Key Insights

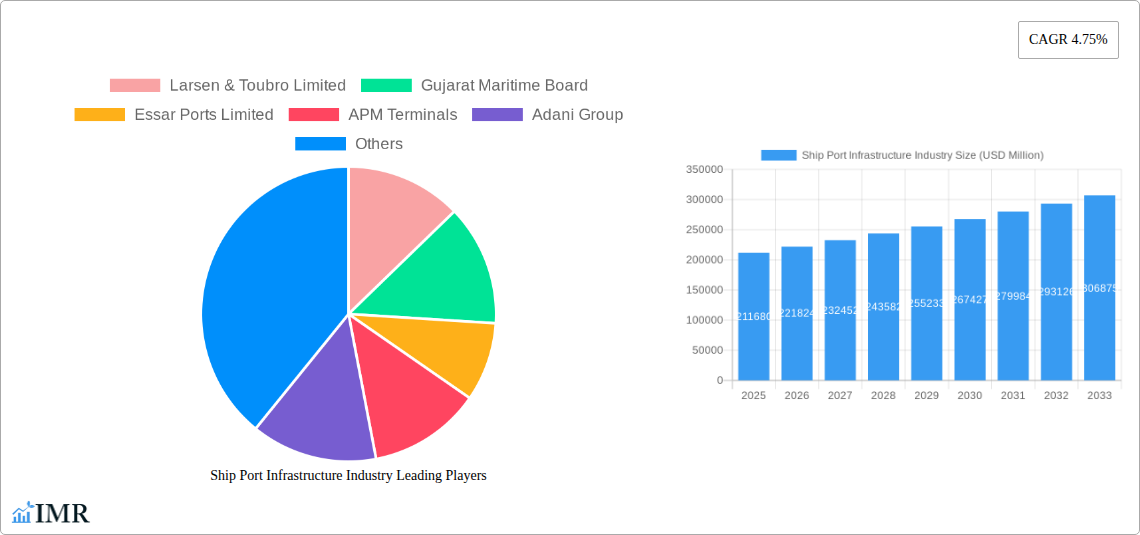

The global Ship Port Infrastructure market is poised for robust expansion, with a projected market size of $211.68 billion in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.75% anticipated over the forecast period from 2025 to 2033. This upward trajectory is largely propelled by several key drivers. The burgeoning global trade volume necessitates continuous upgrades and expansions of port facilities to accommodate larger vessels and increased cargo throughput. Furthermore, government initiatives focused on developing smart ports and enhancing maritime logistics efficiency are acting as significant catalysts. The increasing demand for efficient cargo handling and passenger movement, coupled with investments in modernizing existing infrastructure and developing new ports, will fuel market expansion. The growing emphasis on sustainable port operations and the adoption of green technologies also present opportunities for market players.

Ship Port Infrastructure Industry Market Size (In Billion)

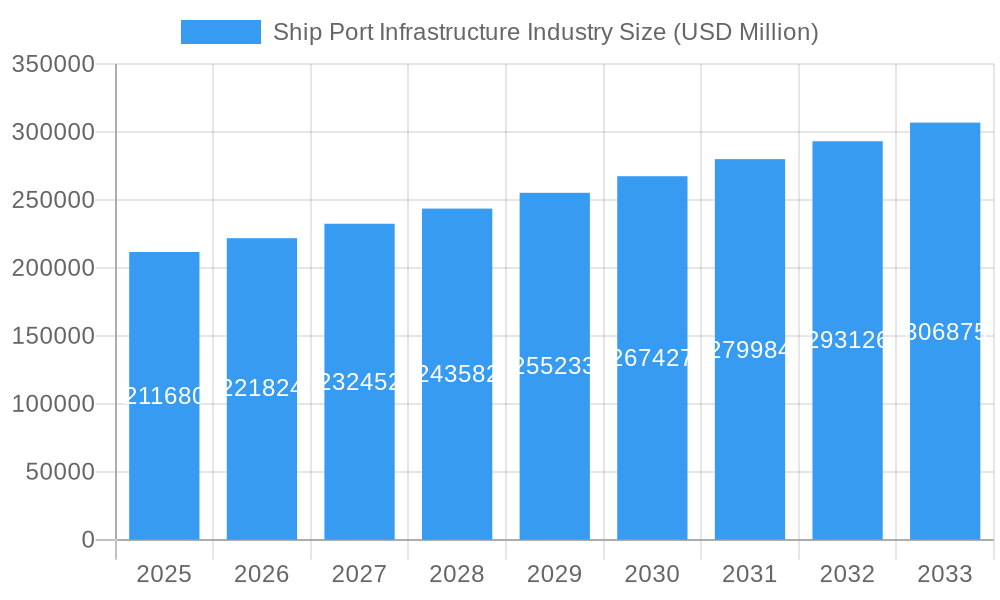

The market's segmentation highlights the diverse applications and types of ports driving this growth. The "Cargo" application segment is expected to dominate, reflecting the increasing reliance on maritime trade for the movement of goods. In terms of port types, both "Sea Port" and "Inland Port" segments are crucial, with sea ports handling the bulk of international trade and inland ports facilitating efficient intermodal connectivity. Key players like Larsen & Toubro Limited, Gujarat Maritime Board, Essar Ports Limited, APM Terminals, Adani Group, and DP World are actively investing in capacity expansion, technological integration, and strategic collaborations to capitalize on these market dynamics. Emerging trends include the integration of AI and IoT for optimizing port operations, the development of specialized terminals for different types of cargo (e.g., LNG, containers), and a greater focus on cybersecurity for port infrastructure. Challenges such as high initial investment costs, regulatory hurdles, and environmental concerns are present but are being addressed through innovative solutions and strategic planning.

Ship Port Infrastructure Industry Company Market Share

Unlock critical insights into the global ship port infrastructure market, a vital sector driving international trade and economic growth. This in-depth report, covering the period from 2019 to 2033 with a base year of 2025, provides an unparalleled analysis of market dynamics, growth trends, and future opportunities. Examine the evolution of sea port infrastructure, inland port development, and specialized port services, driven by the increasing demand for cargo handling, passenger transport, and integrated logistics solutions.

With a focus on key players like Larsen & Toubro Limited, Gujarat Maritime Board, Essar Ports Limited, APM Terminals, Adani Group, Starlog Enterprise, Man Infraconstruction Limited, and DP World, this report offers a granular view of the competitive landscape. Understand the strategic investments and mergers shaping the global port industry, including significant deals in August 2022 involving Adani Ports Group, APM Terminals, and Essar group.

Ship Port Infrastructure Industry Market Dynamics & Structure

The ship port infrastructure market is characterized by a moderate to high level of concentration, with a few dominant players like Adani Group and DP World controlling significant shares of the global port operations and terminal management segments. Technological innovation, particularly in automation, AI-driven logistics, and sustainable port development, serves as a primary driver. However, the substantial capital investment required for developing and upgrading port facilities presents a significant barrier to entry. Regulatory frameworks, including environmental compliance and international maritime standards, play a crucial role in shaping market strategies. Competitive product substitutes, such as advancements in rail and air cargo, exert pressure, necessitating continuous innovation and efficiency improvements in port operations. End-user demographics are increasingly sophisticated, demanding seamless, integrated logistics solutions that encompass port development, container handling, and freight forwarding. Mergers and acquisitions (M&A) are a key feature, driven by the pursuit of economies of scale, market expansion, and the integration of value-added services. For instance, the Essar group's USD 2.4 billion deal in August 2022 exemplifies the trend of consolidation and strategic divestments. The market is also influenced by geopolitical stability and global trade policies, impacting the flow of goods and the demand for port capacity.

- Market Concentration: Moderate to high, with key global players dominating.

- Technological Drivers: Automation, AI, IoT, sustainable technologies.

- Regulatory Impact: Environmental regulations, trade agreements, safety standards.

- Competitive Landscape: Pressure from intermodal transport, need for integrated services.

- End-User Demands: Efficiency, speed, sustainability, digital integration.

- M&A Activity: Driven by scale, market access, and service diversification.

Ship Port Infrastructure Industry Growth Trends & Insights

The global ship port infrastructure market is projected for robust growth, driven by increasing international trade volumes, the expansion of global supply chains, and significant investments in port modernization and terminal expansion. The market size, estimated to reach USD 1.8 trillion in 2025, is expected to witness a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033, reaching an estimated USD 3.1 trillion by 2033. Adoption rates for advanced technologies such as automated container handling systems, intelligent traffic management, and predictive maintenance are on the rise, significantly improving operational efficiency and reducing turnaround times. Technological disruptions, including the implementation of blockchain for supply chain transparency and the use of drones for port surveillance, are further enhancing capabilities. Consumer behavior shifts, characterized by a growing demand for faster and more reliable delivery of goods, are compelling port authorities and operators to invest heavily in infrastructure upgrades and digital solutions. The expansion of e-commerce, coupled with the increasing size of container vessels, necessitates larger and more sophisticated port facilities capable of handling higher throughput. Investments in green port initiatives and sustainable energy solutions are also gaining traction, responding to environmental concerns and regulatory pressures. The development of multi-modal connectivity, integrating sea ports with rail and road networks, is crucial for optimizing logistics flow. The child market for specialized port services, such as bunker fuel supply, ship repair, and warehousing, is also experiencing parallel growth. The parent market for port infrastructure is directly fueling these ancillary services.

- Market Size Evolution: From an estimated USD 1.8 trillion in 2025 to USD 3.1 trillion by 2033.

- CAGR: 7.2% (2025-2033).

- Adoption Rates: High for automation, AI-driven logistics, and sustainability tech.

- Technological Disruptions: Blockchain, IoT, predictive maintenance, drone technology.

- Consumer Behavior: Demand for speed, reliability, and integrated logistics.

- Key Growth Factors: International trade, e-commerce, vessel size increase, multi-modal connectivity.

- Child Market Growth: Driven by demand for specialized port services.

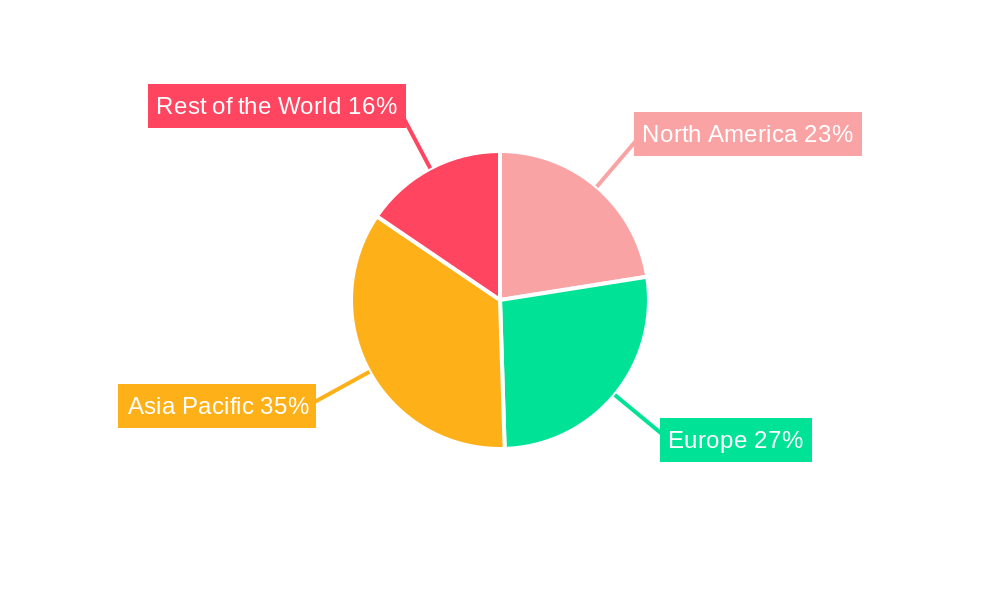

Dominant Regions, Countries, or Segments in Ship Port Infrastructure Industry

The sea port segment is the dominant force within the ship port infrastructure industry, commanding an estimated 65% of the market share in 2025 and projected to maintain its lead throughout the forecast period. This dominance is attributed to its central role in global maritime trade and the transportation of bulk cargo and containers. Asia-Pacific, particularly China, is the leading region, driven by its extensive coastline, massive manufacturing base, and aggressive investment in port infrastructure development. Countries like Singapore, South Korea, and India are also significant contributors, focusing on building world-class container terminals and logistics hubs. The cargo application segment, accounting for approximately 75% of the market in 2025, is the primary driver of growth within the sea port and inland port segments. This is fueled by the continuous increase in global trade volumes, particularly in manufactured goods and raw materials. The passenger application segment, while smaller, is crucial for regions reliant on tourism and ferry services, with significant investments seen in cruise terminals and efficient passenger handling facilities. The growth in the sea port segment is further propelled by the development of specialized ports, such as dedicated LNG terminals, oil terminals, and bulk cargo ports, catering to specific industry needs. Economic policies promoting trade liberalization, coupled with substantial government and private sector investment in port modernization and digitalization, are key factors driving dominance in regions like the Asia-Pacific. Europe and North America are also significant markets, with a focus on upgrading existing infrastructure to enhance efficiency and sustainability, and adopting advanced technologies. The development of smart ports and integrated logistics corridors are key strategic initiatives in these regions.

- Dominant Segment (Type): Sea Port (estimated 65% market share in 2025).

- Dominant Segment (Application): Cargo (estimated 75% market share in 2025).

- Leading Region: Asia-Pacific, with China as a key player.

- Key Drivers in Asia-Pacific: Extensive coastline, manufacturing hub, aggressive investment.

- Growth Factors in Sea Ports: Specialized terminals (LNG, oil, bulk), container handling.

- European & North American Focus: Modernization, efficiency, sustainability, digitalization.

- Strategic Initiatives: Smart ports, integrated logistics corridors.

Ship Port Infrastructure Industry Product Landscape

The product landscape of the ship port infrastructure industry is evolving rapidly, with a focus on enhancing efficiency, sustainability, and safety. Key innovations include advanced quay cranes with higher lifting capacities and faster cycle times, automated guided vehicles (AGVs) for efficient container movement within terminals, and intelligent port management systems that leverage AI and IoT for real-time operational optimization. The development of eco-friendly port technologies, such as shore power facilities for reducing emissions from docked vessels and advanced waste management systems, are becoming increasingly important selling propositions. Performance metrics are centered on throughput capacity, turnaround times, operational costs, and environmental impact. The integration of digital twins for simulating and optimizing port operations, as well as advanced robotics for inspection and maintenance, are technological advancements pushing the boundaries of what's possible in port infrastructure.

Key Drivers, Barriers & Challenges in Ship Port Infrastructure Industry

The ship port infrastructure industry is propelled by several key drivers, including the ever-increasing volume of global trade, the expansion of e-commerce necessitating efficient last-mile delivery solutions, and significant investments in emerging economies. Technological advancements in automation, AI, and digitalization are crucial for improving operational efficiency and competitiveness. Government initiatives promoting trade facilitation and infrastructure development also play a vital role.

However, the industry faces substantial barriers and challenges. The immense capital investment required for port construction and upgrades represents a significant hurdle. Stringent environmental regulations and the need for sustainable practices add complexity and cost. Geopolitical uncertainties and protectionist trade policies can disrupt trade flows, impacting demand. Supply chain disruptions, as witnessed in recent years, can affect the timely delivery of construction materials and equipment, leading to project delays. Furthermore, competition from other modes of transport and the constant need to adapt to evolving shipping technologies pose ongoing challenges.

Emerging Opportunities in Ship Port Infrastructure Industry

Emerging opportunities in the ship port infrastructure industry lie in the development of smart ports and the adoption of Industry 4.0 technologies. The growing demand for green logistics presents a significant opportunity for investing in sustainable port infrastructure, including renewable energy sources and emission reduction technologies. Untapped markets in developing regions with burgeoning trade volumes offer substantial growth potential. Innovative applications such as the integration of drones for inspection and security, and the use of blockchain for enhanced supply chain transparency, are creating new revenue streams. Evolving consumer preferences for faster and more sustainable delivery are driving demand for advanced port logistics solutions and integrated intermodal transportation networks. The expansion of offshore wind farm support infrastructure also presents a niche but growing opportunity.

Growth Accelerators in the Ship Port Infrastructure Industry Industry

Several catalysts are accelerating long-term growth in the ship port infrastructure industry. Technological breakthroughs in automation, AI, and robotics are revolutionizing port operations, leading to increased efficiency and reduced costs. Strategic partnerships between port authorities, shipping lines, and logistics providers are fostering collaboration and driving integrated solutions. Market expansion strategies, particularly in developing economies with rapidly growing trade volumes, are opening up new avenues for investment and development. The increasing adoption of digitalization and the development of smart port ecosystems are creating more resilient and efficient supply chains. Furthermore, a global push towards decarbonization and sustainability is spurring investments in green port technologies and cleaner shipping solutions.

Key Players Shaping the Ship Port Infrastructure Industry Market

- Larsen & Toubro Limited

- Gujarat Maritime Board

- Essar Ports Limited

- APM Terminals

- Adani Group

- Starlog Enterprise

- Man Infraconstruction Limited

- DP World

Notable Milestones in Ship Port Infrastructure Industry Sector

- August 2022: Adani Ports Group signed an MoU with Adani Ports and Special Economic Zone (SEZ) Ltd for strategic joint investments in end-to-end logistics infrastructure and solutions, including rail, maritime services, port operations, digital services, an industrial zone, and the establishment of maritime academies in Tanzania. This marks a significant step in expanding their global logistics footprint and offering integrated solutions.

- August 2022: APM Terminals, a subsidiary of Maersk, emerged as the successful bidder in the judicial auction for the acquisition of the isolated Estaleiro Atlantico Sul production unit located in the Port of Suape, Pernambuco, Brazil. This strategic acquisition underscores APM Terminals' commitment to expanding its presence and developing its operations in key South American maritime hubs.

- August 2022: Essar group signed a USD 2.4 billion deal to sell certain ports and power infrastructure to ArcelorMittal Nippon Steel. This transaction highlights the ongoing consolidation and strategic divestments within the port infrastructure and energy sector, reflecting the dynamic nature of large-scale M&A activities post-pandemic.

In-Depth Ship Port Infrastructure Industry Market Outlook

The future outlook for the ship port infrastructure industry is exceptionally bright, driven by persistent growth in global trade, evolving supply chain dynamics, and a strong impetus for technological advancement and sustainability. The market is poised for significant expansion, fueled by ongoing investments in port modernization, terminal automation, and the development of smart port ecosystems. Strategic collaborations and mergers will continue to reshape the competitive landscape, fostering greater efficiency and integration. The increasing focus on green port initiatives and the adoption of sustainable practices will not only drive investment in eco-friendly technologies but also enhance the long-term resilience and attractiveness of port operations. Emerging economies are expected to be key growth centers, as they invest heavily in developing their maritime infrastructure to support increasing trade volumes. Overall, the industry is set for sustained growth, offering substantial opportunities for innovation and strategic development.

Ship Port Infrastructure Industry Segmentation

-

1. Type

- 1.1. Sea Port

- 1.2. Inland Port

- 1.3. Other Types

-

2. Application

- 2.1. Passenger

- 2.2. Cargo

Ship Port Infrastructure Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Ship Port Infrastructure Industry Regional Market Share

Geographic Coverage of Ship Port Infrastructure Industry

Ship Port Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives for Development of Ports are Driving Growth

- 3.3. Market Restrains

- 3.3.1. High Capital Investment may hamper the target market growth

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Development of Ports are Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ship Port Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sea Port

- 5.1.2. Inland Port

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger

- 5.2.2. Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ship Port Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sea Port

- 6.1.2. Inland Port

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger

- 6.2.2. Cargo

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Ship Port Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sea Port

- 7.1.2. Inland Port

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger

- 7.2.2. Cargo

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Ship Port Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sea Port

- 8.1.2. Inland Port

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger

- 8.2.2. Cargo

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Ship Port Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sea Port

- 9.1.2. Inland Port

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger

- 9.2.2. Cargo

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Larsen & Toubro Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Gujarat Maritime Board

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Essar Ports Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 APM Terminals

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Adani Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Starlog Entrprise

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Man Infraconstruction Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DP World

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Larsen & Toubro Limited

List of Figures

- Figure 1: Global Ship Port Infrastructure Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Ship Port Infrastructure Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Ship Port Infrastructure Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Ship Port Infrastructure Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Ship Port Infrastructure Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ship Port Infrastructure Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Ship Port Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ship Port Infrastructure Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Ship Port Infrastructure Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Ship Port Infrastructure Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Ship Port Infrastructure Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Ship Port Infrastructure Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Ship Port Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Ship Port Infrastructure Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Ship Port Infrastructure Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Ship Port Infrastructure Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Ship Port Infrastructure Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Ship Port Infrastructure Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Ship Port Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Ship Port Infrastructure Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Ship Port Infrastructure Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Ship Port Infrastructure Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Rest of the World Ship Port Infrastructure Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Ship Port Infrastructure Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Ship Port Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global Ship Port Infrastructure Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Mexico Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Ship Port Infrastructure Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ship Port Infrastructure Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Ship Port Infrastructure Industry?

Key companies in the market include Larsen & Toubro Limited, Gujarat Maritime Board, Essar Ports Limited, APM Terminals, Adani Group, Starlog Entrprise, Man Infraconstruction Limited, DP World.

3. What are the main segments of the Ship Port Infrastructure Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives for Development of Ports are Driving Growth.

6. What are the notable trends driving market growth?

Government Initiatives for Development of Ports are Driving Growth.

7. Are there any restraints impacting market growth?

High Capital Investment may hamper the target market growth.

8. Can you provide examples of recent developments in the market?

August 2022: Adani Ports Group signed a memorandum of understanding (MoU) with Adani Ports and special economic zone (SEZ) Ltd for strategic joint investments in end-to-end logistics infrastructure and solutions, which include rail, maritime services, port operations, digital services, an industrial zone, and the establishment of maritime academies in Tanzania.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ship Port Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ship Port Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ship Port Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Ship Port Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence