Key Insights

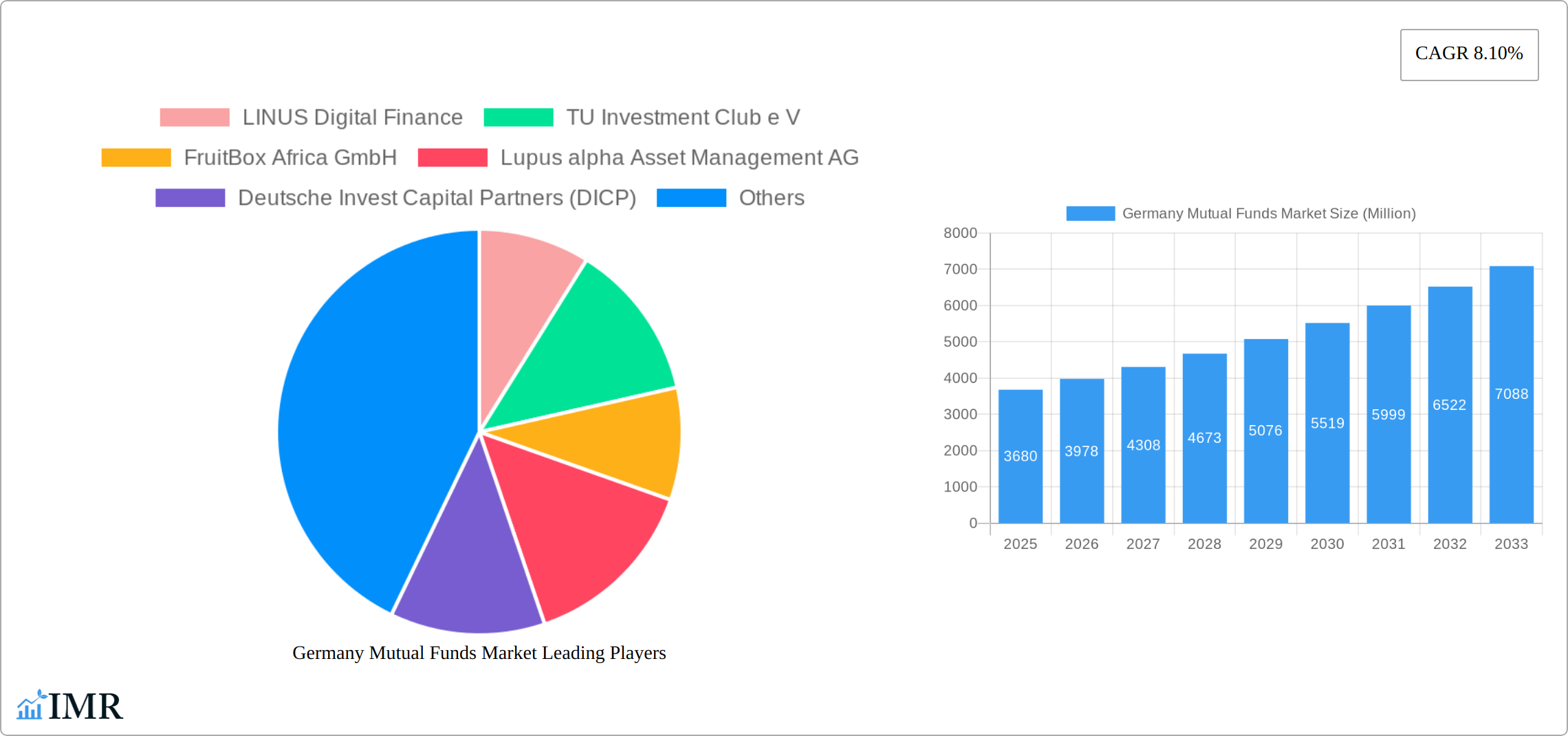

The German mutual funds market, valued at €3.68 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.10% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes among German households, coupled with a growing awareness of the benefits of diversified investment strategies, are driving greater participation in mutual funds. Furthermore, a favorable regulatory environment and the increasing availability of innovative investment products tailored to various risk appetites are contributing to market expansion. The market is segmented by fund type (e.g., equity, bond, balanced), investment strategy (e.g., growth, value, income), and investor type (e.g., retail, institutional). While competition among established players like Linus Digital Finance and Deutsche Invest Capital Partners remains intense, the market also presents opportunities for smaller firms specializing in niche investment strategies or catering to specific investor demographics. Challenges include potential market volatility influenced by global economic conditions and ongoing regulatory changes, requiring fund managers to adapt their strategies and investment offerings proactively.

Germany Mutual Funds Market Market Size (In Billion)

The forecast period (2025-2033) suggests continued growth, driven by increasing investor confidence and technological advancements that enhance accessibility and transparency within the market. However, sustained growth hinges on addressing potential risks, including geopolitical instability and fluctuations in interest rates. Companies will need to leverage technology to enhance their offerings, personalize investment advice, and strengthen their brand presence to attract and retain a growing investor base. The German mutual funds market's resilience and projected growth signify its importance within the broader European financial landscape, offering attractive prospects for both established players and new entrants.

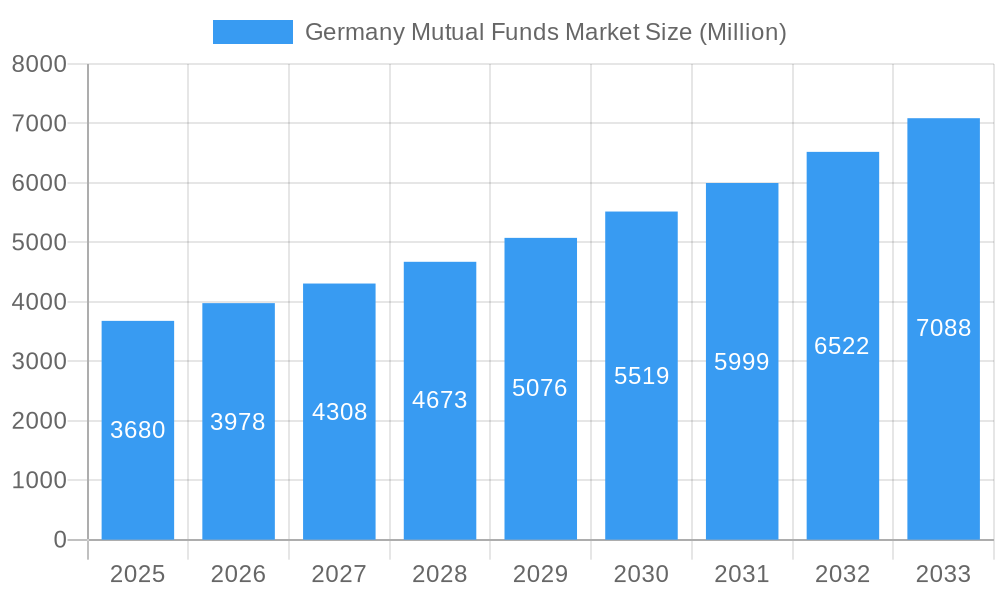

Germany Mutual Funds Market Company Market Share

Germany Mutual Funds Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Mutual Funds Market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Investment Funds) and child market (Mutual Funds), this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Market values are presented in millions.

Germany Mutual Funds Market Market Dynamics & Structure

This section analyzes the German mutual funds market's structure, identifying key dynamics that shape its evolution. The market exhibits a moderately concentrated landscape, with a few dominant players and a larger number of smaller firms vying for market share. Technological innovation, particularly in fintech, is driving efficiency gains and new product offerings, although regulatory hurdles pose a barrier to swift adoption. The regulatory framework, governed by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), significantly influences market operations and product development. Competitive substitutes, such as ETFs and other investment vehicles, exert pressure, while end-user demographics are shifting towards digitally savvy, younger investors. M&A activity has been moderate in recent years, with an estimated xx million in deal volume in 2024.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Fintech advancements, including robo-advisors and digital platforms, are transforming distribution and client engagement.

- Regulatory Framework: BaFin's regulations impact product offerings, compliance, and investor protection.

- Competitive Substitutes: ETFs and other investment instruments present competitive pressure.

- End-User Demographics: Shifting towards younger, tech-savvy investors.

- M&A Trends: Moderate activity in recent years, with xx million in deal volume in 2024.

Germany Mutual Funds Market Growth Trends & Insights

The German mutual funds market has demonstrated robust and consistent growth, reflecting a dynamic investment landscape. Historically, the market experienced a Compound Annual Growth Rate (CAGR) of approximately XX% between 2019 and 2024. In 2024, the market size was estimated at XX million, and projections indicate a significant expansion to XX million by 2025. Looking ahead, the market is poised for sustained expansion with a forecasted CAGR of XX% from 2025 to 2033.

This upward trajectory is propelled by a confluence of strategic factors. Increasing investor awareness, coupled with a burgeoning middle class possessing greater disposable income, fuels demand for diversified investment vehicles. Furthermore, supportive government policies and regulatory frameworks that champion long-term financial planning and savings are providing a fertile ground for mutual fund growth. The digital revolution is also playing a pivotal role, with the advent of robo-advisors and sophisticated digital platforms fundamentally altering how investment products are distributed and how clients engage with financial services. These technological advancements are not only enhancing accessibility but also optimizing operational efficiency. A notable shift in consumer behavior is observed, with a growing preference for personalized investment solutions and an increased demand for transparency in fund operations and performance reporting. The market penetration of mutual funds in Germany currently stands at XX% and is anticipated to reach XX% by 2033, indicating substantial room for further market development.

Dominant Regions, Countries, or Segments in Germany Mutual Funds Market

While the German mutual funds market operates as a cohesive national entity, certain geographical hubs within Germany exhibit amplified levels of investor activity and assets under management (AUM). Major metropolitan areas such as Frankfurt, Munich, and Hamburg are at the forefront of this growth, primarily due to their status as prominent financial centers. These cities benefit from a higher concentration of affluent individuals with greater disposable incomes and a significant presence of leading financial institutions, which naturally attracts substantial investor capital and drives demand for sophisticated financial products.

Segmentation analysis reveals that the equity funds segment currently commands the largest share within the German mutual funds market. This is closely followed by fixed income funds, which offer stability and income generation, and mixed-asset funds, providing a blend of equity and fixed income exposure for diversified portfolios. The dominance of these segments is a testament to the varied investment objectives and risk appetites of German investors.

- Key Drivers of Regional Dominance:

- Higher per capita disposable incomes in key urban centers.

- A concentrated ecosystem of domestic and international financial institutions.

- A strong influx of investment capital from both domestic and international investors.

- Proactive government initiatives and incentives designed to foster investment culture.

- Factors Contributing to Dominance: Greater investor sophistication and a more pronounced awareness of mutual fund benefits in these major cities lead to higher per capita AUM and a more active investment community.

Germany Mutual Funds Market Product Landscape

The German mutual funds market is characterized by a rich and evolving product landscape designed to meet the diverse needs and risk tolerances of a broad spectrum of investors. Innovation within the market is increasingly focused on delivering highly customized investment solutions that align with individual financial goals. A significant trend is the integration of Environmental, Social, and Governance (ESG) criteria into fund offerings, reflecting a growing investor demand for sustainable and ethical investment choices. Furthermore, the leveraging of advanced technologies is enhancing both portfolio management capabilities and the transparency of fund operations, providing investors with clearer insights into their investments.

Performance assessment is a critical aspect of the market, with fund managers and investors closely scrutinizing key metrics. These include Sharpe ratios, which measure risk-adjusted return; Alpha, indicating the excess return relative to a benchmark; and Beta, quantifying a fund's volatility in relation to the market. Unique selling propositions (USPs) for successful funds often revolve around specialized investment strategies that target niche markets or asset classes, a commitment to cost-effectiveness through competitive fee structures, and the provision of exclusive access to specific, potentially high-growth, asset classes.

Key Drivers, Barriers & Challenges in Germany Mutual Funds Market

Key Drivers Fueling Market Expansion:

- A sustained increase in disposable incomes and robust savings rates among German households, creating a larger pool of investable capital.

- The implementation of favorable government policies and tax incentives that actively encourage long-term investment horizons and retirement planning.

- The rapid adoption and integration of technological advancements, which are democratizing market access, enhancing operational efficiency, and improving the overall investor experience.

- A growing public awareness and understanding of mutual funds as a viable and accessible avenue for wealth creation and financial security.

Challenges & Restraints Impeding Growth:

- The intricate nature of regulatory frameworks and the associated compliance costs can present significant hurdles, potentially slowing down product innovation and market entry for new players.

- Intense competition from alternative investment products, such as Exchange Traded Funds (ETFs) and direct investment opportunities, continues to exert pressure on profit margins and market share.

- The inherent volatility of global financial markets poses a substantial risk to investment returns, with market downturns potentially impacting fund performance. The impact of market volatility was particularly evident in 2022, resulting in an estimated XX million reduction in AUM across the market.

- While not directly impacting the financial sector, global supply chain disruptions can indirectly influence fund performance through broader macroeconomic effects such as inflation and economic slowdowns.

Emerging Opportunities in Germany Mutual Funds Market

- Increasing demand for sustainable and ESG-compliant investment products.

- Growth potential in niche segments, such as impact investing and private equity.

- Leveraging technology to personalize client experiences and offer tailored investment advice.

- Expansion into underserved demographics, such as younger investors and individuals with lower net worth.

Growth Accelerators in the Germany Mutual Funds Market Industry

Long-term growth will be fueled by technological innovation that enhances efficiency and client experience. Strategic partnerships between financial institutions and fintech companies will create innovative product offerings. Market expansion through increased product diversification and internationalization will also drive growth.

Key Players Shaping the Germany Mutual Funds Market Market

- LINUS Digital Finance

- TU Investment Club e V

- FruitBox Africa GmbH

- Lupus alpha Asset Management AG

- Deutsche Invest Capital Partners (DICP)

- Angermann-Gruppe

- Haniel

- CONREN Land

- E1 international investment holding

- DWPT Deutsche Wertpapiertreuhand GmbH

List Not Exhaustive

Notable Milestones in Germany Mutual Funds Market Sector

- January 2023: Amundi Asset Management lists a new ETF in Germany for investments in small-cap US companies, broadening investment options for German investors.

- January 2023: The value of German government bonds on loan increased to EUR 111.1 billion (USD 121 billion), the highest level since December 2015, reflecting investor sentiment and potential risks associated with increased government debt.

In-Depth Germany Mutual Funds Market Market Outlook

The German mutual funds market is poised for continued growth, driven by factors like increasing investor awareness, technological innovation, and favorable macroeconomic conditions. Strategic opportunities lie in developing innovative products, leveraging technology for enhanced client engagement, and expanding into new market segments. The market's future potential hinges on adapting to changing investor preferences, navigating regulatory complexities, and managing risks associated with global market volatility. The long-term outlook remains positive, with a projected substantial increase in AUM over the forecast period.

Germany Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity Funds

- 1.2. Bond Funds

- 1.3. Money Market Funds

- 1.4. Hybrid & Other Funds

-

2. Distribution Channel

- 2.1. Banks

- 2.2. Financial Advisors

- 2.3. Direct Sellers

- 2.4. Others

-

3. Investor Type

- 3.1. Institutional

- 3.2. Individual

Germany Mutual Funds Market Segmentation By Geography

- 1. Germany

Germany Mutual Funds Market Regional Market Share

Geographic Coverage of Germany Mutual Funds Market

Germany Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Open-Ended Spezialfonds are the leading funds of the German Fund Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity Funds

- 5.1.2. Bond Funds

- 5.1.3. Money Market Funds

- 5.1.4. Hybrid & Other Funds

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Banks

- 5.2.2. Financial Advisors

- 5.2.3. Direct Sellers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Investor Type

- 5.3.1. Institutional

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LINUS Digital Finance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TU Investment Club e V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FruitBox Africa GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lupus alpha Asset Management AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deutsche Invest Capital Partners (DICP)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Angermann-Gruppe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haniel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CONREN Land

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E1 international investment holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LINUS Digital Finance

List of Figures

- Figure 1: Germany Mutual Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Mutual Funds Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 3: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 6: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 7: Germany Mutual Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Germany Mutual Funds Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 10: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 11: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 14: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 15: Germany Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Mutual Funds Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Mutual Funds Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Germany Mutual Funds Market?

Key companies in the market include LINUS Digital Finance, TU Investment Club e V, FruitBox Africa GmbH, Lupus alpha Asset Management AG, Deutsche Invest Capital Partners (DICP), Angermann-Gruppe, Haniel, CONREN Land, E1 international investment holding, DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive.

3. What are the main segments of the Germany Mutual Funds Market?

The market segments include Fund Type, Distribution Channel, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.68 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Open-Ended Spezialfonds are the leading funds of the German Fund Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Amundi Asset Management Lists New ETF in Germany for Investments in Small Cap US Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Germany Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence