Key Insights

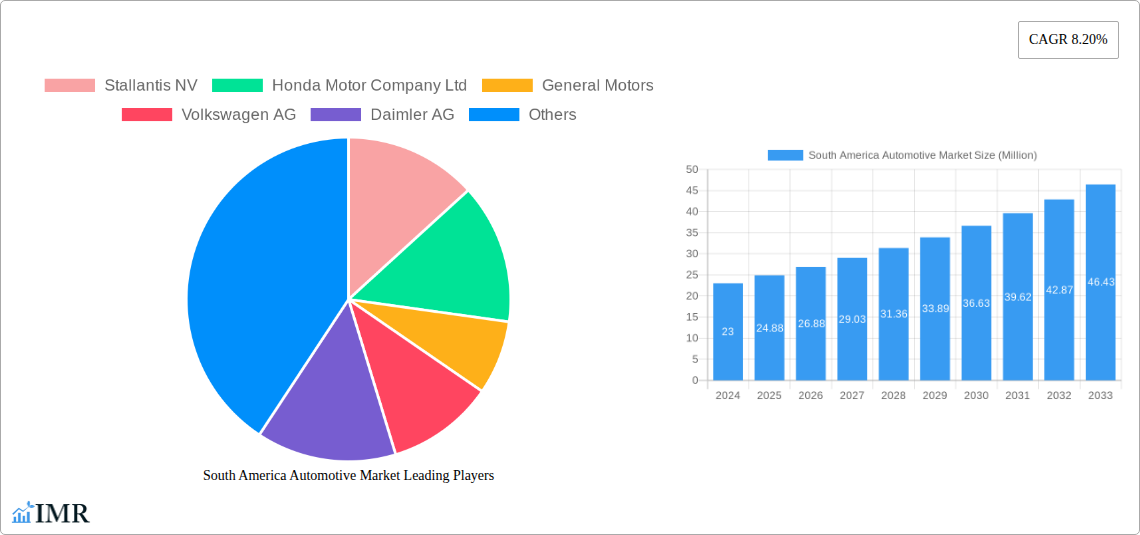

The South America Automotive Market is poised for significant expansion, projected to reach a substantial $24.88 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.20% between 2019 and 2033. A key driver for this burgeoning market is the increasing disposable income and a growing middle class across nations like Brazil and Argentina, fueling demand for both passenger cars and commercial vehicles. Furthermore, the push towards sustainable mobility is accelerating the adoption of electric vehicles (EVs), with government incentives and expanding charging infrastructure playing a crucial role. The commercial vehicle segment is also experiencing a surge, driven by e-commerce growth and the need for efficient logistics solutions. While traditional gasoline and diesel vehicles continue to hold a significant share, their dominance is expected to gradually shift as environmental regulations tighten and consumer preferences evolve towards greener alternatives.

South America Automotive Market Market Size (In Million)

The market's dynamism is further shaped by several underlying trends. The ongoing technological advancements, including the integration of advanced driver-assistance systems (ADAS) and connectivity features, are enhancing vehicle appeal and safety. Companies like Volkswagen AG, Toyota Motor Corp, and Stellantis NV are actively investing in local manufacturing and product portfolios tailored to the specific demands of the South American consumer. However, the market also faces certain restraints. Economic volatility and fluctuating currency exchange rates in some regions can impact consumer purchasing power and automotive sales. Furthermore, the development of robust charging infrastructure for electric vehicles, particularly outside major urban centers, remains a critical challenge that needs to be addressed to unlock the full potential of this segment. Despite these hurdles, the overall outlook for the South America Automotive Market remains overwhelmingly positive, driven by strong demand fundamentals and a commitment to innovation.

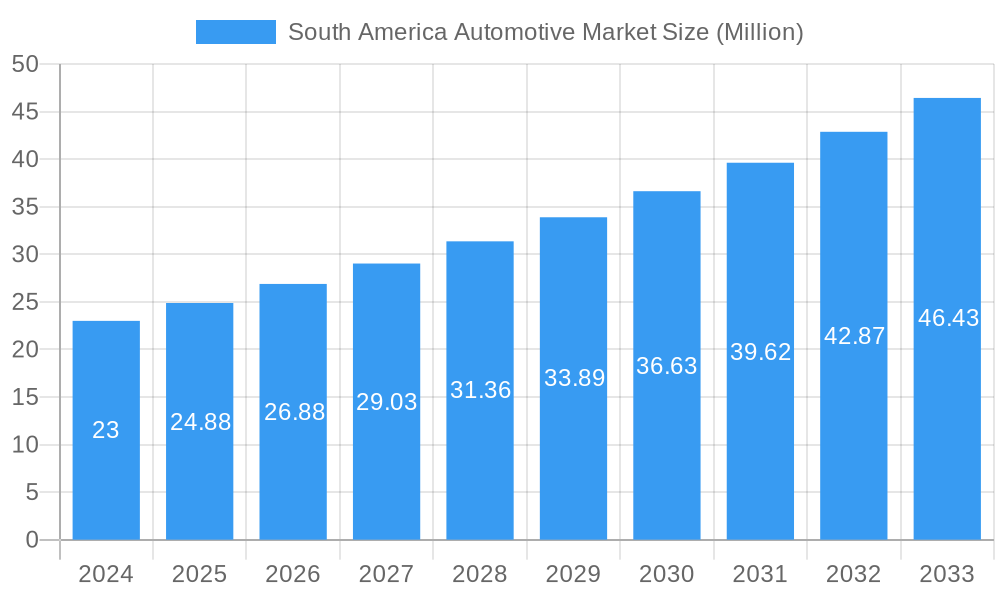

South America Automotive Market Company Market Share

South America Automotive Market Report: Unlocking Growth and Innovation (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic South America automotive market, encompassing passenger cars, commercial vehicles, and two-wheelers. We delve into trends across key fuel types, including diesel, gasoline, electric vehicles, and other emerging alternatives. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report offers actionable insights for industry stakeholders. Discover market size evolution, adoption rates, technological disruptions, dominant regions, and the strategic landscape shaped by major players like Stallantis NV, Honda Motor Company Ltd, General Motors, Volkswagen AG, Daimler AG, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Corp, Groupe Renault, Kia Motor Corporation, and Ford Motor Company. Gain a competitive edge with our detailed analysis of market dynamics, growth drivers, emerging opportunities, and key challenges.

South America Automotive Market Market Dynamics & Structure

The South America automotive market is characterized by a moderate to high level of market concentration, with established global manufacturers holding significant shares, particularly in the passenger car segment. Technological innovation is increasingly driven by the pursuit of electrification and enhanced safety features, although infrastructure development for electric vehicles remains a barrier. Regulatory frameworks are evolving, with a growing emphasis on emission standards and incentives for cleaner technologies, influencing the adoption rates of electric vehicles. Competitive product substitutes are primarily defined by vehicle price points, fuel efficiency, and brand reputation. End-user demographics are diverse, ranging from urban commuters seeking economical and fuel-efficient options to commercial entities requiring robust and versatile vehicles. Mergers and acquisitions (M&A) trends are less pronounced in recent years, with a greater focus on strategic partnerships and investments in local production facilities.

- Market Concentration: Dominated by a few global automotive giants with strong established dealer networks.

- Technological Innovation: Focus on EV powertrain, battery technology, and advanced driver-assistance systems (ADAS).

- Regulatory Frameworks: Increasingly stringent emission norms and government support for EV adoption.

- Product Substitutes: Price-sensitive market with a strong preference for fuel-efficient gasoline and diesel vehicles, with emerging interest in EVs.

- End-User Demographics: Varied, from cost-conscious individuals to fleet operators and evolving urban mobility needs.

- M&A Trends: Limited large-scale M&A, with increased focus on joint ventures and technology licensing.

South America Automotive Market Growth Trends & Insights

The South America automotive market is poised for significant evolution, driven by a confluence of economic recovery, evolving consumer preferences, and technological advancements. Market size is projected to witness a steady upward trajectory, propelled by increasing disposable incomes in key economies and a growing demand for personal mobility solutions. The adoption rates of Electric Vehicles (EVs), while currently nascent compared to global leaders, are expected to accelerate considerably over the forecast period. This surge will be fueled by government incentives, the expansion of charging infrastructure, and a growing environmental consciousness among consumers. Technological disruptions, particularly in battery technology and autonomous driving features, will play a pivotal role in shaping product offerings and consumer choices. The shift towards sustainable transportation is becoming more pronounced, with consumers increasingly considering the environmental impact of their vehicle purchases. This behavioral shift, coupled with the growing availability of more affordable EV models, will contribute to a broader market penetration of electrified vehicles. Furthermore, the commercial vehicle segment is expected to witness robust growth, driven by e-commerce expansion and the need for efficient logistics solutions across the region. The integration of digital technologies, such as connected car services and advanced infotainment systems, will also enhance the overall ownership experience, further stimulating demand. The market is also seeing a resurgence in demand for two-wheelers, particularly in densely populated urban areas, offering a cost-effective and agile mode of transportation. The overall CAGR is projected to be around 4.5% over the forecast period.

Dominant Regions, Countries, or Segments in South America Automotive Market

Brazil and Mexico stand out as the dominant countries within the South America automotive market, collectively accounting for a substantial portion of sales and production. Brazil, with its large population and established automotive manufacturing base, is a consistent leader in vehicle sales across various segments. The country's economic policies and automotive industry incentives have historically supported significant production volumes. Mexico, on the other hand, benefits from its strategic geographical location and free trade agreements, making it a crucial hub for automotive manufacturing and export.

In terms of vehicle types, Passenger Cars continue to represent the largest segment due to widespread consumer demand for personal transportation. However, Commercial Vehicles are experiencing robust growth, fueled by the expansion of e-commerce, logistics, and infrastructure development projects across the continent. The Two-wheelers segment is also gaining traction, particularly in urban environments where they offer an economical and efficient mode of transport.

When examining fuel types, Gasoline remains the dominant fuel, owing to its widespread availability and the existing refuelling infrastructure. However, Electric Vehicles are emerging as a significant growth segment. Government initiatives, increasing environmental awareness, and the growing availability of charging infrastructure are driving higher adoption rates. Diesel vehicles maintain a strong presence in the commercial vehicle sector due to their power and fuel efficiency for heavy-duty applications.

- Dominant Countries: Brazil and Mexico lead in terms of production and sales volume.

- Key Drivers in Brazil: Strong domestic demand, government incentives for local manufacturing, and a developed dealer network.

- Key Drivers in Mexico: Proximity to North American markets, favorable trade agreements, and a skilled manufacturing workforce.

- Dominant Vehicle Type: Passenger Cars, followed by a growing Commercial Vehicle segment.

- Emerging Vehicle Segment: Two-wheelers, driven by urban mobility needs.

- Dominant Fuel Type: Gasoline, with significant growth potential for Electric Vehicles.

- Commercial Vehicle Fuel: Diesel continues to be a strong contender for heavy-duty applications.

- Growth Potential: Electric Vehicles and Commercial Vehicles are expected to exhibit the highest growth rates.

South America Automotive Market Product Landscape

The South America automotive market is witnessing a wave of product innovations aimed at catering to diverse consumer needs and evolving regulatory landscapes. Manufacturers are increasingly focusing on developing fuel-efficient gasoline engines, alongside a growing portfolio of hybrid and fully electric vehicles. Product applications are expanding to include connected car technologies, offering enhanced safety, entertainment, and navigation features. Performance metrics are being redefined by advancements in battery technology, leading to longer ranges and faster charging times for EVs. Unique selling propositions often revolve around affordability, durability for challenging road conditions, and localized features that resonate with regional preferences. Technological advancements are also seen in the integration of advanced driver-assistance systems (ADAS) and improved infotainment systems, enhancing the overall driving experience and safety.

Key Drivers, Barriers & Challenges in South America Automotive Market

Key Drivers:

- Growing Middle Class: Increasing disposable incomes in key South American economies are fueling demand for new vehicles.

- Urbanization: The rapid growth of cities necessitates efficient and accessible transportation solutions, driving demand for passenger cars and two-wheelers.

- Government Incentives: Supportive policies for electric vehicle adoption and local manufacturing are accelerating market growth.

- E-commerce Expansion: The booming e-commerce sector is increasing the demand for commercial vehicles for logistics and delivery services.

- Technological Advancements: Innovations in EV technology, battery efficiency, and connected car features are attracting new consumers.

Barriers & Challenges:

- Economic Volatility: Fluctuations in national economies and currency devaluations can impact consumer purchasing power and investment confidence.

- Infrastructure Deficiencies: The lack of widespread charging infrastructure for EVs remains a significant hurdle in many regions.

- High Import Duties and Taxes: Tariffs on imported vehicles and components can increase the cost of vehicles for consumers.

- Supply Chain Disruptions: Global supply chain issues, particularly for semiconductor chips, continue to affect production volumes and vehicle availability.

- Limited Consumer Awareness: In some regions, there is a lack of comprehensive understanding and awareness regarding the benefits and practicality of electric vehicles.

Emerging Opportunities in South America Automotive Market

Emerging opportunities in the South America automotive market lie in the significant untapped potential of electric vehicle adoption, particularly in urban centers with developing charging infrastructure. The growing demand for ride-sharing and mobility-as-a-service (MaaS) presents avenues for fleet operators and specialized vehicle manufacturers. Furthermore, the increasing focus on sustainability and emission reduction is creating a market for used electric vehicle resale platforms and battery recycling services. Innovative financing models and subscription services are also emerging to make vehicle ownership more accessible to a broader consumer base.

Growth Accelerators in the South America Automotive Market Industry

The South America automotive market industry is witnessing accelerated growth driven by a potent combination of technological breakthroughs, strategic partnerships, and targeted market expansion strategies. The rapid advancements in battery technology are making electric vehicles more affordable and practical, thereby fueling their adoption. Partnerships between automotive manufacturers and energy companies are crucial for expanding charging infrastructure, a key enabler for EV growth. Furthermore, strategic collaborations with technology firms are integrating advanced connectivity and autonomous driving features, enhancing vehicle appeal. Governments' commitment to decarbonization targets and the implementation of supportive policies, such as tax incentives and subsidies for EVs, are acting as significant growth accelerators.

Key Players Shaping the South America Automotive Market Market

- Stallantis NV

- Honda Motor Company Ltd

- General Motors

- Volkswagen AG

- Daimler AG

- Hyundai Motor Company

- Nissan Motor Company Ltd

- Toyota Motor Corp

- Groupe Renault

- Kia Motor Corporation

- Ford Motor Company

Notable Milestones in South America Automotive Market Sector

- April 2022: Nissan Motor Co. invested 1.3 billion reais (USD276.12 million) in its plant in Resende, Brazil, and in launching new products between 2023 and 2025.

- January 2022: Link, a United States-based electric vehicle manufacturer, built a factory in the Mexican state of Puebla. A total of USD 265 million was invested in this production system.

- January 2022: Great Wall Motors announced investing USD 1.81 billion to manufacture electric vehicles in Brazil over the next decade in the factory acquired by Daimler AG.

In-Depth South America Automotive Market Market Outlook

The future outlook for the South America automotive market is exceptionally promising, characterized by sustained growth and transformative shifts. Key growth accelerators include the increasing government commitment towards electrifying transportation, which is driving substantial investments in EV manufacturing and charging infrastructure development. Strategic partnerships between established automotive giants and innovative technology startups will further propel the integration of advanced features like AI-powered connectivity and semi-autonomous driving capabilities. The evolving consumer preference towards sustainable and technologically advanced vehicles, coupled with expanding financing options, will unlock new market segments and accelerate overall market penetration. The region's rich natural resources also present opportunities for localized battery production and recycling initiatives, solidifying a more sustainable automotive ecosystem.

South America Automotive Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Two-wheelers

-

2. Fuel Type

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Electric Vehicle

- 2.4. Other Fuel Types

South America Automotive Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Automotive Market Regional Market Share

Geographic Coverage of South America Automotive Market

South America Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth And Stability; Othe Market Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Of Vehicles To End Users; Other Market Restraints

- 3.4. Market Trends

- 3.4.1 Brazil

- 3.4.2 Argentina

- 3.4.3 and Chile

- 3.4.4 to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Automotive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Two-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Electric Vehicle

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stallantis NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honda Motor Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Motors

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Motor Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan Motor Company Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Groupe Renault

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kia Motor Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Stallantis NV

List of Figures

- Figure 1: South America Automotive Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Automotive Market Share (%) by Company 2025

List of Tables

- Table 1: South America Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South America Automotive Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 3: South America Automotive Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: South America Automotive Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 6: South America Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Automotive Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the South America Automotive Market?

Key companies in the market include Stallantis NV, Honda Motor Company Ltd, General Motors, Volkswagen AG, Daimler AG, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Corp, Groupe Renault, Kia Motor Corporatio, Ford Motor Company.

3. What are the main segments of the South America Automotive Market?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth And Stability; Othe Market Drivers.

6. What are the notable trends driving market growth?

Brazil. Argentina. and Chile. to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Cost Of Vehicles To End Users; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

April 2022: Nissan Motor Co. invested 1.3 billion reais (USD276.12 million) in its plant in Resende, Brazil, and in launching new products between 2023 and 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Automotive Market?

To stay informed about further developments, trends, and reports in the South America Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence