Key Insights

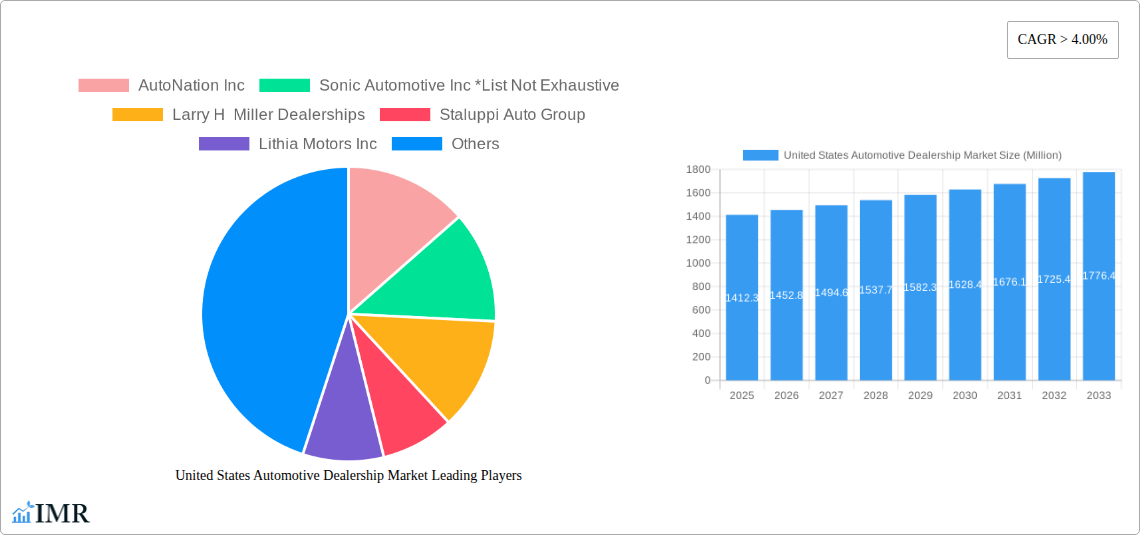

The United States automotive dealership market is poised for steady growth, projected to reach $1412.3 million by 2025. This expansion is driven by a consistent CAGR of 2.9% anticipated throughout the forecast period of 2019-2033. Key growth catalysts include the increasing demand for new vehicles, spurred by new model introductions and evolving consumer preferences for advanced features and fuel efficiency. Furthermore, the robust aftermarket for parts and services continues to be a significant revenue generator, fueled by an aging vehicle parc and the growing emphasis on vehicle maintenance and repair. The market is characterized by a dynamic segmentation across new and used vehicle dealerships, alongside a strong reliance on lucrative finance and insurance services. Franchised retailers, benefiting from manufacturer backing and brand recognition, hold a dominant position, while non-franchised retailers cater to a diverse customer base with flexible options. Passenger cars represent the largest vehicle segment, though commercial vehicles are experiencing considerable interest due to economic activity and fleet expansion.

United States Automotive Dealership Market Market Size (In Billion)

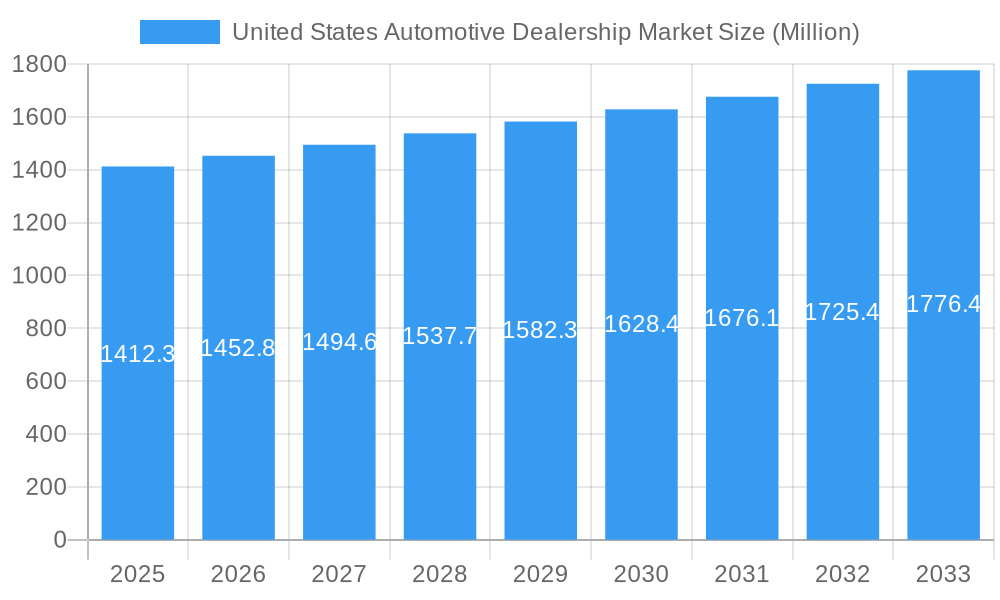

The competitive landscape is robust, featuring prominent players like AutoNation Inc., Sonic Automotive Inc., and Lithia Motors Inc., among others. These large groups are adept at leveraging economies of scale and implementing strategic initiatives to enhance customer experience and operational efficiency. Emerging trends include the integration of digital sales channels, offering online browsing, financing applications, and even vehicle delivery, to cater to the modern car buyer. Dealerships are also focusing on expanding their service departments, offering a wider array of maintenance, repair, and customization options. However, the market faces certain restraints. Fluctuations in vehicle inventory, supply chain disruptions, and evolving regulatory landscapes can impact sales volumes and profitability. Furthermore, the increasing popularity of direct-to-consumer sales models by some electric vehicle manufacturers presents a potential long-term challenge, necessitating traditional dealerships to innovate and adapt their business models to remain competitive.

United States Automotive Dealership Market Company Market Share

Unlock critical insights into the dynamic US Automotive Dealership Market with this in-depth report. Covering the historical period from 2019-2024 and forecasting future growth through 2033, this analysis delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, challenges, emerging opportunities, and the strategic moves of major players. Essential for industry professionals, investors, and stakeholders seeking to navigate the evolving automotive retail sector.

United States Automotive Dealership Market Market Dynamics & Structure

The United States automotive dealership market is characterized by a moderate to high degree of market concentration, with large publicly traded groups and privately held entities dominating significant portions of sales. Technological innovation is a key driver, focusing on enhanced customer experiences, digital retailing platforms, and data analytics for inventory management and customer engagement. Regulatory frameworks, including franchise laws and consumer protection regulations, significantly influence operations. Competitive product substitutes are evolving with the rise of online used car retailers and direct-to-consumer sales models from manufacturers. End-user demographics are shifting, with increasing demand for digital convenience, sustainable vehicle options, and flexible ownership models. Mergers and acquisitions (M&A) remain a prevalent strategy for market expansion and consolidation, driven by economies of scale and the pursuit of new revenue streams.

- Market Concentration: Dominated by large publicly traded automotive groups like AutoNation Inc., Sonic Automotive Inc., and Lithia Motors Inc., alongside a vast network of smaller, independent dealerships.

- Technological Innovation: Focus on digital retailing, AI-powered customer service, virtual showrooms, and advanced CRM systems.

- Regulatory Landscape: Governed by federal and state franchise laws, emissions standards, and consumer financing regulations.

- Competitive Substitutes: Growing threat from online car marketplaces (e.g., Carvana, Vroom) and OEM direct sales initiatives.

- End-User Demographics: Younger demographics demand seamless online experiences, while older demographics may still prefer traditional dealership interactions.

- M&A Trends: Consistent activity, particularly among larger groups acquiring smaller dealerships or consolidating existing operations for efficiency. In 2022, Lithia & Driveway alone announced acquisitions expected to add nearly USD 1 billion in annual revenue.

United States Automotive Dealership Market Growth Trends & Insights

The United States automotive dealership market is projected to experience robust growth, driven by pent-up demand, technological adoption, and evolving consumer preferences. The market size has seen fluctuations due to economic cycles and the pandemic, but the long-term outlook remains positive. Adoption rates for digital tools and online purchasing are steadily increasing, transforming traditional dealership models. Technological disruptions, such as the integration of AI in sales processes and the rise of electric vehicle (EV) sales, are reshaping consumer behavior. Shifts towards sustainable transportation, a focus on total cost of ownership, and the demand for personalized buying experiences are key behavioral changes influencing the market. The base year of 2025 is expected to set a strong foundation for future expansion.

The historical period (2019-2024) has witnessed the market navigating significant challenges, including supply chain disruptions and the accelerated adoption of digital sales channels. The forecast period (2025-2033) anticipates a consistent Compound Annual Growth Rate (CAGR) of approximately 4.5%, reaching an estimated market value of over USD 300 billion by 2033. Market penetration for new vehicles, while mature, is seeing innovation in subscription models and flexible leasing. Used vehicle dealerships are experiencing sustained demand, often outperforming new vehicle sales in unit volume. The Parts and Services segment continues to be a stable revenue generator, benefiting from an aging vehicle parc and the increasing complexity of modern automobiles. Finance and Insurance (F&I) remain a critical profit center for dealerships, with innovation in digital F&I offerings to streamline the customer journey.

The franchised retailer segment continues to hold the dominant share, leveraging manufacturer support and brand recognition. However, non-franchised retailers, particularly those specializing in used vehicles or niche markets, are carving out significant market share through competitive pricing and tailored inventory. The shift towards electrification is gradually influencing vehicle type demand, with passenger cars remaining the largest segment, but with an increasing proportion of electric and hybrid models. Commercial vehicles, vital for logistics and business operations, also represent a significant and stable market segment, experiencing growth driven by e-commerce expansion.

Dominant Regions, Countries, or Segments in United States Automotive Dealership Market

The New Vehicle Dealership segment is the primary driver of market growth and revenue within the United States automotive dealership landscape. This dominance stems from the inherent value of new car sales, which typically involve higher transaction values and stimulate subsequent revenue streams from parts, service, and financing. The franchised retailer model, representing dealerships authorized by specific automotive manufacturers, holds the lion's share within this segment. These franchised retailers benefit from manufacturer support, access to the latest models, warranty services, and established brand loyalty, making them the preferred choice for most new car buyers.

Key Drivers for New Vehicle Dealership Dominance:

- Consumer Preference for New Technology and Features: New vehicles offer the latest advancements in safety, technology, fuel efficiency, and infotainment systems, appealing to a broad consumer base.

- Manufacturer Incentives and Marketing Support: OEMs actively support their franchised dealers with marketing campaigns, sales incentives, and product launches, directly driving sales volume.

- Brand Reputation and Trust: Established automotive brands cultivate trust and loyalty, leading consumers to seek out authorized dealerships for new purchases.

- Financing and Warranty Advantages: New vehicles often come with attractive manufacturer-backed financing options and comprehensive warranties, reducing perceived risk for buyers.

While new vehicle sales lead in overall revenue, the Parts and Services segment is a crucial and consistent revenue generator, contributing significantly to dealership profitability. This segment benefits from the substantial installed base of vehicles on the road, with owners requiring routine maintenance, repairs, and the purchase of replacement parts. The increasing complexity of modern vehicles, with advanced electronics and intricate powertrains, necessitates specialized service expertise, further solidifying the importance of dealership service departments.

Other Significant Segments and Their Contributions:

- Used Vehicle Dealerships: While often having lower per-unit margins than new vehicles, the sheer volume of used car sales, driven by affordability and consumer demand, makes this a substantial market segment.

- Finance and Insurance (F&I): This segment is a critical profit center for dealerships, offering various financing options, extended warranties, and insurance products that enhance profitability per transaction.

- Commercial Vehicles: This segment serves businesses and fleet operators, representing a stable demand driven by economic activity and the need for transportation and logistics solutions.

The dominance of Passenger Cars within the Vehicle Type category remains significant, accounting for the largest share of sales. However, the market is observing a gradual but impactful shift towards SUVs and trucks, driven by consumer preferences for space, utility, and higher driving positions. The burgeoning Electric Vehicle (EV) market, though still a smaller portion, is experiencing exponential growth and is poised to become an increasingly influential segment in the coming years.

United States Automotive Dealership Market Product Landscape

The product landscape in the United States automotive dealership market is evolving beyond traditional vehicle sales. Dealerships are increasingly offering a comprehensive suite of automotive solutions. Innovations include integrated digital platforms for online browsing, virtual test drives, and contactless purchasing. Beyond vehicle sales, dealerships are expanding their Parts and Services offerings to include specialized maintenance for electric vehicles, advanced diagnostics, and detailing services. Finance and Insurance products are becoming more personalized, with flexible loan structures, leasing options, and insurance packages tailored to individual customer needs. Furthermore, many dealerships are exploring subscription-based vehicle access models and integrated mobility solutions, moving towards becoming broader automotive service hubs rather than mere transactional points.

Key Drivers, Barriers & Challenges in United States Automotive Dealership Market

Key Drivers:

- Economic Recovery and Consumer Confidence: A strengthening economy boosts consumer purchasing power and willingness to invest in new vehicles.

- Technological Advancements: Innovations in electric vehicles (EVs), autonomous driving, and digital retail platforms create new market opportunities and consumer interest.

- Product Innovation and Diversification: Manufacturers continually introduce new models and vehicle types, catering to diverse consumer preferences and driving demand.

- Affordable Financing Options: Favorable interest rates and flexible financing plans make vehicle ownership more accessible.

- Replacement Demand: An aging vehicle parc necessitates regular replacement, ensuring a continuous demand for new and used vehicles.

Barriers & Challenges:

- Supply Chain Disruptions: Ongoing shortages of critical components, particularly semiconductors, continue to limit new vehicle production and availability.

- Rising Interest Rates: Increasing interest rates can make vehicle financing more expensive, potentially dampening consumer demand.

- Regulatory Hurdles: Stringent emissions standards and evolving safety regulations can increase manufacturing costs and impact vehicle availability.

- Intensifying Competition: The rise of online retailers and direct-to-consumer sales models presents a significant competitive challenge to traditional dealerships.

- Skilled Labor Shortages: A shortage of qualified technicians and sales professionals can hinder dealership operations and customer service.

- Economic Uncertainty: Potential recessions or economic slowdowns can negatively impact consumer spending on discretionary items like new vehicles.

Emerging Opportunities in United States Automotive Dealership Market

Emerging opportunities in the US automotive dealership market lie in the burgeoning electric vehicle (EV) sector, requiring dealerships to invest in charging infrastructure and specialized service training. The expansion of digital retailing presents a significant opportunity to streamline the customer journey, offering virtual showrooms, online financing, and home delivery options. Furthermore, dealerships can capitalize on the growing demand for vehicle subscription services and mobility-as-a-service (MaaS) platforms, diversifying their revenue streams beyond traditional sales and service. The increasing focus on data analytics offers a chance to personalize customer interactions, optimize inventory, and predict future demand more accurately.

Growth Accelerators in the United States Automotive Dealership Market Industry

Long-term growth in the United States automotive dealership market is being accelerated by several catalysts. The ongoing technological breakthroughs in battery technology, autonomous driving systems, and connected car features are creating exciting new product offerings and driving consumer adoption. Strategic partnerships between dealerships, technology providers, and even manufacturers are fostering innovation and expanding service capabilities. Market expansion strategies, including the acquisition of dealerships in underserved regions and the diversification into related automotive services, are also crucial growth accelerators. The increasing consumer acceptance of online car purchasing and the demand for seamless, integrated customer experiences are fundamentally reshaping the industry, pushing dealerships to adapt and innovate.

Key Players Shaping the United States Automotive Dealership Market Market

- AutoNation Inc.

- Sonic Automotive Inc.

- Larry H Miller Dealerships

- Staluppi Auto Group

- Lithia Motors Inc.

- Asbury Automotive Group Inc.

- Hendrick Automotive Group

- Group 1 Automotive Inc.

- Penske Automotive Group

- Ken Garff Automotive Group

Notable Milestones in United States Automotive Dealership Market Sector

- July 2022: Lithia & Driveway (LAD) expanded its US presence by acquiring nine dealerships in southern Florida and one in Nevada, projected to add nearly USD 1 billion in annual revenue. LAD also acquired Henderson Hyundai and Genesis in Las Vegas, making it the sole owner of these Hyundai and Genesis stores in the greater metro area.

- March 2022: Group 1 Automotive Inc. secured a USD 2.0 billion five-year revolving syndicated credit facility, expiring in March 2027, with an option to expand to USD 2.4 billion. This facility involves 21 financial institutions and includes manufacturer-affiliated finance companies like Mercedes-Benz Financial Services USA LLC and Toyota Motor Credit Corporation.

- January 2022: Penske Automotive Group celebrated the grand opening of Honda Leander in Texas, marking its 14th Honda store nationwide and ninth in the Austin/Round Rock market.

- January 2022: Sonic Automotive Inc. acquired Sun Chevrolet in Chittenango, New York. This followed the December 2021 acquisition of three used car locations from Caputo.

In-Depth United States Automotive Dealership Market Market Outlook

The future outlook for the United States automotive dealership market is characterized by significant growth potential, driven by sustained consumer demand for personal mobility and the continuous evolution of automotive technology. Strategic opportunities lie in embracing digital transformation to offer a more convenient and personalized customer experience, from online browsing to post-purchase service. The increasing shift towards electric vehicles presents a substantial growth area, requiring dealerships to invest in infrastructure and training, while also opening doors for new revenue streams related to EV maintenance and charging solutions. Furthermore, the exploration of innovative business models such as vehicle subscriptions and integrated mobility services will be crucial for dealerships to remain competitive and capture future market share. Adaptability and a customer-centric approach will be paramount for success.

United States Automotive Dealership Market Segmentation

-

1. Type

- 1.1. New Vehicle dealership

- 1.2. Used Vehicle dealership

- 1.3. Parts and Services

- 1.4. Finance and Insurance

-

2. Retailer

- 2.1. Franchised Retailer

- 2.2. Non-Franchised Retailer

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

United States Automotive Dealership Market Segmentation By Geography

- 1. United States

United States Automotive Dealership Market Regional Market Share

Geographic Coverage of United States Automotive Dealership Market

United States Automotive Dealership Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization and Demand for Convinient Transportation

- 3.3. Market Restrains

- 3.3.1. Traffic Congestion in Major Cities

- 3.4. Market Trends

- 3.4.1. Rising Focus of Automotive Dealers on Enhancing Consumer Experience and Dealer Network to Drive Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Automotive Dealership Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicle dealership

- 5.1.2. Used Vehicle dealership

- 5.1.3. Parts and Services

- 5.1.4. Finance and Insurance

- 5.2. Market Analysis, Insights and Forecast - by Retailer

- 5.2.1. Franchised Retailer

- 5.2.2. Non-Franchised Retailer

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AutoNation Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonic Automotive Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Larry H Miller Dealerships

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Staluppi Auto Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lithia Motors Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Asbury Automotive Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hendrick Automotive Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Group 1 Automotive Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Penske Automotive Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ken Garff Automotive Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AutoNation Inc

List of Figures

- Figure 1: United States Automotive Dealership Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Automotive Dealership Market Share (%) by Company 2025

List of Tables

- Table 1: United States Automotive Dealership Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Automotive Dealership Market Revenue undefined Forecast, by Retailer 2020 & 2033

- Table 3: United States Automotive Dealership Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 4: United States Automotive Dealership Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: United States Automotive Dealership Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: United States Automotive Dealership Market Revenue undefined Forecast, by Retailer 2020 & 2033

- Table 7: United States Automotive Dealership Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 8: United States Automotive Dealership Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Automotive Dealership Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the United States Automotive Dealership Market?

Key companies in the market include AutoNation Inc, Sonic Automotive Inc *List Not Exhaustive, Larry H Miller Dealerships, Staluppi Auto Group, Lithia Motors Inc, Asbury Automotive Group Inc, Hendrick Automotive Group, Group 1 Automotive Inc, Penske Automotive Group, Ken Garff Automotive Group.

3. What are the main segments of the United States Automotive Dealership Market?

The market segments include Type, Retailer, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization and Demand for Convinient Transportation.

6. What are the notable trends driving market growth?

Rising Focus of Automotive Dealers on Enhancing Consumer Experience and Dealer Network to Drive Demand.

7. Are there any restraints impacting market growth?

Traffic Congestion in Major Cities.

8. Can you provide examples of recent developments in the market?

July 2022: Lithia & Driveway (LAD) continued its US expansion by buying nine dealerships in southern Florida and one in Nevada, which are expected to add nearly USD 1 billion in annual revenue for the company. LAD also announced its expansion in Las Vegas, Nevada, with the addition of Henderson Hyundai and Genesis. With this purchase, LAD becomes the sole owner of the Hyundai and Genesis stores in the greater metro area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Automotive Dealership Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Automotive Dealership Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Automotive Dealership Market?

To stay informed about further developments, trends, and reports in the United States Automotive Dealership Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence