Key Insights

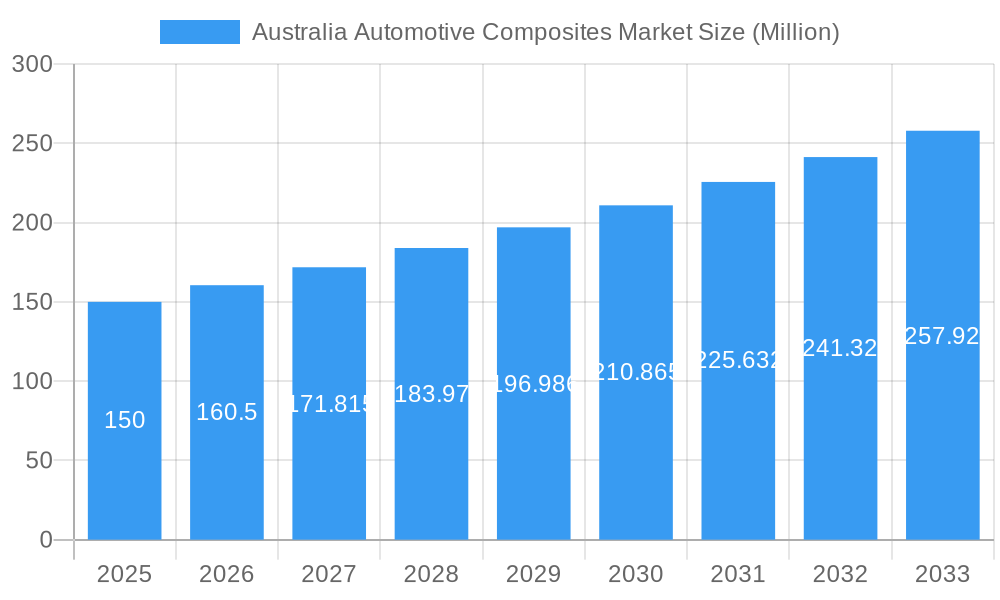

The Australian automotive composites market is poised for significant expansion, driven by the imperative for lightweight vehicle construction to enhance fuel efficiency and curb emissions. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.07%. Market size is estimated at 609.9 million in the base year of 2025. Growth is propelled by the increasing integration of advanced composites in structural assemblies, powertrain systems, and interior/exterior vehicle components. Furthermore, the adoption of sophisticated manufacturing techniques like injection molding and continuous processes is facilitating higher production volumes and improved material performance. Government support for sustainable transportation solutions also underpins this growth trajectory.

Australia Automotive Composites Market Market Size (In Million)

Market segmentation highlights substantial opportunities across various applications and manufacturing processes. Structural assembly commands a significant market share, closely followed by powertrain components, underscoring the growing utilization of composites in load-bearing structures and engine parts. Injection molding and continuous processes are anticipated to outperform traditional methods due to their capacity for high-volume, high-quality component production. Leading industry participants are actively innovating, focusing on developing high-performance materials and cutting-edge manufacturing technologies. Key challenges include the comparative cost of composites and potential supply chain disruptions. The forecast period indicates sustained growth, fueled by technological advancements and escalating demand for eco-friendly vehicles.

Australia Automotive Composites Market Company Market Share

This comprehensive report offers an in-depth analysis of the Australian automotive composites market, covering market dynamics, growth drivers, regional insights, product portfolios, challenges, opportunities, and competitive landscapes. The analysis spans from 2019 to 2033, with 2025 designated as the base year for market sizing and projections. This report is an essential resource for industry stakeholders, investors, and strategists seeking detailed market intelligence. The market is segmented by application type (structural assembly, powertrain components, interior, exterior, other) and process type (hand layup/manual process, compression molding, injection molding, continuous process).

Australia Automotive Composites Market Market Dynamics & Structure

The Australian automotive composites market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, particularly in lightweight materials and manufacturing processes, is a major driver. Stringent government regulations promoting fuel efficiency and emissions reduction further fuel market growth. Competitive substitutes include traditional materials like steel and aluminum, though composites are increasingly favored for their superior strength-to-weight ratio. The market is influenced by end-user demographics, including a growing preference for fuel-efficient vehicles. M&A activity remains moderate, with a projected xx number of deals in the forecast period (2025-2033).

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, improved durability, and sustainable materials.

- Regulatory Framework: Stringent emission standards and fuel efficiency targets driving demand.

- Competitive Substitutes: Steel and aluminum, but composites offer advantages in weight and performance.

- End-User Demographics: Rising demand for fuel-efficient vehicles among environmentally conscious consumers.

- M&A Trends: Moderate activity, with xx projected deals between 2025 and 2033.

Australia Automotive Composites Market Growth Trends & Insights

The Australian automotive composites market exhibits a steady growth trajectory, driven by the increasing adoption of lightweight materials in vehicle manufacturing. The market size is projected to reach AU$ xx million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements leading to improved composite materials and manufacturing processes, along with evolving consumer preferences towards fuel-efficient and environmentally friendly vehicles. Market penetration is expected to increase significantly, with composites gaining market share from traditional materials. Technological disruptions, such as the rise of electric vehicles and autonomous driving, further contribute to the market's dynamic evolution.

Dominant Regions, Countries, or Segments in Australia Automotive Composites Market

While data on specific regional breakdowns within Australia is limited, the Victoria and New South Wales regions are projected to be dominant due to their higher concentration of automotive manufacturing facilities. Within application types, the structural assembly segment holds the largest market share, driven by the need for lightweight yet strong components. The injection molding process type is also expected to dominate due to its high production efficiency and suitability for mass production.

- Key Drivers (Victoria & New South Wales): Established automotive manufacturing clusters, government support for the automotive industry, and access to skilled labor.

- Structural Assembly Segment Dominance: High demand for lightweight components to improve fuel efficiency.

- Injection Molding Process Dominance: Cost-effectiveness and high-volume production capabilities.

Australia Automotive Composites Market Product Landscape

The Australian automotive composites market features a diverse range of products, including high-strength carbon fiber reinforced polymers (CFRP), glass fiber reinforced polymers (GFRP), and hybrid composites. These materials are used in various applications, exhibiting superior properties in terms of weight reduction, improved fuel economy, enhanced safety features, and aesthetic appeal. Continuous innovation is evident in the development of advanced materials with higher strength-to-weight ratios, better durability, and improved recyclability. Unique selling propositions often center around customized solutions that meet the specific performance requirements of automotive manufacturers.

Key Drivers, Barriers & Challenges in Australia Automotive Composites Market

Key Drivers: Increasing demand for lightweight vehicles to improve fuel efficiency, stringent government regulations promoting sustainable materials, and advancements in composite materials and manufacturing processes.

Challenges: High initial investment costs associated with composite manufacturing, the complexity of the manufacturing process, and potential supply chain disruptions due to material sourcing limitations. These limitations can translate into increased manufacturing costs and project delays, impacting overall market growth.

Emerging Opportunities in Australia Automotive Composites Market

Emerging opportunities lie in the expansion of the electric vehicle (EV) market, necessitating lightweight components for extended battery range. Furthermore, advancements in bio-based composites offer sustainable alternatives, aligning with environmental concerns. The growth of autonomous driving technology opens avenues for innovative applications of composites in sensor integration and vehicle design.

Growth Accelerators in the Australia Automotive Composites Market Industry

Technological breakthroughs in material science and manufacturing processes are crucial growth accelerators. Strategic partnerships between automotive manufacturers and composite material suppliers facilitate the development of customized solutions. Market expansion strategies, targeting niche applications within the automotive sector, and increased investment in research and development (R&D) will further propel market growth.

Key Players Shaping the Australia Automotive Composites Market Market

- SGL Carbon

- Toho Tenex (Teijin Ltd)

- Sigmatex

- Toray Industries Inc

- Nippon Carbon Co Ltd

- Nippon Sheet Glass Company Limited

- Solvay S.A.

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- mouldCAM Pty Ltd

Notable Milestones in Australia Automotive Composites Market Sector

- 2022 Q3: Introduction of a new lightweight composite component by [Company Name, if available].

- 2021 Q4: Partnership between [Company Name] and an Australian automotive manufacturer to develop a new composite part.

- 2020 Q1: Government initiative to promote the use of sustainable composites in the automotive industry. (More milestones could be added based on available data).

In-Depth Australia Automotive Composites Market Market Outlook

The Australian automotive composites market holds significant long-term growth potential, driven by a confluence of factors, including technological advancements, evolving consumer preferences, and supportive government regulations. Strategic investments in R&D, fostering innovation, and strengthening supply chains will be crucial to capitalizing on emerging opportunities and overcoming challenges within the market. The continuous evolution of composite materials and manufacturing techniques positions the market for sustainable and robust growth in the coming years.

Australia Automotive Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Power-train Components

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Application Types

-

2. Process Type

- 2.1. Hand Layup / Manual Process

- 2.2. Compression Molding

- 2.3. Injection Molding

- 2.4. Continuous Process

Australia Automotive Composites Market Segmentation By Geography

- 1. Australia

Australia Automotive Composites Market Regional Market Share

Geographic Coverage of Australia Automotive Composites Market

Australia Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Weight Reduction and Performance Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Carbon Fiber Is Anticipated To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Power-train Components

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Process Type

- 5.2.1. Hand Layup / Manual Process

- 5.2.2. Compression Molding

- 5.2.3. Injection Molding

- 5.2.4. Continuous Process

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toho Tenex (Teijin Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sigmatex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toray Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Carbon Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Solvay S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hexcel Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 mouldCAM Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Australia Automotive Composites Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Australia Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 2: Australia Automotive Composites Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 3: Australia Automotive Composites Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Australia Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 5: Australia Automotive Composites Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 6: Australia Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Automotive Composites Market?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the Australia Automotive Composites Market?

Key companies in the market include SGL Carbon, Toho Tenex (Teijin Ltd), Sigmatex, Toray Industries Inc, Nippon Carbon Co Ltd, Nippon Sheet Glass Company Limited, Solvay S, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, mouldCAM Pty Ltd.

3. What are the main segments of the Australia Automotive Composites Market?

The market segments include Application Type, Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 609.9 million as of 2022.

5. What are some drivers contributing to market growth?

Weight Reduction and Performance Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

High Cost of Carbon Fiber Is Anticipated To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Australia Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence