Key Insights

The South African Electric Power Steering (EPS) market is projected for substantial expansion, with an estimated market size of 29378.8 million by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.2%. This growth is propelled by the increasing integration of advanced automotive technologies and supportive government mandates for enhanced fuel efficiency and reduced emissions. Passenger vehicles are anticipated to lead demand for EPS systems, driven by consumer preference for superior driving comfort, safety, and the standard inclusion of EPS in new model releases. The commercial vehicle sector also shows growing EPS adoption, addressing needs for improved maneuverability and reduced driver strain in demanding applications.

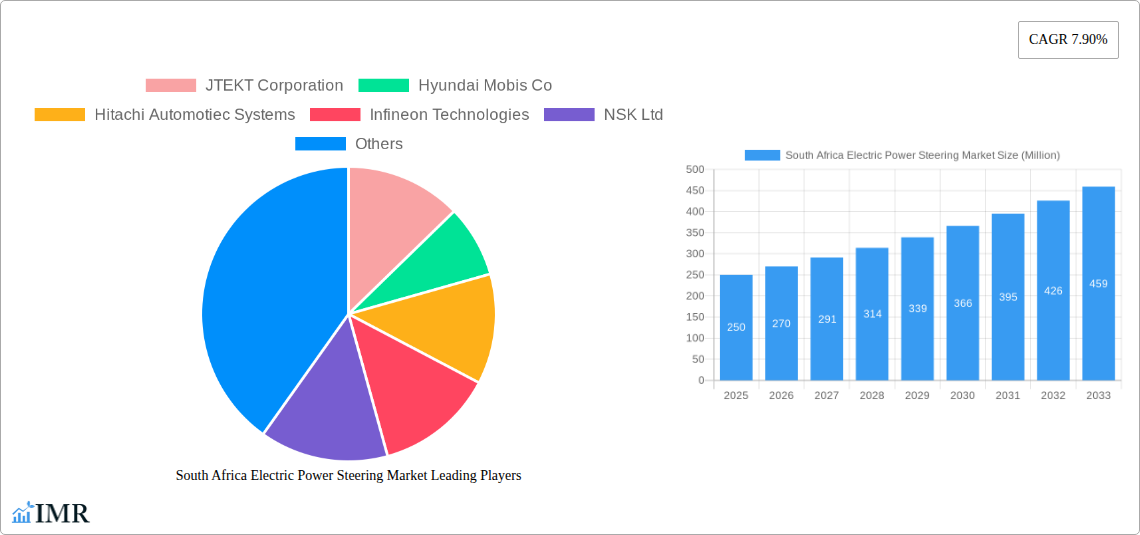

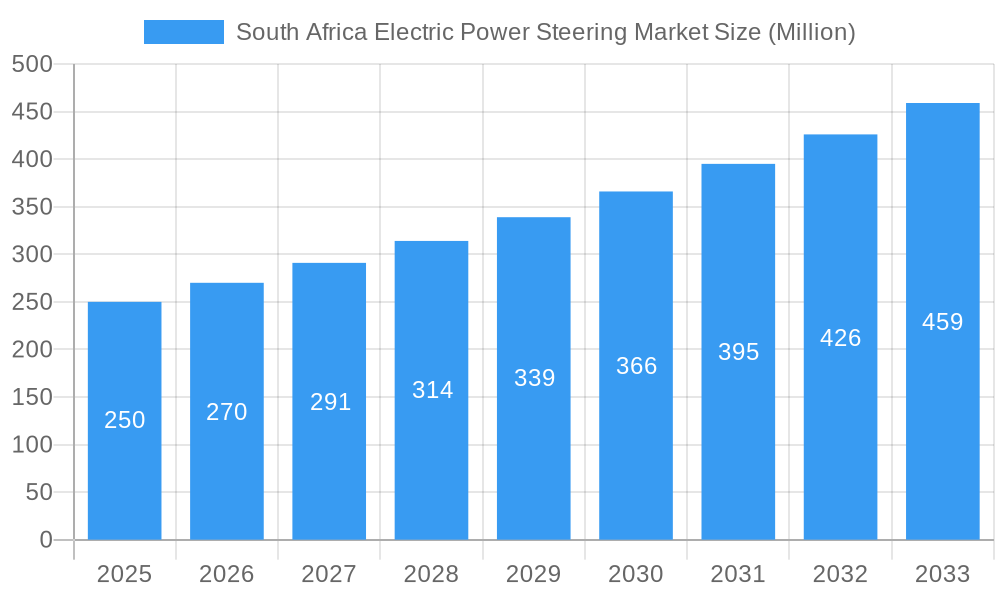

South Africa Electric Power Steering Market Market Size (In Billion)

Key growth drivers include the rising production of electric and hybrid vehicles in South Africa, which necessitates EPS, and increasing disposable incomes boosting passenger car sales. The transition from traditional hydraulic power steering to EPS is a significant factor due to its energy efficiency, reduced maintenance, and performance advantages. While Original Equipment Manufacturers (OEMs) currently dominate due to integration in new vehicle production, the aftermarket replacement segment is also expected to expand. Leading global suppliers are actively involved, fostering innovation and competitive pricing. Potential market restraints include the initial cost of EPS systems and possible supply chain challenges.

South Africa Electric Power Steering Market Company Market Share

South Africa Electric Power Steering Market Report: Market Dynamics & Structure

The South African Electric Power Steering (EPS) market is characterized by a moderately concentrated landscape, with key global players like JTEKT Corporation, Hyundai Mobis Co, Hitachi Automotive Systems, and Mando Corporation holding significant influence. Technological innovation remains a primary driver, fueled by the increasing demand for enhanced vehicle safety features, improved fuel efficiency, and a superior driving experience. Regulatory frameworks, particularly those aligning with global automotive safety and emissions standards, are progressively pushing manufacturers towards EPS adoption. Competitive product substitutes, such as hydraulic power steering (HPS), are steadily being phased out due to EPS's inherent advantages in energy efficiency and design flexibility. End-user demographics are shifting, with a growing middle class demanding more advanced and comfortable vehicles. Mergers and acquisitions (M&A) activities, though not overtly dominant, play a role in market consolidation and technology diffusion.

- Market Concentration: Dominated by a few large, established automotive component suppliers.

- Technological Innovation Drivers: Focus on enhanced driver assistance systems (ADAS) integration, reduced energy consumption, and compact system design.

- Regulatory Frameworks: Increasing alignment with global automotive safety and environmental regulations, favoring EPS.

- Competitive Product Substitutes: Hydraulic Power Steering (HPS) is the primary substitute, with a declining market share.

- End-User Demographics: Growing demand for vehicles equipped with advanced features and improved fuel economy.

- M&A Trends: Strategic partnerships and acquisitions aimed at expanding technological capabilities and market reach.

South Africa Electric Power Steering Market Growth Trends & Insights

The South African Electric Power Steering (EPS) market is poised for robust growth, driven by an escalating demand for sophisticated automotive technologies and evolving consumer preferences. This expansion is underpinned by the increasing penetration of advanced driver-assistance systems (ADAS) and the persistent global push towards more fuel-efficient and environmentally friendly vehicles. The transition from traditional Hydraulic Power Steering (HPS) systems to Electric Power Steering (EPS) is a significant trend, as EPS offers superior energy efficiency, precise control, and greater integration capabilities with modern vehicle electronics.

The market's evolution is also shaped by the underlying economic landscape of South Africa, including government incentives for automotive manufacturing and the overall health of the new vehicle sales sector. As automotive manufacturers continue to invest in local production and R&D, the adoption rate of EPS systems is expected to accelerate. Technological disruptions, such as the development of more compact and cost-effective EPS modules, are further catalyzing this growth. Consumer behavior is increasingly influenced by the perceived value of safety, comfort, and advanced features, all of which are significantly enhanced by EPS technology. The base year 2025 estimates the market to be approximately 1.5 million units, with a projected Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025–2033. This growth trajectory indicates a substantial market expansion, fueled by both OEM demand and the burgeoning replacement market as older vehicles with HPS systems are phased out. The report will delve into the specific adoption rates across various vehicle segments and analyze the impact of emerging technologies on the overall market penetration of EPS in South Africa.

Dominant Regions, Countries, or Segments in South Africa Electric Power Steering Market

Within the South African Electric Power Steering (EPS) market, the Passenger Car segment emerges as the dominant force, driving significant growth and adoption. This dominance is a direct reflection of the broader automotive market trends in the country, where passenger vehicles constitute the largest share of new vehicle sales and registrations. The increasing consumer preference for technologically advanced, comfortable, and fuel-efficient vehicles directly translates to a higher demand for EPS systems in this segment.

Passenger cars benefit from the inherent advantages of EPS, including its ability to provide precise steering feel, reduce driver fatigue, and facilitate the integration of advanced safety features like lane-keeping assist and parking assist systems. Furthermore, the growing middle class in South Africa, with increasing disposable income, is opting for newer models that are increasingly equipped with EPS as a standard feature.

Key Drivers for Passenger Car Dominance:

- Consumer Demand for Advanced Features: Passenger car buyers prioritize comfort, safety, and modern technology, all enhanced by EPS.

- Fuel Efficiency Mandates and Consumer Awareness: EPS contributes to improved fuel economy, a key consideration for passenger vehicle owners.

- Technological Advancements Tailored for Passenger Cars: Innovations in EPS systems are often optimized for the specific needs and size of passenger vehicles.

- OEM Strategy: Manufacturers are increasingly standardizing EPS in popular passenger car models to remain competitive.

While Commercial Vehicles are also adopting EPS, their uptake is at a slightly slower pace due to factors such as cost sensitivity, payload considerations, and the specific operational demands of these vehicles. However, the growing emphasis on fleet efficiency and driver safety in the commercial sector is expected to spur increased EPS adoption in this segment over the forecast period.

In terms of Product Type, the Rack Assist Type (REPS) systems are currently the most prevalent in the South African EPS market. REPS offers a good balance of performance, cost-effectiveness, and packaging efficiency, making it the preferred choice for a majority of passenger car applications.

- Rack Assist Type (REPS): Dominant due to its performance-to-cost ratio and suitability for a wide range of passenger vehicles. Estimated market share in this segment is approximately 65%.

- Column Assist Type (CEPS): Often found in smaller vehicles or as a more cost-effective option.

- Pinion Assist Type (PEPS): Increasingly gaining traction due to its compact design and direct application to the steering pinion.

The Demand Category of OEM (Original Equipment Manufacturer) is the primary driver of the South African EPS market. New vehicle production lines are incorporating EPS systems as standard or optional features, directly influencing the market volume. The Replacement market, while significant, is currently smaller but is expected to witness considerable growth as the installed base of EPS-equipped vehicles ages and requires servicing or upgrades.

South Africa Electric Power Steering Market Product Landscape

The South African Electric Power Steering (EPS) market showcases a dynamic product landscape characterized by continuous innovation aimed at enhancing performance, efficiency, and safety. Manufacturers are focusing on developing lighter, more compact EPS units that are easier to integrate into diverse vehicle architectures. Key advancements include the integration of sophisticated sensors and control algorithms that enable seamless interaction with advanced driver-assistance systems (ADAS), such as adaptive cruise control and lane-keeping assist. Unique selling propositions revolve around the precise steering feel, reduced energy consumption, and the ability to offer variable steering ratios tailored to different driving conditions, ultimately contributing to a superior driving experience.

Key Drivers, Barriers & Challenges in South Africa Electric Power Steering Market

Key Drivers:

- Technological Advancements: The integration of EPS with ADAS features, improved energy efficiency, and enhanced driving comfort are major catalysts.

- Stringent Safety Regulations: Growing emphasis on vehicle safety standards globally and in South Africa is pushing for EPS adoption.

- Fuel Efficiency Mandates: The need to meet stricter fuel economy standards makes EPS a preferred choice over less efficient HPS systems.

- Increasing Vehicle Electrification: The rise of electric and hybrid vehicles naturally favors EPS due to its lower energy draw compared to HPS.

Barriers & Challenges:

- High Initial Cost: EPS systems are generally more expensive than traditional HPS, posing a challenge for cost-sensitive segments of the market.

- Supply Chain Volatility: Dependence on imported components and potential disruptions in the global supply chain can impact availability and pricing.

- Infrastructure and Skilled Workforce: The availability of qualified technicians for installation and repair of EPS systems may be a challenge in certain regions.

- Competition from Existing HPS Technology: While declining, the installed base of HPS systems and the inertia of some manufacturers can slow down the transition.

- Economic Fluctuations: The overall health of the South African automotive industry is directly linked to economic stability, which can impact demand.

Emerging Opportunities in South Africa Electric Power Steering Market

Emerging opportunities in the South African Electric Power Steering (EPS) market lie in the increasing demand for customized steering solutions for niche vehicle segments, such as performance vehicles and specialized utility vehicles. The growing adoption of autonomous driving technologies presents a significant avenue, requiring highly precise and responsive EPS systems for autonomous navigation and control. Furthermore, the expansion of the aftermarket for EPS upgrades and retrofitting in older vehicles offers an untapped market potential. As South Africa continues to bolster its automotive manufacturing capabilities, opportunities arise for local component suppliers to develop and produce EPS modules, fostering domestic innovation and reducing reliance on imports.

Growth Accelerators in the South Africa Electric Power Steering Market Industry

Several key catalysts are accelerating the growth of the South Africa Electric Power Steering (EPS) market. Technological breakthroughs in sensor technology and motor efficiency are leading to more compact, powerful, and cost-effective EPS units. Strategic partnerships between global EPS manufacturers and local South African automotive players are crucial for technology transfer, localized production, and market penetration. Government initiatives promoting advanced manufacturing and the adoption of greener technologies also provide a significant boost. The increasing trend of automakers standardizing EPS across their model lineups to meet evolving consumer expectations for advanced features and fuel efficiency is a major growth accelerator.

Key Players Shaping the South Africa Electric Power Steering Market Market

- JTEKT Corporation

- Hyundai Mobis Co

- Hitachi Automotive Systems

- Infineon Technologies

- NSK Ltd

- GKN PLC

- Mitsubishi Electric Corporation

- Mando Corporation

- Nexteer Automotive

- ATS Automation Tooling Systems Inc

- Delphi Automotive Systems

Notable Milestones in South Africa Electric Power Steering Market Sector

- 2019: Increased integration of EPS in new passenger vehicle models launched in South Africa, reflecting global trends.

- 2020: Growing emphasis on vehicle safety and fuel efficiency due to evolving consumer preferences and potential regulatory shifts.

- 2021: Supply chain disruptions impact component availability and pricing globally, affecting the South African market.

- 2022: Emergence of more cost-effective EPS solutions, making them accessible to a wider range of vehicles.

- 2023: Enhanced focus on ADAS integration, leading to the development of more sophisticated EPS systems.

- 2024: Expectation of continued growth in EPS adoption driven by automotive manufacturers' commitment to advanced features and emission standards.

In-Depth South Africa Electric Power Steering Market Market Outlook

The outlook for the South African Electric Power Steering (EPS) market is highly promising, propelled by robust growth accelerators. The sustained demand for advanced driver-assistance systems, coupled with the imperative for improved fuel efficiency, will continue to drive OEM adoption of EPS technology. Technological innovations, particularly in miniaturization and smart steering functionalities, will further enhance the appeal and applicability of EPS across diverse vehicle types. Strategic collaborations and potential localization of manufacturing will likely bolster the market's resilience and competitiveness. The increasing consumer awareness and preference for vehicles equipped with modern steering systems position the EPS market for significant expansion throughout the forecast period.

South Africa Electric Power Steering Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Product Type

- 2.1. By Rack assist type (REPS)

- 2.2. Colum assist type (CEPS)

- 2.3. Pinion assist type (PEPS)

-

3. Demand Category

- 3.1. OEM

- 3.2. Replacement

South Africa Electric Power Steering Market Segmentation By Geography

- 1. South Africa

South Africa Electric Power Steering Market Regional Market Share

Geographic Coverage of South Africa Electric Power Steering Market

South Africa Electric Power Steering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Luxury Cars Across the Country

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Product

- 3.4. Market Trends

- 3.4.1. ECU is the fastest-growing component amongst all Electric Power Steering (EPS) components

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Electric Power Steering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. By Rack assist type (REPS)

- 5.2.2. Colum assist type (CEPS)

- 5.2.3. Pinion assist type (PEPS)

- 5.3. Market Analysis, Insights and Forecast - by Demand Category

- 5.3.1. OEM

- 5.3.2. Replacement

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Automotiec Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NSK Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GKN PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mando Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nexteer Automotive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ATS Automation Tooling Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Delphi Automotive Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 JTEKT Corporation

List of Figures

- Figure 1: South Africa Electric Power Steering Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Electric Power Steering Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Electric Power Steering Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Electric Power Steering Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: South Africa Electric Power Steering Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 4: South Africa Electric Power Steering Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: South Africa Electric Power Steering Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: South Africa Electric Power Steering Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: South Africa Electric Power Steering Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 8: South Africa Electric Power Steering Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Electric Power Steering Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the South Africa Electric Power Steering Market?

Key companies in the market include JTEKT Corporation, Hyundai Mobis Co, Hitachi Automotiec Systems, Infineon Technologies, NSK Ltd, GKN PLC, Mitsubishi Electric Corporation, Mando Corporation, Nexteer Automotive, ATS Automation Tooling Systems Inc, Delphi Automotive Systems.

3. What are the main segments of the South Africa Electric Power Steering Market?

The market segments include Vehicle Type, Product Type, Demand Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 29378.8 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Luxury Cars Across the Country.

6. What are the notable trends driving market growth?

ECU is the fastest-growing component amongst all Electric Power Steering (EPS) components.

7. Are there any restraints impacting market growth?

High Cost Associated with the Product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Electric Power Steering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Electric Power Steering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Electric Power Steering Market?

To stay informed about further developments, trends, and reports in the South Africa Electric Power Steering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence