Key Insights

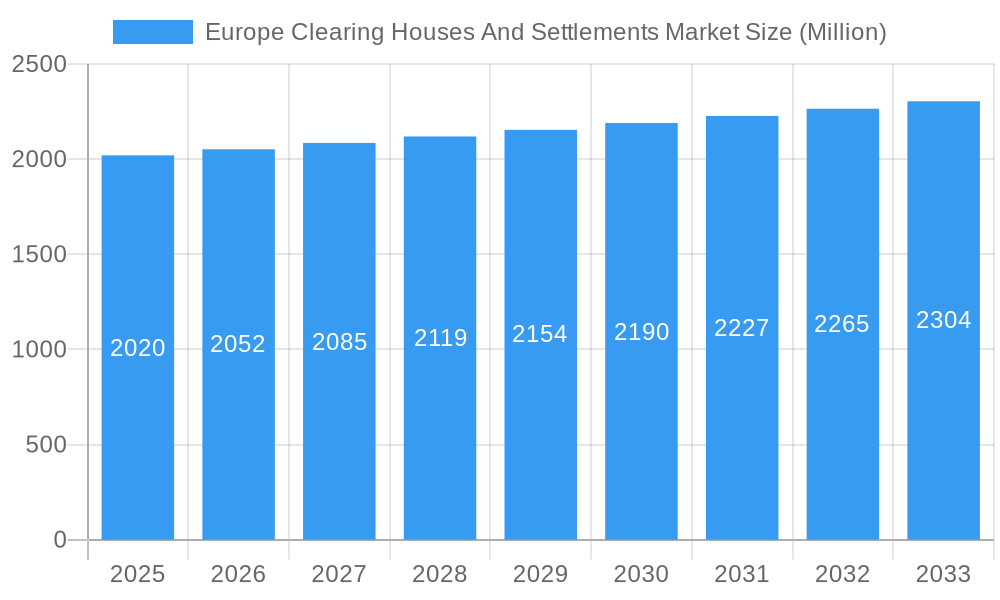

The European Clearing Houses and Settlements market, valued at €2.02 billion in 2025, is projected to experience steady growth, driven primarily by increasing regulatory scrutiny demanding greater transparency and risk mitigation in financial transactions. This necessitates robust clearing and settlement infrastructure, fueling demand for the services offered by established players like Euroclear, Clearstream Banking, and LCH Clearnet, as well as newer entrants leveraging technology such as blockchain for improved efficiency and reduced costs. The market's growth, while modest at a projected Compound Annual Growth Rate (CAGR) of 1.59% between 2025 and 2033, reflects a mature yet evolving landscape. Innovation in areas like digital assets and decentralized finance (DeFi) presents both opportunities and challenges, with established players adapting their offerings and new players emerging to cater to these evolving needs. However, persistent economic uncertainty and potential regulatory changes could act as restraints, impacting the overall growth trajectory. The market segmentation, while not explicitly provided, can be inferred to include segments based on clearing house type (e.g., central securities depositories, payment clearing houses), asset class (e.g., equities, bonds, derivatives), and client type (e.g., institutional investors, retail investors). The competitive landscape remains intense, with both established global players and niche providers vying for market share.

Europe Clearing Houses And Settlements Market Market Size (In Billion)

The forecast period (2025-2033) will likely see continued consolidation within the industry, as smaller players seek strategic partnerships or acquisitions to enhance their competitiveness. Growth will depend heavily on successful technological integrations, the adaptability of clearing houses to regulatory shifts, and their ability to efficiently manage increasing transaction volumes driven by market activity. Expanding into new markets and diversifying services to cater to a broader range of asset classes and client segments will also be key for sustained market success. The historical period (2019-2024) likely demonstrated variations influenced by global economic cycles and specific regulatory developments impacting the financial services sector across Europe. Understanding these historical trends is crucial for accurate forecasting and informed decision-making within this competitive market.

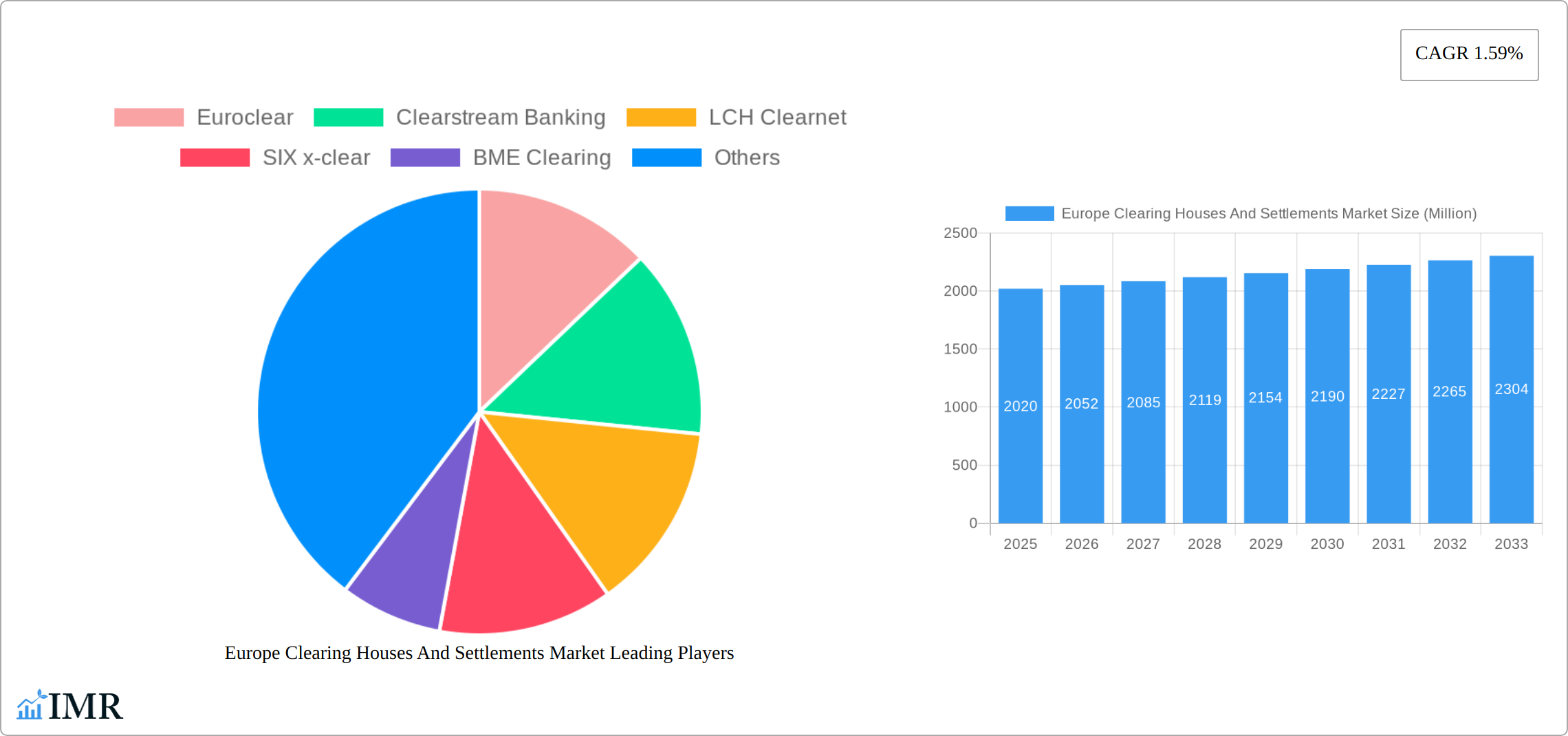

Europe Clearing Houses And Settlements Market Company Market Share

Europe Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European clearing houses and settlements market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is vital for market participants, investors, and industry professionals seeking a clear understanding of this dynamic sector. The total market size in 2025 is estimated at xx Million.

Europe Clearing Houses and Settlements Market Market Dynamics & Structure

The European clearing houses and settlements market is characterized by a moderately concentrated structure with key players such as Euroclear, Clearstream Banking, and LCH Clearnet holding significant market share. The market size in 2025 is estimated to be xx Million. Technological advancements, particularly in distributed ledger technology (DLT) and artificial intelligence (AI), are driving innovation. Stringent regulatory frameworks, including those from the European Securities and Markets Authority (ESMA), heavily influence market operations. The emergence of new fintech companies and the increasing use of digital assets present both opportunities and challenges. Consolidation through mergers and acquisitions (M&A) is another key factor impacting the market structure.

- Market Concentration: The top three players hold approximately xx% of the market share in 2025.

- Technological Innovation: DLT adoption is gradually increasing, streamlining processes and reducing costs. AI-powered solutions are enhancing risk management and fraud detection.

- Regulatory Framework: ESMA regulations influence market operations and compliance requirements.

- Competitive Substitutes: The emergence of decentralized finance (DeFi) platforms presents a potential, albeit currently limited, competitive threat.

- M&A Activity: The past five years have seen xx M&A deals, indicating a trend towards consolidation.

Europe Clearing Houses and Settlements Market Growth Trends & Insights

The European clearing houses and settlements market has experienced steady growth over the historical period (2019-2024), driven by increasing trading volumes and the need for efficient and secure settlement mechanisms. The Compound Annual Growth Rate (CAGR) during this period is estimated at xx%. The adoption of DLT and other technologies is accelerating market growth, as is the increasing complexity of financial instruments. Changing consumer behavior towards digital channels and preference for faster settlements is further fueling market expansion. The market size is projected to reach xx Million by 2033.

- Market Size Evolution: Steady growth from xx Million in 2019 to an estimated xx Million in 2025.

- Adoption Rates: DLT adoption is increasing, with a projected xx% market penetration by 2033.

- Technological Disruptions: The emergence of new technologies continues to drive efficiency and innovation.

- Consumer Behavior: The shift towards digital channels increases the demand for seamless and fast settlement processes.

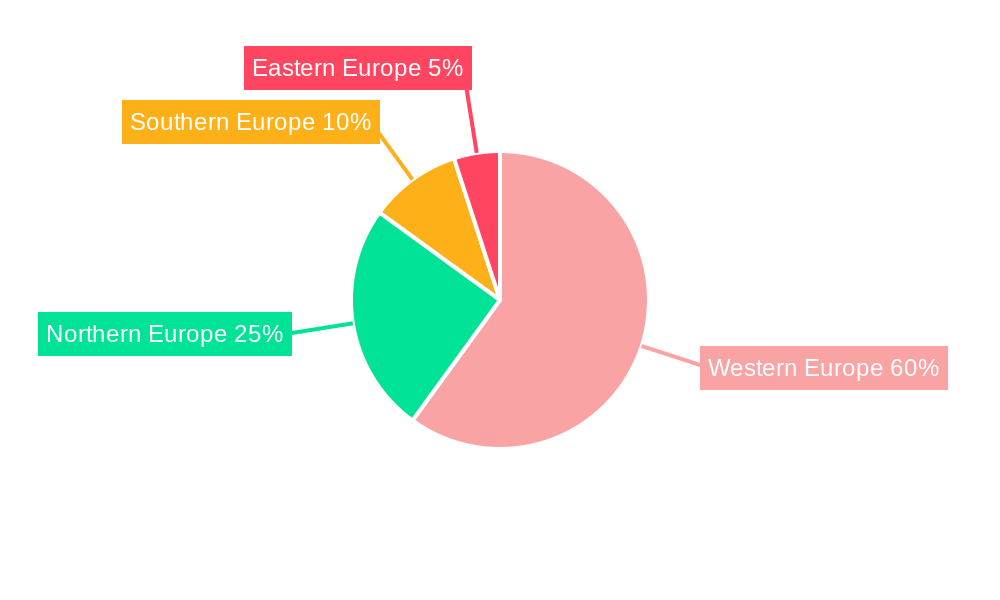

Dominant Regions, Countries, or Segments in Europe Clearing Houses And Settlements Market

The United Kingdom and Germany currently stand as the stalwarts of the European clearing houses and settlements market. This dominance is deeply rooted in their highly developed financial ecosystems, extensive capital markets, and consistently high trading volumes across a diverse range of financial instruments. Beyond these two powerhouses, France, the Netherlands, and Luxembourg also play crucial roles, contributing significantly to the market's overall dynamism. The sustained growth witnessed in these regions is a direct consequence of their strong and stable economic performance, the implementation of robust and forward-thinking regulatory frameworks that foster trust and stability, and ongoing, substantial investments in technological upgrades aimed at enhancing efficiency, security, and scalability.

- Key Regional Strengths:

- United Kingdom: Boasts a world-class financial infrastructure, deep liquidity, and is home to major global trading hubs, attracting significant international financial activity.

- Germany: Characterized by its colossal banking sector, substantial industrial output, and significant domestic and international trading activity, making it a cornerstone of European finance.

- France: Actively fosters a supportive environment for fintech innovation and the development of new financial technologies through strategic government initiatives and venture capital funding.

- Netherlands & Luxembourg: Serve as crucial hubs for international finance and investment funds, benefiting from favorable regulatory regimes and strategic geographical locations.

- Factors Underpinning Dominance: The continued leadership of these regions is attributable to a potent combination of consistently high trading volumes across equities, derivatives, and fixed income, adherence to stringent and well-established regulatory frameworks that ensure market integrity, and the rapid adoption of advanced technologies to optimize clearing and settlement processes.

- Untapped Potential: While established markets lead, the Eastern European region presents a landscape ripe with substantial untapped potential. As these economies mature and their financial markets develop, they offer significant opportunities for growth and expansion for clearing and settlement service providers.

Europe Clearing Houses And Settlements Market Product Landscape

The market offers a range of clearing and settlement services, including securities settlement, derivatives clearing, and collateral management. Recent innovations include the integration of DLT for faster and more efficient processing, as well as AI-powered risk management tools. These advancements are focused on enhancing speed, security, and transparency in transactions.

Key Drivers, Barriers & Challenges in Europe Clearing Houses And Settlements Market

Key Drivers:

The European clearing houses and settlements market is being propelled forward by several critical factors. A paramount driver is the increasing regulatory scrutiny and the subsequent implementation of more stringent compliance requirements, which necessitate enhanced operational efficiency and robustness from market infrastructures. Furthermore, the burgeoning adoption of digital assets, including cryptocurrencies and tokenized securities, is creating new avenues for clearing and settlement. Technological advancements, particularly the exploration and implementation of Distributed Ledger Technology (DLT), are proving instrumental in streamlining complex processes, reducing settlement times, and bolstering overall market security and transparency.

Key Challenges:

Despite the positive momentum, the market faces significant headwinds. Pervasive cybersecurity threats pose an ever-present risk, demanding continuous investment in advanced protective measures. The inherent complexity and ever-evolving nature of regulatory landscapes across different European jurisdictions present a considerable challenge for harmonization and efficient operation. Competition is intensifying, not only from traditional players but also from innovative new market entrants and FinTech firms offering specialized solutions. Moreover, the integration of novel technologies requires substantial upfront investment in infrastructure and talent, and ensuring the utmost data privacy and compliance with GDPR and similar regulations remains a critical and ongoing concern.

Emerging Opportunities in Europe Clearing Houses And Settlements Market

The European clearing houses and settlements market is at the cusp of a transformative era, characterized by several compelling emerging opportunities. The ongoing rise of tokenization, which involves representing real-world assets as digital tokens on a blockchain, is set to revolutionize how assets are traded and settled, offering enhanced liquidity and accessibility. The burgeoning field of Decentralized Finance (DeFi) presents disruptive potential, pushing traditional players to adapt and integrate new models for financial transactions. Furthermore, the increasing demand for efficient and secure cross-border payment solutions, facilitated by technological innovation, opens up significant avenues for growth. The strategic expansion into underserved emerging markets within and beyond Europe also offers substantial potential for market participants seeking new revenue streams.

Growth Accelerators in the Europe Clearing Houses And Settlements Market Industry

Several potent forces are actively accelerating the growth trajectory of the European clearing houses and settlements market. Foremost among these are transformative technological advancements, with Distributed Ledger Technology (DLT) and Artificial Intelligence (AI) leading the charge. DLT promises to enhance transparency, security, and efficiency, while AI can optimize risk management, fraud detection, and operational processes. Strategic partnerships and collaborations between established financial institutions and agile FinTech companies are proving to be powerful catalysts for innovation, enabling the co-creation of cutting-edge solutions and the rapid scaling of new services. Beyond technology, proactive expansion into new geographic markets, coupled with increasing regulatory clarity and a supportive policy environment, further bolsters the industry's growth prospects.

Key Players Shaping the Europe Clearing Houses And Settlements Market Market

- Euroclear

- Clearstream Banking

- LCH Clearnet

- SIX x-clear

- BME Clearing

- National Settlements Depository (NSD)

- Monte Titoli

- Nasdaq CSD

- Bitbond

- Fnality

- Clearmatics (List Not Exhaustive)

Notable Milestones in Europe Clearing Houses And Settlements Market Sector

- June 2023: Cboe Clear Europe plans to launch a CCP clearing service for SFTs.

- March 2023: Euroclear announces the potential release of a new DLT platform for securities trading.

In-Depth Europe Clearing Houses And Settlements Market Market Outlook

The outlook for the European clearing houses and settlements market remains exceptionally strong, with a clear trajectory towards continued and significant growth. This expansion will be underpinned by the relentless pace of technological innovation, the ongoing adaptation to evolving regulatory landscapes, and the sustained increase in trading volumes across various asset classes. The market is expected to be further shaped by strategic alliances and collaborations, as well as aggressive expansion into new and emerging markets, creating a dynamic and opportunity-rich environment for all participants. Projections indicate substantial growth throughout the forecast period, broadly spanning from 2025 to 2033, signaling a period of robust development and transformation for the industry.

Europe Clearing Houses And Settlements Market Segmentation

-

1. Type

- 1.1. Outward House Clearing

- 1.2. Inward House Clearing

-

2. Type of System

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

- 2.4. Other Systems

Europe Clearing Houses And Settlements Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Clearing Houses And Settlements Market Regional Market Share

Geographic Coverage of Europe Clearing Houses And Settlements Market

Europe Clearing Houses And Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Requirements; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Regulatory Requirements; Technological Advancements

- 3.4. Market Trends

- 3.4.1. SEPA Schemes are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Clearing Houses And Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward House Clearing

- 5.1.2. Inward House Clearing

- 5.2. Market Analysis, Insights and Forecast - by Type of System

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euroclear

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearstream Banking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LCH Clearnet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIX x-clear

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BME Clearing

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Settlements Depository (NSD)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Monte Titoli

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nasdaq CSD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bitbond

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fnality

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Clearmatics**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Euroclear

List of Figures

- Figure 1: Europe Clearing Houses And Settlements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Clearing Houses And Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 3: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 4: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 5: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Region 2020 & 2033

- Table 7: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 9: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 10: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 11: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Clearing Houses And Settlements Market?

The projected CAGR is approximately 1.59%.

2. Which companies are prominent players in the Europe Clearing Houses And Settlements Market?

Key companies in the market include Euroclear, Clearstream Banking, LCH Clearnet, SIX x-clear, BME Clearing, National Settlements Depository (NSD), Monte Titoli, Nasdaq CSD, Bitbond, Fnality, Clearmatics**List Not Exhaustive.

3. What are the main segments of the Europe Clearing Houses And Settlements Market?

The market segments include Type, Type of System.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Requirements; Technological Advancements.

6. What are the notable trends driving market growth?

SEPA Schemes are Driving the Market.

7. Are there any restraints impacting market growth?

Regulatory Requirements; Technological Advancements.

8. Can you provide examples of recent developments in the market?

On June 2023, Cboe Clear Europe's plan to launch a central counterparty (CCP) clearing service for securities financing transactions (SFTs). Cboe Clear Europe is a wholly-owned subsidiary of derivatives and securities exchange network Cboe Clear Markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Quadrillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Clearing Houses And Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Clearing Houses And Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Clearing Houses And Settlements Market?

To stay informed about further developments, trends, and reports in the Europe Clearing Houses And Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence