Key Insights

The GCC mutual fund market is poised for significant expansion, fueled by rising disposable incomes, a youthful demographic, and proactive government initiatives aimed at enhancing financial inclusion and investment diversification. The market's Compound Annual Growth Rate (CAGR) is projected to reach 6.5%, indicating sustained growth. Leading entities such as Riyad Capital, NCB Capital, and Samba Capital are instrumental in this growth, providing a wide spectrum of investment products to meet diverse investor needs. Market segmentation is expected to encompass equity, fixed-income, and Sharia-compliant funds, aligning with regional investment preferences. Growing investor awareness, both retail and institutional, further propels market adoption.

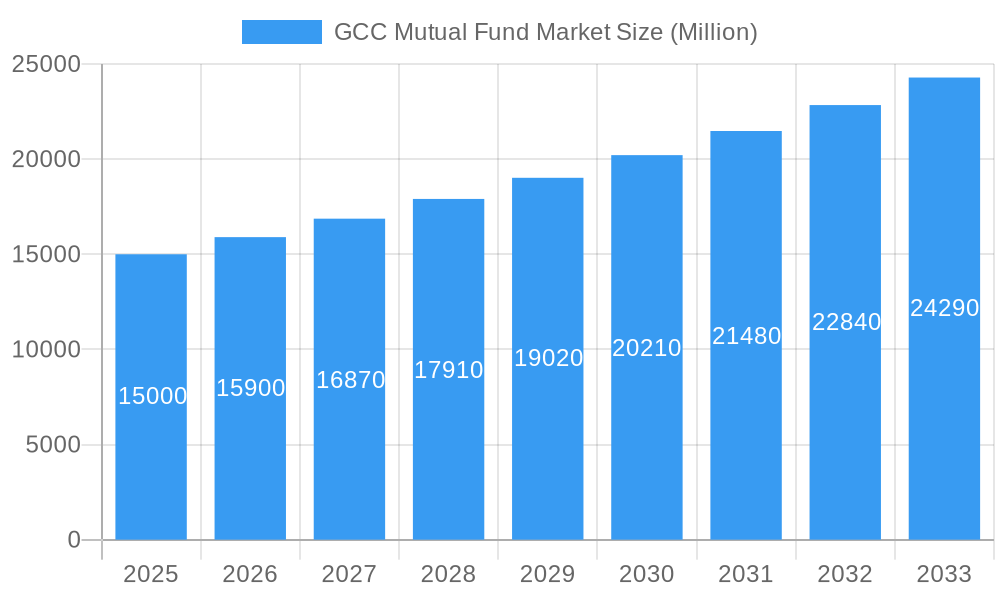

GCC Mutual Fund Market Market Size (In Billion)

Despite regional economic volatility and global market uncertainties, the long-term outlook for the GCC mutual fund market is optimistic. The projected market size is estimated at 4.5 billion by the base year 2025, with substantial growth anticipated through 2033. Key growth drivers include increased foreign direct investment, enhancements in financial infrastructure, and ongoing government efforts to foster economic development. An expanding middle class and heightened financial literacy also contribute significantly. Technological advancements, particularly in digital investment platforms, will be critical for market participants to improve accessibility and broaden their investor base. Competitive dynamics and potential new entrants will continue to foster innovation and shape the market landscape.

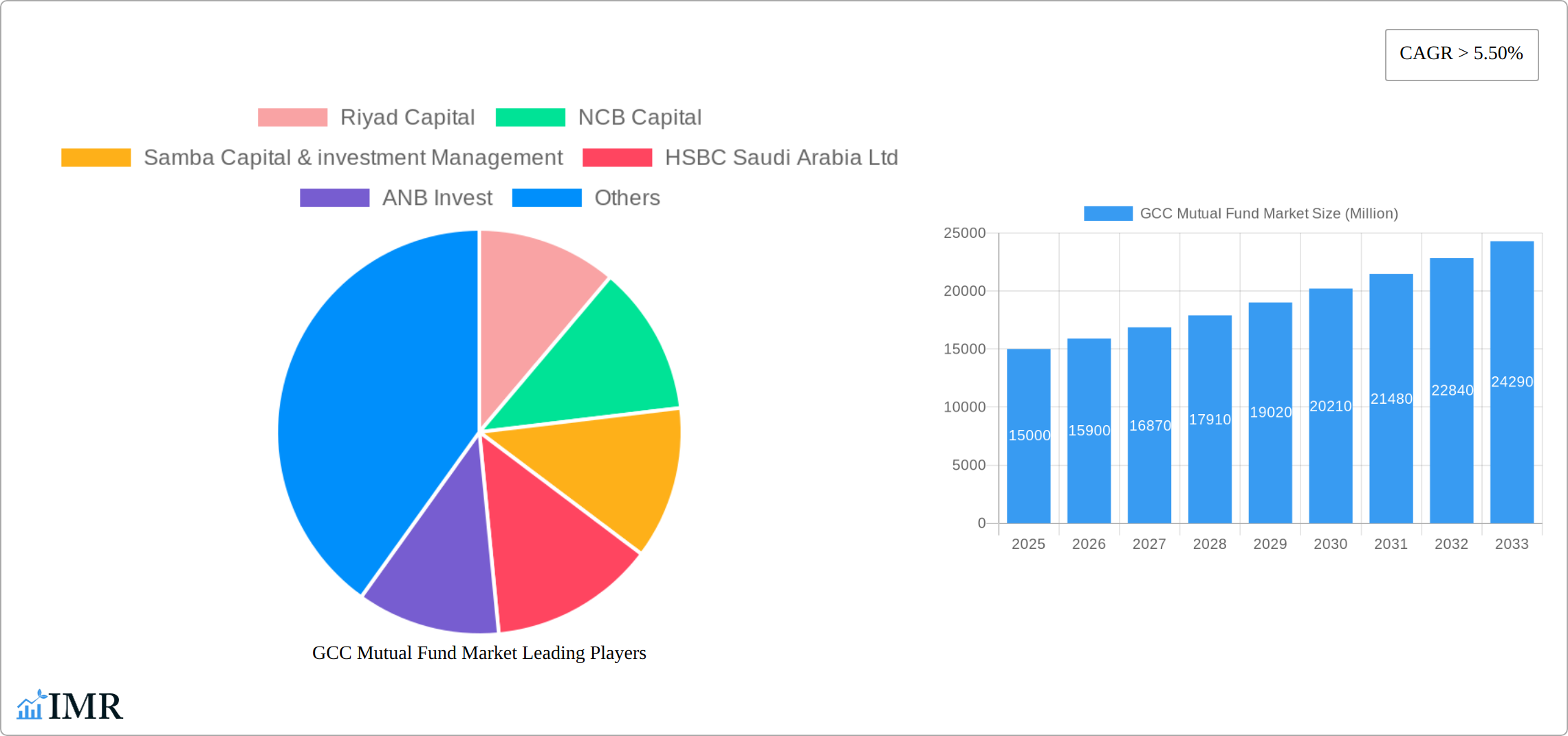

GCC Mutual Fund Market Company Market Share

GCC Mutual Fund Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the GCC Mutual Fund Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data and insights to offer a granular understanding of this dynamic market, crucial for investors, industry professionals, and strategic decision-makers. This report covers the parent market of GCC Financial Services and the child market of GCC Mutual Funds.

GCC Mutual Fund Market Dynamics & Structure

This section analyzes the GCC Mutual Fund market's competitive landscape, regulatory environment, and technological advancements, shaping its structure and growth trajectory. The market is characterized by a blend of established players and emerging entrants, leading to a moderately concentrated market structure. While precise market share figures for each player are unavailable at this time and require further market research, the top players appear to command the majority of market share.

Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share (estimated at xx%). This is mainly due to brand recognition, extensive distribution networks, and established expertise. Smaller players occupy niche segments and offer specialized products.

Technological Innovation: The sector is witnessing increasing technological adoption, with digital platforms and robo-advisors gaining traction. However, high infrastructure costs and digital literacy gaps present innovation barriers in certain segments.

Regulatory Framework: The regulatory environment plays a crucial role in market stability and investor confidence. Recent regulatory changes and reforms designed to improve transparency and investor protection are driving significant change in the market structure.

Competitive Substitutes: Alternative investment options, such as bonds and real estate, compete with mutual funds. The attractiveness of these alternatives depends on prevailing market conditions and risk appetite.

End-User Demographics: The market caters to a diverse range of investors, including retail investors, high-net-worth individuals (HNWIs), and institutional investors. The growth in the middle class and increasing financial literacy drive greater participation.

M&A Trends: The recent merger between NCB and Samba Financial Group (January 2022) illustrates a notable trend of consolidation, which may result in a higher degree of concentration in the years to come. While the exact number of M&A deals is currently xx, it is projected to increase significantly in the coming years. Specific market share data for each player and historical M&A deal volumes require further research.

GCC Mutual Fund Market Growth Trends & Insights

The GCC Mutual Fund market has experienced significant growth during the historical period (2019-2024), driven by factors such as increasing disposable incomes, growing financial awareness, and supportive government policies. The report uses proprietary data and market research methodologies (XXX) to project continued robust growth over the forecast period (2025-2033).

The market size is expected to reach xx Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth will be propelled by increasing investment in digital infrastructure, supportive regulatory initiatives designed to stimulate financial inclusion, and higher participation from retail investors.

The adoption rate of mutual funds is also expected to increase significantly, reaching xx% market penetration by 2033. This is mainly due to rising affluence and greater awareness of the benefits of diversification and professional fund management.

Technological disruptions, such as the introduction of mobile investment apps and robo-advisors, are further accelerating market growth by democratizing access to investment opportunities and enhancing user experience. Shifting consumer behavior patterns, with a preference for convenient and digitally enabled investment platforms, also influence market growth.

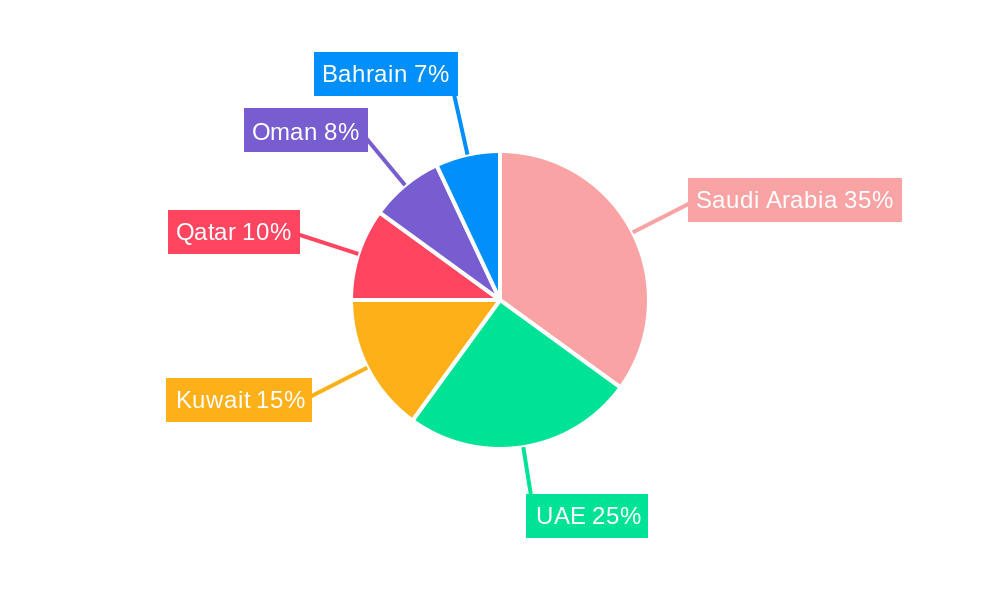

Dominant Regions, Countries, or Segments in GCC Mutual Fund Market

While precise data on regional and segmental breakdown requires further research, the Kingdom of Saudi Arabia is likely to remain the dominant market within the GCC, accounting for the largest share (estimated at xx%) of the total market value. This dominance is underpinned by several key drivers:

- Strong Economic Growth: Saudi Arabia's robust economic growth fosters a favorable environment for investment.

- Government Initiatives: Initiatives aimed at promoting financial inclusion and diversification of the economy are fostering substantial market expansion.

- Developed Financial Infrastructure: The country possesses a relatively well-developed financial infrastructure that supports the growth of the mutual funds market.

- Growing Middle Class: The expansion of the middle class contributes substantially to increasing retail investor participation.

Other GCC countries, such as the UAE and Kuwait, are also expected to exhibit significant growth, albeit at a slower pace compared to Saudi Arabia. The specific market share of each country requires detailed quantitative analysis.

GCC Mutual Fund Market Product Landscape

The GCC mutual fund market offers a diverse range of products catering to different risk profiles and investment goals. These include equity funds, income funds, balanced funds, and sector-specific funds. Recent innovations focus on Sharia-compliant funds and ESG (environmental, social, and governance) investing, reflecting growing demand for ethically responsible investment options. Performance metrics commonly used include Net Asset Value (NAV) growth, Alpha, Beta, and Sharpe Ratio, all of which are influenced by the macroeconomic environment and global investment patterns. Unique selling propositions (USPs) often center around specific investment strategies, performance track records, and experienced fund managers.

Key Drivers, Barriers & Challenges in GCC Mutual Fund Market

Key Drivers:

- Rising Disposable Incomes & Growing Middle Class: As disposable incomes continue to rise across the GCC, a larger segment of the population is seeking sophisticated investment avenues. This increased financial capacity directly translates to a greater propensity to invest in mutual funds, seeking capital appreciation and wealth preservation.

- Government Support & Regulatory Reforms: Proactive government initiatives aimed at diversifying economies away from oil, fostering financial literacy, and creating a more robust regulatory framework are acting as significant tailwinds. These reforms enhance investor confidence and provide a stable environment for market growth.

- Technological Advancements & Digitalization: The rapid adoption of digital platforms, mobile applications, and sophisticated robo-advisory services is revolutionizing accessibility and user experience. These innovations are lowering entry barriers, making mutual funds more appealing to a broader demographic, including younger and tech-savvy investors.

- Growing Demand for Sharia-Compliant Investments: The strong cultural preference for Sharia-compliant financial products presents a substantial opportunity. The development and promotion of Islamic mutual funds catering to these preferences are crucial for capturing a significant portion of the regional market.

Key Challenges & Restraints:

- Regulatory Hurdles & Evolving Compliance: While government support is present, navigating the diverse and often evolving regulatory landscapes across different GCC nations can be complex. Ensuring full compliance, especially for cross-border offerings, requires significant investment in legal and operational infrastructure, posing a challenge for smaller fund managers.

- Market Volatility & Global Economic Headwinds: The GCC markets, while growing, are not immune to global economic uncertainties, geopolitical events, and fluctuations in commodity prices. Such volatility can impact investor sentiment, increase fund performance variability, and necessitate careful risk management strategies.

- Intense Competition & Fee Pressures: The market is characterized by a growing number of domestic and international players, leading to intense competition. This necessitates continuous innovation in product offerings, operational efficiency, and a focus on cost optimization to remain competitive and attract assets under management. The precise impact of these factors requires detailed quantitative analysis.

- Limited Investor Awareness & Financial Literacy: Despite ongoing efforts, a segment of the population still exhibits limited awareness of mutual fund benefits and sophisticated investment strategies. Bridging this gap through enhanced financial education and targeted outreach is crucial for broader market penetration.

Emerging Opportunities in GCC Mutual Fund Market

- Untapped Market Segments & Financial Inclusion: Significant potential lies in expanding access to mutual funds among previously underserved populations, including women, expatriates, and individuals in less developed regions within the GCC. Tailoring products and distribution channels to these segments can unlock substantial growth.

- Innovative Product Development & Specialization: The demand for specialized investment products is on the rise. Developing niche funds focusing on sectors like technology, renewable energy, or specific real estate opportunities, as well as Sharia-compliant ESG (Environmental, Social, and Governance) funds, offers compelling growth avenues.

- Strategic Partnerships & Ecosystem Development: Collaborations between asset managers, fintech companies, banks, and even regional corporations can create synergistic ecosystems. These partnerships can facilitate wider distribution, co-create innovative solutions, and leverage complementary strengths for enhanced market reach and customer engagement.

- Retirement Planning & Long-Term Savings Solutions: With an aging population and a growing emphasis on personal financial planning, there is a burgeoning need for robust mutual fund-based retirement savings solutions. Developing attractive and accessible long-term investment plans will be a key growth driver.

Growth Accelerators in the GCC Mutual Fund Market Industry

The GCC mutual fund market is poised for accelerated growth, driven by a confluence of factors. Technological advancements, particularly the exploration and implementation of blockchain technology, offer the potential for enhanced transparency, reduced transaction costs, and increased efficiency in fund operations and settlements. Furthermore, strategic partnerships between established local asset managers and international financial institutions are crucial for leveraging global expertise, accessing diverse capital pools, and introducing best-in-class investment strategies to the region. The continued expansion of the range of available fund products, with a particular focus on those aligned with Islamic finance principles and the growing global demand for ESG (Environmental, Social, and Governance) investing, is expected to attract a broader and more diverse investor base, thereby significantly fueling market expansion. Complementing these developments, proactive and targeted active marketing campaigns that clearly articulate the benefits of mutual fund investments, coupled with comprehensive financial literacy initiatives designed to empower less financially knowledgeable investors, will play a vital role in stimulating broader market adoption and sustained growth.

Key Players Shaping the GCC Mutual Fund Market Market

- Riyad Capital

- NCB Capital

- Samba Capital & Investment Management

- HSBC Saudi Arabia Ltd

- ANB Invest

- Saudi Hollandi Capital

- Al Rajhi Capital

- Jadwa Investment

- Caaam Saudi Fransi

- BNP Paribas Asset Management

- Standard Chartered Bank

- NBK Capital

- Mashreq Bank

- First Abu Dhabi Bank (FAB)

- Emirates NBD Asset Management

- Investcorp

- GFH Financial Group

- List Not Exhaustive, representing a dynamic and evolving landscape.

Notable Milestones in GCC Mutual Fund Market Sector

- May 2023: Riyad Capital launches the Riyad Real Estate Development fund - Durrat Hitteen (USD 133.3 million), signifying expansion into real estate-focused investments.

- January 2022: Merger of NCB and Samba Financial Group, creating a larger entity and potentially reshaping the market landscape.

In-Depth GCC Mutual Fund Market Market Outlook

The GCC mutual fund market is poised for sustained growth, driven by favorable macroeconomic conditions, supportive government policies, and increasing financial literacy. Strategic opportunities lie in leveraging technological advancements, focusing on innovative product development tailored to evolving investor preferences, and expanding into new market segments. The sector's future depends significantly on maintaining a stable regulatory environment, managing market volatility effectively, and fostering competition while promoting investor confidence.

GCC Mutual Fund Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Money market

- 1.3. Real Estate

- 1.4. Other Fund Types (Bond, Commodities, Mixed)

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Abu Dhabi

- 2.4. Kuwait

- 2.5. Dubai

GCC Mutual Fund Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Abu Dhabi

- 4. Kuwait

- 5. Dubai

GCC Mutual Fund Market Regional Market Share

Geographic Coverage of GCC Mutual Fund Market

GCC Mutual Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth; Rising Wealth and Income Levels

- 3.3. Market Restrains

- 3.3.1. Economic Growth; Rising Wealth and Income Levels

- 3.4. Market Trends

- 3.4.1. Emerging Leadership of Saudi Arabia in GCC Capital Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Money market

- 5.1.3. Real Estate

- 5.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Abu Dhabi

- 5.2.4. Kuwait

- 5.2.5. Dubai

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Abu Dhabi

- 5.3.4. Kuwait

- 5.3.5. Dubai

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Saudi Arabia GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Money market

- 6.1.3. Real Estate

- 6.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Abu Dhabi

- 6.2.4. Kuwait

- 6.2.5. Dubai

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Qatar GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Money market

- 7.1.3. Real Estate

- 7.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Abu Dhabi

- 7.2.4. Kuwait

- 7.2.5. Dubai

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Abu Dhabi GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Money market

- 8.1.3. Real Estate

- 8.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Abu Dhabi

- 8.2.4. Kuwait

- 8.2.5. Dubai

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Kuwait GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Money market

- 9.1.3. Real Estate

- 9.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Abu Dhabi

- 9.2.4. Kuwait

- 9.2.5. Dubai

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Dubai GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Money market

- 10.1.3. Real Estate

- 10.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Abu Dhabi

- 10.2.4. Kuwait

- 10.2.5. Dubai

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riyad Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NCB Capital

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samba Capital & investment Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Saudi Arabia Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ANB Invest

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Hollandi Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Rajhi Capital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jadwa Investment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Caaam Saudi Fransi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BNP Paribas Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Riyad Capital

List of Figures

- Figure 1: Global GCC Mutual Fund Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Qatar GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: Qatar GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: Qatar GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: Qatar GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Qatar GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Qatar GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Kuwait GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Kuwait GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Kuwait GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Kuwait GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Kuwait GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Kuwait GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Dubai GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Dubai GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Dubai GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Dubai GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Dubai GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Dubai GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global GCC Mutual Fund Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Mutual Fund Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the GCC Mutual Fund Market?

Key companies in the market include Riyad Capital, NCB Capital, Samba Capital & investment Management, HSBC Saudi Arabia Ltd, ANB Invest, Saudi Hollandi Capital, Al Rajhi Capital, Jadwa Investment, Caaam Saudi Fransi, BNP Paribas Asset Management**List Not Exhaustive.

3. What are the main segments of the GCC Mutual Fund Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth; Rising Wealth and Income Levels.

6. What are the notable trends driving market growth?

Emerging Leadership of Saudi Arabia in GCC Capital Markets.

7. Are there any restraints impacting market growth?

Economic Growth; Rising Wealth and Income Levels.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi-based Riyad Capital has launched the Riyad Real Estate Development fund - Durrat Hitteen, in partnership with property developer Al Ramz Real Estate Company. The fund, with a value exceeding SAR0.5 billion (USD 133.3 million), aims to develop a mixed-use project in the Hitteen district in Riyadh with a total area of 27,119 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Mutual Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Mutual Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Mutual Fund Market?

To stay informed about further developments, trends, and reports in the GCC Mutual Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence