Key Insights

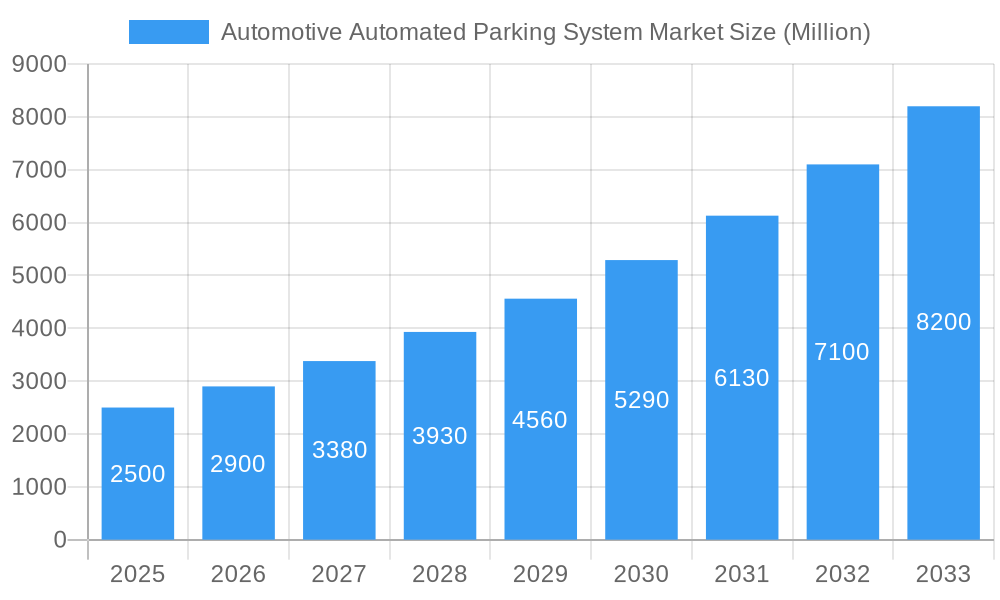

The global automotive automated parking system market is experiencing robust growth, driven by increasing urbanization, limited parking space in densely populated areas, and rising demand for efficient and secure parking solutions. The market's compound annual growth rate (CAGR) of 16.96% from 2019 to 2024 suggests a significant expansion, projected to continue over the forecast period (2025-2033). Key market drivers include advancements in sensor technology, artificial intelligence (AI), and automation, leading to the development of more sophisticated and reliable systems. Furthermore, the rising adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is fueling demand, as these vehicles often require specialized parking solutions. The market is segmented by system (hardware and software) and end-user (residential and commercial), with the commercial segment currently dominating due to higher adoption in multi-level parking garages, shopping malls, and airports. Geographic growth is anticipated across all regions, with North America and Europe maintaining strong positions due to established infrastructure and technological advancements, while the Asia-Pacific region is poised for significant growth due to rapid urbanization and increasing vehicle ownership in countries like China and India. However, high initial investment costs associated with implementing automated parking systems and the need for skilled technicians for maintenance and repair represent key market restraints. Leading companies are continually innovating to overcome these challenges and expand market penetration through strategic partnerships, technological advancements, and targeted marketing efforts.

Automotive Automated Parking System Market Market Size (In Billion)

The growth trajectory of the automotive automated parking system market is expected to remain positive throughout the forecast period. Continued technological advancements, particularly in the integration of IoT and cloud-based solutions for remote monitoring and management, will further enhance system efficiency and appeal. Government initiatives promoting sustainable urban development and smart city initiatives are also contributing to favorable market conditions. The market’s segmentation is expected to evolve with the emergence of specialized solutions catering to the specific needs of electric vehicles, autonomous vehicles, and other emerging mobility trends. Competition among established players and new entrants will intensify, driving innovation and fostering price competitiveness. The successful integration of automated parking systems into wider smart city infrastructure projects will be a critical factor in shaping the market’s future growth and adoption rates. A significant portion of future growth will likely originate from the expansion of automated parking in developing economies, where the need for efficient space utilization is particularly acute.

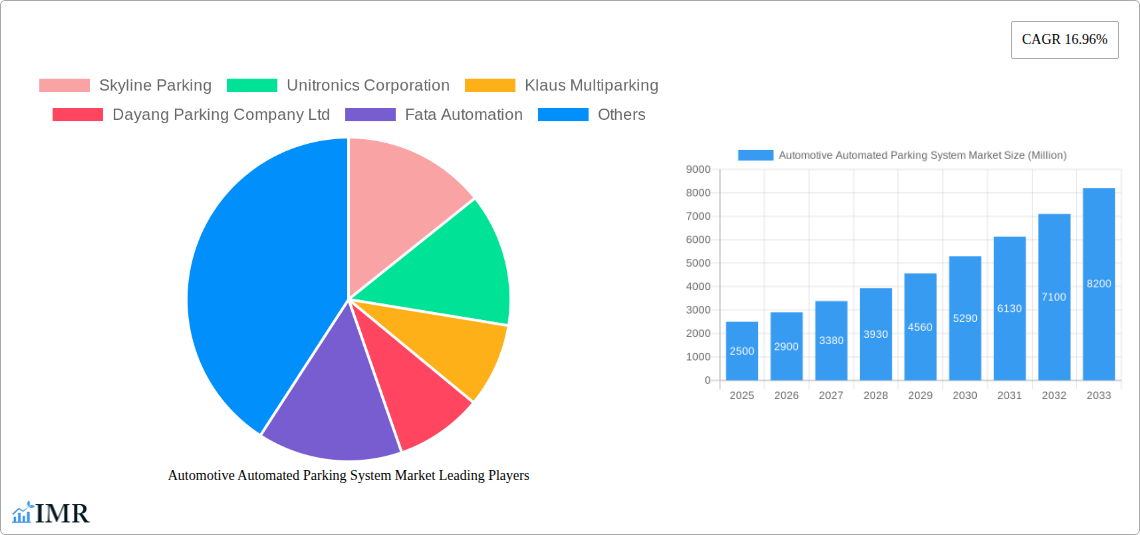

Automotive Automated Parking System Market Company Market Share

Automotive Automated Parking System Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Automotive Automated Parking System market, encompassing market dynamics, growth trends, regional analysis, competitive landscape, and future outlook. The report covers the parent market of automated parking systems and the child market focusing specifically on automotive applications. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The market size is presented in million units.

Automotive Automated Parking System Market Dynamics & Structure

The automotive automated parking system market is characterized by moderate concentration, with key players like Skyline Parking, Unitronics Corporation, and Klaus Multiparking holding significant market share (estimated at xx% collectively in 2025). Technological innovation, particularly in AI and sensor technology, is a primary growth driver. Stringent safety regulations and increasing urbanization are also influencing market expansion. Competitive substitutes include traditional parking solutions and valet services, but the increasing demand for convenience and efficiency is driving adoption of automated systems. End-user demographics are shifting towards a preference for automated parking in commercial and residential settings, especially in densely populated urban areas. M&A activity in the sector has been relatively moderate; for instance, xx M&A deals were recorded between 2019-2024. However, strategic acquisitions like Fauceria's acquisition of Hella Electronics (January 2022) indicate a potential increase in consolidation.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Innovation: AI, sensor technology, and improved software are key drivers.

- Regulatory Landscape: Stringent safety regulations influence system design and adoption.

- Competitive Substitutes: Traditional parking and valet services face increasing competition.

- End-User Demographics: Growing demand from commercial and residential sectors, especially in urban areas.

- M&A Activity: Moderate activity with xx deals between 2019-2024, indicating potential for future consolidation.

- Innovation Barriers: High initial investment costs and integration complexities can hinder adoption.

Automotive Automated Parking System Market Growth Trends & Insights

The global automotive automated parking system market experienced significant growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to several factors, including increasing urbanization leading to parking space scarcity, rising consumer demand for convenience and efficiency, and technological advancements making the systems more affordable and reliable. Market penetration is expected to reach xx% by 2033, driven by increased adoption in both residential and commercial sectors. Technological disruptions, particularly the integration of AI and IoT, are further enhancing system capabilities and expanding application possibilities. Consumer behavior shifts towards preference for automated systems are also contributing to market growth. The forecast period (2025-2033) projects a CAGR of xx%, indicating continued market expansion.

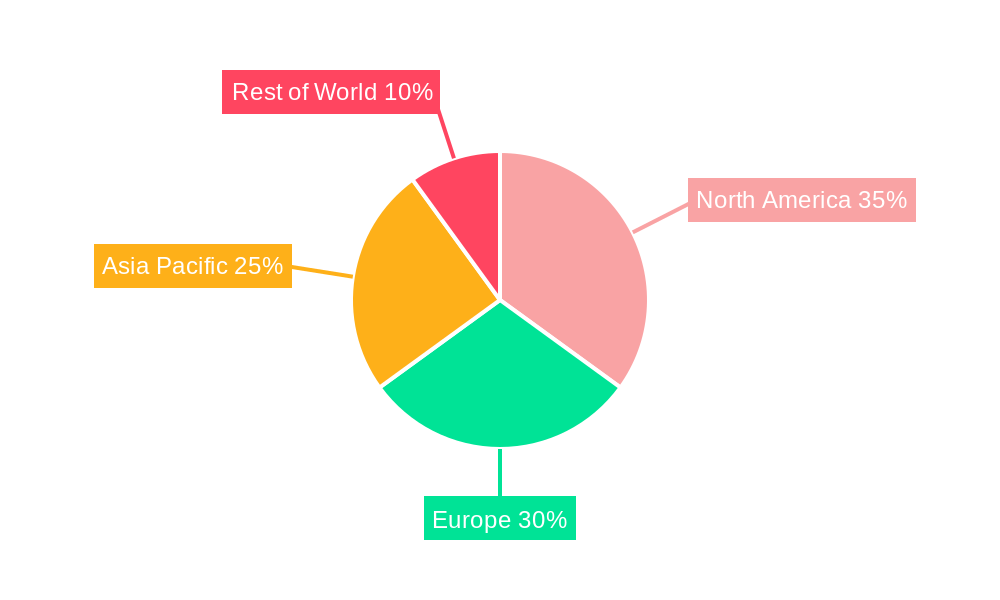

Dominant Regions, Countries, or Segments in Automotive Automated Parking System Market

North America and Europe currently dominate the market, driven by high adoption rates in major cities and strong government support for smart city initiatives. Within the segment breakdown:

- System: The hardware segment holds the larger market share (xx% in 2025), driven by increasing demand for advanced sensor and robotic systems. The software segment is expected to witness faster growth due to continuous improvements in AI-based parking management and control.

- End-User: The commercial sector currently represents the larger market segment (xx% in 2025), followed by the residential segment. However, the residential segment is expected to experience a faster growth rate in the forecast period due to rising disposable incomes and increased demand for convenience in residential parking spaces.

Key Drivers:

- North America: High adoption in urban centers, government funding for smart city projects.

- Europe: Stringent parking regulations, focus on sustainable urban planning.

- Asia-Pacific: Rapid urbanization, increasing vehicle ownership, and government initiatives.

Automotive Automated Parking System Market Product Landscape

The market offers a diverse range of automated parking systems, categorized by hardware (robotic parking systems, automated stacking systems, and vertical lift systems), software (parking management software, and AI-powered parking optimization solutions), and capacity (ranging from small residential solutions to large commercial facilities). Recent innovations focus on improved efficiency, enhanced safety features, and seamless integration with smart city infrastructure. Unique selling propositions include enhanced security, optimized space utilization, and reduced search time for parking spots. Technological advancements like AI-powered parking guidance and autonomous vehicle integration further differentiate offerings.

Key Drivers, Barriers & Challenges in Automotive Automated Parking System Market

Key Drivers:

- Growing urbanization and resulting parking space scarcity.

- Increasing demand for convenience and efficiency in parking.

- Technological advancements reducing costs and improving reliability.

- Government initiatives promoting smart cities and sustainable transportation.

Key Challenges:

- High initial investment costs for both infrastructure and system installation.

- Concerns regarding system reliability and safety.

- Integration complexities with existing parking infrastructure.

- Potential cyber security vulnerabilities. This is estimated to impact xx% of market growth by 2033.

Emerging Opportunities in Automotive Automated Parking System Market

Emerging opportunities include expanding into untapped markets (developing countries with rapid urbanization), integrating automated systems with autonomous vehicles, developing more affordable and user-friendly solutions for residential applications, exploring the use of advanced sensor technologies such as LiDAR, and enhancing integration with smart city infrastructure for optimizing parking resource allocation across multiple locations.

Growth Accelerators in the Automotive Automated Parking System Market Industry

Long-term growth will be fueled by breakthroughs in AI and robotics, fostering more efficient and sophisticated systems. Strategic partnerships between technology providers and parking facility operators will accelerate market penetration. Expansion into new markets and integration with smart city initiatives will further drive growth. The development of modular and scalable systems will make implementation more cost-effective, broadening market access.

Key Players Shaping the Automotive Automated Parking System Market Market

- Skyline Parking

- Unitronics Corporation

- Klaus Multiparking

- Dayang Parking Company Ltd

- Fata Automation

- Lodgie Industries

- Eito and Global

- ShinMaywa Industries

- Citylift

- Westfalia Parking

- Wohr Parking

- ParkPlus Inc

Notable Milestones in Automotive Automated Parking System Market Sector

- February 2022: Nvidia and Jaguar Land Rover partnership to develop software-defined features for automated driving, including automated parking, impacting future system design and capabilities.

- January 2022: Fauceria's acquisition of Hella Electronics expands the market player's product portfolio in automotive technology, including automated parking systems, potentially leading to increased innovation and market consolidation.

In-Depth Automotive Automated Parking System Market Market Outlook

The future of the automotive automated parking system market is bright. Continued technological advancements, coupled with growing urbanization and a rising demand for convenient parking solutions, will drive significant growth over the next decade. Strategic partnerships and expansion into new markets represent key opportunities for market players to capitalize on this expanding market. The focus on AI-powered systems and seamless integration with smart city infrastructure will be crucial for long-term success. The market is poised for considerable expansion, offering attractive investment opportunities for businesses involved in this sector.

Automotive Automated Parking System Market Segmentation

-

1. System

- 1.1. Hardware

- 1.2. Software

-

2. End User

- 2.1. Residential

- 2.2. Commercial

Automotive Automated Parking System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Automated Parking System Market Regional Market Share

Geographic Coverage of Automotive Automated Parking System Market

Automotive Automated Parking System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Rest of the World Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Skyline Parking

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unitronics Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Klaus Multiparking

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dayang Parking Company Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fata Automation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lodgie Industries

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Eito and Global

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ShinMaywa Industries

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Citylift

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Westfalia Parking

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Wohr Parking

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 ParkPlus Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Skyline Parking

List of Figures

- Figure 1: Global Automotive Automated Parking System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 3: North America Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 9: Europe Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 10: Europe Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 15: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 16: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 21: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 22: Rest of the World Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 2: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Automotive Automated Parking System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 5: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 11: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 18: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 26: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Automated Parking System Market?

The projected CAGR is approximately 16.96%.

2. Which companies are prominent players in the Automotive Automated Parking System Market?

Key companies in the market include Skyline Parking, Unitronics Corporation, Klaus Multiparking, Dayang Parking Company Ltd, Fata Automation, Lodgie Industries, Eito and Global, ShinMaywa Industries, Citylift, Westfalia Parking, Wohr Parking, ParkPlus Inc.

3. What are the main segments of the Automotive Automated Parking System Market?

The market segments include System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Increasing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In February 2022, Nvidia and Jaguar Land Rover announced a partnership to develop software-defined features to improve automated driving in their vehicle from 2025. The emphasis is on AI-based features, including advanced visualization and driver and occupant monitoring through the Drive IX software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Automated Parking System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Automated Parking System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Automated Parking System Market?

To stay informed about further developments, trends, and reports in the Automotive Automated Parking System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence