Key Insights

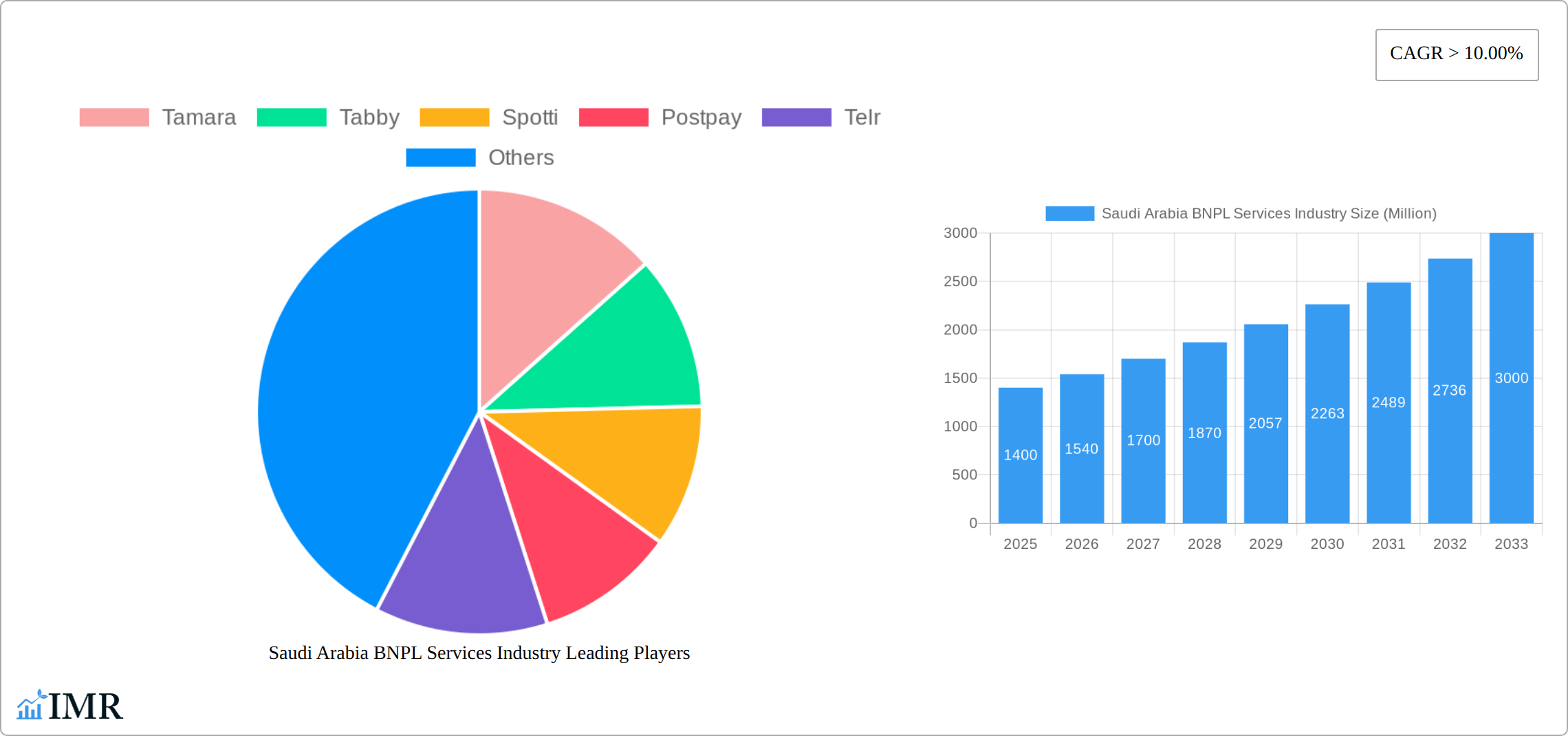

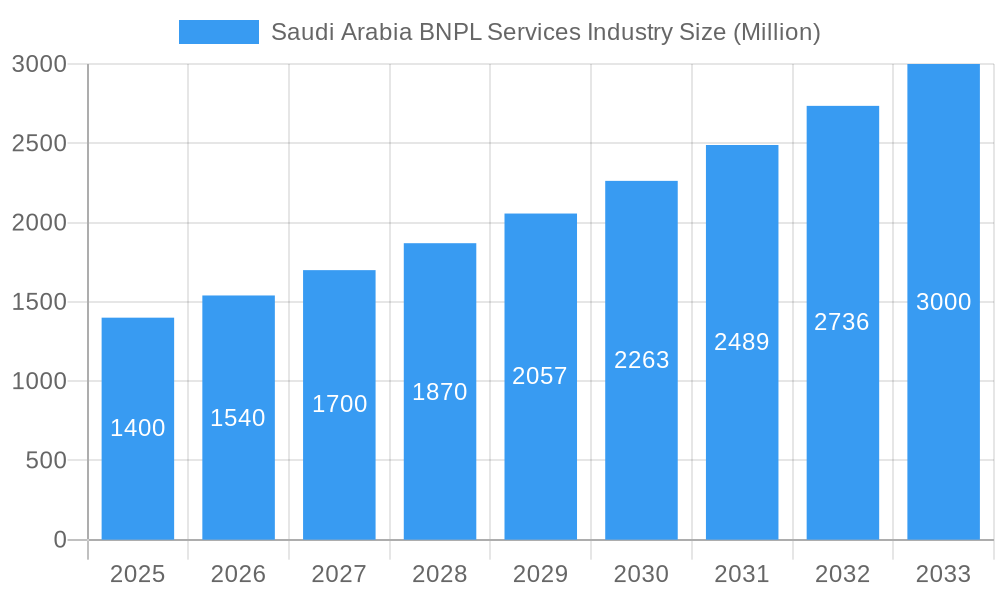

The Saudi Arabian Buy Now, Pay Later (BNPL) services industry is experiencing robust growth, projected to reach a market size of $1.4 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 10% through 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning young and digitally-savvy population readily adopts online shopping and fintech solutions. Secondly, increasing smartphone penetration and improved digital infrastructure provide convenient access to BNPL services. Thirdly, favorable government initiatives promoting digital transformation and financial inclusion further stimulate market growth. The industry is segmented by service type (e.g., point-of-sale financing, installment plans), merchant category (e-commerce, physical retail), and customer demographics. Leading players include both international giants like Mastercard and Visa, and regional fintech disruptors such as Tamara, Tabby, and Spotti, indicating a competitive yet dynamic market landscape. While challenges exist, such as potential regulatory scrutiny and consumer debt concerns, the overall outlook remains positive, driven by the continued expansion of e-commerce and rising consumer demand for flexible payment options.

Saudi Arabia BNPL Services Industry Market Size (In Billion)

The forecast for the Saudi Arabian BNPL market anticipates continued strong growth, exceeding the initial 10% CAGR due to the rapid adoption rate and potential for expansion into underserved segments. Further growth will likely be driven by partnerships between BNPL providers and traditional financial institutions, as well as the integration of BNPL options into existing e-commerce platforms. The introduction of innovative features, such as enhanced risk management tools and personalized payment plans, will also contribute to market expansion. Competition will remain intense, requiring companies to differentiate their offerings through superior customer service, competitive pricing, and strategic partnerships. The increasing financial literacy of the Saudi population will also play a role, influencing consumer adoption and usage patterns.

Saudi Arabia BNPL Services Industry Company Market Share

This comprehensive report provides an in-depth analysis of the burgeoning Buy Now, Pay Later (BNPL) services industry in Saudi Arabia, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly expanding market. The parent market is the broader fintech sector in Saudi Arabia, while the child market focuses specifically on BNPL services. Market values are presented in millions.

Saudi Arabia BNPL Services Industry Market Dynamics & Structure

The Saudi Arabian Buy Now, Pay Later (BNPL) sector is dynamic, characterized by intense competition, rapid technological integration, and a progressively evolving regulatory framework. The market exhibits a moderately concentrated structure, with prominent players such as Tamara, Tabby, and Postpay commanding substantial market share. However, the landscape is dynamic, with a consistent influx of new entrants continually intensifying the competitive environment and pushing for innovation.

- Market Concentration: The top 5 players are estimated to hold approximately 70% of the market share by 2025. This concentration is expected to gradually decrease as the market matures and new, agile players emerge, fostering a more fragmented and competitive future.

- Technological Innovation: The widespread adoption of open banking APIs is a significant growth enabler, facilitating seamless integration and data exchange. Concurrently, advancements in sophisticated fraud prevention technologies are bolstering trust and security. Nevertheless, persistent challenges related to robust data security protocols and the seamless integration with pre-existing legacy systems remain areas for continuous development.

- Regulatory Framework: The Saudi Arabian Monetary Authority (SAMA) plays a pivotal role in shaping the BNPL ecosystem, prioritizing consumer protection, financial stability, and ethical lending practices. Ensuring sustained growth hinges on maintaining clear, consistent, and supportive regulatory guidelines that foster innovation while mitigating risks.

- Competitive Product Substitutes: While traditional financial products like credit cards and personal loans remain viable alternatives, BNPL's inherent convenience, accessibility, and interest-free repayment structures appeal to a distinct and growing customer segment seeking immediate gratification with manageable payments.

- End-User Demographics: The primary user base for BNPL services is predominantly comprised of young adults and millennials. This demographic is strongly drawn to digital-first payment solutions, flexible financial management tools, and the ability to spread costs over time without incurring interest.

- M&A Trends: The industry has witnessed a notable number of strategic mergers and acquisitions, with an estimated 15-20 deals between 2019 and 2024. These transactions have primarily focused on expanding market reach, acquiring innovative technologies, and consolidating market positions. Further consolidation is anticipated as the sector matures and larger players seek to solidify their dominance.

Saudi Arabia BNPL Services Industry Growth Trends & Insights

The Saudi Arabian BNPL market experienced significant growth during the historical period (2019-2024), fueled by increasing smartphone penetration, rising e-commerce adoption, and a growing preference for cashless transactions. Market size, measured by total transaction value, is expected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is driven by factors such as increasing digital literacy, government initiatives promoting financial inclusion, and the expansion of e-commerce platforms. The market penetration rate is expected to increase from xx% in 2025 to xx% in 2033, indicating significant growth potential. Technological disruptions, such as the integration of BNPL services into various e-commerce platforms and mobile wallets, further accelerate market expansion. Consumer behavior shifts towards greater convenience and flexible payment options fuel the ongoing market growth.

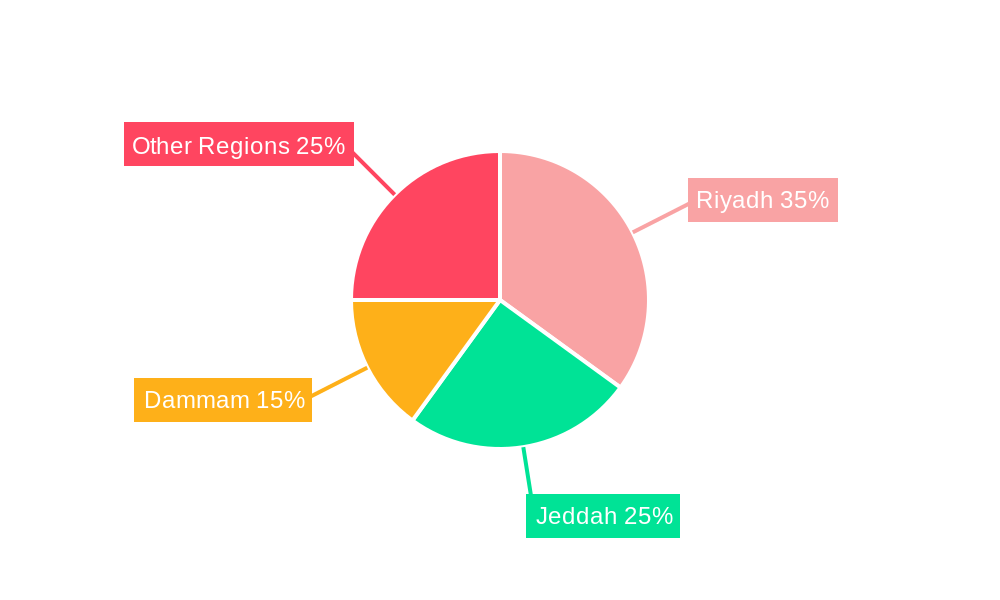

Dominant Regions, Countries, or Segments in Saudi Arabia BNPL Services Industry

The largest segment within the Saudi Arabian BNPL market is driven by online retail transactions, followed by in-store purchases and subscriptions. Major cities like Riyadh, Jeddah, and Dammam exhibit the highest adoption rates due to higher levels of internet penetration and e-commerce activity.

- Key Drivers:

- Growing E-commerce Sector: The booming e-commerce industry fuels the demand for convenient payment solutions like BNPL.

- Government Support: Government initiatives to promote digital transformation and financial inclusion are creating a favorable environment for the BNPL industry.

- Rising Smartphone Penetration: High smartphone penetration rates enhance the accessibility and convenience of BNPL services.

- Favorable Demographics: A young and digitally savvy population readily embraces innovative payment technologies.

Saudi Arabia BNPL Services Industry Product Landscape

BNPL offerings in Saudi Arabia are diverse, ranging from point-of-sale (POS) financing at physical stores to integrated solutions within e-commerce platforms and mobile apps. These services are characterized by varying repayment terms, interest rates, and eligibility criteria. Technological advancements include improved fraud detection mechanisms, AI-powered credit scoring, and seamless integration with various payment gateways. Key differentiators are offered through reward programs, personalized financing options, and flexible repayment schedules. These innovations aim to enhance customer experience and foster wider adoption.

Key Drivers, Barriers & Challenges in Saudi Arabia BNPL Services Industry

Key Drivers:

- The pervasive reach of smartphone penetration and widespread internet access forms the bedrock of BNPL adoption.

- The accelerated growth of e-commerce and online shopping has created a natural ecosystem for BNPL integration.

- Proactive government initiatives and a supportive regulatory environment for digital payments are fostering trust and encouraging adoption.

- An increasing consumer demand for flexible, interest-free payment options that align with modern spending habits.

Key Challenges:

- The dynamic nature of regulatory uncertainty and evolving compliance requirements can pose hurdles, potentially leading to estimated lost revenue of SAR 50-75 Million due to unforeseen delays or adjustments.

- Concerns regarding responsible debt management and the potential for consumer overspending necessitate robust credit assessment and customer education initiatives.

- Sustained competition from established traditional payment methods and incumbent financial institutions requires continuous innovation and differentiation.

- The ever-present risk of fraud and chargebacks demands sophisticated security measures; indeed, a reported 15-20% increase in fraud attempts was observed in 2024, underscoring the need for advanced protective technologies.

Emerging Opportunities in Saudi Arabia BNPL Services Industry

Significant untapped potential lies in extending BNPL services to historically underserved markets, including smaller cities and more remote rural areas, thereby democratizing access to flexible payment solutions. Strategic alliances with traditional financial institutions offer a powerful avenue to broaden credit accessibility and enhance sophisticated risk management frameworks. Integrating BNPL capabilities with existing loyalty programs and attractive reward systems can significantly boost customer engagement and accelerate adoption rates. Furthermore, exploring innovative use cases, such as offering BNPL for recurring utility bill payments or essential healthcare expenses, presents lucrative pathways for substantial growth and market differentiation.

Growth Accelerators in the Saudi Arabia BNPL Services Industry Industry

The market's expansion will be significantly propelled by strategic, synergistic partnerships forged between BNPL providers and leading e-commerce platforms, creating seamless checkout experiences. Advancements in artificial intelligence (AI)-powered risk assessment tools are poised to revolutionize underwriting processes, leading to more accurate credit evaluations and a demonstrable reduction in default rates. Continued government backing and a clear, predictable regulatory landscape will not only foster responsible market development but also attract substantial domestic and international investment. Proactive expansion into new, high-potential consumer segments, such as travel, entertainment, and even larger ticket items, will be crucial for achieving sustained long-term growth and market leadership.

Notable Milestones in Saudi Arabia BNPL Services Industry Sector

- June 2022: Postpay strategically partnered with Tap Payments, significantly expanding its payment options for a wider array of businesses and enhancing merchant capabilities.

- January 2023: ToYou, a leading delivery platform, collaborated with Tabby to launch an integrated BNPL service, offering customers greater flexibility and convenience during their online shopping journeys.

- October 2023: Tamara announced a significant funding round, underscoring investor confidence and fueling its expansion plans within the Saudi market and beyond.

- February 2024: SAMA issued updated guidelines for BNPL providers, reinforcing consumer protection measures and providing clearer operational frameworks, fostering a more secure and stable market environment.

In-Depth Saudi Arabia BNPL Services Industry Market Outlook

The Saudi Arabian BNPL market presents immense growth potential over the next decade. Continued technological advancements, strategic collaborations, and supportive government policies will underpin this expansion. Businesses that successfully navigate the regulatory landscape and address consumer concerns related to responsible borrowing will be well-positioned to capture significant market share. Focusing on enhancing user experience, improving fraud prevention, and expanding into new market segments will be key success factors. The long-term outlook remains positive, with significant opportunities for both established players and new entrants.

Saudi Arabia BNPL Services Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS (Point of Sale)

-

2. End User

- 2.1. Kitchen Appliances

- 2.2. Electronic Appliances

- 2.3. Fashion and Personal Care

- 2.4. Healthcare

Saudi Arabia BNPL Services Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia BNPL Services Industry Regional Market Share

Geographic Coverage of Saudi Arabia BNPL Services Industry

Saudi Arabia BNPL Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.4. Market Trends

- 3.4.1. Raising E-Commerce Platforms with Online Payment Methods Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia BNPL Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS (Point of Sale)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Kitchen Appliances

- 5.2.2. Electronic Appliances

- 5.2.3. Fashion and Personal Care

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tamara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tabby

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spotti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Postpay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cashew Payments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VISA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affirm Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zippay**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tamara

List of Figures

- Figure 1: Saudi Arabia BNPL Services Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia BNPL Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 2: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 3: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 9: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia BNPL Services Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Saudi Arabia BNPL Services Industry?

Key companies in the market include Tamara, Tabby, Spotti, Postpay, Telr, Mastercard, Cashew Payments, VISA, Affirm Inc, Zippay**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia BNPL Services Industry?

The market segments include Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

6. What are the notable trends driving market growth?

Raising E-Commerce Platforms with Online Payment Methods Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

8. Can you provide examples of recent developments in the market?

January 2023: ToYou, a delivery app established in Saudi Arabia, and the shopping and payment app Tabby partnered to create a new BNPL service in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia BNPL Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia BNPL Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia BNPL Services Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia BNPL Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence