Key Insights

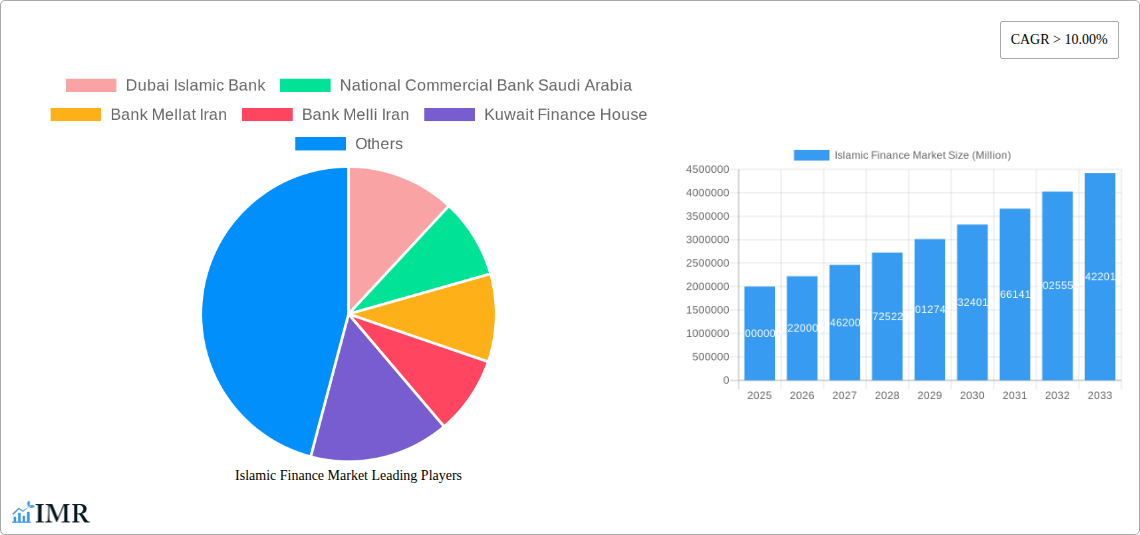

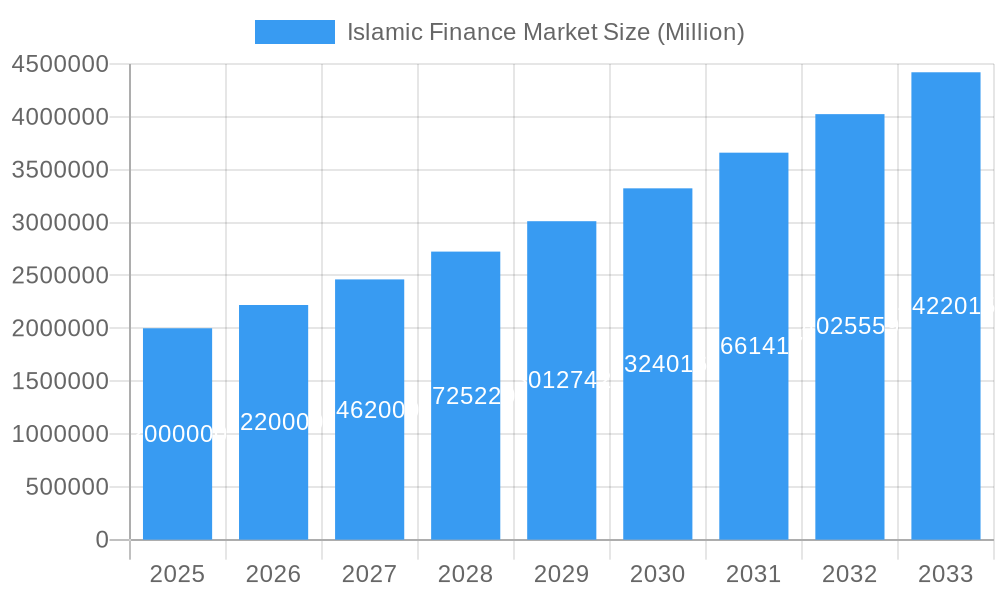

The Islamic finance market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 10% since 2019, is poised for significant expansion throughout the forecast period (2025-2033). This robust growth is driven by several factors, including the increasing global Muslim population, rising awareness of ethical and Sharia-compliant financial products, and supportive government policies in key regions. The market's segmentation encompasses diverse financial services such as Islamic banking, Takaful (Islamic insurance), and Sukuk (Islamic bonds), each contributing to the overall market value. Key players like Dubai Islamic Bank, National Commercial Bank Saudi Arabia, and several Iranian and Malaysian banks are actively shaping the market landscape through innovation and expansion into new geographical areas. The Middle East and North Africa (MENA) region remains a dominant force, yet significant growth potential exists in Southeast Asia and other regions with substantial Muslim populations. While regulatory hurdles and economic uncertainties pose potential restraints, the long-term outlook for Islamic finance remains positive, fueled by consistent demand and increasing global integration.

Islamic Finance Market Market Size (In Million)

The market's projected value in 2025 is estimated at $2 trillion (assuming a reasonable market size based on the provided CAGR and industry knowledge). This figure is expected to increase steadily through 2033, driven by the aforementioned growth drivers. The market's robust growth trajectory is further bolstered by technological advancements, particularly in fintech, that are enhancing accessibility and efficiency within the Islamic finance sector. Increased collaboration between Islamic financial institutions and conventional players is also anticipated, further expanding market reach and product diversification. While specific regional breakdowns are not provided, the MENA region's strong historical presence will likely continue, with Southeast Asia emerging as a critical growth engine in the coming years. Competitive pressures and shifts in global economic conditions will present ongoing challenges, but the inherent resilience and growing global acceptance of Islamic finance suggest sustained long-term growth.

Islamic Finance Market Company Market Share

Islamic Finance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Islamic finance market, encompassing market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report uses data from the historical period of 2019-2024 and leverages proprietary data to provide valuable insights for industry professionals. The market size is projected to reach xx Million by 2033.

Islamic Finance Market Dynamics & Structure

The Islamic finance market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration is moderate, with a few large players holding significant shares, but numerous smaller institutions contributing to overall growth. Technological innovation, particularly in fintech solutions compliant with Sharia principles, is a key driver, while regulatory frameworks vary across jurisdictions, impacting market accessibility and expansion. The competitive landscape includes traditional banking products, creating a complex interplay of substitutes. End-user demographics are primarily driven by the Muslim population's growing financial needs, and M&A activity reflects a trend toward consolidation and expansion.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Fintech solutions, mobile banking, and blockchain technology are driving efficiency and accessibility.

- Regulatory Frameworks: Varying regulatory environments across regions create both opportunities and challenges.

- Competitive Substitutes: Traditional banking products pose a competitive challenge, leading to innovation in Islamic financial offerings.

- End-User Demographics: Growth primarily driven by the expanding Muslim population and increasing financial inclusion initiatives.

- M&A Trends: Consolidation through mergers and acquisitions is increasingly common, driven by expansion goals and economies of scale. Approximately xx M&A deals were recorded in the period 2019-2024, with a total value of xx Million.

Islamic Finance Market Growth Trends & Insights

The Islamic finance market has experienced significant growth over the past few years, driven by factors such as the increasing global Muslim population, rising awareness of Sharia-compliant financial products, and supportive government policies in many Muslim-majority countries. This growth is expected to continue into the future, although the rate of growth may vary depending on the specific segment and region. Technological advancements have also played a significant role in driving market growth by increasing accessibility and efficiency. Consumer behavior is shifting towards digital banking channels and demand for innovative products tailored to specific needs.

- Market Size Evolution: The market experienced a CAGR of xx% during 2019-2024, reaching xx Million in 2024. It is projected to reach xx Million by 2033.

- Adoption Rates: Growing adoption among both individuals and corporations, particularly in underserved markets.

- Technological Disruptions: Fintech solutions are transforming the Islamic finance landscape, increasing efficiency and inclusivity.

- Consumer Behavior Shifts: Increasing preference for digital channels and demand for personalized, Sharia-compliant financial solutions.

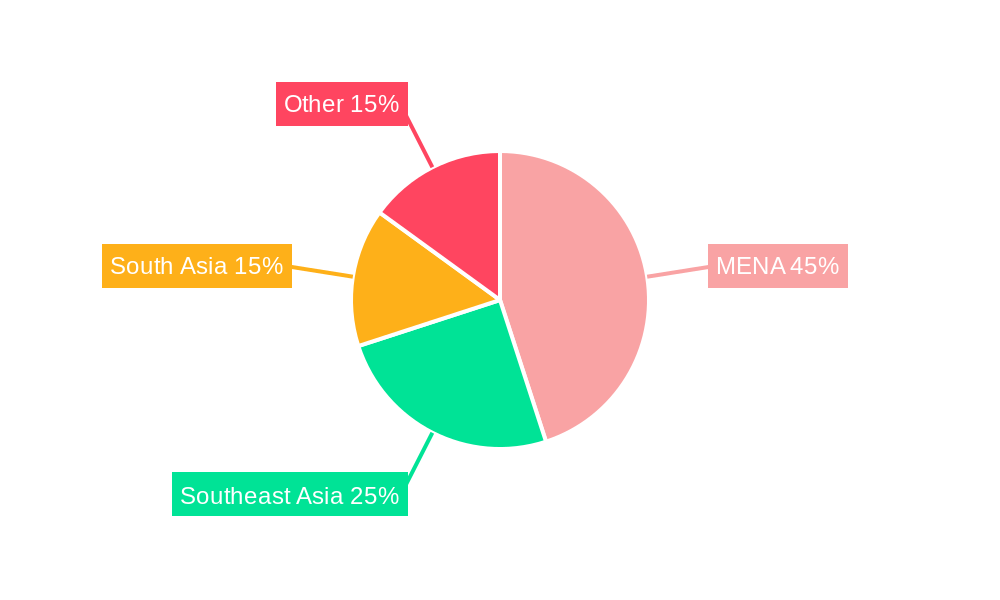

Dominant Regions, Countries, or Segments in Islamic Finance Market

The Gulf Cooperation Council (GCC) region, particularly Saudi Arabia and the UAE, currently dominates the Islamic finance market, driven by strong government support, robust regulatory frameworks, and significant financial resources. However, other regions like Southeast Asia and Africa exhibit strong growth potential, fueled by increasing demand and supportive government policies. The Sukuk market is a key driver, along with Islamic banking and Takaful (Islamic insurance).

- GCC Region: Dominates the market due to strong government support, significant financial resources, and established infrastructure. Market share of approximately xx% in 2024.

- Southeast Asia: Significant growth potential driven by a large Muslim population and increasing financial inclusion initiatives.

- Africa: Untapped potential, with growing demand for Islamic financial services in many countries.

- Key Drivers: Supportive government policies, infrastructure development, and increasing financial literacy.

Islamic Finance Market Product Landscape

The Islamic finance product landscape is expanding, encompassing a range of offerings that comply with Sharia principles. These include Islamic banking services (like Murabaha, Ijara, and Musharakah financing), Sukuk (Islamic bonds), Takaful (Islamic insurance), and ethically invested funds. Technological advancements are driving product innovation, with the emergence of digital platforms, mobile banking apps, and blockchain-based solutions enhancing accessibility and efficiency. Unique selling propositions focus on ethical investment, risk-sharing, and transparency.

Key Drivers, Barriers & Challenges in Islamic Finance Market

Key Drivers:

- Growing Muslim population globally.

- Increasing demand for ethical and Sharia-compliant financial products.

- Supportive government policies and initiatives in many countries.

- Technological advancements improving accessibility and efficiency.

Key Challenges & Restraints:

- Regulatory inconsistencies across jurisdictions.

- Limited awareness and understanding of Islamic finance products among some segments.

- Shortage of skilled professionals specializing in Islamic finance.

- Competition from traditional banking products.

- xx Million lost revenue annually due to supply chain issues.

Emerging Opportunities in Islamic Finance Market

- Expansion into untapped markets, particularly in Africa and Southeast Asia.

- Development of innovative Sharia-compliant products tailored to specific consumer segments.

- Increased use of technology to improve efficiency, accessibility, and transparency.

- Growing demand for green finance and sustainable investments.

Growth Accelerators in the Islamic Finance Market Industry

Technological advancements, strategic partnerships between Islamic financial institutions and fintech companies, and expansion into new markets will drive long-term growth. The increasing awareness of ESG (environmental, social, and governance) factors within Islamic finance will also create significant opportunities.

Key Players Shaping the Islamic Finance Market Market

- Dubai Islamic Bank

- National Commercial Bank Saudi Arabia

- Bank Mellat Iran

- Bank Melli Iran

- Kuwait Finance House

- Bank Maskan Iran

- Qatar Islamic Bank

- Abu Dhabi Islamic Bank

- May Bank Islamic

- CIMB Islamic Bank

- List Not Exhaustive

Notable Milestones in Islamic Finance Market Sector

- January 2023: Abu Dhabi Islamic Bank (ADIB) increased its ownership in ADIB Egypt to over 52%, acquiring 9.6 million shares from the National Investment Bank.

- July 2022: Kuwait Finance House (KFH) agreed to acquire Ahli United Bank (AUB) through a share swap deal, creating a major player in the Gulf region.

In-Depth Islamic Finance Market Market Outlook

The Islamic finance market is poised for sustained growth, driven by technological innovation, expansion into new markets, and the increasing demand for ethical and Sharia-compliant financial products. Strategic partnerships, diversification into new segments, and adaptation to evolving consumer preferences will be crucial for success. The market is expected to witness significant opportunities in green finance, fintech integration, and the development of tailored products for diverse customer segments.

Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance : Takaful

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Islamic Financial Institution (OIFI's)

- 1.5. Islamic Funds

Islamic Finance Market Segmentation By Geography

-

1. GCC

- 1.1. Saudi Arabia

- 1.2. UAE

- 1.3. Qatar

- 1.4. Kuwait

- 1.5. Bahrain

- 1.6. Oman

-

2. MENA

- 2.1. Iran

- 2.2. Egypt

- 2.3. Rest of Middle East

- 3. Southeast Asia

-

4. Malaysia

- 4.1. Indonesia

- 4.2. Brunei

- 4.3. Pakistan

- 4.4. Rest of Southeast Asia and Asia Pacific

-

5. Europe

- 5.1. United Kingdom

- 5.2. Ieland

- 5.3. Italy

- 5.4. Rest of Europe

- 6. Rest of the World

Islamic Finance Market Regional Market Share

Geographic Coverage of Islamic Finance Market

Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Malaysia is the top Score Value for Islamic Finance Development Indicator

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance : Takaful

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Islamic Financial Institution (OIFI's)

- 5.1.5. Islamic Funds

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. GCC

- 5.2.2. MENA

- 5.2.3. Southeast Asia

- 5.2.4. Malaysia

- 5.2.5. Europe

- 5.2.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. GCC Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance : Takaful

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Islamic Financial Institution (OIFI's)

- 6.1.5. Islamic Funds

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. MENA Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance : Takaful

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Islamic Financial Institution (OIFI's)

- 7.1.5. Islamic Funds

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Southeast Asia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance : Takaful

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Islamic Financial Institution (OIFI's)

- 8.1.5. Islamic Funds

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Malaysia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance : Takaful

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Islamic Financial Institution (OIFI's)

- 9.1.5. Islamic Funds

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. Europe Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance : Takaful

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Islamic Financial Institution (OIFI's)

- 10.1.5. Islamic Funds

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of the World Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance : Takaful

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Islamic Financial Institution (OIFI's)

- 11.1.5. Islamic Funds

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dubai Islamic Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 National Commercial Bank Saudi Arabia

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bank Mellat Iran

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bank Melli Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kuwait Finance House

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bank Maskan Iran

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Qatar Islamic Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abu Dhabi Islamic Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 May Bank Islamic

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CIMB Islamic Bank**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dubai Islamic Bank

List of Figures

- Figure 1: Islamic Finance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Islamic Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 2: Islamic Finance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 4: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: UAE Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Qatar Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Kuwait Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Bahrain Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Oman Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 12: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Iran Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Egypt Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Middle East Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 17: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 19: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Indonesia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Brunei Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Pakistan Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Southeast Asia and Asia Pacific Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 25: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: United Kingdom Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Ieland Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 31: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Islamic Finance Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Islamic Finance Market?

Key companies in the market include Dubai Islamic Bank, National Commercial Bank Saudi Arabia, Bank Mellat Iran, Bank Melli Iran, Kuwait Finance House, Bank Maskan Iran, Qatar Islamic Bank, Abu Dhabi Islamic Bank, May Bank Islamic, CIMB Islamic Bank**List Not Exhaustive.

3. What are the main segments of the Islamic Finance Market?

The market segments include Financial Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Malaysia is the top Score Value for Islamic Finance Development Indicator.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Abu Dhabi Islamic Bank (ADIB) has increased its ownership in ADIB Egypt to more than 52%. The UAE-based bank has acquired 9.6 million shares from the National Investment Bank (NIB), representing 2.4% of ADIB Egypt's share capital, the bank told the Abu Dhabi Securities Exchange (ADX). The deal has raised ADIB UAE's ownership in the Egyptian unit to 52.607%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence