Key Insights

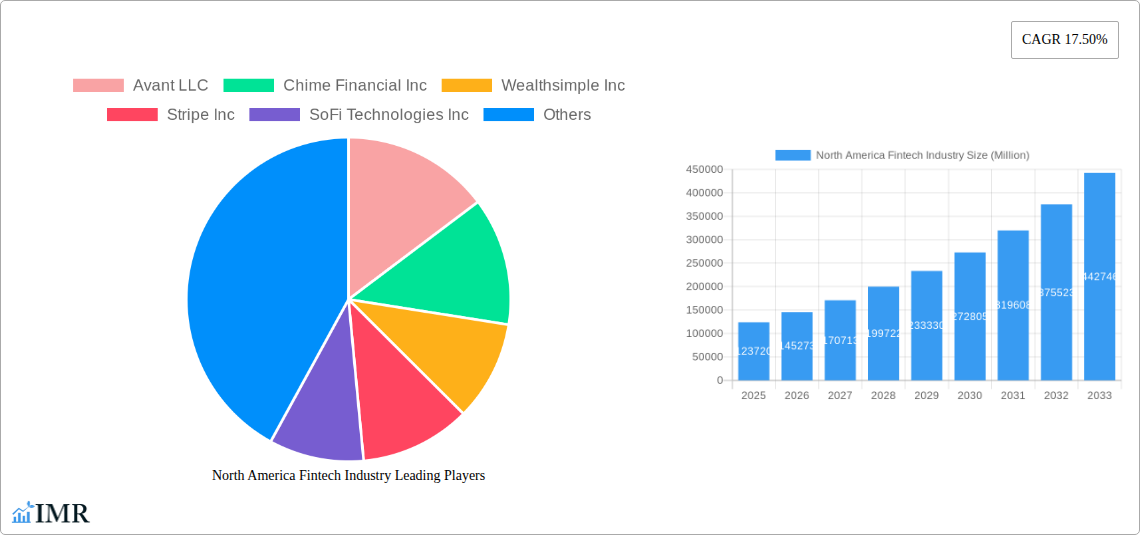

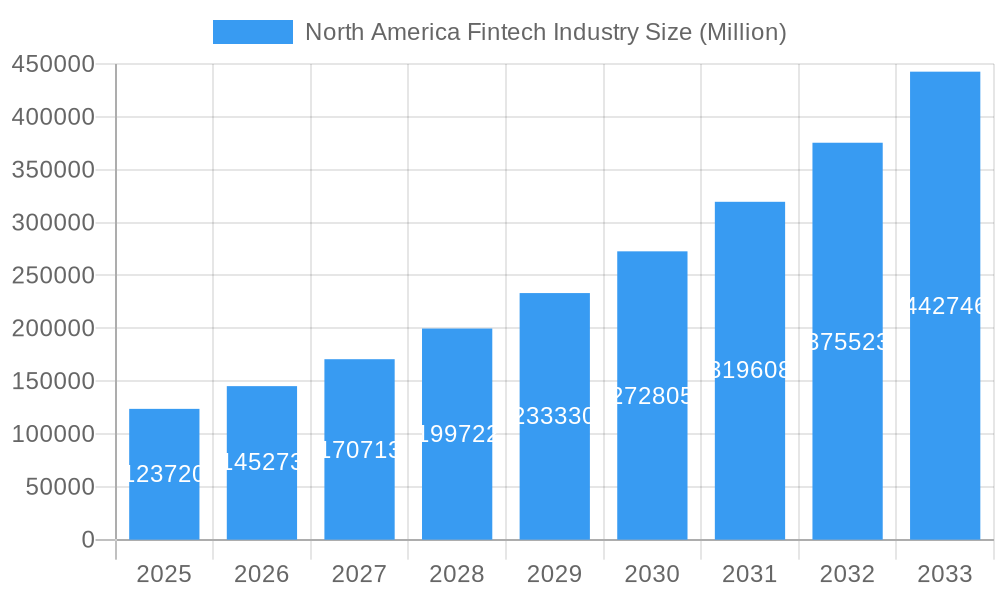

The North American Fintech industry is experiencing explosive growth, projected to reach a market size of $123.72 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.50% from 2025 to 2033. This robust expansion is fueled by several key drivers. Increased smartphone penetration and digital adoption among consumers are creating a fertile ground for innovative financial services. The rising demand for personalized and seamless financial experiences, coupled with the increasing popularity of mobile banking and payment solutions, is further accelerating market growth. Furthermore, supportive regulatory environments in many North American jurisdictions are fostering innovation and attracting significant investments in the sector. The industry is witnessing a rise in embedded finance, where financial services are integrated into non-financial platforms, enhancing customer reach and convenience. Competition remains fierce, with established players like Square and Stripe alongside rapidly growing companies such as Chime, SoFi, and Wealthsimple vying for market share. This competitive landscape is driving innovation and efficiency across the industry, benefiting consumers.

North America Fintech Industry Market Size (In Billion)

Looking ahead, several trends are shaping the future of North American Fintech. The integration of artificial intelligence (AI) and machine learning (ML) is poised to revolutionize areas such as fraud detection, personalized financial advice, and automated customer service. The increasing adoption of open banking initiatives is facilitating greater data sharing and fostering the development of new financial products and services. Moreover, the growing focus on financial inclusion is driving efforts to provide access to financial services for underserved populations. While regulatory scrutiny and cybersecurity threats represent potential constraints, the overall outlook for the North American Fintech market remains overwhelmingly positive, promising sustained growth and innovation throughout the forecast period. This positive trajectory is expected to be particularly strong in areas such as mobile payments, personal financial management, and lending technologies.

North America Fintech Industry Company Market Share

North America Fintech Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Fintech industry, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, dominant segments, key players, and future opportunities, empowering businesses to make informed strategic decisions. The report leverages robust data analysis and incorporates real-world examples to present a clear and actionable picture of this rapidly evolving sector. With a focus on parent and child markets, this report is essential for investors, industry professionals, and anyone seeking a deep understanding of the North American Fintech landscape.

North America Fintech Industry Market Dynamics & Structure

The North American Fintech market, valued at $XX million in 2025, is characterized by intense competition and rapid innovation. Market concentration is moderate, with several large players dominating specific segments while numerous smaller firms specialize in niche areas. Technological advancements, particularly in AI, blockchain, and cloud computing, are driving significant market disruption. Regulatory frameworks, including those governing data privacy and financial security, are constantly evolving, impacting market access and operational procedures. The rise of digital banking and the increasing adoption of mobile payment solutions are driving growth in the consumer segment. Furthermore, there's a notable trend of mergers and acquisitions (M&A) activity, particularly in the payments and lending sectors. Between 2019 and 2024, an estimated xx M&A deals were recorded, reflecting the industry's consolidation.

- Market Concentration: Moderate, with a few dominant players and numerous niche players.

- Technological Innovation: AI, Blockchain, Cloud Computing are key drivers.

- Regulatory Framework: Evolving data privacy and financial security regulations present ongoing challenges and opportunities.

- Competitive Substitutes: Traditional financial institutions remain significant competitors.

- End-User Demographics: Increasing adoption across age groups, fueled by smartphone penetration and digital literacy.

- M&A Trends: High levels of M&A activity (xx deals between 2019-2024), driving consolidation and market share shifts.

North America Fintech Industry Growth Trends & Insights

The North American Fintech market exhibits robust growth, driven by factors such as increasing consumer adoption of digital financial services, rapid technological advancements, and favorable regulatory environments in certain areas. The market size is projected to reach $XX million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is steadily increasing, particularly in mobile payments and personal finance management apps. Technological disruptions, such as the rise of open banking and embedded finance, are creating new opportunities for innovation and market expansion. Consumer behavior shifts toward digital-first financial solutions underscore this trend. The historical period (2019-2024) witnessed significant growth, laying the foundation for the projected expansion in the forecast period.

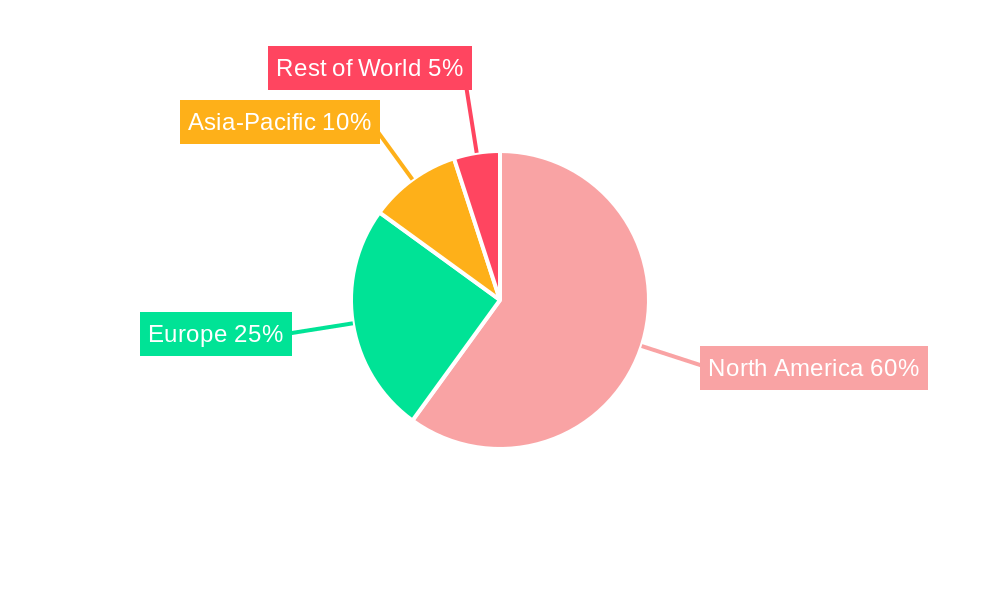

Dominant Regions, Countries, or Segments in North America Fintech Industry

The US currently holds the dominant position in the North American Fintech market, accounting for xx% of the total market value in 2025. This dominance stems from several factors: a mature and well-developed digital infrastructure, a strong entrepreneurial ecosystem, and a relatively welcoming regulatory landscape (in certain areas). Canada and Mexico are also experiencing significant growth, albeit at a slower pace compared to the US. Within the US, key segments contributing to growth include payments, lending, and investment management.

- Key Drivers (US): Strong digital infrastructure, thriving entrepreneurial ecosystem, and favorable regulatory conditions in certain areas.

- Key Drivers (Canada): Growing adoption of digital financial services, government initiatives promoting Fintech innovation.

- Key Drivers (Mexico): Increasing smartphone penetration, expanding financial inclusion initiatives.

North America Fintech Industry Product Landscape

The Fintech product landscape is incredibly diverse, encompassing a wide range of offerings, from mobile payment apps and personal finance management tools to sophisticated AI-driven lending platforms and blockchain-based solutions. Key features driving adoption include enhanced user experience, seamless integration with existing financial systems, and robust security measures. Recent innovations include the use of AI for fraud detection and personalized financial advice, enhancing both efficiency and security.

Key Drivers, Barriers & Challenges in North America Fintech Industry

Key Drivers:

- Technological Advancements: AI, machine learning, blockchain, and cloud computing are transforming financial services.

- Increased Smartphone Penetration: Mobile access fuels the adoption of digital financial solutions.

- Changing Consumer Preferences: Growing demand for convenience, personalization, and transparency.

Key Challenges:

- Regulatory Uncertainty: Evolving regulations regarding data privacy and security create hurdles for innovation and market entry.

- Cybersecurity Threats: The digital nature of Fintech increases vulnerability to cyberattacks.

- Competition: Intense rivalry among established players and new entrants. (estimated xx% market share loss due to competition between 2023-2024)

Emerging Opportunities in North America Fintech Industry

- Open Banking: Enhanced data sharing empowers personalized financial services and innovative product offerings.

- Embedded Finance: Integrating financial services into non-financial platforms broadens reach and accessibility.

- Sustainable Finance: Growing investor and consumer interest in environmentally and socially responsible investments.

Growth Accelerators in the North America Fintech Industry

Technological breakthroughs, such as advancements in AI and blockchain, are major catalysts for long-term growth. Strategic partnerships between Fintech companies and traditional financial institutions are fostering innovation and expanding market reach. Furthermore, expansion into underserved markets, both geographically and demographically, presents significant opportunities for growth.

Key Players Shaping the North America Fintech Industry Market

- Avant LLC

- Chime Financial Inc

- Wealthsimple Inc

- Stripe Inc

- SoFi Technologies Inc

- Square

- Kraken

- Oscar Health

- Mogo *List Not Exhaustive

Notable Milestones in North America Fintech Industry Sector

- August 2024: Stripe named a Leader in the 2024 Gartner Magic Quadrant for Recurring Billing Applications.

- June 2024: Stripe launched new features in France, including Alma’s BNPL integration and advanced Stripe Terminal capabilities.

In-Depth North America Fintech Industry Market Outlook

The North American Fintech market is poised for continued strong growth, driven by sustained technological innovation and evolving consumer preferences. Strategic partnerships, expansion into new markets, and the increasing adoption of open banking and embedded finance will shape the industry's future trajectory. The market's potential for further expansion is significant, presenting lucrative opportunities for both established players and new entrants.

North America Fintech Industry Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

- 1.5. Other Service Propositions

North America Fintech Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fintech Industry Regional Market Share

Geographic Coverage of North America Fintech Industry

North America Fintech Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Innovations Such as Blockchain

- 3.2.2 Artificial Intelligence

- 3.2.3 and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions

- 3.3. Market Restrains

- 3.3.1 Innovations Such as Blockchain

- 3.3.2 Artificial Intelligence

- 3.3.3 and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions

- 3.4. Market Trends

- 3.4.1. Growth in the North American Digital Payment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fintech Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Avant LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chime Financial Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wealthsimple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stripe Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SoFi Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Square

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kraken

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oscar Health

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mogo*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Avant LLC

List of Figures

- Figure 1: North America Fintech Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fintech Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fintech Industry Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: North America Fintech Industry Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: North America Fintech Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Fintech Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 5: North America Fintech Industry Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: North America Fintech Industry Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: North America Fintech Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Fintech Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fintech Industry?

The projected CAGR is approximately 17.50%.

2. Which companies are prominent players in the North America Fintech Industry?

Key companies in the market include Avant LLC, Chime Financial Inc, Wealthsimple Inc, Stripe Inc, SoFi Technologies Inc, Square, Kraken, Oscar Health, Mogo*List Not Exhaustive.

3. What are the main segments of the North America Fintech Industry?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Innovations Such as Blockchain. Artificial Intelligence. and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions.

6. What are the notable trends driving market growth?

Growth in the North American Digital Payment Market.

7. Are there any restraints impacting market growth?

Innovations Such as Blockchain. Artificial Intelligence. and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions.

8. Can you provide examples of recent developments in the market?

August 2024: Stripe was named a Leader in the 2024 Gartner Magic Quadrant for Recurring Billing Applications. Launched in 2018, Stripe Billing manages hundreds of millions of subscriptions for over 300,000 companies, offering flexible billing models and features. This recognition highlights its strong execution and vision in the billing sector.June 2024: Stripe launched new features in France, including Alma’s BNPL integration and advanced Stripe Terminal capabilities. The strengthened CB partnership now supports CB on Apple Pay and enhanced transaction features. Stripe's French user base has grown significantly, with major companies like Accor and TF1 joining the network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fintech Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fintech Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fintech Industry?

To stay informed about further developments, trends, and reports in the North America Fintech Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence