Key Insights

The Australian automotive finance market, valued at an estimated $183.4 billion in 2025, is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 1.4% from 2025 to 2033. This growth is underpinned by escalating new and used vehicle sales, driving increased demand for financing solutions. Favorable lending environments, characterized by competitive interest rates and a diverse array of financing products from original equipment manufacturers (OEMs), banks, credit unions, and other financial entities, are further stimulating consumer uptake of auto loans. The increasing adoption of digital platforms and online application processes is enhancing accessibility and streamlining the borrowing experience. Potential market constraints include economic volatility, potential interest rate adjustments, and evolving regulatory landscapes. The market is segmented by vehicle type (passenger and commercial vehicles), financing source (OEMs, banks, credit unions, other financial institutions), and vehicle condition (new and used). Major players, including The Australia and New Zealand Banking Group Limited, Mahindra Automotive Australia Pty Ltd, and Toyota Finance Australia Limited, actively compete by offering a broad spectrum of customized financing solutions to meet varied customer requirements. Sustained economic growth in Australia and a continued preference for personal vehicle ownership are anticipated to support the enduring expansion of the automotive finance sector throughout the forecast period.

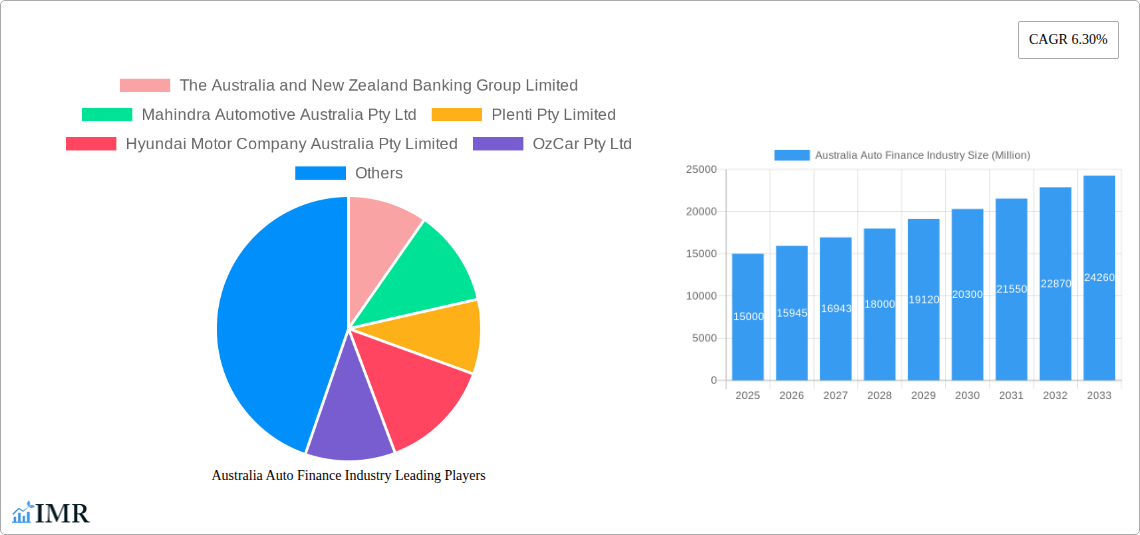

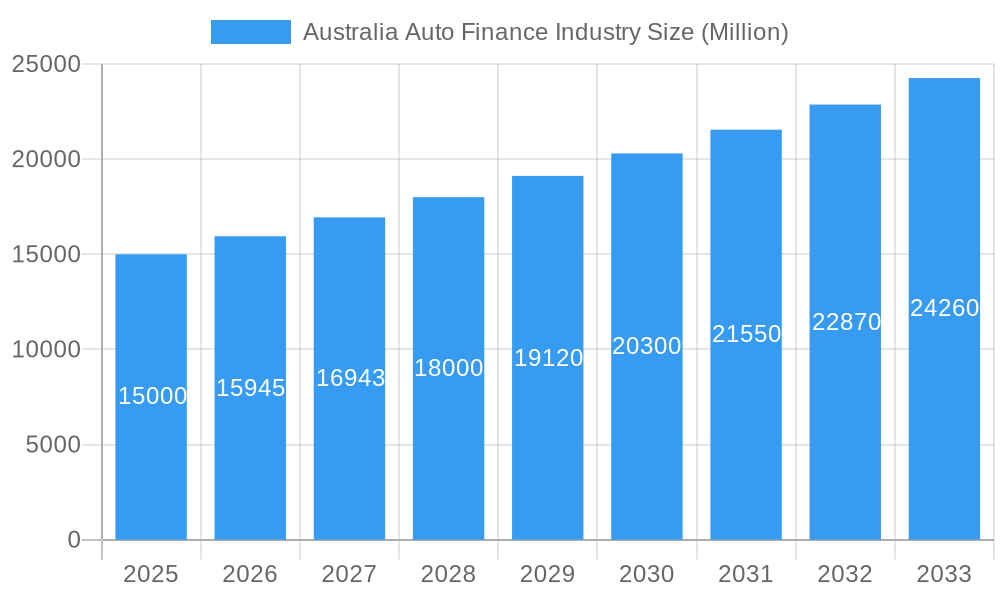

Australia Auto Finance Industry Market Size (In Billion)

The competitive arena features a blend of established financial institutions and specialized automotive lenders. Digital transformation is profoundly reshaping the industry, enabling accelerated loan processing and enhanced customer engagement. Innovative financing models, such as subscription-based offerings and flexible payment plans, are also gaining traction, aligning with evolving consumer expectations. The future growth trajectory of the Australian automotive finance market will be contingent upon macroeconomic stability, shifts in consumer behavior, and technological advancements. The industry is expected to embrace ongoing innovation in product development and service delivery to meet the growing demand for convenient and personalized financial solutions.

Australia Auto Finance Industry Company Market Share

This comprehensive analysis of the Australian automotive finance market covers historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It examines market dynamics, growth drivers, key industry participants, and emerging opportunities, providing critical insights for industry stakeholders, investors, and strategic planners. The market segmentation includes vehicle type (passenger cars, commercial vehicles), financing source (OEMs, banks, credit unions, financial institutions), and vehicle condition (new and used).

Australia Auto Finance Industry Market Dynamics & Structure

The Australian auto finance market, valued at $XX million in 2024, exhibits a moderately concentrated structure with several key players holding significant market share. The market is driven by technological innovation, particularly in digital lending platforms and data analytics, while regulatory frameworks, including responsible lending guidelines, play a crucial role. Competitive pressures from diverse financing options, including lease-to-own schemes and peer-to-peer lending, also shape the market landscape. End-user demographics, characterized by evolving consumer preferences and a growing demand for flexible financing options, significantly influence market demand. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidating smaller players.

- Market Concentration: High, with top 5 players accounting for approximately xx% of the market share in 2024.

- Technological Innovation: Focus on digital lending platforms, AI-powered risk assessment, and personalized financing solutions.

- Regulatory Framework: Stringent responsible lending guidelines influence lending practices and consumer protection.

- Competitive Substitutes: Lease-to-own schemes, peer-to-peer lending, and alternative financing platforms.

- End-User Demographics: Growing preference for flexible financing options, increasing demand for SUVs and electric vehicles.

- M&A Trends: Moderate activity, primarily focused on consolidation and expansion into niche segments.

Australia Auto Finance Industry Growth Trends & Insights

The Australian auto finance market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors including strong vehicle sales, increasing consumer debt, and the growth of online lending platforms. The market is projected to reach $XX million by 2025 and maintain a CAGR of xx% during the forecast period (2025-2033). This growth is influenced by technological advancements (e.g., embedded finance, fintech integration), evolving consumer preferences (e.g., preference for SUVs and EVs), and government initiatives. Market penetration of various financing options also contributes to the overall market growth.

Dominant Regions, Countries, or Segments in Australia Auto Finance Industry

The New South Wales and Victoria regions dominate the Australian auto finance market, representing approximately xx% of the total market value in 2024. This dominance is attributed to higher vehicle sales, a larger population, and a more developed financial infrastructure. Within the segments:

- Type: New vehicle financing constitutes a larger share compared to used vehicle financing due to higher average loan values and increased OEM financing penetration.

- Source Type: Banks hold the largest market share, followed by OEM financing and financial institutions. Credit Unions possess a niche market segment.

- Vehicle Type: Passenger cars contribute the most to the overall market size due to higher demand. Commercial vehicles show a steady growth trajectory.

Key Drivers:

- Robust economic growth in major regions.

- Well-established financial infrastructure.

- High consumer spending and willingness to finance purchases.

Australia Auto Finance Industry Product Landscape

The Australian auto finance product landscape is characterized by diverse financing options, including traditional loans, lease agreements, balloon payments, and various combinations thereof. The emergence of online lending platforms has streamlined the application process and enhanced consumer convenience. Innovation centers around customizable financing plans that cater to individual borrower needs and risk profiles, incorporating technologies such as AI-powered credit scoring and predictive analytics. This diversification in product offerings is a key differentiator in the market, catering to diverse customer needs.

Key Drivers, Barriers & Challenges in Australia Auto Finance Industry

Key Drivers:

- Increased consumer demand for new and used vehicles.

- Favorable economic conditions and low-interest rates (historically).

- Technological advancements and the rise of fintech.

Key Challenges:

- Stringent regulatory requirements and responsible lending standards.

- Fluctuations in interest rates and economic uncertainty.

- Increased competition from various financing options and new entrants. This competition reduces profit margins by an estimated xx% annually.

- Supply chain disruptions impacting vehicle availability.

Emerging Opportunities in Australia Auto Finance Industry

- Growing demand for electric vehicles (EVs) and associated financing options.

- Penetration of embedded finance solutions within automotive ecosystems.

- Expansion into underserved markets and segments.

- Development of innovative financing products for the used car market.

Growth Accelerators in the Australia Auto Finance Industry Industry

Technological advancements such as AI-powered risk assessment and digital lending platforms are key growth drivers, enhancing efficiency and reducing operational costs. Strategic partnerships between automakers, fintech companies, and financial institutions are also expected to expand market reach and product offerings. The expansion into niche market segments, such as electric vehicle financing, will play a significant role in propelling future market growth.

Key Players Shaping the Australia Auto Finance Industry Market

- The Australia and New Zealand Banking Group Limited

- Mahindra Automotive Australia Pty Ltd

- Plenti Pty Limited

- Hyundai Motor Company Australia Pty Limited

- OzCar Pty Ltd

- Toyota Finance Australia Limited

- Kia Australia Pty Ltd

- Mozo Pty Ltd

- National Australian Bank

- Dutton Group

Notable Milestones in Australia Auto Finance Industry Sector

- 2020: Introduction of stricter responsible lending guidelines impacting lending practices.

- 2021: Several major banks launched new digital lending platforms.

- 2022: Increased adoption of embedded finance solutions by several OEMs.

- 2023: Significant investments in fintech companies focused on auto finance. (Specific example of investment amount or company xx)

- 2024: Consolidation of smaller players through mergers and acquisitions.

In-Depth Australia Auto Finance Industry Market Outlook

The Australian auto finance market is poised for continued growth, driven by sustained demand for vehicles, technological innovation, and increasing penetration of various financing products. Strategic partnerships and expansion into niche markets, such as financing for electric vehicles, present lucrative opportunities for market players. Focusing on enhancing customer experience, offering personalized solutions, and leveraging data-driven insights will be essential for success in the dynamic market landscape.

Australia Auto Finance Industry Segmentation

-

1. Type

- 1.1. New Vehicle

- 1.2. Used Vehicle

-

2. Source Type

- 2.1. OEM

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institution

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Australia Auto Finance Industry Segmentation By Geography

- 1. Australia

Australia Auto Finance Industry Regional Market Share

Geographic Coverage of Australia Auto Finance Industry

Australia Auto Finance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Used Vehicle to Gain Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Auto Finance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicle

- 5.1.2. Used Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEM

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institution

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Australia and New Zealand Banking Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahindra Automotive Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plenti Pty Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Motor Company Australia Pty Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OzCar Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Finance Australia Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kia Australia Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mozo Pty Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 National Australian Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dutton Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Australia and New Zealand Banking Group Limited

List of Figures

- Figure 1: Australia Auto Finance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Auto Finance Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Auto Finance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Australia Auto Finance Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 3: Australia Auto Finance Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Australia Auto Finance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Auto Finance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Australia Auto Finance Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 7: Australia Auto Finance Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Australia Auto Finance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Auto Finance Industry?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Australia Auto Finance Industry?

Key companies in the market include The Australia and New Zealand Banking Group Limited, Mahindra Automotive Australia Pty Ltd, Plenti Pty Limited, Hyundai Motor Company Australia Pty Limited, OzCar Pty Ltd, Toyota Finance Australia Limited, Kia Australia Pty Ltd, Mozo Pty Ltd *List Not Exhaustive, National Australian Bank, Dutton Group.

3. What are the main segments of the Australia Auto Finance Industry?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Used Vehicle to Gain Momentum.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Auto Finance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Auto Finance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Auto Finance Industry?

To stay informed about further developments, trends, and reports in the Australia Auto Finance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence