Key Insights

The European Banking as a Service (BaaS) market is experiencing substantial expansion, propelled by escalating demand for embedded finance and accelerated digital transformation in the financial sector. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 26.5%, with the market size anticipated to reach 1674.36 million by 2033, building on a base year of 2024. This growth is driven by fintechs leveraging BaaS for agile product development and traditional banks seeking expanded reach and improved customer experiences. The proliferation of open banking APIs and supportive regulatory frameworks further stimulates market penetration across Europe, a region renowned for its dynamic fintech ecosystem.

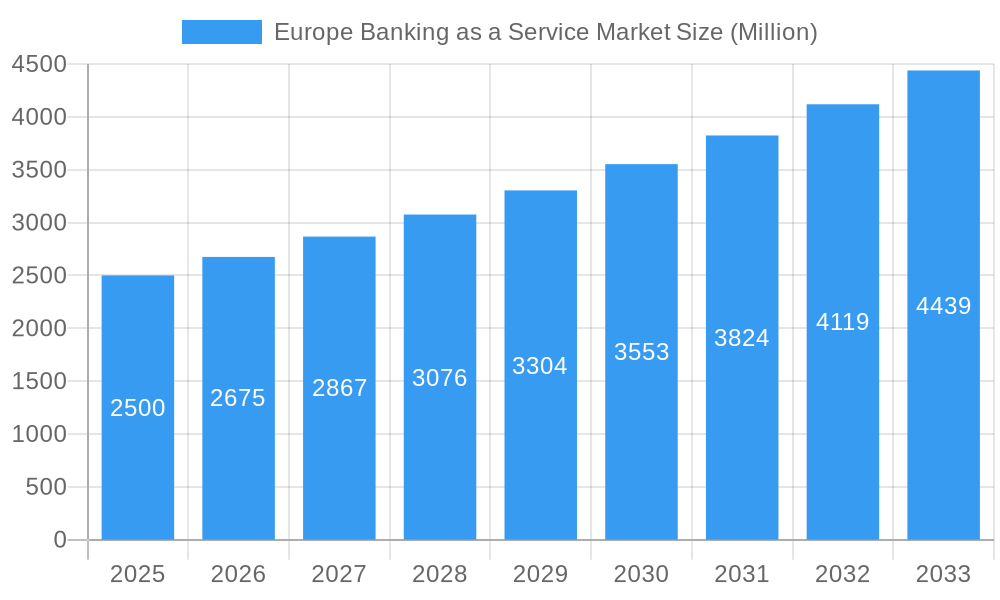

Europe Banking as a Service Market Market Size (In Billion)

The outlook for the European BaaS market remains exceptionally strong through 2033. While the CAGR may normalize as the market matures, continued innovation in AI-driven financial services, blockchain integration, and embedded lending will sustain expansion. Key considerations include addressing cybersecurity, adapting to regulatory shifts, and ensuring stringent data privacy. Market segmentation will likely intensify, fostering specialized providers, alongside industry consolidation driven by strategic acquisitions. The ongoing investment in advanced BaaS solutions positions the European market for sustained, significant growth.

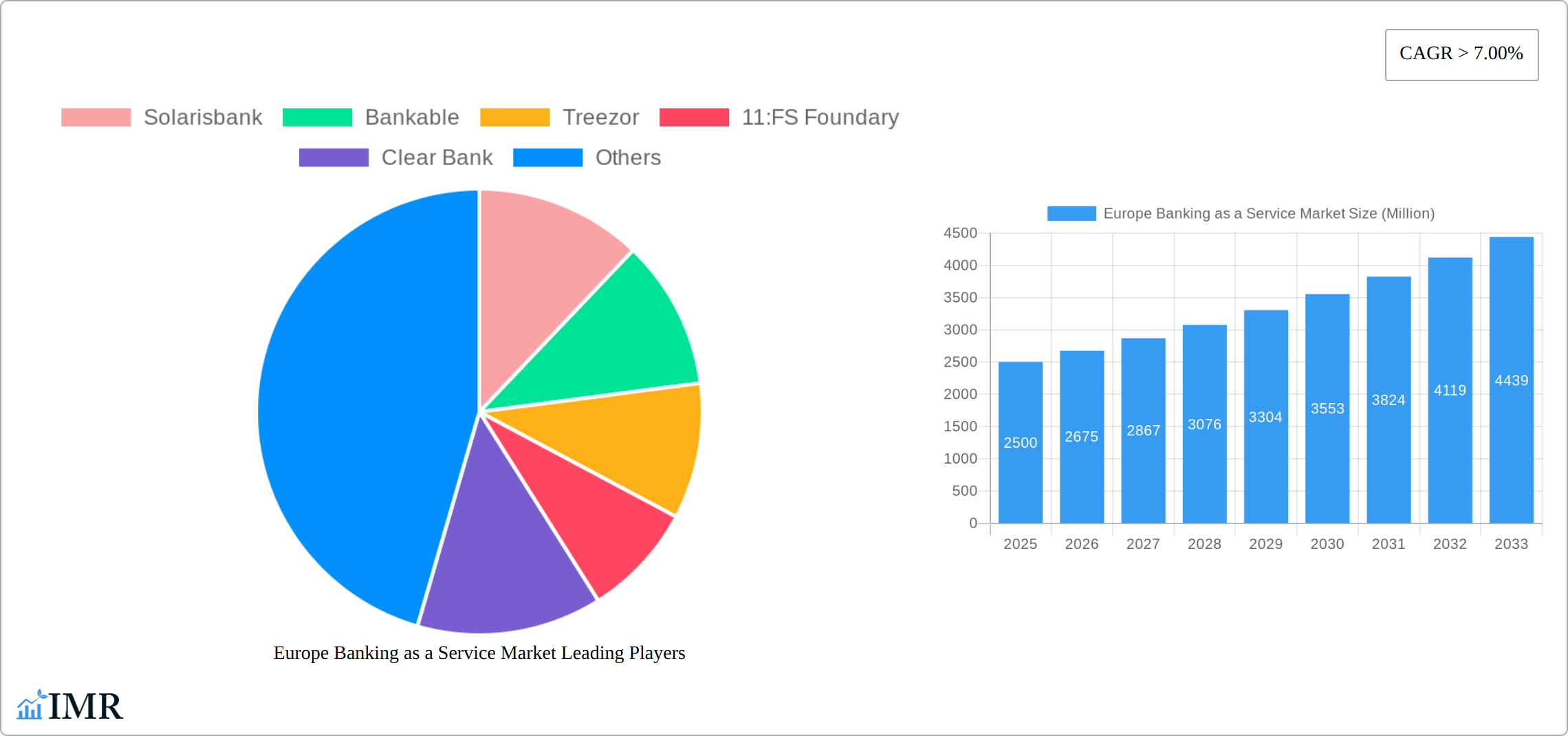

Europe Banking as a Service Market Company Market Share

Europe Banking as a Service Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Banking as a Service (BaaS) market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report delivers crucial insights for industry professionals, investors, and strategists seeking to understand and capitalize on the burgeoning BaaS landscape in Europe. This analysis includes the parent market of Financial Technology (Fintech) and the child market of Embedded Finance.

Europe Banking as a Service Market Market Dynamics & Structure

The European BaaS market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is currently moderate, with several key players vying for market share, alongside a growing number of smaller, niche providers. Technological innovation, particularly in areas like cloud computing, APIs, and AI, is a primary growth driver. However, stringent regulatory frameworks, such as PSD2 and GDPR, present both opportunities and challenges. The market also experiences competitive pressures from traditional banking solutions and emerging fintech players offering alternative financial services. M&A activity remains significant, with larger companies seeking to consolidate market share through acquisitions of smaller, innovative BaaS providers.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors. (Market share data will be provided in the full report - xx% for top 3 players, xx% for others).

- Technological Innovation: Cloud computing, AI, and advanced APIs are key drivers.

- Regulatory Landscape: PSD2, GDPR, and other regulations shape market development.

- Competitive Landscape: Traditional banking and other fintech disruptors pose competition.

- M&A Activity: Significant consolidation efforts through acquisitions and mergers. (e.g., xx number of deals in the last 5 years).

- Innovation Barriers: High regulatory compliance costs, integration complexities, and security concerns.

Europe Banking as a Service Market Growth Trends & Insights

The European Banking as a Service (BaaS) market has experienced a dynamic period of substantial growth from 2019 to 2024. This upward trajectory is predominantly fueled by the escalating demand for embedded finance solutions, which are being seamlessly integrated across a vast spectrum of industries, from retail and e-commerce to fintech and beyond. The ongoing digital transformation within the financial sector, coupled with significant technological advancements such as the widespread adoption of cloud-based infrastructure and the pervasive use of Application Programming Interfaces (APIs), are acting as powerful catalysts for market expansion. Furthermore, a discernible shift in consumer behavior towards seeking out convenient, integrated, and personalized financial services is creating an exceptionally fertile ground for BaaS adoption. Projections indicate a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration anticipated to reach an impressive xx% by the year 2033. Detailed and granular market size projections, presented in Million units, will be comprehensively detailed in the full report for each year.

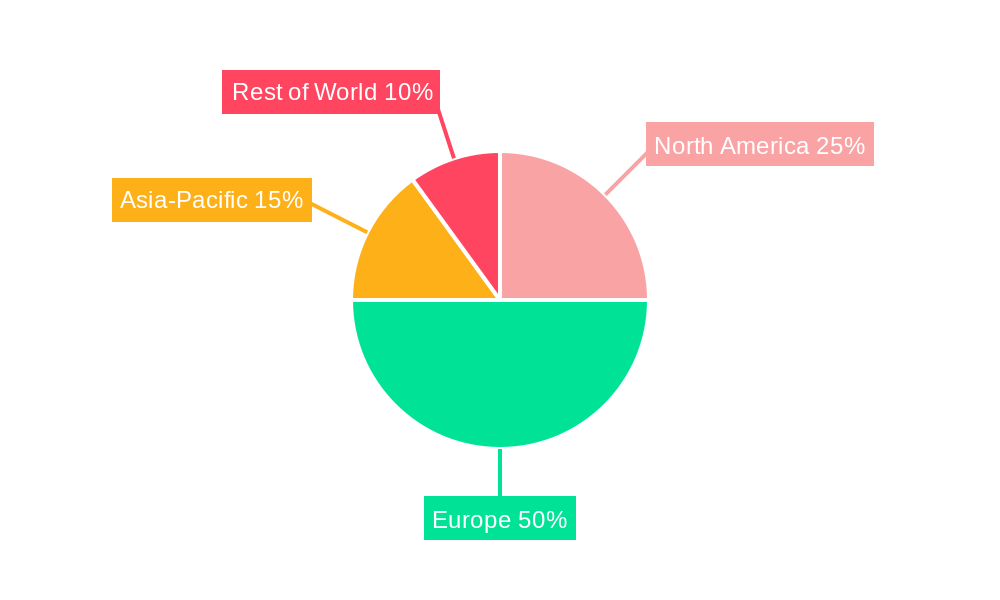

Dominant Regions, Countries, or Segments in Europe Banking as a Service Market

The UK and Germany currently represent the most significant markets within Europe, driven by a robust fintech ecosystem, supportive regulatory environments, and a high concentration of innovative BaaS providers. Other key regions include France, Nordic countries (particularly Sweden and Finland) and the Benelux region.

- UK: Strong fintech ecosystem, high adoption rates, early adoption of open banking.

- Germany: Large market size, strong digital infrastructure, increasing demand for embedded finance solutions.

- France: Growing fintech sector, government initiatives promoting innovation.

- Nordic Countries: High digital literacy rates, progressive regulatory environments.

- Benelux: Strong cross-border collaboration, focus on innovative financial services. Market share data for each region/country will be presented in the full report.

Europe Banking as a Service Market Product Landscape

The BaaS market offers a range of products, from core banking platforms to specialized APIs for specific financial services. Innovation focuses on enhanced security features, streamlined integration processes, and improved customization options. Unique selling propositions often centre on ease of use, scalability, and cost-effectiveness. Technological advancements, like AI-powered risk assessment and blockchain integration, are reshaping the product landscape, improving efficiency and user experience.

Key Drivers, Barriers & Challenges in Europe Banking as a Service Market

Key Drivers: The European BaaS market is propelled by several potent forces. The burgeoning demand for seamlessly embedded financial services, enabling non-financial companies to offer banking functionalities, is a primary driver. Regulatory evolution, particularly the implementation and subsequent impact of initiatives like the Second Payment Services Directive (PSD2), has fostered innovation and opened new avenues for BaaS providers. Rapid technological advancements, including the maturity of cloud computing and the standardization of APIs, are crucial enablers. Moreover, the pervasive adoption of digital banking practices and the increasing comfort of consumers with online financial solutions significantly contribute to market growth.

Key Challenges: Navigating the BaaS landscape is not without its hurdles. Stringent and evolving regulatory compliance remains a paramount concern for both BaaS providers and their partners. Robust security protocols and the constant vigilance against cyber threats are critical, with approximately xx% of businesses citing security concerns as a significant barrier to adoption. The inherent complexities of integrating BaaS solutions with legacy IT systems pose integration challenges. Additionally, the competitive pressure from established financial institutions and emerging BaaS platforms requires continuous innovation and differentiation.

Emerging Opportunities in Europe Banking as a Service Market

The European BaaS market is ripe with emerging opportunities. A significant area of growth lies in extending BaaS capabilities to historically underserved market segments, such as Small and Medium-sized Enterprises (SMEs) and micro-businesses, providing them with access to sophisticated financial tools. The development of highly specialized BaaS solutions tailored to the unique needs of niche industries and market verticals presents another promising avenue. The integration of cutting-edge technologies, including Artificial Intelligence (AI) for enhanced data analytics and personalized offerings, and blockchain for improved transparency and security, holds immense potential to revolutionize BaaS platforms. The ever-increasing consumer and business demand for hyper-personalized financial experiences further amplifies these opportunities.

Growth Accelerators in the Europe Banking as a Service Market Industry

Strategic partnerships between established banks and fintech firms, technological advancements enhancing security and scalability, and expanding regulatory frameworks supporting open banking initiatives are significant long-term growth catalysts. Market expansion into new geographic regions and the increasing integration of BaaS into diverse industries also represent significant growth potential.

Key Players Shaping the Europe Banking as a Service Market Market

- Solarisbank

- Bankable

- Treezor

- 11:FS Foundary

- Clear Bank

- Unnax

- Cambr

- Railsbank

- Deposits Solutions

- Fidor Bank

- True Layer

- FintechOS

- List Not Exhaustive

Notable Milestones in Europe Banking as a Service Market Sector

- July 22, 2021: Bankable announced a strategic partnership with Paysafe, a leading integrated payments platform, to launch comprehensive, integrated omnichannel banking services. This collaboration aimed to provide businesses with a unified and seamless banking experience across all customer touchpoints.

- May 05, 2022: Solarisbank, a prominent BaaS provider, partnered with Snowflake, the Data Cloud company. This alliance was established to significantly enhance Solarisbank's cloud capabilities, enabling more robust data management, analytics, and scalability for its BaaS offerings.

- November 10, 2023: A significant European neobank launched a new BaaS offering, focusing on providing white-label banking solutions for e-commerce platforms, demonstrating the growing trend of specialized BaaS solutions in specific sectors.

- February 15, 2024: A major European bank announced its strategic investment in a leading BaaS technology provider, signaling a strong commitment to expanding its BaaS ecosystem and leveraging innovative technologies for enhanced service delivery.

In-Depth Europe Banking as a Service Market Market Outlook

The outlook for the European BaaS market is exceptionally promising, characterized by sustained and accelerated growth. The foundational drivers of embedded finance expansion, continuous technological innovation, and the persistent evolution of customer expectations will continue to shape the market's trajectory. Strategic alliances and partnerships will be crucial for players seeking to expand their reach and capabilities. There will be a notable emphasis on entering new geographic markets within Europe and developing highly innovative and differentiated BaaS solutions that address specific industry pain points. The market is poised for substantial expansion, creating a wealth of opportunities for both established financial institutions and agile new entrants alike. The long-term forecast points towards significant market growth, increasing consolidation as the BaaS ecosystem matures and the value proposition becomes clearer to a broader range of businesses.

Europe Banking as a Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API Based BaaS

- 2.2. Cloud Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintech Corporations/NBFC

- 4.3. Others

Europe Banking as a Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Banking as a Service Market Regional Market Share

Geographic Coverage of Europe Banking as a Service Market

Europe Banking as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Embedded Finance Driving Banking as a Service.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Banking as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API Based BaaS

- 5.2.2. Cloud Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintech Corporations/NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solarisbank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bankable

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Treezor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 11

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Solarisbank

List of Figures

- Figure 1: Europe Banking as a Service Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Banking as a Service Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 2: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 4: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 5: Europe Banking as a Service Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 7: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 9: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Banking as a Service Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Banking as a Service Market?

The projected CAGR is approximately 26.5%.

2. Which companies are prominent players in the Europe Banking as a Service Market?

Key companies in the market include Solarisbank, Bankable, Treezor, 11:FS Foundary, Clear Bank, Unnax, Cambr, Rails bank, Deposits Solutions, Fidor Bank, True Layer, FintechOS**List Not Exhaustive.

3. What are the main segments of the Europe Banking as a Service Market?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1674.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Embedded Finance Driving Banking as a Service..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 05, 2022, Solaris bank announced that it would partner with Snowflake, the Data Cloud company, to double down on creating a cloud-fluent organization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Banking as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Banking as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Banking as a Service Market?

To stay informed about further developments, trends, and reports in the Europe Banking as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence