Key Insights

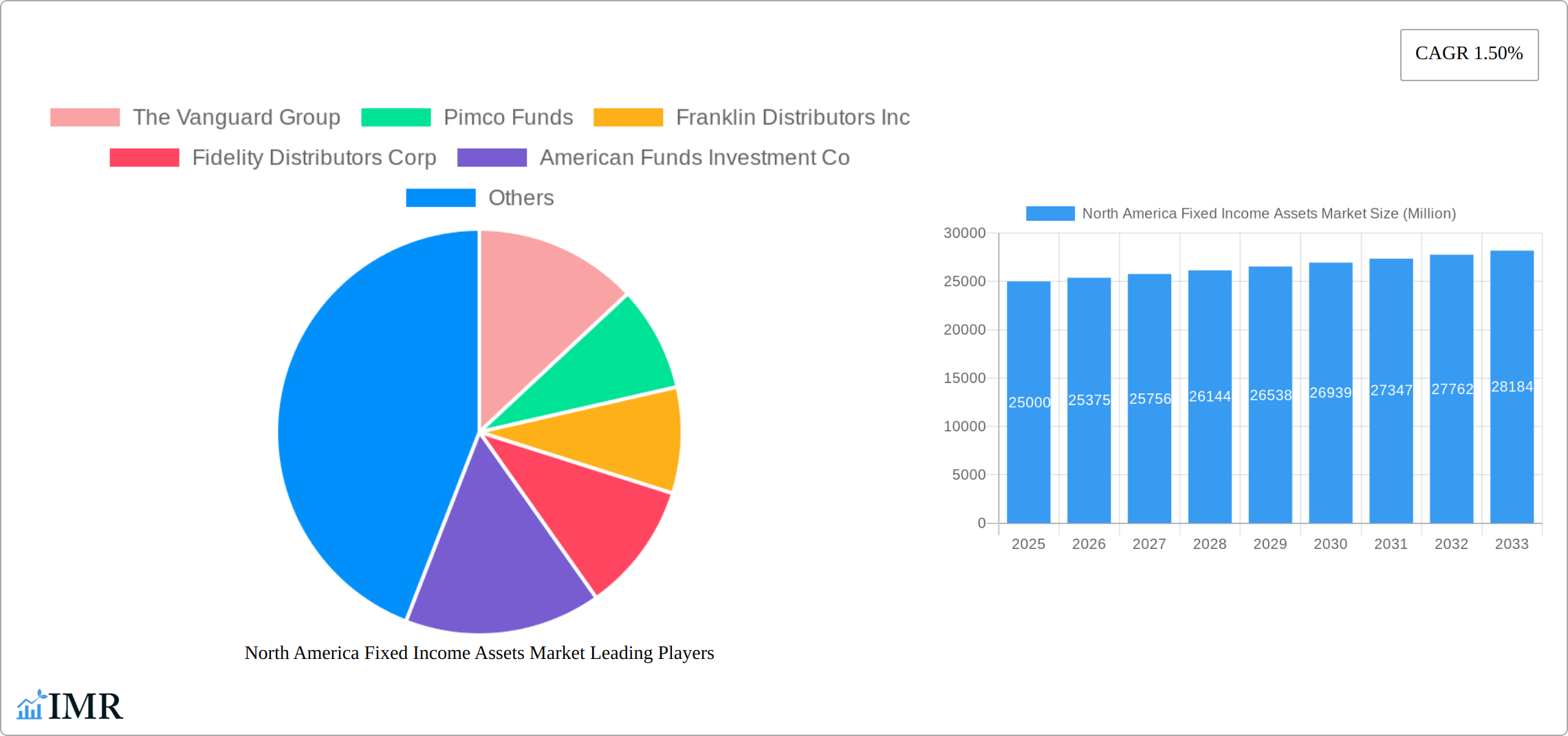

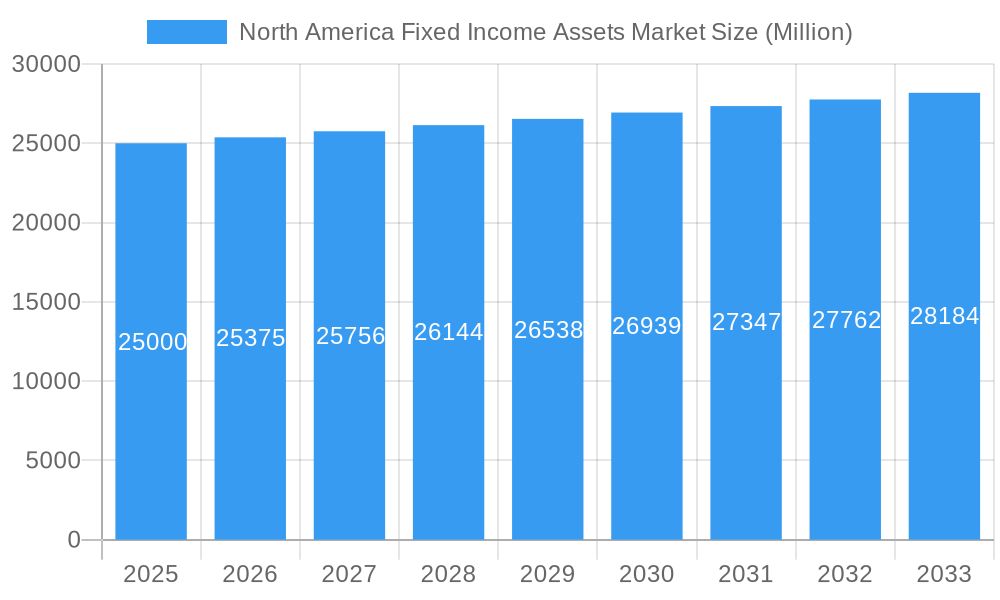

The North America fixed income assets market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.50%, is poised for steady expansion throughout the forecast period (2025-2033). While the exact market size for 2025 is unavailable, considering a base year of 2025 and a historical period of 2019-2024, we can infer substantial market volume. Major drivers include a persistent demand for income-generating investments, particularly amongst institutional investors and high-net-worth individuals seeking stable returns in times of economic uncertainty. Growing concerns about equity market volatility further fuel this demand. This trend is complemented by the increasing prevalence of low-interest rate environments, leading to a search for yield in fixed-income instruments. However, rising inflation and potential interest rate hikes represent key restraints, impacting the attractiveness of certain fixed-income products. Market segmentation, though not explicitly detailed, likely encompasses various asset classes like government bonds, corporate bonds, mortgage-backed securities, and other debt instruments, each responding differently to economic shifts. Key players like The Vanguard Group, Pimco Funds, and Fidelity Distributors Corp. dominate the market, leveraging their extensive expertise and brand recognition to maintain their market share. Geographical distribution within North America, while not specified, likely reveals variations based on regional economic conditions and investor preferences.

North America Fixed Income Assets Market Market Size (In Billion)

The market's future trajectory hinges on several interconnected factors. Fluctuations in interest rates will significantly impact investor sentiment and portfolio allocation. Government policies, regulatory changes, and macroeconomic developments within North America will also shape market dynamics. Furthermore, innovative product offerings and technological advancements impacting trading and portfolio management will contribute to the market's evolution. Considering the conservative nature of fixed-income investments, the anticipated growth, while modest, represents a considerable influx of capital and demonstrates the enduring importance of this asset class in the North American financial landscape. The continued expansion is expected to be driven by both organic growth and potential mergers and acquisitions amongst market participants seeking to enhance their market positioning and product offerings.

North America Fixed Income Assets Market Company Market Share

North America Fixed Income Assets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Fixed Income Assets Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is essential for investors, industry professionals, and strategic decision-makers seeking a clear understanding of this dynamic market. The report delves into key segments of the parent market, Investment Management and the child market, Fixed Income Investments.

Keywords: North America Fixed Income Assets Market, Fixed Income Investments, Investment Management, Market Size, Market Share, Growth Trends, CAGR, Competitive Landscape, Key Players, Investment Strategies, Regulatory Landscape, Market Opportunities, Future Outlook, Vanguard, Pimco, Franklin Templeton, Fidelity, American Funds, Putnam Investments, Oppenheimer Funds, Scudder Investments, Evergreen Investments, Dreyfus Corp, Federated Investors, T. Rowe Price.

North America Fixed Income Assets Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory frameworks, competitive landscape, and M&A activities within the North America Fixed Income Assets Market. The market is characterized by a high degree of concentration, with a few major players holding significant market share. Technological advancements, such as AI-driven portfolio management and robo-advisors, are reshaping the industry. Regulatory changes, particularly those related to risk management and transparency, significantly impact market dynamics. The competitive landscape is intense, with firms competing on factors such as investment performance, fees, and client service. M&A activity remains significant, driven by the pursuit of scale, diversification, and technological capabilities.

- Market Concentration: The top five players account for approximately XX% of the market share in 2025.

- Technological Innovation: Adoption of AI and machine learning in portfolio management is increasing at a CAGR of XX% from 2025-2033.

- Regulatory Framework: Increased scrutiny of ESG (Environmental, Social, and Governance) factors is impacting investment strategies.

- Competitive Substitutes: Alternative investment vehicles, such as private equity and hedge funds, present competition for fixed income assets.

- M&A Activity: An estimated XX M&A deals are expected within the sector from 2025-2033.

North America Fixed Income Assets Market Growth Trends & Insights

The North America Fixed Income Assets Market is navigating a dynamic growth trajectory, shaped by evolving investor priorities and an increasingly sophisticated financial landscape. A significant catalyst remains the persistent demand for robust retirement planning and comprehensive wealth management solutions, directly translating into increased allocation towards fixed-income securities for their perceived stability and income generation potential. While interest rate environments are subject to natural fluctuations, they continue to play a crucial role in dictating investor sentiment and capital flows. Furthermore, the digital transformation continues to reshape market accessibility, with burgeoning fintech platforms democratizing access and offering innovative tools for portfolio management and trading of fixed-income assets. This technological infusion is complemented by a notable shift in consumer behavior, characterized by a strong preference for highly personalized investment strategies and a desire for greater transparency and control over their financial portfolios. These combined forces are collectively driving sustained market expansion. The market size is estimated at $XX million in 2025 and is projected to ascend to $XX million by 2033, reflecting a compound annual growth rate (CAGR) of approximately XX%. Market penetration is anticipated to deepen, increasing from an estimated XX% in 2025 to XX% by 2033, indicating a broader adoption of fixed income strategies across diverse investor segments.

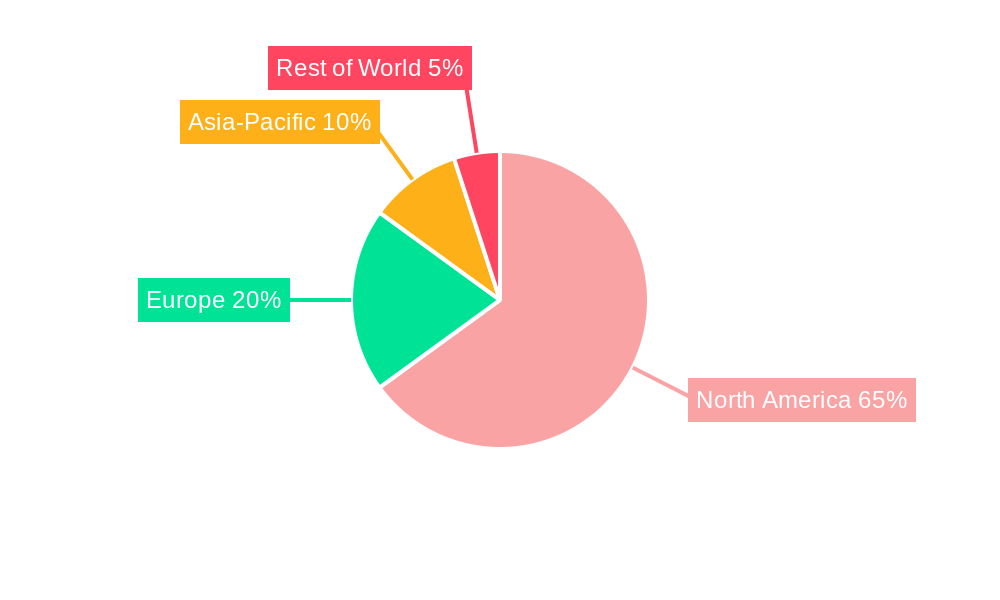

Dominant Regions, Countries, or Segments in North America Fixed Income Assets Market

The United States dominates the North America Fixed Income Assets Market, accounting for approximately XX% of the total market value in 2025. This dominance is attributed to factors such as a large and sophisticated investor base, robust financial markets, and a well-established regulatory framework. Canada and Mexico represent significant, though smaller, markets. Within the US, key growth drivers include increasing household wealth, the expansion of retirement plans, and the growing popularity of ETFs.

- Key Drivers (US): Strong economic growth, favorable interest rate environment, and a mature financial infrastructure.

- Key Drivers (Canada): Growing middle class and increased adoption of retirement savings plans.

- Key Drivers (Mexico): Expanding financial markets and increasing participation in investment products.

North America Fixed Income Assets Market Product Landscape

The market offers a diverse range of fixed-income products, including government bonds, corporate bonds, municipal bonds, mortgage-backed securities, and various funds. Innovations include the emergence of ESG-focused fixed-income products and the increasing use of ETFs for efficient diversification. These products cater to a wide range of investor needs and risk tolerances, with performance metrics closely tracked by investors. The rise of exchange-traded funds (ETFs) and the increased availability of data analytics are transforming the market by increasing access to diverse and transparent investment products.

Key Drivers, Barriers & Challenges in North America Fixed Income Assets Market

Key Drivers: The market is underpinned by several potent drivers. Foremost among these is the inherent demand for stable and predictable income streams, a cornerstone of conservative investment strategies. The ongoing need for effective retirement savings solutions continues to fuel sustained demand. The robust and well-established financial infrastructure within North America, coupled with a generally supportive regulatory framework, provides a fertile ground for market growth. Technological innovation, from algorithmic trading to enhanced data analytics, is a significant accelerator. Finally, the broad spectrum of fixed-income products available, catering to varied risk appetites and investment goals, remains a key draw for investors.

Challenges and Restraints: Despite the positive growth outlook, the market faces several headwinds. Interest rate volatility, particularly in response to monetary policy shifts, presents a significant challenge, impacting bond valuations and investor returns. Increasing regulatory scrutiny, while often aimed at enhancing investor protection, can sometimes introduce compliance burdens and complexity. Competition from alternative investment classes, offering potentially higher returns but also increased risk, continues to vie for investor capital. Geopolitical uncertainty and unforeseen global events can inject significant volatility into financial markets. Furthermore, potential supply chain disruptions stemming from major economic downturns could indirectly impact the broader financial ecosystem and investor confidence.

Emerging Opportunities in North America Fixed Income Assets Market

The North America Fixed Income Assets Market is ripe with emerging opportunities that promise to shape its future. The burgeoning field of Environmental, Social, and Governance (ESG) investing is creating substantial demand for sustainable and ethically aligned fixed-income products, offering investors a chance to align their financial goals with their values. The expansion and refinement of digital distribution channels, including direct-to-consumer platforms and robo-advisors, are making fixed-income investments more accessible and convenient for a wider audience. The development of highly personalized investment solutions, leveraging advanced data analytics and AI, allows for the tailoring of fixed-income portfolios to meet specific individual risk profiles, return objectives, and liquidity needs. The exploration of untapped markets within emerging regions, and the potential integration of distributed ledger technology (like blockchain) for enhanced transaction security, transparency, and operational efficiency, represent further promising avenues for growth and innovation.

Growth Accelerators in the North America Fixed Income Assets Market Industry

The long-term growth trajectory of the North America Fixed Income Assets Market is poised to be significantly propelled by several key accelerators. Continued advancements in technological infrastructure will empower more sophisticated and personalized portfolio management tools, enabling investors to optimize their fixed-income holdings with greater precision. Strategic partnerships and collaborations among financial institutions, including asset managers, custodians, and technology providers, are expected to broaden the scope and accessibility of product offerings and distribution networks. Furthermore, a concerted effort to expand into new and underserved market segments, such as younger demographics and smaller institutional investors, will unlock substantial growth potential. The ongoing innovation in product development, particularly in areas like structured products and alternative fixed-income strategies, will also contribute to a more dynamic and resilient market.

Key Players Shaping the North America Fixed Income Assets Market Market

- The Vanguard Group

- Pimco Funds

- Franklin Distributors Inc

- Fidelity Distributors Corp

- American Funds Investment Co

- Putnam Investments LLC

- Oppenheimer Funds Inc

- Scudder Investments

- Evergreen Investments

- Dreyfus Corp

- Federated Investors Inc

- T Rowe Price Group

Notable Milestones in North America Fixed Income Assets Market Sector

- 2020-Q4: Increased adoption of ESG-focused investment strategies among major players.

- 2021-Q1: Several significant M&A transactions consolidate market share.

- 2022-Q2: Launch of several new ETFs focused on specific fixed-income sectors.

- 2023-Q3: Regulatory changes impact disclosure requirements for fixed-income products.

In-Depth North America Fixed Income Assets Market Outlook

The North America Fixed Income Assets Market presents significant long-term growth potential, driven by continued demand for secure investments and the ongoing evolution of financial technology. Strategic opportunities exist for firms that can effectively leverage technology, cater to evolving investor preferences, and navigate regulatory complexities. The market is poised for expansion, offering attractive prospects for both established players and new entrants.

North America Fixed Income Assets Market Segmentation

-

1. Source of Funds

- 1.1. Pension Funds and Insurance Companies

- 1.2. Retail Investors

- 1.3. Institutional Investors

- 1.4. Government/Sovereign Wealth Fund

- 1.5. Others

-

2. Fixed Income Type

- 2.1. Core Fixed Income

- 2.2. Alternative Credit

-

3. Type of Asset Management Firms

- 3.1. Large financial institutions/Bulge bracket banks

- 3.2. Mutual Funds ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Managed Pension Funds

- 3.6. Others

North America Fixed Income Assets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fixed Income Assets Market Regional Market Share

Geographic Coverage of North America Fixed Income Assets Market

North America Fixed Income Assets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Prominence of HNWIs in Fixed Income Investments in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fixed Income Assets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 5.1.1. Pension Funds and Insurance Companies

- 5.1.2. Retail Investors

- 5.1.3. Institutional Investors

- 5.1.4. Government/Sovereign Wealth Fund

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Fixed Income Type

- 5.2.1. Core Fixed Income

- 5.2.2. Alternative Credit

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large financial institutions/Bulge bracket banks

- 5.3.2. Mutual Funds ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Managed Pension Funds

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Vanguard Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pimco Funds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franklin Distributors Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Distributors Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Funds Investment Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Putnam Investments LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oppenheimer Funds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scudder Investments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Investments

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dreyfus Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Federated Investors Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 T Rowe Price Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Vanguard Group

List of Figures

- Figure 1: North America Fixed Income Assets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fixed Income Assets Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 2: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 3: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: North America Fixed Income Assets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 6: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 7: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: North America Fixed Income Assets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fixed Income Assets Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the North America Fixed Income Assets Market?

Key companies in the market include The Vanguard Group, Pimco Funds, Franklin Distributors Inc, Fidelity Distributors Corp, American Funds Investment Co, Putnam Investments LLC, Oppenheimer Funds Inc, Scudder Investments, Evergreen Investments, Dreyfus Corp, Federated Investors Inc, T Rowe Price Group.

3. What are the main segments of the North America Fixed Income Assets Market?

The market segments include Source of Funds, Fixed Income Type, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Prominence of HNWIs in Fixed Income Investments in North America.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fixed Income Assets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fixed Income Assets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fixed Income Assets Market?

To stay informed about further developments, trends, and reports in the North America Fixed Income Assets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence