Key Insights

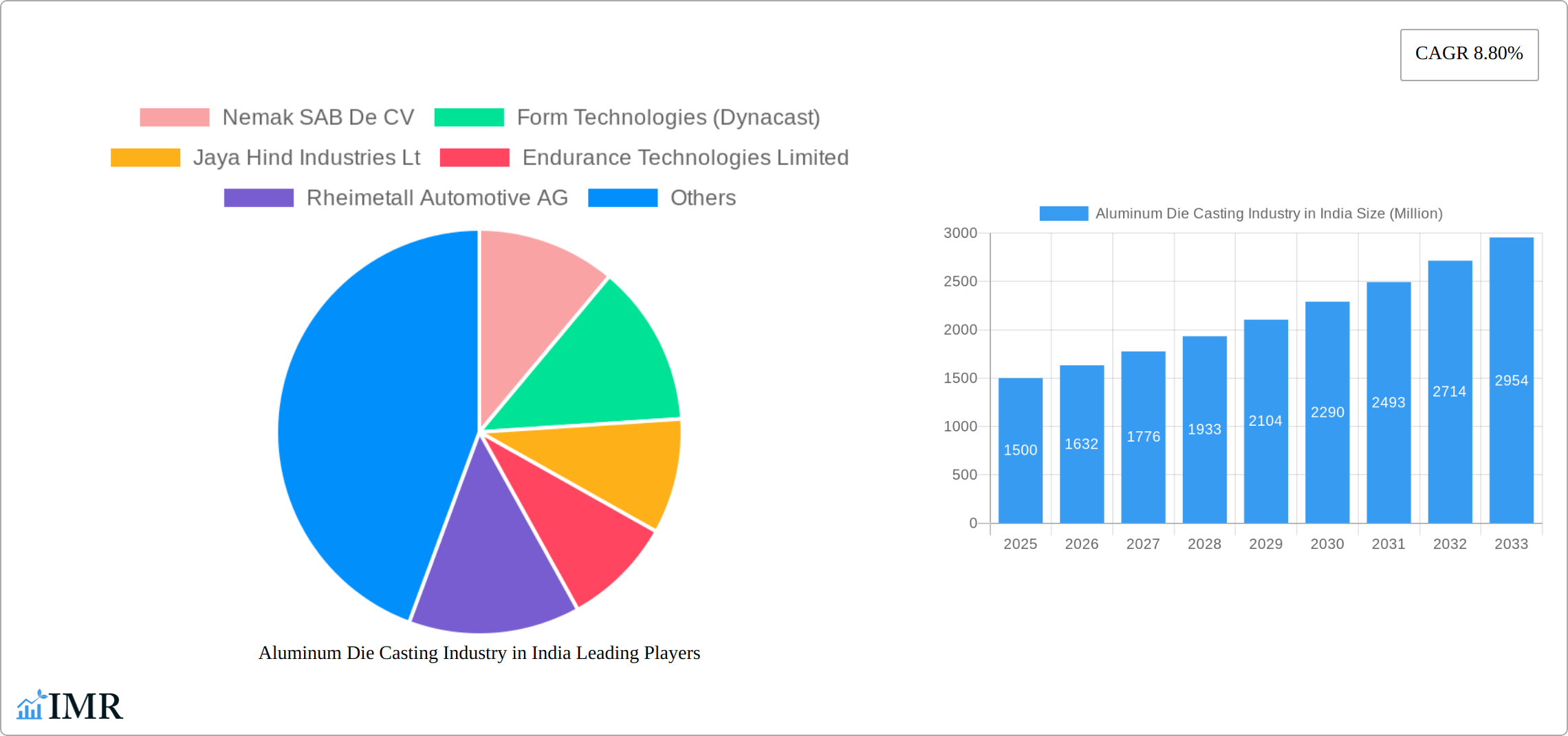

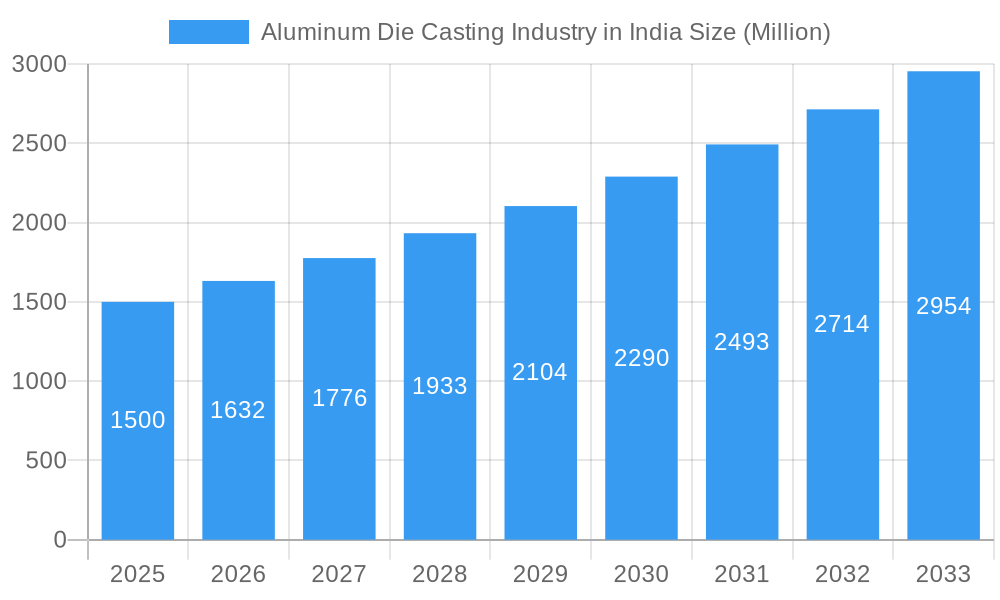

The Indian Aluminum Die Casting Market is poised for significant expansion, driven by the robust automotive sector and increasing demand for lightweight components across industries. Projected to achieve a Compound Annual Growth Rate (CAGR) of 11.1%, the market is forecast to reach $84.9 billion by 2025. Key growth catalysts include the rising adoption of aluminum die castings in automotive body parts, engine components, and transmission systems, supported by government initiatives promoting fuel efficiency and the accelerating growth of electric vehicles (EVs). Technological advancements, particularly in pressure and vacuum die casting, are enhancing manufacturing efficiency and product quality, further propelling market growth. Despite challenges such as fluctuating aluminum prices and intense competition, India's expanding manufacturing base and infrastructure development ensure a strong market outlook. The market is segmented by production process (pressure, vacuum, squeeze, gravity die casting) and application (body parts, engine parts, transmission parts, others), offering diverse investment opportunities. Regional dynamics across North, South, East, and West India necessitate tailored growth strategies. Leading players, including Nemak SAB De CV and Form Technologies (Dynacast), are actively contributing to market evolution through innovation and strategic alliances.

Aluminum Die Casting Industry in India Market Size (In Billion)

The Indian automotive sector's substantial growth is a primary driver for aluminum die casting demand. Lightweighting initiatives are paramount, with aluminum offering superior advantages over heavier materials. Increased production and export of two-wheelers and four-wheelers in India further stimulate market growth. Expansion in consumer electronics and machinery sectors also diversifies demand. The competitive landscape, featuring both domestic and international players, fosters innovation and efficiency improvements. While raw material costs and global economic shifts present potential challenges, the long-term outlook for the Indian aluminum die casting market remains highly optimistic, signaling considerable growth and investment prospects.

Aluminum Die Casting Industry in India Company Market Share

Aluminum Die Casting Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Aluminum Die Casting Industry in India, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. This report is crucial for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic sector. Keywords: Aluminum Die Casting India, Die Casting Market India, Automotive Die Casting, Aluminum Die Casting Industry, India Manufacturing, Pressure Die Casting, Vacuum Die Casting, Gravity Die Casting, Squeeze Die Casting, India Automotive Components.

Aluminum Die Casting Industry in India Market Dynamics & Structure

The Indian aluminum die casting market is characterized by moderate concentration, with several large players and a significant number of smaller firms. Technological innovation, driven by the automotive and electronics sectors, is a key driver, while stringent environmental regulations pose a challenge. The market sees continuous mergers and acquisitions (M&A) activity, primarily driven by consolidation and expansion strategies. Substitute materials like plastics pose competition, but aluminum's lightweight and high-strength properties maintain its appeal. The end-user demographics are primarily driven by the automotive industry, with increasing demand from the burgeoning electric vehicle (EV) segment.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on lightweighting, automation, and precision casting techniques. Barriers include high initial investment costs and skilled labor requirements.

- Regulatory Framework: Stringent emission norms and waste management regulations influence production processes and material selection.

- Competitive Product Substitutes: Plastics and other metals compete based on cost and specific application requirements.

- M&A Trends: Increased M&A activity, with xx deals recorded between 2019 and 2024, primarily driven by automotive industry consolidation.

Aluminum Die Casting Industry in India Growth Trends & Insights

The Indian aluminum die casting market witnessed significant growth during the historical period (2019-2024). Driven by robust growth in the automotive sector, particularly the two-wheeler and passenger vehicle segments, the market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. Technological advancements, such as the adoption of advanced die casting technologies and automation, further boosted market growth. The increasing demand for lightweight vehicles, coupled with the government's push for electric vehicles, is expected to propel market expansion in the forecast period (2025-2033). Changing consumer preferences towards fuel-efficient and technologically advanced vehicles also contribute to the growth trajectory. Market penetration is anticipated to reach xx% by 2033.

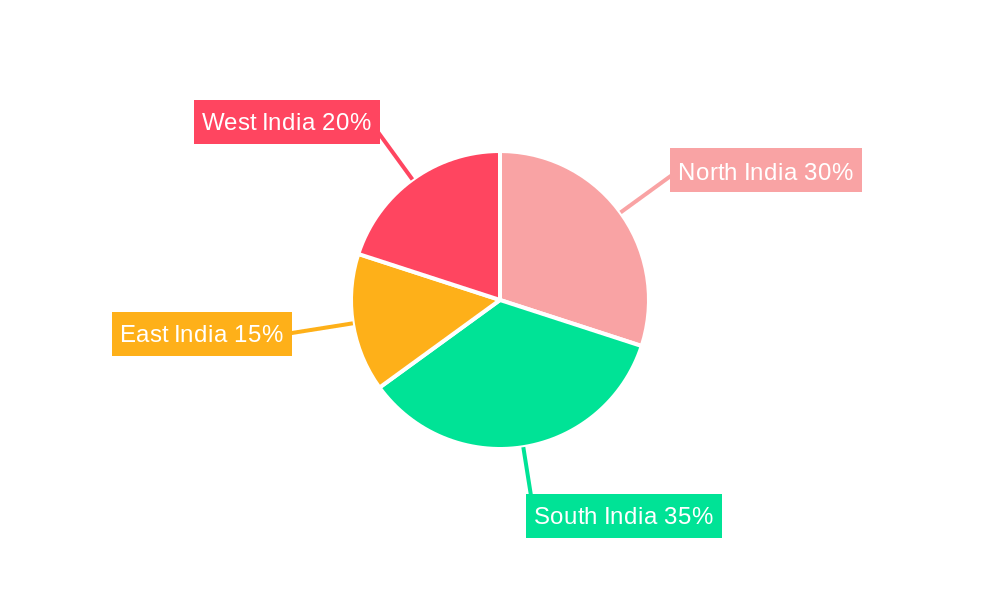

Dominant Regions, Countries, or Segments in Aluminum Die Casting Industry in India

The automotive hub of Southern India (Tamil Nadu, Karnataka) dominates the aluminum die casting market, driven by a high concentration of automotive manufacturers and ancillary units. Pressure die casting constitutes the largest segment by production process, accounting for approximately xx% of the market share in 2024, followed by gravity die casting with xx%. The automotive sector commands the largest application segment, with body parts and engine components forming significant portions of demand, influenced by increasing vehicle production and the shift toward lightweight construction for better fuel efficiency. The growth in the automotive sector and EV adoption are key drivers of regional and segment dominance.

- Key Drivers:

- Robust growth of the automotive industry.

- Increased adoption of electric vehicles.

- Government initiatives promoting domestic manufacturing.

- Favorable economic conditions and rising disposable incomes.

- Dominance Factors:

- High concentration of automotive manufacturing facilities in Southern India.

- Well-established supply chains and infrastructure.

- Skilled labor force.

- Cost-effectiveness of production.

Aluminum Die Casting Industry in India Product Landscape

The Indian aluminum die casting industry is a dynamic and evolving sector, continuously pushing the boundaries of innovation. We are witnessing a significant influx of advanced products that boast enhanced material properties, achieving superior strength-to-weight ratios and improved corrosion resistance. The focus is on delivering exceptional surface finishes, minimizing post-processing requirements, and achieving stringent dimensional accuracy for even the most complex components. The industry offers a comprehensive spectrum of die-cast products, meticulously engineered for diverse applications. This includes high-pressure die casting, adept at producing intricate, thin-walled parts with excellent detail, and vacuum die casting, which significantly elevates surface quality by minimizing porosity and gas inclusions. Furthermore, the integration of cutting-edge technological advancements, such as rapid prototyping and additive manufacturing (3D printing), is revolutionizing product development. These technologies enable faster design iterations, quicker tooling modifications, and the efficient production of prototypes, ultimately accelerating time-to-market and adeptly catering to the ever-diversifying and demanding requirements of a multitude of industrial sectors.

Key Drivers, Barriers & Challenges in Aluminum Die Casting Industry in India

Key Drivers:

- Robust Automotive Sector Growth: The ever-increasing domestic demand for passenger cars, commercial vehicles, and especially the burgeoning electric vehicle (EV) segment, is a primary catalyst. Aluminum die-cast parts are crucial for lightweighting and performance enhancement in these vehicles.

- Expanding Electronics and Electrical Appliances Market: The widespread adoption of consumer electronics and the continuous development of new electrical appliances are creating substantial demand for precisely engineered aluminum die-cast components.

- Supportive Government Policies and Initiatives: Government programs focused on promoting domestic manufacturing, "Make in India," and encouraging the use of aluminum in sectors like automotive, infrastructure, and defense are providing a strong impetus to the industry.

- Increasing Adoption of Lightweight Materials: The global push towards energy efficiency and reduced emissions is driving the demand for lightweight materials like aluminum across various industries.

Challenges & Restraints:

- Volatile Raw Material Prices: Fluctuations in global aluminum prices, a key input material, introduce significant cost uncertainties and impact profitability.

- Intense Global Competition: The Indian market faces stiff competition from established international players with advanced technologies and economies of scale, putting pressure on domestic manufacturers.

- Substantial Capital Investment: Setting up and upgrading to state-of-the-art die casting facilities, including advanced machinery and automation, requires significant capital outlay, posing a barrier for smaller enterprises.

- Skilled Workforce Shortage: The industry requires a highly skilled workforce proficient in operating advanced machinery, process optimization, and quality control. A persistent skill gap can hinder productivity and innovation.

- Stringent Environmental Regulations: Adhering to evolving environmental regulations concerning emissions, waste management, and energy consumption can increase operational costs and necessitate investment in cleaner production technologies.

Emerging Opportunities in Aluminum Die Casting Industry in India

- Electric Vehicle (EV) Component Demand: The exponential growth of the EV market presents a massive opportunity for lightweight aluminum die-cast components such as battery housings, motor casings, chassis parts, and thermal management systems.

- Expansion into High-Growth Sectors: Diversifying into emerging sectors like renewable energy (solar panel frames, wind turbine components), aerospace (structural components), and advanced medical devices offers significant untapped potential.

- Adoption of Industry 4.0 Technologies: Embracing advanced manufacturing technologies like Industrial Internet of Things (IIoT), artificial intelligence (AI) for process optimization, automation, and robotics will enhance efficiency, quality, and competitiveness.

- Focus on Sustainable and Eco-Friendly Practices: Developing and implementing sustainable production processes, including energy-efficient methods, waste reduction, and increased use of recycled aluminum, will be a key differentiator and meet growing market demand for green products.

- Niche and High-Value Applications: Focusing on specialized, high-value applications requiring intricate designs, tight tolerances, and specialized alloys can command premium pricing and create a competitive edge.

Growth Accelerators in the Aluminum Die Casting Industry in India Industry

The long-term growth trajectory of the Indian aluminum die casting industry is intrinsically linked to the sustained expansion of the domestic automotive sector, with a particular emphasis on the rapidly evolving electric vehicle (EV) segment. This growth will be significantly amplified by strategic collaborations and partnerships between Indian manufacturers and international leaders, facilitating technology transfer, best practice adoption, and market access. Substantial investments in advanced manufacturing technologies, including automation, Industry 4.0 solutions, and sophisticated tooling, will be pivotal in not only expanding production capacities but also in elevating the overall quality and precision of die-cast products to meet global standards. Furthermore, proactive government support, manifested through targeted incentives, favorable policies promoting domestic manufacturing, and investments in infrastructure, will play a crucial role in reinforcing the industry's competitiveness and accelerating its overall growth momentum.

Key Players Shaping the Aluminum Die Casting Industry in India Market

- Nemak SAB De CV

- Form Technologies (Dynacast)

- Jaya Hind Industries Ltd

- Endurance Technologies Limited

- Rheinmetall Automotive AG

- Samvardhana Motherson International Limited (SAMIL)

- Rico Auto Industries Ltd

- Sandhar Technologies Ltd

- Sipra Quality Die Casting

- Spark Minda Group

- Rockman Industries Ltd

- Hindustan Composites Limited

- Krishna Group

Notable Milestones in Aluminum Die Casting Industry in India Sector

- April 2021: Jaya Hind Industries extends its technical partnership with KS Huayu Alutech GmbH (KSATAG) for automotive cylinder block and head manufacturing until 2027, expanding to EV and chassis parts.

- March 2021: Sandhar Technologies signs an MOU to acquire Unicast Autotech's aluminum die casting business.

In-Depth Aluminum Die Casting Industry in India Market Outlook

The future of the Indian aluminum die casting industry looks promising, driven by the sustained growth of the automotive sector and the increasing adoption of lightweight materials in various applications. Strategic investments in advanced technologies and capacity expansions will further strengthen the industry's position. The focus on sustainability and eco-friendly practices will also shape the industry's future trajectory. The market is poised for substantial growth, with significant opportunities for players who can adapt to the evolving technological and regulatory landscape.

Aluminum Die Casting Industry in India Segmentation

-

1. Production Process

- 1.1. Pressure Die Casting

- 1.2. Vaccum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Gravity Die Casting

-

2. Application Type

- 2.1. Body Parts

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Applications

Aluminum Die Casting Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aluminum Die Casting Industry in India Regional Market Share

Geographic Coverage of Aluminum Die Casting Industry in India

Aluminum Die Casting Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. Growing Foreign Direct Investment (FDI) is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 5.1.1. Pressure Die Casting

- 5.1.2. Vaccum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Gravity Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Parts

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 6. North America Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 6.1.1. Pressure Die Casting

- 6.1.2. Vaccum Die Casting

- 6.1.3. Squeeze Die Casting

- 6.1.4. Gravity Die Casting

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Body Parts

- 6.2.2. Engine Parts

- 6.2.3. Transmission Parts

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 7. South America Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 7.1.1. Pressure Die Casting

- 7.1.2. Vaccum Die Casting

- 7.1.3. Squeeze Die Casting

- 7.1.4. Gravity Die Casting

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Body Parts

- 7.2.2. Engine Parts

- 7.2.3. Transmission Parts

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 8. Europe Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 8.1.1. Pressure Die Casting

- 8.1.2. Vaccum Die Casting

- 8.1.3. Squeeze Die Casting

- 8.1.4. Gravity Die Casting

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Body Parts

- 8.2.2. Engine Parts

- 8.2.3. Transmission Parts

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 9. Middle East & Africa Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 9.1.1. Pressure Die Casting

- 9.1.2. Vaccum Die Casting

- 9.1.3. Squeeze Die Casting

- 9.1.4. Gravity Die Casting

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Body Parts

- 9.2.2. Engine Parts

- 9.2.3. Transmission Parts

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 10. Asia Pacific Aluminum Die Casting Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Process

- 10.1.1. Pressure Die Casting

- 10.1.2. Vaccum Die Casting

- 10.1.3. Squeeze Die Casting

- 10.1.4. Gravity Die Casting

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Body Parts

- 10.2.2. Engine Parts

- 10.2.3. Transmission Parts

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Production Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nemak SAB De CV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Form Technologies (Dynacast)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jaya Hind Industries Lt

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endurance Technologies Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rheimetall Automotive AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Samvardhana Motherson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rico Auto Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sandhar Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sipra Quality Die Casting

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Spark Minda Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockman Industries

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nemak SAB De CV

List of Figures

- Figure 1: Global Aluminum Die Casting Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aluminum Die Casting Industry in India Revenue (billion), by Production Process 2025 & 2033

- Figure 3: North America Aluminum Die Casting Industry in India Revenue Share (%), by Production Process 2025 & 2033

- Figure 4: North America Aluminum Die Casting Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America Aluminum Die Casting Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Aluminum Die Casting Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Aluminum Die Casting Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Aluminum Die Casting Industry in India Revenue (billion), by Production Process 2025 & 2033

- Figure 9: South America Aluminum Die Casting Industry in India Revenue Share (%), by Production Process 2025 & 2033

- Figure 10: South America Aluminum Die Casting Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 11: South America Aluminum Die Casting Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Aluminum Die Casting Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Aluminum Die Casting Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aluminum Die Casting Industry in India Revenue (billion), by Production Process 2025 & 2033

- Figure 15: Europe Aluminum Die Casting Industry in India Revenue Share (%), by Production Process 2025 & 2033

- Figure 16: Europe Aluminum Die Casting Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 17: Europe Aluminum Die Casting Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Aluminum Die Casting Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Aluminum Die Casting Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Aluminum Die Casting Industry in India Revenue (billion), by Production Process 2025 & 2033

- Figure 21: Middle East & Africa Aluminum Die Casting Industry in India Revenue Share (%), by Production Process 2025 & 2033

- Figure 22: Middle East & Africa Aluminum Die Casting Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa Aluminum Die Casting Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa Aluminum Die Casting Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Aluminum Die Casting Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Aluminum Die Casting Industry in India Revenue (billion), by Production Process 2025 & 2033

- Figure 27: Asia Pacific Aluminum Die Casting Industry in India Revenue Share (%), by Production Process 2025 & 2033

- Figure 28: Asia Pacific Aluminum Die Casting Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Aluminum Die Casting Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Aluminum Die Casting Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Aluminum Die Casting Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 2: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 5: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 11: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 17: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 29: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 30: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Production Process 2020 & 2033

- Table 38: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 39: Global Aluminum Die Casting Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Aluminum Die Casting Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aluminum Die Casting Industry in India?

The projected CAGR is approximately 11.1%.

2. Which companies are prominent players in the Aluminum Die Casting Industry in India?

Key companies in the market include Nemak SAB De CV, Form Technologies (Dynacast), Jaya Hind Industries Lt, Endurance Technologies Limited, Rheimetall Automotive AG, Samvardhana Motherson, Rico Auto Industries, Sandhar Group, Sipra Quality Die Casting, Spark Minda Group, Rockman Industries.

3. What are the main segments of the Aluminum Die Casting Industry in India?

The market segments include Production Process, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

Growing Foreign Direct Investment (FDI) is Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

In April 2021, Jaya Hind Industries has extended its technical partnership with KS Huayu Alutech GmbH (KSATAG) for the manufacturing of automotive Cylinder Blocks and Cylinder Heads till 2027. The scope of the agreement has also been expanded to cover new parts from Sunrise Industries, such as Electric Vehicles (EV), Structural parts for Chassis, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aluminum Die Casting Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aluminum Die Casting Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aluminum Die Casting Industry in India?

To stay informed about further developments, trends, and reports in the Aluminum Die Casting Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence