Key Insights

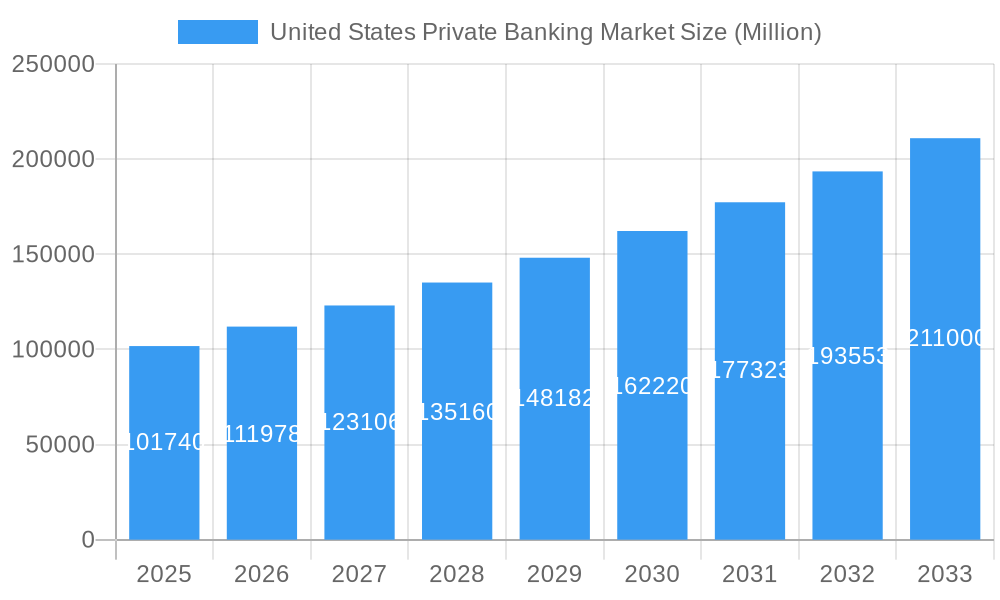

The United States private banking market, valued at $101.74 billion in 2025, is projected to experience robust growth, driven by a rising high-net-worth individual (HNWI) population and increasing demand for sophisticated wealth management services. The market's Compound Annual Growth Rate (CAGR) of 9.87% from 2019 to 2024 suggests a continued upward trajectory through 2033. Key drivers include the accumulation of wealth by entrepreneurs and baby boomers, a growing preference for personalized financial planning, and the increasing complexity of investment vehicles requiring expert guidance. Technological advancements, including the rise of robo-advisors and digital platforms, are also reshaping the industry, offering greater efficiency and accessibility to clients. However, regulatory scrutiny and intense competition among established players like Morgan Stanley, JP Morgan Chase & Co., Bank of America, and others, present significant challenges. The market is segmented by services offered (wealth planning, investment management, trust services, etc.), client demographics (age, wealth level), and geographic location. Future growth will depend on adapting to changing client needs, leveraging technological advancements responsibly, and navigating a complex regulatory landscape.

United States Private Banking Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, fueled by factors such as increasing global economic growth and potentially favorable interest rate environments. The market's competitive landscape remains dynamic, with larger institutions consolidating their positions and smaller, specialized firms focusing on niche markets. This necessitates a focus on innovation, customer experience, and superior investment performance to attract and retain clients in a fiercely competitive environment. The continued expansion of the HNWI population in the US will be a key factor in this growth, along with the adoption of ESG (environmental, social, and governance) investing principles shaping future client preferences and investment strategies within the private banking sector.

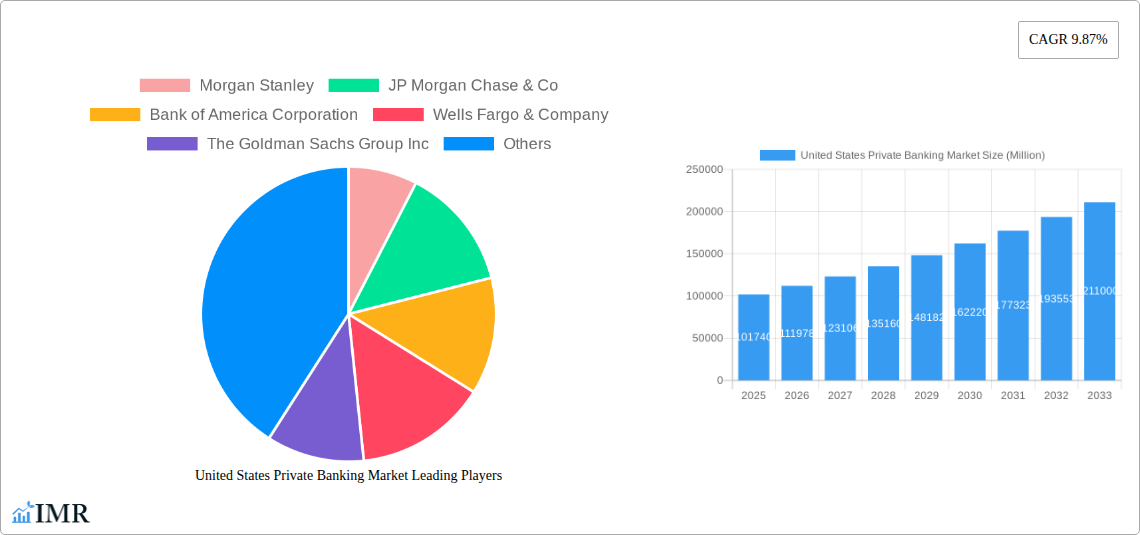

United States Private Banking Market Company Market Share

United States Private Banking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Private Banking Market, covering market dynamics, growth trends, key players, and future outlook. The report analyzes the parent market of financial services and the child market of private banking, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in million USD.

United States Private Banking Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the US private banking sector. The market is characterized by a high degree of concentration amongst leading players. We explore the impact of technological innovation on client experience and operational efficiency, including the rise of digital platforms and AI-driven solutions. Regulatory frameworks, such as those imposed by the SEC and FDIC, significantly influence market operations and risk management. The increasing prevalence of robo-advisors and alternative investment vehicles is examined as a source of competition. Demographic shifts and evolving client preferences, particularly amongst high-net-worth individuals (HNWIs), are analyzed in detail. Finally, mergers & acquisitions (M&A) activities within the sector are assessed, identifying key trends and their implications for market consolidation.

- Market Concentration: High, with top 5 players holding xx% market share (2024).

- Technological Innovation: Rapid adoption of digital banking, AI-driven wealth management tools.

- Regulatory Framework: Stringent regulations driving compliance costs and shaping business strategies.

- Competitive Substitutes: Robo-advisors, alternative investment platforms presenting challenges.

- End-User Demographics: Growing HNWIs and ultra-high-net-worth individuals (UHNWIs) driving demand.

- M&A Trends: Consolidation expected to continue, driven by scale and efficiency advantages. xx M&A deals recorded in 2024.

United States Private Banking Market Growth Trends & Insights

This section details the evolution of the US private banking market, using historical data (2019-2024) and projected figures (2025-2033). We analyze market size expansion, penetration rates among target demographics, and the disruptive impact of technology. The changing landscape of consumer behavior, including preferences for personalized services and digital engagement, is extensively explored. We delve into the factors driving growth, including increased wealth accumulation, evolving investment strategies, and heightened demand for sophisticated wealth management solutions. Specific metrics, including Compound Annual Growth Rate (CAGR) and market penetration rates, are provided for a comprehensive understanding of market dynamics.

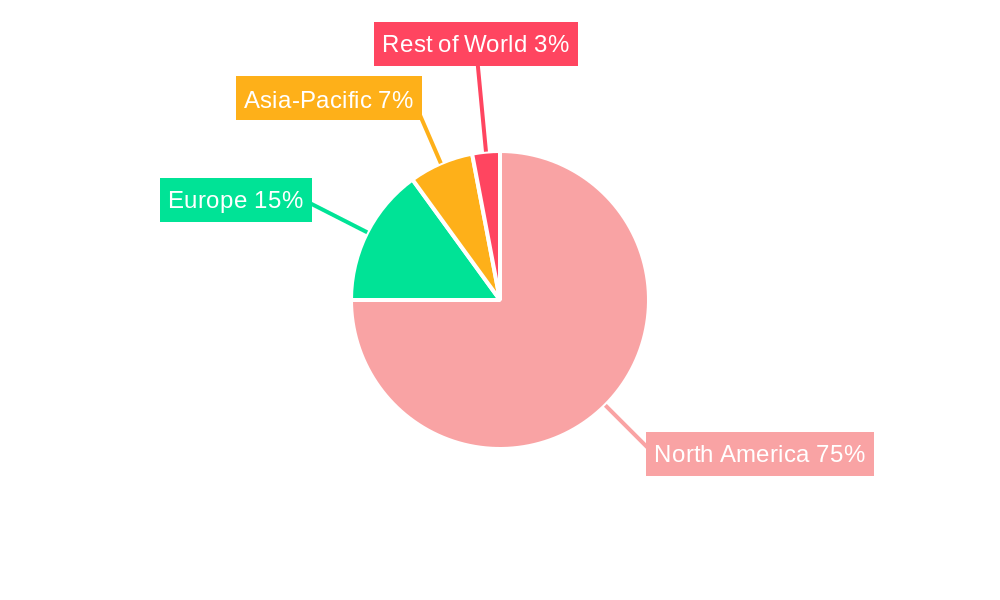

Dominant Regions, Countries, or Segments in United States Private Banking Market

This section identifies the leading geographic regions and market segments contributing to the overall growth of the US private banking market. Factors driving dominance are analyzed, including economic strength, regulatory environment, and the concentration of HNWIs and UHNWIs. The analysis considers regional variations in wealth distribution, investment preferences, and technological adoption rates. We assess the growth potential of different regions and segments, highlighting opportunities for expansion and market penetration.

- Key Drivers: Strong economic growth in specific regions, favorable tax policies, and high concentration of wealthy individuals.

- Dominance Factors: Market share, growth rate, and the presence of major private banking institutions.

- Growth Potential: Untapped market segments offer opportunities for expansion in specific geographic areas.

United States Private Banking Market Product Landscape

The US private banking market offers a diverse range of products and services tailored to the specific needs of HNWIs and UHNWIs. These include wealth management, investment advisory, trust and estate planning, and family office services. Recent innovations focus on digital platforms, personalized investment solutions, and sophisticated risk management strategies. The emphasis is on providing a seamless and efficient client experience, incorporating advanced technologies and data analytics.

Key Drivers, Barriers & Challenges in United States Private Banking Market

Key Drivers:

- Increasing wealth concentration among HNWIs and UHNWIs.

- Growing demand for sophisticated wealth management solutions.

- Technological advancements enhancing efficiency and client experience.

Key Barriers & Challenges:

- Intense competition among established players and emerging fintech companies.

- Regulatory scrutiny and compliance costs.

- Cybersecurity risks and data privacy concerns. Estimated xx million USD in losses due to cyberattacks in 2024.

Emerging Opportunities in United States Private Banking Market

Emerging opportunities include the expansion of services to underserved demographics, the adoption of innovative technologies like blockchain and AI, and the increasing focus on sustainable and impact investing. Demand for personalized financial planning and family office services presents significant potential for growth.

Growth Accelerators in the United States Private Banking Market Industry

Technological innovation, strategic partnerships, and expansion into new market segments are key growth drivers. The adoption of AI-driven solutions, the development of innovative financial products, and strategic alliances with fintech companies are expected to fuel future growth.

Key Players Shaping the United States Private Banking Market Market

- Morgan Stanley

- JP Morgan Chase & Co

- Bank of America Corporation

- Wells Fargo & Company

- The Goldman Sachs Group Inc

- Citigroup

- Raymond James

- Northern Trust

- Charles Schwab

- U S Bancorp

- List Not Exhaustive

Notable Milestones in United States Private Banking Market Sector

- February 2024: Bank of America enhanced its digital banking platform, improving the online client experience.

- March 2024: Goldman Sachs Asset Management announced plans to expand its private credit portfolio from USD 130 billion to USD 300 billion over five years.

In-Depth United States Private Banking Market Market Outlook

The US private banking market is poised for sustained growth, driven by increasing wealth, technological advancements, and evolving client preferences. Strategic partnerships, investments in digital capabilities, and expansion into niche markets will be crucial for success in this dynamic sector. The long-term outlook is positive, with significant opportunities for market expansion and increased profitability.

United States Private Banking Market Segmentation

-

1. Type

- 1.1. Asset Management Service

- 1.2. Insurance Service

- 1.3. Trust Service

- 1.4. Tax Consulting

- 1.5. Real Estate Consulting

-

2. Application

- 2.1. Personal

- 2.2. Enterprise

United States Private Banking Market Segmentation By Geography

- 1. United States

United States Private Banking Market Regional Market Share

Geographic Coverage of United States Private Banking Market

United States Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of HNWIs; Digitization of Private Banking

- 3.3. Market Restrains

- 3.3.1. Rising Number of HNWIs; Digitization of Private Banking

- 3.4. Market Trends

- 3.4.1. Rising Number of HNWIs Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Private Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Asset Management Service

- 5.1.2. Insurance Service

- 5.1.3. Trust Service

- 5.1.4. Tax Consulting

- 5.1.5. Real Estate Consulting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Morgan Stanley

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JP Morgan Chase & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of America Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wells Fargo & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Goldman Sachs Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Citigroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raymond James

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northern Trust

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charles Schwab

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 U S Bancorp**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Morgan Stanley

List of Figures

- Figure 1: United States Private Banking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Private Banking Market Share (%) by Company 2025

List of Tables

- Table 1: United States Private Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Private Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Private Banking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Private Banking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Private Banking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Private Banking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Private Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Private Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Private Banking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: United States Private Banking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: United States Private Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Private Banking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Private Banking Market?

The projected CAGR is approximately 9.87%.

2. Which companies are prominent players in the United States Private Banking Market?

Key companies in the market include Morgan Stanley, JP Morgan Chase & Co, Bank of America Corporation, Wells Fargo & Company, The Goldman Sachs Group Inc, Citigroup, Raymond James, Northern Trust, Charles Schwab, U S Bancorp**List Not Exhaustive.

3. What are the main segments of the United States Private Banking Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of HNWIs; Digitization of Private Banking.

6. What are the notable trends driving market growth?

Rising Number of HNWIs Driving the Market.

7. Are there any restraints impacting market growth?

Rising Number of HNWIs; Digitization of Private Banking.

8. Can you provide examples of recent developments in the market?

February 2024: Bank of America furthered its efforts in tailoring digital banking experiences as clients increasingly gravitated toward managing their finances online.March 2024: Goldman Sachs Asset Management, a division of Goldman Sachs Group, revealed plans to bolster its private credit portfolio. The firm aims to grow it from the current USD 130 billion to a target of USD 300 billion over the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Private Banking Market?

To stay informed about further developments, trends, and reports in the United States Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence