Key Insights

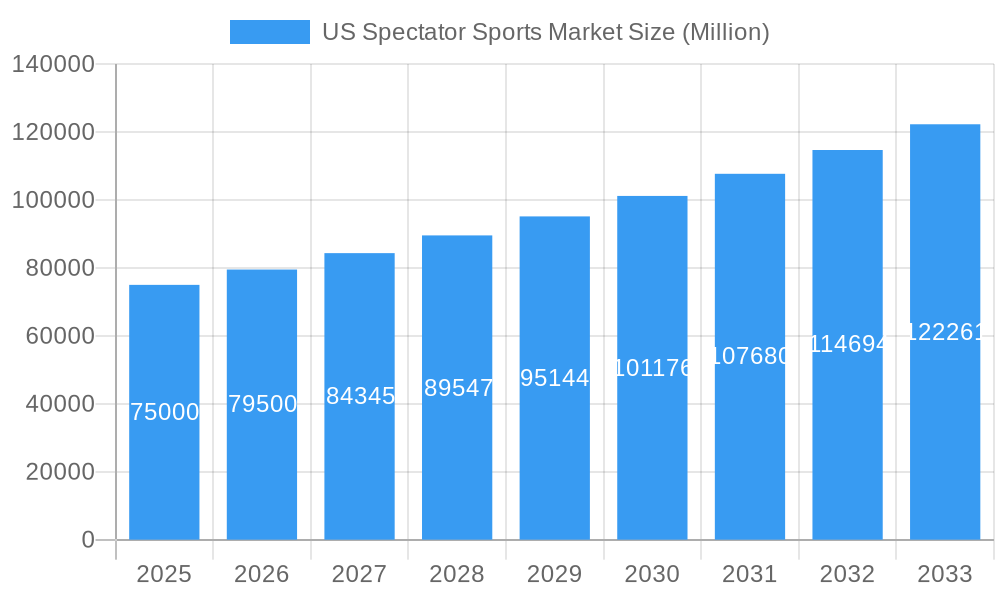

The United States spectator sports market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of 13.26%. This robust expansion is anticipated to drive the market size to $8.66 billion by 2033, with 2025 serving as the base year. Key growth catalysts include rising consumer disposable income, enabling greater expenditure on live entertainment. The proliferation of streaming services and lucrative broadcast agreements has significantly enhanced accessibility to sporting events, fostering deeper fan engagement and consequently boosting ticket sales. Furthermore, sophisticated marketing campaigns, endorsements from prominent figures, and the enhanced immersive experiences offered by contemporary stadiums and arenas are pivotal contributors to market ascendancy. The market is segmented by sport type (e.g., NFL, NBA, MLB, NASCAR), event category (regular season, playoffs, championships), and demographic groups (families, youth, corporate). Intense competition among teams and leagues to capture and retain fan loyalty is a constant impetus for ongoing enhancements in fan engagement and the overall spectator experience.

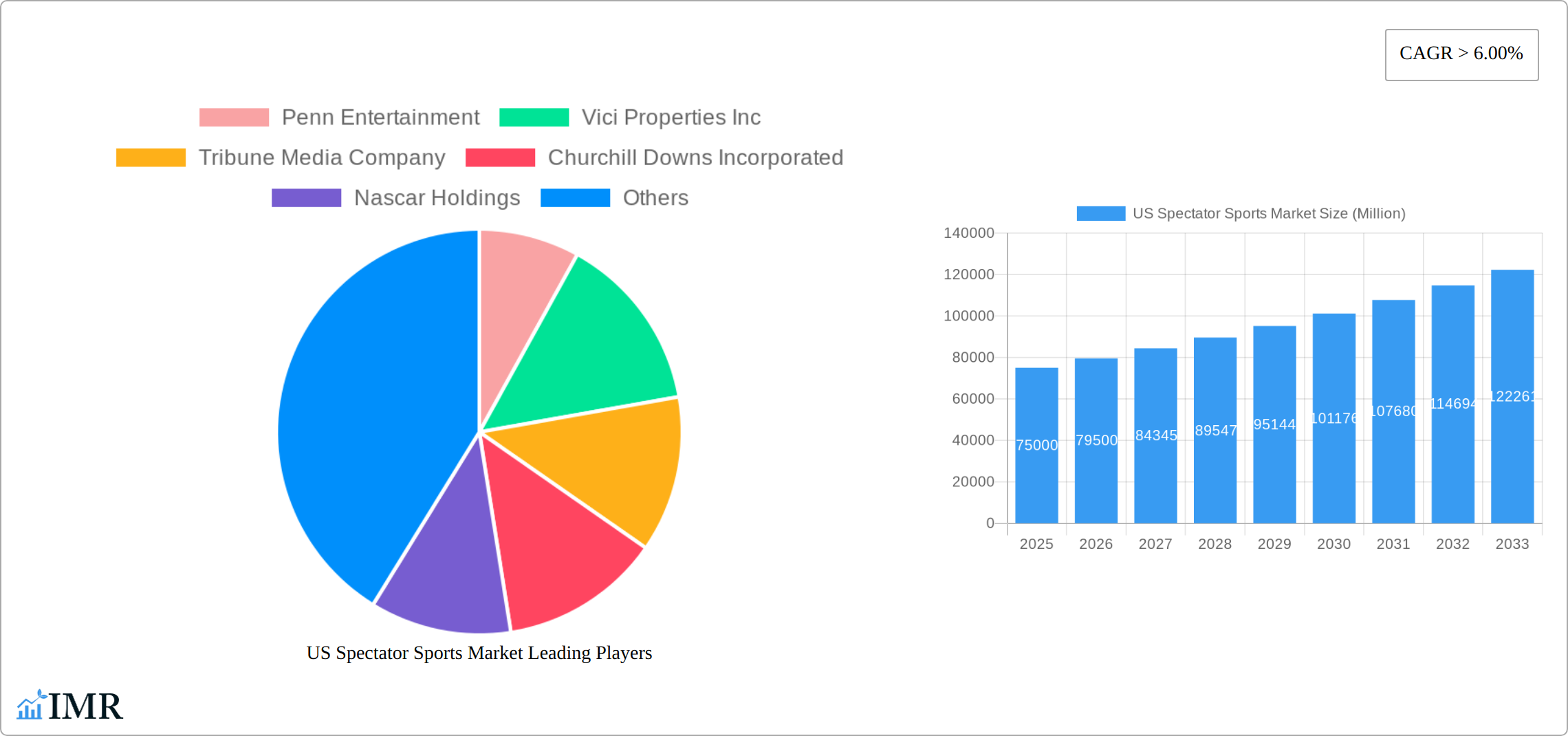

US Spectator Sports Market Market Size (In Billion)

Nevertheless, market expansion faces certain obstacles. Economic recessions can curtail consumer discretionary spending, potentially leading to decreased attendance at live events. Escalating ticket and concession prices may also present affordability challenges for specific consumer segments. Moreover, the increasing availability of digital alternatives for viewing sports, such as enhanced at-home entertainment options, presents ongoing competitive pressure. Despite these impediments, the persistent appeal of live sports, underpinned by their inherent social dynamics and unparalleled atmosphere, guarantees the market's sustained growth and evolution throughout the forecast period. Leading entities such as Penn Entertainment, Vici Properties Inc., and Churchill Downs Incorporated play a crucial role in this trajectory, leveraging their operational capabilities and infrastructure to address escalating demand.

US Spectator Sports Market Company Market Share

US Spectator Sports Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Spectator Sports Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The total market size in 2025 is estimated at $XX Billion.

US Spectator Sports Market Market Dynamics & Structure

The US spectator sports market is a dynamic and multifaceted landscape, characterized by a high degree of market concentration among established powerhouses and a relentless pace of technological innovation. The intricate market structure is significantly shaped by a complex web of regulatory frameworks that govern critical areas such as broadcasting rights, stadium construction and development, and the rapidly evolving landscape of gambling regulations. Competitive pressures are mounting, with compelling product substitutes like immersive home entertainment options and the meteoric rise of esports actively challenging the traditional dominance of live spectator sports. Furthermore, end-user demographics are undergoing a notable shift, with younger generations exhibiting distinct preferences and consumption patterns that diverge from those of older cohorts. To navigate this evolving environment, mergers and acquisitions (M&A) activity remains a frequent and strategic tool, particularly among smaller teams and media companies seeking market consolidation and synergistic growth.

- Market Concentration: The top 5 players are projected to command an estimated XX% market share by 2025, highlighting the significant influence of dominant entities.

- Technological Innovation: The integration of advanced analytics, immersive Virtual Reality (VR) and Augmented Reality (AR) experiences, and cutting-edge broadcasting technologies are powerful growth catalysts. However, significant barriers persist, including substantial investment costs and the inertia of legacy infrastructure.

- Regulatory Framework: State-level variations in gambling regulations are a crucial determinant, significantly impacting and influencing revenue streams for specific teams and leagues.

- M&A Activity: A robust **XX** major M&A deals were recorded between 2019 and 2024, representing a substantial total value of approximately **$XX Billion**. This trend is anticipated to persist as market players seek strategic advantages.

- End-User Demographics: Evolving preferences towards digital content consumption and a growing interest in niche sports are profoundly reshaping the traditional viewership model and fan engagement strategies.

US Spectator Sports Market Growth Trends & Insights

The US spectator sports market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing disposable incomes, rising interest in live events, and advancements in broadcasting and streaming technologies. The market is expected to continue its expansion throughout the forecast period (2025-2033), driven by technological disruptions such as the rise of fantasy sports and esports integration. Consumer behavior shifts toward personalized experiences and digital engagement will continue to shape the market. Market penetration of digital streaming platforms for sports events is currently estimated at xx% and is predicted to reach xx% by 2033.

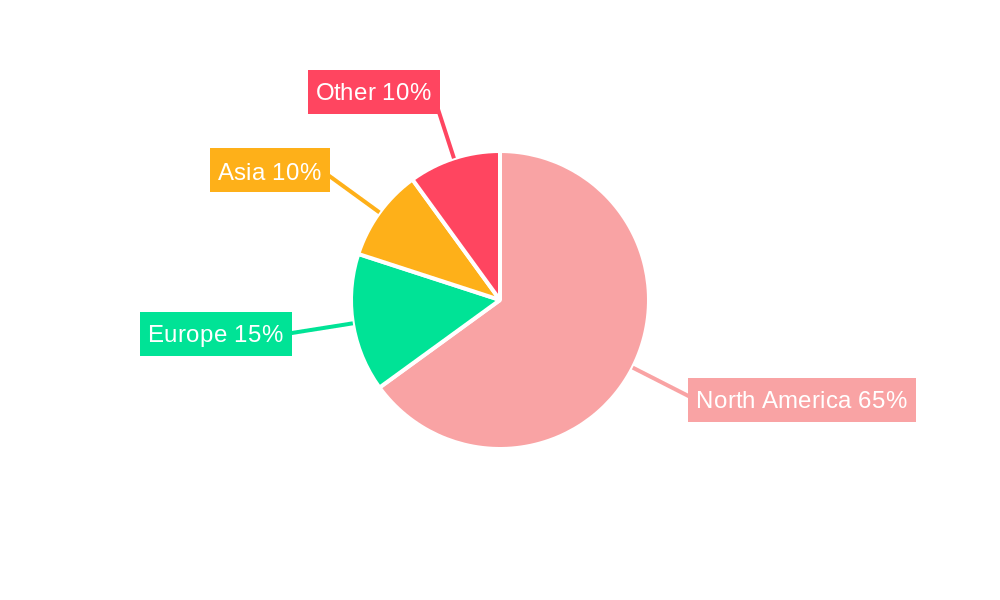

Dominant Regions, Countries, or Segments in US Spectator Sports Market

The Northeast and West Coast regions stand out as the principal hubs for the US spectator sports market. This dominance is fueled by a confluence of factors including higher population densities, greater disposable incomes, and the presence of highly developed and established sporting infrastructure. Within these regions, states like California and New York lead the charge, benefiting immensely from the presence of major league franchises and substantial, engaged spectator bases. The professional leagues – the NFL, MLB, NBA, and NHL – are the primary engines of substantial market growth, further augmented by the steadily increasing popularity of collegiate sports and rapidly emerging niche sports such as esports and mixed martial arts.

- Key Drivers: Robust local economies, well-established sports infrastructure, and high media consumption rates are critical enablers of regional success.

- Dominance Factors: A high concentration of major league teams, access to significant media markets, and deeply ingrained strong fan bases solidify regional leadership.

- Growth Potential: The continuous expansion of streaming services and the ongoing growth in niche spectator sports are poised to stimulate further market expansion into currently less dominant regions.

US Spectator Sports Market Product Landscape

The US spectator sports market encompasses a broad range of products, including live event tickets, merchandise, media rights (TV, streaming), and sponsorships. Technological advancements are continually enhancing the spectator experience, including improvements in stadium infrastructure, high-definition broadcasting, interactive fan engagement platforms, and the incorporation of virtual and augmented reality (VR/AR) experiences. These advancements offer unique selling propositions focused on convenience, engagement, and immersive entertainment.

Key Drivers, Barriers & Challenges in US Spectator Sports Market

Key Drivers: Rising disposable incomes, increasing popularity of fantasy sports and esports, technological advancements in broadcasting and fan engagement, and strategic partnerships between leagues and technology companies.

Key Challenges: High ticket prices, competition from alternative entertainment options (streaming services, video games), increasing costs associated with venue operations and player salaries, and potential regulatory changes impacting gambling revenue. Supply chain disruptions impact merchandise availability and cause price increases. The estimated impact of these supply chain disruptions on the market size in 2025 is approximately xx%.

Emerging Opportunities in US Spectator Sports Market

The US spectator sports market is ripe with emerging opportunities. These include the development of highly personalized fan experiences driven by advanced data analytics, the strategic integration of esports into the fabric of traditional spectator sports, and targeted expansion into underserved markets such as smaller towns and rural communities. The growing market for immersive virtual and augmented reality (VR/AR) experiences also presents significant untapped potential. Furthermore, the continued growth and legal expansion of fantasy sports and betting platforms, where permissible, represent substantial new revenue streams and avenues for fan engagement.

Growth Accelerators in the US Spectator Sports Market Industry

Long-term growth will be fueled by strategic investments in technological advancements that enhance the fan experience, such as AR/VR applications and interactive fan engagement platforms. Strategic partnerships between leagues, teams, and technology companies will facilitate innovation and market expansion. The successful integration of esports into the mainstream spectator sports landscape will also drive future growth.

Key Players Shaping the US Spectator Sports Market Market

- Penn Entertainment

- Vici Properties Inc

- Tribune Media Company

- Churchill Downs Incorporated

- Nascar Holdings

- Cherokee Nation Entertainment

- International Speedway Corporation

- Nfl Properties LLC

- Roush Enterprises Inc

- Fanduel Inc

Notable Milestones in US Spectator Sports Market Sector

- October 2023: The NFLPA partnered with Infinite Athlete to leverage sports technology. This partnership is expected to enhance player performance and potentially lead to improvements in game strategy and broadcast experiences.

- October 2023: PHOENIXCarvana sports partnered with Jaxson Riddle, boosting the visibility of mountain biking and attracting a new audience segment to sponsor activities. This reflects the growing trend of brands investing in niche sports and athletes to expand their reach.

In-Depth US Spectator Sports Market Market Outlook

The US spectator sports market is positioned for significant and sustained growth, propelled by the enduring and passionate interest in live events, continuous technological innovations that are revolutionizing fan engagement, and the expanding appeal of both established and emerging sports. Strategic investments in state-of-the-art infrastructure, fostering vital technological partnerships, and executing well-planned expansions into new and untapped markets are paramount for effectively capitalizing on this promising future potential. The market is on a clear trajectory for continued expansion, driven by shrewd strategic partnerships, groundbreaking technological advancements, and a proactive adaptation to the ever-evolving preferences of the modern consumer.

US Spectator Sports Market Segmentation

-

1. Sports

- 1.1. Soccer

- 1.2. Football

- 1.3. Table Tennis

- 1.4. Badminton

- 1.5. Other Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandizing

- 2.3. Tickets

- 2.4. Sponsorship

US Spectator Sports Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Spectator Sports Market Regional Market Share

Geographic Coverage of US Spectator Sports Market

US Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Fantasy Sports and Online Betting

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Fantasy Sports and Online Betting

- 3.4. Market Trends

- 3.4.1. Sports Teams and Clubs is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 5.1.1. Soccer

- 5.1.2. Football

- 5.1.3. Table Tennis

- 5.1.4. Badminton

- 5.1.5. Other Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandizing

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 6. North America US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 6.1.1. Soccer

- 6.1.2. Football

- 6.1.3. Table Tennis

- 6.1.4. Badminton

- 6.1.5. Other Sports

- 6.2. Market Analysis, Insights and Forecast - by Revenue Source

- 6.2.1. Media Rights

- 6.2.2. Merchandizing

- 6.2.3. Tickets

- 6.2.4. Sponsorship

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 7. South America US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 7.1.1. Soccer

- 7.1.2. Football

- 7.1.3. Table Tennis

- 7.1.4. Badminton

- 7.1.5. Other Sports

- 7.2. Market Analysis, Insights and Forecast - by Revenue Source

- 7.2.1. Media Rights

- 7.2.2. Merchandizing

- 7.2.3. Tickets

- 7.2.4. Sponsorship

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 8. Europe US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 8.1.1. Soccer

- 8.1.2. Football

- 8.1.3. Table Tennis

- 8.1.4. Badminton

- 8.1.5. Other Sports

- 8.2. Market Analysis, Insights and Forecast - by Revenue Source

- 8.2.1. Media Rights

- 8.2.2. Merchandizing

- 8.2.3. Tickets

- 8.2.4. Sponsorship

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 9. Middle East & Africa US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 9.1.1. Soccer

- 9.1.2. Football

- 9.1.3. Table Tennis

- 9.1.4. Badminton

- 9.1.5. Other Sports

- 9.2. Market Analysis, Insights and Forecast - by Revenue Source

- 9.2.1. Media Rights

- 9.2.2. Merchandizing

- 9.2.3. Tickets

- 9.2.4. Sponsorship

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 10. Asia Pacific US Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 10.1.1. Soccer

- 10.1.2. Football

- 10.1.3. Table Tennis

- 10.1.4. Badminton

- 10.1.5. Other Sports

- 10.2. Market Analysis, Insights and Forecast - by Revenue Source

- 10.2.1. Media Rights

- 10.2.2. Merchandizing

- 10.2.3. Tickets

- 10.2.4. Sponsorship

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Penn Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vici Properties Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tribune Media Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Churchill Downs Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nascar Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cherokee Nation Entertainment

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Speedway Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nfl Properties LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Roush Enterprises Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fanduel Inc**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Penn Entertainment

List of Figures

- Figure 1: Global US Spectator Sports Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 3: North America US Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 4: North America US Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 5: North America US Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 6: North America US Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 9: South America US Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 10: South America US Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 11: South America US Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 12: South America US Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 15: Europe US Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 16: Europe US Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 17: Europe US Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 18: Europe US Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 21: Middle East & Africa US Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 22: Middle East & Africa US Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 23: Middle East & Africa US Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 24: Middle East & Africa US Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 27: Asia Pacific US Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 28: Asia Pacific US Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 29: Asia Pacific US Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 30: Asia Pacific US Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 2: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: Global US Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 5: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: Global US Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 11: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 12: Global US Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 17: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 18: Global US Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 29: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 30: Global US Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 38: Global US Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 39: Global US Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Spectator Sports Market?

The projected CAGR is approximately 13.26%.

2. Which companies are prominent players in the US Spectator Sports Market?

Key companies in the market include Penn Entertainment, Vici Properties Inc, Tribune Media Company, Churchill Downs Incorporated, Nascar Holdings, Cherokee Nation Entertainment, International Speedway Corporation, Nfl Properties LLC, Roush Enterprises Inc, Fanduel Inc**List Not Exhaustive.

3. What are the main segments of the US Spectator Sports Market?

The market segments include Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Fantasy Sports and Online Betting.

6. What are the notable trends driving market growth?

Sports Teams and Clubs is Dominating the Market.

7. Are there any restraints impacting market growth?

Increasing Popularity of Fantasy Sports and Online Betting.

8. Can you provide examples of recent developments in the market?

October 2023: The National Football League Players Association (NFLPA) and the players' union for American football's National Football League (NFL) partnered with sports-based technology company Infinite Athlete.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Spectator Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Spectator Sports Market?

To stay informed about further developments, trends, and reports in the US Spectator Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence