Key Insights

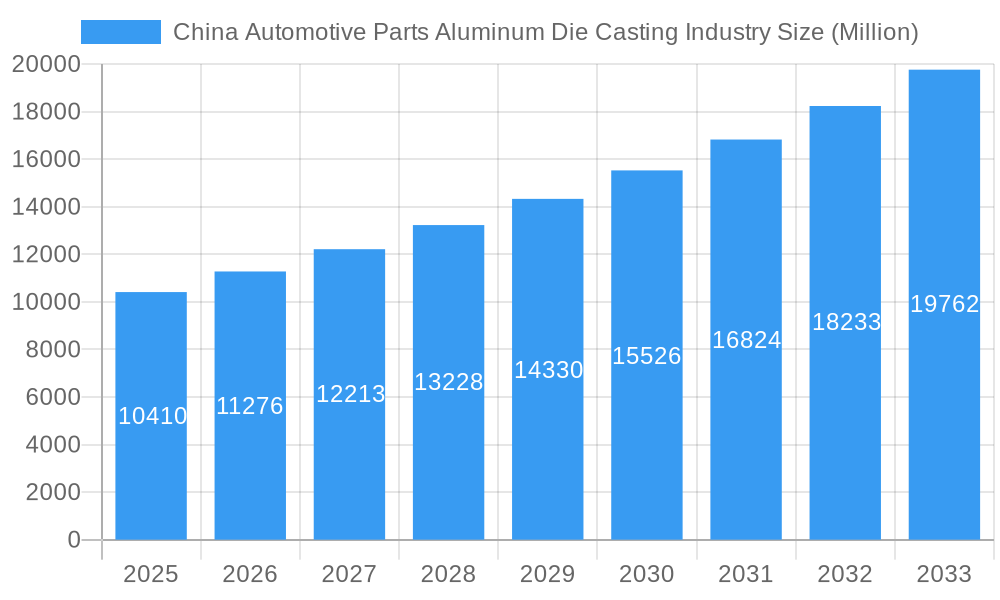

The China automotive parts aluminum die casting market, valued at $10.41 billion in 2025, is projected to experience robust growth, driven by the burgeoning automotive industry and increasing demand for lightweight, high-strength components. A Compound Annual Growth Rate (CAGR) of 8.26% from 2025 to 2033 signifies a substantial expansion, reaching an estimated value exceeding $20 billion by 2033. This growth is fueled by several key factors. Firstly, China's continuous investment in infrastructure and its expanding middle class are significantly boosting automotive production and sales. Secondly, stringent government regulations promoting fuel efficiency and emission reduction are driving the adoption of lightweight aluminum components in vehicles. The rising preference for electric vehicles (EVs) further contributes to market expansion, as aluminum die casting offers advantages in battery casing and motor components. Finally, advancements in die casting technologies, such as semi-solid die casting, enhance the quality and precision of automotive parts, leading to wider adoption. The market is segmented by production process (pressure die casting, vacuum die casting, squeeze die casting, semi-solid die casting) and application (engine parts, transmission components, body parts, other applications). While pressure die casting currently dominates, the adoption of more advanced techniques like semi-solid die casting is expected to gain traction due to superior properties and reduced defects. Competition among major players such as KSPG AG, Montupet SA, and Nemak, alongside domestic Chinese manufacturers, is intensifying, leading to innovation and price competitiveness.

China Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

The dominant position of China in the global automotive manufacturing landscape makes it a crucial market for aluminum die casting. Challenges remain, however, including potential fluctuations in raw material prices and the need for continuous technological upgrades to maintain competitiveness. The industry's future hinges on addressing these issues and adapting to the ever-evolving demands of the automotive sector, particularly in the realms of electric and autonomous vehicles. The integration of Industry 4.0 technologies, such as automation and data analytics, will be vital in enhancing efficiency, improving quality control, and reducing production costs, thus shaping the trajectory of the market's growth. The strategic partnerships and collaborations between established players and emerging technology firms are likely to pave the way for further innovation and market expansion in the coming years.

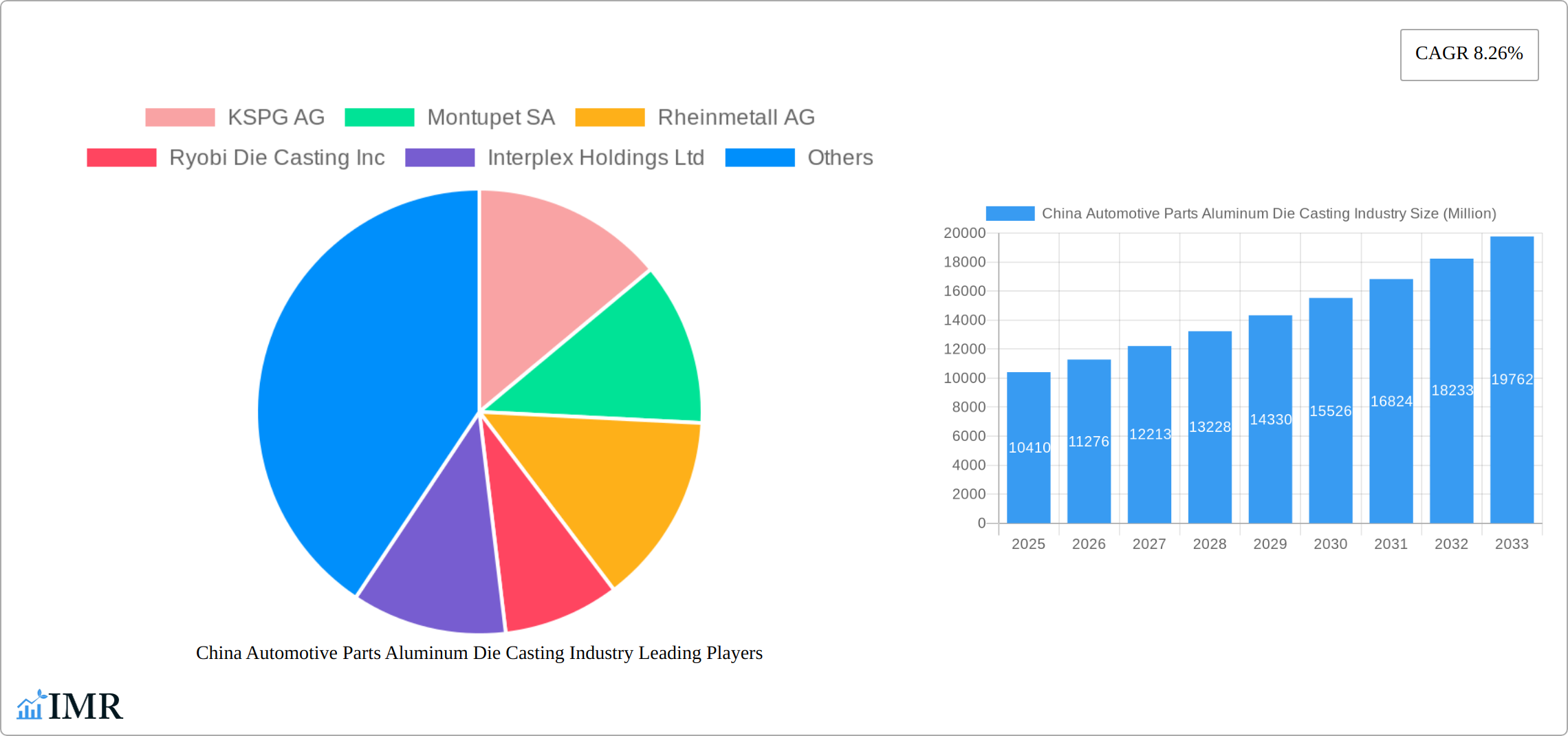

China Automotive Parts Aluminum Die Casting Industry Company Market Share

China Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China automotive parts aluminum die casting industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. It segments the market by production process type (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-solid Die Casting) and application type (Engine Parts, Transmission Components, Body Parts, Other Application Types), providing a granular view of this dynamic market. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within the thriving Chinese automotive sector. The total market size is projected to reach xx Million units by 2033.

China Automotive Parts Aluminum Die Casting Industry Market Dynamics & Structure

The China automotive parts aluminum die casting market is characterized by a moderately concentrated landscape with several major players and a growing number of smaller, specialized firms. Technological innovation, particularly in high-pressure die casting for lightweighting applications in electric vehicles (EVs), is a key driver. Stringent government regulations promoting fuel efficiency and emission reduction further propel market growth. While aluminum die castings face competition from other materials like plastics and steel, their superior strength-to-weight ratio and design flexibility maintain their dominance in many automotive applications. The market witnesses frequent mergers and acquisitions (M&A) activity, reflecting consolidation and expansion strategies by major players.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, high-pressure die casting, and automation.

- Regulatory Framework: Stringent emission norms and fuel efficiency standards drive demand.

- Competitive Substitutes: Plastics and steel pose competition, but aluminum retains advantages in performance.

- M&A Activity: xx major M&A deals recorded between 2019 and 2024. The average deal size was approximately xx Million USD.

- Innovation Barriers: High initial investment costs for advanced die casting technologies and skilled labor shortages.

China Automotive Parts Aluminum Die Casting Industry Growth Trends & Insights

The China automotive parts aluminum die casting market experienced significant growth during the historical period (2019-2024), driven by the booming automotive industry and increasing demand for lightweight vehicles. The market is expected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rapid adoption of advanced die casting technologies, particularly in the EV sector. Consumer preference for fuel-efficient and environmentally friendly vehicles further contributes to this trend. Technological disruptions, such as the introduction of 3-in-1 and 5-in-1 powertrain die casting solutions, are transforming the industry landscape, increasing production efficiency, and reducing costs.

Market size evolution: The market size increased from xx Million units in 2019 to xx Million units in 2024. The market is projected to reach xx Million units by 2033.

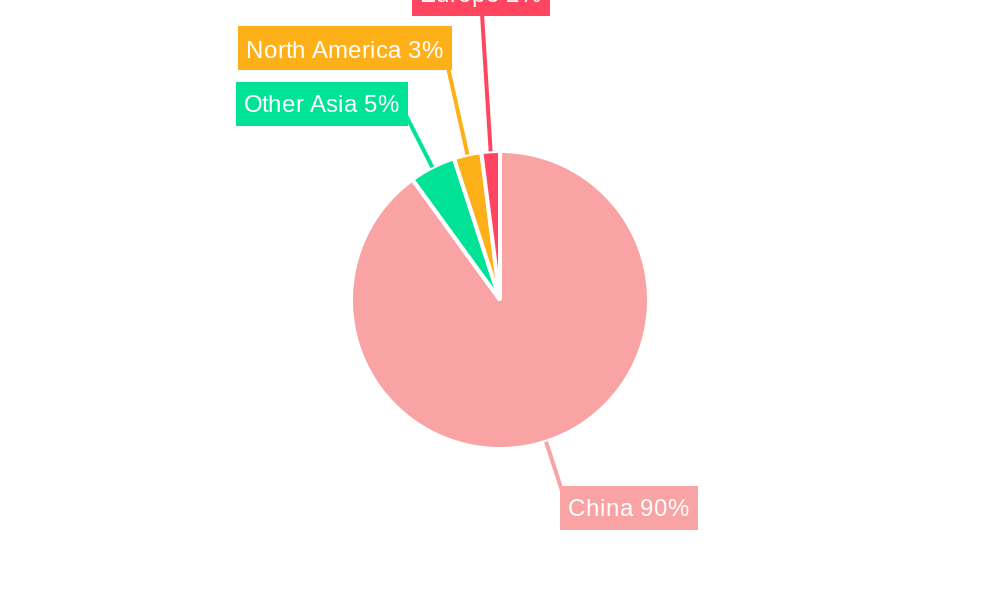

Dominant Regions, Countries, or Segments in China Automotive Parts Aluminum Die Casting Industry

The coastal regions of China, particularly Guangdong, Jiangsu, and Shanghai, are the dominant players in the aluminum die casting industry, benefiting from established automotive manufacturing hubs and robust infrastructure. Within the segment breakdown, Pressure Die Casting holds the largest market share (xx%), followed by High-Pressure Die Casting (xx%), reflecting the industry's focus on high-volume production and lightweight applications. Engine parts and transmission components are the leading application segments, driven by high demand from both conventional and electric vehicles.

- Key Drivers: Government support for automotive manufacturing, substantial foreign direct investment, and readily available skilled labor.

- Dominance Factors: Established supply chains, access to raw materials, and proximity to major automotive manufacturers.

- Growth Potential: The inland provinces are expected to witness significant growth driven by government initiatives to develop automotive clusters in those regions.

China Automotive Parts Aluminum Die Casting Industry Product Landscape

The product landscape within China's automotive parts aluminum die casting industry is characterized by a relentless pursuit of innovation, with a strong emphasis on developing components that offer superior strength, significant weight reduction, and improved cost-effectiveness. High-pressure die casting (HPDC) is emerging as a pivotal technology, enabling the efficient production of intricate, thin-walled parts that were previously challenging to manufacture. To meet the demanding requirements of modern vehicles, advanced surface treatments such as anodizing and powder coating are increasingly being employed to enhance corrosion resistance and provide superior aesthetic finishes. The industry is continuously focused on refining dimensional accuracy and achieving ultra-smooth surface finishes, aligning with the stringent quality benchmarks set by automotive manufacturers worldwide. Key unique selling propositions that differentiate players in this market include exceptional design flexibility for complex geometries, a demonstrable reduction in vehicle weight contributing to fuel efficiency and EV range, and an enhanced level of component durability and longevity.

Key Drivers, Barriers & Challenges in China Automotive Parts Aluminum Die Casting Industry

Key Drivers: The rapid growth of the Chinese automotive industry, especially the EV segment, is the primary driver. Government support for technological advancement and incentives for lightweighting also play crucial roles. The increasing demand for improved fuel efficiency and reduced emissions further accelerates market growth.

Challenges: Intense competition from domestic and international players, rising raw material costs (aluminum prices), and stringent environmental regulations pose significant challenges. Maintaining consistent quality across large production volumes and addressing supply chain disruptions are also critical concerns. The impact of these challenges is estimated to decrease the market growth by xx% in the next 5 years.

Emerging Opportunities in China Automotive Parts Aluminum Die Casting Industry

The China automotive parts aluminum die casting industry is poised to capitalize on several significant emerging opportunities. The exponential growth of the Electric Vehicle (EV) market presents a substantial demand for lightweight aluminum components, crucial for optimizing battery range and overall vehicle performance. Similarly, the increasing emphasis on fuel efficiency and payload capacity in the commercial vehicle sector is driving demand for lighter, yet robust, die-cast parts. The widespread adoption of high-pressure die casting technology for the production of structural components, such as chassis parts and battery enclosures, offers a considerable avenue for growth. Furthermore, as automotive penetration expands into smaller cities and rural areas across China, untapped market potential is being unlocked. Innovative applications, particularly the integration of multiple functionalities into single die castings (e.g., combining brackets, housings, and cooling channels), represent a significant growth frontier, offering substantial cost and assembly advantages.

Growth Accelerators in the China Automotive Parts Aluminum Die Casting Industry

Several critical factors are acting as significant growth accelerators for the China automotive parts aluminum die casting industry. Technological breakthroughs in advanced die casting processes, including advancements in automation, simulation software, and new alloy development, are continuously improving efficiency and product quality. Strategic partnerships and collaborative initiatives between leading automotive manufacturers and specialized die casting suppliers are fostering innovation and ensuring alignment with evolving vehicle requirements, thereby accelerating long-term growth. Continued and robust government support for the domestic automotive industry, coupled with substantial investments in infrastructure development such as improved logistics networks and industrial zones, further facilitates market expansion. The increasing global and domestic emphasis on sustainability is also a key growth driver, spurring the development and adoption of more environmentally friendly die casting processes, including energy-efficient machinery and the use of recycled aluminum, which will increasingly influence market competitiveness.

Key Players Shaping the China Automotive Parts Aluminum Die Casting Industry Market

- KSPG AG (now part of DTR VTEC)

- Montupet SA (acquired by Marelli)

- Rheinmetall AG

- Ryobi Die Casting Inc.

- Interplex Holdings Ltd.

- Nemak

- Sandhar Technologies Limited

- Linamar Corporation

- Shiloh Industries, Inc. (now part of Middlebrook)

- Alcoa Corporation

- Faist Group

- Georg Fischer AG (GF)

- Koch Enterprises, Inc.

- Addison Extrusions Limited (significant player in aluminum extrusion, often supplying for downstream die casting)

- Dongfeng Motor Parts & Components Group Co., Ltd. (major Chinese player)

Notable Milestones in China Automotive Parts Aluminum Die Casting Industry Sector

- August 2023: Dongfeng Electronic Technology Co., Ltd. announced plans to raise CNY 1.4 billion (USD 192.4 million) to enhance 3-in-1 and 5-in-1 die-casting technology for EV powertrains.

- April 2023: Rheinmetall AG partnered with Xiaomi to produce die-cast parts for vehicle suspension systems, starting production in 2024.

- March 2022: Georg Fischer Casting Solutions announced the completion of a new plant in Shenyang, China, expanding production capacity.

In-Depth China Automotive Parts Aluminum Die Casting Industry Market Outlook

The future trajectory of the China automotive parts aluminum die casting market is overwhelmingly positive, underpinned by the sustained expansion of the automotive sector and continuous technological advancements. The industry is set to be shaped by strategic collaborations between global and domestic players, significant investments in research and development for novel alloys and processes, and an unwavering focus on lightweighting solutions that are paramount for both conventional and electric vehicles. The market presents substantial opportunities for agile and forward-thinking players who can adeptly navigate the evolving technological landscape, embrace stringent quality and environmental regulations, and proactively respond to the dynamic demands of the automotive supply chain. The projected growth indicators point towards a highly promising future, characterized by ample opportunities for expansion, significant innovation, and the consolidation of leadership within this rapidly evolving and strategically important market.

China Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Other Application Types

China Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. China

China Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of China Automotive Parts Aluminum Die Casting Industry

China Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market

- 3.3. Market Restrains

- 3.3.1. Rising Aluminum Prices Hindering the Market Growth -

- 3.4. Market Trends

- 3.4.1. Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KSPG AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Montupet SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ryobi Die Casting Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sandhar Group*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Linamar Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiloh Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alcoa Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Faist Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 George Fischer Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Koch Enterprises

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KSPG AG

List of Figures

- Figure 1: China Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the China Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include KSPG AG, Montupet SA, Rheinmetall AG, Ryobi Die Casting Inc, Interplex Holdings Ltd, Nemak, Sandhar Group*List Not Exhaustive, Linamar Corporation, Shiloh Industries, Alcoa Inc, Faist Group, George Fischer Ltd, Koch Enterprises.

3. What are the main segments of the China Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market.

6. What are the notable trends driving market growth?

Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Aluminum Prices Hindering the Market Growth -.

8. Can you provide examples of recent developments in the market?

August 2023: Dongfeng Electronic Technology Co., Ltd. announced its plans to raise CNY 1.4 billion (USD 192.4 million). The fund is scheduled to transform 3-in-1 and 5-in-1 die-casting technology and improve the manufacturing capacity of EV powertrain and core components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the China Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence