Key Insights

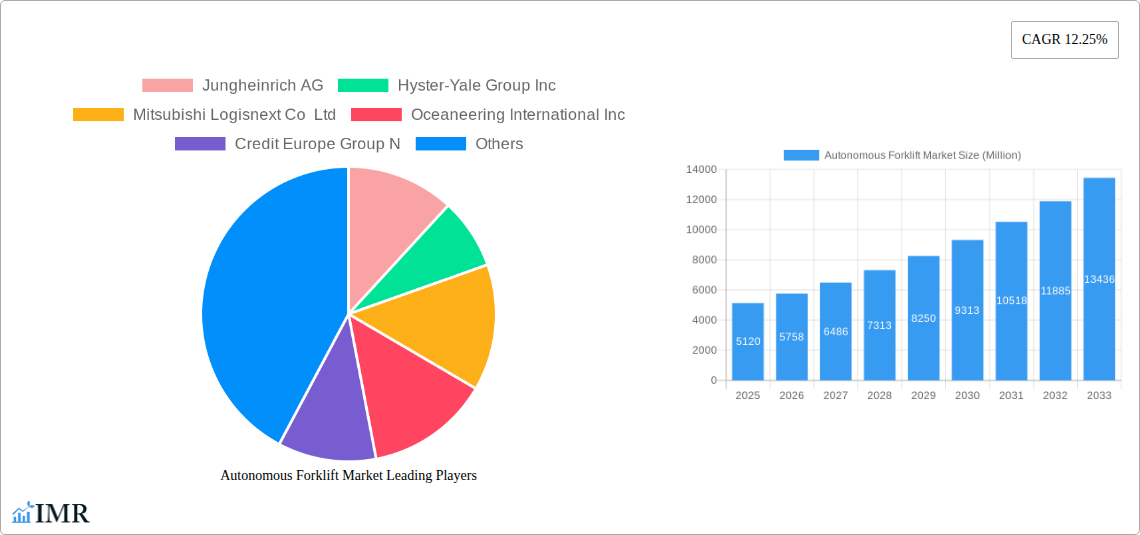

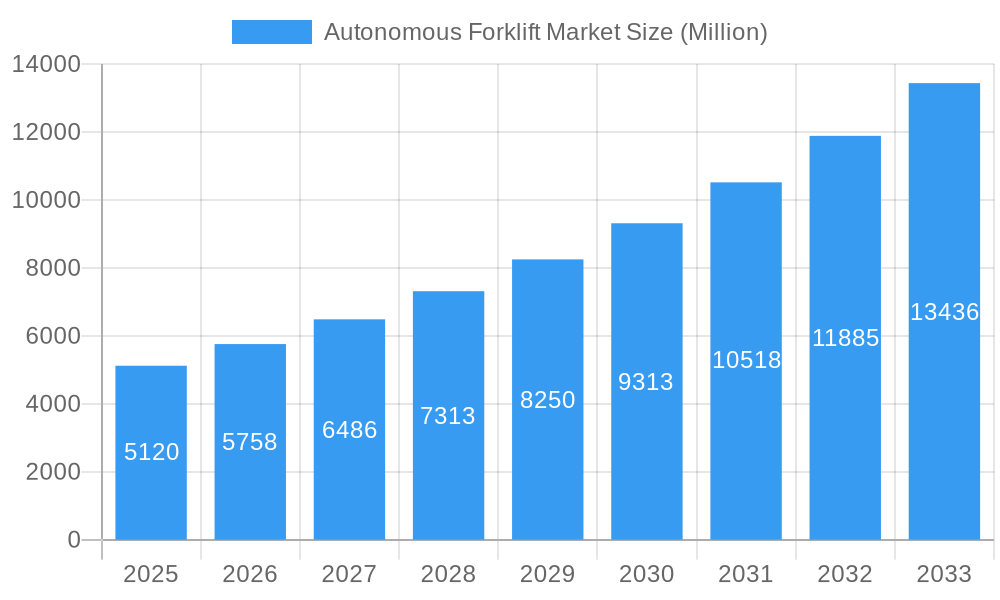

The Autonomous Forklift Market is experiencing robust growth, projected to reach a market size of $5.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.25% from 2025 to 2033. This expansion is driven primarily by the increasing demand for enhanced efficiency and safety in warehousing and manufacturing operations. Automation offers significant advantages, including reduced labor costs, improved throughput, and minimized risks associated with human error. Key trends shaping the market include the rising adoption of sophisticated navigation technologies like laser guidance and vision guidance systems, enabling greater precision and adaptability in dynamic environments. Furthermore, the burgeoning e-commerce sector and the need for faster order fulfillment are fueling the demand for autonomous forklifts capable of handling high-volume operations. While initial investment costs and the integration complexities of autonomous systems pose certain restraints, the long-term benefits of increased productivity and reduced operational expenses are overcoming these challenges, leading to substantial market growth.

Autonomous Forklift Market Market Size (In Billion)

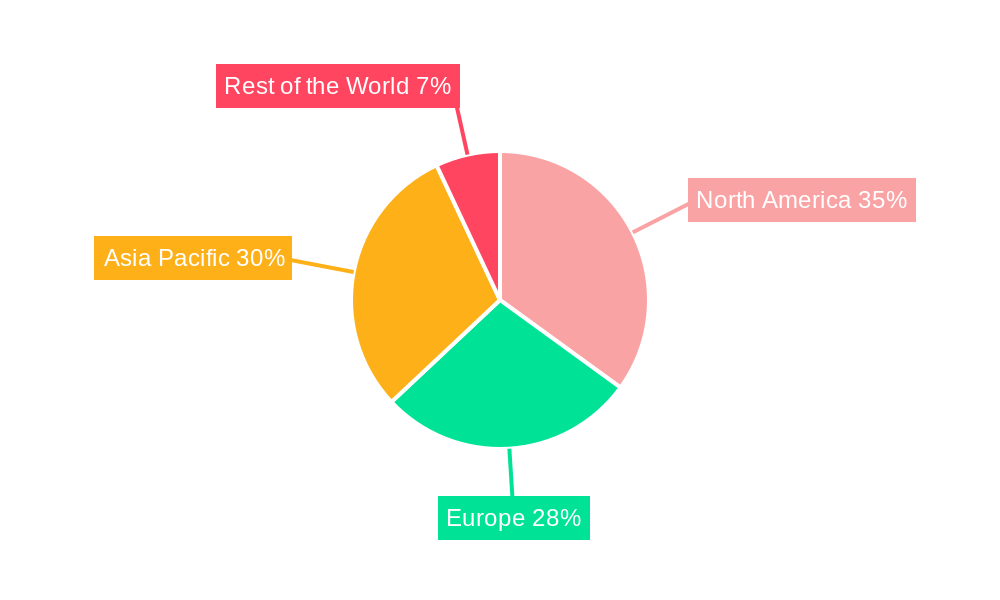

The market segmentation reveals a diverse landscape. Electric propulsion systems dominate due to their environmental friendliness and lower operational costs. In terms of tonnage capacity, the segment comprising forklifts with capacities above 10 tons is exhibiting strong growth, driven by the needs of heavy industries. Logistics and warehousing remain the leading application segment, followed closely by manufacturing. Major players like Jungheinrich AG, Hyster-Yale Group Inc., and Toyota Industries Corporation are actively driving innovation and expanding their market presence through strategic partnerships and technological advancements. Geographical expansion is also a prominent trend, with North America and Asia Pacific expected to lead the market, fueled by strong industrial growth and early adoption of automation technologies in these regions. The continuous improvement of autonomous navigation algorithms, coupled with falling hardware costs, is expected to further accelerate market expansion throughout the forecast period.

Autonomous Forklift Market Company Market Share

Autonomous Forklift Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Autonomous Forklift Market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is designed for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this rapidly evolving market, valued at xx Million units in 2025 and projected to reach xx Million units by 2033.

Autonomous Forklift Market Market Dynamics & Structure

The Autonomous Forklift Market is experiencing significant growth driven by the increasing demand for automation in logistics, warehousing, and manufacturing. Market concentration is moderate, with several key players competing intensely. Technological innovation, particularly in navigation and AI, is a primary driver, while regulatory frameworks concerning safety and data privacy influence market adoption. Competitive substitutes include traditional forklifts and other automated material handling equipment. The end-user demographic is diverse, encompassing large enterprises and smaller businesses across various industries. M&A activity in the sector has been relatively moderate, with xx deals recorded in the historical period (2019-2024), representing a xx% increase compared to the previous five-year period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Rapid advancements in AI, sensor technology, and navigation systems are key growth drivers.

- Regulatory Framework: Safety standards and data privacy regulations are crucial considerations for market participants.

- Competitive Substitutes: Traditional forklifts and other automated guided vehicles (AGVs) represent primary competition.

- End-User Demographics: Large enterprises in logistics and manufacturing are the primary adopters, with increasing uptake by smaller businesses.

- M&A Trends: Moderate M&A activity, with a focus on strategic acquisitions to enhance technological capabilities and expand market reach.

Autonomous Forklift Market Growth Trends & Insights

The Autonomous Forklift Market demonstrates robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the rising adoption of automation technologies in diverse industries to enhance operational efficiency and reduce labor costs. The market penetration rate is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the integration of AI and advanced sensor technologies, are significantly impacting market dynamics. Consumer behavior is shifting towards automated solutions seeking enhanced productivity and safety.

Dominant Regions, Countries, or Segments in Autonomous Forklift Market

The North American and European regions currently dominate the Autonomous Forklift Market, driven by strong adoption rates in logistics and manufacturing sectors. Within these regions, countries like the US and Germany are leading markets. Segment-wise, the "Below 5 Tons" tonnage capacity segment holds the largest market share due to its wide applicability across various industries. The "Logistics and Warehousing" application segment is also a major contributor to overall market growth.

- Leading Regions: North America and Europe, fueled by high automation adoption rates and favorable regulatory environments.

- Leading Countries: United States and Germany exhibit strong market growth due to substantial investments in automation technologies.

- Leading Segment (Tonnage Capacity): Below 5 tons, owing to its versatility and suitability for a wide range of applications.

- Leading Segment (Application): Logistics and Warehousing, driven by the high demand for efficient material handling solutions in these sectors.

- Leading Segment (Navigation Technology): Laser Guidance, currently the dominant technology due to its accuracy and reliability.

Autonomous Forklift Market Product Landscape

Autonomous forklift innovations focus on enhanced safety features, improved navigation accuracy, and increased payload capacities. New models incorporate advanced AI capabilities for optimal path planning and obstacle avoidance. Key performance metrics include payload capacity, lift height, operating speed, and battery life. Unique selling propositions often revolve around enhanced safety, increased efficiency, and reduced operational costs. Technological advancements in areas like LiDAR, computer vision, and machine learning constantly improve these functionalities.

Key Drivers, Barriers & Challenges in Autonomous Forklift Market

Key Drivers:

- Increasing demand for efficient material handling solutions.

- Rising labor costs and labor shortages.

- Growing adoption of Industry 4.0 technologies.

- Technological advancements leading to improved safety and efficiency.

Key Challenges and Restraints:

- High initial investment costs.

- Concerns about safety and reliability.

- Integration challenges with existing warehouse management systems.

- Limited skilled workforce for installation and maintenance. This translates to an estimated xx% increase in implementation costs.

Emerging Opportunities in Autonomous Forklift Market

Untapped markets in developing economies present significant growth potential. Innovative applications, like autonomous forklifts in cold storage or hazardous environments, are emerging. Evolving consumer preferences towards more sophisticated and user-friendly systems create opportunities for advanced features and service offerings.

Growth Accelerators in the Autonomous Forklift Market Industry

Technological breakthroughs, such as the development of more robust and reliable sensor technologies and AI algorithms, will be crucial. Strategic partnerships between autonomous vehicle technology providers and leading forklift manufacturers can accelerate market growth. Market expansion into new industries and geographies will unlock significant opportunities.

Key Players Shaping the Autonomous Forklift Market Market

- Jungheinrich AG

- Hyster-Yale Group Inc

- Mitsubishi Logisnext Co Ltd

- Oceaneering International Inc

- Credit Europe Group N

- HD Hyundai Construction Equipment

- Toyota Industries Corporation

- Balyo

- Vecna AFL

- Agilox Services GmbH

- Hangcha Group Co Ltd

- Kion Group AG

- Otto Motors

- Gridbots Technologies Private Limited

- Swisslog Holding AG

Notable Milestones in Autonomous Forklift Market Sector

- February 2024: Seegrid Corporation launches Palion Lift CR1, a high-capacity autonomous lift truck with advanced navigation.

- September 2023: Worldwide Flight Services (WFS) initiates a trial of Linde AGV forklifts at Barcelona Airport.

- August 2023: Cyngn Inc. secures a pre-order agreement with Arauco for 100 autonomous electric forklifts.

In-Depth Autonomous Forklift Market Market Outlook

The future of the Autonomous Forklift Market is bright, driven by continuous technological innovation and increasing industry adoption. Strategic partnerships and collaborations will be crucial for success. Expansion into new applications and geographical markets offers substantial growth potential. The market is poised for significant expansion, presenting lucrative opportunities for both established players and new entrants.

Autonomous Forklift Market Segmentation

-

1. Tonnage Capacity

- 1.1. Below 5 Tons

- 1.2. 5-10 Tons

- 1.3. Above 10 Tons

-

2. Navigation Technology

- 2.1. Laser Guidance

- 2.2. Vision Guidance

- 2.3. Optical Tape Guidance

- 2.4. Magnetic Guidance

- 2.5. Inductive Guidance

- 2.6. Others (

-

3. Application

- 3.1. Logistics and Warehousing

- 3.2. Manufacturing

- 3.3. Material Handling

- 3.4. Others (Retail, etc.)

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Diesel

- 4.3. Others (CNG, LPG, etc.)

-

5. Type

- 5.1. Pallet Truck/Mover/Jack

- 5.2. Pallet Stackers

- 5.3. Others (Forked AGV, etc.)

Autonomous Forklift Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Autonomous Forklift Market Regional Market Share

Geographic Coverage of Autonomous Forklift Market

Autonomous Forklift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.1.1. Below 5 Tons

- 5.1.2. 5-10 Tons

- 5.1.3. Above 10 Tons

- 5.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 5.2.1. Laser Guidance

- 5.2.2. Vision Guidance

- 5.2.3. Optical Tape Guidance

- 5.2.4. Magnetic Guidance

- 5.2.5. Inductive Guidance

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logistics and Warehousing

- 5.3.2. Manufacturing

- 5.3.3. Material Handling

- 5.3.4. Others (Retail, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Diesel

- 5.4.3. Others (CNG, LPG, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Pallet Truck/Mover/Jack

- 5.5.2. Pallet Stackers

- 5.5.3. Others (Forked AGV, etc.)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6. North America Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6.1.1. Below 5 Tons

- 6.1.2. 5-10 Tons

- 6.1.3. Above 10 Tons

- 6.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 6.2.1. Laser Guidance

- 6.2.2. Vision Guidance

- 6.2.3. Optical Tape Guidance

- 6.2.4. Magnetic Guidance

- 6.2.5. Inductive Guidance

- 6.2.6. Others (

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Logistics and Warehousing

- 6.3.2. Manufacturing

- 6.3.3. Material Handling

- 6.3.4. Others (Retail, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. Electric

- 6.4.2. Diesel

- 6.4.3. Others (CNG, LPG, etc.)

- 6.5. Market Analysis, Insights and Forecast - by Type

- 6.5.1. Pallet Truck/Mover/Jack

- 6.5.2. Pallet Stackers

- 6.5.3. Others (Forked AGV, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7. Europe Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7.1.1. Below 5 Tons

- 7.1.2. 5-10 Tons

- 7.1.3. Above 10 Tons

- 7.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 7.2.1. Laser Guidance

- 7.2.2. Vision Guidance

- 7.2.3. Optical Tape Guidance

- 7.2.4. Magnetic Guidance

- 7.2.5. Inductive Guidance

- 7.2.6. Others (

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Logistics and Warehousing

- 7.3.2. Manufacturing

- 7.3.3. Material Handling

- 7.3.4. Others (Retail, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. Electric

- 7.4.2. Diesel

- 7.4.3. Others (CNG, LPG, etc.)

- 7.5. Market Analysis, Insights and Forecast - by Type

- 7.5.1. Pallet Truck/Mover/Jack

- 7.5.2. Pallet Stackers

- 7.5.3. Others (Forked AGV, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8. Asia Pacific Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8.1.1. Below 5 Tons

- 8.1.2. 5-10 Tons

- 8.1.3. Above 10 Tons

- 8.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 8.2.1. Laser Guidance

- 8.2.2. Vision Guidance

- 8.2.3. Optical Tape Guidance

- 8.2.4. Magnetic Guidance

- 8.2.5. Inductive Guidance

- 8.2.6. Others (

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Logistics and Warehousing

- 8.3.2. Manufacturing

- 8.3.3. Material Handling

- 8.3.4. Others (Retail, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. Electric

- 8.4.2. Diesel

- 8.4.3. Others (CNG, LPG, etc.)

- 8.5. Market Analysis, Insights and Forecast - by Type

- 8.5.1. Pallet Truck/Mover/Jack

- 8.5.2. Pallet Stackers

- 8.5.3. Others (Forked AGV, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9. Rest of the World Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9.1.1. Below 5 Tons

- 9.1.2. 5-10 Tons

- 9.1.3. Above 10 Tons

- 9.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 9.2.1. Laser Guidance

- 9.2.2. Vision Guidance

- 9.2.3. Optical Tape Guidance

- 9.2.4. Magnetic Guidance

- 9.2.5. Inductive Guidance

- 9.2.6. Others (

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Logistics and Warehousing

- 9.3.2. Manufacturing

- 9.3.3. Material Handling

- 9.3.4. Others (Retail, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. Electric

- 9.4.2. Diesel

- 9.4.3. Others (CNG, LPG, etc.)

- 9.5. Market Analysis, Insights and Forecast - by Type

- 9.5.1. Pallet Truck/Mover/Jack

- 9.5.2. Pallet Stackers

- 9.5.3. Others (Forked AGV, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyster-Yale Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Logisnext Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oceaneering International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Credit Europe Group N

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HD Hyundai Construction Equipment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Industries Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Balyo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vecna AFL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilox Services GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hangcha Group Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kion Group AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Otto Motors

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gridbots Technologies Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Swisslog Holding AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Autonomous Forklift Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 3: North America Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 4: North America Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 5: North America Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 6: North America Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 9: North America Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: North America Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 15: Europe Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 16: Europe Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 17: Europe Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 18: Europe Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 21: Europe Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Europe Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 27: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 28: Asia Pacific Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 29: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 30: Asia Pacific Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 33: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: Asia Pacific Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 39: Rest of the World Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 40: Rest of the World Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 41: Rest of the World Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 42: Rest of the World Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 45: Rest of the World Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Rest of the World Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Rest of the World Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Rest of the World Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 2: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 3: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Autonomous Forklift Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 8: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 9: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 17: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 18: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 28: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 29: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Japan Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Korea Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 39: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 40: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 42: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Middle East and Africa Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Forklift Market?

The projected CAGR is approximately 12.25%.

2. Which companies are prominent players in the Autonomous Forklift Market?

Key companies in the market include Jungheinrich AG, Hyster-Yale Group Inc, Mitsubishi Logisnext Co Ltd, Oceaneering International Inc, Credit Europe Group N, HD Hyundai Construction Equipment, Toyota Industries Corporation, Balyo, Vecna AFL, Agilox Services GmbH, Hangcha Group Co Ltd, Kion Group AG, Otto Motors, Gridbots Technologies Private Limited, Swisslog Holding AG.

3. What are the main segments of the Autonomous Forklift Market?

The market segments include Tonnage Capacity, Navigation Technology, Application, Propulsion Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Forklift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Forklift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Forklift Market?

To stay informed about further developments, trends, and reports in the Autonomous Forklift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence