Key Insights

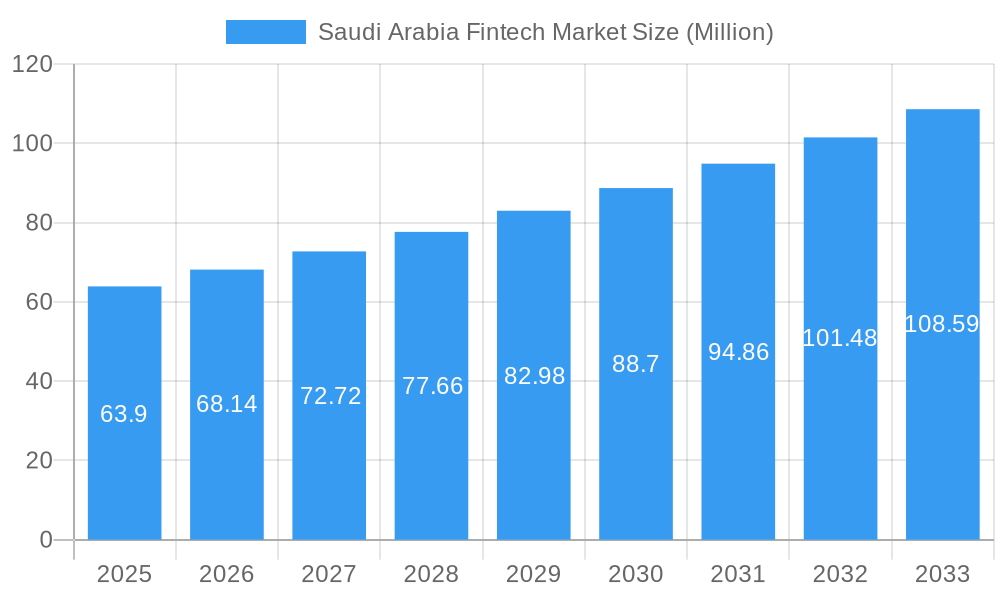

The Saudi Arabian Fintech market is experiencing robust growth, projected to reach $63.90 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 6.07% from 2025 to 2033. This expansion is fueled by several key drivers. The Kingdom's Vision 2030 initiative, focused on economic diversification and digital transformation, is a significant catalyst, promoting widespread adoption of digital financial services. A burgeoning young and tech-savvy population, coupled with increasing smartphone penetration and internet access, creates a fertile ground for fintech innovation. Government support through regulatory frameworks encouraging innovation and investment further accelerates market growth. Furthermore, the rise of e-commerce and the increasing demand for convenient and accessible financial solutions are propelling the adoption of digital payment platforms, lending services, and investment technologies. Competition among established players like Rasanah Technologies, SURE, and Foodics, and the emergence of new entrants, fosters innovation and drives market expansion.

Saudi Arabia Fintech Market Market Size (In Million)

The market segmentation, while not explicitly provided, is likely to include key areas such as payments, lending, investment management, and insurance technology. The growth trajectory is expected to be influenced by factors such as the success of government initiatives to promote financial inclusion, the level of investment in fintech infrastructure, and the evolving regulatory landscape. Potential restraints could include challenges in cybersecurity, data privacy concerns, and the need for robust consumer education to foster trust and adoption of new financial technologies. The continued success of the Saudi Arabian fintech market hinges on addressing these challenges while capitalizing on the opportunities presented by Vision 2030 and the growing demand for digital financial services. The forecast period of 2025-2033 indicates a considerable expansion, with the market likely exceeding $100 million by 2030, based on the projected CAGR.

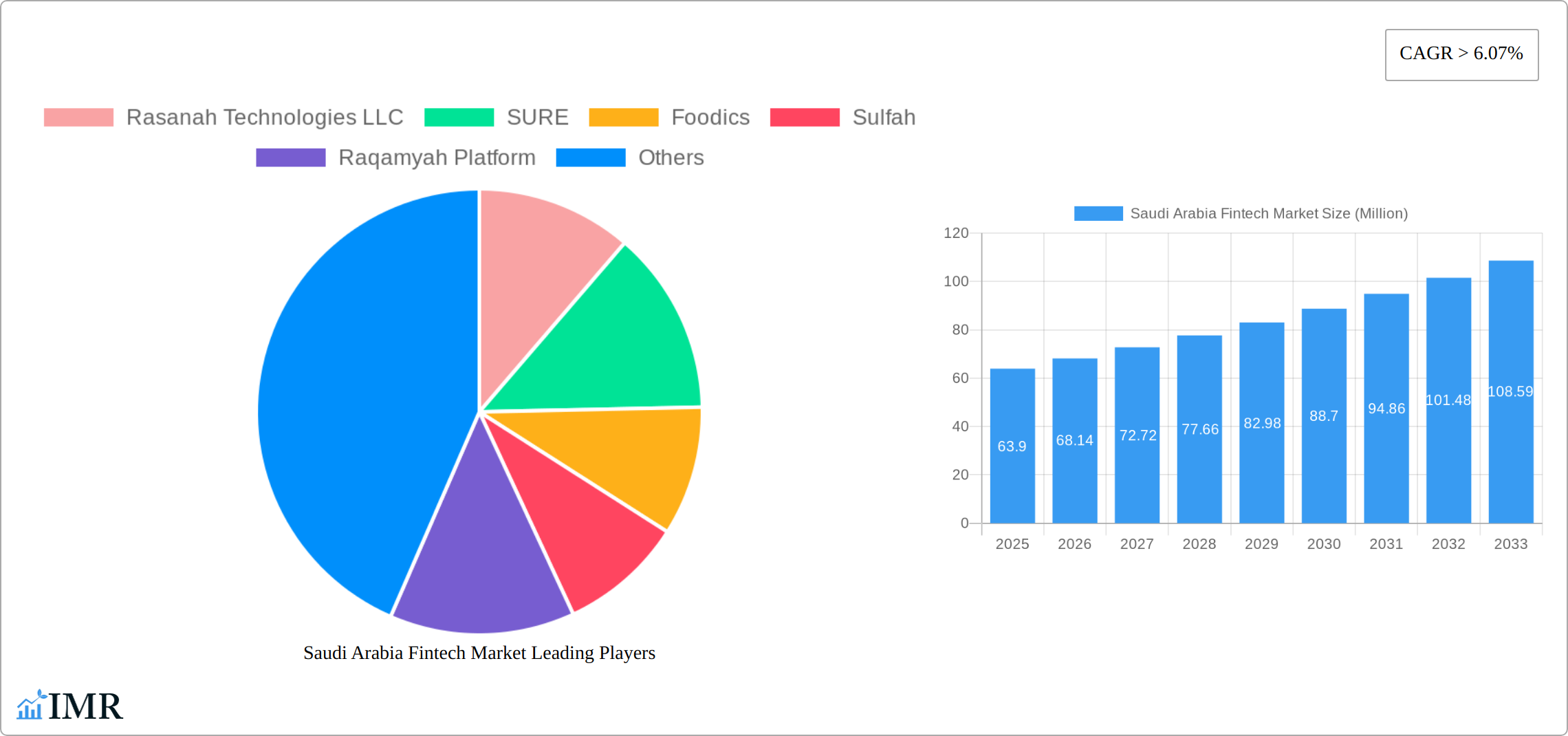

Saudi Arabia Fintech Market Company Market Share

Saudi Arabia Fintech Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia Fintech market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for investors, industry professionals, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report analyzes parent markets like digital payments and lending, and child markets such as Insurtech and Regtech to provide a holistic view.

Saudi Arabia Fintech Market Dynamics & Structure

The Saudi Arabian Fintech market is characterized by increasing market concentration, driven by significant investments and acquisitions. Technological innovation, fueled by government initiatives like Vision 2030, is a key driver, alongside a supportive regulatory framework from the Saudi Arabian Monetary Authority (SAMA). However, challenges remain, including competition from established financial institutions and navigating the complexities of a relatively new regulatory landscape. The market is witnessing a rise in M&A activity, with several large deals shaping the competitive landscape.

- Market Concentration: The market is moderately concentrated, with a few major players holding significant market share (estimated at xx% for the top 3 players in 2025).

- Technological Innovation: Significant investments in AI, blockchain, and big data analytics are transforming the Fintech landscape.

- Regulatory Framework: SAMA's supportive regulations are encouraging innovation while ensuring consumer protection.

- Competitive Product Substitutes: Traditional banking services pose a significant competitive challenge.

- End-User Demographics: The young and tech-savvy population is driving adoption of Fintech solutions.

- M&A Trends: The number of M&A deals increased by xx% between 2021 and 2022, indicating a consolidating market.

Saudi Arabia Fintech Market Growth Trends & Insights

The Saudi Arabia Fintech market is experiencing robust and dynamic growth, fueled by a trifecta of soaring smartphone penetration, rapidly expanding internet access, and a burgeoning, digitally-native young population. Projections indicate the market size is set to reach a significant figure of **[Insert Specific Market Size Value Here] Million by 2025**, demonstrating a Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR Value Here]%** during the forecast period of 2025-2033. Transformative technological advancements, including the widespread adoption of open banking frameworks and the seamless integration of embedded finance solutions, are powerfully accelerating this market expansion. Consequently, consumer behavior is undergoing a pronounced shift towards prioritizing digital-first financial services, which in turn is significantly impacting adoption rates and cultivating a strong demand for innovative, user-centric solutions. The increasing reliance and adoption of sophisticated mobile payment systems stand out as a primary and pivotal driver behind this burgeoning sector.

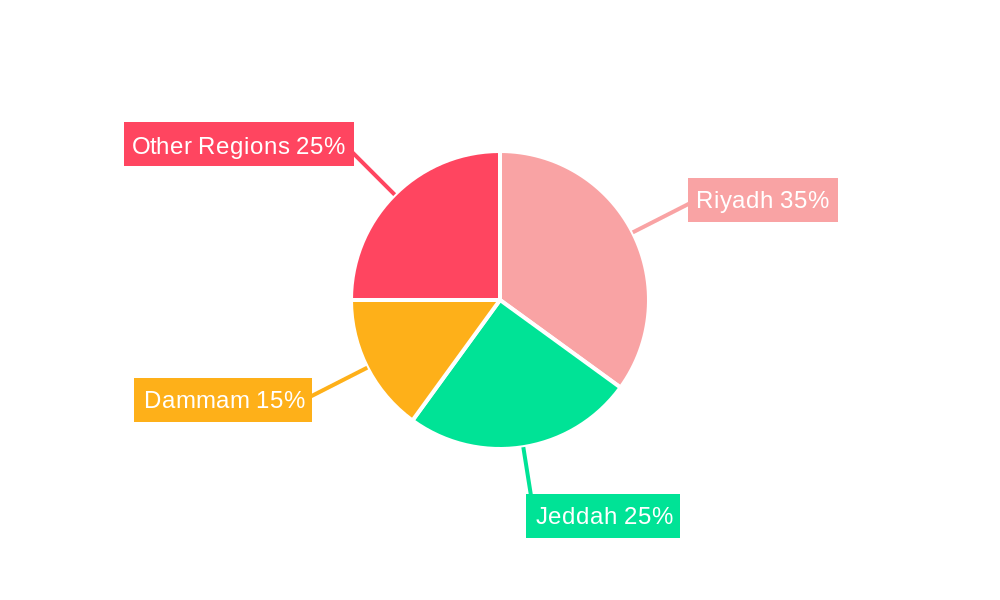

Dominant Regions, Countries, or Segments in Saudi Arabia Fintech Market

Currently, the Riyadh region stands as the epicenter of the Saudi Arabia Fintech market, primarily due to its high concentration of established financial institutions, thriving tech innovation hubs, and a larger, more active population base. However, a significant trend to note is the emergence of other regions exhibiting substantial growth potential. This is largely attributed to strategic government initiatives focused on economic diversification and the concerted efforts to enhance and expand digital infrastructure across the Kingdom.

- Key Catalysts for Growth:

- Vision 2030: The ambitious national transformation plan provides a strong strategic framework and government backing for digital and financial innovation.

- Advanced Digital Infrastructure: Continuous investment and development in high-speed internet, 5G networks, and cloud computing are foundational for digital services.

- High Smartphone Penetration: An ever-increasing percentage of the population owns smartphones, serving as the primary gateway to digital financial services.

- Supportive Regulatory Environment: Forward-thinking regulations and sandbox initiatives by regulatory bodies like the Saudi Central Bank (SAMA) foster experimentation and innovation in the fintech space.

- Growing E-commerce and Digital Payments: The surge in online retail and digital transactions directly correlates with increased demand for fintech solutions.

- Factors Contributing to Dominance (and potential diffusion):

- Concentration of Financial Ecosystem in Riyadh: The historical presence of major banks and financial services in the capital naturally fosters early fintech adoption and development.

- Urban vs. Rural Penetration: Higher internet and smartphone penetration rates in major urban centers, including Riyadh, contribute to their current dominance.

- Targeted Government Investment: Significant government investment in digital infrastructure development and economic diversification programs in other regions are poised to reduce disparities and spur growth beyond the capital.

- Emergence of FinTech Hubs: Initiatives to establish specialized fintech clusters and innovation centers in other cities are beginning to attract talent and investment.

Saudi Arabia Fintech Market Product Landscape

The Saudi Arabian Fintech market offers a diverse range of products, including digital payment solutions, mobile banking apps, peer-to-peer lending platforms, and robo-advisors. Innovations focus on enhancing user experience, improving security, and integrating with existing financial systems. Many companies offer unique selling propositions such as localized features catering to the specific needs of the Saudi Arabian market.

Key Drivers, Barriers & Challenges in Saudi Arabia Fintech Market

Key Drivers:

- Increased smartphone penetration and internet access.

- Government support through initiatives like Vision 2030.

- Growing demand for convenient and accessible financial services.

- Rising adoption of digital payments.

Challenges:

- Competition from traditional banks.

- Regulatory hurdles and compliance requirements.

- Cybersecurity concerns and data protection issues.

- Limited financial literacy among some segments of the population.

Emerging Opportunities in Saudi Arabia Fintech Market

- Expanding Financial Inclusion:

- Leveraging mobile-first solutions to reach and serve previously underserved segments, including rural populations and small businesses.

- Developing micro-lending, micro-insurance, and accessible investment platforms tailored for these demographics.

- Specialized and Niche Fintech Applications:

- Innovating and developing bespoke solutions deeply integrated with the principles and practices of Islamic finance, a significant cultural and economic component of Saudi Arabia.

- Creating Sharia-compliant digital banking, investment, and wealth management tools.

- Developing specialized solutions for sectors undergoing digital transformation, such as real estate (PropTech), supply chain (Supply Chain Finance), and healthcare (HealthTech).

- Meeting Evolving Consumer Demands:

- Prioritizing the development of highly personalized financial management tools that offer proactive insights, budgeting assistance, and tailored investment recommendations.

- Enhancing user experience with intuitive interfaces, seamless onboarding, and omnichannel access.

- Focusing on hyper-personalization through data analytics and AI to anticipate user needs and offer relevant financial products and services.

- Exploring embedded finance models that integrate financial services directly into non-financial platforms and customer journeys.

Growth Accelerators in the Saudi Arabia Fintech Market Industry

Several powerful forces are propelling the Saudi Arabia Fintech market forward. Key among these are relentless technological advancements, particularly the integration of sophisticated Artificial Intelligence (AI) for data analysis, fraud detection, and personalized services, and the burgeoning potential of blockchain technology for secure and transparent transactions. Strategic and mutually beneficial partnerships between agile Fintech startups and established traditional financial institutions are proving to be instrumental in fostering cross-pollination of innovation, accelerating product development, and significantly expanding market reach and customer bases. Furthermore, ongoing and robust government initiatives dedicated to driving digital transformation across all sectors of the economy are creating a fertile ground and providing significant impetus for the continued and accelerated expansion of the fintech market in Saudi Arabia.

Key Players Shaping the Saudi Arabia Fintech Market Market

- Rasanah Technologies LLC

- SURE

- Foodics

- Sulfah

- Raqamyah Platform

- Maalem Financing Company

- Skyband

- Saudi Fintech Company

- Fleap

- Tamara

List Not Exhaustive

Notable Milestones in Saudi Arabia Fintech Market Sector

- January 2022: The Saudi Arabian Monetary Authority (SAMA) issued licenses to 15 new fintech companies, bringing the total to 45.

- February 2023: Hala acquired Paymennt.com, significantly expanding its payment processing capabilities and market reach (payment processing increased by over 250% year-on-year).

In-Depth Saudi Arabia Fintech Market Market Outlook

The Saudi Arabia Fintech market is poised for continued strong growth, driven by sustained government support, technological innovation, and evolving consumer preferences. Strategic partnerships and expansion into new market segments will be crucial for companies to capitalize on the significant opportunities in this dynamic sector. The market is expected to witness further consolidation through M&A activity, leading to a more mature and competitive landscape.

Saudi Arabia Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

Saudi Arabia Fintech Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fintech Market Regional Market Share

Geographic Coverage of Saudi Arabia Fintech Market

Saudi Arabia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation and Regulatory Support Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rasanah Technologies LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SURE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Foodics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sulfah

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raqamyah Platform

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maalem Financing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyband

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saudi Fintech Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fleap

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tamara**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rasanah Technologies LLC

List of Figures

- Figure 1: Saudi Arabia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Saudi Arabia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: Saudi Arabia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fintech Market?

The projected CAGR is approximately > 6.07%.

2. Which companies are prominent players in the Saudi Arabia Fintech Market?

Key companies in the market include Rasanah Technologies LLC, SURE, Foodics, Sulfah, Raqamyah Platform, Maalem Financing Company, Skyband, Saudi Fintech Company, Fleap, Tamara**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

6. What are the notable trends driving market growth?

Digital Transformation and Regulatory Support Driving the Market.

7. Are there any restraints impacting market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Hala, a fintech company in Saudi Arabia, purchased Paymennt.com, a payments service provider based in the United Arab Emirates. With this acquisition, Hala can handle omnichannel payments, integrate digital payments into its product offerings, and help its SME clients become more visible online. According to a press release by Wamda, the platform's payment processing increased by more than 250% yearly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fintech Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence