Key Insights

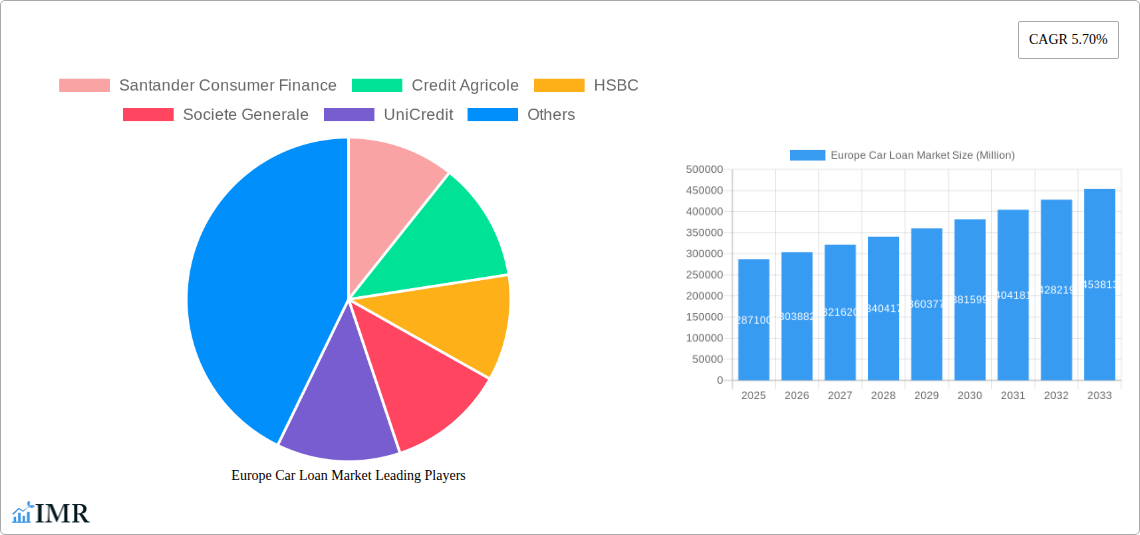

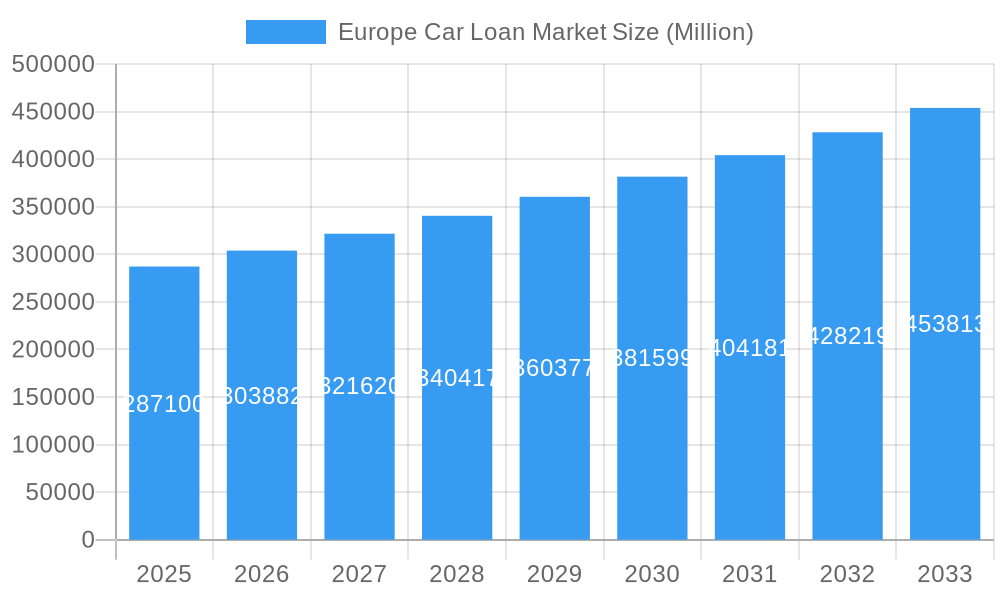

The European car loan market, valued at €287.10 billion in 2025, is projected to experience robust growth, driven by a rising demand for personal vehicles, particularly in emerging economies within the region, and supportive financing options offered by lending institutions. The market's Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033 signifies a steady expansion. Key growth drivers include increasing vehicle sales, attractive loan schemes focusing on low interest rates and flexible repayment plans, and the rising popularity of used car financing. However, economic fluctuations, stricter lending regulations aimed at mitigating financial risk, and potential shifts in consumer preferences toward alternative transportation methods like public transit and ride-sharing services could act as restraints. The competitive landscape comprises a mix of large international banks like Santander Consumer Finance, Credit Agricole, HSBC, and Societe Generale, as well as regional players like Nordea and CaixaBank, all vying for market share. Segment analysis, though not provided, would likely reveal variations in loan terms and interest rates based on factors like vehicle type, buyer credit history, and loan duration.

Europe Car Loan Market Market Size (In Billion)

The forecast period of 2025-2033 presents substantial opportunities for lenders to innovate, offering tailored financing solutions for electric vehicles (EVs) and hybrid cars, further bolstering market growth. While the current market size is primarily defined by new and used car loans, a rising focus on responsible lending practices and transparency could shape future market dynamics. The long-term outlook suggests continued growth, albeit subject to macroeconomic influences and evolving consumer behavior. Further granularity in regional data will provide a more nuanced understanding of growth drivers and market penetration across different European countries.

Europe Car Loan Market Company Market Share

Europe Car Loan Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Car Loan Market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of the European Financial Services sector and the child market of automotive financing, offering granular insights into market segmentation and regional variations.

The report's value is estimated at xx Million units in 2025.

Europe Car Loan Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the Europe Car Loan Market. We delve into market concentration, identifying key players like Santander Consumer Finance, Credit Agricole, HSBC, Societe Generale, UniCredit, Nordea, Lloyds Banking Group, CaixaBank, Banque Populaire, and NatWest Group (list not exhaustive), and examining their market share percentages. The report also explores the impact of mergers and acquisitions (M&A) activities on market structure, providing quantitative data on deal volumes during the historical period (2019-2024). Qualitative insights examine innovation barriers and the influence of regulatory frameworks on market participants.

- Market Concentration: Analysis of market share distribution among major players. The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Examination of the impact of digital lending platforms, AI-driven credit scoring, and blockchain technology.

- Regulatory Frameworks: Assessment of the influence of European Union regulations on lending practices and consumer protection.

- Competitive Substitutes: Analysis of alternative financing options and their impact on market demand.

- End-User Demographics: Profiling of borrowers based on age, income, location, and credit history.

- M&A Trends: Analysis of M&A activity, including deal volumes and their effect on market consolidation.

Europe Car Loan Market Growth Trends & Insights

Leveraging extensive data analysis, this section presents a detailed overview of the Europe Car Loan Market's growth trajectory. We examine market size evolution from 2019 to 2024 and project its growth through 2033, including CAGR calculations. The analysis incorporates factors such as adoption rates of new technologies, technological disruptions, and shifts in consumer behavior influencing borrowing patterns. We analyze the impact of economic fluctuations, interest rate changes, and consumer confidence on loan demand.

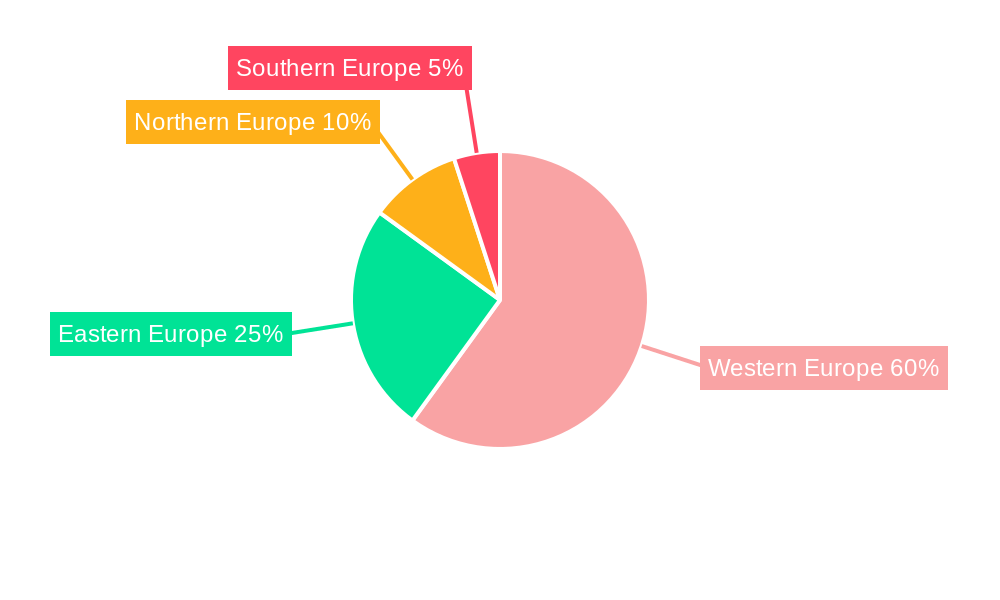

Dominant Regions, Countries, or Segments in Europe Car Loan Market

This section identifies the leading regions, countries, or segments driving market growth. It analyzes factors contributing to their dominance, such as economic policies, infrastructure development, and consumer preferences. Detailed market share data and growth potential projections are provided for each leading region/country/segment.

- Key Drivers: Specific economic policies, infrastructure investments, and consumer trends driving growth in the dominant region. (e.g., Germany's robust automotive industry driving high car loan demand.)

- Dominance Factors: Detailed analysis of the competitive landscape, regulatory environment, and consumer behavior in the leading region.

- Market Share & Growth Potential: Quantitative data on market share and projected growth rates for each dominant region/country/segment.

Europe Car Loan Market Product Landscape

This section describes the range of car loan products available in the European market, highlighting product innovations, applications, and key performance metrics. We analyze unique selling propositions (USPs) offered by different lenders and the technological advancements shaping product development, such as online application portals and personalized loan offers.

Key Drivers, Barriers & Challenges in Europe Car Loan Market

This section identifies the key factors driving market growth and the challenges hindering its expansion.

Key Drivers:

- Increased car sales.

- Favorable financing options.

- Technological advancements in lending.

Challenges:

- Economic uncertainty and potential recessionary pressures may limit consumer spending on vehicles and impact creditworthiness, potentially reducing loan demand by xx% in a severe downturn.

- Stringent regulatory requirements could increase compliance costs for lenders.

- Intense competition among lenders could lead to price wars and reduced profit margins.

Emerging Opportunities in Europe Car Loan Market

This section highlights emerging opportunities arising from evolving consumer preferences, technological innovations, and untapped market segments.

- Expansion into underserved markets with higher growth potential.

- Development of innovative loan products tailored to specific consumer needs.

- Adoption of new technologies to enhance customer experience and efficiency.

Growth Accelerators in the Europe Car Loan Market Industry

Strategic partnerships and technological breakthroughs are key growth catalysts in the Europe Car Loan Market. The increasing adoption of digital lending platforms and innovative financing solutions fuels market expansion. Market expansion strategies into new European markets with high growth potential will also contribute to long-term growth.

Key Players Shaping the Europe Car Loan Market Market

Notable Milestones in Europe Car Loan Market Sector

- March 2023: AMS and Tesco Bank announce a 3-year partnership, potentially impacting talent acquisition within the banking sector and influencing operational efficiency.

- February 2022: Barclays' partnership with Rainmaking signals increased investment in FinTech innovation and may lead to the development of new lending solutions.

In-Depth Europe Car Loan Market Market Outlook

The Europe Car Loan Market is poised for continued growth, driven by technological advancements, strategic partnerships, and market expansion initiatives. The increasing adoption of digital lending platforms and innovative financing solutions will create new opportunities for lenders and enhance customer experience. Expansion into underserved markets and the development of tailored loan products will further fuel market growth. The projected market value is estimated at xx Million units by 2033.

Europe Car Loan Market Segmentation

-

1. Product Type

- 1.1. Used Cars

- 1.2. New Cars

-

2. Provider Type

- 2.1. Non-Captive Banks

- 2.2. Non-banking Financial Services

- 2.3. Original Equipment Manufacturers (Captives)

- 2.4. Other Providers

Europe Car Loan Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Car Loan Market Regional Market Share

Geographic Coverage of Europe Car Loan Market

Europe Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In EV Sales; Rapid Digitalization And Shifting Consumer Preference For Digital Lending Platforms

- 3.3. Market Restrains

- 3.3.1. Increase In EV Sales; Rapid Digitalization And Shifting Consumer Preference For Digital Lending Platforms

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Luxury Cars Fueling the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Used Cars

- 5.1.2. New Cars

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Non-Captive Banks

- 5.2.2. Non-banking Financial Services

- 5.2.3. Original Equipment Manufacturers (Captives)

- 5.2.4. Other Providers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Used Cars

- 6.1.2. New Cars

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Non-Captive Banks

- 6.2.2. Non-banking Financial Services

- 6.2.3. Original Equipment Manufacturers (Captives)

- 6.2.4. Other Providers

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Used Cars

- 7.1.2. New Cars

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Non-Captive Banks

- 7.2.2. Non-banking Financial Services

- 7.2.3. Original Equipment Manufacturers (Captives)

- 7.2.4. Other Providers

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Used Cars

- 8.1.2. New Cars

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Non-Captive Banks

- 8.2.2. Non-banking Financial Services

- 8.2.3. Original Equipment Manufacturers (Captives)

- 8.2.4. Other Providers

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Used Cars

- 9.1.2. New Cars

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Non-Captive Banks

- 9.2.2. Non-banking Financial Services

- 9.2.3. Original Equipment Manufacturers (Captives)

- 9.2.4. Other Providers

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Used Cars

- 10.1.2. New Cars

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Non-Captive Banks

- 10.2.2. Non-banking Financial Services

- 10.2.3. Original Equipment Manufacturers (Captives)

- 10.2.4. Other Providers

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Used Cars

- 11.1.2. New Cars

- 11.2. Market Analysis, Insights and Forecast - by Provider Type

- 11.2.1. Non-Captive Banks

- 11.2.2. Non-banking Financial Services

- 11.2.3. Original Equipment Manufacturers (Captives)

- 11.2.4. Other Providers

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Santander Consumer Finance

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Credit Agricole

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 HSBC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Societe Generale

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 UniCredit

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nordea

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lloyds Banking Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CaixaBank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Banque Populaire

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 NatWest Group**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Santander Consumer Finance

List of Figures

- Figure 1: Global Europe Car Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Car Loan Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Germany Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: Germany Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: Germany Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Germany Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: Germany Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 8: Germany Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 9: Germany Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 10: Germany Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 11: Germany Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Germany Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Germany Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Germany Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 15: United Kingdom Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: United Kingdom Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 17: United Kingdom Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: United Kingdom Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: United Kingdom Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 20: United Kingdom Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 21: United Kingdom Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 22: United Kingdom Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 23: United Kingdom Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 24: United Kingdom Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 25: United Kingdom Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: United Kingdom Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 27: France Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: France Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: France Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: France Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: France Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 32: France Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 33: France Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 34: France Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 35: France Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 36: France Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 37: France Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: France Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Italy Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Italy Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 41: Italy Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Italy Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Italy Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 44: Italy Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 45: Italy Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 46: Italy Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 47: Italy Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Italy Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Italy Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Italy Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Spain Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Spain Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Spain Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Spain Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Spain Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 56: Spain Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 57: Spain Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 58: Spain Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 59: Spain Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Spain Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Spain Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Spain Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Europe Europe Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 64: Rest of Europe Europe Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 65: Rest of Europe Europe Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Rest of Europe Europe Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Rest of Europe Europe Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 68: Rest of Europe Europe Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 69: Rest of Europe Europe Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 70: Rest of Europe Europe Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 71: Rest of Europe Europe Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Europe Europe Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Rest of Europe Europe Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Europe Europe Car Loan Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 5: Global Europe Car Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Car Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 11: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 17: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 22: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 23: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 28: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 29: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 34: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 35: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Europe Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Europe Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 40: Global Europe Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 41: Global Europe Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Loan Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Europe Car Loan Market?

Key companies in the market include Santander Consumer Finance, Credit Agricole, HSBC, Societe Generale, UniCredit, Nordea, Lloyds Banking Group, CaixaBank, Banque Populaire, NatWest Group**List Not Exhaustive.

3. What are the main segments of the Europe Car Loan Market?

The market segments include Product Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 287.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase In EV Sales; Rapid Digitalization And Shifting Consumer Preference For Digital Lending Platforms.

6. What are the notable trends driving market growth?

Rise in Demand for Luxury Cars Fueling the Market Growth.

7. Are there any restraints impacting market growth?

Increase In EV Sales; Rapid Digitalization And Shifting Consumer Preference For Digital Lending Platforms.

8. Can you provide examples of recent developments in the market?

March 2023: AMS, the global talent solutions business, and Tesco Bank, which serves over 5 million customers in the UK, announced the establishment of a new 3-year partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Loan Market?

To stay informed about further developments, trends, and reports in the Europe Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence