Key Insights

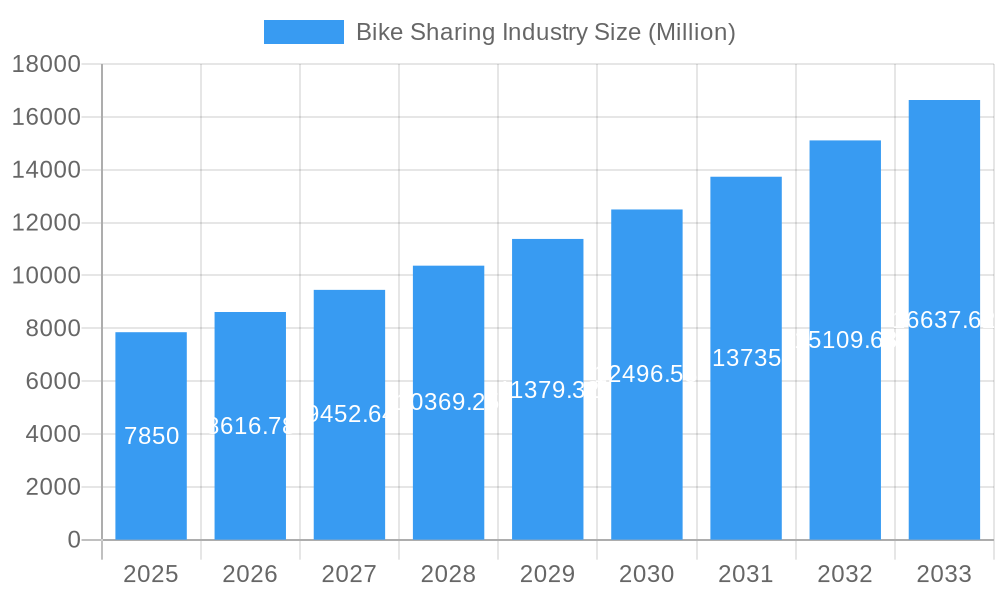

The global bike-sharing market, valued at $7.85 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental concerns, and the growing popularity of micro-mobility solutions. The market's Compound Annual Growth Rate (CAGR) of 9.65% from 2025 to 2033 signifies a significant expansion opportunity. Several factors contribute to this growth. Firstly, the increasing adoption of e-bikes within sharing systems offers a faster and more convenient alternative to traditional bicycles, particularly for longer commutes. Secondly, the advancement of technology, including improved GPS tracking, secure locking mechanisms, and user-friendly mobile applications, enhances the overall user experience and expands market accessibility. The shift towards dockless systems provides greater flexibility and convenience for users, further fueling market expansion. While regulatory challenges and concerns about safety and maintenance remain, the market is adapting with innovations that address these concerns.

Bike Sharing Industry Market Size (In Billion)

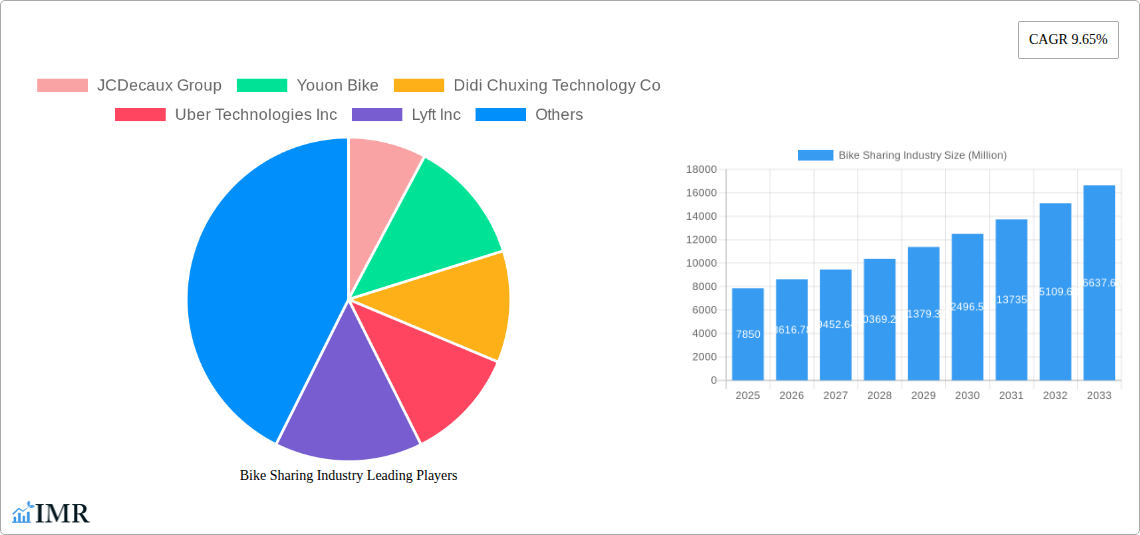

Competitive landscape analysis reveals a mix of established players like JCDecaux Group and emerging companies like Bird Rides Inc and Hellobike. These companies are vying for market share through strategic partnerships, technological advancements, and aggressive expansion into new geographical markets. Regional variations in market penetration are expected, with Asia Pacific likely dominating due to its high population density and increasing adoption of shared mobility services. North America and Europe are also significant markets, experiencing steady growth driven by government initiatives promoting sustainable transportation. The segmentation of the market into traditional bikes, e-bikes, and different sharing systems (docked and dockless) presents diverse opportunities for businesses to cater to specific user needs and preferences. Continued innovation and strategic investments in infrastructure will be crucial for sustaining the market’s momentum in the coming years.

Bike Sharing Industry Company Market Share

Bike Sharing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the bike-sharing industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic planners. The report analyzes both parent market (Micromobility) and child markets (Traditional Bikes, E-bikes, Docked & Dockless systems) to provide a complete overview. The market size is measured in million units.

Bike Sharing Industry Market Dynamics & Structure

The bike-sharing market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with several key players vying for dominance, while smaller startups and regional players also contribute significantly. Technological innovation, particularly in e-bike technology and smart-locking systems, is a crucial driver. Regulatory frameworks, varying widely across geographies, significantly impact market expansion and operational strategies. Competitive product substitutes include ride-hailing services and public transportation. End-user demographics are expanding beyond the traditional young, urban demographic, encompassing a broader range of ages and socioeconomic groups. Mergers and acquisitions (M&A) activity is notable, with larger companies consolidating market share and acquiring innovative technologies. In the historical period (2019-2024), the M&A deal volume was approximately xx million, with an estimated xx% increase in 2025.

- Market Concentration: Moderate, with a few dominant players and numerous smaller companies.

- Technological Innovation: E-bikes, smart-locking, GPS tracking, and app-based systems are key drivers.

- Regulatory Frameworks: Vary significantly by region, impacting operational costs and market access.

- Competitive Substitutes: Ride-hailing services, public transportation, and personal vehicles.

- End-User Demographics: Expanding beyond younger, urban populations to encompass a wider demographic.

- M&A Trends: Significant activity, with larger companies acquiring smaller players and technologies.

Bike Sharing Industry Growth Trends & Insights

The global bike-sharing market experienced substantial growth during the historical period (2019-2024), driven by increasing urbanization, growing environmental concerns, and the rising popularity of micro-mobility solutions. The market size reached xx million units in 2024, exhibiting a CAGR of xx% from 2019 to 2024. Technological disruptions, such as the introduction of e-bikes and improved dockless systems, significantly impacted adoption rates. Consumer behavior shifts toward sustainable transportation options and convenient, on-demand services further fueled market expansion. The forecast period (2025-2033) anticipates continued growth, with the market size projected to reach xx million units by 2033, driven by increasing investments in bike-sharing infrastructure, expansion into new markets, and continued technological advancements. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

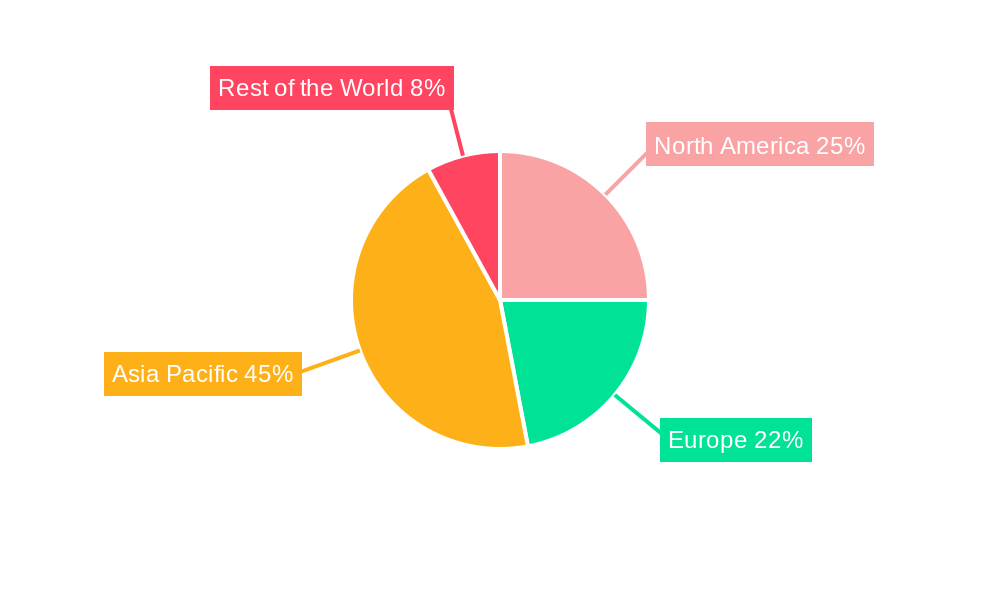

Dominant Regions, Countries, or Segments in Bike Sharing Industry

Asia-Pacific, specifically China, currently dominates the global bike-sharing market, holding the largest market share driven by high population density, government support for sustainable transport, and significant investments in bike-sharing infrastructure. However, North America and Europe are also exhibiting substantial growth, driven by increasing environmental awareness and the adoption of e-bikes. The e-bike segment is rapidly gaining traction globally, outpacing the growth of traditional bike-sharing due to increased range and convenience. Dockless systems have achieved greater market penetration compared to docked systems owing to their flexibility and convenience.

- Key Drivers: Government initiatives promoting sustainable transport, increasing urbanization, favorable demographics.

- Dominance Factors: Strong infrastructure investment, high population density, favorable government policies, high adoption rate.

- Growth Potential: Expansion in emerging markets, increasing adoption of e-bikes, advancements in technology.

Bike Sharing Industry Product Landscape

The bike-sharing industry features a diverse range of products, encompassing traditional bicycles, e-bikes with varying battery capacities and ranges, and smart-locking mechanisms. E-bikes offer enhanced convenience and usability, expanding the market to a broader range of users. Innovative features include integrated GPS tracking for security and real-time monitoring, and app-based unlocking and payment systems. Performance metrics focus on battery life, range, durability, and user-friendliness. Unique selling propositions highlight convenience, sustainability, and cost-effectiveness compared to other transportation options.

Key Drivers, Barriers & Challenges in Bike Sharing Industry

Key Drivers:

- Increasing urbanization and traffic congestion.

- Growing environmental concerns and the push for sustainable transportation.

- Government incentives and policies promoting bike-sharing programs.

- Technological advancements in e-bikes and smart-locking systems.

Key Challenges:

- Vandalism and theft of bikes.

- High operational and maintenance costs.

- Regulatory hurdles and permitting complexities.

- Competition from other micro-mobility solutions.

- Supply chain disruptions impacting the availability of components. The impact on market growth is estimated at xx million units annually.

Emerging Opportunities in Bike Sharing Industry

- Expansion into underserved markets and smaller cities.

- Integration with other modes of transportation, creating multimodal transit systems.

- Development of specialized bike-sharing programs (e.g., cargo bikes for delivery).

- Personalized subscription models tailored to individual usage patterns.

- Utilizing data analytics to improve efficiency and optimize operations.

Growth Accelerators in the Bike Sharing Industry

Technological advancements, particularly in battery technology for e-bikes and the development of more robust and tamper-resistant locking mechanisms, are key catalysts for long-term growth. Strategic partnerships with municipalities and businesses to integrate bike-sharing into existing transportation networks are also significant drivers. Expansion into new geographic markets and the development of innovative business models, such as subscription services and corporate partnerships, will further propel market expansion.

Key Players Shaping the Bike Sharing Industry Market

- JCDecaux Group

- Youon Bike

- Didi Chuxing Technology Co

- Uber Technologies Inc

- Lyft Inc

- Bluegogo

- Hellbike

- Meituan Bik

- Bird Rides Inc

- Neutron Holdings Inc

Notable Milestones in Bike Sharing Industry Sector

- March 2023: MYBYK launched two electric bicycle variants, impacting the e-bike segment.

- March 2023: Brighton and Hove launched a bike-sharing scheme with Beryl, demonstrating local market expansion.

- December 2023: USD 23 million investment in Tembici fuels Latin American expansion.

In-Depth Bike Sharing Industry Market Outlook

The bike-sharing industry is poised for sustained growth, driven by ongoing technological innovation, expanding infrastructure, and increasing consumer adoption. The market will likely see further consolidation through M&A activity, and the emergence of innovative business models focused on sustainability and integration with smart city initiatives. The focus on e-bikes and the expansion into untapped markets present significant strategic opportunities for both established players and new entrants.

Bike Sharing Industry Segmentation

-

1. Bike

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System

- 2.1. Docked

- 2.2. Dockless

Bike Sharing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Bike Sharing Industry Regional Market Share

Geographic Coverage of Bike Sharing Industry

Bike Sharing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. E-bike Segment Expected to be the Fastest-growing Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bike Sharing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Bike

- 6. North America Bike Sharing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Bike

- 6.1.1. Traditional/Regular Bike

- 6.1.2. E-bike

- 6.2. Market Analysis, Insights and Forecast - by Sharing System

- 6.2.1. Docked

- 6.2.2. Dockless

- 6.1. Market Analysis, Insights and Forecast - by Bike

- 7. Europe Bike Sharing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Bike

- 7.1.1. Traditional/Regular Bike

- 7.1.2. E-bike

- 7.2. Market Analysis, Insights and Forecast - by Sharing System

- 7.2.1. Docked

- 7.2.2. Dockless

- 7.1. Market Analysis, Insights and Forecast - by Bike

- 8. Asia Pacific Bike Sharing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Bike

- 8.1.1. Traditional/Regular Bike

- 8.1.2. E-bike

- 8.2. Market Analysis, Insights and Forecast - by Sharing System

- 8.2.1. Docked

- 8.2.2. Dockless

- 8.1. Market Analysis, Insights and Forecast - by Bike

- 9. Rest of the World Bike Sharing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Bike

- 9.1.1. Traditional/Regular Bike

- 9.1.2. E-bike

- 9.2. Market Analysis, Insights and Forecast - by Sharing System

- 9.2.1. Docked

- 9.2.2. Dockless

- 9.1. Market Analysis, Insights and Forecast - by Bike

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JCDecaux Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Youon Bike

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Didi Chuxing Technology Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Uber Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lyft Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bluegogo

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hellobike

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Meituan Bik

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bird Rides Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Neutron Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 JCDecaux Group

List of Figures

- Figure 1: Global Bike Sharing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bike Sharing Industry Revenue (Million), by Bike 2025 & 2033

- Figure 3: North America Bike Sharing Industry Revenue Share (%), by Bike 2025 & 2033

- Figure 4: North America Bike Sharing Industry Revenue (Million), by Sharing System 2025 & 2033

- Figure 5: North America Bike Sharing Industry Revenue Share (%), by Sharing System 2025 & 2033

- Figure 6: North America Bike Sharing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bike Sharing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bike Sharing Industry Revenue (Million), by Bike 2025 & 2033

- Figure 9: Europe Bike Sharing Industry Revenue Share (%), by Bike 2025 & 2033

- Figure 10: Europe Bike Sharing Industry Revenue (Million), by Sharing System 2025 & 2033

- Figure 11: Europe Bike Sharing Industry Revenue Share (%), by Sharing System 2025 & 2033

- Figure 12: Europe Bike Sharing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bike Sharing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Bike Sharing Industry Revenue (Million), by Bike 2025 & 2033

- Figure 15: Asia Pacific Bike Sharing Industry Revenue Share (%), by Bike 2025 & 2033

- Figure 16: Asia Pacific Bike Sharing Industry Revenue (Million), by Sharing System 2025 & 2033

- Figure 17: Asia Pacific Bike Sharing Industry Revenue Share (%), by Sharing System 2025 & 2033

- Figure 18: Asia Pacific Bike Sharing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Bike Sharing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Bike Sharing Industry Revenue (Million), by Bike 2025 & 2033

- Figure 21: Rest of the World Bike Sharing Industry Revenue Share (%), by Bike 2025 & 2033

- Figure 22: Rest of the World Bike Sharing Industry Revenue (Million), by Sharing System 2025 & 2033

- Figure 23: Rest of the World Bike Sharing Industry Revenue Share (%), by Sharing System 2025 & 2033

- Figure 24: Rest of the World Bike Sharing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Bike Sharing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bike Sharing Industry Revenue Million Forecast, by Bike 2020 & 2033

- Table 2: Global Bike Sharing Industry Revenue Million Forecast, by Sharing System 2020 & 2033

- Table 3: Global Bike Sharing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bike Sharing Industry Revenue Million Forecast, by Bike 2020 & 2033

- Table 5: Global Bike Sharing Industry Revenue Million Forecast, by Sharing System 2020 & 2033

- Table 6: Global Bike Sharing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Bike Sharing Industry Revenue Million Forecast, by Bike 2020 & 2033

- Table 8: Global Bike Sharing Industry Revenue Million Forecast, by Sharing System 2020 & 2033

- Table 9: Global Bike Sharing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Bike Sharing Industry Revenue Million Forecast, by Bike 2020 & 2033

- Table 11: Global Bike Sharing Industry Revenue Million Forecast, by Sharing System 2020 & 2033

- Table 12: Global Bike Sharing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Bike Sharing Industry Revenue Million Forecast, by Bike 2020 & 2033

- Table 14: Global Bike Sharing Industry Revenue Million Forecast, by Sharing System 2020 & 2033

- Table 15: Global Bike Sharing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bike Sharing Industry?

The projected CAGR is approximately 9.65%.

2. Which companies are prominent players in the Bike Sharing Industry?

Key companies in the market include JCDecaux Group, Youon Bike, Didi Chuxing Technology Co, Uber Technologies Inc, Lyft Inc, Bluegogo, Hellobike, Meituan Bik, Bird Rides Inc, Neutron Holdings Inc.

3. What are the main segments of the Bike Sharing Industry?

The market segments include Bike, Sharing System.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

E-bike Segment Expected to be the Fastest-growing Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: The US International Development Finance Corporation (DFC) and IDB Invest announced that they were co-investing a combined USD 23 million in equity in micro-mobility platform Tembici to support the expansion of bicycle-sharing services in Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bike Sharing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bike Sharing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bike Sharing Industry?

To stay informed about further developments, trends, and reports in the Bike Sharing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence