Key Insights

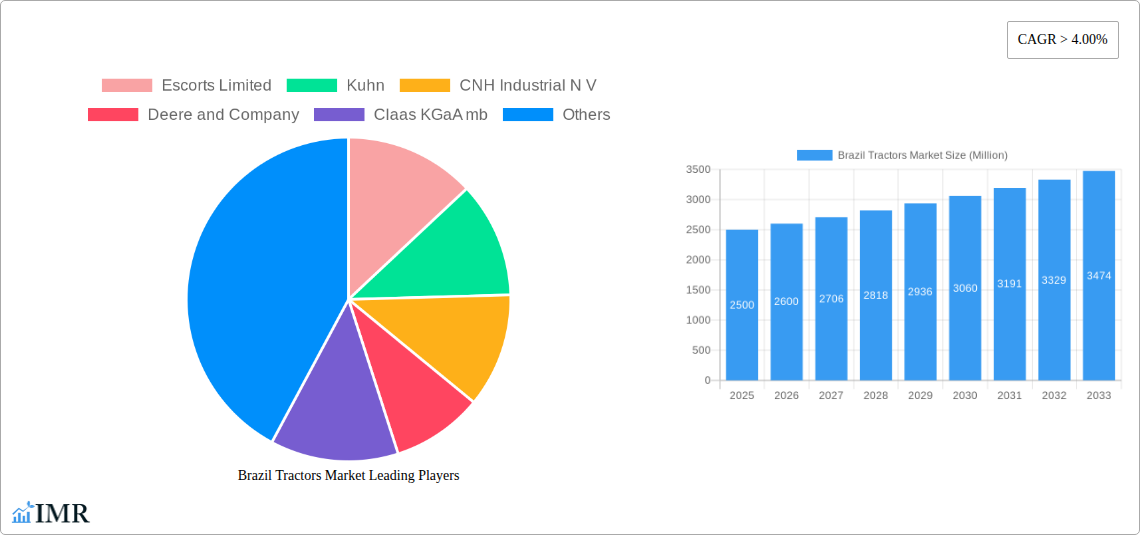

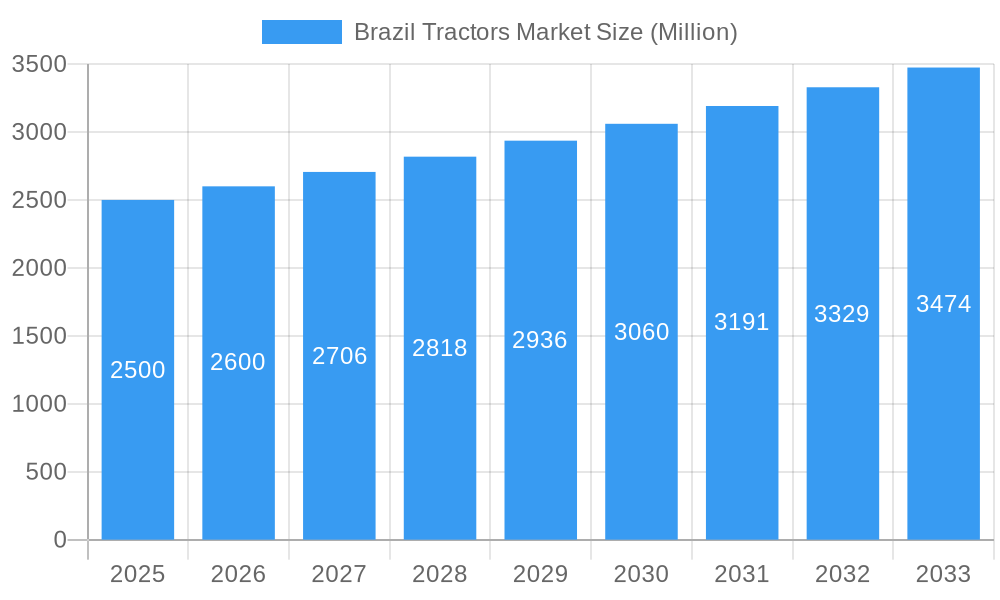

Brazil's tractor market is poised for significant expansion, driven by advancements in the agricultural sector and enhanced governmental support for modern farming techniques. With an estimated market size of $3.6 billion, the market is projected to grow at a compound annual growth rate (CAGR) of 5.02% from the base year 2025 through 2033. This growth is propelled by increasing demand for high-performance tractors, particularly those exceeding 100 HP, to cater to extensive agricultural operations. The adoption of precision farming technologies and the preference for 4WD/AWD tractors for superior traction across varied landscapes are key growth catalysts. Despite potential economic volatility and supply chain concerns, the market outlook remains favorable. Row crop tractors lead market share, followed by orchard tractors, aligning with Brazil's dominant farming practices. Major industry players, including Escorts Limited, Kuhn, CNH Industrial N.V., and Deere & Company, are actively innovating and expanding their distribution to leverage market opportunities.

Brazil Tractors Market Market Size (In Billion)

The competitive arena features a blend of international and domestic manufacturers. Established brands benefit from strong brand equity and technological leadership, while local companies offer specialized, cost-effective solutions for Brazilian farmers. Market segmentation highlights substantial demand for high-horsepower tractors, fueled by the growth of large-scale agribusinesses. The integration of advanced technologies like GPS guidance and automation in tractors is boosting productivity and efficiency, thereby expanding the market. Government programs promoting agricultural mechanization and rural infrastructure development are also vital growth drivers. Potential challenges include rising input costs, interest rate fluctuations, and farmer financing accessibility. Nevertheless, the long-term forecast for the Brazil tractor market is optimistic, offering considerable opportunities for both established and emerging companies.

Brazil Tractors Market Company Market Share

Brazil Tractors Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil tractors market, encompassing market dynamics, growth trends, key players, and future outlook. With a detailed segmentation by horsepower (Below 40 HP, 40 HP - 100 HP, Above 100 HP), drive type (Two-Wheel Drive, Four-Wheel Drive/All-Wheel Drive), and application (Row Crop Tractors, Orchard Tractors, Other Applications), this report is an indispensable resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), projecting market size in million units.

Brazil Tractors Market Dynamics & Structure

The Brazilian tractors market is characterized by a moderate level of concentration, with key players like Escorts Limited, Kuhn, CNH Industrial N V, Deere and Company, Claas KGaA mbH, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, and Tractors and Farm Equipment Limited (TAFE) vying for market share. Technological innovation, driven by the need for increased efficiency and precision agriculture, is a significant factor. Government regulations concerning emission standards and safety also play a key role. The market faces competition from used tractors and alternative farming methods. The end-user demographic is largely comprised of medium-to-large scale farmers, with increasing participation from smaller farms due to government initiatives. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, resulting in a xx% market share shift amongst the top players.

- Market concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological innovation drivers: Precision agriculture, automation, and emission control technologies.

- Regulatory framework: Stringent emission norms and safety standards.

- Competitive product substitutes: Used tractors, alternative farming practices.

- End-user demographics: Predominantly medium-to-large scale farms, increasing small farm participation.

- M&A trends: xx deals between 2019 and 2024, leading to xx% market share redistribution.

Brazil Tractors Market Growth Trends & Insights

The Brazilian tractors market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to factors such as government support for agriculture, rising agricultural output, and increasing mechanization rates. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, including the adoption of precision farming techniques and autonomous tractors, are influencing market dynamics. Consumer behavior is shifting towards preference for higher horsepower tractors and advanced features. Market penetration of four-wheel-drive tractors is increasing due to improved land accessibility and operational efficiency. The adoption rate of advanced technologies remains relatively low but is experiencing growth.

Dominant Regions, Countries, or Segments in Brazil Tractors Market

The largest segment by horsepower is the 40 HP - 100 HP category, accounting for xx% of the market in 2024. This dominance is driven by the suitability of these tractors for a wide range of farming operations and affordability. The Four-Wheel Drive/All-Wheel Drive segment holds significant market share due to its superior traction and performance across various terrains. In terms of application, Row Crop Tractors lead the market, reflecting the large-scale cultivation of row crops in Brazil. The growth in the above 100 HP segment is expected to be significant in the forecast period due to large-scale farming operations requiring high power output tractors and preference for advanced technologies. Favorable government policies promoting agricultural modernization and increased investment in rural infrastructure are key drivers. Specific regions exhibiting high growth include [mention specific regions with highest growth projections and reasons].

- Key Drivers: Government agricultural subsidies, improved infrastructure, rising agricultural output, increasing farm sizes, favorable climate conditions in certain regions.

- Dominance Factors: Cost-effectiveness of 40-100 HP tractors, superior traction of four-wheel-drive tractors, prevalence of row crop farming.

Brazil Tractors Market Product Landscape

The Brazilian tractors market showcases a diverse product landscape featuring models with varying horsepower, drive types, and advanced technologies. Manufacturers are increasingly incorporating features like GPS-guided systems, automated steering, and telematics for improved efficiency and precision. Unique selling propositions include fuel efficiency, enhanced operator comfort, and robust build quality tailored to the demanding conditions of Brazilian agriculture. Technological advancements are focused on improving fuel efficiency, operator comfort, and machine automation.

Key Drivers, Barriers & Challenges in Brazil Tractors Market

Key Drivers: Growing agricultural sector, government support for agricultural modernization, increasing demand for high-efficiency tractors, technological advancements in precision agriculture.

Challenges and Restraints: High initial investment costs, fluctuating fuel prices, limited access to financing for small farmers, supply chain disruptions impacting timely delivery of parts and equipment, and intense competition resulting in reduced profit margins (approximately xx% decrease projected by 2028).

Emerging Opportunities in Brazil Tractors Market

Emerging opportunities include the expansion into precision farming technologies, growing demand for tractors equipped with advanced features (such as automated guidance systems), increasing adoption of rental services for tractors to reduce upfront capital expenditure, and the untapped potential in smaller farming operations through targeted financing schemes.

Growth Accelerators in the Brazil Tractors Market Industry

Long-term growth will be driven by continued technological advancements, strategic partnerships between tractor manufacturers and agricultural technology companies, government initiatives promoting agricultural mechanization, expansion of tractor rental services, and increasing investments in rural infrastructure.

Key Players Shaping the Brazil Tractors Market Market

- Escorts Limited

- Kuhn

- CNH Industrial N V

- Deere and Company

- Claas KGaA mbH

- AGCO Corporation

- Kubota Agricultural Machinery Pvt Ltd

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

Notable Milestones in Brazil Tractors Market Sector

- August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms, emphasizing four-wheel-drive technology. This expansion significantly boosts their presence in the Brazilian market and signifies commitment to local technological advancements.

- August 2023: New Holland Agriculture launched the TL5 'Acessível' tractor, a pioneering inclusive design improving accessibility for farmers with disabilities. This initiative fosters broader participation and positive social impact.

In-Depth Brazil Tractors Market Market Outlook

The Brazilian tractors market exhibits strong growth potential, driven by the country's expanding agricultural sector and ongoing technological advancements. Strategic opportunities exist in developing tailored financing solutions for small farmers, promoting the adoption of precision farming techniques, and expanding the service and parts network to support wider geographical reach. The continued development of innovative products and strategic partnerships will play a pivotal role in shaping the future of the Brazilian tractors market.

Brazil Tractors Market Segmentation

-

1. Horsepower

- 1.1. Below 40 HP

- 1.2. 40 HP - 100 HP

- 1.3. Above 100 H

-

2. Drive Type

- 2.1. Two-Wheel Drive

- 2.2. Four-Wheel Drive/All-Wheel Drive

-

3. Application

- 3.1. Row Crop Tractors

- 3.2. Orchard Tractors

- 3.3. Other Applications

Brazil Tractors Market Segmentation By Geography

- 1. Brazil

Brazil Tractors Market Regional Market Share

Geographic Coverage of Brazil Tractors Market

Brazil Tractors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption Rate Of Mechanization

- 3.3. Market Restrains

- 3.3.1. High Cost Of Tractors May Affect the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Need for Agricultural mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Tractors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 5.1.1. Below 40 HP

- 5.1.2. 40 HP - 100 HP

- 5.1.3. Above 100 H

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Two-Wheel Drive

- 5.2.2. Four-Wheel Drive/All-Wheel Drive

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Row Crop Tractors

- 5.3.2. Orchard Tractors

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Escorts Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CNH Industrial N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Claas KGaA mb

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kubota Agricultural Machinery Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tractors and Farm Equipment Limited (TAFE)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Escorts Limited

List of Figures

- Figure 1: Brazil Tractors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Tractors Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 2: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Brazil Tractors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 6: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 7: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Brazil Tractors Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Tractors Market?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Brazil Tractors Market?

Key companies in the market include Escorts Limited, Kuhn, CNH Industrial N V, Deere and Company, Claas KGaA mb, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE).

3. What are the main segments of the Brazil Tractors Market?

The market segments include Horsepower, Drive Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption Rate Of Mechanization.

6. What are the notable trends driving market growth?

Increasing Need for Agricultural mechanization.

7. Are there any restraints impacting market growth?

High Cost Of Tractors May Affect the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms. These platforms represent the company's commitment to developing four-wheel drive tractors not only in Brazil but also in various other nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Tractors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Tractors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Tractors Market?

To stay informed about further developments, trends, and reports in the Brazil Tractors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence