Key Insights

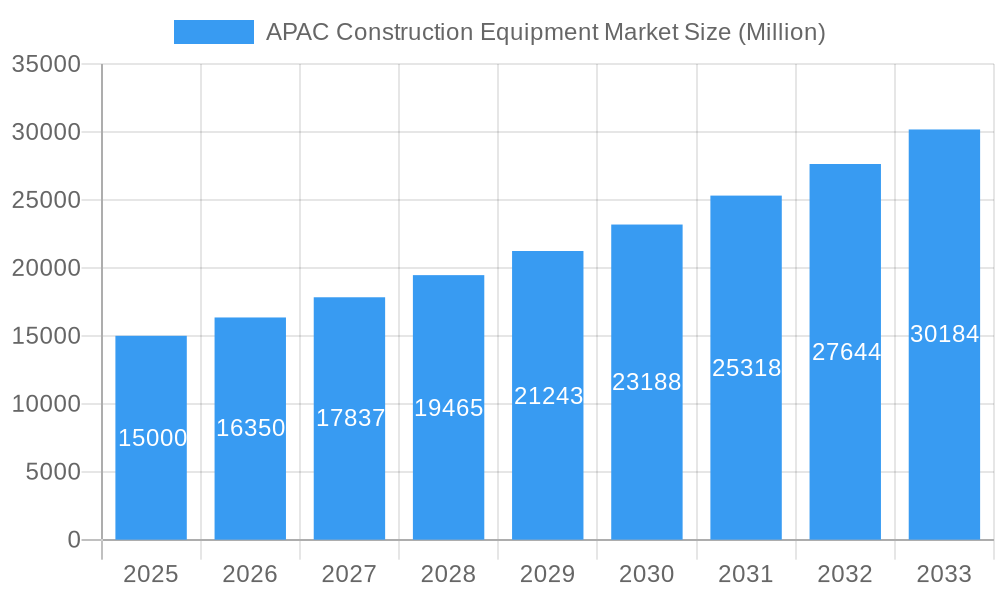

The Asia-Pacific (APAC) construction equipment market is poised for substantial expansion, driven by extensive infrastructure development and urbanization. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7%, reaching a market size of 242.17 billion by 2025. Key growth drivers include robust government initiatives for infrastructure enhancement in major economies such as China and India, coupled with rapid industrialization across the region. Demand for a variety of machinery, including excavators, loaders, and cranes, is on the rise. China's leading role, alongside India's escalating infrastructure requirements, significantly shapes market dynamics. The growing adoption of electric and hybrid equipment underscores a trend towards sustainability within the construction sector. Despite potential challenges like raw material price volatility and global economic uncertainties, the APAC construction equipment market demonstrates a strong positive outlook, supported by ongoing regional development.

APAC Construction Equipment Market Market Size (In Billion)

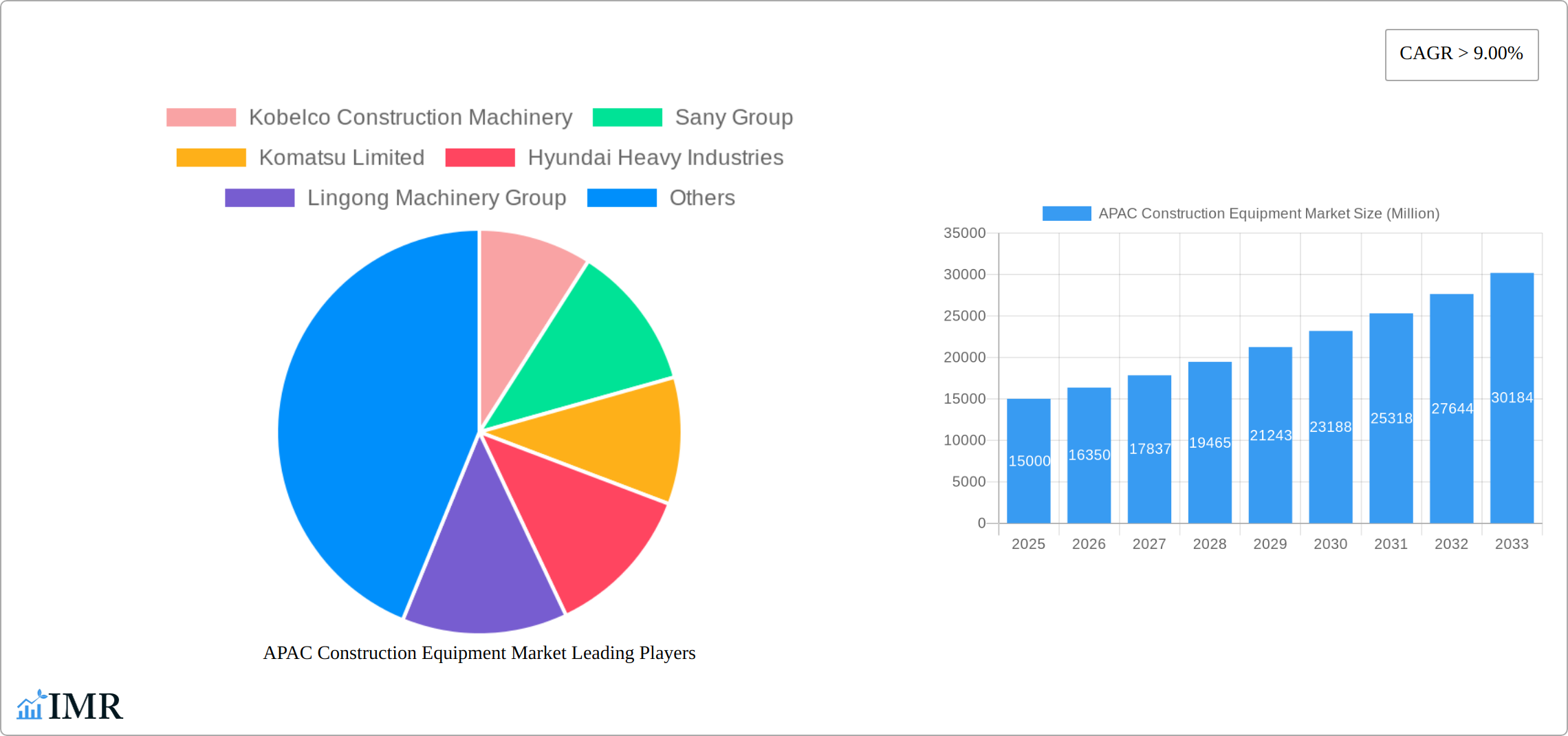

Market segmentation highlights significant opportunities within key national markets and machinery categories. China and India are dominant markets, with Japan and South Korea also showing considerable contribution. Cranes and excavators consistently exhibit high demand, essential for large-scale construction projects. The transition to electric and hybrid drive systems is a significant trend, influenced by government regulations promoting sustainable construction and the economic benefits of reduced fuel consumption. Leading global manufacturers such as Komatsu, Sany, and Kobelco are strategically positioned to leverage this growth. Regional players are also expanding their market share, fostering increased competition and innovation. Continued infrastructure investment and technological advancements will be critical in shaping the future of the APAC construction equipment market.

APAC Construction Equipment Market Company Market Share

APAC Construction Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) construction equipment market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by country (China, India, Japan, South Korea, Rest of Asia Pacific), machinery type (Cranes, Telescopic Handling, Excavators, Loaders & Backhoe, Motor Grader, Others), and drive type (IC Engine, Electric & Hybrid). The total market value in 2025 is estimated at xx million units, projected to reach xx million units by 2033.

APAC Construction Equipment Market Dynamics & Structure

The APAC construction equipment market is characterized by a dynamic interplay of factors influencing its growth trajectory. Market concentration is relatively high, with a few major players dominating significant market share. Technological innovation, particularly in electric and hybrid drive systems and automation, is a key driver, though high initial investment costs and lack of supporting infrastructure pose barriers to widespread adoption. Stringent regulatory frameworks regarding emissions and safety standards influence product development and market access. The market also faces competition from substitute products, such as alternative construction methods and labor-intensive approaches. End-user demographics, encompassing government infrastructure projects, private sector development, and industrial growth, greatly impact demand. Finally, M&A activity is increasingly prevalent, driven by consolidation among major players and entry by smaller, specialized firms.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Focus on electric and hybrid systems, automation, and data analytics for improved efficiency and reduced emissions.

- Regulatory Framework: Stringent emission norms, safety standards, and infrastructure regulations shape market dynamics.

- Competitive Substitutes: Alternative construction methods and labor-intensive techniques compete with traditional machinery.

- M&A Activity: xx M&A deals recorded between 2019-2024, with an estimated xx deals predicted for 2025-2033.

- End-user Demographics: Government infrastructure projects, especially in high-growth economies, are a significant demand driver.

APAC Construction Equipment Market Growth Trends & Insights

The APAC construction equipment market is experiencing a period of significant and sustained growth, propelled by ambitious infrastructure development projects, rapid urbanization, and a burgeoning industrial sector across the region. This dynamic market demonstrated a Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period spanning from 2019 to 2024. Projections indicate a continuation of this upward trajectory, with an anticipated CAGR of XX% for the forecast period of 2025 to 2033.

The integration of advanced technologies such as telematics for enhanced fleet management and operational efficiency, along with increasingly sophisticated automated systems, is a notable trend. While adoption is steadily rising, it is contingent upon factors including the initial investment costs, the availability of skilled technical personnel for operation and maintenance, and the supportive nature of regulatory frameworks within different countries. Consumer behavior is undergoing a marked transformation, with a discernible preference emerging for construction equipment that prioritizes energy efficiency, environmental sustainability, and cutting-edge technological features. This shift is creating a substantial demand for eco-friendlier equipment alternatives, including those powered by electric or hybrid powertrains.

The market exhibits considerable regional disparities. China and India stand out as dominant forces, leading in both overall market size and the pace of growth. Emerging technological innovations, particularly the development and adoption of electric and hybrid drive systems, are actively reshaping the future landscape of the construction equipment sector. The evolving consumer demand for efficient, sustainable, and technologically advanced machinery is a key driver, fostering a greater impetus towards sustainable construction practices and consequently amplifying the need for greener equipment solutions.

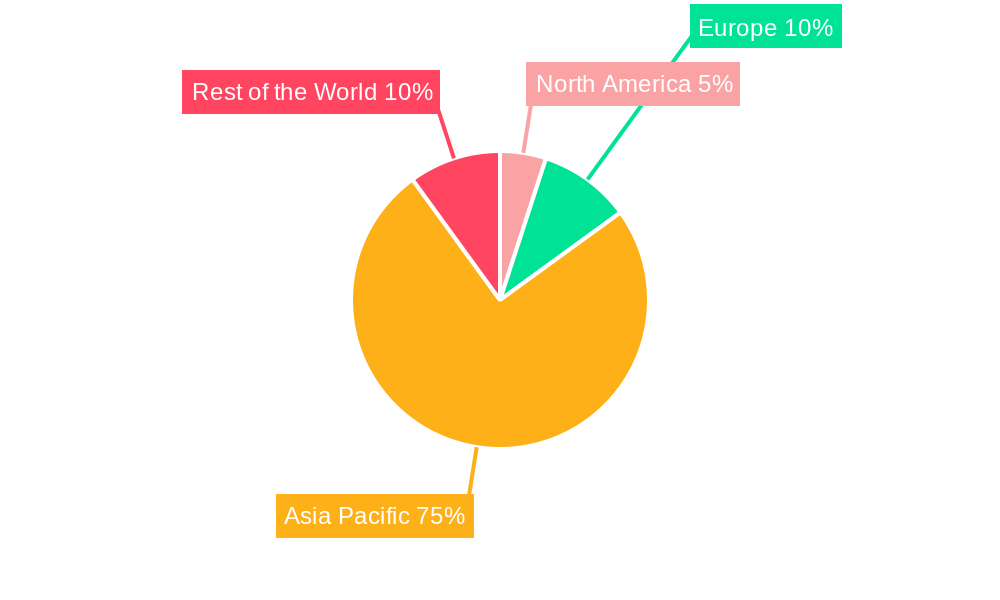

Dominant Regions, Countries, or Segments in APAC Construction Equipment Market

China remains the dominant market within APAC, accounting for approximately xx% of the total market value in 2025 due to extensive infrastructure projects and rapid industrialization. India holds the second largest market share with xx% in 2025, fuelled by substantial government investments in infrastructure and urban development. The excavator segment leads in terms of market share, with xx% in 2025, driven by high demand in construction and mining activities. The IC engine drive type dominates the market in 2025, holding xx% market share, however, the electric and hybrid segment is experiencing rapid growth, driven by increased environmental awareness and government initiatives promoting sustainable construction practices.

- Key Drivers for China: Government infrastructure spending, rapid urbanization, and industrial expansion.

- Key Drivers for India: Government's focus on infrastructure development ("Make in India" initiative), rising urbanization, and growing industrial sector.

- Excavator Segment Dominance: High demand from construction and mining sectors, coupled with continuous technological advancements.

- IC Engine Dominance (2025): Lower initial cost and wider availability compared to electric and hybrid alternatives.

- Growth Potential of Electric & Hybrid: Increasing environmental concerns, government incentives for green technology adoption.

APAC Construction Equipment Market Product Landscape

The APAC construction equipment market showcases a diverse range of products with varying features and technological advancements. Manufacturers are continually innovating to improve efficiency, reduce emissions, enhance safety features, and integrate advanced technologies such as telematics and automation. Key product innovations include the development of electric and hybrid drive systems, autonomous or semi-autonomous operating capabilities, and advanced operator assistance systems. These advancements contribute to improved productivity, reduced operating costs, and enhanced environmental sustainability. The unique selling propositions (USPs) of various products often revolve around fuel efficiency, operational performance, safety features, and technological integration.

Key Drivers, Barriers & Challenges in APAP Construction Equipment Market

Key Drivers: Robust infrastructure development plans across many APAC nations, rising urbanization, industrial growth, and government support for infrastructure projects are key drivers. Technological advancements, specifically in automation and electric/hybrid systems, are also fueling market expansion.

Key Barriers and Challenges: High initial investment costs for advanced equipment, a lack of skilled labor, and supply chain disruptions pose significant challenges. Stringent regulatory compliance requirements and intense competition from established and emerging players also impact market growth. The predicted impact of these challenges on market growth in 2025 is estimated to be a xx% reduction in projected growth.

Emerging Opportunities in APAC Construction Equipment Market

Significant opportunities are presenting themselves within the APAC construction equipment market. Untapped potential exists in less-developed regions across the APAC landscape, where nascent infrastructure needs are substantial. Concurrently, the escalating demand for construction equipment that adheres to stringent environmental standards and promotes sustainable building practices offers a fertile ground for innovation and market penetration. The strategic adoption of advanced construction technologies, such as the integration of Building Information Modeling (BIM) for enhanced project planning and execution, and the deployment of Internet of Things (IoT) devices for real-time data monitoring and predictive maintenance, are unlocking novel avenues for market expansion and revenue generation. Furthermore, evolving consumer preferences that emphasize superior safety features and a reduced ecological footprint are acting as powerful catalysts for market growth.

Growth Accelerators in the APAC Construction Equipment Market Industry

Technological breakthroughs in areas like automation, electrification, and digitalization are primary catalysts. Strategic partnerships and collaborations between equipment manufacturers and technology providers are accelerating innovation and market penetration. Government initiatives and policies promoting sustainable construction practices are boosting demand for eco-friendly equipment. Expanding into new markets within APAC and focusing on customized solutions for specific regional needs are fueling long-term market expansion.

Key Players Shaping the APAC Construction Equipment Market Market

Notable Milestones in APAC Construction Equipment Market Sector

- May 2022: Sany Bharat launched 22 new products designed for the Indian market during Excon 2022.

- April 2022: Manitowoc launched the Potain MCT 805 crane, manufactured in China.

- June 2022: Cummins Inc. and Komatsu Corp. announced a collaboration to develop zero-emission mining haul trucks.

- August 2022: Volvo CE announced the development of its Bengaluru facility into an export hub for medium-sized excavators.

In-Depth APAC Construction Equipment Market Market Outlook

The APAC construction equipment market is on a trajectory for continued robust expansion, primarily fueled by ongoing large-scale infrastructure initiatives, sustained urbanization trends, and the relentless pace of technological innovation. Strategic advantages lie with manufacturers who can effectively focus on delivering sustainable equipment solutions, embrace and integrate advanced technologies, and offer customized product portfolios that meticulously address the distinct requirements of various regional markets. The future trajectory of this market will be profoundly influenced by the evolution of governmental regulations, the emergence of groundbreaking technological advancements, and significant shifts in consumer priorities towards enhanced efficiency and environmental responsibility. Companies that demonstrate agility in adapting to these multifaceted dynamics are strategically positioned to harness the considerable growth potential inherent in this dynamic market.

APAC Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handling

- 1.3. Excavator

- 1.4. Loaders And Backhoe

- 1.5. Motor Grader

- 1.6. Others

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric And Hybrid

APAC Construction Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Construction Equipment Market Regional Market Share

Geographic Coverage of APAC Construction Equipment Market

APAC Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Government Regulations to Adopt Fire Safety Standards

- 3.3. Market Restrains

- 3.3.1. High Purchase and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handling

- 5.1.3. Excavator

- 5.1.4. Loaders And Backhoe

- 5.1.5. Motor Grader

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric And Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Telescopic Handling

- 6.1.3. Excavator

- 6.1.4. Loaders And Backhoe

- 6.1.5. Motor Grader

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. IC Engine

- 6.2.2. Electric And Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. South America APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Telescopic Handling

- 7.1.3. Excavator

- 7.1.4. Loaders And Backhoe

- 7.1.5. Motor Grader

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. IC Engine

- 7.2.2. Electric And Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Europe APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Telescopic Handling

- 8.1.3. Excavator

- 8.1.4. Loaders And Backhoe

- 8.1.5. Motor Grader

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. IC Engine

- 8.2.2. Electric And Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Middle East & Africa APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Telescopic Handling

- 9.1.3. Excavator

- 9.1.4. Loaders And Backhoe

- 9.1.5. Motor Grader

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. IC Engine

- 9.2.2. Electric And Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Asia Pacific APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Telescopic Handling

- 10.1.3. Excavator

- 10.1.4. Loaders And Backhoe

- 10.1.5. Motor Grader

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. IC Engine

- 10.2.2. Electric And Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kobelco Construction Machinery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sany Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Komatsu Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hyundai Heavy Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lingong Machinery Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XCMG Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Construction Equipments Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoomlion Heavy Industry Science And Technology Co Lt

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global APAC Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 3: North America APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 9: South America APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 10: South America APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: South America APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: South America APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 15: Europe APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Europe APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Europe APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Europe APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 27: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 29: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global APAC Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 5: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 11: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 17: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 18: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 29: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 30: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 38: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 39: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Construction Equipment Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the APAC Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Sany Group, Komatsu Limited, Hyundai Heavy Industries, Lingong Machinery Group, XCMG Group, Doosan Group, Hitachi Construction Equipments Co Ltd, Zoomlion Heavy Industry Science And Technology Co Lt.

3. What are the main segments of the APAC Construction Equipment Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 242.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Strict Government Regulations to Adopt Fire Safety Standards.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

High Purchase and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In August 2022, Volvo CE announced to development of its manufacturing facility located in Bengaluru in India into an export hub. The company stated that this investment will allow Volvo Construction Equipment to produce medium-sized excavators at the plant. The company further stated that these machines will primarily be used in the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Construction Equipment Market?

To stay informed about further developments, trends, and reports in the APAC Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence