Key Insights

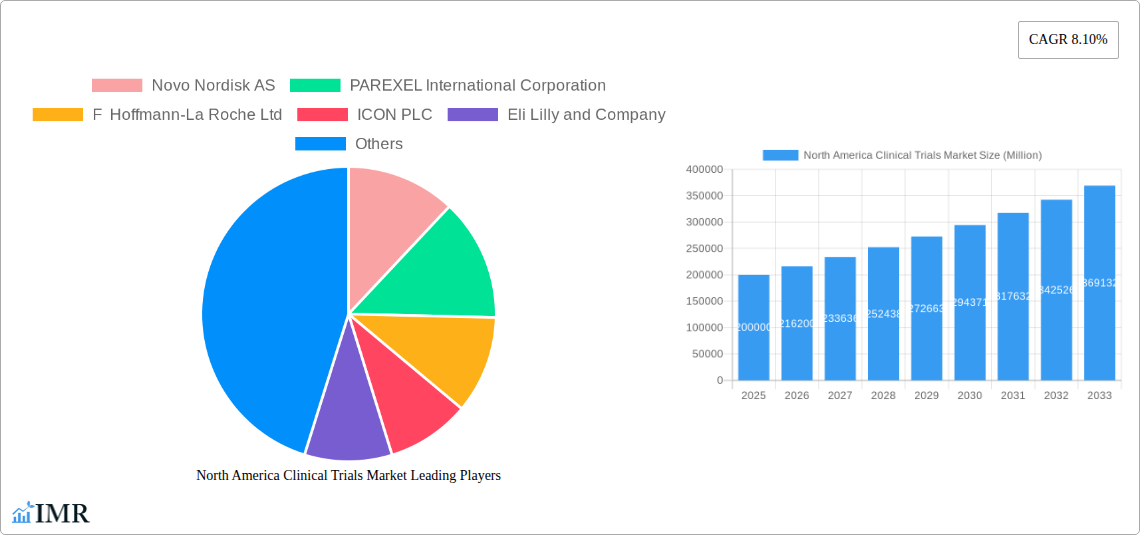

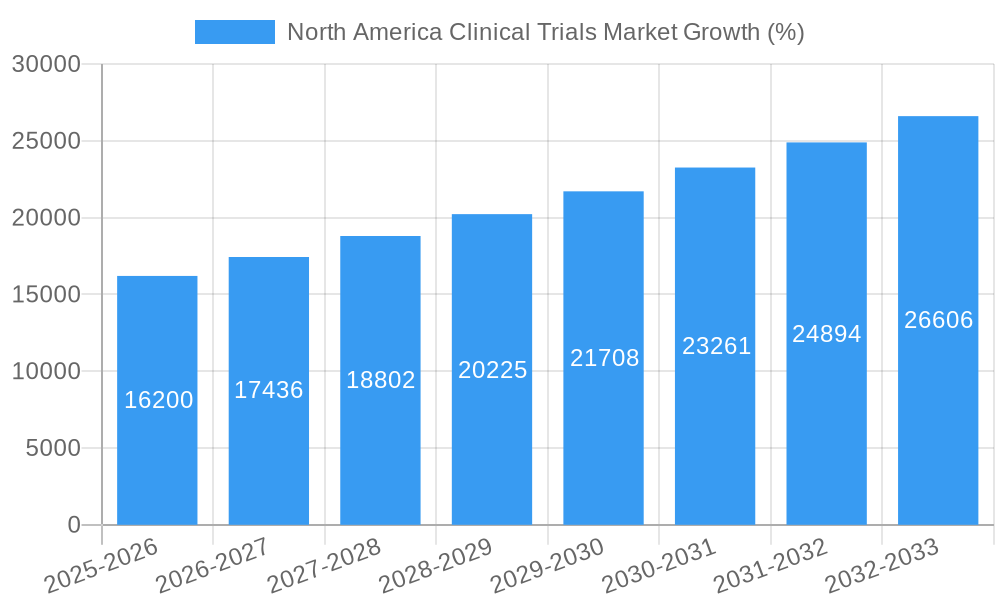

The North American clinical trials market, projected to be worth [Estimate based on CAGR and provided market size, for example: $200 billion] in 2025, is experiencing robust growth, fueled by a confluence of factors. The increasing prevalence of chronic diseases like cancer, diabetes, and cardiovascular conditions necessitates extensive clinical research for novel therapies and improved treatment protocols. Furthermore, significant advancements in biotechnology, particularly in areas like gene therapy and immunotherapy, are driving demand for clinical trials to assess the safety and efficacy of these innovative treatments. Government initiatives supporting medical research and the presence of a large, well-established pharmaceutical industry within North America contribute significantly to this market’s expansion. The market segmentation reveals a strong focus on various phases of clinical trials, including Phase III trials, where late-stage efficacy and safety are evaluated extensively before market release. The preference for Randomized Control Trials (RCTs), especially double-blind RCTs, underlines the commitment to rigorous scientific methodology for reliable data generation. Competitive intensity is high, with major players like Novo Nordisk, Roche, Pfizer, and IQVIA dominating the landscape.

Despite the promising growth trajectory, the North American clinical trials market faces certain challenges. The high cost associated with conducting clinical trials, stringent regulatory requirements, and the increasing complexity of clinical trial designs pose hurdles to market expansion. Recruitment of diverse patient populations for clinical trials can also prove difficult. However, innovative approaches such as decentralized clinical trials and the adoption of digital technologies in data management are mitigating some of these constraints. The continued development of new therapeutics and the growing focus on personalized medicine are expected to further fuel market expansion throughout the forecast period (2025-2033), despite these headwinds. The United States, as the largest market within North America, will continue to dominate, driven by factors such as robust research infrastructure and high healthcare spending.

North America Clinical Trials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America clinical trials market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by Phase (Phase I, Phase II, Phase III, Phase IV) and Design (Treatment Studies, Randomized Control Trials - including Double Blind, Single Blind, and Non-blind; Non-randomized Control Trials - including Observational Studies). Key players analyzed include Novo Nordisk AS, PAREXEL International Corporation, F Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America, and Pfizer Inc. The market is expected to reach xx Million by 2033.

North America Clinical Trials Market Dynamics & Structure

The North American clinical trials market is characterized by a moderately concentrated landscape with a few large players holding significant market share. Technological innovation, particularly in areas like AI and digital health, is a key driver, alongside stringent regulatory frameworks enforced by agencies like the FDA. Competitive pressures are intense, with ongoing M&A activity reshaping the industry. Substitute therapies and novel treatment approaches are constantly emerging, affecting market dynamics. The end-user demographics are diverse, encompassing various patient populations and research institutions across the US and Canada.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Adoption of AI for drug discovery and clinical trial design is accelerating.

- Regulatory Framework: Stringent FDA guidelines influence trial design and timelines.

- M&A Activity: An average of xx M&A deals occurred annually between 2019 and 2024.

- Innovation Barriers: High R&D costs and lengthy regulatory approval processes hinder innovation.

- End-User Demographics: A growing aging population and increased prevalence of chronic diseases drive demand.

North America Clinical Trials Market Growth Trends & Insights

The North America clinical trials market experienced significant growth during the historical period (2019-2024), driven by factors including increasing prevalence of chronic diseases, rising healthcare expenditure, and technological advancements. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the increasing use of telemedicine and decentralized clinical trials, are reshaping the landscape. Consumer behavior shifts towards personalized medicine and greater patient involvement in clinical trials are also influencing market growth. Market penetration of advanced technologies is expected to increase from xx% in 2025 to xx% by 2033.

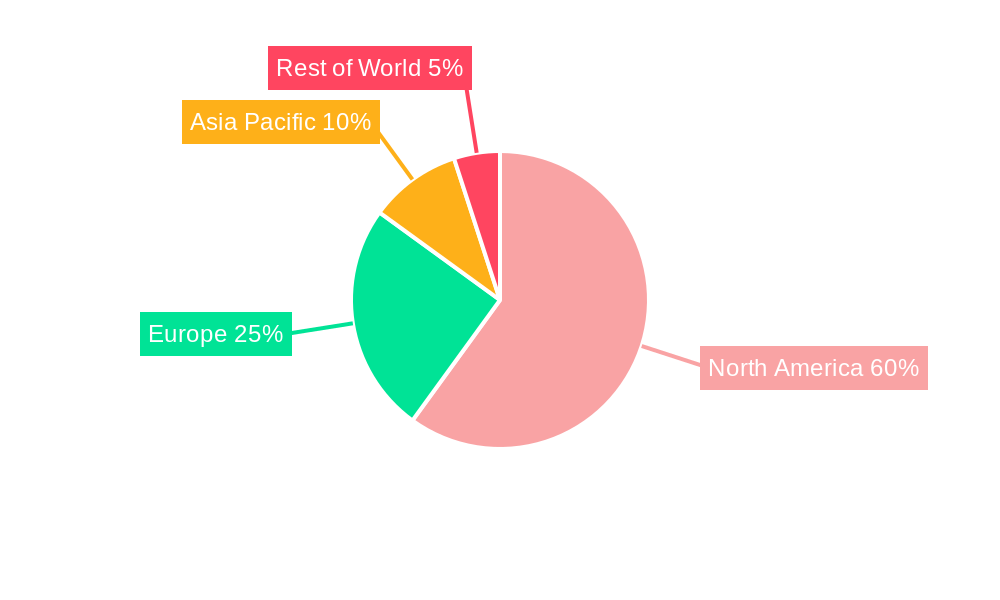

Dominant Regions, Countries, or Segments in North America Clinical Trials Market

The United States dominates the North American clinical trials market, accounting for the largest share due to factors such as advanced healthcare infrastructure, high research funding, and a large pool of patients. Within the US, California and Massachusetts are leading states. Phase III trials currently hold the largest segment share, followed by Phase II. Treatment studies represent the dominant design type.

- Key Drivers (US): Robust healthcare infrastructure, significant R&D investment, favorable regulatory environment.

- Key Drivers (Canada): Growing healthcare expenditure, government initiatives promoting medical research.

- Phase III Dominance: High demand for late-stage trials to support drug approvals.

- Treatment Studies: These account for a larger share compared to observational studies.

- Market Share: The US holds an estimated xx% market share, while Canada accounts for xx%.

North America Clinical Trials Market Product Landscape

The market offers a diverse range of services, including study design, data management, monitoring, and regulatory submissions. Innovations center around technologies like AI-powered data analysis, remote patient monitoring, and blockchain for enhanced data security. These improvements improve efficiency, reduce costs, and accelerate clinical trial timelines. Unique selling propositions often revolve around speed, cost-effectiveness, and expertise in specific therapeutic areas.

Key Drivers, Barriers & Challenges in North America Clinical Trials Market

Key Drivers: Rising prevalence of chronic diseases, increased healthcare spending, technological advancements in trial design and data analysis, and government support for medical research.

Challenges: High costs of clinical trials, stringent regulatory requirements, lengthy approval processes, patient recruitment challenges, and increasing competition. These factors can lead to delays and increased costs, potentially impacting overall market growth. For instance, the average cost of bringing a new drug to market is estimated to be xx Million.

Emerging Opportunities in North America Clinical Trials Market

Emerging opportunities lie in the adoption of decentralized clinical trials (DCTs), leveraging AI and machine learning for faster and more efficient data analysis, and expansion into personalized medicine. Untapped markets exist in the treatment of rare diseases and the utilization of real-world data (RWD). Growing focus on patient centricity presents further opportunities to enhance trial participation and outcomes.

Growth Accelerators in the North America Clinical Trials Market Industry

Technological breakthroughs such as AI-driven drug discovery and advanced imaging techniques are key growth accelerators. Strategic partnerships between pharmaceutical companies, CROs, and technology providers are fostering innovation. Expansion into new therapeutic areas and geographic regions, coupled with increased focus on personalized medicine, will further drive market growth.

Key Players Shaping the North America Clinical Trials Market Market

- Novo Nordisk AS

- PAREXEL International Corporation

- F Hoffmann-La Roche Ltd

- ICON PLC

- Eli Lilly and Company

- Clinipace

- Pharmaceutical Product Development LLC

- IQVIA

- Laboratory Corporation of America

- Pfizer Inc

Notable Milestones in North America Clinical Trials Market Sector

- September 2022: IVERIC bio, Inc. initiated an Open-label Extension (OLE) phase 3 trial for avacincaptad pegol.

- September 2022: The University of Illinois at Chicago launched a clinical trial investigating blood flow and blood pressure in Down syndrome.

In-Depth North America Clinical Trials Market Market Outlook

The North America clinical trials market is poised for continued growth, driven by technological advancements, increasing demand for novel therapies, and favorable regulatory environments. Strategic partnerships and investments in innovative technologies will further fuel market expansion. The focus on personalized medicine and decentralized clinical trials will create significant opportunities for market players to enhance efficiency, reduce costs, and accelerate drug development timelines. The market is expected to witness robust growth in the coming years, presenting substantial opportunities for stakeholders across the value chain.

North America Clinical Trials Market Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

-

2.1.1. Randomized Control Trial

- 2.1.1.1. Double Blind Trial Randomized Trial

- 2.1.1.2. Single Blind Trial Randomized Trial

- 2.1.1.3. Non-blind Randomized Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.1.1. Randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Clinical Trials Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Clinical Trials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce for Clinical Research; Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.1.1. Double Blind Trial Randomized Trial

- 5.2.1.1.2. Single Blind Trial Randomized Trial

- 5.2.1.1.3. Non-blind Randomized Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.1.1. Randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. United States North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.1.1. Double Blind Trial Randomized Trial

- 6.2.1.1.2. Single Blind Trial Randomized Trial

- 6.2.1.1.3. Non-blind Randomized Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.1.1. Randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. Canada North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.1.1. Double Blind Trial Randomized Trial

- 7.2.1.1.2. Single Blind Trial Randomized Trial

- 7.2.1.1.3. Non-blind Randomized Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.1.1. Randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. Mexico North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.1.1. Double Blind Trial Randomized Trial

- 8.2.1.1.2. Single Blind Trial Randomized Trial

- 8.2.1.1.3. Non-blind Randomized Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.1.1. Randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. United States North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Novo Nordisk AS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PAREXEL International Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 F Hoffmann-La Roche Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ICON PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eli Lilly and Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Clinipace

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Pharmaceutical Product Development LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 IQVIA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Laboratory Corporation of America

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pfizer Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Novo Nordisk AS

List of Figures

- Figure 1: North America Clinical Trials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Clinical Trials Market Share (%) by Company 2024

List of Tables

- Table 1: North America Clinical Trials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 3: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 4: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Clinical Trials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 12: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 13: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 16: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 17: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 20: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 21: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clinical Trials Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the North America Clinical Trials Market?

Key companies in the market include Novo Nordisk AS, PAREXEL International Corporation, F Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America, Pfizer Inc.

3. What are the main segments of the North America Clinical Trials Market?

The market segments include Phase, Design, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases.

6. What are the notable trends driving market growth?

Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce for Clinical Research; Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In September 2022, IVERIC bio, Inc. started an Open-label Extension (OLE) phase 3 trial to assess the safety of intravitreal administration of avacincaptad pegol (complement C5 inhibitor) in patients with geographic atrophy who previously completed phase 3 study ISEE2008 (GATHER2).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clinical Trials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clinical Trials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clinical Trials Market?

To stay informed about further developments, trends, and reports in the North America Clinical Trials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence