Key Insights

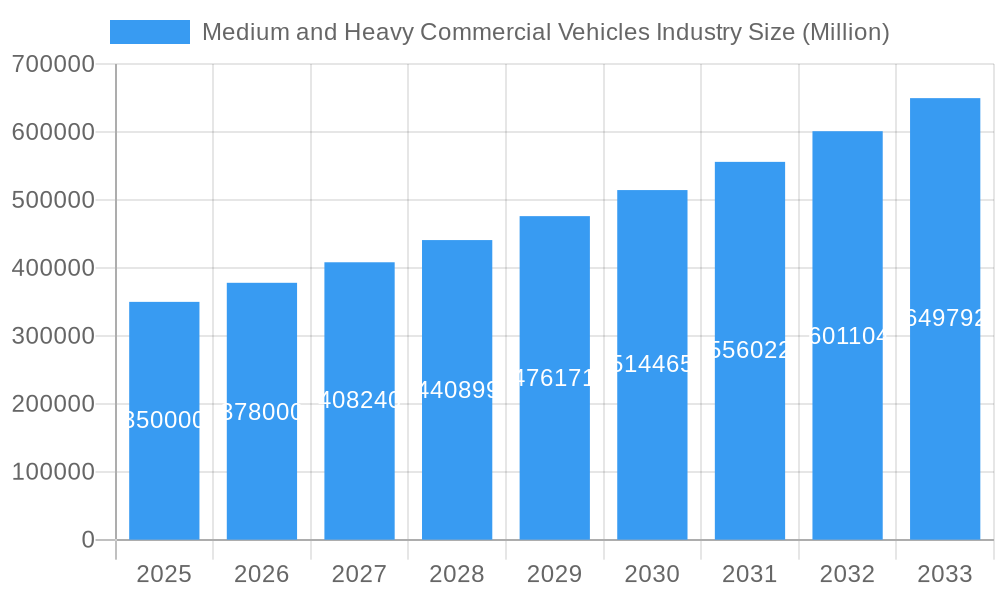

The global Medium and Heavy Commercial Vehicles (M&HCV) market is projected to reach USD 504.97 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 8.6%. This growth is propelled by increasing global trade, the e-commerce boom, and significant infrastructure investments in emerging economies. A key trend is the rising adoption of electric and alternative fuel M&HCVs, driven by stricter emission standards and corporate sustainability goals. Manufacturers are prioritizing R&D for more efficient, longer-range, and affordable green powertrains. Demand is particularly robust for vehicles in the 7.5-16 ton and above 16 ton segments, reflecting the need for high hauling capacity across industries.

Medium and Heavy Commercial Vehicles Industry Market Size (In Billion)

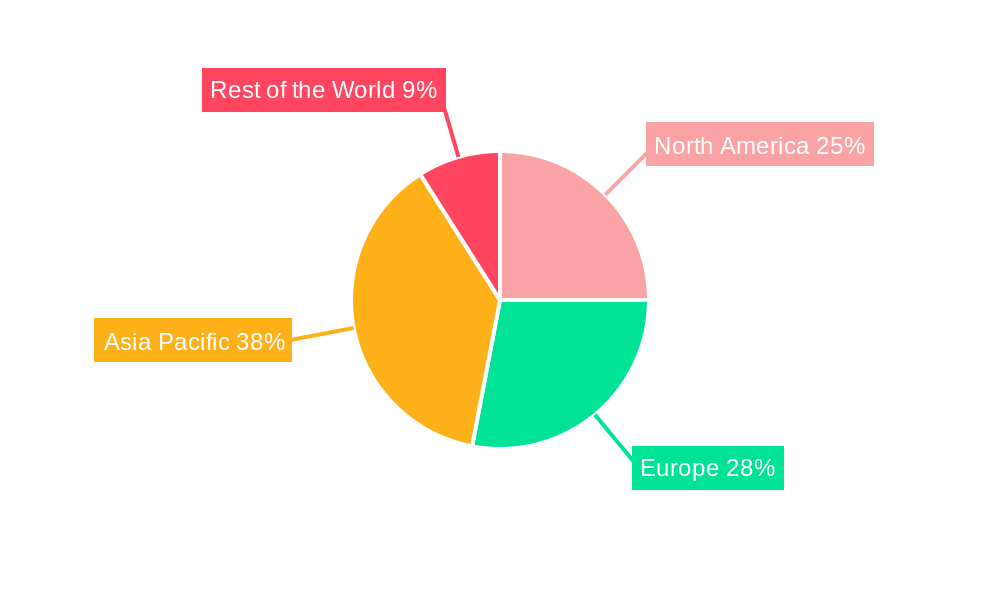

Challenges to M&HCV market growth include the high initial investment for advanced technologies, particularly electric and hybrid vehicles, and price volatility of raw materials like steel and battery components. The availability and reliability of charging infrastructure for electric heavy-duty trucks also present adoption hurdles. Geographically, the Asia Pacific region, led by China, is expected to lead the market, supported by its strong manufacturing base and expanding logistics sector. North America and Europe are significant markets, driven by technological innovation and regulatory push for sustainable transport. Leading players such as Daimler AG, Volvo Group, and PACCAR Inc. are at the forefront of developing diverse M&HCV offerings across various tonnage and propulsion types.

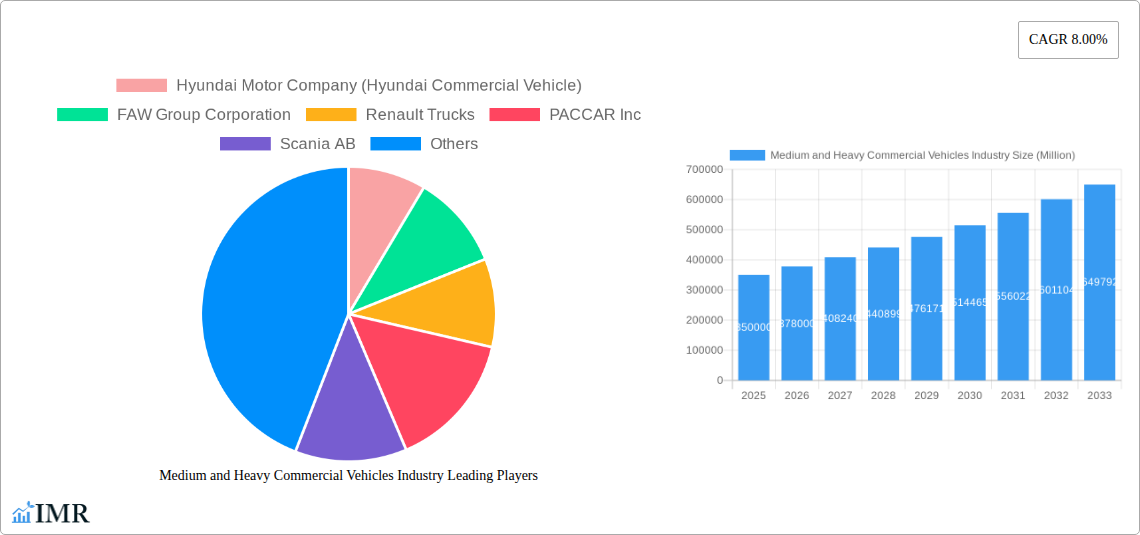

Medium and Heavy Commercial Vehicles Industry Company Market Share

This report provides an in-depth analysis of the global M&HCV industry, detailing market dynamics, growth trends, and opportunities. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, it utilizes historical data from 2019–2024 to offer actionable insights. The report examines key drivers, challenges, and the impact of electrification and alternative fuels. Focusing on parent and child market segments, this research is vital for understanding the evolving commercial transportation landscape.

Medium and Heavy Commercial Vehicles Industry Market Dynamics & Structure

The Medium and Heavy Commercial Vehicles industry is characterized by a moderately concentrated market structure, with leading players like Daimler AG, Volvo Group, and PACCAR Inc. holding significant market shares. Technological innovation, particularly in electrification and autonomous driving, is a primary driver of market evolution, pushing manufacturers towards more sustainable and efficient solutions. Stringent emission regulations, such as Euro 7 standards, are compelling rapid adoption of advanced powertrains and cleaner technologies. Competitive product substitutes are emerging in the form of electric vehicles (EVs) and hydrogen fuel cell trucks, posing a growing challenge to traditional Internal Combustion Engine (ICE) vehicles. End-user demographics are shifting towards logistics companies and fleet operators prioritizing total cost of ownership, operational efficiency, and environmental compliance. Mergers and acquisitions (M&A) activity remains robust, with manufacturers actively seeking partnerships and acquisitions to enhance technological capabilities, expand geographical reach, and consolidate market presence. For instance, recent M&A deals in the sector indicate a strategic focus on acquiring expertise in battery technology and charging infrastructure.

- Market Concentration: Dominated by a few major global players.

- Technological Innovation Drivers: Electrification, autonomous driving, connectivity, advanced driver-assistance systems (ADAS).

- Regulatory Frameworks: Emission standards (Euro 7, EPA mandates), safety regulations, carbon neutrality targets.

- Competitive Product Substitutes: Battery Electric Trucks (BETs), Plug-In Hybrid Electric Vehicles (PHEVs), Hydrogen Fuel Cell Electric Vehicles (HFCEVs).

- End-User Demographics: Logistics and transportation companies, construction, mining, last-mile delivery services.

- M&A Trends: Strategic acquisitions for technological capabilities, market access, and supply chain integration.

Medium and Heavy Commercial Vehicles Industry Growth Trends & Insights

The global Medium and Heavy Commercial Vehicles market is poised for significant evolution, driven by a confluence of technological advancements, evolving regulatory landscapes, and shifting consumer preferences. Market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, reaching an estimated XXX million units by the end of the forecast period. This growth trajectory is underpinned by a sustained demand for freight transportation, amplified by the expansion of e-commerce and global supply chains. The adoption rate of alternative propulsion types, especially Battery Electric Vehicles (BEVs), is accelerating rapidly. This surge is fueled by declining battery costs, increasing charging infrastructure availability, and governmental incentives aimed at decarbonizing the transportation sector. Technological disruptions, including the integration of artificial intelligence (AI) for route optimization and predictive maintenance, are enhancing operational efficiency and reducing downtime for fleets. Consumer behavior is increasingly influenced by a growing emphasis on sustainability and corporate social responsibility, pushing fleet operators to invest in greener vehicle options. Furthermore, the increasing integration of telematics and connected vehicle technologies is providing real-time data for enhanced fleet management and fuel efficiency, further solidifying the market's upward trend.

Dominant Regions, Countries, or Segments in Medium and Heavy Commercial Vehicles Industry

The Above 16 ton tonnage segment is a dominant force within the Medium and Heavy Commercial Vehicles industry, consistently representing the largest market share due to its critical role in long-haul freight transportation and heavy-duty applications. Within this segment, IC Engine propulsion, while gradually ceding ground, still holds substantial dominance due to established infrastructure and lower upfront costs. However, the Battery Electric propulsion type is experiencing the most dynamic growth and is projected to capture significant market share in the coming years. Geographically, Asia-Pacific is the leading region, driven by economic powerhouses like China and India, which exhibit immense demand for commercial vehicles owing to robust manufacturing sectors, extensive infrastructure development projects, and a burgeoning logistics industry.

- Dominant Tonnage Segment: Above 16 ton, crucial for freight and heavy-duty operations.

- Dominant Propulsion Type (Current): IC Engine, supported by existing infrastructure.

- Fastest Growing Propulsion Type: Battery Electric, driven by sustainability and regulations.

- Leading Region: Asia-Pacific, fueled by China and India's economic expansion.

- Key Drivers in Asia-Pacific:

- Economic Policies: Government initiatives promoting industrial growth and trade.

- Infrastructure Development: Significant investments in roads, ports, and logistics networks.

- E-commerce Growth: Surging demand for efficient freight movement.

- Fleet Modernization: Companies upgrading to more efficient and compliant vehicles.

- Market Share & Growth Potential: The "Above 16 ton" segment is expected to maintain its leading position, while the "Battery Electric" propulsion type will see the highest CAGR across all tonnage categories. The "7.5 - 16 ton" segment is also demonstrating strong growth potential, particularly in urban logistics and specialized applications.

Medium and Heavy Commercial Vehicles Industry Product Landscape

The product landscape of the Medium and Heavy Commercial Vehicles industry is undergoing a rapid transformation, with a strong emphasis on electrification and advanced powertrain technologies. Innovations are centered around improving energy efficiency, reducing emissions, and enhancing operational capabilities. Battery Electric Trucks (BETs) are emerging as a key product category, offering zero tailpipe emissions and lower running costs, with manufacturers like Volvo Trucks and PACCAR Inc. investing heavily in their development and deployment. Plug-In Hybrid Electric Vehicles (PHEVs) provide a transitional solution, bridging the gap between ICE and full electric powertrains. Alternative fuel-powered vehicles, including those utilizing hydrogen fuel cells and biofuels, are also gaining traction as sustainable alternatives. Performance metrics are increasingly being evaluated not just on horsepower and torque, but also on electric range, charging times, and total cost of ownership. Unique selling propositions now include smart connectivity features, advanced driver-assistance systems (ADAS), and predictive maintenance capabilities, all contributing to enhanced safety and productivity for fleet operators.

Key Drivers, Barriers & Challenges in Medium and Heavy Commercial Vehicles Industry

Key Drivers: The Medium and Heavy Commercial Vehicles industry is propelled by several key drivers. Technological advancements in battery technology, charging infrastructure, and vehicle efficiency are crucial. Growing global demand for freight transportation, driven by e-commerce and globalization, fuels the need for more vehicles. Increasingly stringent environmental regulations and government incentives for zero-emission vehicles are accelerating the adoption of alternative powertrains. Economic growth and infrastructure development projects worldwide also necessitate robust commercial vehicle fleets.

Key Barriers & Challenges: Significant challenges exist for the M&HCV industry. The high upfront cost of electric vehicles remains a barrier for many fleet operators, despite potential long-term savings. The limited availability and long charging times of charging infrastructure, especially for long-haul routes, pose practical limitations. Supply chain disruptions, particularly for critical components like semiconductors and batteries, continue to impact production and delivery timelines. Intense competition and the need for continuous innovation require substantial R&D investment. Regulatory uncertainty in some regions regarding the pace of electrification and supportive policies also presents a challenge.

Emerging Opportunities in Medium and Heavy Commercial Vehicles Industry

Emerging opportunities in the Medium and Heavy Commercial Vehicles industry are plentiful, particularly in the realm of sustainable logistics. The expanding e-commerce sector presents a massive opportunity for last-mile delivery vehicles, with a growing demand for electric and smaller-sized commercial trucks. The development of hydrogen fuel cell technology for heavy-duty long-haul trucking offers a significant long-term growth avenue, especially in regions with established hydrogen infrastructure plans. The integration of autonomous driving technology into commercial fleets promises to revolutionize logistics by increasing efficiency and safety, creating opportunities for specialized technology providers and service providers. Furthermore, the circular economy trend is opening up avenues for remanufacturing and refurbishment of commercial vehicles, extending their lifespan and reducing environmental impact.

Growth Accelerators in the Medium and Heavy Commercial Vehicles Industry Industry

Several catalysts are accelerating long-term growth in the Medium and Heavy Commercial Vehicles industry. Breakthroughs in battery energy density and faster charging capabilities are crucial for overcoming range anxiety and improving the practicality of electric trucks. Strategic partnerships between traditional automotive manufacturers, technology companies, and charging infrastructure providers are essential for building comprehensive ecosystems. Government subsidies, tax credits, and supportive policies for zero-emission vehicles play a pivotal role in driving adoption and market expansion. Investments in robust charging infrastructure networks, including public and private charging solutions, will significantly de-risk the transition for fleet operators. The increasing focus on data analytics and telematics for optimizing fleet operations and predictive maintenance will further enhance the value proposition of modern commercial vehicles.

Key Players Shaping the Medium and Heavy Commercial Vehicles Industry Market

- Hyundai Motor Company (Hyundai Commercial Vehicle)

- FAW Group Corporation

- Renault Trucks

- PACCAR Inc

- Scania AB

- MAN SE

- Daimler AG

- Tata Motors Limited

- Volvo Group

- Isuzu Motors Ltd

- Dongfeng Motor Corporation

Notable Milestones in Medium and Heavy Commercial Vehicles Industry Sector

- 2023: Launch of new generation electric trucks with extended range and faster charging capabilities by multiple OEMs.

- 2023: Significant government announcements regarding stricter emission norms and increased incentives for zero-emission commercial vehicles globally.

- 2023: Strategic collaborations formed between truck manufacturers and battery technology providers to secure supply chains.

- 2022: Introduction of advanced driver-assistance systems (ADAS) becoming standard on a wider range of heavy-duty trucks.

- 2022: Increased investment in hydrogen fuel cell truck development and pilot programs.

- 2021: Growing adoption of connected vehicle technologies for real-time fleet management and diagnostics.

- 2020: Expansion of charging infrastructure networks, particularly in key logistics hubs.

- 2019: Debut of commercially viable plug-in hybrid electric heavy-duty trucks.

In-Depth Medium and Heavy Commercial Vehicles Industry Market Outlook

The future outlook for the Medium and Heavy Commercial Vehicles industry is exceptionally bright, driven by a sustained commitment to sustainability and efficiency. Growth accelerators such as rapid advancements in battery technology, supportive government policies, and the relentless expansion of e-commerce will continue to shape market dynamics. Strategic partnerships and investments in charging infrastructure are poised to unlock new opportunities for widespread electrification. The industry is on the cusp of a transformative era, moving towards a cleaner, smarter, and more interconnected future of commercial transportation, presenting significant potential for innovation and market expansion.

Medium and Heavy Commercial Vehicles Industry Segmentation

-

1. Tonnage

- 1.1. 3.5 - 7.5 ton

- 1.2. 7.5 - 16 ton

- 1.3. Above 16 ton

-

2. Propulsion Type

- 2.1. IC Engine

- 2.2. Plug-In Hybrid Electric

- 2.3. Battery Electric

- 2.4. Alternative Fuel Powered

Medium and Heavy Commercial Vehicles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Medium and Heavy Commercial Vehicles Industry Regional Market Share

Geographic Coverage of Medium and Heavy Commercial Vehicles Industry

Medium and Heavy Commercial Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements In Vehicles Driving Demand; Others

- 3.3. Market Restrains

- 3.3.1. High Scan Tool Costs to Limit Growth; Others

- 3.4. Market Trends

- 3.4.1. Electric Commercial Vehicle to Witness Steady Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medium and Heavy Commercial Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage

- 5.1.1. 3.5 - 7.5 ton

- 5.1.2. 7.5 - 16 ton

- 5.1.3. Above 16 ton

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. IC Engine

- 5.2.2. Plug-In Hybrid Electric

- 5.2.3. Battery Electric

- 5.2.4. Alternative Fuel Powered

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage

- 6. North America Medium and Heavy Commercial Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage

- 6.1.1. 3.5 - 7.5 ton

- 6.1.2. 7.5 - 16 ton

- 6.1.3. Above 16 ton

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. IC Engine

- 6.2.2. Plug-In Hybrid Electric

- 6.2.3. Battery Electric

- 6.2.4. Alternative Fuel Powered

- 6.1. Market Analysis, Insights and Forecast - by Tonnage

- 7. Europe Medium and Heavy Commercial Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage

- 7.1.1. 3.5 - 7.5 ton

- 7.1.2. 7.5 - 16 ton

- 7.1.3. Above 16 ton

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. IC Engine

- 7.2.2. Plug-In Hybrid Electric

- 7.2.3. Battery Electric

- 7.2.4. Alternative Fuel Powered

- 7.1. Market Analysis, Insights and Forecast - by Tonnage

- 8. Asia Pacific Medium and Heavy Commercial Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage

- 8.1.1. 3.5 - 7.5 ton

- 8.1.2. 7.5 - 16 ton

- 8.1.3. Above 16 ton

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. IC Engine

- 8.2.2. Plug-In Hybrid Electric

- 8.2.3. Battery Electric

- 8.2.4. Alternative Fuel Powered

- 8.1. Market Analysis, Insights and Forecast - by Tonnage

- 9. Rest of the World Medium and Heavy Commercial Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage

- 9.1.1. 3.5 - 7.5 ton

- 9.1.2. 7.5 - 16 ton

- 9.1.3. Above 16 ton

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. IC Engine

- 9.2.2. Plug-In Hybrid Electric

- 9.2.3. Battery Electric

- 9.2.4. Alternative Fuel Powered

- 9.1. Market Analysis, Insights and Forecast - by Tonnage

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hyundai Motor Company (Hyundai Commercial Vehicle)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FAW Group Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Renault Trucks

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PACCAR Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Scania AB

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 MAN SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Daimler AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tata Motors Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Volvo Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Isuzu Motors Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dongfeng Motor Corporatio

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hyundai Motor Company (Hyundai Commercial Vehicle)

List of Figures

- Figure 1: Global Medium and Heavy Commercial Vehicles Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Tonnage 2025 & 2033

- Figure 3: North America Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Tonnage 2025 & 2033

- Figure 4: North America Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 5: North America Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Tonnage 2025 & 2033

- Figure 9: Europe Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Tonnage 2025 & 2033

- Figure 10: Europe Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 11: Europe Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: Europe Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Tonnage 2025 & 2033

- Figure 15: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Tonnage 2025 & 2033

- Figure 16: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 17: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Tonnage 2025 & 2033

- Figure 21: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Tonnage 2025 & 2033

- Figure 22: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 23: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Medium and Heavy Commercial Vehicles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Tonnage 2020 & 2033

- Table 2: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Tonnage 2020 & 2033

- Table 5: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Tonnage 2020 & 2033

- Table 11: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Tonnage 2020 & 2033

- Table 19: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Tonnage 2020 & 2033

- Table 27: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 28: Global Medium and Heavy Commercial Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Medium and Heavy Commercial Vehicles Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medium and Heavy Commercial Vehicles Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Medium and Heavy Commercial Vehicles Industry?

Key companies in the market include Hyundai Motor Company (Hyundai Commercial Vehicle), FAW Group Corporation, Renault Trucks, PACCAR Inc, Scania AB, MAN SE, Daimler AG, Tata Motors Limited, Volvo Group, Isuzu Motors Ltd, Dongfeng Motor Corporatio.

3. What are the main segments of the Medium and Heavy Commercial Vehicles Industry?

The market segments include Tonnage, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 504.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements In Vehicles Driving Demand; Others.

6. What are the notable trends driving market growth?

Electric Commercial Vehicle to Witness Steady Sales.

7. Are there any restraints impacting market growth?

High Scan Tool Costs to Limit Growth; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medium and Heavy Commercial Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medium and Heavy Commercial Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medium and Heavy Commercial Vehicles Industry?

To stay informed about further developments, trends, and reports in the Medium and Heavy Commercial Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence