Key Insights

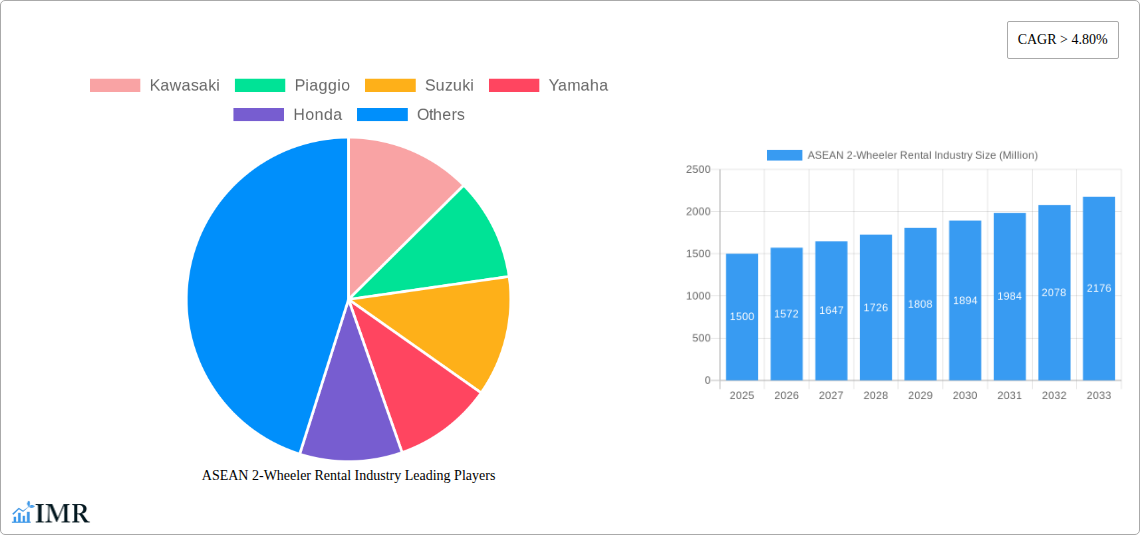

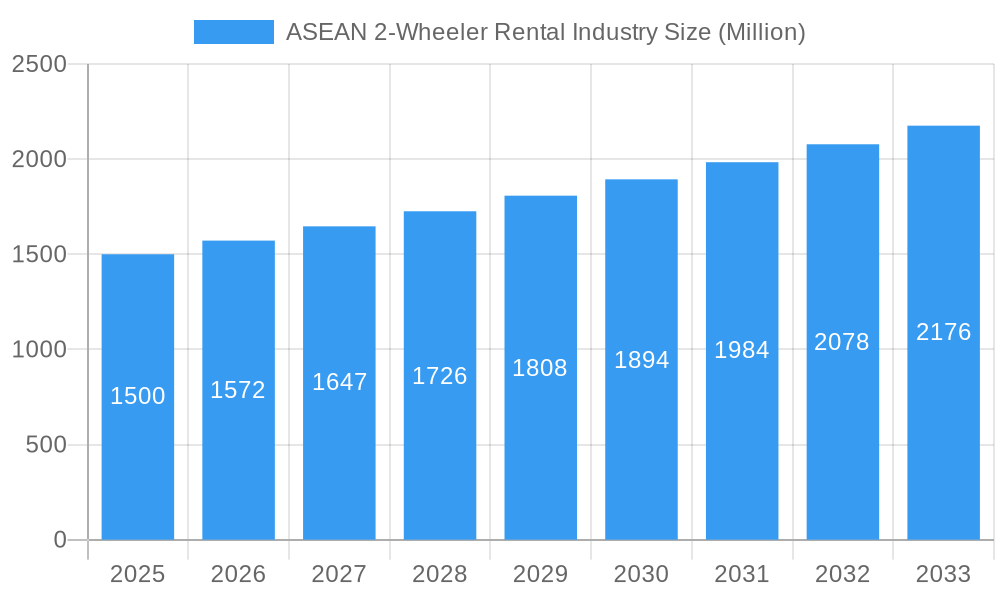

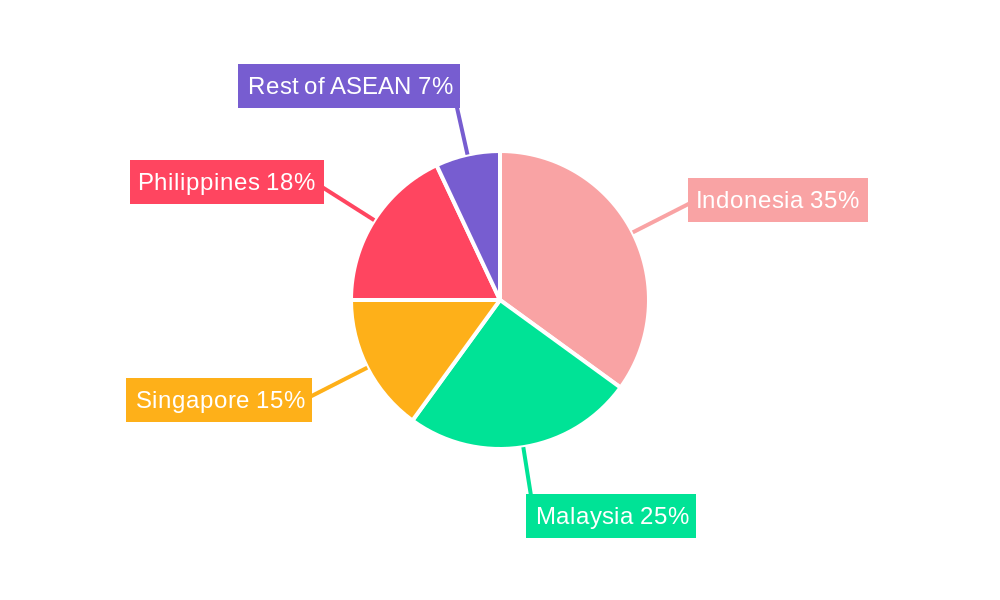

The ASEAN two-wheeler rental market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 8% from the base year 2024 to 2033. This growth is propelled by surging motorcycle and scooter tourism, particularly among younger demographics, alongside increasing urbanization and rising car ownership costs in major ASEAN cities. These factors are driving a shift towards more economical and efficient two-wheeler rentals for daily commuting. The market is segmented by vehicle type (motorcycles, scooters/mopeds), rental duration (short-term, long-term), and application (tourism, daily commuting). Key growth areas include Indonesia, Malaysia, Singapore, and the Philippines, supported by infrastructure development and tourism initiatives. Leading players such as Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, and BMW, alongside numerous local operators, are shaping the competitive landscape.

ASEAN 2-Wheeler Rental Industry Market Size (In Billion)

The long-term outlook for the ASEAN two-wheeler rental market remains optimistic, dependent on sustained regional economic growth and infrastructure improvements. Potential challenges include navigating regulatory complexities, enhancing safety standards and rider training, and managing fuel price volatility. Successful market penetration will rely on targeted marketing strategies emphasizing convenience, affordability, and safety. The growing influence of two-wheeler ride-hailing services necessitates adaptive business models from rental providers.

ASEAN 2-Wheeler Rental Industry Company Market Share

This report offers an in-depth analysis of the ASEAN two-wheeler rental market, covering historical data (2019-2024), the base year (2024), and a detailed forecast (2025-2033). It provides critical insights for industry professionals and investors on market dynamics, growth trends, dominant segments, and key players. The total market size is valued at $2.27 billion and is segmented by vehicle type (Motorcycle, Scooter/Moped), rental duration (Short-term, Long-term), and application (Tourism, Daily Commuting).

ASEAN 2-Wheeler Rental Industry Market Dynamics & Structure

This section dissects the ASEAN 2-wheeler rental market's structure, identifying key dynamics influencing its growth. We analyze market concentration, revealing the market share held by major players and the level of competition. Technological innovation, including the adoption of electric vehicles and mobile booking platforms, is explored alongside its impact. Regulatory frameworks and their influence on market access and operations are also examined. Further analysis includes a study of competitive substitutes (e.g., ride-hailing services), end-user demographics (age, income, and travel preferences), and recent merger and acquisition (M&A) trends within the sector. Quantitative insights, such as market share percentages and M&A deal volumes (XX Million units for 2019-2024), are provided, alongside qualitative assessments of innovation barriers and other limiting factors.

- Market Concentration: XX% concentrated amongst top 5 players in 2024.

- Technological Innovation: Rapid adoption of mobile apps and GPS tracking systems.

- Regulatory Landscape: Varying regulations across ASEAN countries impacting operations.

- Competitive Substitutes: Growing competition from ride-hailing services and private car ownership.

- M&A Activity: XX deals recorded between 2019 and 2024, totaling XX Million units in market value.

- End-User Demographics: Significant growth driven by young professionals and tourists.

ASEAN 2-Wheeler Rental Industry Growth Trends & Insights

This section presents a detailed analysis of the ASEAN 2-wheeler rental market's growth trajectory from 2019 to 2033. We examine market size evolution, adoption rates across different segments, technological disruptions impacting the industry, and shifts in consumer behavior. Key performance indicators such as the Compound Annual Growth Rate (CAGR) and market penetration rates are provided, offering granular insights into market performance. The impact of economic fluctuations, changing consumer preferences, and evolving travel patterns on market growth is discussed in detail. The analysis leverages extensive primary and secondary research to provide a comprehensive and accurate picture of market trends.

- Market Size: XX Million units in 2024, projected to reach XX Million units by 2033.

- CAGR (2025-2033): XX%

- Market Penetration: XX% in 2024, expected to increase to XX% by 2033.

- Technological Disruptions: Impact of electric two-wheelers and shared mobility platforms.

- Consumer Behavior: Increasing preference for convenience and cost-effectiveness.

Dominant Regions, Countries, or Segments in ASEAN 2-Wheeler Rental Industry

This section identifies the leading regions, countries, and segments within the ASEAN 2-wheeler rental market driving its growth. We analyze the market share and growth potential of different vehicle types (motorcycles, scooters/mopeds), rental durations (short-term, long-term), and applications (tourism, daily commuting). Key drivers such as economic policies, infrastructure development, tourism growth, and urbanization are highlighted using bullet points, while paragraphs delve into the factors underpinning the dominance of specific regions or segments.

- Dominant Region: Thailand (XX% market share in 2024)

- Leading Vehicle Type: Scooters/mopeds (XX% market share in 2024)

- Fastest Growing Segment: Short-term rentals for tourism (XX% CAGR 2025-2033)

- Key Drivers: Growing tourism sector, improving infrastructure, rising disposable incomes.

ASEAN 2-Wheeler Rental Industry Product Landscape

This section provides an overview of the product innovations, applications, and performance metrics of two-wheelers within the rental market. We discuss unique selling propositions (USPs) such as fuel efficiency, ease of use, and technological features (e.g., GPS tracking, smart locks). Technological advancements, such as the introduction of electric vehicles and connected technology, are analyzed, highlighting their impact on the market.

The market offers a diverse range of vehicles, from fuel-efficient scooters ideal for city commuting to powerful motorcycles suited for longer journeys. Innovation is focused on improving convenience, safety, and technological integration.

Key Drivers, Barriers & Challenges in ASEAN 2-Wheeler Rental Industry

This section identifies the primary forces driving the growth of the ASEAN 2-wheeler rental market, including technological advancements (e.g., electric vehicles, mobile apps), favorable economic conditions, and supportive government policies (e.g., tourism promotion). It then details key challenges and restraints, including supply chain disruptions (e.g., semiconductor shortages), regulatory hurdles (e.g., licensing requirements), and intense competition from other mobility services. Quantitative impacts of these challenges are assessed where data is available.

Key Drivers: Increased tourism, growing urbanization, rising disposable incomes. Key Barriers: High initial investment costs, stringent regulations, competition from ride-hailing services.

Emerging Opportunities in ASEAN 2-Wheeler Rental Industry

This section highlights emerging trends and opportunities within the ASEAN 2-wheeler rental market. It focuses on untapped markets (e.g., rural areas), innovative applications (e.g., last-mile delivery services), and evolving consumer preferences (e.g., environmentally friendly vehicles). Opportunities for market expansion, diversification, and technological innovation are discussed.

Emerging opportunities lie in expanding into less-penetrated regions, offering specialized rental services (e.g., adventure tourism), and integrating with other mobility solutions.

Growth Accelerators in the ASEAN 2-Wheeler Rental Industry Industry

This section discusses catalysts driving long-term growth in the ASEAN 2-wheeler rental market. It emphasizes technological breakthroughs, strategic partnerships, and market expansion strategies as key growth drivers.

Continued technological advancements, strategic collaborations with hotels and tourism operators, and expansion into new markets will be crucial for long-term growth.

Key Players Shaping the ASEAN 2-Wheeler Rental Industry Market

- Kawasaki

- Piaggio

- Suzuki

- Yamaha

- Honda

- Triumph

- BMW

Notable Milestones in ASEAN 2-Wheeler Rental Industry Sector

- 2020: Introduction of government subsidies for electric two-wheelers in several ASEAN countries.

- 2021: Launch of several mobile booking platforms specializing in two-wheeler rentals.

- 2022: Significant increase in tourism-related two-wheeler rentals following easing of pandemic restrictions.

In-Depth ASEAN 2-Wheeler Rental Industry Market Outlook

The ASEAN 2-wheeler rental market is poised for significant growth in the coming years, driven by increasing urbanization, rising disposable incomes, and a growing tourism sector. Strategic partnerships, technological innovations, and expansion into new markets will be key to unlocking this potential. The market is expected to see continued consolidation, with larger players acquiring smaller firms. The adoption of electric vehicles and sustainable practices will also shape future market dynamics.

ASEAN 2-Wheeler Rental Industry Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter/Moped

-

2. Rental Duration Type

- 2.1. Short term

- 2.2. Long Term

-

3. Application Type

- 3.1. Tourism

- 3.2. Daily Commuting

-

4. Geography

-

4.1. ASEAN

- 4.1.1. Indonesia

- 4.1.2. Malaysia

- 4.1.3. Singapore

- 4.1.4. Philippines

- 4.1.5. Rest of ASEAN

-

4.1. ASEAN

ASEAN 2-Wheeler Rental Industry Segmentation By Geography

-

1. ASEAN

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Philippines

- 1.5. Rest of ASEAN

ASEAN 2-Wheeler Rental Industry Regional Market Share

Geographic Coverage of ASEAN 2-Wheeler Rental Industry

ASEAN 2-Wheeler Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter/Moped

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 5.2.1. Short term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Daily Commuting

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. ASEAN

- 5.4.1.1. Indonesia

- 5.4.1.2. Malaysia

- 5.4.1.3. Singapore

- 5.4.1.4. Philippines

- 5.4.1.5. Rest of ASEAN

- 5.4.1. ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kawasaki

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Piaggio

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suzuki

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yamaha

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Triumph

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BMW*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Kawasaki

List of Figures

- Figure 1: Global ASEAN 2-Wheeler Rental Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 5: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 6: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 7: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 3: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 8: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Indonesia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Philippines ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN 2-Wheeler Rental Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the ASEAN 2-Wheeler Rental Industry?

Key companies in the market include Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, BMW*List Not Exhaustive.

3. What are the main segments of the ASEAN 2-Wheeler Rental Industry?

The market segments include Vehicle Type, Rental Duration Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN 2-Wheeler Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN 2-Wheeler Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN 2-Wheeler Rental Industry?

To stay informed about further developments, trends, and reports in the ASEAN 2-Wheeler Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence