Key Insights

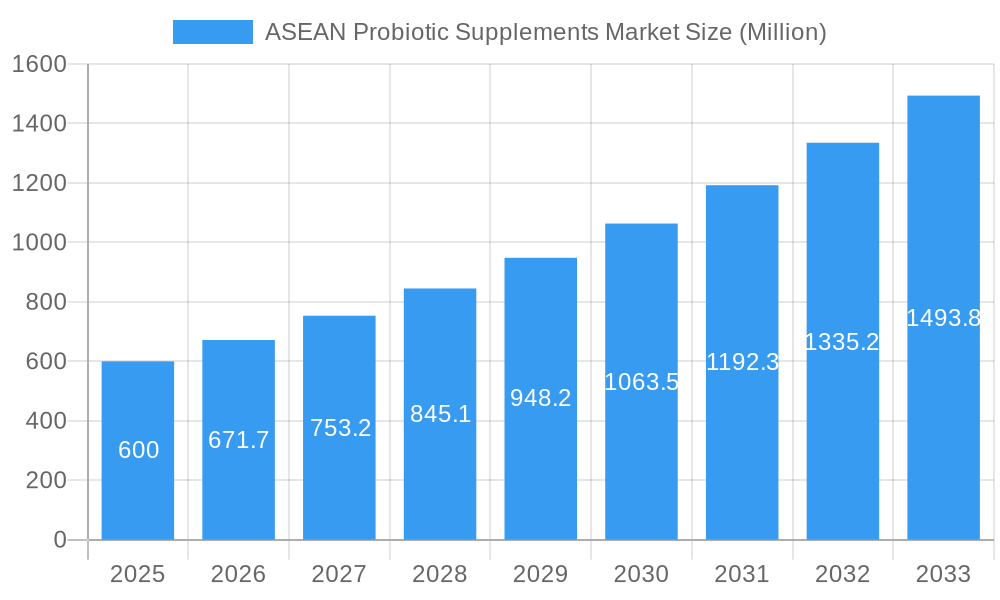

The ASEAN probiotic supplements market is experiencing robust growth, driven by increasing health consciousness, rising disposable incomes, and a growing awareness of the gut-microbiome's role in overall well-being. The market's Compound Annual Growth Rate (CAGR) of 11.74% from 2019-2024 indicates significant potential. Key market segments include tablets/capsules, powders, and liquids, distributed through supermarkets/hypermarkets, pharmacies, online stores, and specialty retailers. While the exact market size for 2025 isn't provided, extrapolating from the CAGR and considering the region's expanding middle class and increasing adoption of health supplements, a reasonable estimate for the ASEAN market size in 2025 would be between $500 and $700 million USD. This growth is further fueled by trends like the increasing popularity of functional foods and beverages incorporating probiotics, alongside the rising demand for personalized nutrition and preventative healthcare. However, challenges remain including regulatory hurdles in some ASEAN countries, inconsistent product quality, and price sensitivity among certain consumer segments. The competitive landscape is diverse, with both international players like Nestle and Reckitt Benckiser alongside regional and local brands vying for market share. Future growth will likely be shaped by further regulatory clarity, increased investment in research and development for innovative probiotic formulations, and strategic partnerships to improve distribution networks.

ASEAN Probiotic Supplements Market Market Size (In Million)

The strong growth trajectory of the ASEAN probiotic supplements market presents significant opportunities for both established and emerging players. Companies are leveraging digital marketing strategies to reach consumers directly, while also focusing on product innovation to cater to specific health needs and preferences. The expansion of e-commerce platforms and increasing accessibility to health information are further contributing to market expansion. Moreover, collaborative efforts with healthcare professionals and educational campaigns emphasizing the benefits of probiotics are likely to propel market growth in the coming years. Focusing on sustainable and ethically sourced ingredients will also be crucial to attract health-conscious consumers. Government initiatives promoting health and wellness could significantly impact the market's trajectory in the long term. This combination of factors suggests a continued upward trend for the ASEAN probiotic supplements market throughout the forecast period (2025-2033).

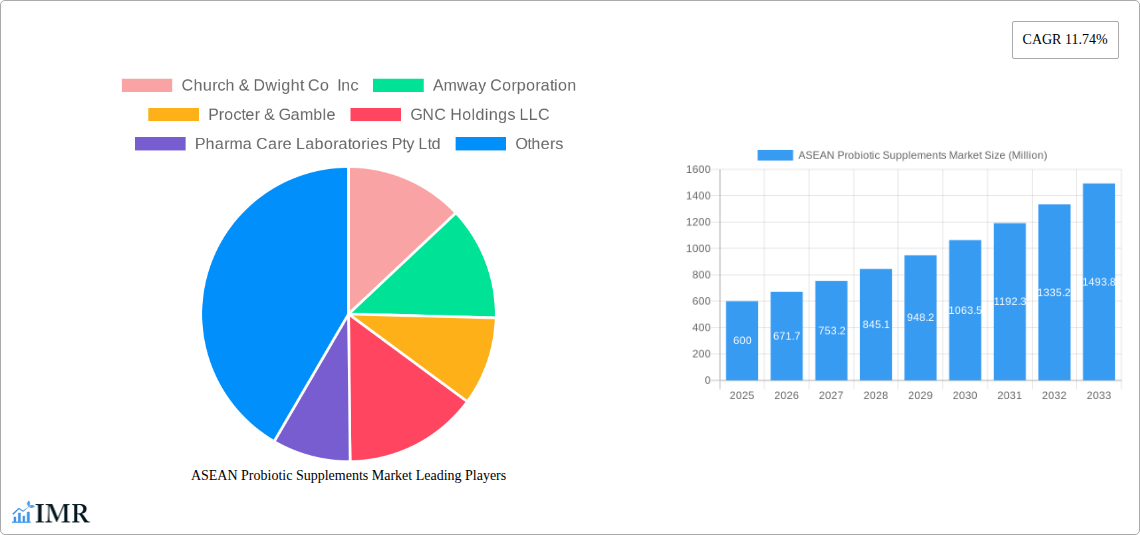

ASEAN Probiotic Supplements Market Company Market Share

ASEAN Probiotic Supplements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the ASEAN probiotic supplements market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for industry professionals, investors, and market researchers seeking to understand and capitalize on opportunities within this rapidly expanding sector. The market is segmented by distribution channel (Supermarkets/Hypermarkets, Pharmacies & Drug Stores, Specialty Stores, Online Stores, Other Distribution Channels) and product form (Tablets/Capsules, Powders, Liquids, Other Products).

ASEAN Probiotic Supplements Market Dynamics & Structure

The ASEAN probiotic supplements market is characterized by moderate concentration, with several key players dominating the landscape. Technological innovation, particularly in formulation and delivery systems, is a significant driver, alongside increasing consumer awareness of gut health and its impact on overall well-being. Regulatory frameworks vary across ASEAN nations, influencing market access and product development. Competitive substitutes include traditional health supplements and functional foods. The end-user demographic is diverse, encompassing individuals of all ages and health statuses, with a growing focus on specific health concerns like digestive health and immunity. M&A activity has been relatively moderate in recent years, xx major deals in the past five years, reflecting a strategic shift toward consolidation and expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on novel delivery systems (e.g., microencapsulation), improved strain efficacy, and personalized probiotics.

- Regulatory Framework: Varies across ASEAN countries, creating both opportunities and challenges for market entry.

- Competitive Substitutes: Traditional health supplements, functional foods, and prebiotics.

- End-User Demographics: Diverse age groups, with increasing demand from health-conscious consumers and those with specific health needs.

- M&A Trends: Moderate activity, driven by strategic expansion and consolidation efforts.

ASEAN Probiotic Supplements Market Growth Trends & Insights

The ASEAN probiotic supplements market exhibits robust growth, driven by rising health awareness, increasing disposable incomes, and a shift towards preventive healthcare. Market size grew from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. Adoption rates are increasing, particularly in urban areas and among younger demographics. Technological disruptions, such as the development of personalized probiotic solutions, further fuel market expansion. Consumer behavior is shifting towards seeking evidence-based products with enhanced efficacy and improved delivery systems. The market is projected to reach xx million units by 2033, maintaining a strong CAGR of xx%.

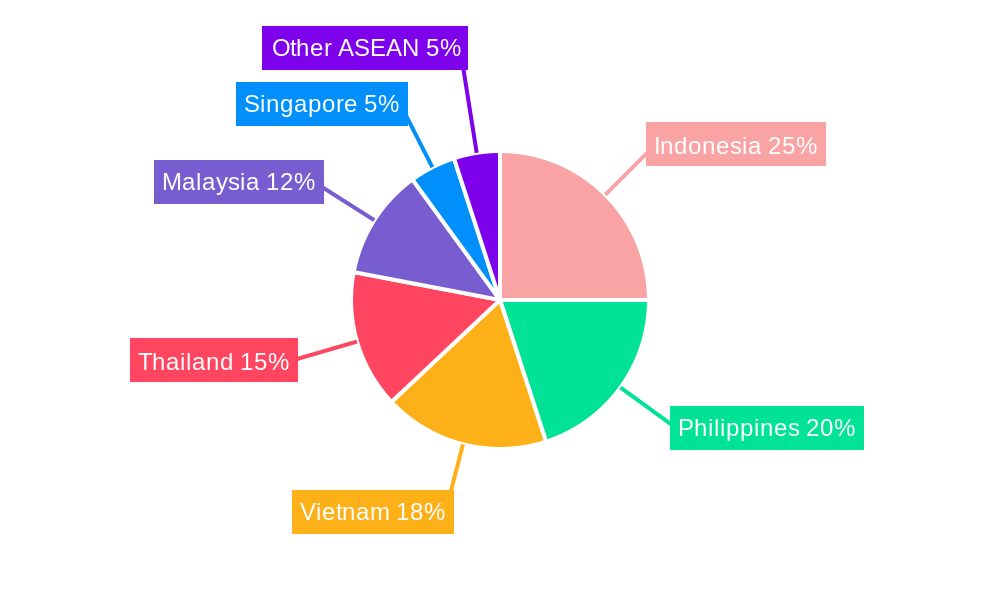

Dominant Regions, Countries, or Segments in ASEAN Probiotic Supplements Market

Indonesia and Vietnam are the leading markets, accounting for xx% and xx% of the total market value in 2024, respectively, driven by high population density, rising health consciousness and growing disposable income. The Philippines and Thailand also show significant growth potential. Pharmacies & Drug Stores and Supermarkets/Hypermarkets represent the most significant distribution channels, capturing xx% and xx% of total sales, respectively, due to extensive reach and consumer trust. Tablets/Capsules dominate the product form segment, holding a market share of xx%, owing to convenience and established consumer preference.

- Key Growth Drivers: Rising health awareness, increasing disposable incomes, and expanding distribution networks.

- Indonesia: High population density, strong economic growth, and increasing health consciousness drive market expansion.

- Vietnam: Growing middle class, increased access to healthcare information, and significant investment in the health and wellness sector.

- Distribution Channels: Pharmacies/Drug Stores and Supermarkets/Hypermarkets due to widespread accessibility and established consumer trust.

- Product Forms: Tablets/Capsules, due to convenience and established consumer preference.

ASEAN Probiotic Supplements Market Product Landscape

The ASEAN probiotic supplements market offers a diverse product landscape with innovations focusing on improved strain efficacy, targeted applications (e.g., gut health, immunity), and enhanced delivery systems. Products are increasingly differentiated based on unique selling propositions like specific strain combinations, enhanced bioavailability, or functional benefits beyond gut health. Technological advancements, such as microencapsulation and personalized formulations, are transforming the product landscape, leading to improved efficacy and consumer experience.

Key Drivers, Barriers & Challenges in ASEAN Probiotic Supplements Market

Key Drivers: Rising health awareness, increasing disposable incomes, growing demand for natural health solutions, and the proactive approach towards preventive healthcare. Government initiatives promoting health and wellness further accelerate market growth.

Challenges: Stringent regulatory approvals, varying levels of health literacy across the region, potential for counterfeit products, and competition from other health supplements. Supply chain disruptions due to geopolitical uncertainties could impact product availability and pricing.

Emerging Opportunities in ASEAN Probiotic Supplements Market

Untapped markets in less-developed regions, increasing demand for personalized probiotic solutions, the rise of functional foods incorporating probiotics, and expansion into niche health conditions (e.g., specific gut disorders) represent substantial opportunities. Growing online sales channels also offer significant potential for market expansion.

Growth Accelerators in the ASEAN Probiotic Supplements Market Industry

Technological breakthroughs, such as advanced strain identification, targeted delivery systems, and personalized probiotic solutions, will propel market growth. Strategic partnerships between probiotic manufacturers and healthcare professionals will expand market reach and build consumer trust. Government support for health and wellness initiatives will further drive market expansion.

Key Players Shaping the ASEAN Probiotic Supplements Market Market

- Church & Dwight Co Inc

- Amway Corporation

- Procter & Gamble

- GNC Holdings LLC

- Pharma Care Laboratories Pty Ltd

- Reckitt Benckiser LLC

- Nature's Way Products LLC

- Nestle SA

- Blackmores Probiotics

- Bio Gaia

Notable Milestones in ASEAN Probiotic Supplements Market Sector

- September 2021: BioGaia partnered with Abbott to distribute probiotics in Singapore.

- September 2022: NutiFood acquired a majority stake in Cawells, expanding its presence in Vietnam.

- October 2022: BioGaia launched BioGaia Prodentis Iozenges in Indonesia.

In-Depth ASEAN Probiotic Supplements Market Market Outlook

The ASEAN probiotic supplements market is poised for sustained growth, driven by favorable demographic trends, rising health awareness, and technological advancements. Strategic investments in research and development, expansion into new markets, and the development of innovative products will be crucial for companies seeking to capitalize on the market's significant potential. The market is expected to experience strong growth over the forecast period, driven by increasing consumer awareness of the benefits of probiotics and the development of innovative products.

ASEAN Probiotic Supplements Market Segmentation

-

1. Product Form

- 1.1. Tablets/Capsules

- 1.2. Powders

- 1.3. Liquids

- 1.4. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drug Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Indonesia

- 3.2. Malaysia

- 3.3. Thailand

- 3.4. Vietnam

- 3.5. Singapore

- 3.6. Philippines

- 3.7. Rest of ASEAN

ASEAN Probiotic Supplements Market Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Vietnam

- 5. Singapore

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Probiotic Supplements Market Regional Market Share

Geographic Coverage of ASEAN Probiotic Supplements Market

ASEAN Probiotic Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Significance of Health Consciousness among Millennials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Form

- 5.1.1. Tablets/Capsules

- 5.1.2. Powders

- 5.1.3. Liquids

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drug Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Vietnam

- 5.3.5. Singapore

- 5.3.6. Philippines

- 5.3.7. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Vietnam

- 5.4.5. Singapore

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Product Form

- 6. Indonesia ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Form

- 6.1.1. Tablets/Capsules

- 6.1.2. Powders

- 6.1.3. Liquids

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Drug Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Malaysia

- 6.3.3. Thailand

- 6.3.4. Vietnam

- 6.3.5. Singapore

- 6.3.6. Philippines

- 6.3.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Product Form

- 7. Malaysia ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Form

- 7.1.1. Tablets/Capsules

- 7.1.2. Powders

- 7.1.3. Liquids

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Drug Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Malaysia

- 7.3.3. Thailand

- 7.3.4. Vietnam

- 7.3.5. Singapore

- 7.3.6. Philippines

- 7.3.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Product Form

- 8. Thailand ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Form

- 8.1.1. Tablets/Capsules

- 8.1.2. Powders

- 8.1.3. Liquids

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Drug Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Malaysia

- 8.3.3. Thailand

- 8.3.4. Vietnam

- 8.3.5. Singapore

- 8.3.6. Philippines

- 8.3.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Product Form

- 9. Vietnam ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Form

- 9.1.1. Tablets/Capsules

- 9.1.2. Powders

- 9.1.3. Liquids

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Drug Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Malaysia

- 9.3.3. Thailand

- 9.3.4. Vietnam

- 9.3.5. Singapore

- 9.3.6. Philippines

- 9.3.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Product Form

- 10. Singapore ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Form

- 10.1.1. Tablets/Capsules

- 10.1.2. Powders

- 10.1.3. Liquids

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Pharmacies and Drug Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Malaysia

- 10.3.3. Thailand

- 10.3.4. Vietnam

- 10.3.5. Singapore

- 10.3.6. Philippines

- 10.3.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Product Form

- 11. Philippines ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Form

- 11.1.1. Tablets/Capsules

- 11.1.2. Powders

- 11.1.3. Liquids

- 11.1.4. Other Products

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Pharmacies and Drug Stores

- 11.2.3. Specialty Stores

- 11.2.4. Online Stores

- 11.2.5. Other Distribution Channels

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Malaysia

- 11.3.3. Thailand

- 11.3.4. Vietnam

- 11.3.5. Singapore

- 11.3.6. Philippines

- 11.3.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Product Form

- 12. Rest of ASEAN ASEAN Probiotic Supplements Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Form

- 12.1.1. Tablets/Capsules

- 12.1.2. Powders

- 12.1.3. Liquids

- 12.1.4. Other Products

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Pharmacies and Drug Stores

- 12.2.3. Specialty Stores

- 12.2.4. Online Stores

- 12.2.5. Other Distribution Channels

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Malaysia

- 12.3.3. Thailand

- 12.3.4. Vietnam

- 12.3.5. Singapore

- 12.3.6. Philippines

- 12.3.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Product Form

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Church & Dwight Co Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Procter & Gamble

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 GNC Holdings LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Pharma Care Laboratories Pty Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Reckitt Benckiser LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nature's Way Products LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nestle SA*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Blackmores Probiotics

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bio Gaia

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Church & Dwight Co Inc

List of Figures

- Figure 1: Global ASEAN Probiotic Supplements Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Indonesia ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 3: Indonesia ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 4: Indonesia ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: Indonesia ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: Indonesia ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: Indonesia ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Indonesia ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Indonesia ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 11: Malaysia ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 12: Malaysia ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: Malaysia ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Malaysia ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Malaysia ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Malaysia ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Malaysia ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Thailand ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 19: Thailand ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 20: Thailand ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Thailand ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Thailand ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Thailand ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Thailand ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Thailand ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Vietnam ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 27: Vietnam ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 28: Vietnam ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Vietnam ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Vietnam ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 31: Vietnam ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Vietnam ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Vietnam ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Singapore ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 35: Singapore ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 36: Singapore ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Singapore ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Singapore ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Singapore ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Singapore ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 43: Philippines ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 44: Philippines ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 45: Philippines ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Philippines ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 47: Philippines ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Philippines ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Philippines ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue (Million), by Product Form 2025 & 2033

- Figure 51: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue Share (%), by Product Form 2025 & 2033

- Figure 52: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 53: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 54: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue (Million), by Geography 2025 & 2033

- Figure 55: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 57: Rest of ASEAN ASEAN Probiotic Supplements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 2: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 6: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 10: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 14: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 18: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 22: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 26: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 30: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Global ASEAN Probiotic Supplements Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Probiotic Supplements Market?

The projected CAGR is approximately 11.74%.

2. Which companies are prominent players in the ASEAN Probiotic Supplements Market?

Key companies in the market include Church & Dwight Co Inc, Amway Corporation, Procter & Gamble, GNC Holdings LLC, Pharma Care Laboratories Pty Ltd, Reckitt Benckiser LLC, Nature's Way Products LLC, Nestle SA*List Not Exhaustive, Blackmores Probiotics, Bio Gaia.

3. What are the main segments of the ASEAN Probiotic Supplements Market?

The market segments include Product Form, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Significance of Health Consciousness among Millennials.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

October 2022: BioGaia AB company launched its new product BioGaia Prodentis Iozenges with a new apple flavor in Indonesia. The product is claimed to be distributed through PT Interbatcompany. As per the company claim, BioGaia Prodentis lozenges is a food supplement for oral health containing the patented lactic acid bacterium Limosilactobacillus reuteri (formerly known as Lactobacillus reuteri) Prodentis (a strain combination of L. reuteri DSM 17938 and L. reuteri ATCC PTA 5289) that helps the good microorganisms keep a natural balance in the mouth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Probiotic Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Probiotic Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Probiotic Supplements Market?

To stay informed about further developments, trends, and reports in the ASEAN Probiotic Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence