Key Insights

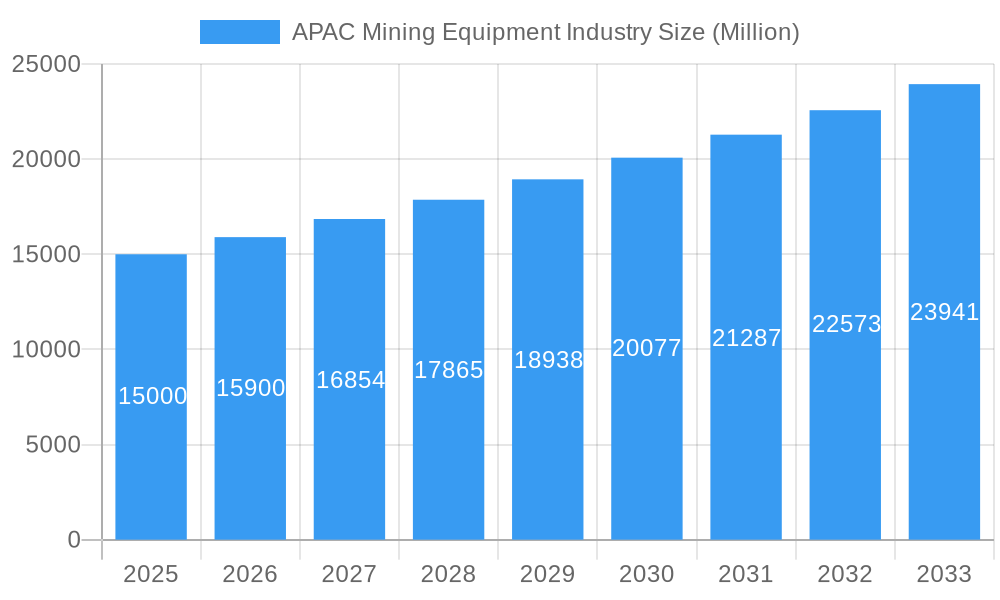

The Asia-Pacific (APAC) mining equipment market is poised for substantial expansion, propelled by escalating demand for essential minerals and metals, amplified investments in mining infrastructure, and the accelerating integration of automation and advanced technologies. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.8%, indicating significant growth from its current market size of 88.2 billion in the base year 2025. Key growth catalysts include extensive construction and infrastructure development across the APAC region, particularly in burgeoning economies such as India and China. Governmental initiatives aimed at modernizing mining operations and boosting efficiency further contribute to this upward trend. The global shift towards sustainable mining practices, exemplified by the increasing adoption of electric and hybrid mining vehicles, is also a significant demand driver for specialized equipment. The market segmentation includes vehicle types and battery types, with Lithium-ion batteries rapidly gaining prominence due to their superior energy density and extended lifespan. Prominent industry leaders are actively engaged in research and development to introduce innovative and technologically advanced solutions within this competitive landscape.

APAC Mining Equipment Industry Market Size (In Billion)

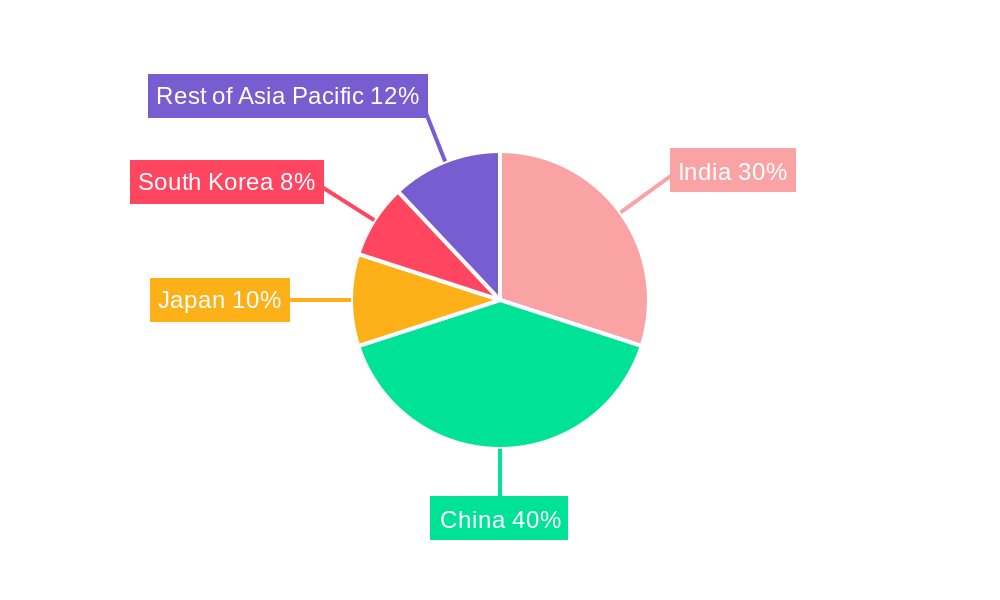

Geographically, the APAC mining equipment market exhibits notable concentration within key economies including India, China, Japan, and South Korea. India's ambitious infrastructure development projects and China's continuously expanding industrial sector are primary contributors to market expansion. However, potential challenges such as volatile commodity prices, rigorous environmental regulations, and geopolitical uncertainties may influence the market's growth trajectory. Despite these considerations, the long-term market outlook remains robust, underpinned by consistent demand for mining equipment and the ongoing implementation of technological advancements designed to elevate operational efficiency, productivity, and safety standards within the mining industry. This sustained expansion is further supported by the significant market size of 88.2 billion in 2025 and a projected CAGR of 6.8%.

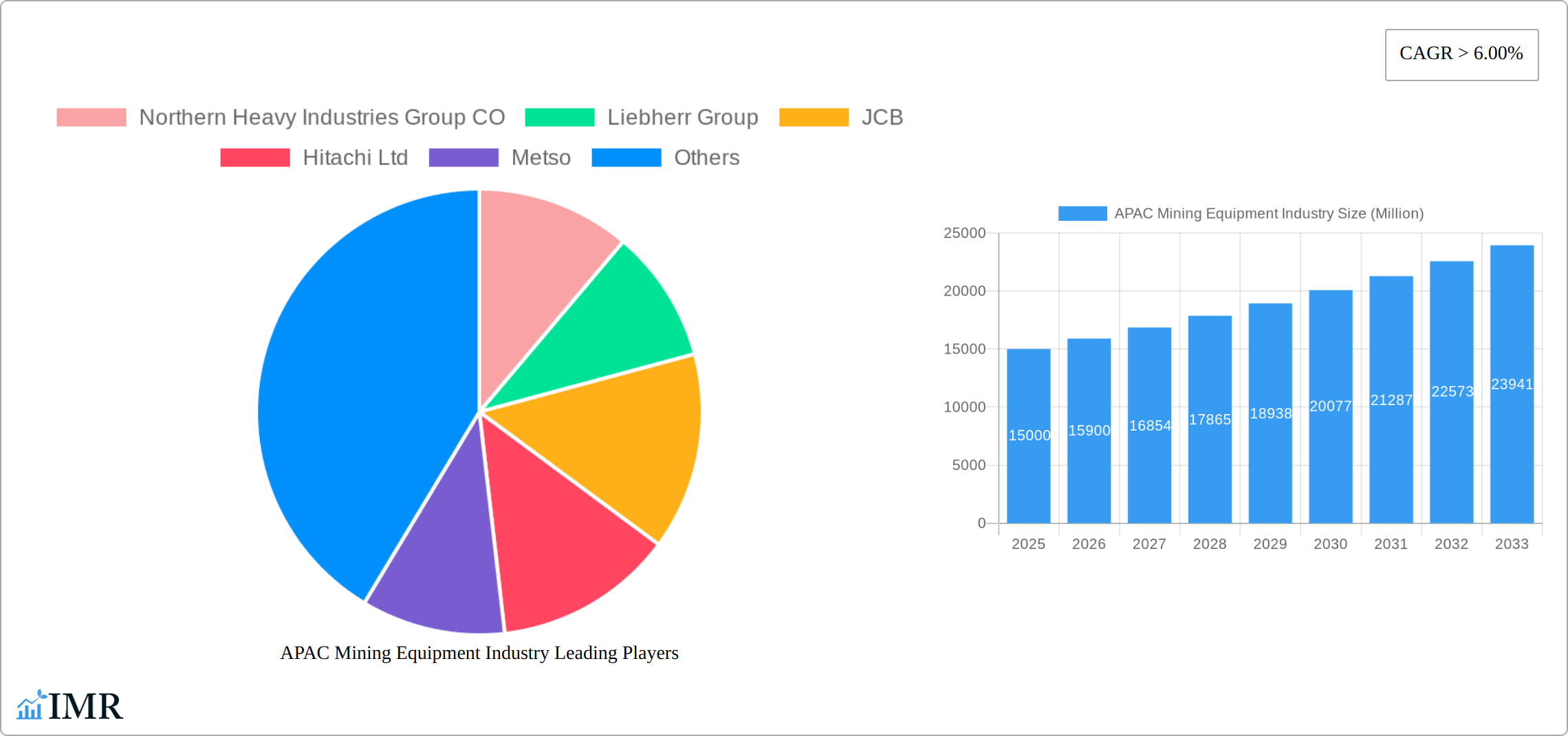

APAC Mining Equipment Industry Company Market Share

APAC Mining Equipment Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) mining equipment industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report segments the market by vehicle type (passenger vehicles and commercial vehicles) and battery type (Li-ion and Lead Acid), offering granular insights into this dynamic sector. The report forecasts a market value of xx Million units by 2033.

APAC Mining Equipment Industry Market Dynamics & Structure

The APAC mining equipment market is a dynamic landscape shaped by a blend of established global leaders and agile regional contenders. This moderately concentrated market is witnessing a significant transformation driven by relentless technological innovation. The push towards automation, electrification, and digitalization is revolutionizing mining operations, promising enhanced efficiency, safety, and sustainability. Concurrently, a tightening regulatory environment, with increasingly stringent environmental protection and worker safety standards, is a key influencer, guiding product development and dictating market access. Challenges emerge from the competitive pressure exerted by substitute materials and emerging extraction technologies, particularly in niche mining applications. The market caters to a broad spectrum of end-users, from vast, multinational mining conglomerates to smaller, independent operations. Merger and acquisition (M&A) activities, while moderate, are strategically focused on expanding geographical footprints and acquiring advanced technological capabilities.

- Market Concentration: The market exhibits moderate concentration, with projections indicating the top 5 players are expected to command approximately 60% of the market share by 2025.

- Technological Innovation: Key areas of technological advancement include the development and deployment of autonomous vehicles, energy-efficient electric-powered equipment, and sophisticated predictive maintenance solutions.

- Regulatory Framework: Diverse and evolving environmental regulations across various APAC nations significantly influence equipment design specifications and operational mandates.

- Competitive Substitutes: The market faces increasing competition from alternative mineral extraction methodologies and substitute materials that offer comparable or superior performance in certain applications.

- End-User Demographics: A varied end-user base spans large-scale, globally recognized mining enterprises to smaller, independent mining ventures.

- M&A Trends: Strategic acquisitions are predominantly geared towards integrating new technologies and extending market reach geographically. Approximately xx M&A deals were recorded between 2019 and 2024, highlighting this trend.

APAC Mining Equipment Industry Growth Trends & Insights

The APAC mining equipment market has experienced a period of robust expansion between 2019 and 2024. This growth was largely propelled by escalating global demand for essential minerals and metals, substantial investments in regional infrastructure development, and a surge in mining project investments across the APAC region. The market size is currently estimated at xx Million units for 2025. Transformative technological advancements, such as the widespread adoption of autonomous haulage systems and remote operational capabilities, are profoundly influencing equipment purchasing and integration patterns. A growing consumer preference for sustainable mining practices, coupled with an intensified focus on workplace safety, is actively reshaping product demand. The market is forecasted to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with particularly strong growth anticipated in the developing economies of the region. The penetration of advanced technologies is expected to rise, bolstered by ongoing technological breakthroughs and supportive government initiatives.

Dominant Regions, Countries, or Segments in APAC Mining Equipment Industry

Within the APAC mining equipment industry, Australia, China, and Indonesia stand out as the dominant markets. Australia's leadership is attributed to its abundant mineral wealth, coupled with sophisticated mining methodologies and strong governmental backing for the sector. China's immense infrastructure development programs and continuous industrial expansion are significant drivers of substantial equipment demand. Indonesia's burgeoning mining sector, particularly its production of coal and nickel, makes a substantial contribution to the regional market's overall size. On a segment level, the commercial vehicle category asserts dominance due to the high-volume requirement for heavy-duty machinery such as trucks, excavators, and loaders in large-scale mining operations. While Li-ion battery technology is gaining significant traction due to its superior energy density and enhanced performance characteristics compared to traditional lead-acid batteries, the latter continues to maintain a prevalent position in specific, established applications.

- Key Drivers in Australia: Advanced mining techniques, extensive mineral reserves, and robust government support for the mining sector.

- Key Drivers in China: Large-scale infrastructure projects, rapid industrial expansion, and substantial government investment in the mining industry.

- Key Drivers in Indonesia: A rapidly expanding mining sector, particularly in coal and nickel extraction, alongside increasing foreign direct investment.

- Commercial Vehicle Dominance: High demand for large-capacity trucks, excavators, and loaders essential for large-scale mining operations.

- Li-ion Battery Growth: Fueled by advancements in performance, extended operational lifespan, and an increasing emphasis on environmental sustainability.

APAC Mining Equipment Industry Product Landscape

The APAC mining equipment market showcases a diverse range of products, from basic excavation equipment to highly sophisticated autonomous vehicles. Innovations focus on improving efficiency, safety, and sustainability. Key features include advanced automation systems, improved fuel efficiency, and enhanced safety features. The unique selling propositions of many products center around their enhanced productivity, reduced operational costs, and minimal environmental impact. Technological advancements encompass the incorporation of AI and IoT for predictive maintenance and optimized operations.

Key Drivers, Barriers & Challenges in APAC Mining Equipment Industry

Key Drivers: Rising demand for minerals and metals, infrastructure development, government support for the mining industry, and technological advancements driving efficiency and productivity. Specific examples include government incentives for the adoption of sustainable mining practices and increasing investments in automation technologies.

Challenges: Fluctuations in commodity prices, volatile geopolitical situations, stringent environmental regulations, skilled labor shortages, and supply chain disruptions (estimated to impact market growth by xx% in 2026). These factors pose significant challenges to the industry's growth and profitability.

Emerging Opportunities in APAP Mining Equipment Industry

Untapped potential lies in the adoption of electric and autonomous equipment, particularly in smaller and remote mining operations. The growing focus on sustainable mining practices offers opportunities for environmentally friendly equipment and technologies. The increasing demand for rare earth minerals creates opportunities for specialized equipment and processing solutions. Emerging markets in Southeast Asia present significant growth potential.

Growth Accelerators in the APAC Mining Equipment Industry

Technological breakthroughs in automation, electrification, and digitalization are key growth catalysts. Strategic partnerships between equipment manufacturers and mining companies promote innovation and market penetration. Expanding into emerging markets and diversifying product offerings are crucial for long-term growth. Government policies supporting sustainable mining practices create a favorable environment for technological advancements and market expansion.

Key Players Shaping the APAC Mining Equipment Industry Market

Notable Milestones in APAC Mining Equipment Industry Sector

- 2021: Introduction of fully autonomous haulage systems by Caterpillar in Australian mines.

- 2022: Metso launches a new range of energy-efficient crushers in China.

- 2023: Several significant mergers and acquisitions consolidate market share amongst key players.

- 2024: Increased focus on sustainable mining practices, such as the implementation of electric mining vehicles.

In-Depth APAC Mining Equipment Industry Market Outlook

The APAC mining equipment market is strongly positioned for sustained and significant growth. This upward trajectory will be primarily fueled by continuous technological advancements, the ever-increasing global demand for critical minerals, and favorable government policies that support the mining sector. Strategic opportunities abound in the development and deployment of mining equipment that is both sustainable and autonomous, with a particular emphasis on catering to the evolving needs of emerging markets within the region. The successful integration of digital technologies and the optimization of supply chain efficiencies are identified as crucial determinants for unlocking the market's future potential. The long-term outlook for the APAC mining equipment industry remains decidedly positive, with robust expansion anticipated throughout the entire forecast period.

APAC Mining Equipment Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Battery Type

- 2.1. Li-ion

- 2.2. Lead Acid

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. India

- 3.1.2. China

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

APAC Mining Equipment Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

APAC Mining Equipment Industry Regional Market Share

Geographic Coverage of APAC Mining Equipment Industry

APAC Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Increase in number of Mineral Exploration Sites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Mining Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Li-ion

- 5.2.2. Lead Acid

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. India

- 5.3.1.2. China

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Northern Heavy Industries Group CO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sany Heavy Equipment International Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Northern Heavy Industries Group CO

List of Figures

- Figure 1: APAC Mining Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Mining Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 3: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: APAC Mining Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 7: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: APAC Mining Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: India APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mining Equipment Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the APAC Mining Equipment Industry?

Key companies in the market include Northern Heavy Industries Group CO, Liebherr Group, JCB, Hitachi Ltd, Metso, Caterpillar Inc, Sany Heavy Equipment International Holdings, Tata Motor, AB Volvo.

3. What are the main segments of the APAC Mining Equipment Industry?

The market segments include Vehicle Type, Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Increase in number of Mineral Exploration Sites.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the APAC Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence