Key Insights

The Israel commercial real estate market is poised for significant expansion, projected to reach approximately $25 billion by 2025, with a compound annual growth rate (CAGR) of 6.5% expected from 2025 through 2033. This growth is underpinned by a robust technology sector, expanding tourism industry, and a resilient domestic economy. Key growth drivers include high demand for office spaces in innovation hubs like Tel Aviv and a flourishing retail sector meeting consumer needs. A strong emphasis on modern and sustainable developments is also influencing investment in renovations and new construction. Despite potential headwinds from global economic volatility and interest rate fluctuations, government-led urban development initiatives and consistent foreign investment support a positive long-term outlook. The market's stability is further reinforced by established major players such as Azrieli Group, Gazit-Globe, and Melisron.

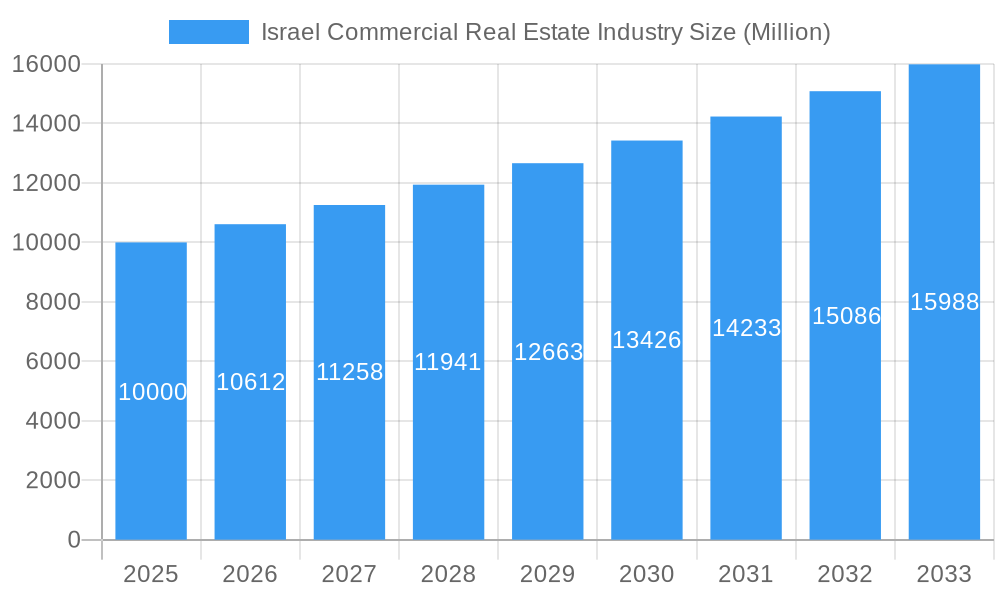

Israel Commercial Real Estate Industry Market Size (In Billion)

Within the broader Middle East & Africa region, the UAE, South Africa, and Saudi Arabia represent key markets, offering promising avenues for expansion and cross-border investment. Government-driven infrastructure development and favorable tax policies are instrumental in shaping market trends. The market's segmentation by property type (office, retail, industrial, residential) and end-user (businesses, government, individuals) provides a detailed landscape for identifying investment opportunities. Strategic analysis of these segments is vital for investors and developers navigating this dynamic market. While the historical period (2019-2024) may have encountered economic shifts, the forecast period anticipates sustained growth driven by current trends and economic projections. An examination of the strategies employed by the eight profiled companies highlights their individual competitive advantages and market approaches.

Israel Commercial Real Estate Industry Company Market Share

Israel Commercial Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Israel commercial real estate industry, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future opportunities, offering invaluable insights for investors, developers, and industry professionals. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects forward to the estimated year (2025) and forecast period (2025-2033). Market values are presented in millions.

Israel Commercial Real Estate Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the Israeli commercial real estate market, considering key factors influencing its growth and development. The market is characterized by a moderate level of concentration, with a few dominant players alongside numerous smaller firms.

Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately concentrated market. This is expected to remain relatively stable throughout the forecast period, although potential M&A activity could shift the landscape.

Technological Innovation: Technological advancements, such as PropTech solutions for property management and smart building technologies, are gradually being adopted, but adoption rates are still relatively low compared to other developed markets. This presents both opportunities and challenges, with barriers including high initial investment costs and a lack of widespread digital literacy among industry professionals.

Regulatory Framework: The Israeli government's regulatory framework significantly influences the industry, impacting zoning laws, construction permits, and tax incentives. Changes in regulations can significantly impact market dynamics and investment decisions.

Competitive Product Substitutes: The primary competitive substitute is the residential sector in cases of flexible work arrangements. However, the unique features of commercial spaces, including specialized infrastructure and location advantages, typically maintain their appeal.

End-User Demographics: The commercial real estate market caters to a diverse range of end-users, including businesses (both large corporations and SMEs), government entities, and individuals (for retail spaces and residential properties). Growth across different end-user segments is uneven, and shifts in economic activity and demographics will impact demand.

M&A Trends: M&A activity in the Israeli commercial real estate market has been relatively moderate over the historical period. The forecast indicates xx deals annually in the forecast period, primarily driven by consolidation and expansion strategies among larger companies.

- Market Size (2025): xx Million

- CAGR (2025-2033): xx%

- Average M&A Deal Value (2025): xx Million

Israel Commercial Real Estate Industry Growth Trends & Insights

The Israeli commercial real estate market experienced significant growth in the historical period, driven by strong economic performance and increased foreign investment. However, growth rates fluctuated due to cyclical economic factors and global events. The forecast period (2025-2033) anticipates continued growth, though at a slightly moderated pace compared to the preceding years, with certain segments outperforming others. The report leverages proprietary data and market analysis to provide a detailed overview of market size evolution, adoption rates of new technologies, and shifting consumer preferences for office and retail spaces, and also impact of technological disruptions like remote work on demand.Specific factors contributing to variations in growth rates include fluctuating interest rates, government policies related to construction and infrastructure development, technological innovation, and changing preferences from end users for workspace, retail, and other commercial real estate products. This analysis is supported by key metrics that include Compound Annual Growth Rate (CAGR), market penetration rates across various segments, and qualitative assessments of prevailing trends impacting market performance. Further details on the quantitative analysis are provided in the main report.

Dominant Regions, Countries, or Segments in Israel Commercial Real Estate Industry

Tel Aviv remains the dominant region, accounting for the largest share of the commercial real estate market. High concentration of businesses, strong economic activity, and a limited land supply contribute to its dominance. Within the product types, the office segment is projected to continue its leading position.

- Tel Aviv Metropolitan Area: Key driver: High concentration of businesses and high demand.

- Jerusalem: Key driver: Growing government sector and religious tourism.

- Office Segment: Key driver: Consistent demand from businesses.

- Retail Segment: Key driver: Growth of e-commerce impacting physical retail.

- Industrial Segment: Key driver: Growth of technology and logistics sectors.

- Residential Segment (Commercial): Key driver: Increasing demand for rental apartments near commercial hubs.

Israel Commercial Real Estate Industry Product Landscape

The Israeli commercial real estate market offers a range of products, including office buildings (Class A, B, and C), retail spaces (shopping malls, high-street retail), industrial properties (warehouses, logistics facilities), and residential buildings integrated with commercial spaces. Recent innovations focus on sustainable building practices, smart building technologies, and flexible workspace solutions. A key selling point is the strategic location of many properties within close proximity to major transportation arteries and amenities.

Key Drivers, Barriers & Challenges in Israel Commercial Real Estate Industry

Key Drivers:

- Strong economic growth in Israel

- Increasing foreign investment

- Growing demand from businesses and individuals

- Government initiatives promoting infrastructure development

Key Challenges:

- High construction costs

- Limited land availability in prime locations

- Regulatory hurdles and bureaucratic processes

- Competition from other asset classes

Emerging Opportunities in Israel Commercial Real Estate Industry

- Growing demand for flexible workspaces and co-working spaces.

- Increasing interest in sustainable and green buildings.

- Development of innovative technologies for property management.

- Expansion into secondary markets outside of Tel Aviv.

Growth Accelerators in the Israel Commercial Real Estate Industry Industry

Long-term growth is projected to be fuelled by further technological advancements, strategic partnerships between developers and technology companies, and government policies to encourage infrastructural development in strategic regions. This also includes increased demand from specific sectors like tech and innovative companies leading to growth in office and commercial space.

Key Players Shaping the Israel Commercial Real Estate Industry Market

- Azrieli Group Ltd

- Gazit-Globe Ltd

- Melisron Ltd

- Arko Holdings Ltd

- Ashtrom Group Ltd

- Elbit Imaging Lt

Notable Milestones in Israel Commercial Real Estate Industry Sector

- 2021: Significant increase in demand for warehouse space due to e-commerce boom.

- 2022: Launch of several large-scale mixed-use developments in Tel Aviv.

- 2023: Government introduces new incentives for green building construction.

In-Depth Israel Commercial Real Estate Industry Market Outlook

The Israeli commercial real estate market is poised for continued growth in the forecast period, driven by a strong economy, increasing demand from diverse sectors, and government investment in infrastructure. The sector will continue to adapt to new technological advancements and evolving preferences for office space and retail experiences. Opportunities exist in developing eco-friendly spaces, adopting innovative technologies, and expanding into underserved regions across Israel. Strategic partnerships and investments in smart building solutions will be crucial for success in this dynamic market.

Israel Commercial Real Estate Industry Segmentation

- 1. Offices

- 2. Industrial

- 3. Retail

- 4. Hotels

- 5. Other Property Types

Israel Commercial Real Estate Industry Segmentation By Geography

- 1. Israel

Israel Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Israel Commercial Real Estate Industry

Israel Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Shortage of Building Land and Labor Availability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 5.2. Market Analysis, Insights and Forecast - by Industrial

- 5.3. Market Analysis, Insights and Forecast - by Retail

- 5.4. Market Analysis, Insights and Forecast - by Hotels

- 5.5. Market Analysis, Insights and Forecast - by Other Property Types

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 8 COMPANY PROFILES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Azrieli Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gazit-Globe Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melisron Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arko Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashtrom Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elbit Imaging Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 8 COMPANY PROFILES

List of Figures

- Figure 1: Israel Commercial Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Israel Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 2: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 3: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 4: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 5: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 6: Israel Commercial Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 8: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 9: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 10: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 11: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 12: Israel Commercial Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Commercial Real Estate Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Israel Commercial Real Estate Industry?

Key companies in the market include 8 COMPANY PROFILES, Azrieli Group Ltd, Gazit-Globe Ltd, Melisron Ltd, Arko Holdings Ltd, Ashtrom Group Ltd, Elbit Imaging Lt.

3. What are the main segments of the Israel Commercial Real Estate Industry?

The market segments include Offices, Industrial, Retail, Hotels, Other Property Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Shortage of Building Land and Labor Availability.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Israel Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence