Key Insights

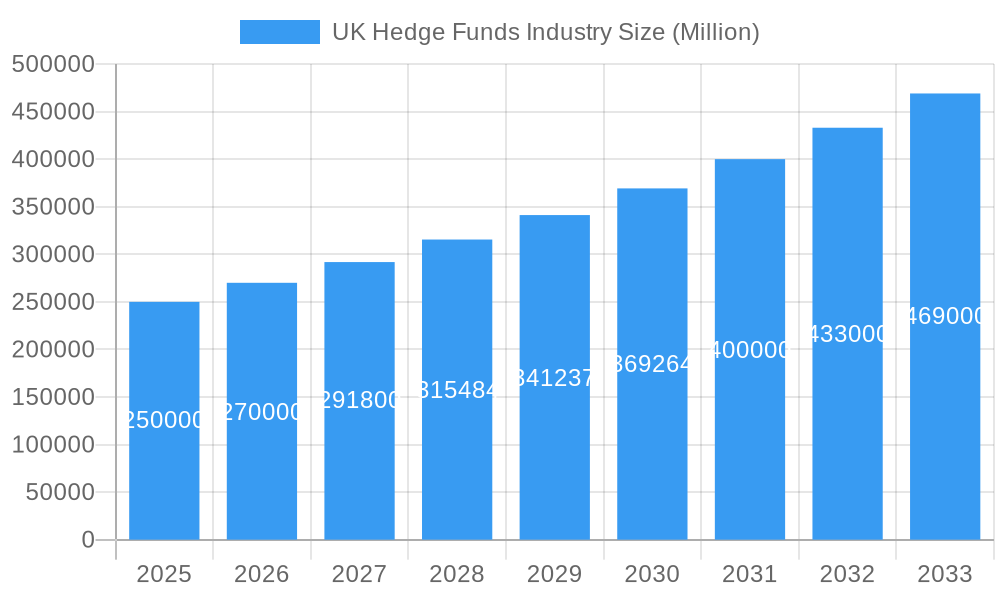

The UK hedge fund industry is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 10.48% from 2025 to 2033. This robust growth is fueled by the increasing complexity of global financial markets, driving demand for sophisticated hedge fund strategies. High-net-worth individuals and institutional investors are increasingly turning to alternative investments for portfolio diversification and enhanced returns. Advancements in data analytics and algorithmic trading are further empowering hedge funds to optimize performance. Key challenges include ongoing regulatory scrutiny regarding transparency and risk management, alongside macroeconomic uncertainties impacting investor sentiment. Intense competition from established and emerging firms characterizes the landscape. The industry is segmented by diverse investment approaches, including long/short equity, global macro, quantitative trading, and distressed debt. Regional variations will likely be influenced by talent availability and infrastructure. Adaptability to evolving market dynamics and sustained investor confidence amidst regulatory pressures will be critical for future success.

UK Hedge Funds Industry Market Size (In Billion)

The UK hedge fund market size was valued at $12.13 billion in 2025, with projections indicating substantial growth by 2033. This expansion reflects increased assets under management driven by both established firms and new entrants. The sector's projected trajectory underscores its growing contribution to the UK economy and its influence on global financial markets, contingent on effective adaptation to regulatory and market shifts.

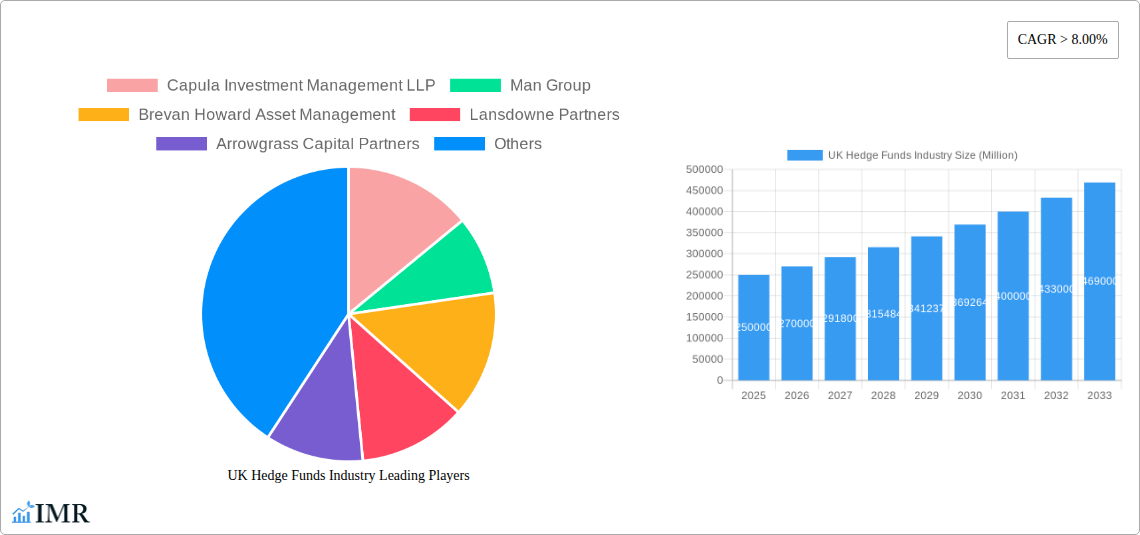

UK Hedge Funds Industry Company Market Share

UK Hedge Funds Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report delivers an in-depth analysis of the UK hedge funds industry, providing crucial insights for investors, industry professionals, and strategic decision-makers. The report covers market dynamics, growth trends, key players, and future opportunities, offering a 360-degree view of this dynamic sector. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report uses data from the historical period (2019-2024) and leverages extensive research to provide valuable predictions. The market size is presented in millions (M).

UK Hedge Funds Industry Market Dynamics & Structure

This section analyzes the UK hedge fund market's structure, identifying key characteristics influencing its performance. We examine market concentration, exploring the dominance of major players and the presence of smaller, niche firms. Technological innovation, particularly in areas like algorithmic trading and AI-driven investment strategies, is also evaluated, along with its impact on market efficiency and competition. The report further details the regulatory landscape, including compliance requirements and their effects on operational costs and investment strategies. The analysis also considers competitive substitutes, such as private equity and venture capital, highlighting their impact on market share and investor choices. Finally, the report examines M&A activity, including deal volumes and their implications for market consolidation and future growth.

- Market Concentration: The UK hedge fund market exhibits a high degree of concentration, with a few large firms controlling a significant share (xx%). However, a substantial number of smaller, specialized funds also contribute to market diversity.

- Technological Innovation: AI and machine learning are driving significant changes, enhancing portfolio management and risk assessment capabilities. However, the high cost of implementing these technologies represents a barrier for smaller firms.

- Regulatory Framework: The UK's regulatory environment, while robust, can impact operational efficiency and compliance costs for hedge funds. Ongoing regulatory changes influence strategic decisions and investment approaches.

- Competitive Product Substitutes: Private equity and venture capital pose a competitive challenge, attracting investors seeking alternative high-growth opportunities.

- M&A Trends: The past five years have seen xx M&A deals, with deal value reaching xxM in 2024. Consolidation is expected to continue, driven by economies of scale and access to technology.

- End-User Demographics: The majority of investors in UK hedge funds are institutional investors (xx%), followed by high-net-worth individuals (xx%).

UK Hedge Funds Industry Growth Trends & Insights

This section provides a comprehensive overview of the UK hedge fund industry's growth trajectory. The analysis encompasses historical data, current market dynamics, and projections for the future, incorporating technological disruptions, shifting investor preferences, and evolving market conditions. Key performance indicators, such as Compound Annual Growth Rate (CAGR) and market penetration rates, are used to measure industry performance. We explore the impact of macroeconomic factors, such as interest rate changes and geopolitical events, on hedge fund performance.

The UK hedge fund market experienced a CAGR of xx% during 2019-2024, reaching a market size of xxM in 2024. The forecast period (2025-2033) projects a CAGR of xx%, driven by increasing institutional investments and the adoption of innovative investment strategies. Market penetration within specific investor segments is expected to increase, driven by greater awareness of hedge fund strategies and their risk-adjusted returns. Technological advancements, like AI-powered trading platforms, further enhance the appeal and efficiency of hedge fund strategies.

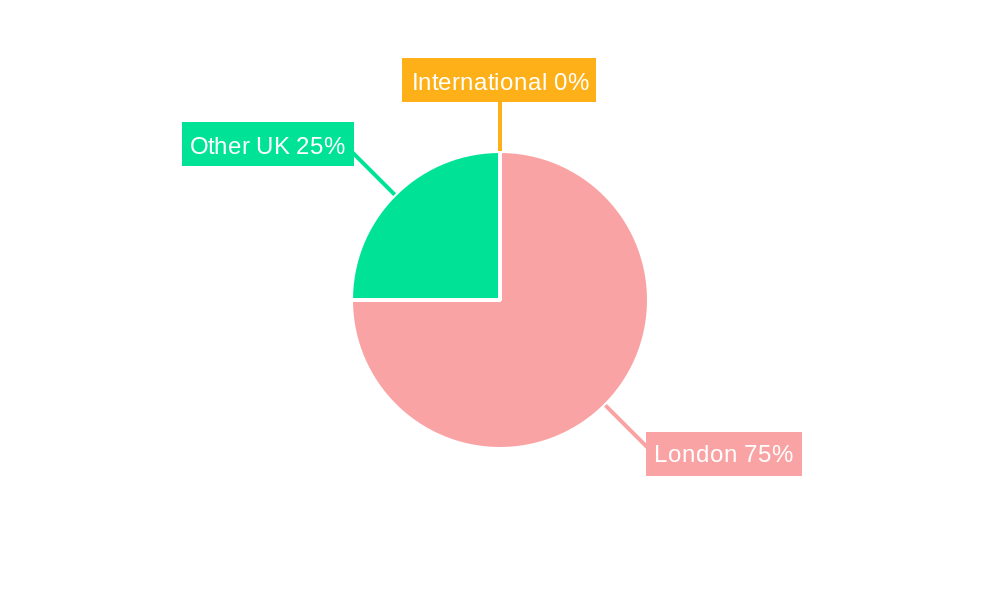

Dominant Regions, Countries, or Segments in UK Hedge Funds Industry

This section identifies the leading regions or segments driving market growth within the UK hedge fund industry. London remains the undisputed hub, accounting for xx% of the total market, attracting both domestic and international investors. We explore the contributing factors underpinning London's dominance, focusing on its established financial infrastructure, highly skilled workforce, access to capital, and favorable regulatory environment. Other regions, while contributing to overall growth, hold a smaller market share.

- London's Dominance: London's established financial ecosystem, access to talent, and supportive regulatory framework drive its dominance.

- Regional Variation: While London is the primary center, other UK regions show promising growth, though at a lower scale than London.

- Segment-Specific Growth: Specific investment strategies, such as long-short equity and global macro, exhibit stronger growth compared to others.

UK Hedge Funds Industry Product Landscape

The UK hedge fund industry offers a diverse range of investment strategies, catering to varied investor risk profiles and return expectations. Product innovation is largely driven by technological advancements in data analysis, predictive modeling, and risk management. These innovations allow hedge funds to refine their strategies, leading to enhanced performance and more precise risk mitigation. Unique selling propositions vary widely, with some funds specializing in specific sectors or geographies, while others focus on niche strategies with superior risk-adjusted returns.

Key Drivers, Barriers & Challenges in UK Hedge Funds Industry

Key Drivers: The primary drivers for growth include the rising demand for sophisticated investment strategies from institutional investors, technological advancements in algorithmic trading and AI, and the UK's favorable regulatory framework (despite ongoing changes). The pursuit of alpha generation and diversification within portfolios also fuels the market's growth.

Key Challenges: High regulatory compliance costs, intense competition, and the potential for market volatility pose significant challenges. Succession planning within established hedge fund management teams, and attracting and retaining top talent, represent critical operational hurdles. Supply chain disruptions, though less directly impactful than in other sectors, can affect access to critical market data and resources.

Emerging Opportunities in UK Hedge Funds Industry

Emerging opportunities lie in the increasing adoption of alternative data sources, the integration of AI-driven strategies, and the growing demand for sustainable and responsible investment solutions. Untapped markets exist in specific sectors or geographies, while evolving investor preferences towards ESG factors create new avenues for growth. The expansion into new asset classes or trading strategies can further unlock growth potential.

Growth Accelerators in the UK Hedge Funds Industry Industry

Technological advancements in AI and machine learning will continue to drive market expansion. Strategic partnerships between hedge funds and fintech companies enhance operational efficiency and access to innovative technologies. Market expansion into new geographies and the development of niche investment strategies further stimulate growth.

Key Players Shaping the UK Hedge Funds Industry Market

- Capula Investment Management LLP

- Man Group

- Brevan Howard Asset Management

- Lansdowne Partners

- Arrowgrass Capital Partners

- Marshall Wace

- Aviva Investors

- LMR Partners

- Investcorp

- BlueCrest Capital Management (List Not Exhaustive)

Notable Milestones in UK Hedge Funds Industry Sector

- January 2023: Tiger Global Management accelerates its shift towards venture capital, with startups now accounting for nearly 75% of its assets. This reflects a broader industry trend towards alternative investment strategies.

- January 2023: SurgoCap Partners, a USD 1.8 billion female-led hedge fund, launches, setting a record for the largest debut of its kind. This highlights growing diversity and entrepreneurial activity within the industry.

In-Depth UK Hedge Funds Industry Market Outlook

The UK hedge fund industry is poised for sustained growth over the next decade. Technological advancements, coupled with evolving investor preferences and the expansion into new markets and investment strategies, will drive market expansion. Strategic partnerships and a focus on responsible investing will further contribute to shaping the future of the industry. The continued dominance of London, supported by a robust regulatory framework and access to capital and talent, will solidify its position as a global hub for hedge fund activity.

UK Hedge Funds Industry Segmentation

-

1. Core Investment Strategies

- 1.1. Equity

- 1.2. Alternative Risk Premia

- 1.3. Crypto

- 1.4. Equities others

- 1.5. Event-Driven

- 1.6. Fixed Income Credit

- 1.7. Macro

- 1.8. Managed Futures

- 1.9. Multi-Strategy

- 1.10. Relative Value

UK Hedge Funds Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Hedge Funds Industry Regional Market Share

Geographic Coverage of UK Hedge Funds Industry

UK Hedge Funds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Assets Managed in the UK by Client Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 5.1.1. Equity

- 5.1.2. Alternative Risk Premia

- 5.1.3. Crypto

- 5.1.4. Equities others

- 5.1.5. Event-Driven

- 5.1.6. Fixed Income Credit

- 5.1.7. Macro

- 5.1.8. Managed Futures

- 5.1.9. Multi-Strategy

- 5.1.10. Relative Value

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6. North America UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6.1.1. Equity

- 6.1.2. Alternative Risk Premia

- 6.1.3. Crypto

- 6.1.4. Equities others

- 6.1.5. Event-Driven

- 6.1.6. Fixed Income Credit

- 6.1.7. Macro

- 6.1.8. Managed Futures

- 6.1.9. Multi-Strategy

- 6.1.10. Relative Value

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7. South America UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7.1.1. Equity

- 7.1.2. Alternative Risk Premia

- 7.1.3. Crypto

- 7.1.4. Equities others

- 7.1.5. Event-Driven

- 7.1.6. Fixed Income Credit

- 7.1.7. Macro

- 7.1.8. Managed Futures

- 7.1.9. Multi-Strategy

- 7.1.10. Relative Value

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8. Europe UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8.1.1. Equity

- 8.1.2. Alternative Risk Premia

- 8.1.3. Crypto

- 8.1.4. Equities others

- 8.1.5. Event-Driven

- 8.1.6. Fixed Income Credit

- 8.1.7. Macro

- 8.1.8. Managed Futures

- 8.1.9. Multi-Strategy

- 8.1.10. Relative Value

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9. Middle East & Africa UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9.1.1. Equity

- 9.1.2. Alternative Risk Premia

- 9.1.3. Crypto

- 9.1.4. Equities others

- 9.1.5. Event-Driven

- 9.1.6. Fixed Income Credit

- 9.1.7. Macro

- 9.1.8. Managed Futures

- 9.1.9. Multi-Strategy

- 9.1.10. Relative Value

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10. Asia Pacific UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10.1.1. Equity

- 10.1.2. Alternative Risk Premia

- 10.1.3. Crypto

- 10.1.4. Equities others

- 10.1.5. Event-Driven

- 10.1.6. Fixed Income Credit

- 10.1.7. Macro

- 10.1.8. Managed Futures

- 10.1.9. Multi-Strategy

- 10.1.10. Relative Value

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Capula Investment Management LLP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Man Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brevan Howard Asset Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lansdowne Partners

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arrowgrass Capital Partners

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marshall Wace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aviva Investors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LMR Partners

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Investcorp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BlueCrest Capital Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Capula Investment Management LLP

List of Figures

- Figure 1: Global UK Hedge Funds Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 3: North America UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 4: North America UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 7: South America UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 8: South America UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 11: Europe UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 12: Europe UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 15: Middle East & Africa UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 16: Middle East & Africa UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 19: Asia Pacific UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 20: Asia Pacific UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 2: Global UK Hedge Funds Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 4: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 9: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 14: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 25: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 33: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Hedge Funds Industry?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the UK Hedge Funds Industry?

Key companies in the market include Capula Investment Management LLP, Man Group, Brevan Howard Asset Management, Lansdowne Partners, Arrowgrass Capital Partners, Marshall Wace, Aviva Investors, LMR Partners, Investcorp, BlueCrest Capital Management**List Not Exhaustive.

3. What are the main segments of the UK Hedge Funds Industry?

The market segments include Core Investment Strategies.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Assets Managed in the UK by Client Type.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023: Tiger Global Management fund is accelerating its transformation from a traditional stock-picking hedge find to a venture capital investment business, with startup bets now accounting for nearly 75% of the firm's assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Hedge Funds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Hedge Funds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Hedge Funds Industry?

To stay informed about further developments, trends, and reports in the UK Hedge Funds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence