infrastructure.

Key Challenges:

- Regulatory Uncertainty and Complexity: The regulatory landscape for financial services is inherently complex and continually evolving. BaaS providers and their clients must navigate a maze of compliance requirements, data protection laws, and evolving consumer protection standards, demanding continuous adaptation and robust risk management.

- Cybersecurity Threats and Data Privacy: As BaaS platforms handle sensitive financial data, they are prime targets for cyberattacks. Maintaining the highest levels of cybersecurity, ensuring data integrity, and complying with stringent data privacy regulations like GDPR are paramount concerns.

- Intense Competition and Differentiation: The UK BaaS market is becoming increasingly crowded. Providers face pressure to differentiate their offerings through specialized features, superior customer experience, competitive pricing, and a clear value proposition to stand out in a competitive landscape.

- Talent Acquisition and Retention: The demand for skilled professionals in areas like API development, cybersecurity, compliance, and financial engineering is high, posing a challenge for companies seeking to build and scale their BaaS capabilities.

Emerging Opportunities in Banking as a Service Industry in UK

Significant untapped potential exists within specialized and underserved sectors, such as healthcare, agriculture, and supply chain finance, where embedded BaaS can revolutionize operational efficiency and customer engagement. The persistent and growing consumer and business demand for highly personalized financial products and tailored digital experiences presents a fertile ground for BaaS providers to develop bespoke solutions. Furthermore, the convergence of BaaS with emerging technologies like blockchain for enhanced transparency and security, the Internet of Things (IoT) for data-driven financial services, and advanced analytics for predictive insights promises to unlock entirely new paradigms of innovation and create novel revenue streams within the UK market.

Growth Accelerators in the Banking as a Service Industry in UK Industry

The rapid expansion of the UK BaaS sector is significantly propelled by the formation of strategic, synergistic partnerships between established BaaS providers and agile technology companies. These collaborations foster the co-creation of innovative solutions and expand market reach. Substantial investments in cutting-edge technologies, particularly Artificial Intelligence (AI) and Machine Learning (ML), are instrumental in refining existing service offerings, enabling advanced analytics, enhancing fraud detection, and personalizing customer interactions. Geographic expansion into new international markets and the strategic penetration of previously unaddressed industry segments are also critical drivers of sustained growth and market leadership.

Key Players Shaping the Banking as a Service Industry in UK Market

- Thought Machine

- Starling Bank

- Bankable

- 11:FS Foundry

- ClearBank

- Solarisbank

- Treezor

- Unnax

- Cambr

- List Not Exhaustive

Notable Milestones in Banking as a Service Industry in UK Sector

- July 2021: Paysafe, a global leader in online payments, strategically partnered with Bankable, a leading BaaS provider, to launch integrated banking services, enhancing their payment solutions for businesses.

- April 2022: PEXA, the UK's leading digital conveyancing platform, formed a key alliance with ClearBank, the UK's first new clearing bank in over 250 years, to expand its remortgage platform and offer enhanced financial services to its users.

- Q1 2023: Numerous BaaS providers reported significant growth in API call volumes and customer acquisition, signaling strong market adoption and continued demand for embedded financial services.

- Late 2023: New regulatory guidance focused on enhancing consumer protection within BaaS frameworks was introduced, aiming to build further trust and confidence in the sector.

In-Depth Banking as a Service Industry in UK Market Outlook

The UK BaaS market is poised for continued robust growth, driven by technological innovation, regulatory support, and the increasing demand for embedded finance. Strategic partnerships, expansion into new markets, and the development of innovative product offerings will shape future market dynamics. The focus on enhancing security, improving customer experiences, and maintaining regulatory compliance will be critical for success.

Banking as a Service Industry in UK Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Product Type

- 2.1. API based BaaS

- 2.2. Cloud-based BaaS

-

3. Enterprise Size

- 3.1. Large enterprise

- 3.2. Small & Medium enterprise

-

4. End-User

- 4.1. Banks

- 4.2. NBFC/Fintech Corporations

- 4.3. Others

Banking as a Service Industry in UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking as a Service Industry in UK Regional Market Share

Geographic Coverage of Banking as a Service Industry in UK

Banking as a Service Industry in UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Embedded Finance is Driving Banking as a Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. API based BaaS

- 5.2.2. Cloud-based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large enterprise

- 5.3.2. Small & Medium enterprise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Banks

- 5.4.2. NBFC/Fintech Corporations

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Platform

- 6.1.2. Service

- 6.1.2.1. Professional Service

- 6.1.2.2. Managed Service

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. API based BaaS

- 6.2.2. Cloud-based BaaS

- 6.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.3.1. Large enterprise

- 6.3.2. Small & Medium enterprise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Banks

- 6.4.2. NBFC/Fintech Corporations

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Platform

- 7.1.2. Service

- 7.1.2.1. Professional Service

- 7.1.2.2. Managed Service

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. API based BaaS

- 7.2.2. Cloud-based BaaS

- 7.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.3.1. Large enterprise

- 7.3.2. Small & Medium enterprise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Banks

- 7.4.2. NBFC/Fintech Corporations

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Platform

- 8.1.2. Service

- 8.1.2.1. Professional Service

- 8.1.2.2. Managed Service

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. API based BaaS

- 8.2.2. Cloud-based BaaS

- 8.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.3.1. Large enterprise

- 8.3.2. Small & Medium enterprise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Banks

- 8.4.2. NBFC/Fintech Corporations

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Platform

- 9.1.2. Service

- 9.1.2.1. Professional Service

- 9.1.2.2. Managed Service

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. API based BaaS

- 9.2.2. Cloud-based BaaS

- 9.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.3.1. Large enterprise

- 9.3.2. Small & Medium enterprise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Banks

- 9.4.2. NBFC/Fintech Corporations

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Platform

- 10.1.2. Service

- 10.1.2.1. Professional Service

- 10.1.2.2. Managed Service

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. API based BaaS

- 10.2.2. Cloud-based BaaS

- 10.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.3.1. Large enterprise

- 10.3.2. Small & Medium enterprise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Banks

- 10.4.2. NBFC/Fintech Corporations

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thought Machine

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Starling Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankable

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 11

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Thought Machine

List of Figures

- Figure 1: Global Banking as a Service Industry in UK Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 7: North America Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 8: North America Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 13: South America Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 14: South America Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 15: South America Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: South America Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 17: South America Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 18: South America Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 23: Europe Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 25: Europe Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 27: Europe Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 28: Europe Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 33: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 37: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 38: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 43: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 44: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 47: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 48: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 4: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global Banking as a Service Industry in UK Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 9: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 16: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 17: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 25: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 37: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 39: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 48: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 50: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking as a Service Industry in UK?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the Banking as a Service Industry in UK?

Key companies in the market include Thought Machine, Starling Bank, Bankable, 11:FS Foundry, ClearBank, Solarisbank, Treezor, Unnax, Cambr**List Not Exhaustive.

3. What are the main segments of the Banking as a Service Industry in UK?

The market segments include Component, Product Type, Enterprise Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Embedded Finance is Driving Banking as a Service.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On April 2022, PEXA, the Australian-founded fintech developed of a brand new payment scheme - PEXA Pay. At the same time, PEXA has partnered with ClearBank, clearing and embedded banking platform in the UK, to broaden access to its forthcoming remortgage platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking as a Service Industry in UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking as a Service Industry in UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking as a Service Industry in UK?

To stay informed about further developments, trends, and reports in the Banking as a Service Industry in UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence