Key Insights

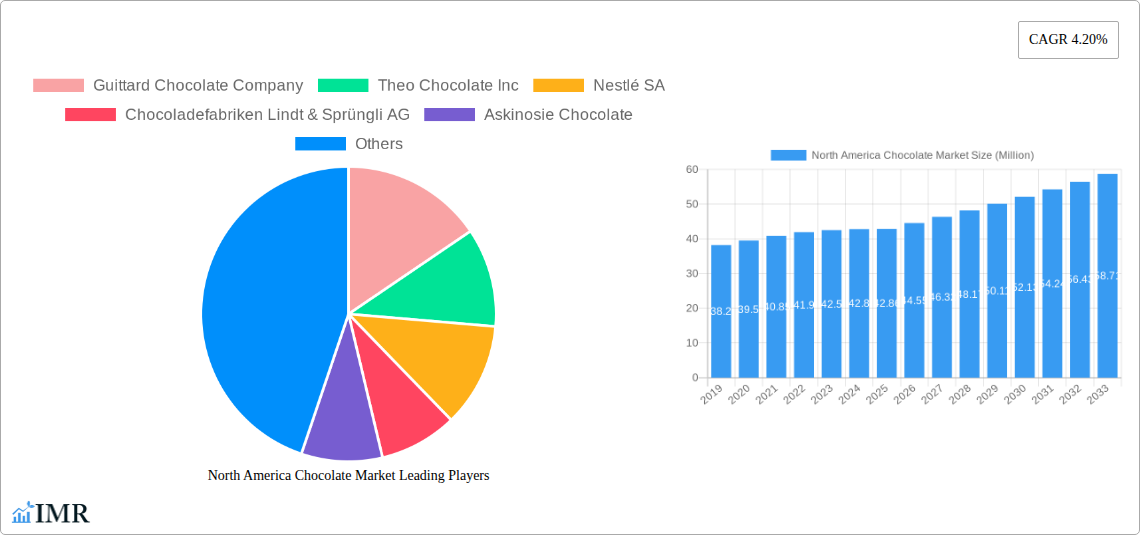

The North America Chocolate Market is projected for robust growth, with a current estimated market size of approximately USD 42.86 million in the base year 2025. This segment is expected to expand at a Compound Annual Growth Rate (CAGR) of 4.20% during the forecast period of 2025-2033. The market's expansion is propelled by a confluence of factors, including an increasing consumer preference for premium and artisanal chocolate varieties, particularly dark and milk chocolate. This trend is bolstered by growing health consciousness, with consumers seeking out dark chocolate for its perceived health benefits and antioxidants. Furthermore, evolving distribution channels, with a significant surge in online retail alongside traditional convenience stores and supermarkets/hypermarkets, are making a wider array of chocolate products more accessible to a larger consumer base. The demand is also influenced by product innovation, with manufacturers continuously introducing new flavors, formats, and ethically sourced options to cater to diverse and discerning palates. The significant presence of key industry players like Nestlé SA, Mondelēz International Inc., and The Hershey Company underscores a competitive landscape, driving investment in product development and marketing.

North America Chocolate Market Market Size (In Million)

Looking ahead, the market is poised to benefit from sustained consumer spending and a growing demand for indulgence and gifting occasions. While market growth is strong, it will likely be influenced by fluctuating raw material costs, particularly cocoa and sugar, which can present a degree of restraint. However, these challenges are often mitigated by strategic sourcing and innovative product formulations. The segmentation within the market, encompassing confectionery variants like dark, milk, and white chocolate, and distribution channels from convenience stores to e-commerce platforms, offers significant opportunities for targeted marketing and product development. The North American region, encompassing the United States, Canada, and Mexico, is expected to remain a dominant force in this market due to its mature consumer base and high disposable incomes. Continued emphasis on sustainable sourcing and ethical practices will also play a crucial role in shaping consumer choices and brand loyalty in the coming years.

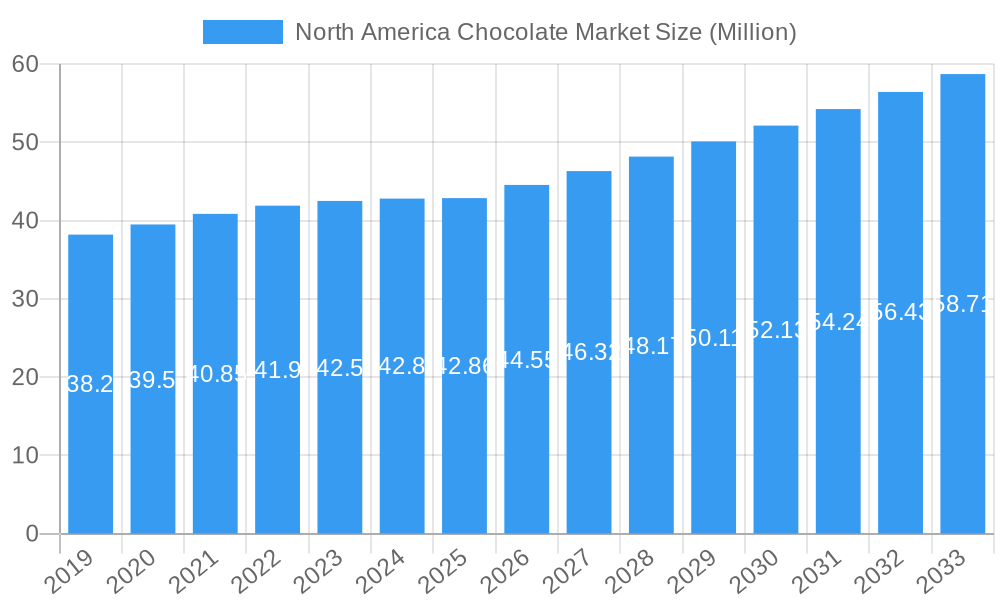

North America Chocolate Market Company Market Share

North America Chocolate Market: Comprehensive Report & Outlook (2019-2033)

This comprehensive report delves into the dynamic North America chocolate market, offering deep insights into market structure, growth trends, regional dominance, product landscape, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this analysis utilizes granular data to equip industry professionals with actionable intelligence. We explore the intricate interplay of consumer preferences, technological advancements, and regulatory landscapes shaping the future of premium and mass-market chocolate consumption. Discover critical opportunities, emerging trends, and strategic imperatives for navigating this evolving confectionery sector. All values presented in Million Units.

North America Chocolate Market Market Dynamics & Structure

The North America chocolate market is characterized by a moderately concentrated structure, with a blend of global giants and artisanal players vying for market share. Technological innovation remains a pivotal driver, influencing product development, manufacturing efficiency, and distribution strategies. From advanced cocoa processing techniques to the integration of AI in supply chain management, innovation is key to maintaining a competitive edge. The regulatory framework, encompassing food safety standards, labeling requirements, and ethical sourcing mandates, also plays a significant role in shaping market operations and consumer trust. Competitive product substitutes, ranging from other confectionery items to healthier snack alternatives, constantly challenge chocolate's dominance, necessitating continuous product differentiation and value proposition enhancement.

- Market Concentration: Dominated by key players with established brand recognition, but with growing space for niche and premium brands.

- Technological Innovation Drivers: Automation in manufacturing, sustainable sourcing technologies, and personalized product development are key trends.

- Regulatory Frameworks: Strict adherence to FDA and Health Canada regulations for food safety and labeling. Growing emphasis on fair trade and sustainability certifications.

- Competitive Product Substitutes: Impact of healthier snack options, sugar-free alternatives, and other confectionery categories.

- End-User Demographics: Shifting consumer preferences towards premium, ethically sourced, and healthier chocolate options.

- M&A Trends: Strategic acquisitions to expand product portfolios, gain market share, and integrate new technologies. For instance, approximately 15-20 M&A deals are anticipated annually between 2025-2030, focusing on specialized chocolate brands and ingredient suppliers.

North America Chocolate Market Growth Trends & Insights

The North America chocolate market has witnessed consistent growth, driven by evolving consumer behaviors and increasing disposable incomes. Market size has expanded from an estimated 1,500 million units in 2019 to a projected 1,850 million units in 2025. This growth is further fueled by the rising adoption of premium and artisanal chocolates, as consumers increasingly seek unique flavor profiles, high-quality ingredients, and ethical sourcing. Technological disruptions, such as advancements in tempering and molding techniques, allow for the creation of intricate and visually appealing chocolate products, enhancing their appeal. Consumer behavior shifts are marked by a growing demand for dark chocolate due to its perceived health benefits, alongside a sustained preference for the indulgent nature of milk and white chocolate. The online retail channel has become a significant growth engine, offering convenience and wider product selection, contributing an estimated 25% of the market's total sales by 2025.

The forecast period of 2025-2033 predicts a Compound Annual Growth Rate (CAGR) of approximately 4.5%, indicating a robust and sustained expansion trajectory. This growth will be underpinned by the increasing popularity of dark chocolate variants, which are projected to capture a significant portion of market share due to their antioxidant properties and less sweet profile. The health and wellness trend continues to influence product development, leading to innovations in sugar-free, low-calorie, and plant-based chocolate offerings. Furthermore, the personalization of chocolate experiences, driven by data analytics and direct-to-consumer (DTC) models, is set to become a major differentiator. As supply chain efficiencies improve and sustainability initiatives gain traction, the market is poised for further penetration into various consumer segments.

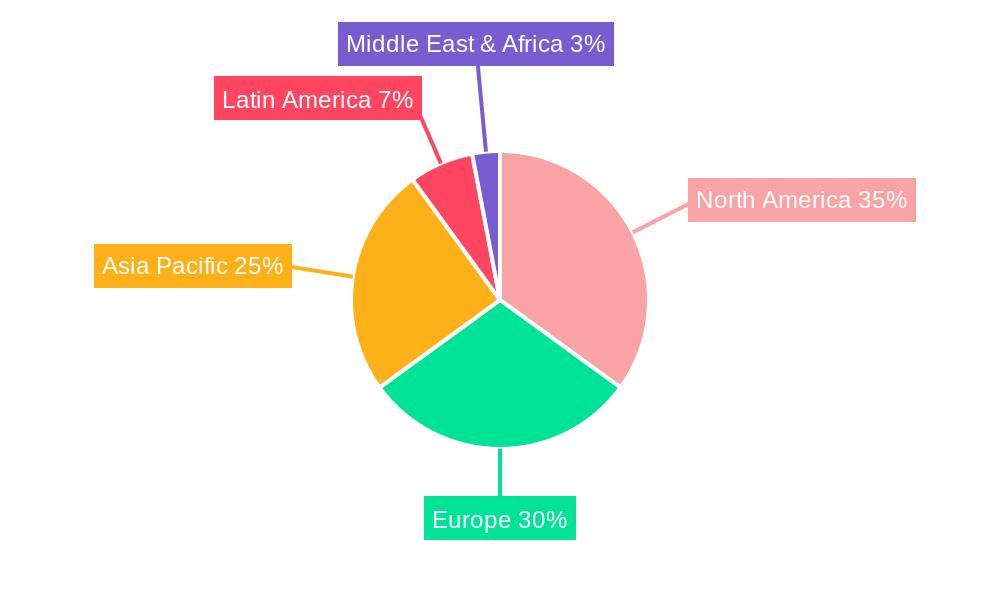

Dominant Regions, Countries, or Segments in North America Chocolate Market

The United States stands as the dominant region within the North America chocolate market, consistently accounting for over 70% of the total market share. This dominance is attributed to its large consumer base, high per capita income, and a well-established culture of chocolate consumption, both for everyday indulgence and gifting occasions. Within the United States, states with higher population density and greater disposable income, such as California, Texas, and New York, lead in chocolate sales. The "Confectionery" segment, encompassing a wide array of chocolate bars, boxes, and novelty items, is the primary driver of market growth.

Within the "Confectionery Variant" parent market, "Milk and White Chocolate" collectively hold the largest share, estimated at around 60% of the total market. This is due to their widespread appeal, versatility in various confectionery applications, and established consumer preference for their sweet and creamy profiles. However, "Dark Chocolate" is exhibiting a faster growth rate, projected to increase its market share from approximately 30% in 2025 to over 35% by 2033, driven by increasing health consciousness and a growing appreciation for complex flavor profiles.

The "Supermarket/Hypermarket" distribution channel continues to be the most significant contributor to sales, accounting for an estimated 55% of the market in 2025. These large retail formats offer extensive product variety, competitive pricing, and convenient shopping experiences for a broad consumer base. However, the "Online Retail Store" segment is experiencing the most rapid expansion, with its market share projected to grow from 20% in 2025 to over 30% by 2033. This surge is propelled by the convenience of e-commerce, the ability to access a wider range of specialty and artisanal chocolates, and the increasing adoption of online shopping by all age demographics.

- Dominant Region: United States, contributing over 70% of the North American market value.

- Key Country Drivers (USA): Large consumer base, high disposable income, strong brand loyalty, and diverse retail infrastructure.

- Dominant Segment (Parent): Confectionery.

- Dominant Variant: Milk and White Chocolate, with Dark Chocolate showing significant growth potential.

- Dominant Distribution Channel: Supermarket/Hypermarket, with Online Retail Stores exhibiting the fastest growth.

North America Chocolate Market Product Landscape

The North America chocolate market is characterized by a vibrant product landscape focused on innovation, premiumization, and evolving consumer demands. Manufacturers are increasingly investing in developing artisanal and gourmet chocolate bars with unique flavor infusions like sea salt caramel, chili, and exotic fruits. The demand for healthier options is driving the development of dark chocolate variants with higher cocoa percentages, sugar-free formulations, and plant-based alternatives made with oat or almond milk. Performance metrics are closely monitored, with a focus on ingredient quality, ethical sourcing certifications (e.g., Fair Trade, Rainforest Alliance), and appealing packaging that communicates premium value.

Key Drivers, Barriers & Challenges in North America Chocolate Market

Key Drivers:

- Premiumization and Indulgence: Consumers are increasingly willing to spend more on high-quality, artisanal chocolates for gifting and personal enjoyment.

- Health and Wellness Trends: Growing demand for dark chocolate, sugar-free, and plant-based options due to perceived health benefits.

- E-commerce Growth: The convenience and accessibility of online retail channels are significantly boosting sales and market reach.

- Innovation in Flavors and Formats: Continuous introduction of new flavor combinations and product formats to cater to evolving tastes.

Barriers & Challenges:

- Fluctuating Cocoa Prices: Volatility in global cocoa bean prices impacts production costs and profitability. The market can experience price increases of up to 15% due to supply chain disruptions.

- Supply Chain Disruptions: Geopolitical events, climate change, and logistical challenges can affect the availability and cost of raw materials.

- Intense Competition: A crowded market with numerous players, from global corporations to small craft chocolatiers, creates significant competitive pressure.

- Consumer Price Sensitivity: While premiumization is a trend, a segment of the market remains price-sensitive, posing a challenge for higher-priced products.

- Regulatory Compliance: Adherence to stringent food safety and labeling regulations across different North American countries adds to operational complexity and cost.

Emerging Opportunities in North America Chocolate Market

Emerging opportunities in the North America chocolate market lie in catering to niche consumer segments and embracing innovative product development. The growing demand for functional chocolates, fortified with vitamins, minerals, or adaptogens, presents a significant untapped market. Furthermore, the expansion of plant-based chocolate offerings, beyond simple vegan alternatives, to include sophisticated flavor profiles and textures is a key area for growth. The increasing interest in sustainable and ethically sourced products creates opportunities for brands with transparent supply chains and a strong commitment to environmental and social responsibility. Direct-to-consumer (DTC) models and subscription boxes offer personalized experiences and foster brand loyalty, especially for artisanal and specialty chocolate producers.

Growth Accelerators in the North America Chocolate Market Industry

Several catalysts are driving the long-term growth of the North America chocolate market. Technological breakthroughs in cocoa bean processing and chocolate manufacturing are enabling the creation of superior textures and novel flavor profiles, enhancing consumer appeal. Strategic partnerships between chocolate manufacturers and ingredient suppliers are fostering innovation in healthier and sustainable product development. Market expansion strategies, including penetration into emerging urban centers and the development of localized product offerings, are crucial for capturing new consumer bases. The increasing consumer awareness of the health benefits associated with dark chocolate and ethically sourced cocoa further propels market expansion.

Key Players Shaping the North America Chocolate Market Market

- Guittard Chocolate Company

- Theo Chocolate Inc

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Askinosie Chocolate

- Albanese Confectionery Group Inc

- Ezaki Glico Co Ltd

- Vosges Haut-Chocolat LLC

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A

- Lake Champlain Chocolates

- Mast Brothers & Co

- Mondelēz International Inc

- The Hershey Company

Notable Milestones in North America Chocolate Market Sector

- November 2022: Yıldız Holding AS' brand GODIVA launched "Holiday Collection Packs" of premium chocolates. The chocolate packs include Milk Chocolate Praline Heart, Midnight Swirl, and White Chocolate Raspberry Star, enhancing seasonal gifting options.

- October 2022: Lindt & Sprungli USA launched its first-ever 3D virtual store. Lindt's new online storefront allows consumers across the country to engage in the enchanting brand experience of a Lindt Chocolate store from the comfort of their homes or even on the go, expanding digital retail presence.

- October 2022: Mondelēz International introduced Cadbury’s Plant Bar, a vegan chocolate version of the brand’s famous Dairy Milk bar, to the Canadian market, catering to the growing demand for plant-based alternatives.

In-Depth North America Chocolate Market Market Outlook

The North America chocolate market is poised for sustained growth, driven by a confluence of factors including evolving consumer preferences towards premium and healthier options, and continuous innovation in product development. The increasing penetration of e-commerce channels offers significant potential for market expansion, particularly for niche and artisanal brands. Growth accelerators such as advancements in sustainable sourcing practices and the development of functional chocolate variants will further bolster market performance. Strategic investments in R&D, coupled with a keen understanding of emerging consumer trends, will be crucial for stakeholders to capitalize on future market potential and secure a competitive advantage in this dynamic confectionery landscape.

North America Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

North America Chocolate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Chocolate Market Regional Market Share

Geographic Coverage of North America Chocolate Market

North America Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Guittard Chocolate Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Theo Chocolate Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestlé SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Askinosie Chocolate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Albanese Confectionery Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ezaki Glico Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vosges Haut-Chocolat LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ferrero International SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mars Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yıldız Holding A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lake Champlain Chocolates

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mast Brothers & Co

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mondelēz International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 The Hershey Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Guittard Chocolate Company

List of Figures

- Figure 1: North America Chocolate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: North America Chocolate Market Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 2: North America Chocolate Market Volume Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 3: North America Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Chocolate Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Chocolate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Chocolate Market Volume Tons Forecast, by Region 2020 & 2033

- Table 7: North America Chocolate Market Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 8: North America Chocolate Market Volume Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 9: North America Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Chocolate Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Chocolate Market Volume Tons Forecast, by Country 2020 & 2033

- Table 13: United States North America Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Chocolate Market Volume (Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Chocolate Market Volume (Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Chocolate Market Volume (Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Chocolate Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the North America Chocolate Market?

Key companies in the market include Guittard Chocolate Company, Theo Chocolate Inc, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Askinosie Chocolate, Albanese Confectionery Group Inc, Ezaki Glico Co Ltd, Vosges Haut-Chocolat LLC, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Lake Champlain Chocolates, Mast Brothers & Co, Mondelēz International Inc, The Hershey Company.

3. What are the main segments of the North America Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

November 2022: Yıldız Holding AS' brand GODIVA launched "Holiday Collection Packs" of premium chocolates. The chocolate packs include Milk Chocolate Praline Heart, Midnight Swirl, and White Chocolate Raspberry Star.October 2022: Lindt & Sprungli USA launched its first-ever 3D virtual store. Lindt's new online storefront allows consumers across the country to engage in the enchanting brand experience of a Lindt Chocolate store from the comfort of their homes or even on the go.October 2022: Mondelēz International introduced Cadbury’s Plant Bar, a vegan chocolate version of the brand’s famous Dairy Milk bar, to the Canadian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Chocolate Market?

To stay informed about further developments, trends, and reports in the North America Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence