Key Insights

The European capital market exchange ecosystem, featuring major players such as Euronext, Nasdaq Nordic, and the London Stock Exchange, is poised for significant expansion. Projections indicate a compound annual growth rate (CAGR) of 5.8%, contributing to a projected market size of 151.36 million by 2025. This growth is propelled by several key drivers: increasing regulatory demands necessitating advanced trading technologies, the ongoing digitalization of financial markets fostering fintech innovation and automated trading, and the expanding influence of ESG investing, where exchanges provide essential transparency. Emerging challenges include geopolitical instability and varied regulatory landscapes across European jurisdictions. Market segmentation is anticipated across asset classes (equities, bonds, derivatives), trading technologies, and geographical regions within Europe.

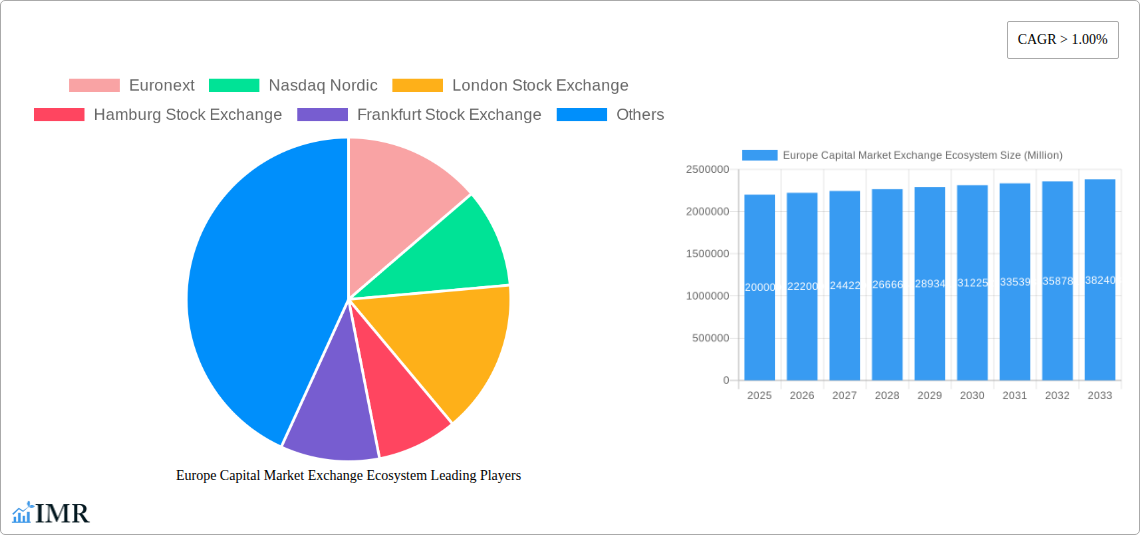

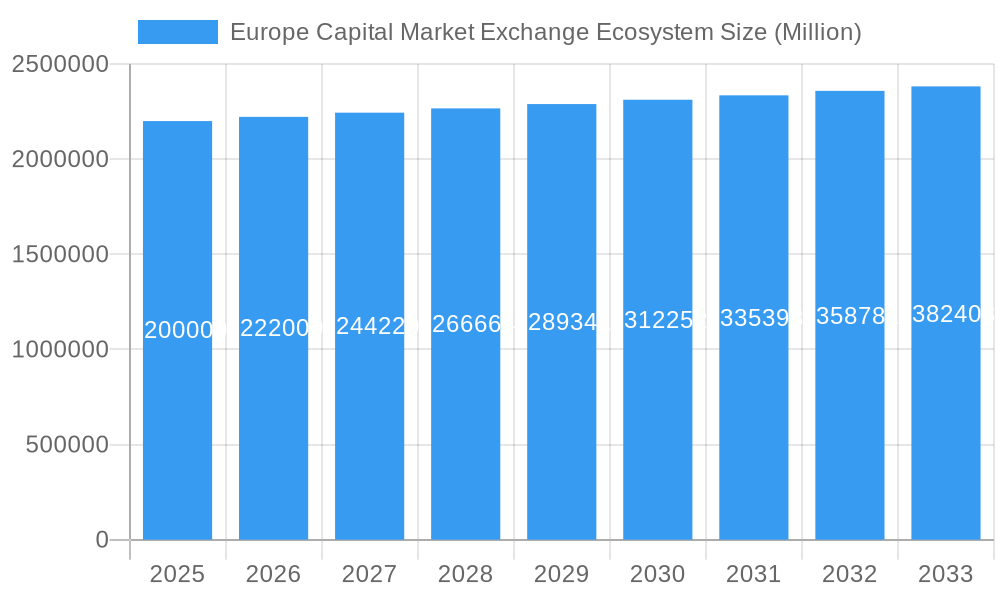

Europe Capital Market Exchange Ecosystem Market Size (In Million)

The forecast period, extending from 2025 to 2033, anticipates sustained growth driven by the adoption of innovative trading solutions and rising trading volumes, particularly in emerging sectors like green energy and technology. The competitive landscape is characterized by established entities pursuing market share through strategic mergers, acquisitions, and technological advancements. Collaborations with fintech firms are also becoming increasingly prevalent. Regional growth rates may vary based on local economic conditions and regulatory frameworks. Nevertheless, the overall outlook for the European capital market exchange ecosystem is positive, with considerable expansion expected throughout the forecast period.

Europe Capital Market Exchange Ecosystem Company Market Share

Europe Capital Market Exchange Ecosystem Market Analysis (2019-2033)

This comprehensive report analyzes the Europe Capital Market Exchange Ecosystem, detailing market dynamics, growth trajectories, key participants, and future projections. The study covers the period from 2019 to 2033, with 2025 designated as the base year. Utilizing extensive data analysis and expert insights, the report delivers actionable intelligence for industry professionals. Focusing on interconnected market segments, this report offers detailed forecasts crucial for strategic decision-making. The market size is projected in million units.

Europe Capital Market Exchange Ecosystem Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the European capital market exchange ecosystem. The report delves into market concentration, identifying key players and their respective market share percentages. It examines the impact of technological innovations (e.g., algorithmic trading, blockchain technology) and regulatory frameworks (e.g., MiFID II, GDPR) on market dynamics. The analysis further explores the influence of competitive product substitutes and evolving end-user demographics. Finally, it quantifies M&A activity, providing insights into deal volumes and their implications for market structure.

- Market Concentration: The European capital market exchange ecosystem demonstrates a moderately concentrated structure, with major players like Euronext, London Stock Exchange, and Deutsche Börse holding significant market share. Estimates indicate that the top 5 players control approximately xx% of the overall market in 2025.

- Technological Innovation Drivers: High-frequency trading, AI-powered analytics, and blockchain technology are key drivers of innovation, improving trading efficiency and transparency. However, implementation requires significant investment, posing a barrier for smaller exchanges.

- Regulatory Frameworks: Regulations like MiFID II and GDPR significantly impact market operations and data security, influencing cost structures and competitive dynamics. Compliance necessitates substantial investment, affecting market entry barriers.

- Competitive Product Substitutes: Alternative trading platforms and decentralized finance (DeFi) protocols are emerging as competitive substitutes, although their market penetration remains limited in 2025. Estimated market share for DeFi in the capital markets segment is xx%.

- M&A Trends: The historical period (2019-2024) witnessed xx M&A deals in the European capital market exchange ecosystem. The forecast period (2025-2033) is projected to see an increase, driven by consolidation and expansion strategies.

Europe Capital Market Exchange Ecosystem Growth Trends & Insights

This section provides a comprehensive analysis of the market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior within the European capital market exchange ecosystem from 2019 to 2033. Utilizing detailed data, the report presents a detailed overview of historical growth trends and projects future expansion based on anticipated factors. Key metrics such as Compound Annual Growth Rate (CAGR), market penetration, and adoption rates are used to provide a deeper understanding of market performance. Factors influencing market size will include regulatory changes, economic conditions, and technological innovations. The analysis considers the impact of these factors on various segments within the market. Specific details on trading volume growth, market capitalization evolution, and the influx of new investors are included. The report identifies key technological advancements that are expected to alter market dynamics, as well as emerging consumer preferences and their influence on market growth.

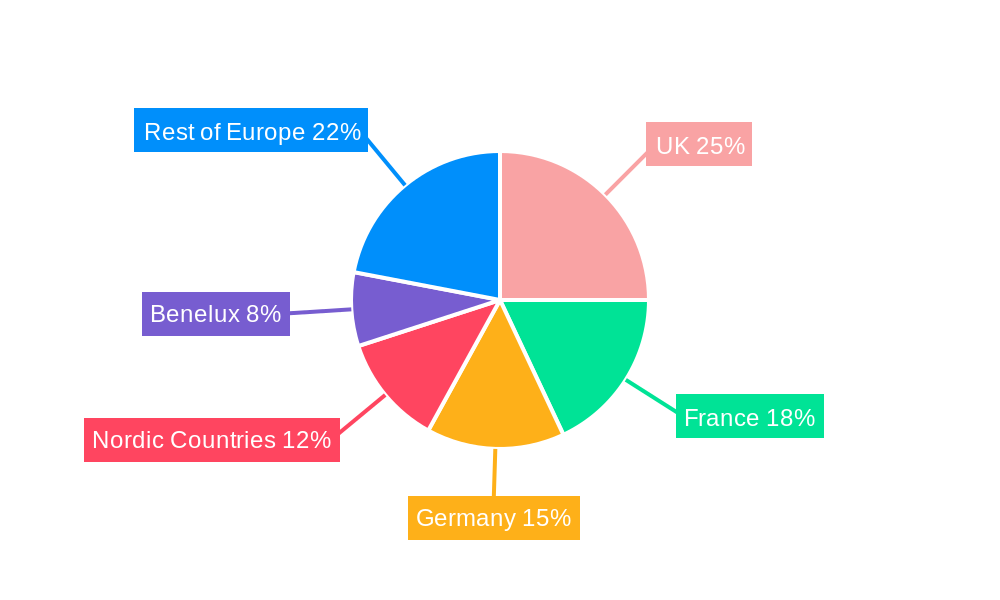

Dominant Regions, Countries, or Segments in Europe Capital Market Exchange Ecosystem

This section identifies the leading regions, countries, and segments driving market growth within the European capital market exchange ecosystem. It provides in-depth analysis of market share and growth potential for each key area. The analysis highlights crucial economic policies, infrastructure development, and regulatory factors that contribute to the dominance of specific regions or segments. The report considers factors like investor confidence, regulatory environment, and technological infrastructure.

- Key Drivers:

- Strong economic growth in certain regions.

- Favorable regulatory environments promoting investment.

- Robust technological infrastructure supporting advanced trading systems.

- Dominant Regions: The UK, France, and Germany are expected to remain dominant in 2025, with the UK projected to account for approximately xx% of the market. However, Eastern European markets are showing significant growth potential.

- Growth Potential: Specific regions or segments exhibit higher growth potential due to factors like increasing investor participation, the expansion of fintech adoption, and supportive governmental policies.

Europe Capital Market Exchange Ecosystem Product Landscape

The European capital market exchange ecosystem offers a diverse range of products and services, including equities, bonds, derivatives, and ETFs. Innovations in trading technology, such as high-frequency trading algorithms and advanced order management systems, have significantly enhanced market efficiency and liquidity. The increasing adoption of electronic trading platforms contributes to higher transaction speeds and reduced costs. Furthermore, the integration of blockchain technology is driving developments toward greater transparency and security.

Key Drivers, Barriers & Challenges in Europe Capital Market Exchange Ecosystem

Key Drivers: Technological advancements (AI, high-frequency trading), increased investor participation (particularly from institutional investors), and supportive government policies promoting market development drive significant growth.

Key Challenges: Regulatory uncertainty, cybersecurity risks, and increasing competition from alternative trading platforms pose considerable challenges. Brexit's impact on cross-border trading and the ongoing geopolitical uncertainty also present headwinds. Supply chain disruptions due to the global economic climate and inflation have added to cost pressures. Estimates indicate that xx million in potential revenue is at risk due to these challenges.

Emerging Opportunities in Europe Capital Market Exchange Ecosystem

The increasing adoption of fintech solutions, the growth of ESG investing, and the rise of new asset classes (e.g., cryptocurrencies) present significant opportunities. Untapped markets in Eastern Europe, coupled with the increasing demand for sustainable investment options, suggest considerable market potential.

Growth Accelerators in the Europe Capital Market Exchange Ecosystem Industry

Technological breakthroughs in artificial intelligence (AI) and blockchain technologies are poised to enhance efficiency and security within the exchange ecosystem. Strategic partnerships between exchanges and fintech firms, combined with market expansion strategies focusing on underserved regions, are crucial for accelerating market growth. Investments in infrastructure and improving regulatory frameworks will play a significant role.

Key Players Shaping the Europe Capital Market Exchange Ecosystem Market

- Euronext

- Nasdaq Nordic

- London Stock Exchange

- Hamburg Stock Exchange

- Frankfurt Stock Exchange

- Italian Stock Exchange

- SIX Swiss Exchange

- Budapest Stock Exchange

- Moscow Exchange

- Ukrainian Exchange

Notable Milestones in Europe Capital Market Exchange Ecosystem Sector

- October 2023: Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF and financial derivatives markets. This aims to enhance risk management and market stability.

- March 2023: Innovate UK and the London Stock Exchange partnered to improve financial access for innovative businesses, unlocking EUR 6 trillion in long-term capital for growth. This collaboration significantly boosts the UK's innovation ecosystem.

In-Depth Europe Capital Market Exchange Ecosystem Market Outlook

The European capital market exchange ecosystem is poised for sustained growth driven by technological advancements, increased regulatory clarity, and growing investor participation. Strategic opportunities lie in leveraging technological innovations, expanding into new markets, and fostering strategic partnerships to capture a significant share of the expanding market. The forecast period shows promising growth with potential for substantial returns.

Europe Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Europe Capital Market Exchange Ecosystem Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Europe Capital Market Exchange Ecosystem

Europe Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significance of Primary Market in European Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euronext

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nasdaq Nordic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 London Stock Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hamburg Stock Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frankfurt Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Italian Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIX Swiss Exchange

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Budapest Stock Exchange

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moscow Exchange

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ukrainian Exchange**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Euronext

List of Figures

- Figure 1: Europe Capital Market Exchange Ecosystem Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 2: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 3: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 4: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 6: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 7: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 8: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Capital Market Exchange Ecosystem?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Capital Market Exchange Ecosystem?

Key companies in the market include Euronext, Nasdaq Nordic, London Stock Exchange, Hamburg Stock Exchange, Frankfurt Stock Exchange, Italian Stock Exchange, SIX Swiss Exchange, Budapest Stock Exchange, Moscow Exchange, Ukrainian Exchange**List Not Exhaustive.

3. What are the main segments of the Europe Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Instruments, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significance of Primary Market in European Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF and financial derivatives markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Europe Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence