Key Insights

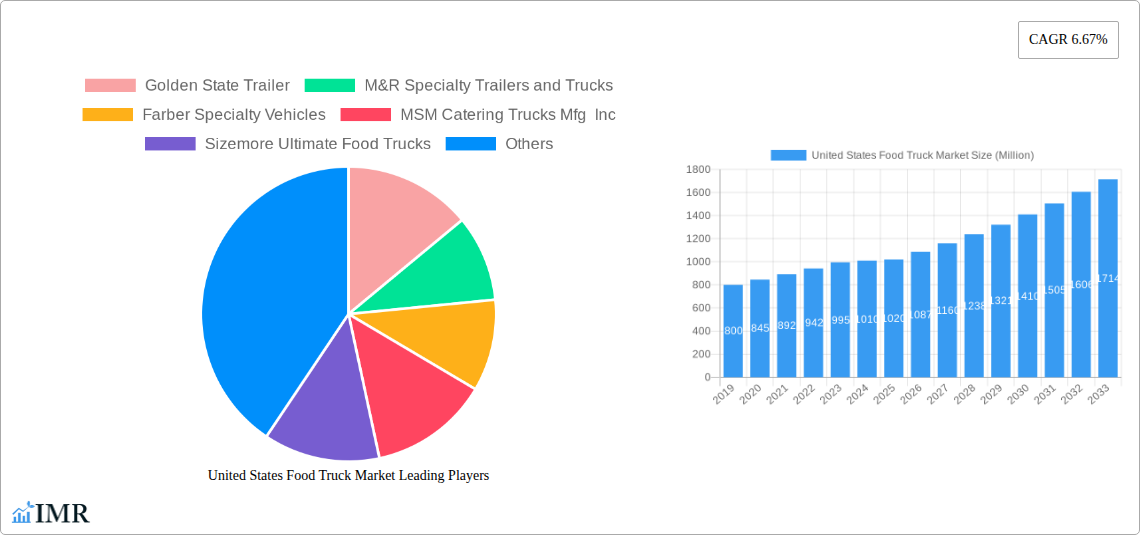

The United States food truck market is poised for substantial growth, with a market size of $1.02 billion in 2025, projected to expand at a robust CAGR of 6.67% through 2033. This expansion is fueled by several key drivers, including the increasing entrepreneurial spirit and the desire for flexible, lower-overhead business models in the food industry. Consumers are increasingly drawn to the convenience, diverse culinary offerings, and unique experiences that food trucks provide, especially in urban and event-driven settings. The market is also benefiting from the growing popularity of specialized cuisines, with fast food, vegan and plant-based options, and barbeque and snacks leading the charge. Furthermore, the rising trend of customization in food trucks, catering to specific niche markets and branding needs, is another significant growth catalyst. The evolution of food truck designs, from traditional vans and trailers to more advanced expandable models and customized trucks, is enhancing operational efficiency and customer appeal.

United States Food Truck Market Market Size (In Million)

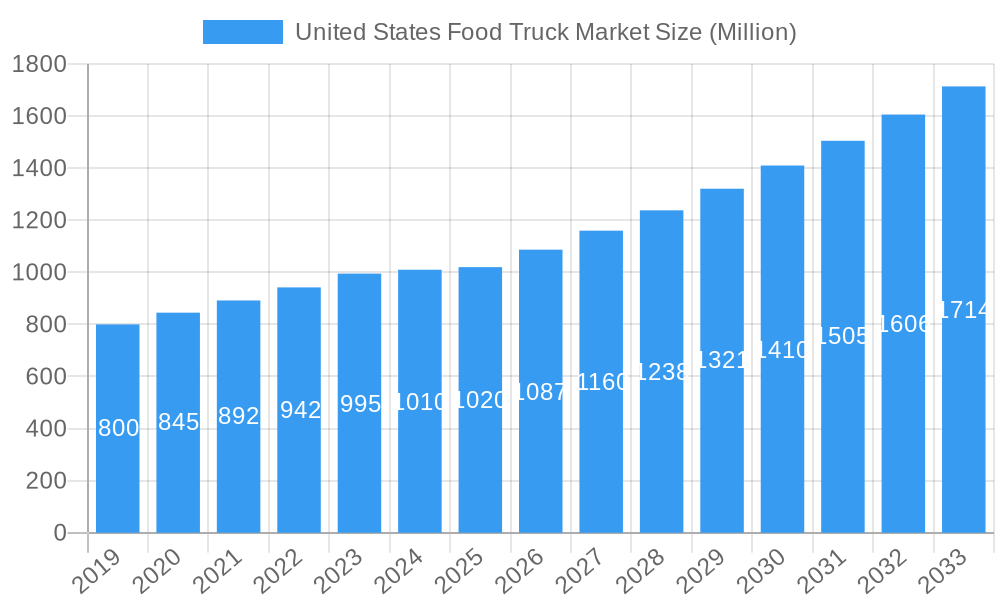

Despite the strong growth trajectory, the market faces certain restraints. These include evolving local regulations and zoning laws that can impact operating locations, as well as intense competition within the food service industry. However, these challenges are being mitigated by innovative business strategies and the adaptability of food truck operators. The market is segmented by type, application, and size, offering a wide array of choices to meet diverse demands. The United States, being the primary focus, is a fertile ground for this market's expansion, with companies like Golden State Trailer, M&R Specialty Trailers and Trucks, and Farber Specialty Vehicles at the forefront of manufacturing and innovation. The trend towards gourmet food trucks and the integration of technology for ordering and payment are further shaping the landscape, ensuring continued dynamism and opportunity within this vibrant sector.

United States Food Truck Market Company Market Share

This in-depth report provides a crucial analysis of the United States food truck market, offering a detailed examination of its current state and future trajectory. Covering the historical period of 2019–2024 and a forecast period extending to 2033, with a base year of 2025, this report is an indispensable resource for industry stakeholders. It delves into market dynamics, growth trends, regional dominance, product innovation, key players, and emerging opportunities, all while integrating high-traffic SEO keywords to maximize visibility. Values are presented in million units for clear quantitative understanding.

United States Food Truck Market Market Dynamics & Structure

The United States food truck market exhibits a moderately concentrated structure, with a blend of established manufacturers and a growing number of emerging players. Technological innovation is a significant driver, particularly in areas like energy efficiency, advanced kitchen equipment, and sustainable operational designs. Regulatory frameworks, while varying by state and municipality, play a crucial role in shaping operational feasibility and market entry. Competitive product substitutes include brick-and-mortar restaurants and other forms of quick-service dining. End-user demographics are diverse, ranging from young professionals seeking convenient and diverse culinary options to families looking for affordable and accessible meal solutions. Merger and acquisition (M&A) trends are observed as larger manufacturers aim to expand their product portfolios and market reach, while smaller, innovative firms may seek strategic partnerships for growth. Key innovation barriers include the capital investment required for advanced manufacturing and the complexities of navigating diverse local regulations. The market is projected to see approximately 120,000 units by 2025, with a projected CAGR of 5.2% over the forecast period.

- Market Concentration: Moderate, with a significant presence of specialized manufacturers.

- Technological Innovation: Focus on efficiency, sustainability, and advanced mobile kitchen solutions.

- Regulatory Frameworks: Varies by location, impacting operational licenses, permits, and zoning.

- Competitive Substitutes: Traditional restaurants, ghost kitchens, and other mobile food vendors.

- End-User Demographics: Broad appeal across age groups and income levels, with a focus on convenience and value.

- M&A Trends: Consolidation among larger players and strategic acquisitions of innovative startups.

- Innovation Barriers: High initial capital costs, regulatory compliance, and market saturation in certain areas.

United States Food Truck Market Growth Trends & Insights

The United States food truck market is experiencing robust growth, driven by evolving consumer preferences for diverse, convenient, and affordable culinary experiences. The market size is projected to expand from approximately 95,000 units in 2019 to an estimated 125,000 units by 2025, with a projected CAGR of 5.2% for the forecast period (2025–2033). Adoption rates are steadily increasing as more entrepreneurs recognize the lower overhead and flexibility offered by mobile food ventures compared to traditional brick-and-mortar establishments. Technological disruptions are manifesting in the form of advanced point-of-sale systems, online ordering platforms, and energy-efficient cooking equipment, enhancing operational efficiency and customer engagement. Consumer behavior shifts are characterized by a growing demand for unique food concepts, plant-based options, and ethically sourced ingredients, all of which food trucks are well-positioned to deliver. The rise of food truck parks and curated events further amplifies market penetration, creating dedicated hubs for mobile culinary innovation. The market penetration of specialized food trucks is expected to reach 18% by 2027.

- Market Size Evolution: Significant growth from historical figures to projected future expansion.

- Adoption Rates: Increasing adoption by entrepreneurs seeking a flexible and cost-effective business model.

- Technological Disruptions: Integration of digital technologies for ordering, payments, and operational management.

- Consumer Behavior Shifts: Growing demand for diverse cuisines, healthier options, and unique dining experiences.

- Market Penetration: Amplified by events, food truck parks, and supportive local regulations.

- Projected Market Size (2025): 125,000 units

- Projected CAGR (2025-2033): 5.2%

Dominant Regions, Countries, or Segments in United States Food Truck Market

The United States food truck market demonstrates dynamic growth across various segments, with certain regions and vehicle types leading the charge. Customized Trucks currently hold the largest market share, driven by the demand for unique branding and specialized operational needs, projected to account for 35% of the market by 2025. Vans represent a significant portion, favored for their agility and lower initial investment, expected to capture 30% of the market. Trailers are also a key segment, offering greater kitchen space and customization options for more elaborate food preparations.

Among applications, Fast Food remains dominant, catering to the immediate demand for quick and accessible meals, projected at 40% of the market. However, the Vegan and Plant Meat segment is experiencing rapid growth, reflecting evolving dietary trends and consumer preferences for sustainable and healthier options, with an anticipated 15% market share by 2025. Barbeque and Snacks, and Desserts and Confectionery also represent substantial application segments, each catering to specific consumer cravings.

In terms of size, the 16-25 Feet segment is the most popular, balancing maneuverability with sufficient operational space, expected to constitute 45% of the market by 2025. The Up to 15 Feet segment is crucial for urban environments with parking constraints, while the Above 25 Feet segment caters to larger operations and specialized catering needs.

- Dominant Segments by Type:

- Customized Trucks: 35% market share (projected 2025)

- Vans: 30% market share (projected 2025)

- Trailers: Significant market presence

- Dominant Segments by Application:

- Fast Food: 40% market share (projected 2025)

- Vegan and Plant Meat: Rapidly growing, 15% market share (projected 2025)

- Barbeque and Snacks: Strong consumer demand

- Desserts and Confectionery: Popular niche

- Dominant Segments by Size:

- 16-25 Feet: 45% market share (projected 2025)

- Up to 15 Feet: Ideal for urban mobility

- Above 25 Feet: For larger-scale operations

United States Food Truck Market Product Landscape

The United States food truck market is characterized by a dynamic product landscape focused on enhancing operational efficiency, consumer experience, and aesthetic appeal. Manufacturers are increasingly incorporating advanced kitchen technologies, such as energy-efficient cooking appliances and sophisticated ventilation systems, to meet evolving culinary demands and environmental standards. Innovations in trailer and truck design emphasize modularity, allowing for customizable layouts that cater to diverse food types and service models. The integration of smart technology for inventory management, POS systems, and customer feedback mechanisms is also a growing trend. Unique selling propositions often revolve around robust construction, customizable features tailored to specific culinary concepts, and adherence to stringent safety and hygiene regulations.

Key Drivers, Barriers & Challenges in United States Food Truck Market

The United States food truck market is propelled by several key drivers, including the entrepreneurial spirit seeking lower startup costs compared to traditional restaurants, and the growing consumer demand for diverse and convenient food options. Technological advancements in vehicle manufacturing and kitchen equipment also contribute significantly. Furthermore, supportive local regulations and the proliferation of food truck events and parks create a fertile ground for growth.

However, the market faces notable barriers and challenges. Stringent and often inconsistent regulations across different municipalities pose a significant hurdle, impacting operational flexibility and expansion. Competition from established fast-food chains and the increasing saturation in popular urban areas present ongoing competitive pressures. Supply chain issues for specialized components and rising material costs can also impact profitability. The initial capital investment for a well-equipped food truck, though lower than a brick-and-mortar, remains a barrier for some aspiring entrepreneurs. The market is estimated to face a 10% increase in operational costs due to rising fuel prices in the short term.

Emerging Opportunities in United States Food Truck Market

Emerging opportunities in the United States food truck market lie in the growing demand for niche culinary experiences and specialized dietary options. The increasing popularity of ethnic cuisines, gourmet street food, and plant-based diets presents a fertile ground for innovation. Furthermore, the expansion of food truck operations into underserved suburban and rural areas, along with strategic partnerships with businesses for employee catering or private events, offers untapped market potential. The development of eco-friendly food truck designs and sustainable operational practices is also gaining traction, aligning with growing consumer environmental consciousness.

Growth Accelerators in the United States Food Truck Market Industry

Several catalysts are accelerating long-term growth in the United States food truck market. Technological breakthroughs in vehicle electrification and energy efficiency are reducing operational costs and environmental impact. Strategic partnerships between food truck manufacturers and culinary incubators are fostering innovation and entrepreneurship. Furthermore, the development of robust online ordering and delivery integration platforms is expanding reach and customer accessibility. Market expansion strategies focusing on specialized themes and unique culinary concepts are also driving growth, attracting a dedicated customer base and enhancing brand loyalty.

Key Players Shaping the United States Food Truck Market Market

- Golden State Trailer

- M&R Specialty Trailers and Trucks

- Farber Specialty Vehicles

- MSM Catering Trucks Mfg Inc

- Sizemore Ultimate Food Trucks

- The Fud Trailer Company

- Custom Concessions

- Titan Trucks Manufacturing

- All American Food Trucks

- US Food Truck Factory

- Prestige Food Trucks

- United Food Truck LLC

Notable Milestones in United States Food Truck Market Sector

- March 2024: The National Park of Boston announced a call for bids for food truck vendors to operate at the Charlestown Navy Yard. The administration is willing to lease two spaces suitable for mobile food and beverage vending, with a minimum rent of USD 40 per shift per day. This initiative aims to enhance visitor experience and support local businesses.

- April 2023: Aggie Campus Basic Needs Center, Student Housing and Dining Services, and the Division of Student Affairs launched "AggieEats," a food truck brand to combat food insecurity among students at the University of California, Davies. The truck operates at four campus locations on weekdays, providing accessible meal options.

In-Depth United States Food Truck Market Market Outlook

The United States food truck market is poised for sustained growth, driven by ongoing shifts in consumer preferences towards convenience, variety, and value. The integration of advanced technologies in vehicle design and operational management will continue to enhance efficiency and customer engagement. Strategic expansion into new geographical areas and the development of specialized culinary concepts catering to evolving dietary trends, such as plant-based and healthy eating, will further fuel market penetration. The increasing acceptance and integration of food trucks into urban planning and public spaces, coupled with supportive regulatory environments, will act as significant growth accelerators, promising a dynamic and expanding future for the industry.

United States Food Truck Market Segmentation

-

1. Type

- 1.1. Vans

- 1.2. Trailers

- 1.3. Customized Trucks

- 1.4. Others (Expandable Food Trucks, etc.)

-

2. Application

- 2.1. Fast Food

- 2.2. Vegan and Plant Meat

- 2.3. Barbeque and Snacks

- 2.4. Desserts and Confectionery

- 2.5. Others (Fruits and Vegetables, etc.)

-

3. Size

- 3.1. Up to 15 Feet

- 3.2. 16-25 Feet

- 3.3. Above 25 Feet

United States Food Truck Market Segmentation By Geography

- 1. United States

United States Food Truck Market Regional Market Share

Geographic Coverage of United States Food Truck Market

United States Food Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Food Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vans

- 5.1.2. Trailers

- 5.1.3. Customized Trucks

- 5.1.4. Others (Expandable Food Trucks, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fast Food

- 5.2.2. Vegan and Plant Meat

- 5.2.3. Barbeque and Snacks

- 5.2.4. Desserts and Confectionery

- 5.2.5. Others (Fruits and Vegetables, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Size

- 5.3.1. Up to 15 Feet

- 5.3.2. 16-25 Feet

- 5.3.3. Above 25 Feet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Golden State Trailer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 M&R Specialty Trailers and Trucks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farber Specialty Vehicles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MSM Catering Trucks Mfg Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sizemore Ultimate Food Trucks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Fud Trailer Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Custom Concessions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Titan Trucks Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 All American Food Trucks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Food Truck Factory

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prestige Food Trucks

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 United Food Truck LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Golden State Trailer

List of Figures

- Figure 1: United States Food Truck Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Food Truck Market Share (%) by Company 2025

List of Tables

- Table 1: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 4: United States Food Truck Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 8: United States Food Truck Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Food Truck Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the United States Food Truck Market?

Key companies in the market include Golden State Trailer, M&R Specialty Trailers and Trucks, Farber Specialty Vehicles, MSM Catering Trucks Mfg Inc, Sizemore Ultimate Food Trucks, The Fud Trailer Company, Custom Concessions, Titan Trucks Manufacturing, All American Food Trucks, US Food Truck Factory, Prestige Food Trucks, United Food Truck LLC.

3. What are the main segments of the United States Food Truck Market?

The market segments include Type, Application, Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: The National Park of Boston in the United States announced the call for bids for food truck vendors to operate at the Charlestown Navy Yard through a Request for Bids (RFB) proposal. The administration is willing to lease two spaces identified by the National Park Service (NPS) as suitable for mobile food and beverage vending in the Charlestown Navy Yard at Boston National Historical Park. Further, the administration stated that the minimum rent for the lease is USD 40 per shift per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Food Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Food Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Food Truck Market?

To stay informed about further developments, trends, and reports in the United States Food Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence