Key Insights

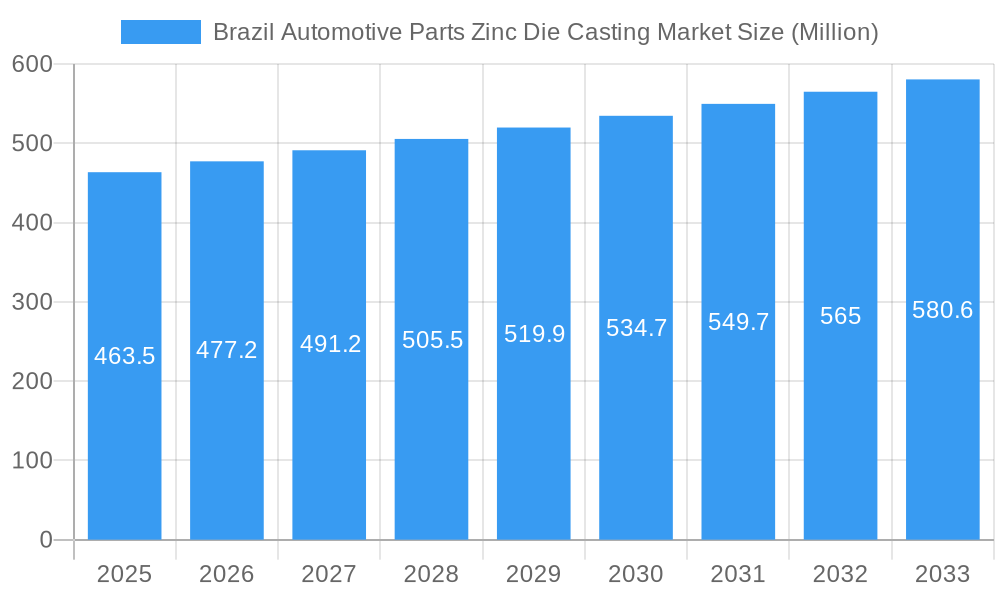

The Brazil automotive parts zinc die casting market, valued at $463.5 million in 2025, is projected to experience steady growth, driven by the expansion of the automotive industry and increasing demand for lightweight and high-strength components. The market's Compound Annual Growth Rate (CAGR) of 3.00% from 2025 to 2033 reflects a consistent, albeit moderate, growth trajectory. Key drivers include the rising adoption of zinc die casting in engine parts, transmission components, and body assemblies due to its cost-effectiveness and superior mechanical properties. Furthermore, advancements in die casting technologies, such as pressure die casting and vacuum die casting, are enhancing the quality and precision of produced parts, further fueling market expansion. While specific restraining factors aren't provided, potential challenges could include fluctuations in raw material prices (zinc), competition from alternative materials, and the overall economic health of the Brazilian automotive sector. The market segmentation reveals a strong emphasis on automotive applications, with engine parts, transmission parts, and body assemblies dominating the demand landscape. Major players like Sandhar Technologies Ltd, Empire Casting Co, and Pace Industries are actively shaping the market dynamics through their technological capabilities and market reach. The focus on improving fuel efficiency and reducing vehicle weight in the automotive sector is expected to further stimulate demand for lightweight zinc die castings in the coming years.

Brazil Automotive Parts Zinc Die Casting Market Market Size (In Million)

The forecast period of 2025-2033 anticipates continued growth, albeit at a moderate pace. This is largely attributed to the anticipated expansion of the Brazilian automotive market, which will influence the demand for zinc die casting components. However, factors such as government regulations on emissions and fuel economy standards, as well as the overall economic climate in Brazil, could influence the pace of market expansion. Companies operating in this space are likely to focus on improving their production processes, investing in research and development, and exploring new market segments to maintain competitiveness and capitalize on growth opportunities. The strategic focus will likely be on providing high-quality, cost-effective zinc die castings that meet the evolving demands of the automotive industry in Brazil.

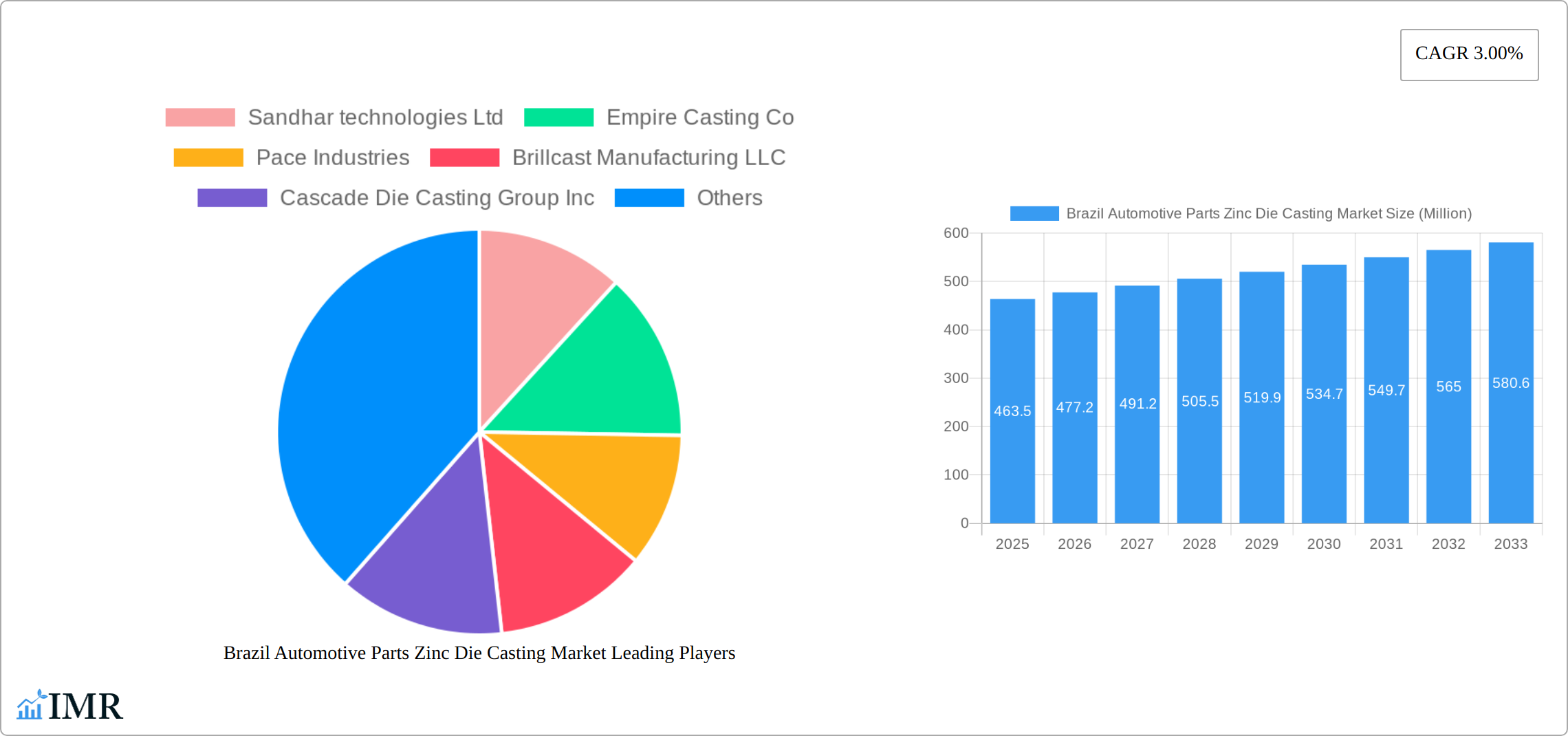

Brazil Automotive Parts Zinc Die Casting Market Company Market Share

Brazil Automotive Parts Zinc Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Brazil automotive parts zinc die casting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The report meticulously analyzes market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook, providing a 360° view of this lucrative market segment. This report covers the parent market of Brazil Automotive Parts Market and the child market of Brazil Automotive Parts Zinc Die Casting Market.

Keywords: Brazil automotive parts market, zinc die casting, automotive parts zinc die casting Brazil, pressure die casting, vacuum die casting, body assemblies, engine parts, transmission parts, Sandhar Technologies, Empire Casting, Pace Industries, Brillcast Manufacturing, Cascade Die Casting, Ningbo Die Casting, Dynacast, Ashook Minda Group, Kemlows Diecasting, market size, market share, CAGR, market forecast, industry analysis, Brazil automotive industry.

Brazil Automotive Parts Zinc Die Casting Market Dynamics & Structure

The Brazil automotive parts zinc die casting market exhibits a moderately concentrated structure with a few dominant players and several smaller, specialized firms. Technological innovation, primarily driven by advancements in die casting processes and materials science, is a significant growth driver. Stringent regulatory frameworks concerning emissions and safety standards influence design and manufacturing processes. Competitive product substitutes, such as plastic injection molding and forging, pose challenges, although zinc die casting maintains its edge in certain applications due to its superior strength-to-weight ratio and cost-effectiveness. End-user demographics, largely focused on the burgeoning middle class and increased vehicle ownership, fuel market expansion. M&A activity in the sector has been moderate, with a focus on strengthening market presence and technology acquisition. Over the period 2019-2024, approximately xx M&A deals were concluded, resulting in a market concentration of xx%.

- Market Concentration: xx% (2024)

- Technological Innovation: Focus on automation, lightweighting, and high-pressure die casting.

- Regulatory Framework: Compliance with emission and safety standards.

- Competitive Substitutes: Plastic injection molding, forging.

- M&A Activity: xx deals (2019-2024), driving consolidation.

Brazil Automotive Parts Zinc Die Casting Market Growth Trends & Insights

The Brazil automotive parts zinc die casting market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including increasing domestic vehicle production, rising disposable incomes fueling demand for automobiles, and the growing adoption of advanced driver-assistance systems (ADAS) requiring sophisticated die-cast components. Technological disruptions, such as the integration of Industry 4.0 technologies in manufacturing processes, are enhancing efficiency and reducing costs. Consumer behavior shifts towards fuel-efficient and technologically advanced vehicles further reinforce market expansion. The market size is projected to reach xx million units by 2025, with a forecasted CAGR of xx% during 2025-2033. This expansion is propelled by continuous improvements in die casting technology and the rising demand for lightweight and durable automotive components. The adoption rate of zinc die casting in the automotive sector is expected to reach xx% by 2033, driven by innovations in material science and increased preference for customized parts.

Dominant Regions, Countries, or Segments in Brazil Automotive Parts Zinc Die Casting Market

The Southeast region of Brazil continues to solidify its position as the undisputed leader in the automotive parts zinc die casting market, commanding an estimated xx% of the total market share in 2024. This sustained dominance is underpinned by the region's robust concentration of major automotive manufacturers, a highly developed industrial ecosystem, and deeply entrenched, efficient supply chains. Within the production process segments, Pressure Die Casting remains the prevailing method, capturing an impressive xx% market share. This is largely attributed to its inherent cost-effectiveness, exceptional suitability for high-volume, precision manufacturing, and its ability to produce intricate part geometries consistently. Looking at application types, Engine Parts are demonstrating substantial growth potential. This upward trend is fueled by the continuous evolution towards more complex engine designs that demand lightweight, high-performance, and durable components, where zinc die casting excels.

- Key Drivers:

- Strong and concentrated automotive manufacturing base situated in Southeast Brazil, fostering proximity and collaboration.

- Well-established and mature supply chains, logistical infrastructure, and a skilled workforce.

- The inherent cost-effectiveness, scalability, and high precision offered by pressure die casting for mass production.

- Ever-increasing demand for lightweight, fuel-efficient, and high-performance engine components driven by automotive trends.

- Dominant Segments:

- Region: Southeast Brazil (Estimated xx% market share)

- Production Process Type: Pressure Die Casting (Estimated xx% market share)

- Application Type: Engine Parts (Estimated xx% market share)

Brazil Automotive Parts Zinc Die Casting Market Product Landscape

The Brazilian automotive parts zinc die casting market is characterized by a dynamic and diverse product portfolio, meticulously engineered to meet the stringent demands of various automotive applications. Ongoing product innovations are at the forefront, with a significant focus on developing advanced, high-strength zinc alloys that offer superior mechanical properties and corrosion resistance. Furthermore, manufacturers are continuously refining enhanced surface finishing techniques to improve aesthetics, durability, and functional performance. A key trend is the integration of complex features directly into the die-cast components, aiming to simplify assembly processes, reduce part counts, and ultimately lower manufacturing costs. Performance metrics are rigorously monitored, with paramount importance placed on achieving exceptional dimensional accuracy, superior surface quality, and robust fatigue resistance to ensure component reliability and longevity. The unique selling propositions that resonate most strongly in this market frequently highlight a compelling combination of cost-effectiveness, the design flexibility enabling lightweight solutions, and the unparalleled ability to produce intricate and complex geometries with high fidelity. Technological advancements are driving the industry forward, with a strong emphasis on increasing automation in the die casting process, the development of precision tooling for enhanced accuracy, and the systematic implementation of stringent quality control measures at every stage of manufacturing.

Key Drivers, Barriers & Challenges in Brazil Automotive Parts Zinc Die Casting Market

Key Drivers: The burgeoning demand for lighter, more fuel-efficient vehicles is a significant catalyst, directly aligning with the lightweighting capabilities of zinc die casting. Complementing this is the increasing stringency of global emission regulations, which further incentivizes the adoption of lightweight materials to reduce a vehicle's overall footprint. The rapid proliferation and increasing sophistication of Advanced Driver-Assistance Systems (ADAS) also contribute substantially, as these systems often require precisely cast components for sensors and housings. Government initiatives aimed at stimulating local manufacturing and fostering technological innovation within the automotive sector, coupled with advancements in die casting process technologies themselves, are also powerful drivers of market expansion.

Key Challenges: Volatility in the prices of raw materials, most notably zinc, presents a persistent and significant challenge for manufacturers, impacting cost predictability and profit margins. Disruptions within the global supply chain, exacerbated by geopolitical events and logistical complexities, pose another formidable hurdle. The intricate nature of managing a sophisticated global supply network adds layers of complexity and risk. Furthermore, the automotive industry faces intense competition from alternative manufacturing processes that may offer perceived advantages in certain applications, alongside the continuous need to navigate and comply with evolving regulatory frameworks pertaining to environmental standards and labor laws.

Emerging Opportunities in Brazil Automotive Parts Zinc Die Casting Market

The transformative shift towards electric vehicles (EVs) represents a monumental opportunity for the Brazil automotive parts zinc die casting market. The demand for lightweight, durable, and precisely manufactured components for battery enclosures, motor housings, and other critical EV systems is projected to surge. Beyond EVs, expansion into specialized niche markets, such as the production of highly customized parts for luxury vehicles and bespoke components for high-performance automotive applications, offers significant untapped growth potential. Furthermore, the integration of additive manufacturing techniques for the rapid prototyping and production of complex tooling, alongside the research and development of more sustainable and environmentally friendly zinc alloy formulations, could unlock entirely new avenues for innovation and market leadership.

Growth Accelerators in the Brazil Automotive Parts Zinc Die Casting Market Industry

Technological breakthroughs in die casting materials and processes, along with strategic partnerships between die casters and automotive manufacturers, will fuel long-term growth. Market expansion strategies targeting new vehicle segments and geographic regions, particularly in emerging markets, will further enhance market dynamics.

Key Players Shaping the Brazil Automotive Parts Zinc Die Casting Market Market

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Dynacast

- Ashook Minda Group

- Kemlows Diecasting Products Ltd

Notable Milestones in Brazil Automotive Parts Zinc Die Casting Market Sector

- 2022: Introduction of a new high-strength zinc alloy formulation by [Specific Company Name in Brazil], enhancing component durability and weight reduction capabilities for automotive applications.

- 2023: Strategic acquisition of [Company A in Brazil] by [Company B in Brazil], aimed at consolidating market share and expanding manufacturing capacity within the automotive zinc die casting sector.

- 2024: Launch of a new state-of-the-art automated die casting facility by [Specific Company Name in Brazil], significantly increasing production efficiency and precision for key automotive components. (Note: Specific dates and company names require in-depth market research for accurate insertion.)

In-Depth Brazil Automotive Parts Zinc Die Casting Market Market Outlook

The Brazil automotive parts zinc die casting market is poised for substantial growth, driven by continued advancements in technology, increasing demand for lightweight vehicles, and the expansion of the automotive industry. Strategic partnerships, focus on innovation, and expansion into new geographic markets and application areas will further accelerate growth in the coming years. The market holds significant potential, presenting attractive opportunities for both established players and new entrants.

Brazil Automotive Parts Zinc Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

Brazil Automotive Parts Zinc Die Casting Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Parts Zinc Die Casting Market Regional Market Share

Geographic Coverage of Brazil Automotive Parts Zinc Die Casting Market

Brazil Automotive Parts Zinc Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Materials and Processes Is Likely To Drive The Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs Will Is Anticipated To Restrain The Market Growth.

- 3.4. Market Trends

- 3.4.1. Rising Demand for Pressure Die Casting in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Parts Zinc Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dynacast

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ashook Minda Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: Brazil Automotive Parts Zinc Die Casting Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Automotive Parts Zinc Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Brazil Automotive Parts Zinc Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Parts Zinc Die Casting Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Brazil Automotive Parts Zinc Die Casting Market?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Dynacast, Ashook Minda Group*List Not Exhaustive, Kemlows Diecasting Products Ltd.

3. What are the main segments of the Brazil Automotive Parts Zinc Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Materials and Processes Is Likely To Drive The Market.

6. What are the notable trends driving market growth?

Rising Demand for Pressure Die Casting in Automobiles.

7. Are there any restraints impacting market growth?

High Initial Costs Will Is Anticipated To Restrain The Market Growth..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Parts Zinc Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Parts Zinc Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Parts Zinc Die Casting Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Parts Zinc Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence