Key Insights

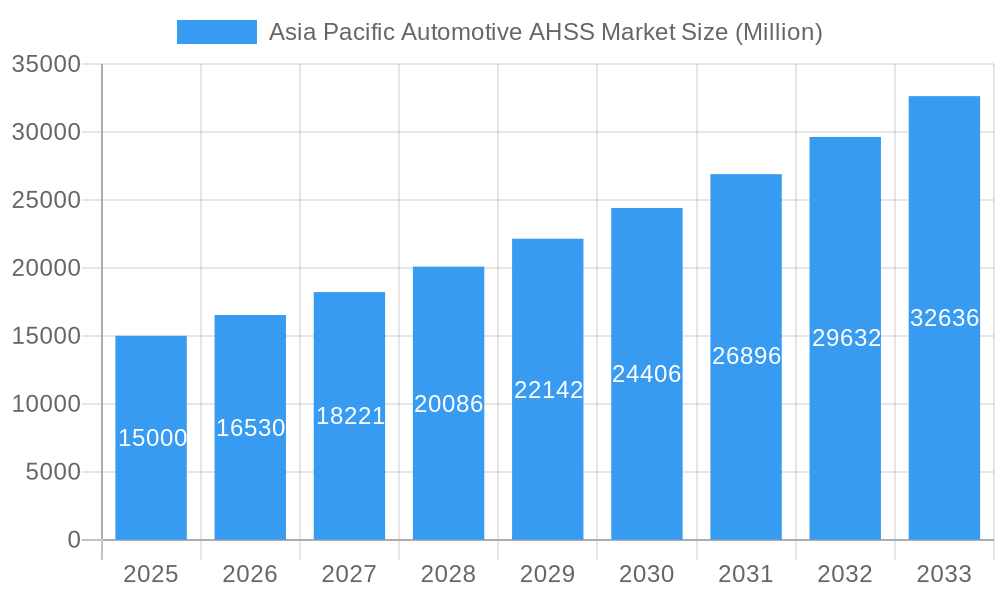

The Asia Pacific automotive Advanced High-Strength Steel (AHSS) market is poised for substantial growth, driven by the escalating demand for lightweight and safer vehicles. The region's robust automotive manufacturing sector, especially in China, India, and South Korea, is a primary catalyst for this expansion. Forecasted to grow at a Compound Annual Growth Rate (CAGR) of 13.1%, the market size is projected to reach $26,269.5 million by 2025. Key growth drivers include stringent fuel efficiency mandates encouraging automakers to adopt lighter materials, growing consumer preference for enhanced safety features, and technological advancements in AHSS production leading to improved cost-effectiveness. The market is segmented by vehicle type, with passenger vehicles dominating over commercial vehicles. Dual-Phase steel holds a significant share within product types, while structural assembly and closures are the primary application areas. Leading industry players like China Baowu Steel Group Corp, ThyssenKrupp AG, and POSCO are strategically positioned to leverage their manufacturing capabilities and technological expertise to capitalize on this growth. The forecast period (2025-2033) anticipates continued expansion, fueled by rising vehicle production, particularly in the electric vehicle segment, which requires high-strength materials to offset battery weight. However, market growth may face challenges from fluctuating raw material prices and potential supply chain disruptions.

Asia Pacific Automotive AHSS Market Market Size (In Billion)

The Asia Pacific region's leading position in the automotive AHSS market is reinforced by the presence of major steel producers and extensive automotive manufacturing capacities in countries such as China, Japan, India, and South Korea. While the market's growth trajectory is expected to remain positive, the rate may moderate due to economic factors and evolving automotive technologies. Nevertheless, the sustained focus on lightweighting and safety, coupled with advancements in next-generation AHSS grades, indicates a promising long-term outlook. Competitive intensity is expected to remain high, with key players focusing on innovation, strategic partnerships, and capacity expansion. The ongoing transition to electric vehicles presents both opportunities and challenges, necessitating further advancements in AHSS technology to meet the unique demands of this dynamic sector.

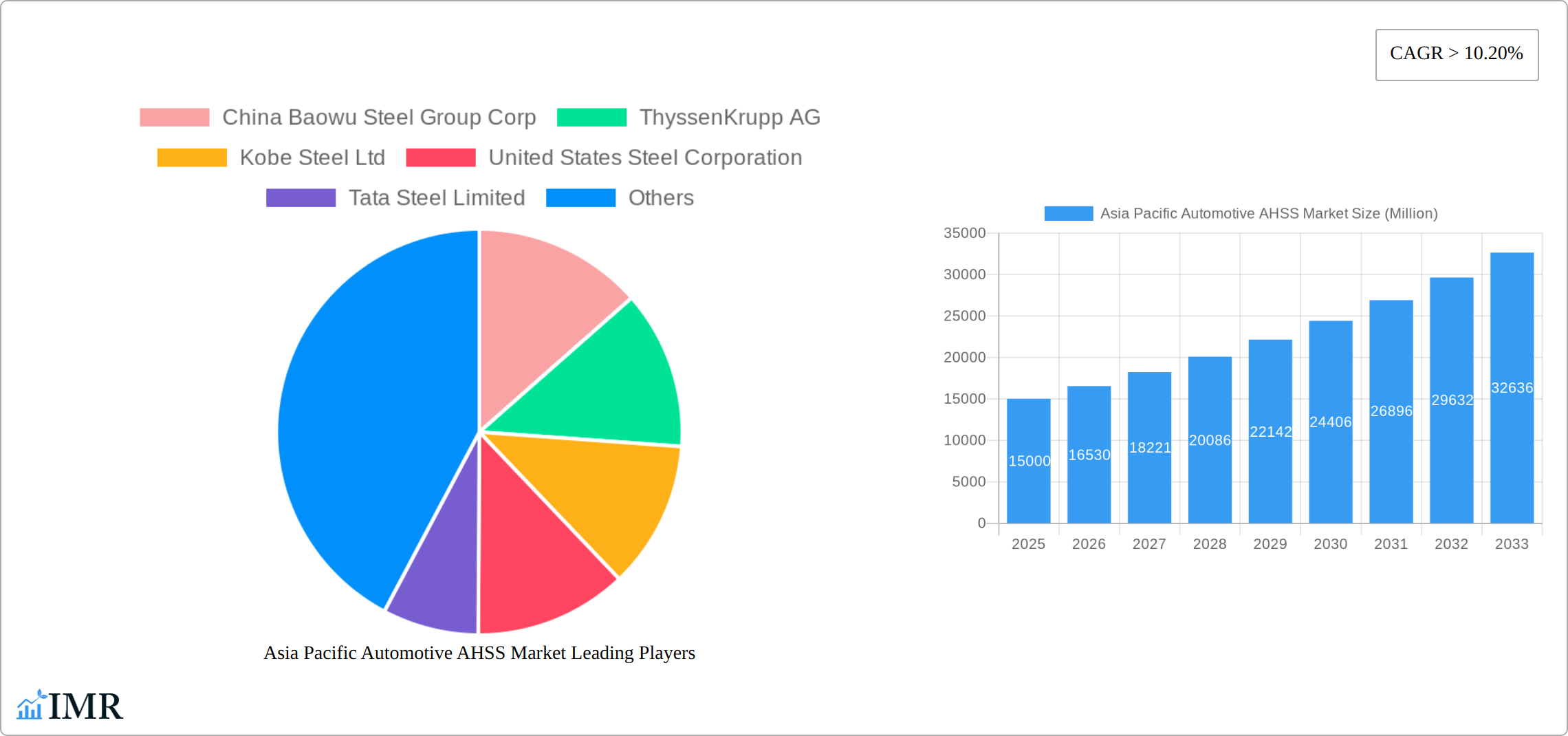

Asia Pacific Automotive AHSS Market Company Market Share

Asia Pacific Automotive AHSS Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific Automotive Advanced High-Strength Steel (AHSS) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study covers the period from 2019 to 2033, with 2025 as the base year and forecast period spanning 2025-2033. The report segments the market by vehicle type (passenger vehicles, commercial vehicles), product type (dual-phase steel, boron steel, transformation-induced plasticity (TRIP) steel, others), and application (structural assembly and closures, bumpers, suspension, others). This granular analysis equips industry professionals with actionable insights to navigate the dynamic landscape of the automotive AHSS market in the Asia-Pacific region. The market size is presented in million units.

Asia Pacific Automotive AHSS Market Market Dynamics & Structure

The Asia Pacific Automotive AHSS market is characterized by a moderately concentrated landscape with key players like China Baowu Steel Group Corp, ThyssenKrupp AG, and POSCO holding significant market share. Technological innovation, particularly in advanced steel grades with improved strength-to-weight ratios and formability, is a primary growth driver. Stringent fuel efficiency regulations and increasing demand for lightweight vehicles are further bolstering market expansion. However, the market faces challenges from the rising cost of raw materials and the emergence of alternative lightweight materials like aluminum and carbon fiber. Mergers and acquisitions (M&A) activity has been moderate, with strategic partnerships playing a more significant role in expanding market presence.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improving strength-to-weight ratio, formability, and cost-effectiveness of AHSS grades.

- Regulatory Framework: Stringent fuel efficiency standards are driving demand for lightweight materials.

- Competitive Substitutes: Aluminum, carbon fiber composites pose a competitive threat.

- End-User Demographics: Growth fueled by rising disposable incomes and increasing vehicle ownership in developing economies.

- M&A Trends: Moderate M&A activity, with strategic alliances and joint ventures becoming increasingly prevalent. Estimated xx M&A deals in the historical period (2019-2024).

Asia Pacific Automotive AHSS Market Growth Trends & Insights

The Asia Pacific Automotive Advanced High-Strength Steel (AHSS) market demonstrated robust expansion during the historical period (2019-2024). This growth was primarily fueled by the dynamic evolution of the automotive industry across key markets, notably China and India, which are leading the charge in vehicle production and sales. The market is poised for continued healthy growth, with a projected Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR value]%** during the forecast period (2025-2033).

Several pivotal trends are accelerating the demand for AHSS. The increasing integration of Advanced Driver-Assistance Systems (ADAS) and the rapid proliferation of Electric Vehicles (EVs) are significant catalysts. AHSS plays a crucial role in enhancing the safety features of these advanced vehicles while simultaneously contributing to weight reduction, which is critical for improving EV range and overall fuel efficiency. Furthermore, a growing consumer preference for vehicles that offer both superior safety and enhanced fuel economy directly translates into a higher demand for AHSS solutions. Technological advancements are also playing a vital role, with continuous innovations in tailored blanks and sophisticated manufacturing processes making AHSS production more efficient and cost-effective, thereby broadening its applicability across a wider range of vehicle models.

Market Size Evolution: The market has seen a significant expansion from **[Insert specific value] million units** in 2019 to **[Insert specific value] million units** in 2024. Projections indicate a further rise to **[Insert specific value] million units** by 2033.

Market Penetration: AHSS achieved **[Insert specific percentage]%** market penetration in 2024 and is anticipated to reach **[Insert specific percentage]%** by 2033.

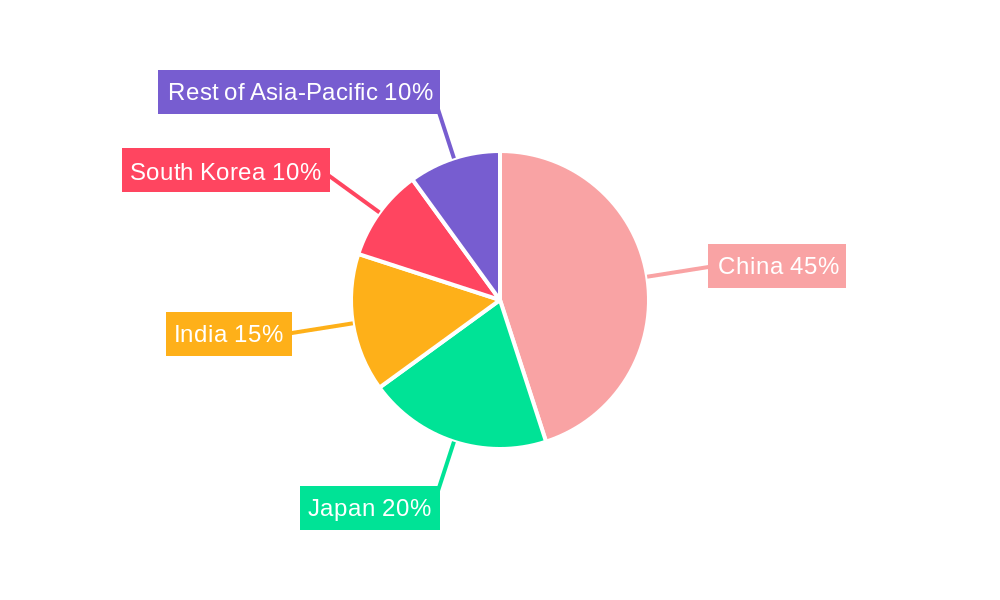

Dominant Regions, Countries, or Segments in Asia Pacific Automotive AHSS Market

China stands as the undisputed leader in the Asia Pacific Automotive AHSS market, commanding the largest market share. This dominance is attributed to its colossal automotive manufacturing infrastructure and consistently strong economic growth. Following closely, India and other Southeast Asian nations are experiencing accelerated growth trajectories, propelled by expanding vehicle sales and ongoing infrastructure development initiatives. Within the market segments, passenger vehicles represent a substantial contributor to the overall volume. The demand for specific AHSS grades like Dual-Phase steel and Boron steel remains particularly high, owing to their optimal balance of cost-effectiveness and superior mechanical properties, making them ideal for a wide array of applications.

- Key Drivers (China): Extensive automotive manufacturing ecosystem, supportive government policies for the automotive sector, and sustained robust economic expansion.

- Key Drivers (India): A rapidly expanding middle-class population, increasing rates of vehicle ownership, and significant investments in infrastructure development.

- Dominant Segment (Vehicle Type): Passenger Vehicles (accounted for **[Insert specific percentage]%** of the market share in 2024).

- Dominant Segment (Product Type): Dual-Phase Steel (held **[Insert specific percentage]%** of the market share in 2024).

- Dominant Segment (Application): Structural Assembly and Closures (represented **[Insert specific percentage]%** of the market share in 2024).

Asia Pacific Automotive AHSS Market Product Landscape

The Asia Pacific Automotive AHSS market is characterized by a sophisticated and diverse product portfolio, with each type of steel meticulously engineered to meet specific vehicle application requirements. Dual-phase (DP) steels are highly valued for their advantageous combination of strength and formability, making them versatile for numerous body-in-white components. Boron steels offer exceptional tensile strength, a critical attribute for high-stress structural elements that demand utmost resilience. Transformation-induced plasticity (TRIP) steels are recognized for their superior energy absorption capabilities, making them indispensable in safety-critical areas where crashworthiness is paramount. The industry is continuously engaged in research and development to further enhance the formability, weldability, and overall cost-efficiency of various AHSS grades, while simultaneously focusing on achieving significant weight reduction and bolstering vehicle safety features.

Key Drivers, Barriers & Challenges in Asia Pacific Automotive AHSS Market

Key Drivers: Growing demand for lightweight vehicles, stringent fuel efficiency regulations, technological advancements in AHSS production, rising disposable incomes in developing economies.

Challenges: Fluctuations in raw material prices, increasing competition from alternative materials, technological barriers to further advancements, complex supply chain management. The estimated impact of supply chain disruptions on market growth is xx% in 2024.

Emerging Opportunities in Asia Pacific Automotive AHSS Market

The evolving automotive landscape presents a wealth of emerging opportunities for the Asia Pacific AHSS market. The accelerated adoption of electric vehicles (EVs) is a major growth driver, creating a significant demand for high-strength steel in the construction of Battery Electric Vehicle (BEV) chassis, crucial for optimizing structural integrity and battery protection. Furthermore, the exploration and integration of novel AHSS applications within the rapidly advancing field of autonomous driving technologies promise new avenues for innovation and market expansion. Untapped potential also exists in the developing markets of Southeast Asia, alongside the growing prospect of expanding AHSS utilization in the commercial vehicle sector, further diversifying its application base and contributing to substantial market growth.

Growth Accelerators in the Asia Pacific Automotive AHSS Market Industry

Technological breakthroughs in AHSS production, such as the development of advanced high-strength steel grades with improved formability and weldability, are accelerating market growth. Strategic partnerships between steel manufacturers and automotive OEMs are fostering innovation and streamlining the supply chain. Expanding into new markets and catering to the evolving demands of the automotive industry are further propelling market expansion.

Key Players Shaping the Asia Pacific Automotive AHSS Market Market

Notable Milestones in Asia Pacific Automotive AHSS Market Sector

- Jan 2022: POSCO launches a new grade of AHSS with enhanced formability.

- Oct 2021: China Baowu Steel Group Corp invests in a new AHSS production facility.

- March 2020: ThyssenKrupp AG and Tata Steel Limited announce a joint venture for AHSS production. (Note: Further milestones can be added based on available data)

In-Depth Asia Pacific Automotive AHSS Market Market Outlook

The Asia Pacific Automotive AHSS market is poised for continued strong growth, driven by factors such as the increasing adoption of lightweight vehicles, the growing demand for advanced safety features, and technological advancements in AHSS production. Strategic investments in research and development, strategic partnerships, and expansions into new markets will play a crucial role in shaping the future of the industry, opening up significant opportunities for established and emerging players alike.

Asia Pacific Automotive AHSS Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Product Type

- 2.1. Dual-Phase Steel

- 2.2. Boron Steel

- 2.3. Transformation-induced plasticity (TRIP) Steel

- 2.4. Others

-

3. Application

- 3.1. Structural Assembly and Closures

- 3.2. Bumpers

- 3.3. Suspension

- 3.4. Others

-

4. Geography

-

4.1. Asia Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. South Korea

- 4.1.5. Rest of Asia Pacific

-

4.1. Asia Pacific

Asia Pacific Automotive AHSS Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

Asia Pacific Automotive AHSS Market Regional Market Share

Geographic Coverage of Asia Pacific Automotive AHSS Market

Asia Pacific Automotive AHSS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Advancement in AHSS Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Dual-Phase Steel

- 5.2.2. Boron Steel

- 5.2.3. Transformation-induced plasticity (TRIP) Steel

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Structural Assembly and Closures

- 5.3.2. Bumpers

- 5.3.3. Suspension

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. South Korea

- 5.4.1.5. Rest of Asia Pacific

- 5.4.1. Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Baowu Steel Group Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ThyssenKrupp AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kobe Steel Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United States Steel Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Steel Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 POSCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SSAB AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AK Steel Holding Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ArcelorMittal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Baoshan Iron & Steel Co Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Baowu Steel Group Corp

List of Figures

- Figure 1: Asia Pacific Automotive AHSS Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Automotive AHSS Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Application 2020 & 2033

- Table 9: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Automotive AHSS Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Automotive AHSS Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Japan Asia Pacific Automotive AHSS Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: South Korea Asia Pacific Automotive AHSS Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Asia Pacific Automotive AHSS Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Automotive AHSS Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the Asia Pacific Automotive AHSS Market?

Key companies in the market include China Baowu Steel Group Corp, ThyssenKrupp AG, Kobe Steel Ltd, United States Steel Corporation, Tata Steel Limited, POSCO, SSAB AB, AK Steel Holding Corporation, ArcelorMittal SA, Baoshan Iron & Steel Co Lt.

3. What are the main segments of the Asia Pacific Automotive AHSS Market?

The market segments include Vehicle Type, Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 26269.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Advancement in AHSS Driving the Market.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Automotive AHSS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Automotive AHSS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Automotive AHSS Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Automotive AHSS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence