Key Insights

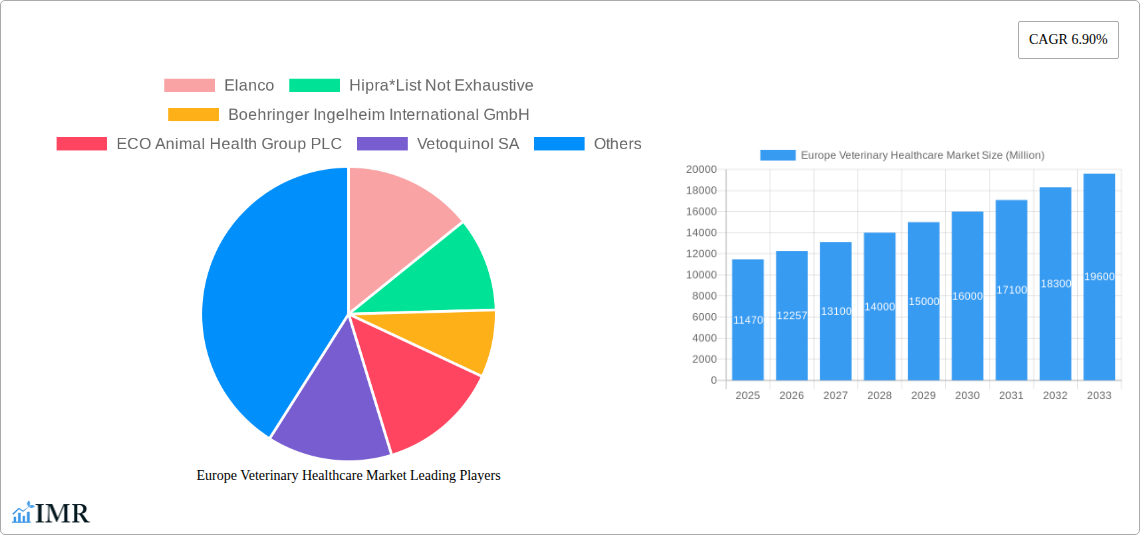

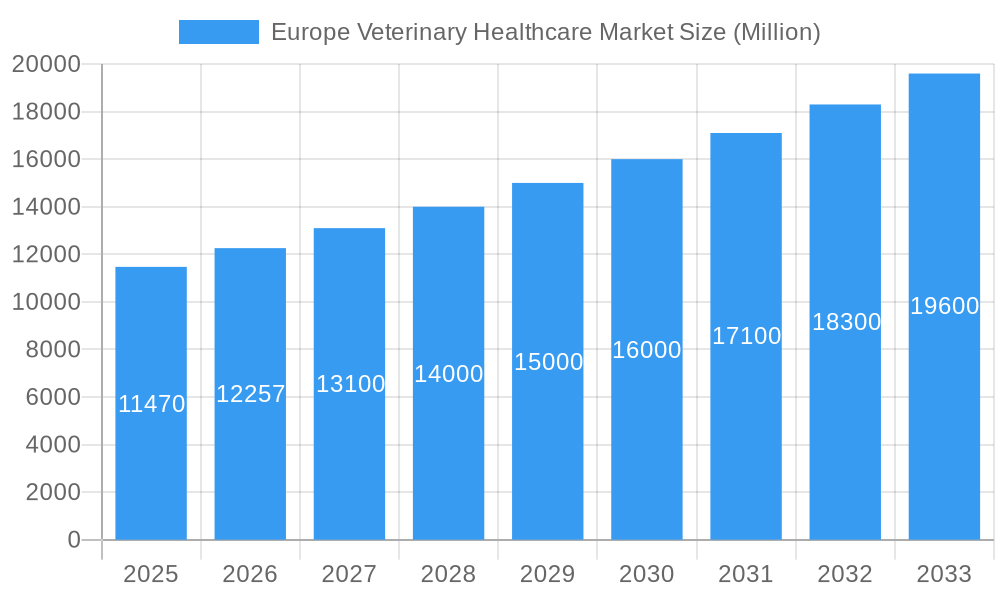

The European veterinary healthcare market, valued at €11.47 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing pet ownership across Europe, coupled with rising pet humanization—treating pets as family members—is fueling demand for higher-quality veterinary care and advanced diagnostics. The growing awareness of animal health and welfare among pet owners is also a significant driver, leading to increased spending on preventative care, specialized treatments, and premium pet food. Technological advancements, such as the development of innovative pharmaceuticals and diagnostic tools, contribute to market expansion by enabling more effective disease management and improved animal health outcomes. Furthermore, the increasing prevalence of chronic diseases in animals, similar to human health trends, necessitates ongoing veterinary care, further bolstering market growth. The market's segmentation reflects this diversified demand, with therapeutics dominating the product segment, followed by diagnostics. Dogs and cats constitute the largest animal type segment, although horses, ruminants, and poultry contribute significantly depending on regional agricultural practices. Major players like Zoetis, Elanco, Boehringer Ingelheim, and others are actively shaping the market through research and development, strategic acquisitions, and expansion into new therapeutic areas.

Europe Veterinary Healthcare Market Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033 indicates substantial growth potential for the European veterinary healthcare market. This growth is anticipated to be consistent across various segments, although some may experience faster growth based on evolving veterinary practices and consumer preferences. Regulatory changes impacting the availability and pricing of veterinary pharmaceuticals and diagnostic tools will influence the market’s trajectory. The competitive landscape is characterized by both large multinational corporations and smaller specialized companies, suggesting opportunities for both innovation and consolidation. Regional variations within Europe are expected, with countries like Germany, France, and the United Kingdom exhibiting larger market shares due to higher pet ownership rates and greater disposable incomes. However, growth in other European nations, driven by improving economies and changing pet ownership trends, is anticipated to contribute significantly to overall market expansion.

Europe Veterinary Healthcare Market Company Market Share

Europe Veterinary Healthcare Market: A Comprehensive Market Report (2019-2033)

This comprehensive report offers a detailed analysis of the Europe Veterinary Healthcare Market, providing invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, and provides a granular understanding of market dynamics, growth trends, key players, and emerging opportunities across various segments. The base year for this analysis is 2025. Market values are presented in million units.

Europe Veterinary Healthcare Market Market Dynamics & Structure

The European veterinary healthcare market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. Technological innovation, particularly in diagnostics and therapeutics, is a primary growth driver. Stringent regulatory frameworks, including those governing drug approvals and animal welfare, significantly influence market operations. The market experiences competition from both established players and emerging companies offering innovative solutions. End-user demographics, specifically the increasing pet ownership and the shift towards companion animal healthcare, are key factors influencing market demand. Furthermore, the market witnesses continuous mergers and acquisitions (M&A) activity, reflecting consolidation and strategic expansion.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share (2024).

- Technological Innovation: Driven by advancements in diagnostics (e.g., point-of-care testing), therapeutics (e.g., targeted therapies), and data analytics.

- Regulatory Framework: Stringent regulations across EU countries impacting product approvals and market access.

- Competitive Landscape: Intense competition among established players and emerging companies with novel technologies.

- M&A Activity: Moderate level of M&A activity in recent years, with xx deals recorded between 2019-2024.

- Innovation Barriers: High R&D costs, lengthy regulatory approval processes, and limited market access in some regions.

Europe Veterinary Healthcare Market Growth Trends & Insights

The European veterinary healthcare market exhibits strong growth, driven by factors such as rising pet ownership, increasing humanization of pets, growing awareness of animal health, and technological advancements. The market size experienced steady growth during the historical period (2019-2024), and is projected to maintain a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Adoption rates for advanced diagnostics and therapeutics are rising, while technological disruptions, such as the implementation of telemedicine and AI-driven diagnostics, are transforming the market. Consumer behavior shows a willingness to invest more in pet health, creating a favorable environment for market expansion. The increasing prevalence of chronic diseases in animals also boosts demand for veterinary healthcare services.

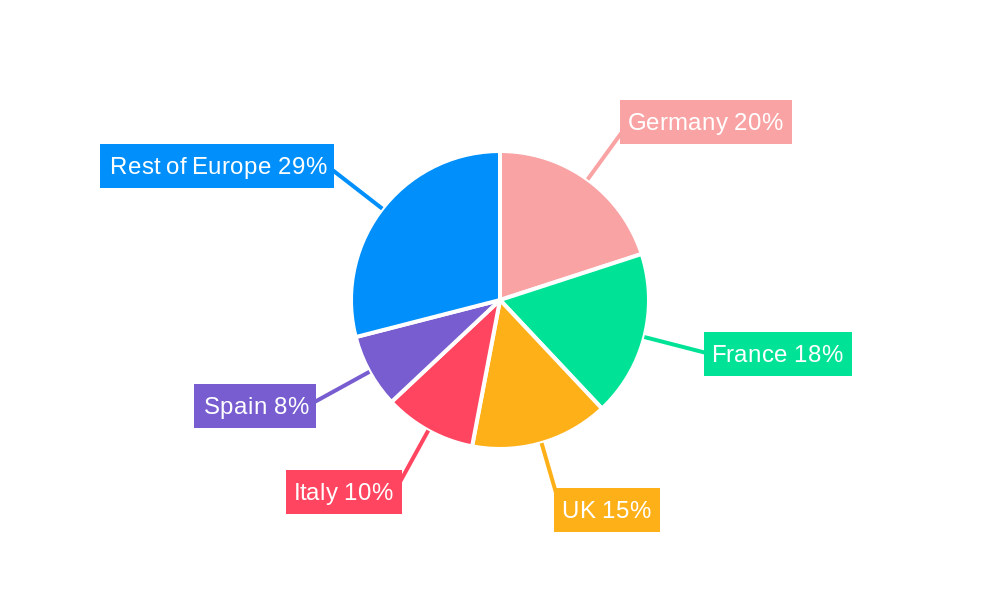

Dominant Regions, Countries, or Segments in Europe Veterinary Healthcare Market

Germany, France, and the UK represent the leading national markets within Europe, collectively accounting for approximately xx% of the total market value. The "Dogs and Cats" segment dominates the animal type classification, followed by the "Ruminants" and "Swine" segments. Within product categories, the "Therapeutics" segment commands a larger market share compared to "Diagnostics," though both demonstrate substantial growth potential. This dominance is driven by several factors. Germany and France possess well-established veterinary healthcare infrastructures and higher pet ownership rates compared to other European nations. The economic strength and consumer spending in these countries contributes substantially to the market's growth. The high prevalence of companion animals drives the “Dogs and Cats” segment, while the significant livestock population in certain regions fuels demand for animal health solutions in “Ruminants” and “Swine.”

- Key Drivers: High pet ownership, strong veterinary infrastructure, government support for animal health initiatives, and rising disposable incomes.

- Dominance Factors: High per capita spending on veterinary care, well-developed distribution networks, and significant livestock populations.

- Growth Potential: Untapped markets in Eastern Europe, increasing demand for specialized veterinary services, and the potential for technological advancements.

Europe Veterinary Healthcare Market Product Landscape

The European veterinary healthcare market offers a diverse range of products, including therapeutics for various animal species and a growing portfolio of diagnostic tools. Innovations focus on improving efficacy, safety, and ease of use. Therapeutic advancements involve targeted therapies and personalized medicine, while diagnostics benefit from point-of-care testing, allowing for rapid diagnosis and treatment. Unique selling propositions often highlight superior efficacy, reduced side effects, and improved convenience for both veterinarians and animal owners. Technological advancements, such as AI and machine learning, are being integrated into diagnostic tools to enhance accuracy and speed.

Key Drivers, Barriers & Challenges in Europe Veterinary Healthcare Market

Key Drivers:

- Rising pet ownership and humanization of pets.

- Increasing prevalence of chronic diseases in animals.

- Technological advancements in diagnostics and therapeutics.

- Growing awareness of animal welfare and preventative care.

Key Challenges:

- Stringent regulatory approvals and high R&D costs.

- Competition from generic products and price pressure.

- Supply chain disruptions impacting availability of raw materials and finished goods.

- Economic downturns affecting consumer spending on veterinary services. A xx% decline in veterinary spending was observed in 2023 during a minor recession in some regions.

Emerging Opportunities in Europe Veterinary Healthcare Market

- Telemedicine for veterinary care: Expanding access to veterinary services in remote areas.

- Personalized medicine for animals: Tailored treatments based on individual animal genetics and health status.

- Advancements in diagnostic tools: Increased accuracy and speed of disease detection.

- Growth of specialized veterinary services: Addressing niche animal health needs.

- Expansion into untapped markets in Eastern Europe: High potential for growth in emerging economies.

Growth Accelerators in the Europe Veterinary Healthcare Market Industry

Several factors contribute to the long-term growth of the European veterinary healthcare market. Technological breakthroughs, such as AI-powered diagnostic tools and advanced therapeutics, continue to enhance the efficiency and effectiveness of veterinary care. Strategic partnerships between pharmaceutical companies, veterinary clinics, and technology providers facilitate the development and deployment of innovative solutions. Furthermore, the increasing prevalence of chronic diseases in animals creates an ongoing need for advanced therapies, driving market expansion. Market expansion strategies, such as the introduction of new products and services in untapped markets, will also accelerate growth.

Key Players Shaping the Europe Veterinary Healthcare Market Market

- Elanco

- Hipra

- Boehringer Ingelheim International GmbH

- ECO Animal Health Group PLC

- Vetoquinol SA

- Ceva Sante Animale (CEVA)

- MSD Animal Health

- Idexx Laboratories Inc

- Virbac

- Zoetis Inc

Notable Milestones in Europe Veterinary Healthcare Market Sector

- April 2024: VolitionRx Limited, in collaboration with Antech, launched the Nu.Q Vet Cancer Test for in-clinic use in the US and Europe. This affordable blood test aids early cancer detection in at-risk dog breeds.

- February 2024: VIC Group's VIC Animal Health opened a new plant producing 214,000 vials of sterile injectable suspensions, 660,000 anti-mastitis suspensions in syringes, and 142,000 vials of sterile powder for farm animals.

In-Depth Europe Veterinary Healthcare Market Market Outlook

The European veterinary healthcare market is poised for sustained growth, driven by technological innovation, increasing pet ownership, and the rising demand for advanced veterinary services. Strategic opportunities lie in the development and commercialization of novel therapeutics and diagnostics, expansion into untapped markets, and leveraging telemedicine and other digital technologies to improve access to care. The market presents significant opportunities for both established players and innovative newcomers to capitalize on the ongoing evolution of the veterinary healthcare landscape.

Europe Veterinary Healthcare Market Segmentation

-

1. Product

-

1.1. Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Europe Veterinary Healthcare Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Veterinary Healthcare Market Regional Market Share

Geographic Coverage of Europe Veterinary Healthcare Market

Europe Veterinary Healthcare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising number of Pet Adoptions; Increasing Initiatives by Governments and Animal Welfare Associations; Technological Advancements in Animal Healthcare

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicines; Increasing Pet Care Costs

- 3.4. Market Trends

- 3.4.1. Dogs and Cats Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti-infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs and Cats

- 6.2.2. Horses

- 6.2.3. Ruminants

- 6.2.4. Swine

- 6.2.5. Poultry

- 6.2.6. Other Animals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti-infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs and Cats

- 7.2.2. Horses

- 7.2.3. Ruminants

- 7.2.4. Swine

- 7.2.5. Poultry

- 7.2.6. Other Animals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti-infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs and Cats

- 8.2.2. Horses

- 8.2.3. Ruminants

- 8.2.4. Swine

- 8.2.5. Poultry

- 8.2.6. Other Animals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Italy Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti-infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular Diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs and Cats

- 9.2.2. Horses

- 9.2.3. Ruminants

- 9.2.4. Swine

- 9.2.5. Poultry

- 9.2.6. Other Animals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Spain Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti-infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular Diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs and Cats

- 10.2.2. Horses

- 10.2.3. Ruminants

- 10.2.4. Swine

- 10.2.5. Poultry

- 10.2.6. Other Animals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Therapeutics

- 11.1.1.1. Vaccines

- 11.1.1.2. Parasiticides

- 11.1.1.3. Anti-infectives

- 11.1.1.4. Medical Feed Additives

- 11.1.1.5. Other Therapeutics

- 11.1.2. Diagnostics

- 11.1.2.1. Immunodiagnostic Tests

- 11.1.2.2. Molecular Diagnostics

- 11.1.2.3. Diagnostic Imaging

- 11.1.2.4. Clinical Chemistry

- 11.1.2.5. Other Diagnostics

- 11.1.1. Therapeutics

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Dogs and Cats

- 11.2.2. Horses

- 11.2.3. Ruminants

- 11.2.4. Swine

- 11.2.5. Poultry

- 11.2.6. Other Animals

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Elanco

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hipra*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Boehringer Ingelheim International GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 ECO Animal Health Group PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vetoquinol SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ceva Sante Animale (CEVA)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MSD Animal Health

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Idexx Laboratories Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Virbac

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zoetis Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Elanco

List of Figures

- Figure 1: Europe Veterinary Healthcare Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Veterinary Healthcare Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Europe Veterinary Healthcare Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 9: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 15: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Veterinary Healthcare Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Europe Veterinary Healthcare Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 21: Europe Veterinary Healthcare Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Veterinary Healthcare Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Europe Veterinary Healthcare Market?

Key companies in the market include Elanco, Hipra*List Not Exhaustive, Boehringer Ingelheim International GmbH, ECO Animal Health Group PLC, Vetoquinol SA, Ceva Sante Animale (CEVA), MSD Animal Health, Idexx Laboratories Inc, Virbac, Zoetis Inc.

3. What are the main segments of the Europe Veterinary Healthcare Market?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising number of Pet Adoptions; Increasing Initiatives by Governments and Animal Welfare Associations; Technological Advancements in Animal Healthcare.

6. What are the notable trends driving market growth?

Dogs and Cats Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicines; Increasing Pet Care Costs.

8. Can you provide examples of recent developments in the market?

April 2024: VolitionRx Limited, in collaboration with Antech, introduced its Nu.Q Vet Cancer Test for in-clinic use by veterinarians throughout the United States and Europe. The Nu.Q Vet Cancer Test is an affordable and accessible screening test to aid early detection. It is a blood test for dogs in breeds with an increased risk of developing cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Veterinary Healthcare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Veterinary Healthcare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Veterinary Healthcare Market?

To stay informed about further developments, trends, and reports in the Europe Veterinary Healthcare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence