Key Insights

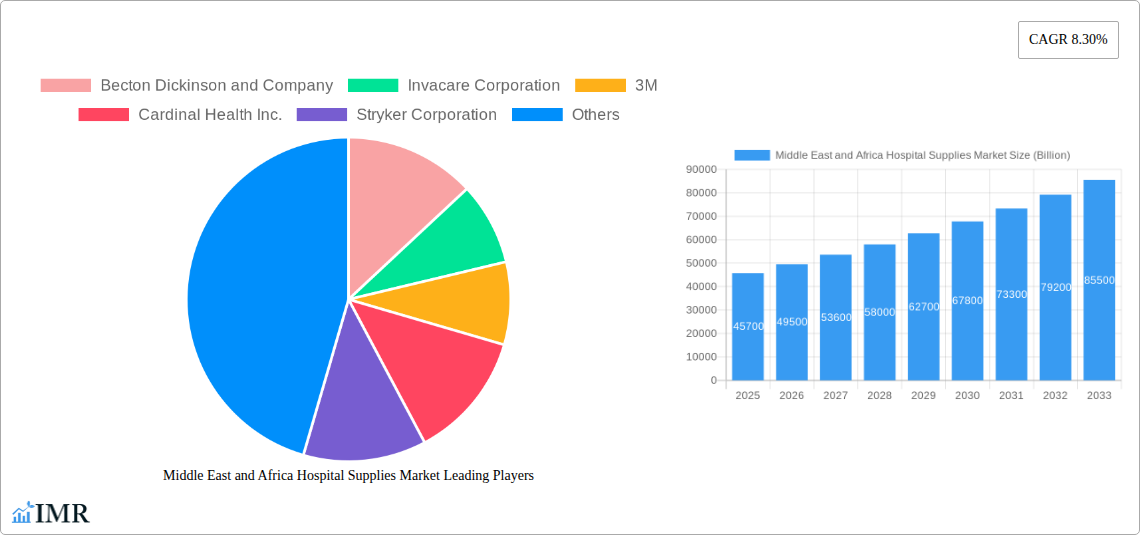

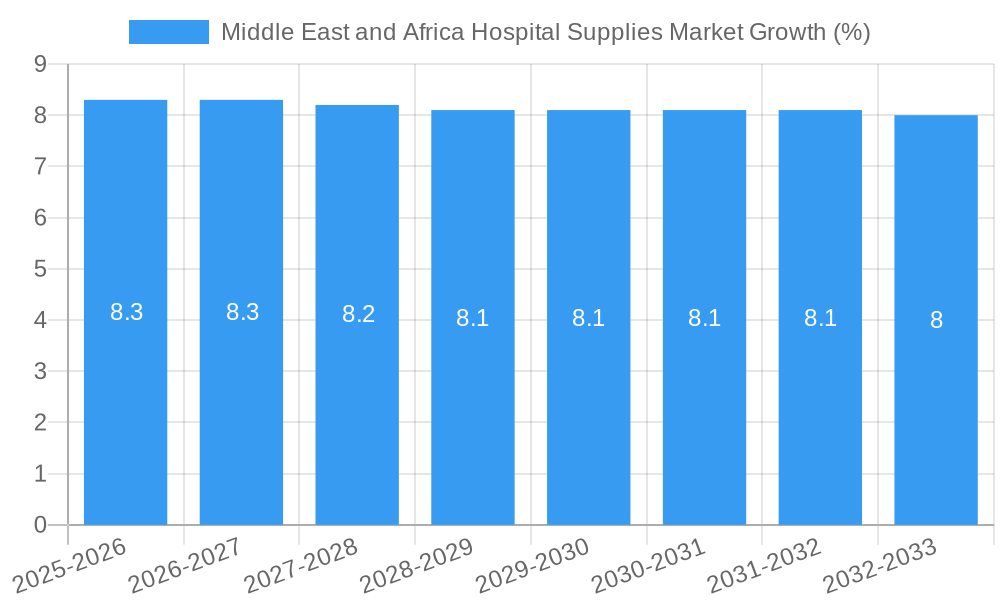

The Middle East and Africa (MEA) Hospital Supplies Market is poised for significant expansion, projected to reach a valuation of approximately $45.7 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.30% expected to drive its trajectory through 2033. This substantial growth is primarily fueled by escalating healthcare expenditure across the region, driven by an increasing prevalence of chronic diseases and a growing demand for advanced medical treatments. Government initiatives aimed at enhancing healthcare infrastructure and increasing access to quality medical services also play a crucial role. Furthermore, the rising adoption of innovative medical technologies and a greater awareness among the populace regarding preventative healthcare are contributing to this upward trend. The market's dynamism is further accentuated by a growing expatriate population and an expanding middle class with higher disposable incomes, leading to an increased demand for premium healthcare services and, consequently, hospital supplies.

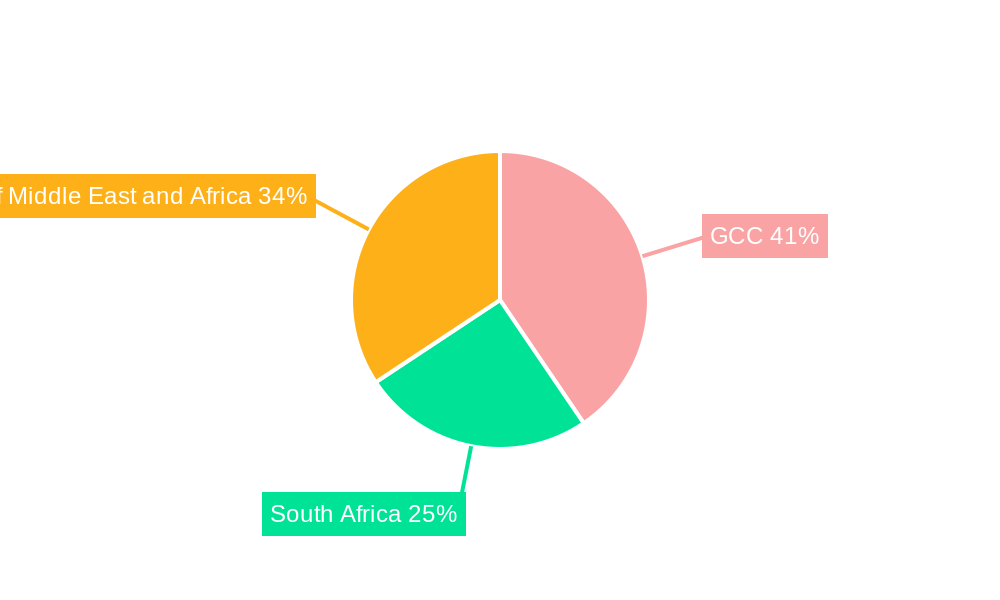

The MEA Hospital Supplies Market is characterized by a diverse range of product segments, with Patient Examination Devices and Disposable Hospital Supplies anticipated to dominate in terms of revenue. Operating Room Equipment and Sterilization and Disinfectant Equipment are also experiencing considerable demand, reflecting the ongoing modernization of healthcare facilities and a heightened focus on infection control protocols. The market's geographical landscape is segmented into the GCC, South Africa, and the Rest of Middle East and Africa. The GCC countries are expected to lead the market share due to their advanced healthcare infrastructure and substantial investments in medical tourism. South Africa, with its well-established healthcare system, also presents a significant market opportunity. The Rest of Middle East and Africa, while currently representing a smaller share, offers substantial untapped potential for growth, driven by increasing healthcare investments and a rising demand for essential medical consumables. Key players such as Becton Dickinson and Company, 3M, and Stryker Corporation are actively expanding their presence through strategic partnerships and product innovations to capitalize on these burgeoning opportunities.

Middle East and Africa Hospital Supplies Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa hospital supplies market, projecting significant growth from 2025 and extending through 2033. Our research offers critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, growth accelerators, and a detailed company and milestone overview. With a focus on product type segmentation including Patient Examination Devices, Operating Room Equipment, Mobility Aids and Transportation Equipment, Sterilization and Disinfectant Equipment, Disposable Hospital Supplies, Syringes and Needles, and Other Product Types, alongside geographical segmentation across GCC, South Africa, and Rest of Middle East and Africa, this report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning healthcare infrastructure and increasing demand for advanced medical solutions in the region. The study covers the historical period of 2019–2024 and the forecast period of 2025–2033, with 2025 serving as the base and estimated year.

Middle East and Africa Hospital Supplies Market Market Dynamics & Structure

The Middle East and Africa hospital supplies market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration varies across segments and sub-regions, with some areas exhibiting consolidated presence of major global players and others fostering a more fragmented competitive landscape. Technological innovation serves as a significant driver, fueled by ongoing advancements in medical devices, diagnostics, and patient care solutions. The demand for disposable hospital supplies, syringes and needles, and sterilization and disinfectant equipment remains robust due to infection control mandates and routine healthcare procedures. Regulatory frameworks, while evolving, are increasingly aligned with international standards, promoting quality and safety in patient examination devices and operating room equipment. Competitive product substitutes are emerging, particularly in areas like reusable versus disposable medical supplies, necessitating continuous innovation and cost-effectiveness. End-user demographics are shifting, with an aging population in certain regions and a growing middle class in others driving demand for a wider range of healthcare services and associated supplies. Mergers and acquisitions (M&A) trends are observed as key players seek to expand their geographical reach and product portfolios, consolidating their market position.

- Market Concentration: Higher in GCC countries due to established healthcare systems and greater investment capacity.

- Technological Innovation: Driven by advancements in diagnostic imaging, minimally invasive surgical tools, and smart medical devices.

- Regulatory Frameworks: Growing emphasis on quality certifications (e.g., ISO, CE marking) and patient safety standards.

- Competitive Product Substitutes: Rise of home healthcare solutions and advancements in remote patient monitoring impacting traditional hospital supply demand.

- End-User Demographics: Increasing prevalence of chronic diseases and a growing demand for advanced treatments.

- M&A Trends: Strategic acquisitions aimed at market entry, portfolio diversification, and gaining access to new technologies.

Middle East and Africa Hospital Supplies Market Growth Trends & Insights

The Middle East and Africa hospital supplies market is poised for remarkable growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This expansion is underpinned by a confluence of factors including escalating healthcare expenditure, a rising prevalence of chronic diseases, and significant government initiatives aimed at bolstering healthcare infrastructure across the region. The market size is estimated to reach $XX Billion in 2025, driven by increasing adoption rates of advanced medical technologies and a growing awareness regarding infection control measures, particularly for sterilization and disinfectant equipment. Technological disruptions, such as the integration of AI in diagnostics and robotics in surgery, are transforming the operating room equipment segment. Consumer behavior shifts are also playing a crucial role, with an increased demand for patient-centric care and home healthcare solutions, influencing the market for mobility aids and transportation equipment and certain disposable hospital supplies. The continuous influx of investments in new hospital construction and upgrades of existing facilities further propels the demand for a comprehensive range of hospital supplies. The penetration of advanced patient examination devices is also on an upward trajectory as healthcare providers prioritize early and accurate diagnosis. The overall market evolution reflects a maturing healthcare landscape eager to embrace innovative and efficient medical solutions, thereby solidifying its growth trajectory. The significant increase in healthcare spending, especially post-pandemic, has created a robust demand for a wide array of hospital consumables and equipment, from basic syringes and needles to complex medical devices.

Dominant Regions, Countries, or Segments in Middle East and Africa Hospital Supplies Market

The GCC region is anticipated to be the dominant force within the Middle East and Africa hospital supplies market, projected to command a significant market share of over XX% by 2025. This dominance is attributed to several key drivers, including robust economic growth, substantial government investments in healthcare infrastructure, and a high per capita income that fuels demand for advanced medical services and products. Countries like Saudi Arabia, the UAE, and Qatar are at the forefront of this expansion, actively promoting medical tourism and establishing world-class healthcare facilities. The disposable hospital supplies segment is expected to lead the market growth within the GCC, driven by stringent hygiene protocols and the sheer volume of patient throughput.

- GCC Dominance Factors:

- Economic Policies: Favorable investment climate and government commitment to healthcare modernization.

- Infrastructure Development: Rapid construction of new hospitals, clinics, and specialized medical centers.

- Technological Adoption: High propensity to adopt cutting-edge medical technologies and equipment.

- Medical Tourism: Significant influx of international patients driving demand for comprehensive medical supplies.

- Growing Awareness: Increased patient and provider awareness of the importance of advanced healthcare solutions.

While the GCC leads, South Africa represents a significant and growing market within the African continent, driven by a large population, a developing private healthcare sector, and increasing government focus on improving public healthcare access. The sterilization and disinfectant equipment and syringes and needles segments are particularly strong in South Africa due to the ongoing need for infection control and routine medical procedures in both public and private facilities. The Rest of Middle East and Africa region, encompassing countries like Egypt, Nigeria, and Kenya, presents substantial untapped potential, with a growing demand for basic and intermediate hospital supplies driven by an expanding population and gradual improvements in healthcare access.

Middle East and Africa Hospital Supplies Market Product Landscape

The Middle East and Africa hospital supplies market is witnessing a surge in innovative product offerings across all segments. In patient examination devices, advancements include portable ultrasound machines and AI-powered diagnostic tools. The operating room equipment landscape is being reshaped by robotic surgical systems and advanced anesthesia machines, promising enhanced precision and patient outcomes. Mobility aids and transportation equipment are evolving with lightweight, ergonomic designs and integrated smart features for patient comfort and safety. The demand for sterilization and disinfectant equipment is met with the introduction of high-efficiency autoclaves and eco-friendly disinfectants. Disposable hospital supplies, particularly surgical gloves, masks, and gowns, are seeing innovations in material science for improved barrier protection and comfort. The syringes and needles segment is advancing with safety-engineered devices and pre-filled syringes to reduce needlestick injuries and medication errors.

Key Drivers, Barriers & Challenges in Middle East and Africa Hospital Supplies Market

Key Drivers:

- Increasing Healthcare Expenditure: Governments and private entities are significantly investing in healthcare infrastructure and services, boosting demand for all types of hospital supplies.

- Rising Prevalence of Chronic Diseases: The growing burden of non-communicable diseases necessitates advanced diagnostics, treatment, and ongoing patient care, driving demand for sophisticated medical equipment and consumables.

- Government Initiatives and Reforms: Numerous countries are implementing healthcare reforms and initiatives to improve access and quality of care, leading to increased procurement of hospital supplies.

- Technological Advancements: The adoption of new technologies in medical devices and equipment is creating demand for related supplies and consumables.

- Growing Medical Tourism: Countries like the UAE and Saudi Arabia are actively promoting medical tourism, attracting foreign patients and further stimulating the hospital supplies market.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical instability and logistical challenges in some regions can disrupt the availability and timely delivery of hospital supplies.

- Regulatory Hurdles: Navigating diverse and sometimes complex regulatory requirements across different countries can pose challenges for market entry and product approval.

- Pricing Pressures and Affordability: In certain markets, particularly in sub-Saharan Africa, price sensitivity can be a significant barrier to the adoption of high-cost advanced equipment.

- Skilled Workforce Shortage: A lack of trained personnel to operate and maintain sophisticated medical equipment can hinder its widespread adoption.

- Counterfeit Products: The presence of counterfeit medical supplies poses a threat to patient safety and erodes trust in genuine products.

Emerging Opportunities in Middle East and Africa Hospital Supplies Market

Emerging opportunities in the Middle East and Africa hospital supplies market are abundant, driven by a burgeoning healthcare sector and increasing unmet medical needs. The expansion of telehealth and remote patient monitoring presents significant opportunities for specialized diagnostic tools and connected medical devices. The growing focus on preventive healthcare and wellness programs creates demand for screening devices and diagnostic kits. Furthermore, the increasing adoption of home-based care models will fuel the market for patient-friendly, portable medical equipment and consumables. There is also a substantial opportunity in developing and manufacturing cost-effective, yet high-quality, medical supplies tailored to the specific needs and economic conditions of the African continent. Investments in localized manufacturing and R&D can further unlock this potential.

Growth Accelerators in the Middle East and Africa Hospital Supplies Market Industry

Several catalysts are accelerating the growth of the Middle East and Africa hospital supplies market. Strategic partnerships between international manufacturers and local distributors are crucial for market penetration and understanding regional nuances. Significant investments in public healthcare infrastructure projects across several African nations are creating substantial demand. Technological breakthroughs, such as the development of more affordable and durable medical equipment suitable for varied environmental conditions, are also acting as growth accelerators. Moreover, the increasing emphasis on medical education and training programs is building a skilled workforce capable of utilizing advanced hospital supplies, thereby fostering their adoption and driving market expansion.

Key Players Shaping the Middle East and Africa Hospital Supplies Market

- Becton Dickinson and Company

- Invacare Corporation

- 3M

- Cardinal Health Inc.

- Stryker Corporation

- General Electric Company (GE Healthcare)

- Johnson & Johnson

- B Braun Melsungen AG

- Baxter International

Notable Milestones in Middle East and Africa Hospital Supplies Market Sector

- May 2022: Aston University product design experts announced a collaboration with the Central University of Technology in Bloemfontein, South Africa, to improve wheelchair design and manufacture in Africa.

- January 2022: Cedars-Sinai collaborated with Elegancia Healthcare, a division of Power International Holding, to plan a new, state-of-the-art hospital in Doha, Qatar, the 'View hospital', expected to be the nation's first private healthcare option, scheduled for completion in August with 244 inpatient beds, including 12 ICU beds, and 10 surgical suites.

In-Depth Middle East and Africa Hospital Supplies Market Market Outlook

The future outlook for the Middle East and Africa hospital supplies market is exceptionally promising, driven by sustained investments in healthcare infrastructure and a growing demand for advanced medical solutions. The region is expected to witness continuous innovation, particularly in areas like remote patient monitoring, personalized medicine, and advanced surgical technologies, which will fuel the demand for specialized hospital supplies. Strategic market expansion initiatives by key players, coupled with favorable government policies aimed at enhancing healthcare accessibility and quality, will further solidify this growth trajectory. The increasing disposable incomes in certain segments of the population will also contribute to the demand for higher-quality and more advanced medical products and services, making this market a key focus for global healthcare providers and manufacturers.

Middle East and Africa Hospital Supplies Market Segmentation

-

1. Product Type

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Product Types

-

2. Geography

-

2.1. Middle East and Africa

- 2.1.1. GCC

- 2.1.2. South Africa

- 2.1.3. Rest of Middle East and Africa

-

2.1. Middle East and Africa

Middle East and Africa Hospital Supplies Market Segmentation By Geography

-

1. Middle East and Africa

- 1.1. GCC

- 1.2. South Africa

- 1.3. Rest of Middle East and Africa

Middle East and Africa Hospital Supplies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Spending on Healthcare; Increasing Occurrences of Communal Diseases and Hospital Acquired Infections

- 3.3. Market Restrains

- 3.3.1. Emergence of Home Care Services; Stringent Regulatory Bodies

- 3.4. Market Trends

- 3.4.1. Operating Room Equipment Segment Expected to Hold Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Hospital Supplies Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Middle East and Africa

- 5.2.1.1. GCC

- 5.2.1.2. South Africa

- 5.2.1.3. Rest of Middle East and Africa

- 5.2.1. Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Middle East Middle East and Africa Hospital Supplies Market Analysis, Insights and Forecast, 2019-2031

- 7. Africa Middle East and Africa Hospital Supplies Market Analysis, Insights and Forecast, 2019-2031

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Becton Dickinson and Company

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Invacare Corporation

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 3M

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Cardinal Health Inc.

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Stryker Corporation

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 General Electric Company (GE Healthcare)

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Johnson & Johnson

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 B Braun Melsungen AG

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Baxter International

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Middle East and Africa Hospital Supplies Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Hospital Supplies Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 3: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 4: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Middle East Middle East and Africa Hospital Supplies Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: Africa Middle East and Africa Hospital Supplies Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 9: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 10: Middle East and Africa Hospital Supplies Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 11: GCC Middle East and Africa Hospital Supplies Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: South Africa Middle East and Africa Hospital Supplies Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East and Africa Middle East and Africa Hospital Supplies Market Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Hospital Supplies Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Middle East and Africa Hospital Supplies Market?

Key companies in the market include Becton Dickinson and Company, Invacare Corporation, 3M, Cardinal Health Inc., Stryker Corporation, General Electric Company (GE Healthcare), Johnson & Johnson, B Braun Melsungen AG, Baxter International.

3. What are the main segments of the Middle East and Africa Hospital Supplies Market?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Spending on Healthcare; Increasing Occurrences of Communal Diseases and Hospital Acquired Infections.

6. What are the notable trends driving market growth?

Operating Room Equipment Segment Expected to Hold Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

Emergence of Home Care Services; Stringent Regulatory Bodies.

8. Can you provide examples of recent developments in the market?

In May 2022, Aston University product design experts announced to help improve wheelchair design and manufacture in Africa. The project was a collaboration with the Central University of Technology in Bloemfontein, South Africa

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Hospital Supplies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Hospital Supplies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Hospital Supplies Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Hospital Supplies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence