Key Insights

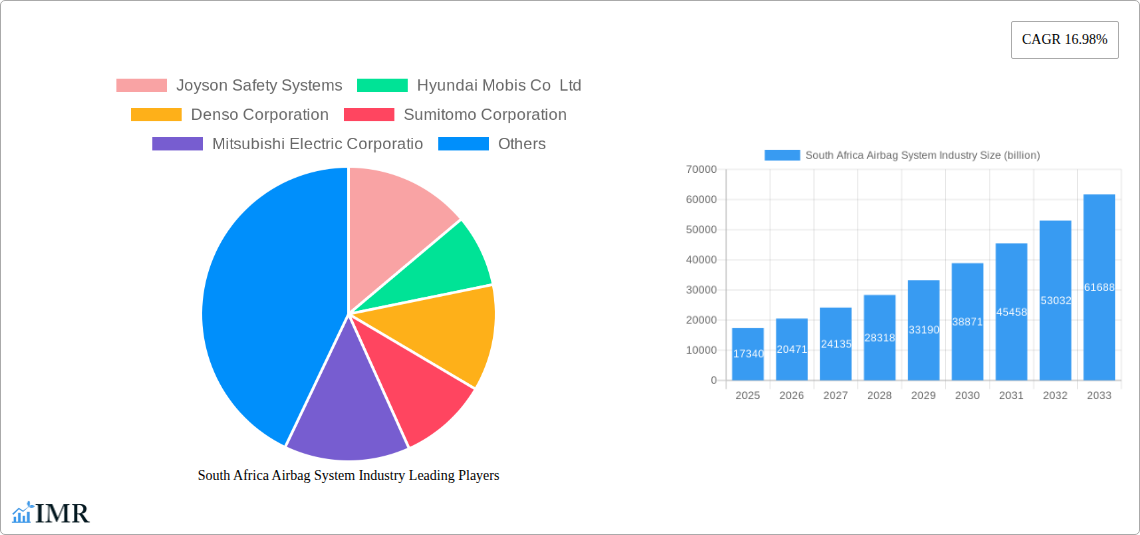

The South African airbag system market is poised for substantial growth, projecting a market size of $17.34 billion in 2025, driven by an impressive CAGR of 16.98% through 2033. This robust expansion is fueled by increasingly stringent automotive safety regulations in South Africa and a growing consumer awareness regarding vehicle safety features. The demand for advanced airbag systems, including driver, passenger, curtain, and knee airbags, is on the rise as vehicle manufacturers prioritize occupant protection. Furthermore, the increasing adoption of sophisticated inflator technologies like pyrotechnic and hybrid systems contributes to the market's upward trajectory, enhancing the overall effectiveness of airbag deployment.

South Africa Airbag System Industry Market Size (In Billion)

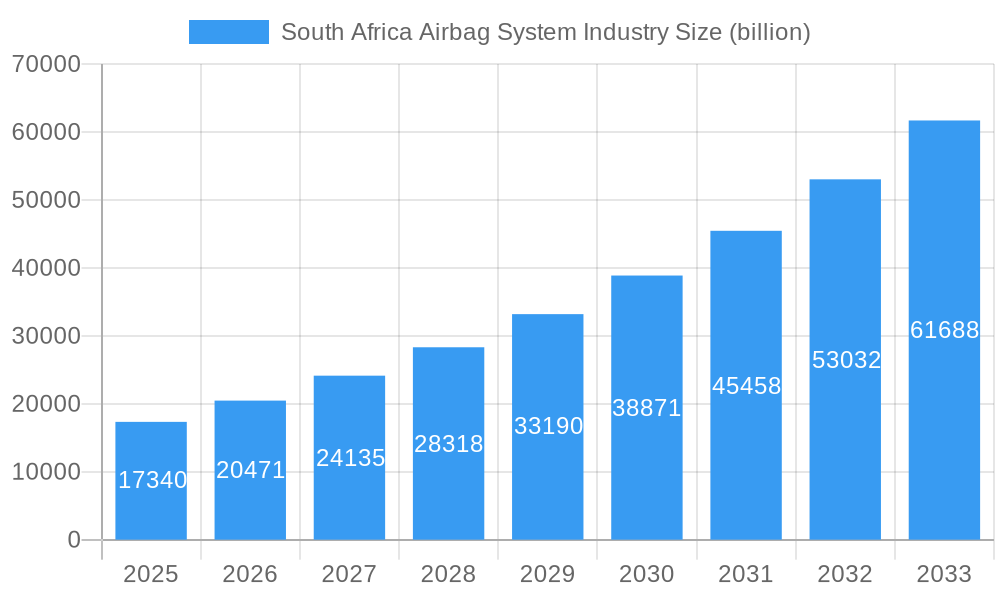

The competitive landscape within the South African airbag system industry is characterized by the presence of major global players such as Continental AG, Autoliv Inc., and Robert Bosch GmbH, alongside significant regional contributors like Hyundai Mobis Co Ltd. These companies are actively investing in research and development to innovate and integrate next-generation safety solutions. Trends such as the development of smart airbags that can adapt to occupant size and position, and the integration of airbags with other advanced driver-assistance systems (ADAS), are expected to shape the market. While the market benefits from strong regulatory backing and rising consumer demand for safety, challenges such as the high cost of advanced airbag technologies and the need for specialized training for installation and maintenance could influence the pace of adoption in certain segments of the vehicle market.

South Africa Airbag System Industry Company Market Share

South Africa Airbag System Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the South Africa airbag system industry, providing critical insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025, the report delves into market structure, growth drivers, regional dominance, product landscape, key challenges, emerging opportunities, and the influential players shaping the future of automotive safety in South Africa. With a focus on high-traffic keywords and a structured presentation of data, this report is optimized for search engine visibility and delivers actionable intelligence for industry professionals. Values are presented in billion units where available, with xx or predicted values used for missing data.

South Africa Airbag System Industry Market Dynamics & Structure

The South Africa airbag system market is characterized by a moderate level of concentration, with several key global and regional players vying for market share. Technological innovation serves as a primary driver, fueled by advancements in sensor technology, airbag deployment algorithms, and the integration of intelligent safety systems. Stringent regulatory frameworks, including mandatory passive safety standards and upcoming legislative changes, are compelling automakers to equip vehicles with a higher number and more sophisticated types of airbags. Competitive product substitutes are limited, as airbags remain a fundamental safety component. End-user demographics, particularly the growing middle class and increased vehicle ownership, are indirectly influencing demand. Mergers and acquisitions (M&A) activity is present, as companies seek to expand their product portfolios and geographic reach.

- Market Concentration: Dominated by a few major global suppliers with strong local presence.

- Technological Innovation: Driven by advancements in multi-stage inflators, advanced sensor systems, and integration with other Advanced Driver-Assistance Systems (ADAS).

- Regulatory Frameworks: Mandates for advanced airbag systems are increasing, pushing manufacturers to adopt the latest technologies.

- End-User Demographics: Rising disposable incomes and a preference for safer vehicles are boosting demand for premium safety features.

- M&A Trends: Companies are consolidating to achieve economies of scale and broaden their offerings in the automotive safety sector.

South Africa Airbag System Industry Growth Trends & Insights

The South Africa airbag system industry is poised for significant expansion, driven by a confluence of economic, regulatory, and technological factors. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period, reflecting an increasing adoption rate of advanced airbag technologies across various vehicle segments. Technological disruptions are playing a crucial role, with the development of more intelligent and adaptive airbag systems that can respond to the severity of an accident and the occupant's position. Consumer behavior is shifting towards a greater emphasis on vehicle safety, with buyers increasingly considering airbag count and types as key purchasing criteria. Government initiatives aimed at improving road safety and reducing accident fatalities are also indirectly stimulating the demand for enhanced airbag systems. The penetration of airbags, particularly in the passenger car segment, is expected to reach near-saturation levels, while growth in commercial vehicles will be driven by evolving safety regulations. The aftermarket segment for airbag replacement and upgrades also presents a consistent revenue stream. Overall, the market's trajectory indicates a sustained upward trend fueled by a proactive approach to vehicle safety. The introduction of new vehicle models with enhanced safety features is a consistent factor, pushing the demand for diverse airbag types like curtain and knee airbags.

Dominant Regions, Countries, or Segments in South Africa Airbag System Industry

Within the South Africa airbag system industry, the Passenger Car vehicle type segment is the dominant force driving market growth. This dominance is attributed to several interconnected factors, including higher production volumes, a larger consumer base, and more established regulatory frameworks specifically targeting passenger vehicle safety. The Driver airbag and Passenger airbag types also hold significant market share due to their ubiquitous nature and mandated inclusion in virtually all new vehicles. However, the growth potential for Curtain airbag and Knee airbag segments is notably higher, driven by increasing consumer awareness and evolving safety standards that push for more comprehensive occupant protection.

- Vehicle Type Dominance:

- Passenger Cars: Account for the largest market share due to high sales volumes and stringent safety mandates.

- Commercial Vehicles: Experiencing growing demand due to increasing safety regulations and fleet operator focus on reducing operational risks.

- Airbag Type Dynamics:

- Driver & Passenger Airbags: Represent the largest segment by volume but with slower growth rates due to near-universal adoption.

- Curtain Airbags: Exhibit strong growth potential, driven by their effectiveness in side-impact collisions and increasing consumer demand for holistic protection.

- Knee Airbags: Emerging as a significant growth segment, particularly in higher-tier passenger vehicles, offering enhanced protection for the lower extremities.

- Others (e.g., Center Airbags, Seat-belt Integrated Airbags): Represent niche but growing segments, showcasing innovation and tailored safety solutions.

- Inflator Type Trends:

- Pyrotechnic Inflators: Remain the dominant technology due to their reliability and cost-effectiveness, widely used across all airbag types.

- Stored Gas Inflators: Gaining traction in specific applications requiring finer control over deployment, such as advanced passenger airbags.

- Hybrid Inflators: Offer a balance of speed and control, finding application in a variety of airbag systems.

South Africa Airbag System Industry Product Landscape

The South Africa airbag system product landscape is marked by continuous innovation aimed at enhancing occupant safety. Modern airbag systems feature multi-stage deployment capabilities, allowing for adaptive responses to varying impact severities and occupant sizes. Advanced materials and computational fluid dynamics are employed to optimize airbag shape and inflation characteristics for maximum protection. Innovations include the development of smaller, more integrated airbag modules that reduce vehicle weight and complexity. Furthermore, the integration of sophisticated sensor networks and intelligent algorithms enables personalized safety, anticipating and mitigating potential injuries with greater precision. The trend towards integrating airbags with other active and passive safety systems, such as pre-tensioning seatbelts and adaptive cruise control, is a key technological advancement defining the current product landscape.

Key Drivers, Barriers & Challenges in South Africa Airbag System Industry

Key Drivers: The South Africa airbag system industry is propelled by a confluence of critical factors. Primarily, stringent government safety regulations and the increasing adoption of global NCAP (New Car Assessment Program) standards are mandating higher airbag counts and advanced technologies. A growing consumer awareness regarding vehicle safety, coupled with rising disposable incomes, fuels demand for vehicles equipped with comprehensive airbag systems. Technological advancements in airbag design, materials, and deployment mechanisms are also significant drivers, leading to more effective and integrated solutions. Furthermore, the robust automotive manufacturing sector in South Africa, with its focus on export markets adhering to high safety standards, indirectly boosts the demand for advanced airbag systems.

Barriers & Challenges: Despite the positive outlook, several barriers and challenges impede the industry's growth. The cost of advanced airbag systems can be a significant deterrent, particularly for entry-level vehicle segments and price-sensitive consumers. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of critical components. Navigating evolving and sometimes fragmented regulatory landscapes across different vehicle types and export markets presents a challenge. Intense competition among global suppliers can lead to price pressures, impacting profitability margins. Lastly, the ongoing development of alternative safety technologies, though complementary rather than directly substitutive to airbags, requires continuous investment in R&D to maintain a competitive edge. The high cost of specialized raw materials required for airbag production is also a significant challenge.

Emerging Opportunities in South Africa Airbag System Industry

Emerging opportunities within the South Africa airbag system industry are primarily centered around the expansion of niche airbag applications and the integration of intelligent safety solutions. The growing demand for enhanced protection in commercial vehicles, particularly for long-haul drivers, presents an untapped market. Furthermore, the development of innovative airbag solutions for specialized vehicles, such as electric vehicles (EVs) with unique structural considerations, offers a burgeoning avenue. The increasing adoption of semi-autonomous driving features is also creating opportunities for more sophisticated airbag systems that can anticipate and react to potential collision scenarios. Consumer preference for personalized safety features and retrofitting options for older vehicles also represent potential growth areas. The development of sustainable and lighter airbag materials also presents an opportunity for market differentiation.

Growth Accelerators in the South Africa Airbag System Industry Industry

The long-term growth of the South Africa airbag system industry is being significantly accelerated by several key catalysts. Technological breakthroughs in sensing and artificial intelligence are enabling the development of truly adaptive and predictive airbag systems, moving beyond reactive protection. Strategic partnerships between airbag manufacturers, automakers, and technology providers are fostering innovation and accelerating the integration of new safety features into vehicle platforms. Market expansion strategies, including a focus on export markets with stringent safety regulations and the development of cost-effective solutions for emerging economies, are crucial growth accelerators. The continuous pursuit of lighter, more compact, and more efficient airbag inflator technologies also contributes to overall market expansion by improving vehicle performance and reducing manufacturing costs. Investment in advanced manufacturing processes and automation further enhances production efficiency.

Key Players Shaping the South Africa Airbag System Industry Market

- Joyson Safety Systems

- Hyundai Mobis Co Ltd

- Denso Corporation

- Sumitomo Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- ZF TRW

- Toyoda Gosei Co Ltd

Notable Milestones in South Africa Airbag System Industry Sector

- 2019: Increased focus on mandated driver and passenger airbag installations across all new vehicle models.

- 2020: Growing adoption of curtain airbags in mid-range passenger cars driven by safety awareness campaigns.

- 2021: Introduction of advanced sensor technologies for more precise airbag deployment in response to accident severity.

- 2022: Government initiatives to enhance road safety leading to discussions on stricter passive safety regulations.

- 2023: Significant investment by major automotive manufacturers in R&D for next-generation airbag systems, including knee airbags.

- 2024: Emerging trend towards intelligent airbag systems capable of adapting to occupant size and position.

In-Depth South Africa Airbag System Industry Market Outlook

The future outlook for the South Africa airbag system industry is exceptionally positive, driven by a sustained demand for enhanced vehicle safety. Growth accelerators, including technological advancements in smart airbag systems and strategic collaborations between industry leaders, are poised to redefine automotive safety. The market is expected to witness an increasing penetration of advanced airbag types like curtain and knee airbags, alongside a continued focus on optimizing existing driver and passenger airbag systems. Emerging opportunities in niche segments and the growing emphasis on integrated safety solutions within autonomous and semi-autonomous vehicles will further propel growth. Stakeholders can anticipate a market characterized by innovation, stringent regulatory compliance, and a strong consumer pull towards safer mobility solutions. The strategic expansion into evolving vehicle segments, particularly EVs, will be crucial for long-term success.

South Africa Airbag System Industry Segmentation

-

1. Airbag Type

- 1.1. Driver airbag

- 1.2. Passenger airbag

- 1.3. Curtain airbag

- 1.4. Knee airbag

- 1.5. Others

-

2. Inflator Type

- 2.1. Pyrotechnic

- 2.2. Stored Gas

- 2.3. Hybrid

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

South Africa Airbag System Industry Segmentation By Geography

- 1. South Africa

South Africa Airbag System Industry Regional Market Share

Geographic Coverage of South Africa Airbag System Industry

South Africa Airbag System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market

- 3.4. Market Trends

- 3.4.1. Hybrid Inflator Segment is Growing with a High Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Airbag System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Driver airbag

- 5.1.2. Passenger airbag

- 5.1.3. Curtain airbag

- 5.1.4. Knee airbag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Inflator Type

- 5.2.1. Pyrotechnic

- 5.2.2. Stored Gas

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Joyson Safety Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Denso Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sumitomo Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autoliv Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZF TRW

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyoda Gosei Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Joyson Safety Systems

List of Figures

- Figure 1: South Africa Airbag System Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Airbag System Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Airbag System Industry Revenue billion Forecast, by Airbag Type 2020 & 2033

- Table 2: South Africa Airbag System Industry Revenue billion Forecast, by Inflator Type 2020 & 2033

- Table 3: South Africa Airbag System Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: South Africa Airbag System Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Africa Airbag System Industry Revenue billion Forecast, by Airbag Type 2020 & 2033

- Table 6: South Africa Airbag System Industry Revenue billion Forecast, by Inflator Type 2020 & 2033

- Table 7: South Africa Airbag System Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: South Africa Airbag System Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Airbag System Industry?

The projected CAGR is approximately 16.98%.

2. Which companies are prominent players in the South Africa Airbag System Industry?

Key companies in the market include Joyson Safety Systems, Hyundai Mobis Co Ltd, Denso Corporation, Sumitomo Corporation, Mitsubishi Electric Corporatio, Continental AG, Autoliv Inc, Robert Bosch GmbH, ZF TRW, Toyoda Gosei Co Ltd.

3. What are the main segments of the South Africa Airbag System Industry?

The market segments include Airbag Type, Inflator Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers.

6. What are the notable trends driving market growth?

Hybrid Inflator Segment is Growing with a High Rate.

7. Are there any restraints impacting market growth?

Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Airbag System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Airbag System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Airbag System Industry?

To stay informed about further developments, trends, and reports in the South Africa Airbag System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence