Key Insights

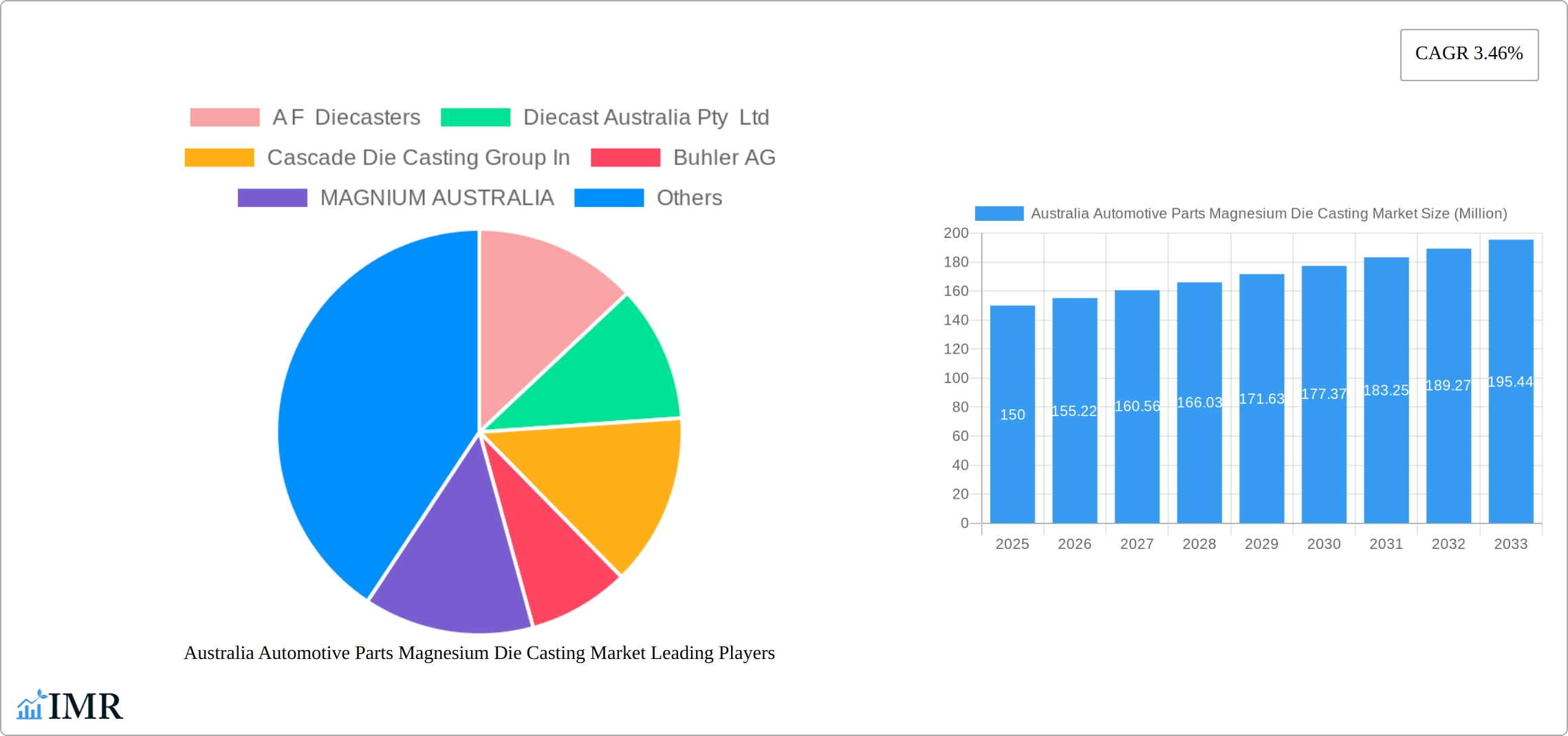

The Australian automotive parts magnesium die casting market is projected to experience significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 3.46% between 2025 and 2033. This growth trajectory is primarily propelled by the escalating demand for lightweight vehicles, essential for enhancing fuel efficiency and mitigating emissions, a critical consideration within Australia's environmentally aware consumer base. The global automotive industry's accelerating pivot towards electric vehicles (EVs) further amplifies this demand, as magnesium's inherent lightweight characteristics are vital for optimizing EV battery performance and extending operational range. Innovations in die casting technologies, particularly high-pressure and semi-solid die casting, are also contributing to market expansion by improving part quality, precision, and overall production efficiency. Key applications driving this market include body assemblies, engine components, and transmission parts, showcasing the versatile utility of magnesium die casting in contemporary vehicle engineering. Despite potential challenges such as magnesium price volatility and competition from alternative materials like aluminum, the robust outlook for Australia's automotive sector and the intrinsic advantages of magnesium die casting indicate a sustained period of market growth.

Australia Automotive Parts Magnesium Die Casting Market Market Size (In Billion)

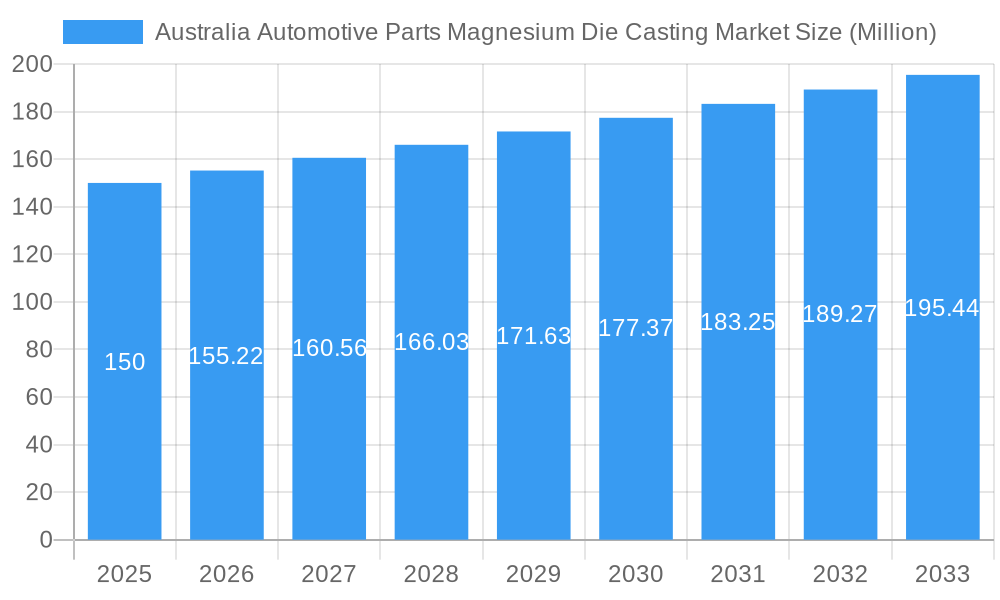

The market is segmented by application (body assemblies, engine parts, transmission components, and others) and production process (pressure die casting, vacuum die casting, squeeze die casting, and semi-solid die casting). Leading industry participants, including A F Diecasters, Diecast Australia Pty Ltd, and Cascade Die Casting Group, are strategically positioned to capitalize on this anticipated growth, serving both domestic and international markets. The preceding period (2019-2024) likely exhibited a more gradual growth rate, influenced by global economic conditions and the nascent stages of EV adoption. However, the forecast period (2025-2033) is expected to witness accelerated expansion, driven by the synergistic impact of the aforementioned growth catalysts. Australia's commitment to sustainable manufacturing practices further complements the environmentally beneficial aspects of magnesium, fostering continued market development.

Australia Automotive Parts Magnesium Die Casting Market Company Market Share

Australia Automotive Parts Magnesium Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Australia automotive parts magnesium die casting market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This in-depth analysis is crucial for industry professionals, investors, and stakeholders seeking to understand this dynamic market and capitalize on emerging opportunities within the broader Australian automotive and manufacturing sectors. The report segments the market by application type (Body Assemblies, Engine Parts, Transmission Parts, Other Application Types) and production process type (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting).

Australia Automotive Parts Magnesium Die Casting Market Market Dynamics & Structure

The Australian automotive parts magnesium die casting market is characterized by a moderately consolidated landscape, with established entities such as A F Diecasters, Diecast Australia Pty Ltd, and Cascade Die Casting Group In commanding a substantial portion of the market share. A significant impetus for market growth stems from continuous technological advancements, particularly in refining die casting methodologies and developing superior magnesium alloys. The stringent Australian automotive emission regulations and a pronounced industry-wide emphasis on lightweight vehicle design further amplify market expansion. Nevertheless, the market navigates inherent challenges, including the elevated cost of magnesium and the competitive presence of alternative materials like aluminum. Mergers and acquisitions (M&A) remain a relatively infrequent occurrence, with only xx M&A deals recorded within the historical timeframe of 2019-2024, consequently leading to an approximate xx% shift in market share.

- Market Concentration: The market exhibits moderate consolidation, with the top three leading players collectively holding approximately xx% of the total market share.

- Technological Innovation: A primary focus remains on enhancing die casting efficiency, minimizing component defects, and the development of high-strength, application-specific magnesium alloys.

- Regulatory Framework: Adherence to Australia's stringent automotive emission standards and mandated lightweight vehicle design initiatives directly fuels demand for magnesium die cast components.

- Competitive Product Substitutes: The strong presence and cost-effectiveness of aluminum and other lightweight material alternatives present significant competitive pressure.

- End-User Demographics: The primary consumer base consists of automotive manufacturers and their direct Tier 1 suppliers.

- M&A Trends: Mergers and acquisition activities have been relatively subdued, with xx deals occurring between 2019 and 2024, contributing to a xx% fluctuation in market share. Barriers to innovation are compounded by high research and development expenditures and a discernible scarcity of a skilled workforce.

Australia Automotive Parts Magnesium Die Casting Market Growth Trends & Insights

The Australian automotive parts magnesium die casting market is projected to experience substantial growth during the forecast period (2025-2033). Driven by increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions, the market size is expected to reach xx million units by 2033, exhibiting a CAGR of xx% from 2025. This growth is further fueled by advancements in magnesium die casting technologies, leading to improved product quality and reduced production costs. Adoption rates are increasing, particularly among manufacturers aiming to meet stricter fuel economy standards and consumer preferences for environmentally friendly vehicles. Technological disruptions are minimal; however, continuous improvements in casting techniques and alloy compositions are driving efficiency and cost-effectiveness. Consumer behavior shifts towards eco-conscious vehicle purchases reinforce market demand.

Dominant Regions, Countries, or Segments in Australia Automotive Parts Magnesium Die Casting Market

The automotive hub of Victoria is the dominant region in the Australian automotive parts magnesium die casting market, holding approximately xx% market share in 2025. This dominance is attributed to a high concentration of automotive manufacturing facilities and supporting infrastructure. Within application types, Engine Parts account for the largest segment (xx%), driven by the need for lightweight and high-strength components in modern engines. Pressure Die Casting remains the most widely used production process (xx%), due to its cost-effectiveness and versatility.

- Key Drivers in Victoria: Established automotive manufacturing base, robust supply chain network, and supportive government policies.

- Engine Parts Dominance: Demand for lightweight and high-strength engine components.

- Pressure Die Casting Prevalence: Cost-effectiveness and established infrastructure.

Australia Automotive Parts Magnesium Die Casting Market Product Landscape

The market features a range of magnesium die castings for various automotive applications, including engine blocks, transmission cases, and body panels. Product innovation focuses on enhancing mechanical properties, improving surface finish, and optimizing designs for weight reduction. Unique selling propositions include improved fuel efficiency and reduced emissions due to lightweight design. Technological advancements concentrate on precision casting techniques, advanced alloy development, and process automation to ensure high quality and cost efficiency.

Key Drivers, Barriers & Challenges in Australia Automotive Parts Magnesium Die Casting Market

Key Drivers:

The escalating demand for lighter vehicles, propelled by fuel efficiency mandates and a growing consumer preference for eco-friendly transportation solutions, stands as the paramount driver for this market. Complementary government incentives that encourage the adoption of lightweight materials further bolster the market's upward trajectory. Concurrent technological advancements in die casting processes are instrumental in optimizing production efficiency and improving cost-effectiveness.

Key Barriers & Challenges:

The inherent higher cost of magnesium when juxtaposed with alternative materials such as aluminum represents a significant impediment to widespread adoption. Vulnerability to supply chain disruptions, particularly during periods of global economic volatility, impacts material availability and escalates production expenses. The relatively modest scale of the Australian automotive industry, when compared to global counterparts, inherently caps the potential for exponential growth. Furthermore, the current market grapples with a pronounced shortage of skilled labor, leading to increased training investments and a reduction in overall productivity.

Emerging Opportunities in Australia Automotive Parts Magnesium Die Casting Market

The burgeoning electric vehicle (EV) sector presents a substantial arena of opportunity. This growth is driven by an increasing demand for lightweight components essential for battery packs and electric motor housings. The continuous development of advanced magnesium alloys, boasting enhanced mechanical properties, is paving the way for novel applications. Moreover, strategic expansion into specialized market niches, such as components for off-road vehicles and bespoke automotive parts, offers additional avenues for potential growth.

Growth Accelerators in the Australia Automotive Parts Magnesium Die Casting Market Industry

The cultivation of strategic alliances and partnerships between magnesium producers, specialized die casting companies, and major automotive manufacturers serves as a catalyst for innovation and market penetration. Proactive government initiatives designed to promote the integration of lightweight materials within vehicle manufacturing significantly accelerate market expansion. Concurrently, technological breakthroughs in advanced die casting techniques contribute to enhanced productivity and cost reductions, thereby facilitating broader market adoption.

Key Players Shaping the Australia Automotive Parts Magnesium Die Casting Market Market

- A F Diecasters

- Diecast Australia Pty Ltd

- Cascade Die Casting Group In

- Buhler AG

- MAGNIUM AUSTRALIA

- Dongguan Minghe Die Casting Company

- HARROP ENGINEERING

- Kemlows Diecasting Products Ltd

Notable Milestones in Australia Automotive Parts Magnesium Die Casting Market Sector

- July 2022: Magnium Australia developed manufacturing technology that enables Australia to take advantage of a USD 300 billion magnesium export opportunity. This significantly boosts the domestic magnesium supply chain and strengthens the market.

- May 2022: GF Casting Solutions and the Bocar Group signed an agreement to offer a specialized range of products and services worldwide, potentially impacting the Australian market through increased product availability and enhanced technologies.

In-Depth Australia Automotive Parts Magnesium Die Casting Market Market Outlook

The Australian automotive parts magnesium die casting market is poised for significant growth, driven by increasing demand for lightweight vehicles, technological advancements, and supportive government policies. Strategic partnerships and investments in research and development will further propel market expansion. The focus on sustainability and reducing carbon emissions in the automotive sector presents substantial long-term opportunities for this market. The projected growth indicates a promising future for companies operating in this sector, particularly those embracing innovation and strategic collaborations.

Australia Automotive Parts Magnesium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

Australia Automotive Parts Magnesium Die Casting Market Segmentation By Geography

- 1. Australia

Australia Automotive Parts Magnesium Die Casting Market Regional Market Share

Geographic Coverage of Australia Automotive Parts Magnesium Die Casting Market

Australia Automotive Parts Magnesium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Pressure Die Casting Process dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A F Diecasters

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Diecast Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cascade Die Casting Group In

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Buhler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAGNIUM AUSTRALIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dongguan Minghe Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HARROP ENGINEERING

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kemlows Diecasting Products Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 A F Diecasters

List of Figures

- Figure 1: Australia Automotive Parts Magnesium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Automotive Parts Magnesium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Australia Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Automotive Parts Magnesium Die Casting Market?

The projected CAGR is approximately 15.35%.

2. Which companies are prominent players in the Australia Automotive Parts Magnesium Die Casting Market?

Key companies in the market include A F Diecasters, Diecast Australia Pty Ltd, Cascade Die Casting Group In, Buhler AG, MAGNIUM AUSTRALIA, Dongguan Minghe Die Casting Company, HARROP ENGINEERING, Kemlows Diecasting Products Ltd.

3. What are the main segments of the Australia Automotive Parts Magnesium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Pressure Die Casting Process dominating the market.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

July 2022: Magnium Australia developed manufacturing technology that enable Australia to take advantage of a USD 300 billion magnesium export opportunity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Automotive Parts Magnesium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Automotive Parts Magnesium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Automotive Parts Magnesium Die Casting Market?

To stay informed about further developments, trends, and reports in the Australia Automotive Parts Magnesium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence