Key Insights

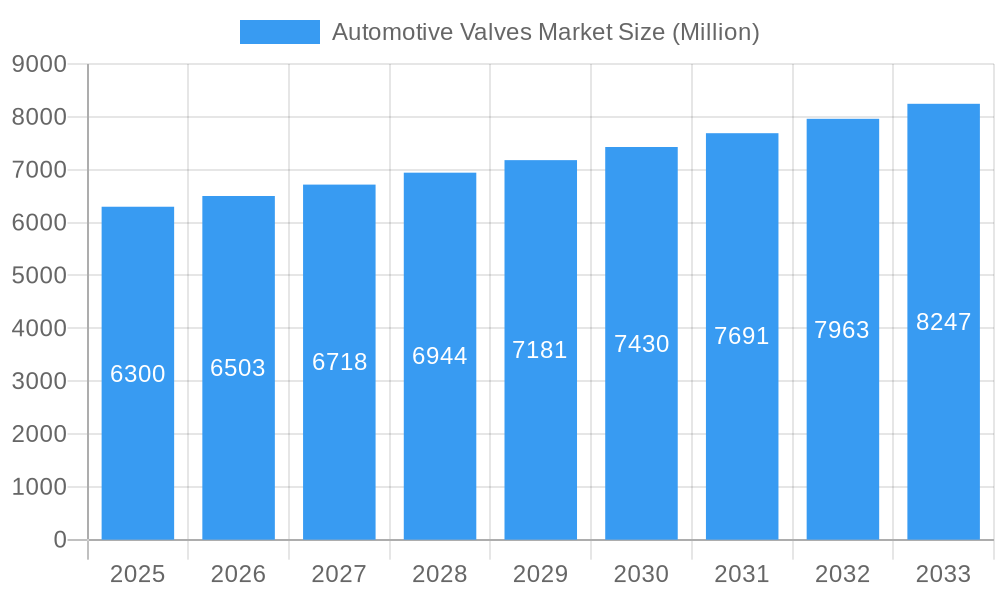

The global Automotive Valves Market is poised for robust expansion, projected to reach approximately USD 6.3 billion in 2025. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 3.3% from 2019 to 2033. A primary driver for this upward trend is the increasing complexity and sophistication of modern vehicles, demanding advanced valve technologies for improved performance, fuel efficiency, and emissions control. The proliferation of internal combustion engines, particularly in emerging economies, continues to fuel demand for essential valve components. Furthermore, the burgeoning automotive sector in the Asia Pacific region, characterized by rising disposable incomes and a growing middle class, is a significant contributor to market expansion. Technological advancements, such as the integration of electric actuation and smart valve systems for enhanced precision and diagnostics, are also shaping market dynamics, creating new opportunities for innovation and market penetration.

Automotive Valves Market Market Size (In Billion)

The market is segmented across various applications, including Engine Valves, Air Conditioning Valves, Fuel System Valves, and EGR Valves, each catering to specific vehicular needs. Passenger cars and commercial vehicles represent the dominant vehicle types, while pneumatic, hydraulic, and electric functions highlight the diverse operational mechanisms employed. The sales channel landscape is characterized by strong OEM partnerships and a growing aftermarket segment, driven by vehicle servicing and replacement needs. While the market benefits from continuous innovation and increasing vehicle production, it also faces certain restraints. Stringent emission regulations are a double-edged sword; they drive the need for advanced valve technologies but also necessitate substantial R&D investment and can lead to higher manufacturing costs. The increasing adoption of electric vehicles (EVs) presents a long-term shift in demand, potentially impacting the traditional internal combustion engine valve market, although EVs still utilize various forms of valves for thermal management and other functions.

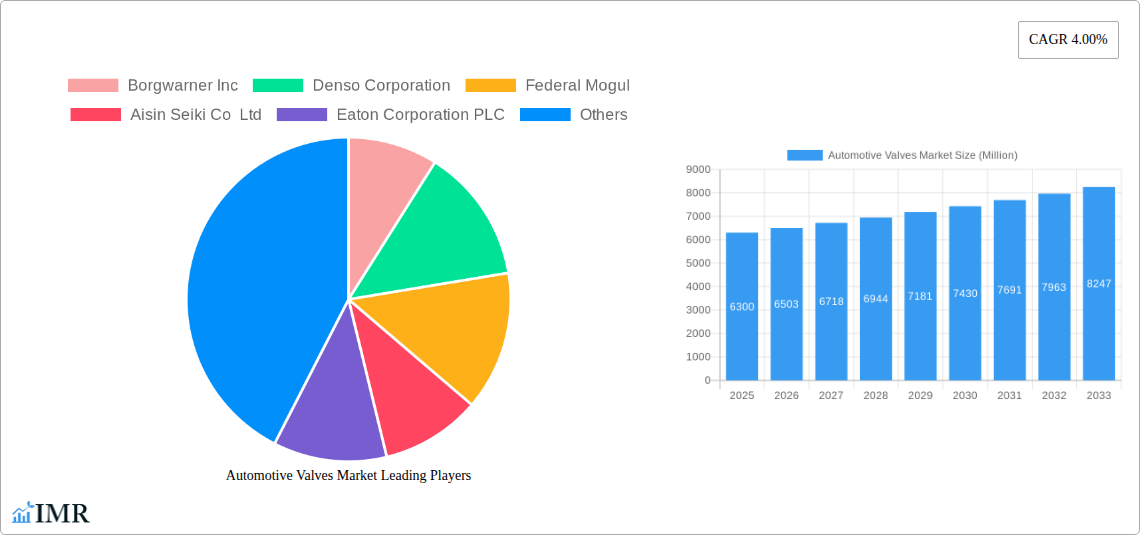

Automotive Valves Market Company Market Share

This comprehensive report provides an in-depth analysis of the global automotive valves market, a critical component in modern vehicle functionality and emissions control. Covering the period from 2019 to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the strategic moves of leading industry players. With an estimated market size of $XX billion units in 2025, this report is an indispensable resource for manufacturers, suppliers, investors, and automotive industry professionals seeking to navigate the evolving landscape of automotive valve technology.

Automotive Valves Market Market Dynamics & Structure

The automotive valves market is characterized by a moderate to high level of concentration, with a few major players dominating global production and innovation. Key technological innovation drivers include the relentless pursuit of enhanced fuel efficiency, reduced emissions to meet stringent global regulations, and the integration of advanced materials for improved durability and performance. Regulatory frameworks, such as Euro 7 and EPA standards, are profoundly shaping product development, pushing for more sophisticated valve technologies like variable valve actuation and advanced EGR systems. Competitive product substitutes, while limited in core functionality, emerge in the form of alternative engine designs or advanced emission control systems that might reduce the reliance on certain valve types. End-user demographics are shifting towards a demand for more sustainable and high-performance vehicles, influencing the types of valves that are prioritized. Mergers and Acquisitions (M&A) trends are evident as companies seek to consolidate market share, acquire cutting-edge technologies, and expand their geographical reach. For instance, the historical period has seen numerous strategic acquisitions aimed at bolstering portfolios in areas like electric and electronic valve actuation. Innovation barriers include the high cost of R&D for new valve technologies, the long product development cycles in the automotive sector, and the need for extensive testing and validation to meet safety and performance standards.

- Market Concentration: Dominated by key players like Borgwarner Inc., Denso Corporation, Federal Mogul, Aisin Seiki Co Ltd., Eaton Corporation PLC, Valeo S.A., and Robert Bosch GmbH.

- Technological Drivers: Focus on emission reduction, fuel efficiency improvement, lightweighting, and electrification compatibility.

- Regulatory Impact: Stringent emission standards (e.g., Euro 7, CAFE) mandate the development of advanced valve technologies.

- End-User Demands: Growing preference for fuel-efficient, low-emission, and performance-oriented vehicles.

- M&A Landscape: Strategic acquisitions aimed at technology integration and market expansion.

- Innovation Barriers: High R&D costs, long development cycles, and rigorous validation requirements.

Automotive Valves Market Growth Trends & Insights

The automotive valves market is poised for substantial growth, driven by an increasing global vehicle parc and the imperative for cleaner combustion engines and efficient thermal management systems. The market size, estimated at $XX billion units in 2025, is projected to expand at a significant Compound Annual Growth Rate (CAGR) of X.X% from 2025 to 2033. This growth trajectory is underpinned by rising adoption rates of advanced valve technologies, such as variable valve actuation (VVA) and electronically controlled EGR valves, which are crucial for meeting evolving emissions regulations. Technological disruptions, including the integration of smart valve systems with real-time diagnostics and the development of novel materials for extreme temperature and pressure resistance, are also shaping the market. Consumer behavior shifts, particularly the growing awareness of environmental impact and the demand for sustainable mobility solutions, are indirectly influencing valve development, pushing for greater efficiency and reduced particulate matter. The transition towards hybrid and electric vehicles, while posing a long-term challenge to traditional engine valve demand, is simultaneously creating opportunities for specialized valves in battery thermal management systems and other ancillary functions within these new powertrains. The aftermarket segment is expected to witness steady growth, driven by the aging vehicle population and the need for replacement parts. The penetration of advanced valve technologies is accelerating, particularly in new vehicle platforms designed to meet future emission standards.

Dominant Regions, Countries, or Segments in Automotive Valves Market

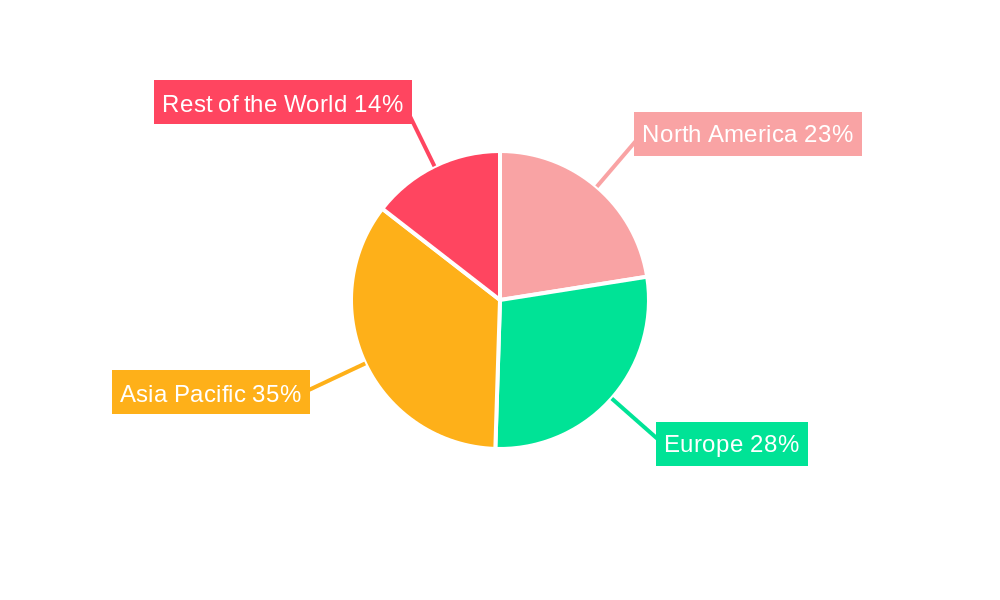

Asia Pacific is currently the dominant region driving growth in the global automotive valves market, with China and India leading the charge due to their massive vehicle production volumes and rapidly expanding automotive sectors. The region's dominance is fueled by strong economic policies supporting manufacturing, significant investments in automotive infrastructure, and a burgeoning middle class with increasing disposable income, leading to higher passenger car and commercial vehicle sales.

- Application Type: Engine Valves remain the largest segment, accounting for an estimated XX% of the market in 2025, driven by the sheer volume of internal combustion engine vehicles produced globally. However, EGR Valves are experiencing rapid growth due to stringent emission regulations.

- Vehicle Type: Passenger Cars constitute the largest share of the market, representing approximately XX% in 2025. Commercial Vehicles are also a significant segment, with increasing demand for specialized valves to optimize engine performance and fuel efficiency for heavy-duty applications.

- Function Type: Pneumatic valves hold a substantial market share, but hydraulic and electric valves are gaining traction, especially in advanced engine management systems and for applications in hybrid and electric vehicles.

- Sales Channel: The Original Equipment Manufacturer (OEM) segment is the primary driver of market volume, given the direct integration of valves into new vehicle production lines. The Aftermarket segment, however, provides a consistent revenue stream due to the ongoing need for replacement parts.

In terms of specific countries, China's unparalleled automotive manufacturing capacity makes it the largest single-country market for automotive valves. Its government's focus on developing indigenous automotive technology and stricter emission norms further stimulates demand for advanced valve solutions. India follows closely, driven by its significant two-wheeler and passenger car production, coupled with government initiatives aimed at improving fuel efficiency and reducing emissions. Europe, particularly Germany and its strong automotive manufacturing base, remains a critical market for high-performance and emission-compliant engine valves and specialized VVA technologies. North America, with its robust demand for larger vehicles and a strong focus on emissions compliance, also represents a substantial market, especially for commercial vehicle valves and advanced engine technologies.

Automotive Valves Market Product Landscape

The automotive valves market is witnessing continuous product innovation focused on enhancing performance, reducing weight, and improving emission control capabilities. Key advancements include the development of lighter, stronger materials such as hollow valves and those with advanced coatings for increased durability and thermal resistance. Companies are investing heavily in variable valve actuation (VVA) technologies that dynamically adjust valve timing and lift, optimizing engine efficiency and reducing emissions across various operating conditions. The integration of electronic controls and sensors into valve systems is becoming more prevalent, enabling real-time adjustments and improved diagnostics. Furthermore, innovations in EGR valve designs are yielding more precise control over exhaust gas recirculation, directly contributing to cleaner emissions. Unique selling propositions often revolve around proprietary designs that offer superior sealing, reduced friction, and enhanced longevity, catering to the evolving demands of modern internal combustion engines and hybrid powertrains.

Key Drivers, Barriers & Challenges in Automotive Valves Market

Key Drivers:

- Stringent Emission Regulations: Global mandates for reduced CO2 and NOx emissions are the primary catalyst, driving demand for advanced valve technologies like EGR and VVA.

- Fuel Efficiency Imperatives: Growing consumer and governmental pressure to improve fuel economy necessitates more efficient engine designs, where advanced valves play a crucial role.

- Increasing Vehicle Production: A steady rise in global vehicle production, particularly in emerging economies, directly correlates with increased demand for automotive valves.

- Technological Advancements: Innovations in materials science and electronic control systems enable the development of higher-performing and more durable valves.

Key Barriers & Challenges:

- Transition to Electric Vehicles (EVs): The long-term shift towards EVs, which do not rely on internal combustion engines, poses a significant challenge to the traditional automotive valves market.

- High R&D Investment: Developing advanced valve technologies requires substantial capital expenditure in research and development.

- Supply Chain Volatility: Geopolitical factors, raw material price fluctuations, and logistical disruptions can impact the availability and cost of valve components.

- Intense Competition: The market faces intense competition, leading to price pressures and the need for continuous innovation to maintain market share.

- Regulatory Uncertainty: Evolving and sometimes inconsistent emission standards across different regions can create planning complexities for manufacturers.

Emerging Opportunities in Automotive Valves Market

Emerging opportunities in the automotive valves market lie in the niche applications within hybrid and electric vehicles, such as advanced thermal management valves for batteries and power electronics. The growing demand for aftermarket replacement parts, especially for older but still functional internal combustion engine vehicles, presents a stable revenue stream. Furthermore, the development of smart valves with integrated diagnostics and predictive maintenance capabilities offers a pathway for value-added services and enhanced customer relationships. The expansion into new geographical markets with rapidly growing automotive sectors also represents a significant opportunity. Additionally, advancements in materials for extreme temperature and pressure resistance can open doors for specialized valve applications in performance engines and heavy-duty vehicles.

Growth Accelerators in the Automotive Valves Market Industry

The automotive valves market is experiencing accelerated growth driven by several key catalysts. Technological breakthroughs in areas like variable valve timing and lift (VVT/VVL) systems are enabling engines to operate more efficiently across a wider range of conditions, directly boosting demand for these sophisticated valve components. Strategic partnerships between valve manufacturers and automotive OEMs are crucial for co-developing solutions that meet specific vehicle platform requirements and future emission standards. Market expansion strategies, particularly focusing on high-growth regions in Asia and Latin America, are also contributing to the industry's upward trajectory. The increasing integration of electronic actuation and control systems into valves is another significant accelerator, driving demand for specialized electronic components and advanced manufacturing processes.

Key Players Shaping the Automotive Valves Market Market

- Borgwarner Inc.

- Denso Corporation

- Federal Mogul

- Aisin Seiki Co Ltd.

- Eaton Corporation PLC

- Valeo S A

- Robert Bosch GmbH

- Cummins Inc.

- Hitachi Ltd

- Johnson Electric Group

Notable Milestones in Automotive Valves Market Sector

- February 2022: Borgwarner introduced a new range of Exhaust gas recirculation valves, adding over 80 new part numbers to their product portfolio. These new EGR valves help to reduce emissions for most engine types, thereby supporting cleaner and more energy-efficient mobility.

- December 2021: Eaton Corporation introduced variable valve actuation technology to help commercial vehicle manufacturers meet forthcoming emissions regulations in China.

- July 2021: Eaton Corporation announced that the company supplies hollow valves for the engine families that Stellantis builds in Brazil. The valves are specifically designed for Fiat T3 and T4 engine families.

In-Depth Automotive Valves Market Market Outlook

The future outlook for the automotive valves market remains robust, driven by the persistent need for efficient and cleaner internal combustion engines in the medium term, alongside emerging opportunities in hybrid and niche EV applications. Growth accelerators such as ongoing investments in advanced materials, precision manufacturing, and intelligent valve control systems will continue to shape the industry. Strategic collaborations between key players and automotive manufacturers will be instrumental in navigating the evolving regulatory landscape and meeting the demands for sustainable mobility. While the long-term transition to full electrification presents a challenge, the immediate and medium-term focus on optimizing existing powertrains ensures a sustained demand for innovative and high-performance automotive valves, particularly those that contribute to emission reduction and fuel efficiency.

Automotive Valves Market Segmentation

-

1. Application Type

- 1.1. Engine Valves

- 1.2. Air Conditioning Valves

- 1.3. Fuel System Valves

- 1.4. EGR Valves

- 1.5. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Function Type

- 3.1. Pneumatic

- 3.2. Hydraulic

- 3.3. Electric

-

4. Sales Channel

- 4.1. OEM

- 4.2. Aftermarket

Automotive Valves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Valves Market Regional Market Share

Geographic Coverage of Automotive Valves Market

Automotive Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.3. Market Restrains

- 3.3.1. Lack of Electric Charging Infrastructure May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Aftermarket is witnessing major growth during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Valves Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Engine Valves

- 5.1.2. Air Conditioning Valves

- 5.1.3. Fuel System Valves

- 5.1.4. EGR Valves

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Function Type

- 5.3.1. Pneumatic

- 5.3.2. Hydraulic

- 5.3.3. Electric

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Valves Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Engine Valves

- 6.1.2. Air Conditioning Valves

- 6.1.3. Fuel System Valves

- 6.1.4. EGR Valves

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Function Type

- 6.3.1. Pneumatic

- 6.3.2. Hydraulic

- 6.3.3. Electric

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Valves Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Engine Valves

- 7.1.2. Air Conditioning Valves

- 7.1.3. Fuel System Valves

- 7.1.4. EGR Valves

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Function Type

- 7.3.1. Pneumatic

- 7.3.2. Hydraulic

- 7.3.3. Electric

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Valves Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Engine Valves

- 8.1.2. Air Conditioning Valves

- 8.1.3. Fuel System Valves

- 8.1.4. EGR Valves

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Function Type

- 8.3.1. Pneumatic

- 8.3.2. Hydraulic

- 8.3.3. Electric

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Valves Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Engine Valves

- 9.1.2. Air Conditioning Valves

- 9.1.3. Fuel System Valves

- 9.1.4. EGR Valves

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Function Type

- 9.3.1. Pneumatic

- 9.3.2. Hydraulic

- 9.3.3. Electric

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Borgwarner Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Denso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Federal Mogul

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aisin Seiki Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eaton Corporation PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Valeo S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH (Bosch Rexroth)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cummins Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hitachi Ltd (Hitachi Astemo)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Johnson Electric Grou

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Borgwarner Inc

List of Figures

- Figure 1: Global Automotive Valves Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Valves Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 3: North America Automotive Valves Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Automotive Valves Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Valves Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Valves Market Revenue (undefined), by Function Type 2025 & 2033

- Figure 7: North America Automotive Valves Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 8: North America Automotive Valves Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 9: North America Automotive Valves Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 10: North America Automotive Valves Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Automotive Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Valves Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 13: Europe Automotive Valves Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Automotive Valves Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Valves Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Valves Market Revenue (undefined), by Function Type 2025 & 2033

- Figure 17: Europe Automotive Valves Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 18: Europe Automotive Valves Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 19: Europe Automotive Valves Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 20: Europe Automotive Valves Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Automotive Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Valves Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Valves Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Valves Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Valves Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Valves Market Revenue (undefined), by Function Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Valves Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Valves Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 29: Asia Pacific Automotive Valves Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Asia Pacific Automotive Valves Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Valves Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 33: Rest of the World Automotive Valves Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 34: Rest of the World Automotive Valves Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 35: Rest of the World Automotive Valves Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Rest of the World Automotive Valves Market Revenue (undefined), by Function Type 2025 & 2033

- Figure 37: Rest of the World Automotive Valves Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 38: Rest of the World Automotive Valves Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 39: Rest of the World Automotive Valves Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 40: Rest of the World Automotive Valves Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of the World Automotive Valves Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Valves Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Global Automotive Valves Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Valves Market Revenue undefined Forecast, by Function Type 2020 & 2033

- Table 4: Global Automotive Valves Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 5: Global Automotive Valves Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Valves Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Global Automotive Valves Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Valves Market Revenue undefined Forecast, by Function Type 2020 & 2033

- Table 9: Global Automotive Valves Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 10: Global Automotive Valves Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Valves Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 15: Global Automotive Valves Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 16: Global Automotive Valves Market Revenue undefined Forecast, by Function Type 2020 & 2033

- Table 17: Global Automotive Valves Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 18: Global Automotive Valves Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Russia Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Valves Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 26: Global Automotive Valves Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Automotive Valves Market Revenue undefined Forecast, by Function Type 2020 & 2033

- Table 28: Global Automotive Valves Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 29: Global Automotive Valves Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: India Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: China Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Japan Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: South Korea Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Automotive Valves Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 36: Global Automotive Valves Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Automotive Valves Market Revenue undefined Forecast, by Function Type 2020 & 2033

- Table 38: Global Automotive Valves Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 39: Global Automotive Valves Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: South America Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Middle East and Africa Automotive Valves Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Valves Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Automotive Valves Market?

Key companies in the market include Borgwarner Inc, Denso Corporation, Federal Mogul, Aisin Seiki Co Ltd, Eaton Corporation PLC, Valeo S A, Robert Bosch GmbH (Bosch Rexroth), Cummins Inc, Hitachi Ltd (Hitachi Astemo), Johnson Electric Grou.

3. What are the main segments of the Automotive Valves Market?

The market segments include Application Type, Vehicle Type, Function Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's.

6. What are the notable trends driving market growth?

Aftermarket is witnessing major growth during the forecast period.

7. Are there any restraints impacting market growth?

Lack of Electric Charging Infrastructure May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

In February 2022, Borgwarner introduced a new range of Exhaust gas recirculation valves by adding over 80 new part numbers to the product portfolio. These new EGR valves help to reduce emissions for most engine types, thereby supporting cleaner and more energy-efficient mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Valves Market?

To stay informed about further developments, trends, and reports in the Automotive Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence