Key Insights

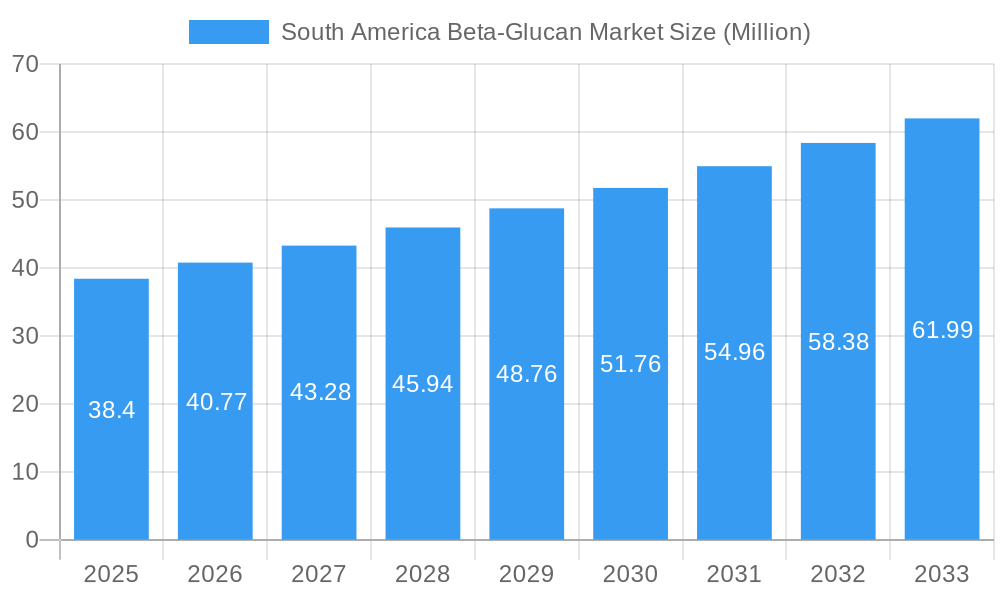

The South America Beta-Glucan Market is poised for robust expansion, projected to reach a valuation of USD 38.40 million by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 6.21% throughout the forecast period of 2025-2033. This significant growth is primarily propelled by a confluence of escalating consumer demand for health-beneficial ingredients and a burgeoning awareness of beta-glucan's diverse applications. The food and beverage sector stands as a dominant force, driven by its incorporation into dairy products, snacks, confectionery, and baked goods, catering to a growing appetite for functional foods. Within this segment, soluble beta-glucans are likely to lead, owing to their established efficacy in cholesterol management and immune support, making them a preferred choice for fortified products. The healthcare and dietary supplements segment, particularly infant nutrition, is another key growth avenue, as parents increasingly seek scientifically-backed ingredients for early childhood development.

South America Beta-Glucan Market Market Size (In Million)

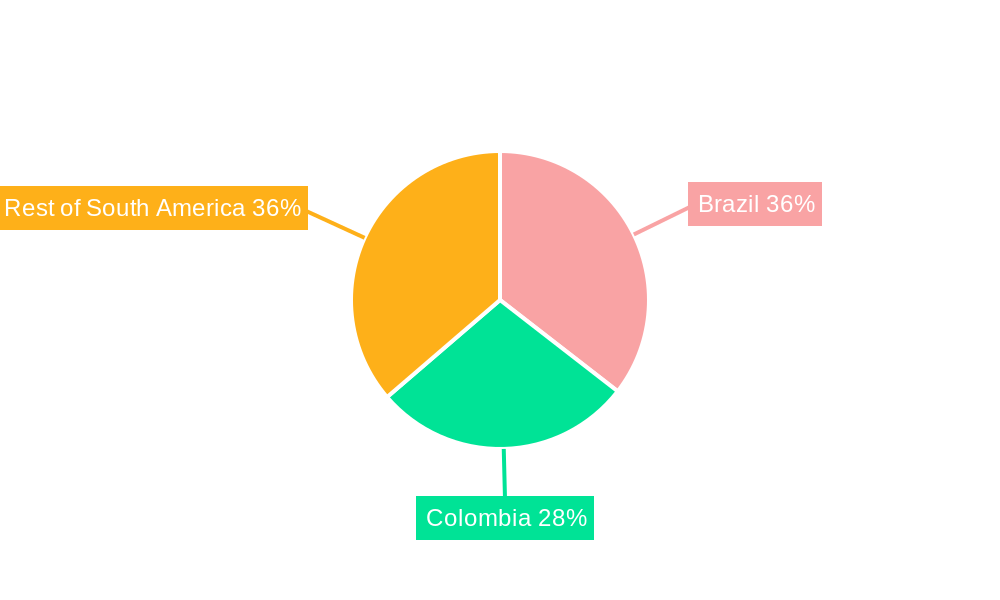

The market's upward trajectory is further supported by emerging trends such as the rising popularity of plant-based diets and the continuous innovation in product formulations that leverage beta-glucan's texturizing, emulsifying, and water-binding properties. While the market enjoys a favorable outlook, certain restraints, such as the cost-effectiveness of sourcing and processing, and the need for greater consumer education on the specific benefits of different beta-glucan types, require strategic attention. Geographically, Brazil and Colombia are expected to be significant contributors to the market's expansion, driven by their substantial food processing industries and increasing disposable incomes. The rest of South America is also anticipated to witness steady growth as awareness and adoption of beta-glucan-rich products gain momentum. Key industry players are actively investing in research and development, aiming to expand their product portfolios and geographical reach to capitalize on this promising market.

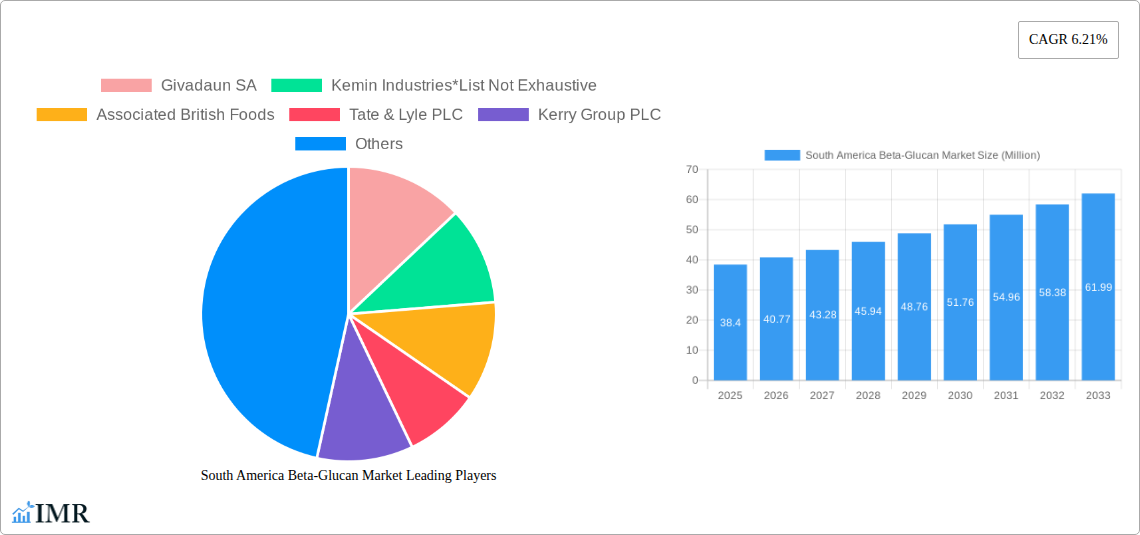

South America Beta-Glucan Market Company Market Share

This in-depth report provides a granular analysis of the South America Beta-Glucan Market, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. With a comprehensive study period from 2019 to 2033, a base year of 2025, and a detailed forecast period (2025-2033), this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on this evolving market. We delve into parent and child market segments, providing detailed segmentation by category, application, and geography, with all values presented in Million units for clarity and precise business intelligence.

South America Beta-Glucan Market Market Dynamics & Structure

The South America Beta-Glucan Market is characterized by a moderately concentrated structure, with key players investing heavily in research and development to drive technological innovation. The increasing demand for health-promoting ingredients, particularly within the food and beverages and healthcare sectors, is a significant market driver. Regulatory frameworks, while evolving, are generally supportive of functional food ingredients, though varying compliance standards across countries can present challenges. Competitive product substitutes, such as other soluble fibers and prebiotics, exist but beta-glucans offer distinct health benefits, especially regarding cholesterol management and immune support. End-user demographics reveal a growing health-conscious consumer base across urban centers, with a rising disposable income fueling demand for premium health-enhancing products. Merger and acquisition (M&A) trends are on the rise as larger entities seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: Focus on extraction efficiency, purity, and new application development.

- Regulatory Frameworks: Evolving, with an emphasis on food safety and health claims.

- Competitive Product Substitutes: Other soluble fibers, prebiotics, and functional ingredients.

- End-User Demographics: Growing middle class, health-conscious consumers, and aging populations.

- M&A Trends: Increasing as companies seek market consolidation and vertical integration.

South America Beta-Glucan Market Growth Trends & Insights

The South America Beta-Glucan Market is poised for significant expansion, driven by a confluence of increasing consumer awareness of health and wellness, a growing preference for natural and functional ingredients, and a robust expansion in the food and beverage and healthcare sectors. The market's trajectory is characterized by rising adoption rates of beta-glucans in a variety of food products, including dairy, snacks, and baked goods, due to their established benefits in heart health and immune system support. Technological advancements in extraction and processing are leading to more efficient production methods and higher purity beta-glucan ingredients, thereby enhancing their appeal and cost-effectiveness. Consumer behavior shifts are playing a pivotal role, with a discernible move towards preventative healthcare and a willingness to invest in products that offer tangible health advantages. This is further amplified by the increasing availability of beta-glucans in various formats, from food additives to dietary supplements, making them more accessible to a broader consumer base. The estimated CAGR for the South America Beta-Glucan Market is projected to be approximately xx% during the forecast period. Market penetration is expected to climb from xx% in the base year to an estimated xx% by 2033, indicating substantial growth potential. The increasing prevalence of lifestyle diseases, such as cardiovascular conditions and metabolic disorders, is also a critical factor spurring demand for ingredients like beta-glucans that are scientifically proven to mitigate these risks. Furthermore, the burgeoning pet food industry's interest in beta-glucans for immune support in animals presents a unique growth avenue. The impact of global health trends, such as the demand for clean-label and naturally derived ingredients, is also a significant contributor to the positive market outlook for beta-glucans across South America.

Dominant Regions, Countries, or Segments in South America Beta-Glucan Market

Within the South America Beta-Glucan Market, Brazil stands out as the dominant region, significantly outpacing other countries due to its large population, robust agricultural sector, and a rapidly expanding food and beverage industry. The country's economic policies, which often support innovation and investment in value-added agricultural products, further bolster its leading position. The widespread adoption of beta-glucans in the Brazilian food and beverages sector, specifically within dairy products, snacks, and baked goods, reflects strong consumer demand for healthier options. The healthcare and dietary supplements segment in Brazil is also experiencing considerable growth, driven by increased health consciousness and the availability of scientifically backed health claims associated with beta-glucans, such as cholesterol reduction.

- Brazil's Dominance:

- Market Share: Holds an estimated xx% of the South American beta-glucan market.

- Economic Factors: Supportive government policies, strong agricultural output, and a growing middle class.

- Consumer Demand: High preference for functional foods and dietary supplements.

- Application Penetration: Widespread use in dairy, snacks, baked goods, and confectionery.

- Leading Category: Soluble Beta-Glucan:

- Health Benefits: Renowned for its cholesterol-lowering and immune-boosting properties, making it highly sought after.

- Application Versatility: Widely incorporated into functional foods and beverages.

- Key Application: Food and Beverages:

- Dairy Products: Integral in yogurts, milk-based beverages, and cheese for added fiber and health benefits.

- Snacks and Baked Goods: Used to enhance nutritional profiles and appeal to health-conscious consumers.

- Confectionery: Emerging use in sugar-reduced confectionery for satiety and health benefits.

- Growing Segment: Healthcare and Dietary Supplements:

- Immune Support: High demand for immune-boosting supplements, particularly post-pandemic.

- Infant Nutrition: Emerging applications for beta-glucans in infant formulas to support immune development.

Colombia and the "Rest of South America" also represent significant growth markets, with increasing awareness and investment in functional ingredients. However, Brazil's established market infrastructure, larger consumer base, and proactive industry players currently solidify its position as the market leader.

South America Beta-Glucan Market Product Landscape

The product landscape for South America Beta-Glucan is dynamic, with a strong emphasis on innovation in ingredient sourcing and processing. Companies are focusing on developing high-purity beta-glucans from diverse sources, including oats, barley, and yeast, to cater to specific application needs and consumer preferences for clean labels. Product performance is increasingly measured by its solubility, particle size, and functional efficacy in target applications, such as cholesterol reduction and immune modulation. Technological advancements are enabling the creation of specialized beta-glucan ingredients with enhanced bioavailability and improved sensory profiles, crucial for their seamless integration into everyday food and beverage products. The launch of novel barley beta-glucan ingredients by BENEO highlights the industry’s commitment to expanding the product offering and catering to the growing demand for natural, fiber-rich ingredients.

Key Drivers, Barriers & Challenges in South America Beta-Glucan Market

The South America Beta-Glucan Market is propelled by several key drivers, including the escalating consumer demand for health-promoting ingredients, particularly for cardiovascular health and immune support. Technological innovations in extraction and purification processes are making beta-glucans more accessible and cost-effective. Supportive government initiatives promoting healthier food options and the expanding functional food sector further fuel growth.

Key challenges and restraints in the market include the relatively higher cost of beta-glucans compared to conventional ingredients, which can limit widespread adoption, especially in price-sensitive markets. Supply chain complexities and fluctuations in raw material availability can also impact production costs and consistency. Furthermore, navigating diverse regulatory landscapes across different South American countries and the need for robust scientific substantiation for health claims can pose significant hurdles for market expansion.

Emerging Opportunities in South America Beta-Glucan Market

Emerging opportunities in the South America Beta-Glucan Market lie in the untapped potential of novel applications and expanding geographical reach. The growing interest in plant-based diets and the demand for ingredients that offer functional benefits beyond basic nutrition present significant avenues. The infant nutrition sector, where beta-glucans can support immune system development, is a promising area for innovation. Furthermore, the increasing adoption of beta-glucans in animal nutrition, particularly for pet food, is an expanding niche. Leveraging advancements in biotechnology to develop beta-glucans with tailored functionalities and improved sensory attributes will be crucial for unlocking these opportunities and catering to evolving consumer preferences.

Growth Accelerators in the South America Beta-Glucan Market Industry

Long-term growth in the South America Beta-Glucan Market will be significantly accelerated by continued technological breakthroughs in extraction and formulation, leading to more cost-effective and versatile beta-glucan products. Strategic partnerships between ingredient manufacturers and food and beverage companies will foster greater product innovation and market penetration. The expanding middle class across South America, coupled with increasing disposable incomes, will drive demand for premium health and wellness products, including those fortified with beta-glucans. Furthermore, greater awareness and education campaigns highlighting the scientifically validated health benefits of beta-glucans will play a crucial role in accelerating consumer adoption and market expansion.

Key Players Shaping the South America Beta-Glucan Market Market

- Givadaun SA

- Kemin Industries

- Associated British Foods

- Tate & Lyle PLC

- Kerry Group PLC

- Koninklijke DSM NV

- Lantmannen

- Lesaffre International

- Angel Yeast Co Ltd

- Biotec Pharmacon

Notable Milestones in South America Beta-Glucan Market Sector

- February 2024: Kemin Industries opened an Innovation Center and second spray-drying facility in Vargeão, Santa Catarina, Brazil, expanding its pet food manufacturing capabilities in Latin America.

- March 2024: Bio-Thera Solutions and SteinCares entered a licensing agreement for the distribution and marketing of Bio-Thera's pharmaceuticals in Brazil and the wider region.

- July 2023: BENEO launched Orafti β-Fit, a barley beta-glucan ingredient, globally, including in South America, extending its functional fiber range.

In-Depth South America Beta-Glucan Market Market Outlook

The South America Beta-Glucan Market is set for robust growth, driven by increasing health consciousness and a strong demand for functional ingredients. Future market potential is underpinned by ongoing innovation in product development and an expanding range of applications across the food and beverage, healthcare, and animal nutrition sectors. Strategic opportunities include capitalizing on the trend towards plant-based and clean-label products, as well as penetrating emerging markets with tailored solutions. Continued investment in research and development, coupled with effective marketing strategies that highlight the proven health benefits of beta-glucans, will be instrumental in accelerating market penetration and solidifying the position of beta-glucans as a vital ingredient in the South American health and wellness landscape. The market's outlook remains exceptionally positive, with significant room for expansion and diversification.

South America Beta-Glucan Market Segmentation

-

1. Category

- 1.1. Soluble

- 1.2. Insoluble

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Dairy

- 2.1.2. Snacks

- 2.1.3. Confectionery

- 2.1.4. Baked Goods

- 2.1.5. Other Products

-

2.2. Healthcare and Dietary Supplements

- 2.2.1. Infant Nutrition

- 2.3. Other Applications

-

2.1. Food and Beverages

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Rest of South America

South America Beta-Glucan Market Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Rest of South America

South America Beta-Glucan Market Regional Market Share

Geographic Coverage of South America Beta-Glucan Market

South America Beta-Glucan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Application in Dietary Supplements

- 3.3. Market Restrains

- 3.3.1. Increasing prevalence of hydroglycemia

- 3.4. Market Trends

- 3.4.1. Increased Demand for Algae derived Beta Glucan in Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Soluble

- 5.1.2. Insoluble

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Dairy

- 5.2.1.2. Snacks

- 5.2.1.3. Confectionery

- 5.2.1.4. Baked Goods

- 5.2.1.5. Other Products

- 5.2.2. Healthcare and Dietary Supplements

- 5.2.2.1. Infant Nutrition

- 5.2.3. Other Applications

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Soluble

- 6.1.2. Insoluble

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.1.1. Dairy

- 6.2.1.2. Snacks

- 6.2.1.3. Confectionery

- 6.2.1.4. Baked Goods

- 6.2.1.5. Other Products

- 6.2.2. Healthcare and Dietary Supplements

- 6.2.2.1. Infant Nutrition

- 6.2.3. Other Applications

- 6.2.1. Food and Beverages

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Colombia South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Soluble

- 7.1.2. Insoluble

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.1.1. Dairy

- 7.2.1.2. Snacks

- 7.2.1.3. Confectionery

- 7.2.1.4. Baked Goods

- 7.2.1.5. Other Products

- 7.2.2. Healthcare and Dietary Supplements

- 7.2.2.1. Infant Nutrition

- 7.2.3. Other Applications

- 7.2.1. Food and Beverages

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Rest of South America South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Soluble

- 8.1.2. Insoluble

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.1.1. Dairy

- 8.2.1.2. Snacks

- 8.2.1.3. Confectionery

- 8.2.1.4. Baked Goods

- 8.2.1.5. Other Products

- 8.2.2. Healthcare and Dietary Supplements

- 8.2.2.1. Infant Nutrition

- 8.2.3. Other Applications

- 8.2.1. Food and Beverages

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Givadaun SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Kemin Industries*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Associated British Foods

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tate & Lyle PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kerry Group PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Koninklijke DSM NV

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Lantmannen

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Lesaffre International

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Angel Yeast Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Biotec Pharmacon

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Givadaun SA

List of Figures

- Figure 1: South America Beta-Glucan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Beta-Glucan Market Share (%) by Company 2025

List of Tables

- Table 1: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 2: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South America Beta-Glucan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 6: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 10: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 14: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Beta-Glucan Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the South America Beta-Glucan Market?

Key companies in the market include Givadaun SA, Kemin Industries*List Not Exhaustive, Associated British Foods, Tate & Lyle PLC, Kerry Group PLC, Koninklijke DSM NV, Lantmannen, Lesaffre International, Angel Yeast Co Ltd, Biotec Pharmacon.

3. What are the main segments of the South America Beta-Glucan Market?

The market segments include Category, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Application in Dietary Supplements.

6. What are the notable trends driving market growth?

Increased Demand for Algae derived Beta Glucan in Dietary Supplements.

7. Are there any restraints impacting market growth?

Increasing prevalence of hydroglycemia.

8. Can you provide examples of recent developments in the market?

February 2024: Kemin Industries, a global ingredient manufacturer, opened an Innovation Center and second spray-drying facility at its regional headquarters in Vargeão, Santa Catarina, Brazil, making the Kemin Nutrisurance location the largest pet food manufacturing plant in Latin America by volume capacity for producing dry and liquid palatants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Beta-Glucan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Beta-Glucan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Beta-Glucan Market?

To stay informed about further developments, trends, and reports in the South America Beta-Glucan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence