Key Insights

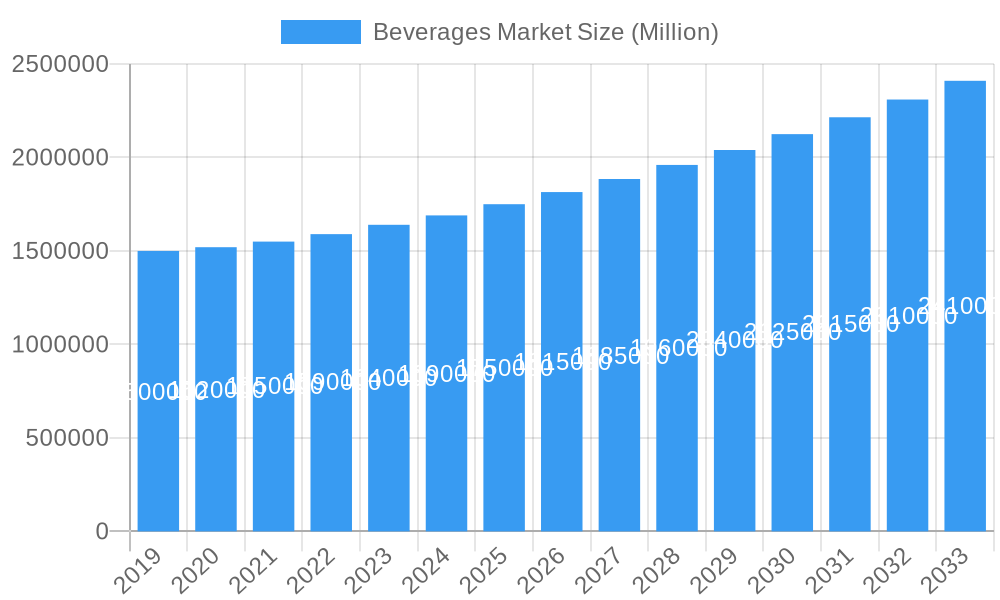

The global Beverages Market is poised for robust growth, projected to reach a substantial market size of approximately USD 1.75 trillion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.26% through 2033. This impressive expansion is fueled by a confluence of dynamic consumer preferences and evolving lifestyle trends. A key driver is the increasing demand for healthier and functional beverages, including energy and sports drinks, as consumers prioritize well-being and active lifestyles. The burgeoning popularity of ready-to-drink (RTD) beverages, encompassing tea, coffee, and alcoholic options, further propels market growth, catering to convenience-seeking demographics. Furthermore, the premiumization trend is evident across both alcoholic and non-alcoholic segments, with consumers willing to invest in higher-quality wines, spirits, and craft beers, as well as specialty packaged juices and artisanal teas. The growing disposable incomes in emerging economies, particularly in the Asia Pacific region, also contribute significantly to this upward trajectory, creating new consumer bases and increasing overall consumption.

Beverages Market Market Size (In Million)

However, the market is not without its challenges. Stringent regulations concerning sugar content, labeling, and marketing of certain beverage categories, especially in developed regions, pose a restraint. Fluctuations in raw material prices, such as those for coffee beans, tea leaves, and certain fruits, can impact profit margins for manufacturers. Despite these headwinds, strategic innovations in product development, sustainable packaging, and effective distribution strategies are expected to navigate these complexities. The proliferation of online retail channels is a transformative trend, offering consumers unparalleled access and convenience, and compelling traditional off-trade channels like supermarkets and convenience stores to adapt their offerings and strategies. Key players are actively investing in research and development to launch innovative products that align with evolving health consciousness and sustainability concerns, ensuring sustained market dynamism.

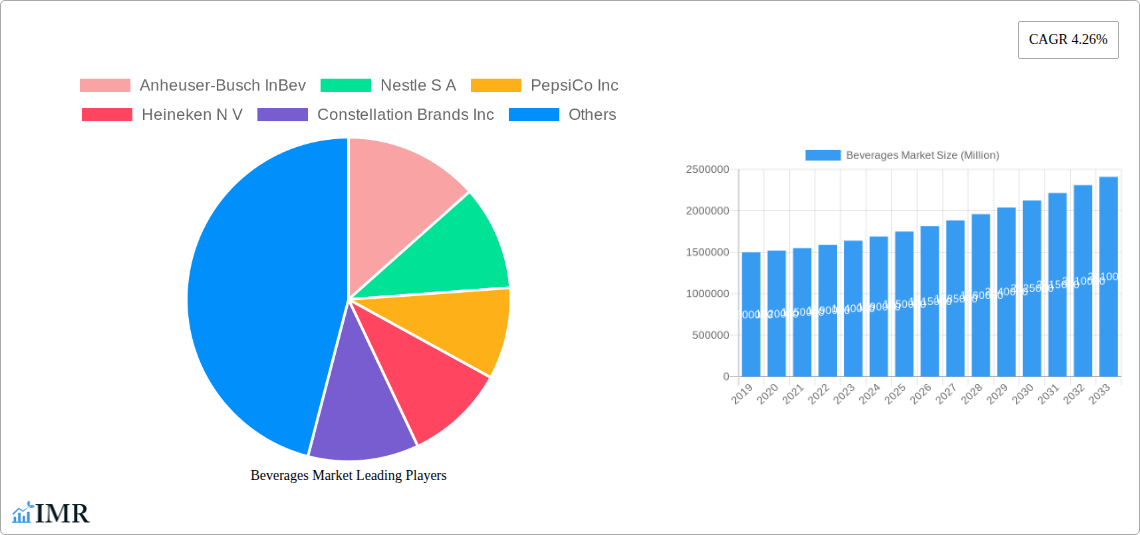

Beverages Market Company Market Share

Comprehensive Beverages Market Report: Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the global Beverages Market, covering its dynamics, growth trajectories, regional dominance, product landscape, key players, and future potential. Leveraging high-traffic keywords such as "Beverages Market," "Alcoholic Beverages," "Non-Alcoholic Beverages," "Energy Drinks Market," "Soft Drinks Market," "Bottled Water Market," and "Beer Market," this report is optimized for maximum search engine visibility and designed to engage industry professionals, investors, and stakeholders.

The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, incorporating historical data from 2019-2024. This report offers quantitative insights and qualitative analysis, identifying key drivers, barriers, and emerging opportunities to guide strategic decision-making.

Beverages Market Market Dynamics & Structure

The global Beverages Market is characterized by dynamic interplay between market concentration, technological innovation, regulatory frameworks, and evolving consumer preferences. Leading players like The Coca-Cola Company, PepsiCo Inc., and Anheuser-Busch InBev exert significant influence, driving innovation and shaping market trends. However, the presence of numerous regional and niche players fosters a competitive landscape. Technological advancements in production, packaging, and distribution are critical growth drivers, enabling companies to enhance product quality, efficiency, and reach. Regulatory frameworks, including those related to health, safety, and taxation, play a crucial role in shaping market access and product development. Competitive product substitutes, ranging from traditional beverages to functional drinks and plant-based alternatives, continuously challenge established market positions. End-user demographics, with a growing emphasis on health-conscious consumers and younger generations seeking novel experiences, are reshaping demand patterns. Mergers and acquisitions (M&A) are prevalent, as companies strategically consolidate to expand market share, acquire new technologies, and enter new geographies. For instance, the volume of M&A deals in the beverage sector has seen a consistent upward trend, indicating a strong drive for consolidation and growth.

- Market Concentration: Dominated by a few multinational corporations, but with significant room for specialized and regional players.

- Technological Innovation: Focus on sustainable packaging, functional ingredients, and advanced processing techniques.

- Regulatory Frameworks: Evolving regulations around sugar content, labeling, and environmental impact influencing product formulation and marketing.

- Competitive Product Substitutes: Increasing demand for healthier and plant-based alternatives to traditional soft drinks and alcoholic beverages.

- End-User Demographics: Younger consumers driving demand for RTD (Ready-to-Drink) formats, novel flavors, and premium products.

- M&A Trends: Strategic acquisitions to expand product portfolios and gain market share in high-growth segments.

Beverages Market Growth Trends & Insights

The global Beverages Market is poised for robust growth, driven by a confluence of evolving consumer behaviors, technological disruptions, and increasing global disposable incomes. The market size is projected to witness a significant expansion from approximately $1,600,000 million units in 2025 to an estimated $2,100,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 3.8%. This growth is propelled by the escalating adoption of innovative beverage categories, particularly within the non-alcoholic segment. Energy & Sports Drink and Bottled Water markets are experiencing accelerated adoption rates, fueled by growing health and wellness consciousness among consumers worldwide. Technological disruptions, including advancements in UHT processing, aseptic packaging, and smart beverage dispensing systems, are enhancing product shelf-life, convenience, and consumer engagement. Consumer behavior shifts are evident, with a pronounced trend towards premiumization, seeking beverages with functional benefits, natural ingredients, and sustainable sourcing. The demand for RTD (Ready-to-Drink) formats continues to surge across both alcoholic and non-alcoholic categories, catering to on-the-go lifestyles. Furthermore, the increasing penetration of online retail channels for beverage purchases is reshaping distribution strategies and expanding market access. The proliferation of personalized nutrition trends is also creating opportunities for niche beverage products tailored to specific dietary needs and preferences.

Dominant Regions, Countries, or Segments in Beverages Market

The global Beverages Market exhibits varied growth patterns across regions and segments, with certain areas and product categories demonstrating exceptional dominance and potential.

Product Type Dominance:

Non-Alcoholic Beverages: This segment is a significant growth engine, projected to command a substantial market share.

- Bottled Water: Continues its reign as a staple, driven by increasing health awareness and the demand for convenient hydration solutions. Its market penetration is exceptionally high in developed and developing economies alike.

- Soft Drinks: Despite evolving health concerns, carbonated soft drinks maintain a strong presence, with innovation in low-sugar and natural ingredient options driving sustained demand.

- Energy & Sports Drinks: Experiencing rapid growth, particularly among younger demographics, due to increased focus on performance and active lifestyles.

- Packaged Juice: Steady demand, with a growing preference for 100% natural and functional juices.

- RTD Tea and Coffee: Significant expansion driven by convenience and the burgeoning coffee culture, especially in urban centers.

Alcoholic Beverages: While facing regulatory scrutiny in some regions, this segment remains a substantial contributor.

- Beer: Holds the largest share within alcoholic beverages, with craft beer and premiumization trends fueling its growth.

- Spirits: Shows robust growth, driven by premiumization, cocktail culture, and innovation in flavored variants.

- Wine: Maintains a stable market, with growth influenced by consumer preferences for specific varietals and regions.

Distribution Channel Dominance:

- Off-trade: This channel, encompassing retail environments, dominates beverage sales.

- Supermarkets/Hypermarkets: The primary distribution hub, offering wide product variety and competitive pricing. Their market share is substantial due to their extensive reach and consumer trust.

- Convenience/Grocery Stores: Crucial for impulse purchases and immediate consumption, especially in urban and high-traffic areas.

- Online Retail Stores: Experiencing exponential growth, offering unparalleled convenience, wider selection, and often competitive pricing. This channel is critical for reaching younger, tech-savvy consumers.

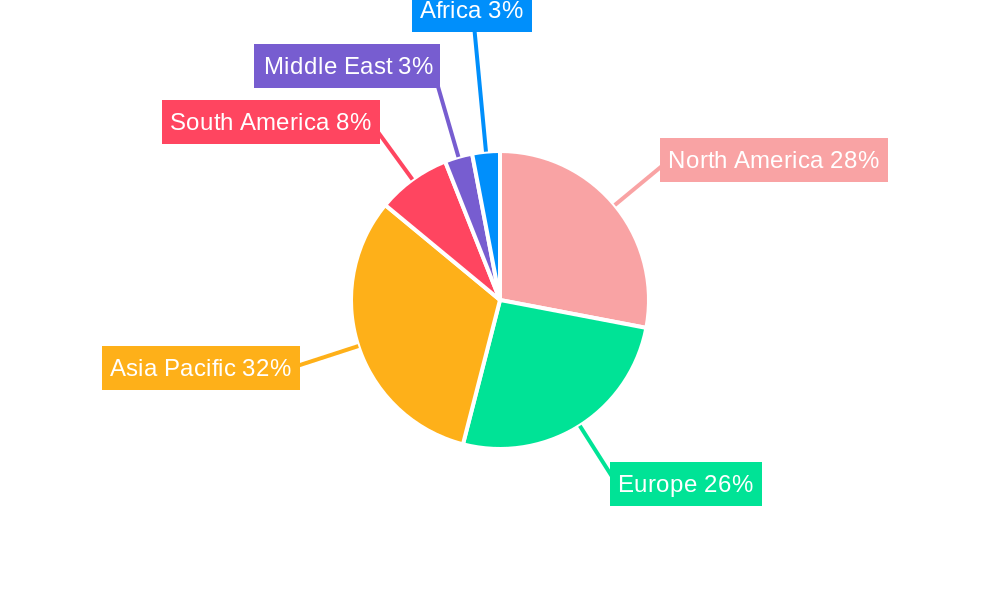

Regional Dominance:

- Asia-Pacific: This region is a powerhouse, driven by a massive population, rising disposable incomes, and increasing urbanization. Countries like China and India are key contributors to both alcoholic and non-alcoholic beverage consumption. The burgeoning middle class in this region is a significant factor.

- North America: A mature yet innovative market, characterized by high per capita consumption and a strong focus on health and wellness trends, particularly in the bottled water and functional beverage segments.

- Europe: A significant market with established brands and a strong appreciation for premium and craft beverages, both alcoholic and non-alcoholic.

Beverages Market Regional Market Share

Beverages Market Product Landscape

The Beverages Market product landscape is characterized by continuous innovation aimed at meeting diverse consumer needs and preferences. From traditional staples to novel functional concoctions, product development is driven by health, sustainability, and sensory experiences.

- Innovations in Alcoholic Beverages: The market is witnessing a surge in premiumization and the introduction of unique flavor profiles in beer, wine, and spirits. Craft beer continues its expansion, alongside a growing demand for ready-to-drink (RTD) alcoholic beverages offering convenience and novel taste combinations.

- Non-Alcoholic Beverage Advancements: This segment is a hotbed of innovation. Bottled water is evolving beyond basic hydration with infused flavors, functional additives, and electrolyte enrichment. Soft drinks are seeing a push towards natural sweeteners, lower sugar content, and unique botanical infusions. Energy and sports drinks are incorporating adaptogens and nootropics for cognitive and physical enhancement. RTD teas and coffees are diversifying with plant-based milk alternatives and exotic flavor profiles.

- Sustainable Packaging: A key technological advancement across all beverage categories, with a focus on recyclable materials, plant-based plastics, and reduced packaging weight to minimize environmental impact.

- Functional Benefits: A major trend, with beverages increasingly fortified with vitamins, minerals, probiotics, and other ingredients purported to offer health advantages, from immune support to stress reduction.

Key Drivers, Barriers & Challenges in Beverages Market

Key Drivers:

- Growing Health and Wellness Consciousness: A paramount driver, fueling demand for healthier alternatives, functional beverages, and natural ingredients. This includes a shift towards low-sugar, organic, and plant-based options.

- Rising Disposable Incomes: Particularly in emerging economies, increased purchasing power enables consumers to spend more on a wider variety of beverages, including premium and specialized products.

- Convenience and On-the-Go Lifestyles: The demand for RTD (Ready-to-Drink) formats in both alcoholic and non-alcoholic categories is a significant growth catalyst, catering to busy schedules.

- Technological Advancements in Production and Packaging: Innovations in processing, preservation, and packaging extend shelf life, improve product quality, and enhance consumer convenience and sustainability.

- Expanding E-commerce and Digitalization: Online retail channels provide greater accessibility and a wider product selection, transforming purchasing habits and market reach.

- Urbanization and Youth Demographics: Urban populations and a growing youth demographic are key consumers, often driving trends in novel flavors, energy drinks, and RTD alcoholic beverages.

Barriers & Challenges:

- Stringent Regulatory Frameworks: Evolving regulations concerning sugar taxes, ingredient labeling, health claims, and environmental impact can pose challenges for product development and marketing strategies. For instance, a 5% increase in sugar taxes in certain markets has led to a 2-4% decrease in sales of affected soft drinks.

- Supply Chain Disruptions: Volatility in raw material prices (e.g., agricultural commodities for juices, grains for beer), logistics challenges, and geopolitical events can impact production costs and product availability.

- Intense Competition and Market Saturation: The presence of numerous established brands and new entrants leads to fierce price competition and the need for continuous product differentiation.

- Consumer Skepticism and Health Concerns: Negative perceptions regarding artificial ingredients, high sugar content, and the health impacts of certain beverages can lead to consumer avoidance and a shift towards perceived healthier alternatives.

- Sustainability Pressures and Consumer Expectations: Increasing consumer demand for eco-friendly packaging and ethical sourcing adds complexity and cost to production processes.

- Economic Downturns and Reduced Consumer Spending: Economic slowdowns can lead to reduced discretionary spending on non-essential beverage categories.

Emerging Opportunities in Beverages Market

The Beverages Market is ripe with emerging opportunities driven by evolving consumer preferences and technological advancements.

- Functional Beverages with Proven Health Benefits: Growing consumer interest in beverages that offer tangible health advantages, such as immune support, cognitive enhancement, and gut health, presents a significant growth avenue. This includes beverages fortified with vitamins, probiotics, adaptogens, and nootropics.

- Plant-Based and Alternative Dairy Beverages: The sustained rise in veganism and lactose intolerance fuels the demand for plant-based milk alternatives, yogurts, and other dairy-free beverages across various categories.

- Low- and No-Alcoholic Beverages: The sober-curious movement and a desire for healthier social options are creating substantial growth opportunities for sophisticated non-alcoholic wines, beers, and spirits that mimic the taste and experience of their alcoholic counterparts.

- Personalized and Customizable Beverages: Leveraging AI and data analytics to offer tailored beverage formulations based on individual health profiles, taste preferences, and dietary needs represents a future frontier.

- Sustainable and Ethical Sourcing: Consumers are increasingly prioritizing brands that demonstrate a commitment to environmental sustainability, ethical labor practices, and transparent sourcing, creating opportunities for brands with strong ESG credentials.

- Innovative Flavors and Experiences: Continuous exploration of unique, exotic, and globally inspired flavors, as well as novel textures and formats, will captivate consumer curiosity and drive demand.

Growth Accelerators in the Beverages Market Industry

Several key catalysts are propelling long-term growth within the Beverages Market. Technological breakthroughs in formulation and processing enable the creation of beverages with enhanced nutritional profiles and novel sensory experiences, such as plant-based proteins and natural flavor encapsulation. Strategic partnerships between beverage companies and health and wellness influencers, as well as collaborations with ingredient suppliers specializing in functional components, are crucial for innovation and market penetration. Market expansion strategies, including targeting underserved demographics and geographical regions, are vital for capturing new consumer bases. Furthermore, the increasing adoption of sustainable practices and packaging solutions resonates with environmentally conscious consumers, fostering brand loyalty and driving sales. The development of sophisticated distribution networks, including direct-to-consumer (DTC) models and enhanced online retail presence, also accelerates market reach and accessibility.

Key Players Shaping the Beverages Market Market

- Anheuser-Busch InBev

- Nestle S A

- PepsiCo Inc

- Heineken N V

- Constellation Brands Inc

- Suntory Holdings Limited

- Red Bull GmbH

- Keurig Dr Pepper

- The Coca-Cola Company

- Diageo plc

Notable Milestones in Beverages Market Sector

- March 2023: Red Bull unveiled its Summer Edition product line in the United Kingdom, featuring an exciting new flavor - Juneberry. These Juneberry-flavored energy drinks are now widely accessible, being distributed across major retailers throughout the country. Consumers can enjoy them in both single-serving and multipack options.

- October 2022: VictoriaTM introduced Vicky Chamoy, a unique beer with a Mexican twist. Infused with the distinct flavors of chamoy, this beer offers a delightful blend of sweet, salty, spicy, and sour notes. Imported from Mexico, Vicky Chamoy is available in convenient 24-ounce single-serve cans.

- October 2022: Budweiser APAC opened its state-of-the-art brewery in Putian, China. This strategic move is part of Anheuser-Busch InBev's plan to drive economic growth in China and cater to the evolving preferences of consumers. Situated in the Fujian province, this Budweiser craft brewery stands as the largest of its kind in the Asia-Pacific region.

In-Depth Beverages Market Market Outlook

The Beverages Market outlook remains exceptionally positive, driven by a sustained demand for both established and innovative product categories. Growth accelerators such as the burgeoning functional beverage segment, the increasing adoption of plant-based and low/no-alcohol alternatives, and the expansion of online retail channels are set to redefine market dynamics. Strategic opportunities lie in catering to the growing health-conscious consumer base, embracing sustainable production and packaging, and leveraging data analytics for personalized product offerings. Companies that prioritize innovation, adapt to evolving consumer trends, and build robust, sustainable supply chains will be best positioned to capitalize on the significant future market potential. The convergence of technology, health, and convenience will continue to shape the landscape, ensuring a dynamic and expanding market for years to come.

Beverages Market Segmentation

-

1. Product Type

-

1.1. Alcoholic Beverages

- 1.1.1. Beer

- 1.1.2. Wine

- 1.1.3. Spirits

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Energy & Sports Drink

- 1.2.2. Soft Drinks

- 1.2.3. Bottled Water

- 1.2.4. Packaged Juice

- 1.2.5. RTD Tea and Coffee

- 1.2.6. Other Non-Alcoholic Beverages

-

1.1. Alcoholic Beverages

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off Trade Channels

Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Beverages Market Regional Market Share

Geographic Coverage of Beverages Market

Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated With Beverages

- 3.4. Market Trends

- 3.4.1. Consumer Inclination Toward Sugar-Free Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcoholic Beverages

- 5.1.1.1. Beer

- 5.1.1.2. Wine

- 5.1.1.3. Spirits

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Energy & Sports Drink

- 5.1.2.2. Soft Drinks

- 5.1.2.3. Bottled Water

- 5.1.2.4. Packaged Juice

- 5.1.2.5. RTD Tea and Coffee

- 5.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1. Alcoholic Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Alcoholic Beverages

- 6.1.1.1. Beer

- 6.1.1.2. Wine

- 6.1.1.3. Spirits

- 6.1.2. Non-Alcoholic Beverages

- 6.1.2.1. Energy & Sports Drink

- 6.1.2.2. Soft Drinks

- 6.1.2.3. Bottled Water

- 6.1.2.4. Packaged Juice

- 6.1.2.5. RTD Tea and Coffee

- 6.1.2.6. Other Non-Alcoholic Beverages

- 6.1.1. Alcoholic Beverages

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Retail Stores

- 6.2.2.4. Other Off Trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Alcoholic Beverages

- 7.1.1.1. Beer

- 7.1.1.2. Wine

- 7.1.1.3. Spirits

- 7.1.2. Non-Alcoholic Beverages

- 7.1.2.1. Energy & Sports Drink

- 7.1.2.2. Soft Drinks

- 7.1.2.3. Bottled Water

- 7.1.2.4. Packaged Juice

- 7.1.2.5. RTD Tea and Coffee

- 7.1.2.6. Other Non-Alcoholic Beverages

- 7.1.1. Alcoholic Beverages

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Retail Stores

- 7.2.2.4. Other Off Trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Alcoholic Beverages

- 8.1.1.1. Beer

- 8.1.1.2. Wine

- 8.1.1.3. Spirits

- 8.1.2. Non-Alcoholic Beverages

- 8.1.2.1. Energy & Sports Drink

- 8.1.2.2. Soft Drinks

- 8.1.2.3. Bottled Water

- 8.1.2.4. Packaged Juice

- 8.1.2.5. RTD Tea and Coffee

- 8.1.2.6. Other Non-Alcoholic Beverages

- 8.1.1. Alcoholic Beverages

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Retail Stores

- 8.2.2.4. Other Off Trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Alcoholic Beverages

- 9.1.1.1. Beer

- 9.1.1.2. Wine

- 9.1.1.3. Spirits

- 9.1.2. Non-Alcoholic Beverages

- 9.1.2.1. Energy & Sports Drink

- 9.1.2.2. Soft Drinks

- 9.1.2.3. Bottled Water

- 9.1.2.4. Packaged Juice

- 9.1.2.5. RTD Tea and Coffee

- 9.1.2.6. Other Non-Alcoholic Beverages

- 9.1.1. Alcoholic Beverages

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Retail Stores

- 9.2.2.4. Other Off Trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Alcoholic Beverages

- 10.1.1.1. Beer

- 10.1.1.2. Wine

- 10.1.1.3. Spirits

- 10.1.2. Non-Alcoholic Beverages

- 10.1.2.1. Energy & Sports Drink

- 10.1.2.2. Soft Drinks

- 10.1.2.3. Bottled Water

- 10.1.2.4. Packaged Juice

- 10.1.2.5. RTD Tea and Coffee

- 10.1.2.6. Other Non-Alcoholic Beverages

- 10.1.1. Alcoholic Beverages

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Retail Stores

- 10.2.2.4. Other Off Trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Beverages Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Alcoholic Beverages

- 11.1.1.1. Beer

- 11.1.1.2. Wine

- 11.1.1.3. Spirits

- 11.1.2. Non-Alcoholic Beverages

- 11.1.2.1. Energy & Sports Drink

- 11.1.2.2. Soft Drinks

- 11.1.2.3. Bottled Water

- 11.1.2.4. Packaged Juice

- 11.1.2.5. RTD Tea and Coffee

- 11.1.2.6. Other Non-Alcoholic Beverages

- 11.1.1. Alcoholic Beverages

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience/Grocery Stores

- 11.2.2.3. Online Retail Stores

- 11.2.2.4. Other Off Trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Anheuser-Busch InBev

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nestle S A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PepsiCo Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Heineken N V

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Constellation Brands Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Suntory Holdings Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Red Bull GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Keurig Dr Pepper*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Coca-Cola Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Diageo plc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: Global Beverages Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Saudi Arabia Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Saudi Arabia Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Beverages Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 39: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: South Africa Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beverages Market?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the Beverages Market?

Key companies in the market include Anheuser-Busch InBev, Nestle S A, PepsiCo Inc, Heineken N V, Constellation Brands Inc, Suntory Holdings Limited, Red Bull GmbH, Keurig Dr Pepper*List Not Exhaustive, The Coca-Cola Company, Diageo plc.

3. What are the main segments of the Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks.

6. What are the notable trends driving market growth?

Consumer Inclination Toward Sugar-Free Drinks.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated With Beverages.

8. Can you provide examples of recent developments in the market?

March 2023: Red Bull unveiled its Summer Edition product line in the United Kingdom, featuring an exciting new flavor - Juneberry. These Juneberry-flavored energy drinks are now widely accessible, being distributed across major retailers throughout the country. Consumers can enjoy them in both single-serving and multipack options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beverages Market?

To stay informed about further developments, trends, and reports in the Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence