Key Insights

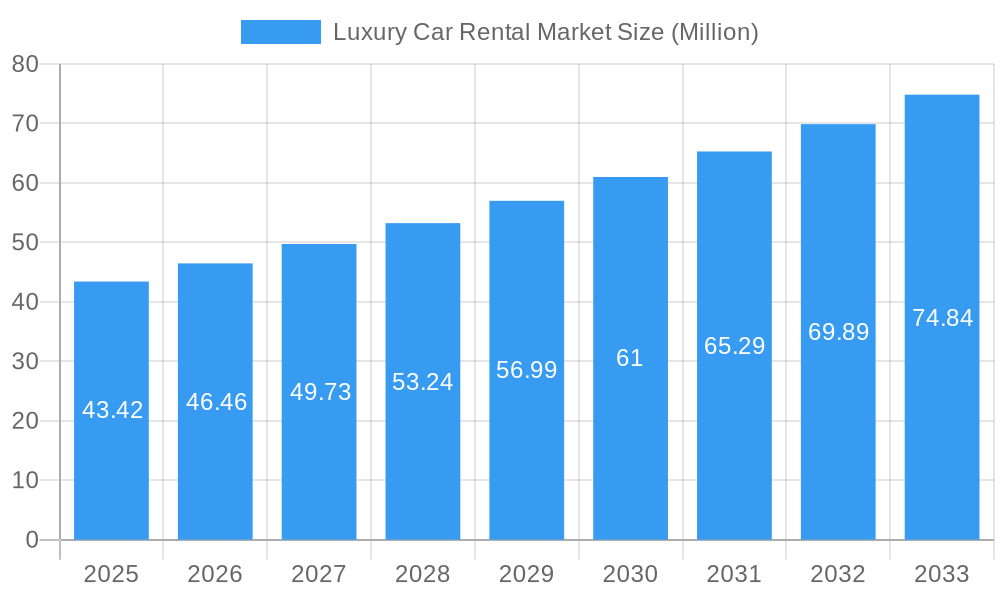

The global luxury car rental market is poised for robust expansion, projected to reach a valuation of approximately $43.42 million by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 7.00% during the forecast period of 2025-2033. This growth trajectory is significantly propelled by evolving consumer preferences, an increasing disposable income among affluent demographics, and a growing desire for experiential travel. The market is witnessing a surge in demand for premium mobility solutions that offer comfort, status, and a superior driving experience, especially for special occasions, business trips, and high-end tourism. Furthermore, technological advancements have streamlined the rental process, with online booking platforms and mobile applications enhancing convenience and accessibility for customers worldwide. The expansion of the tourism sector and the rise of business travel in emerging economies are also contributing factors to this positive market outlook.

Luxury Car Rental Market Market Size (In Million)

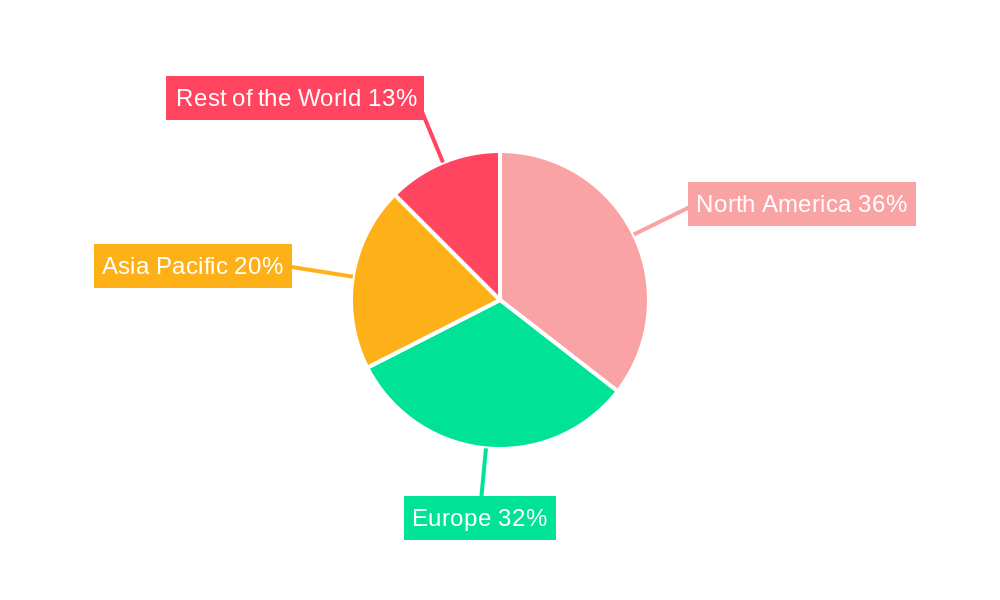

The market's segmentation reveals diverse opportunities across vehicle types, rental durations, booking methods, and drive types. Sport Utility Vehicles (SUVs) and Sedans are anticipated to lead in terms of adoption due to their versatility and widespread appeal among luxury renters. While short-term rentals cater to immediate travel needs, the growing trend of long-term leases for extended business assignments or personal usage is also gaining traction. Online booking channels are dominating the landscape, reflecting a global shift towards digital transactions, although offline bookings still hold relevance for specific customer segments. The self-driven segment is expected to outperform chauffeur-driven options, aligning with the preference for personal control and flexibility among many luxury car renters. Geographically, North America and Europe are expected to remain dominant markets, driven by established luxury car cultures and high tourism influx, while the Asia Pacific region is emerging as a significant growth frontier.

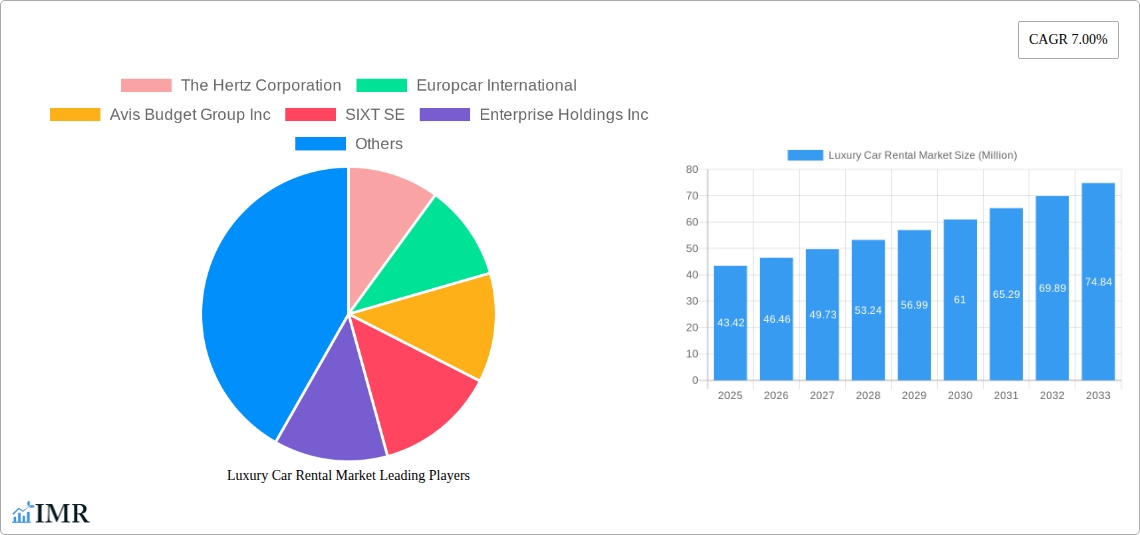

Luxury Car Rental Market Company Market Share

Luxury Car Rental Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report on the global luxury car rental market provides a detailed analysis of market dynamics, growth trends, competitive landscape, and future opportunities. Covering the historical period from 2019 to 2024 and forecasting to 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders, including premium car rental companies, automakers, travel agencies, and investors seeking to understand the evolving luxury vehicle rental sector. We delve into the parent market and its crucial child markets, offering unparalleled insights into market size, segmentation, and regional dominance.

Luxury Car Rental Market Market Dynamics & Structure

The luxury car rental market exhibits a moderately concentrated structure, with key players like Enterprise Holdings Inc., The Hertz Corporation, Europcar International, and SIXT SE holding significant market shares. Technological innovation, particularly in the integration of AI for personalized customer experiences and predictive fleet management, acts as a significant driver. Regulatory frameworks, such as those governing fleet emissions and safety standards, are evolving and influencing operational strategies. Competitive product substitutes include traditional car ownership, ride-sharing services for specific journeys, and premium public transportation options. End-user demographics are expanding to include affluent millennials and Gen Z consumers seeking aspirational travel experiences, alongside traditional high-net-worth individuals. Mergers and acquisition (M&A) trends are observed as companies aim to expand their geographical reach, diversify their fleets, and enhance their technological capabilities. For instance, strategic acquisitions of smaller, niche luxury rental providers have been noted to bolster market presence. Barriers to innovation can include the high capital investment required for acquiring and maintaining luxury vehicle fleets and the need for specialized maintenance and repair services. The market share of top players is estimated to be around 60% of the total market value. M&A deal volumes are projected to increase by 15% over the forecast period.

Luxury Car Rental Market Growth Trends & Insights

The global luxury car rental market is poised for robust growth, driven by increasing disposable incomes, a rising trend in experiential travel, and a growing desire for premium mobility solutions among affluent consumers. The market size is projected to reach USD 35,500 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. Adoption rates for luxury car rentals are steadily increasing, particularly in emerging economies, as more individuals seek to experience high-end vehicles for special occasions, business trips, or vacations. Technological disruptions are playing a pivotal role, with advancements in digital booking platforms, in-car connectivity, and the growing adoption of electric and hybrid luxury vehicles enhancing the customer experience and operational efficiency. Consumer behavior is shifting towards a preference for flexibility and convenience, leading to a surge in demand for both short-term and long-term rental options. The increasing emphasis on luxury travel experiences and the "try before you buy" mentality for high-value vehicles are further accelerating market penetration. The market penetration for luxury car rentals is expected to grow from 18% in 2025 to 25% by 2033.

Dominant Regions, Countries, or Segments in Luxury Car Rental Market

North America currently dominates the luxury car rental market, driven by a well-established infrastructure for premium tourism and business travel, coupled with a high concentration of affluent consumers. The United States, in particular, leads with its extensive network of airports and popular tourist destinations, offering a wide array of luxury vehicle model styles, including Sedans and Sport Utility Vehicles (SUVs), which are highly sought after. Europe follows closely, with countries like Germany, the UK, and France showcasing strong demand for chauffeur-driven services and short-term rentals for leisure and corporate events.

Key drivers for dominance in North America and Europe include:

- High Disposable Incomes: A significant segment of the population can afford premium rental services.

- Developed Tourism Infrastructure: Robust tourism sectors and a plethora of luxury hotels and resorts cater to high-spending travelers.

- Corporate Travel Hubs: Major business centers generate substantial demand for luxury vehicles for executive travel.

- Economic Policies: Favorable economic conditions and policies supporting the travel and hospitality industry.

- Availability of Luxury Fleets: A wide selection of the latest models from luxury automotive brands is readily available.

In terms of segments, Self-driven rentals represent the largest share, appealing to individuals who desire the freedom and control over their driving experience. However, the Chauffeur-driven segment is experiencing substantial growth, driven by clients who prioritize convenience, comfort, and discretion. Short-term rentals continue to be the most popular, fulfilling the needs of vacationers and business travelers for specific periods. The Online Booking channel dominates due to its ease of use and accessibility, though Offline Booking remains relevant for corporate accounts and bespoke requests. Among vehicle model styles, Sedans and SUVs lead, accounting for an estimated 70% of the market share, followed by Multi-purpose Vehicles and Hatchbacks for specific travel needs. The market share of North America in the global luxury car rental market is approximately 40%.

Luxury Car Rental Market Product Landscape

The product landscape of the luxury car rental market is characterized by an increasing focus on advanced technology, sustainability, and personalized experiences. Rental companies are diversifying their fleets to include a wider range of high-performance sedans, opulent SUVs, and increasingly, eco-friendly electric luxury vehicles. Innovations include integrated infotainment systems, advanced driver-assistance features, and seamless connectivity options. The application of these luxury vehicles extends beyond mere transportation, encompassing aspirational travel, business executive mobility, and special occasion rentals, such as weddings and events. Performance metrics are evaluated not only on vehicle specifications but also on the overall customer journey, from intuitive booking interfaces to immaculate vehicle presentation and responsive customer service. Unique selling propositions often revolve around exclusivity, access to the latest models, and tailored service packages.

Key Drivers, Barriers & Challenges in Luxury Car Rental Market

Key Drivers:

- Rising Global Affluence: Increasing disposable income globally fuels demand for premium goods and services, including luxury car rentals.

- Experiential Travel Trend: Consumers are prioritizing experiences over possessions, leading to a greater willingness to rent luxury vehicles for unique travel moments.

- Technological Advancements: Improved online booking platforms, AI-driven personalization, and the growing availability of electric luxury vehicles enhance customer convenience and appeal.

- Corporate Travel Needs: Businesses increasingly require premium mobility solutions for executives and clients, driving demand for chauffeur-driven services.

Key Barriers & Challenges:

- High Capital Investment: Acquiring and maintaining a fleet of luxury vehicles requires substantial financial resources, creating a barrier to entry.

- Depreciation and Maintenance Costs: Luxury vehicles depreciate rapidly and incur high maintenance and repair expenses, impacting profitability.

- Economic Downturns: Luxury spending is often discretionary and can be significantly impacted by economic recessions or instability.

- Intense Competition: The market is competitive, with established players and emerging services vying for market share, leading to price pressures.

- Regulatory Compliance: Adhering to evolving environmental regulations and safety standards for a luxury fleet can be complex and costly. Supply chain disruptions can also impact vehicle acquisition timelines, with an estimated impact of 5-10% on fleet availability.

Emerging Opportunities in Luxury Car Rental Market

Emerging opportunities in the luxury car rental market lie in the expansion of services into untapped niche markets and the integration of innovative technologies. The growing demand for sustainable luxury mobility presents a significant opportunity for rental companies to expand their fleets of electric and hybrid luxury vehicles, appealing to environmentally conscious consumers. Furthermore, the development of subscription-based models for luxury car rentals can cater to a segment of consumers seeking consistent access to premium vehicles without the commitment of ownership. Partnerships with luxury hotels, high-end event organizers, and premium travel agencies can unlock new customer bases and create bundled service offerings. The increasing digitalization of travel services also opens avenues for AI-powered personalized recommendations and dynamic pricing strategies.

Growth Accelerators in the Luxury Car Rental Market Industry

Catalysts driving long-term growth in the luxury car rental industry are multi-faceted. Technological breakthroughs, such as the widespread adoption of autonomous driving features and advanced telematics, promise to enhance safety and convenience, further elevating the luxury experience. Strategic partnerships between rental companies and luxury automakers can lead to exclusive access to new models and co-branded marketing initiatives. Market expansion strategies, including tapping into emerging economies with a growing affluent population and establishing a strong presence in key global tourism hubs, are crucial for sustained growth. The increasing focus on customer loyalty programs and personalized service offerings will also foster repeat business and brand advocacy, acting as significant growth accelerators.

Key Players Shaping the Luxury Car Rental Market Market

- The Hertz Corporation

- Europcar International

- Avis Budget Group Inc

- SIXT SE

- Enterprise Holdings Inc

- Zoomcar Ltd

- Luxury Car Rentals LLC (Resla)

- Blue Car Rental ehf

- Friends Car Rental LLC

- VIP Rent A Car LLC

- eZhire Technologies FZ LL

Notable Milestones in Luxury Car Rental Market Sector

- March 2024: Hype, a luxury traveler company based in Bengaluru, India, extended its luxury car rental services nationwide. With this expansion, the company broadened its offerings, providing compelling rates for premium car rental services throughout the country.

- January 2024: Sixt, a premium mobility service provider, entered an agreement with Stellantis, a leading automaker. As per the agreement, Sixt has the option to purchase up to 250,000 vehicles over the successive three years for its rental fleet in corporate countries across Europe and North America.

In-Depth Luxury Car Rental Market Market Outlook

The luxury car rental market is on an upward trajectory, propelled by sustained economic growth and evolving consumer preferences for premium experiences. The integration of sustainable mobility solutions and the expansion into new geographical markets are identified as key growth accelerators. Future market potential will be significantly influenced by the ability of rental companies to adapt to technological advancements, such as connected car technology and AI-driven personalization, to deliver an unparalleled customer journey. Strategic alliances and innovative service models, including flexible subscription plans, will further enhance market penetration and customer retention. The overall outlook for the luxury car rental market remains exceptionally positive, promising lucrative opportunities for stakeholders who can effectively capitalize on these evolving trends and strategic imperatives.

Luxury Car Rental Market Segmentation

-

1. Vehicle Model Style

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles

- 1.4. Multi-purpose Vehicles

-

2. Rental Duration

- 2.1. Short-term

- 2.2. Long-term

-

3. Booking Type

- 3.1. Online Booking

- 3.2. Offline Booking

-

4. Drive Type

- 4.1. Self-driven

- 4.2. Chauffeur-driven

Luxury Car Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Luxury Car Rental Market Regional Market Share

Geographic Coverage of Luxury Car Rental Market

Luxury Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Smartphones and Internet Penetration Opening New Market Avenues

- 3.3. Market Restrains

- 3.3.1. Rising Smartphones and Internet Penetration Opening New Market Avenues

- 3.4. Market Trends

- 3.4.1. Online Booking Holds a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles

- 5.1.4. Multi-purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online Booking

- 5.3.2. Offline Booking

- 5.4. Market Analysis, Insights and Forecast - by Drive Type

- 5.4.1. Self-driven

- 5.4.2. Chauffeur-driven

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 6. North America Luxury Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 6.1.1. Hatchback

- 6.1.2. Sedan

- 6.1.3. Sport Utility Vehicles

- 6.1.4. Multi-purpose Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Rental Duration

- 6.2.1. Short-term

- 6.2.2. Long-term

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online Booking

- 6.3.2. Offline Booking

- 6.4. Market Analysis, Insights and Forecast - by Drive Type

- 6.4.1. Self-driven

- 6.4.2. Chauffeur-driven

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 7. Europe Luxury Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 7.1.1. Hatchback

- 7.1.2. Sedan

- 7.1.3. Sport Utility Vehicles

- 7.1.4. Multi-purpose Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Rental Duration

- 7.2.1. Short-term

- 7.2.2. Long-term

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online Booking

- 7.3.2. Offline Booking

- 7.4. Market Analysis, Insights and Forecast - by Drive Type

- 7.4.1. Self-driven

- 7.4.2. Chauffeur-driven

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 8. Asia Pacific Luxury Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 8.1.1. Hatchback

- 8.1.2. Sedan

- 8.1.3. Sport Utility Vehicles

- 8.1.4. Multi-purpose Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Rental Duration

- 8.2.1. Short-term

- 8.2.2. Long-term

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online Booking

- 8.3.2. Offline Booking

- 8.4. Market Analysis, Insights and Forecast - by Drive Type

- 8.4.1. Self-driven

- 8.4.2. Chauffeur-driven

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 9. Rest of the World Luxury Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 9.1.1. Hatchback

- 9.1.2. Sedan

- 9.1.3. Sport Utility Vehicles

- 9.1.4. Multi-purpose Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Rental Duration

- 9.2.1. Short-term

- 9.2.2. Long-term

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online Booking

- 9.3.2. Offline Booking

- 9.4. Market Analysis, Insights and Forecast - by Drive Type

- 9.4.1. Self-driven

- 9.4.2. Chauffeur-driven

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Model Style

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Hertz Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Europcar International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Avis Budget Group Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SIXT SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Enterprise Holdings Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Zoomcar Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Luxury Car Rentals LLC (Resla)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Blue Car Rental ehf

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Friends Car Rental LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 VIP Rent A Car LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 eZhire Technologies FZ LL

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Luxury Car Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Luxury Car Rental Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Luxury Car Rental Market Revenue (Million), by Vehicle Model Style 2025 & 2033

- Figure 4: North America Luxury Car Rental Market Volume (Billion), by Vehicle Model Style 2025 & 2033

- Figure 5: North America Luxury Car Rental Market Revenue Share (%), by Vehicle Model Style 2025 & 2033

- Figure 6: North America Luxury Car Rental Market Volume Share (%), by Vehicle Model Style 2025 & 2033

- Figure 7: North America Luxury Car Rental Market Revenue (Million), by Rental Duration 2025 & 2033

- Figure 8: North America Luxury Car Rental Market Volume (Billion), by Rental Duration 2025 & 2033

- Figure 9: North America Luxury Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 10: North America Luxury Car Rental Market Volume Share (%), by Rental Duration 2025 & 2033

- Figure 11: North America Luxury Car Rental Market Revenue (Million), by Booking Type 2025 & 2033

- Figure 12: North America Luxury Car Rental Market Volume (Billion), by Booking Type 2025 & 2033

- Figure 13: North America Luxury Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 14: North America Luxury Car Rental Market Volume Share (%), by Booking Type 2025 & 2033

- Figure 15: North America Luxury Car Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 16: North America Luxury Car Rental Market Volume (Billion), by Drive Type 2025 & 2033

- Figure 17: North America Luxury Car Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: North America Luxury Car Rental Market Volume Share (%), by Drive Type 2025 & 2033

- Figure 19: North America Luxury Car Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Luxury Car Rental Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Luxury Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Luxury Car Rental Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Luxury Car Rental Market Revenue (Million), by Vehicle Model Style 2025 & 2033

- Figure 24: Europe Luxury Car Rental Market Volume (Billion), by Vehicle Model Style 2025 & 2033

- Figure 25: Europe Luxury Car Rental Market Revenue Share (%), by Vehicle Model Style 2025 & 2033

- Figure 26: Europe Luxury Car Rental Market Volume Share (%), by Vehicle Model Style 2025 & 2033

- Figure 27: Europe Luxury Car Rental Market Revenue (Million), by Rental Duration 2025 & 2033

- Figure 28: Europe Luxury Car Rental Market Volume (Billion), by Rental Duration 2025 & 2033

- Figure 29: Europe Luxury Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 30: Europe Luxury Car Rental Market Volume Share (%), by Rental Duration 2025 & 2033

- Figure 31: Europe Luxury Car Rental Market Revenue (Million), by Booking Type 2025 & 2033

- Figure 32: Europe Luxury Car Rental Market Volume (Billion), by Booking Type 2025 & 2033

- Figure 33: Europe Luxury Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 34: Europe Luxury Car Rental Market Volume Share (%), by Booking Type 2025 & 2033

- Figure 35: Europe Luxury Car Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 36: Europe Luxury Car Rental Market Volume (Billion), by Drive Type 2025 & 2033

- Figure 37: Europe Luxury Car Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 38: Europe Luxury Car Rental Market Volume Share (%), by Drive Type 2025 & 2033

- Figure 39: Europe Luxury Car Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Luxury Car Rental Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Luxury Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Luxury Car Rental Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Luxury Car Rental Market Revenue (Million), by Vehicle Model Style 2025 & 2033

- Figure 44: Asia Pacific Luxury Car Rental Market Volume (Billion), by Vehicle Model Style 2025 & 2033

- Figure 45: Asia Pacific Luxury Car Rental Market Revenue Share (%), by Vehicle Model Style 2025 & 2033

- Figure 46: Asia Pacific Luxury Car Rental Market Volume Share (%), by Vehicle Model Style 2025 & 2033

- Figure 47: Asia Pacific Luxury Car Rental Market Revenue (Million), by Rental Duration 2025 & 2033

- Figure 48: Asia Pacific Luxury Car Rental Market Volume (Billion), by Rental Duration 2025 & 2033

- Figure 49: Asia Pacific Luxury Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 50: Asia Pacific Luxury Car Rental Market Volume Share (%), by Rental Duration 2025 & 2033

- Figure 51: Asia Pacific Luxury Car Rental Market Revenue (Million), by Booking Type 2025 & 2033

- Figure 52: Asia Pacific Luxury Car Rental Market Volume (Billion), by Booking Type 2025 & 2033

- Figure 53: Asia Pacific Luxury Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 54: Asia Pacific Luxury Car Rental Market Volume Share (%), by Booking Type 2025 & 2033

- Figure 55: Asia Pacific Luxury Car Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 56: Asia Pacific Luxury Car Rental Market Volume (Billion), by Drive Type 2025 & 2033

- Figure 57: Asia Pacific Luxury Car Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 58: Asia Pacific Luxury Car Rental Market Volume Share (%), by Drive Type 2025 & 2033

- Figure 59: Asia Pacific Luxury Car Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Luxury Car Rental Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Luxury Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Luxury Car Rental Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of the World Luxury Car Rental Market Revenue (Million), by Vehicle Model Style 2025 & 2033

- Figure 64: Rest of the World Luxury Car Rental Market Volume (Billion), by Vehicle Model Style 2025 & 2033

- Figure 65: Rest of the World Luxury Car Rental Market Revenue Share (%), by Vehicle Model Style 2025 & 2033

- Figure 66: Rest of the World Luxury Car Rental Market Volume Share (%), by Vehicle Model Style 2025 & 2033

- Figure 67: Rest of the World Luxury Car Rental Market Revenue (Million), by Rental Duration 2025 & 2033

- Figure 68: Rest of the World Luxury Car Rental Market Volume (Billion), by Rental Duration 2025 & 2033

- Figure 69: Rest of the World Luxury Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 70: Rest of the World Luxury Car Rental Market Volume Share (%), by Rental Duration 2025 & 2033

- Figure 71: Rest of the World Luxury Car Rental Market Revenue (Million), by Booking Type 2025 & 2033

- Figure 72: Rest of the World Luxury Car Rental Market Volume (Billion), by Booking Type 2025 & 2033

- Figure 73: Rest of the World Luxury Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 74: Rest of the World Luxury Car Rental Market Volume Share (%), by Booking Type 2025 & 2033

- Figure 75: Rest of the World Luxury Car Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 76: Rest of the World Luxury Car Rental Market Volume (Billion), by Drive Type 2025 & 2033

- Figure 77: Rest of the World Luxury Car Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 78: Rest of the World Luxury Car Rental Market Volume Share (%), by Drive Type 2025 & 2033

- Figure 79: Rest of the World Luxury Car Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of the World Luxury Car Rental Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Rest of the World Luxury Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of the World Luxury Car Rental Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Car Rental Market Revenue Million Forecast, by Vehicle Model Style 2020 & 2033

- Table 2: Global Luxury Car Rental Market Volume Billion Forecast, by Vehicle Model Style 2020 & 2033

- Table 3: Global Luxury Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 4: Global Luxury Car Rental Market Volume Billion Forecast, by Rental Duration 2020 & 2033

- Table 5: Global Luxury Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Global Luxury Car Rental Market Volume Billion Forecast, by Booking Type 2020 & 2033

- Table 7: Global Luxury Car Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 8: Global Luxury Car Rental Market Volume Billion Forecast, by Drive Type 2020 & 2033

- Table 9: Global Luxury Car Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Luxury Car Rental Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Luxury Car Rental Market Revenue Million Forecast, by Vehicle Model Style 2020 & 2033

- Table 12: Global Luxury Car Rental Market Volume Billion Forecast, by Vehicle Model Style 2020 & 2033

- Table 13: Global Luxury Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 14: Global Luxury Car Rental Market Volume Billion Forecast, by Rental Duration 2020 & 2033

- Table 15: Global Luxury Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 16: Global Luxury Car Rental Market Volume Billion Forecast, by Booking Type 2020 & 2033

- Table 17: Global Luxury Car Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 18: Global Luxury Car Rental Market Volume Billion Forecast, by Drive Type 2020 & 2033

- Table 19: Global Luxury Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Luxury Car Rental Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of North America Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of North America Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Luxury Car Rental Market Revenue Million Forecast, by Vehicle Model Style 2020 & 2033

- Table 28: Global Luxury Car Rental Market Volume Billion Forecast, by Vehicle Model Style 2020 & 2033

- Table 29: Global Luxury Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 30: Global Luxury Car Rental Market Volume Billion Forecast, by Rental Duration 2020 & 2033

- Table 31: Global Luxury Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 32: Global Luxury Car Rental Market Volume Billion Forecast, by Booking Type 2020 & 2033

- Table 33: Global Luxury Car Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 34: Global Luxury Car Rental Market Volume Billion Forecast, by Drive Type 2020 & 2033

- Table 35: Global Luxury Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Luxury Car Rental Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Germany Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Luxury Car Rental Market Revenue Million Forecast, by Vehicle Model Style 2020 & 2033

- Table 50: Global Luxury Car Rental Market Volume Billion Forecast, by Vehicle Model Style 2020 & 2033

- Table 51: Global Luxury Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 52: Global Luxury Car Rental Market Volume Billion Forecast, by Rental Duration 2020 & 2033

- Table 53: Global Luxury Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 54: Global Luxury Car Rental Market Volume Billion Forecast, by Booking Type 2020 & 2033

- Table 55: Global Luxury Car Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 56: Global Luxury Car Rental Market Volume Billion Forecast, by Drive Type 2020 & 2033

- Table 57: Global Luxury Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Luxury Car Rental Market Volume Billion Forecast, by Country 2020 & 2033

- Table 59: China Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: China Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: India Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: India Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Japan Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Japan Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: South Korea Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: South Korea Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Rest of Asia Pacific Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Asia Pacific Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Global Luxury Car Rental Market Revenue Million Forecast, by Vehicle Model Style 2020 & 2033

- Table 70: Global Luxury Car Rental Market Volume Billion Forecast, by Vehicle Model Style 2020 & 2033

- Table 71: Global Luxury Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 72: Global Luxury Car Rental Market Volume Billion Forecast, by Rental Duration 2020 & 2033

- Table 73: Global Luxury Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 74: Global Luxury Car Rental Market Volume Billion Forecast, by Booking Type 2020 & 2033

- Table 75: Global Luxury Car Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 76: Global Luxury Car Rental Market Volume Billion Forecast, by Drive Type 2020 & 2033

- Table 77: Global Luxury Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Luxury Car Rental Market Volume Billion Forecast, by Country 2020 & 2033

- Table 79: South America Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South America Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Middle East and Africa Luxury Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Middle East and Africa Luxury Car Rental Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Car Rental Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Luxury Car Rental Market?

Key companies in the market include The Hertz Corporation, Europcar International, Avis Budget Group Inc, SIXT SE, Enterprise Holdings Inc, Zoomcar Ltd, Luxury Car Rentals LLC (Resla), Blue Car Rental ehf, Friends Car Rental LLC, VIP Rent A Car LLC, eZhire Technologies FZ LL.

3. What are the main segments of the Luxury Car Rental Market?

The market segments include Vehicle Model Style, Rental Duration, Booking Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smartphones and Internet Penetration Opening New Market Avenues.

6. What are the notable trends driving market growth?

Online Booking Holds a Major Market Share.

7. Are there any restraints impacting market growth?

Rising Smartphones and Internet Penetration Opening New Market Avenues.

8. Can you provide examples of recent developments in the market?

March 2024: Hype, a luxury traveler company based in Bengaluru, India, extended its luxury car rental services nationwide. With this expansion, the company broadened its offerings, providing compelling rates for premium car rental services throughout the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Car Rental Market?

To stay informed about further developments, trends, and reports in the Luxury Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence