Key Insights

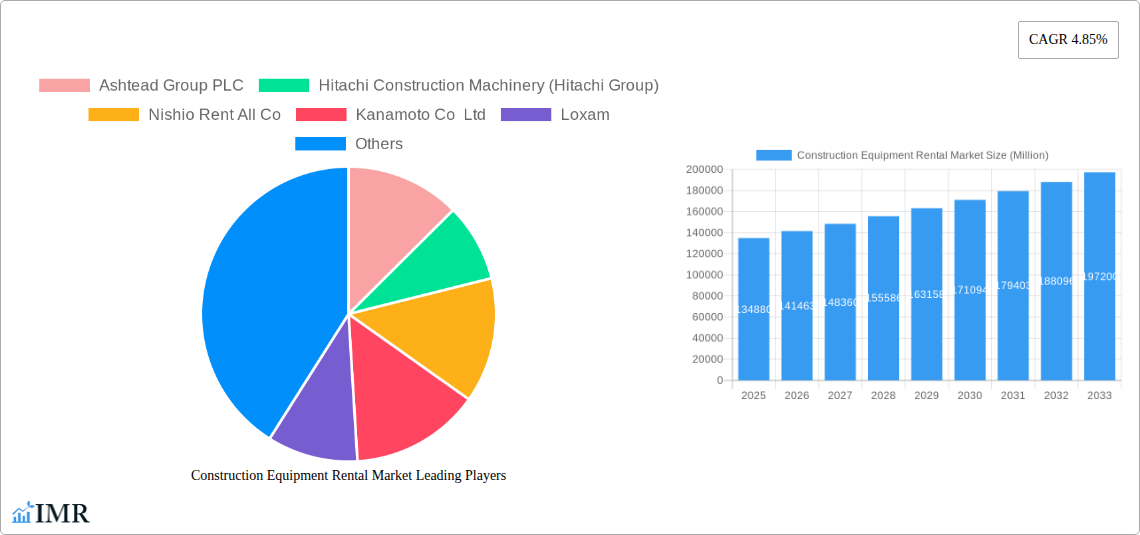

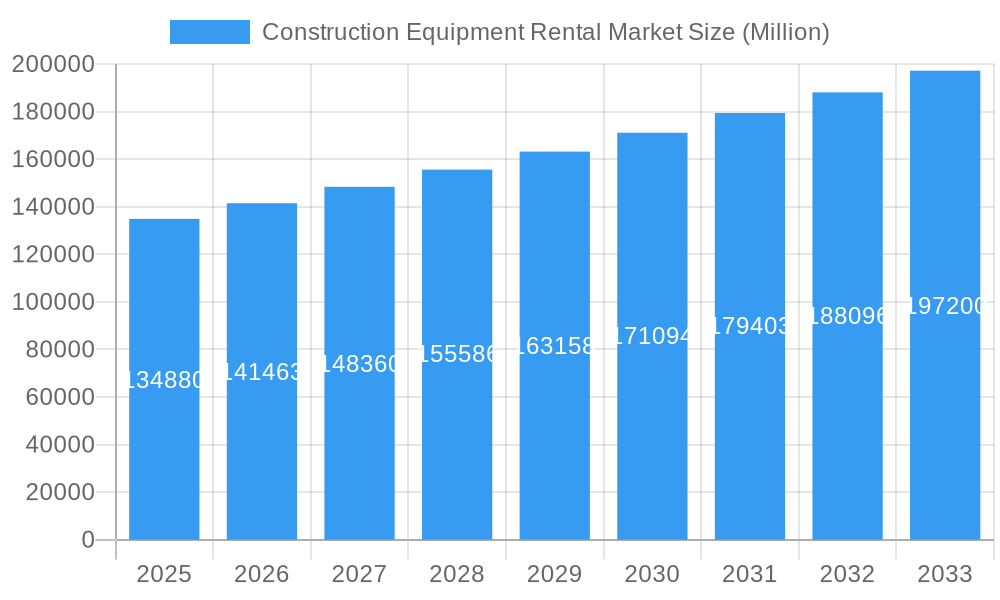

The global construction equipment rental market, valued at $134.88 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.85% from 2025 to 2033. This expansion is fueled by several key factors. The increasing preference for rental over outright purchase, particularly among small and medium-sized construction firms, reduces capital expenditure and allows for flexibility in equipment usage. Furthermore, government infrastructure projects worldwide, coupled with a surge in residential and commercial construction activity, significantly boost demand. Technological advancements, such as the incorporation of telematics and digitalization in equipment management, contribute to enhanced efficiency and reduced operational costs, further driving market growth. The market is segmented by drive type (IC Engine and Hybrid) and vehicle type (earthmoving equipment, including material handling equipment, and other types). Key players like Ashtead Group PLC, Hitachi Construction Machinery, and United Rentals Inc. are leveraging strategic acquisitions, technological innovations, and expansion into new geographies to maintain their competitive edge. Regional growth is expected to vary, with North America and Asia Pacific anticipated to lead due to substantial infrastructural investments and economic expansion.

Construction Equipment Rental Market Market Size (In Billion)

The market's growth, however, is not without challenges. Fluctuations in raw material prices, particularly steel and other metals, impact the cost of manufacturing and leasing equipment. Economic downturns and stringent environmental regulations can also restrain growth. Nonetheless, the overall outlook remains positive, with the market expected to benefit from long-term trends such as urbanization, infrastructure development, and increasing adoption of sustainable construction practices. The integration of hybrid and electric equipment is anticipated to gain momentum, propelled by stricter emission norms and a rising focus on environmental sustainability within the construction industry. This shift towards environmentally friendly equipment will present opportunities for rental companies that embrace and invest in this technology.

Construction Equipment Rental Market Company Market Share

Construction Equipment Rental Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Construction Equipment Rental Market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. The report utilizes both qualitative and quantitative data to offer invaluable insights for industry professionals, investors, and strategic decision-makers. The parent market is the Construction Equipment Market, and the child market is the Construction Equipment Rental Market. The report's projected market value in 2033 is xx Million Units.

Construction Equipment Rental Market Dynamics & Structure

The Construction Equipment Rental market is characterized by moderate concentration, with key players like United Rentals Inc., Ashtead Group PLC, and Loxam holding significant market share. The market exhibits dynamic competition, driven by technological advancements, evolving regulatory landscapes, and strategic mergers and acquisitions (M&A). The market is valued at xx Million Units in 2025.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2025.

- Technological Innovation: Adoption of telematics, digitalization of rental processes, and the introduction of hybrid and electric equipment are key innovation drivers. However, high initial investment costs and integration challenges present barriers.

- Regulatory Framework: Stringent safety regulations, emission standards, and environmental concerns influence equipment choices and rental operations.

- Competitive Product Substitutes: Owning versus renting equipment presents a significant substitute, influencing market demand based on project size and frequency.

- End-User Demographics: The market is primarily driven by construction companies of varying sizes, ranging from small contractors to large multinational firms. Government infrastructure projects significantly influence demand.

- M&A Trends: The past five years have witnessed a notable increase in M&A activity, with xx major deals recorded, indicating consolidation and expansion strategies among leading players. This consolidation is expected to continue.

Construction Equipment Rental Market Growth Trends & Insights

The Construction Equipment Rental market has experienced robust growth in recent years, driven by increasing construction activity globally, particularly in developing economies. The market size is estimated at xx Million Units in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Technological advancements such as telematics and digital platforms are further boosting market growth by increasing efficiency and optimizing resource allocation. The forecast period (2025-2033) anticipates continued growth, driven by sustained infrastructure development, urbanization, and a preference for rental over ownership among construction companies. Market penetration is projected to reach xx% by 2033, with significant growth in emerging markets. Technological disruptions, such as the increased adoption of autonomous equipment, are expected to further shape market dynamics. Shifting consumer behavior, towards favoring short-term rentals for specialized equipment, also drives growth.

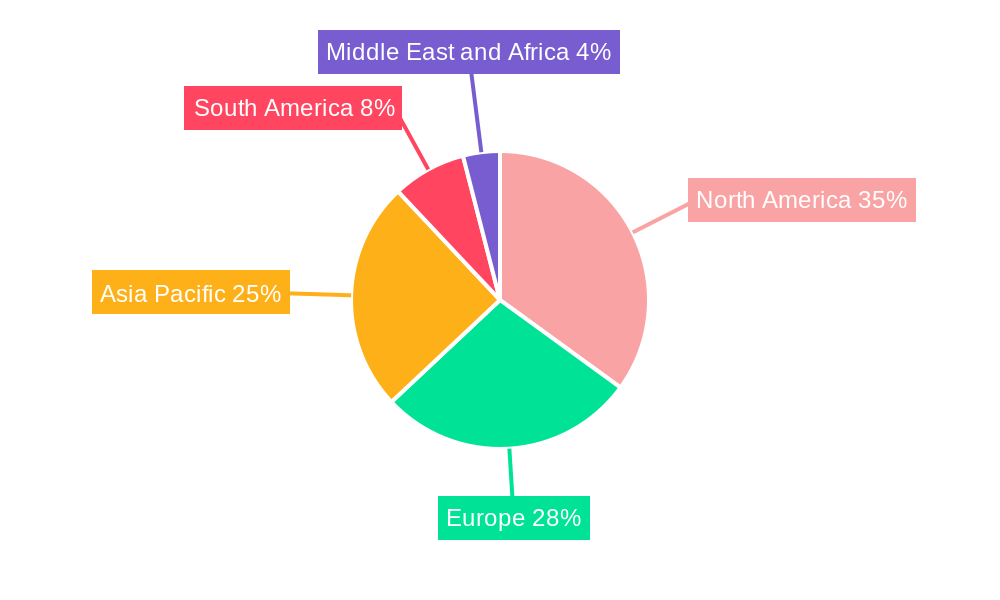

Dominant Regions, Countries, or Segments in Construction Equipment Rental Market

North America currently dominates the Construction Equipment Rental market, followed by Europe and Asia-Pacific. Within the segment breakdown:

By Drive Type: The IC Engine segment currently holds the largest market share due to established infrastructure and lower initial costs. However, the Hybrid Type segment is experiencing rapid growth, driven by increasing environmental concerns and government regulations.

By Vehicle Type: The Earthmoving Equipment segment is the dominant segment, driven by the high demand for excavators, bulldozers, and loaders in construction projects. The Other Earthmoving Equipment (Material Handling) segment is also exhibiting significant growth due to the rising demand for efficient material handling solutions on construction sites.

Key drivers for growth include:

- Robust Infrastructure Development: Government initiatives focusing on infrastructure upgrades and expansion are fueling demand across regions.

- Economic Growth: Strong economic performance in various regions translates to increased construction activity and higher equipment rental needs.

- Urbanization: Rapid urbanization in developing countries drives the demand for construction, resulting in increased rental demand.

Construction Equipment Rental Market Product Landscape

The market offers a wide array of equipment, ranging from basic earthmoving machinery to specialized tools and heavy-duty cranes. Recent innovations focus on improving fuel efficiency, safety features, and technological integration. Telematics systems provide real-time data on equipment usage and location, optimizing maintenance and reducing downtime. Hybrid and electric options are gaining traction, driven by environmental concerns and potential cost savings. Unique selling propositions emphasize ease of use, superior safety features, and advanced technology integration.

Key Drivers, Barriers & Challenges in Construction Equipment Rental Market

Key Drivers:

- Rising Construction Activity: Global infrastructure projects and increased urbanization are key drivers.

- Technological Advancements: Improved equipment features and telematics enhance efficiency and productivity.

- Favorable Economic Conditions: Strong economies lead to higher construction spending and rental demand.

Challenges and Restraints:

- Supply Chain Disruptions: Global supply chain issues can impact equipment availability and rental prices.

- Regulatory Compliance: Meeting stringent safety and environmental regulations increases operational costs.

- Intense Competition: The market's competitive landscape can lead to price wars and reduced profit margins.

Emerging Opportunities in Construction Equipment Rental Market

- Expansion in Emerging Markets: Untapped potential exists in developing economies with rapidly expanding construction sectors.

- Specialized Equipment Rental: Demand for specialized and niche equipment is growing.

- Subscription-Based Rental Models: Subscription services offer flexible and cost-effective options for clients.

Growth Accelerators in the Construction Equipment Rental Market Industry

Technological advancements, strategic partnerships, and market expansion initiatives into emerging economies are key growth accelerators. The ongoing development of autonomous equipment presents a significant long-term opportunity, alongside the increased adoption of digital platforms for rental management and customer service.

Key Players Shaping the Construction Equipment Rental Market Market

- Ashtead Group PLC

- Hitachi Construction Machinery (Hitachi Group)

- Nishio Rent All Co

- Kanamoto Co Ltd

- Loxam

- CNH Industrial

- Sumitomo Corp

- H&E Equipment Services Inc

- Liebherr International AG

- HSS Hire Group PLC

- Herc Rentals Inc

- Cramo Oyj

- Caterpillar

- United Rentals Inc

Notable Milestones in Construction Equipment Rental Market Sector

- June 2023: Renta Group's acquisition of My Lift expands its Norwegian market presence and revenue.

- August 2023: Zeppelin Rental's acquisition of Bauhof Service GmbH strengthens its pump and generator rental capabilities.

- November 2022: Maxim Crane Works LP launches Maxim MarketplaceTM, a new online used equipment sales platform.

- December 2023: MyCrane expands its operations to the United States, establishing a direct presence rather than a franchise.

In-Depth Construction Equipment Rental Market Market Outlook

The Construction Equipment Rental market is poised for continued growth driven by sustained infrastructure investment globally and technological innovation. Strategic partnerships, expansion into emerging markets, and the adoption of sustainable equipment will shape future market dynamics. Opportunities abound for companies that can effectively leverage technology, optimize operations, and offer innovative rental solutions.

Construction Equipment Rental Market Segmentation

-

1. Vehicle Type

-

1.1. Earthmoving Equipment

- 1.1.1. Backhoe

- 1.1.2. Loaders

- 1.1.3. Excavators

- 1.1.4. Other Earthmoving Equipment

-

1.2. Material Handling

- 1.2.1. Cranes

- 1.2.2. Dump Trucks

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Hybrid Type

Construction Equipment Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Construction Equipment Rental Market Regional Market Share

Geographic Coverage of Construction Equipment Rental Market

Construction Equipment Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost of Construction Equipment

- 3.4. Market Trends

- 3.4.1. ICE Engine is Expected to Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Backhoe

- 5.1.1.2. Loaders

- 5.1.1.3. Excavators

- 5.1.1.4. Other Earthmoving Equipment

- 5.1.2. Material Handling

- 5.1.2.1. Cranes

- 5.1.2.2. Dump Trucks

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Hybrid Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Earthmoving Equipment

- 6.1.1.1. Backhoe

- 6.1.1.2. Loaders

- 6.1.1.3. Excavators

- 6.1.1.4. Other Earthmoving Equipment

- 6.1.2. Material Handling

- 6.1.2.1. Cranes

- 6.1.2.2. Dump Trucks

- 6.1.1. Earthmoving Equipment

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. IC Engine

- 6.2.2. Hybrid Type

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Earthmoving Equipment

- 7.1.1.1. Backhoe

- 7.1.1.2. Loaders

- 7.1.1.3. Excavators

- 7.1.1.4. Other Earthmoving Equipment

- 7.1.2. Material Handling

- 7.1.2.1. Cranes

- 7.1.2.2. Dump Trucks

- 7.1.1. Earthmoving Equipment

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. IC Engine

- 7.2.2. Hybrid Type

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Earthmoving Equipment

- 8.1.1.1. Backhoe

- 8.1.1.2. Loaders

- 8.1.1.3. Excavators

- 8.1.1.4. Other Earthmoving Equipment

- 8.1.2. Material Handling

- 8.1.2.1. Cranes

- 8.1.2.2. Dump Trucks

- 8.1.1. Earthmoving Equipment

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. IC Engine

- 8.2.2. Hybrid Type

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. South America Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Earthmoving Equipment

- 9.1.1.1. Backhoe

- 9.1.1.2. Loaders

- 9.1.1.3. Excavators

- 9.1.1.4. Other Earthmoving Equipment

- 9.1.2. Material Handling

- 9.1.2.1. Cranes

- 9.1.2.2. Dump Trucks

- 9.1.1. Earthmoving Equipment

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. IC Engine

- 9.2.2. Hybrid Type

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Earthmoving Equipment

- 10.1.1.1. Backhoe

- 10.1.1.2. Loaders

- 10.1.1.3. Excavators

- 10.1.1.4. Other Earthmoving Equipment

- 10.1.2. Material Handling

- 10.1.2.1. Cranes

- 10.1.2.2. Dump Trucks

- 10.1.1. Earthmoving Equipment

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. IC Engine

- 10.2.2. Hybrid Type

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashtead Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi Construction Machinery (Hitachi Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nishio Rent All Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kanamoto Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loxam

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CNH Industrial

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sumitomo Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 H&E Equipment Services Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Liebherr International AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HSS Hire Group PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Herc Rentals Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cramo Oyj

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Caterpillar

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 United Rentals Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ashtead Group PLC

List of Figures

- Figure 1: Global Construction Equipment Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 5: North America Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 11: Europe Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: South America Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: South America Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 23: South America Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: South America Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 29: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Global Construction Equipment Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 13: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 22: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 31: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 36: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 37: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Equipment Rental Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Construction Equipment Rental Market?

Key companies in the market include Ashtead Group PLC, Hitachi Construction Machinery (Hitachi Group), Nishio Rent All Co, Kanamoto Co Ltd, Loxam, CNH Industrial, Sumitomo Corp, H&E Equipment Services Inc, Liebherr International AG, HSS Hire Group PLC, Herc Rentals Inc, Cramo Oyj, Caterpillar, United Rentals Inc.

3. What are the main segments of the Construction Equipment Rental Market?

The market segments include Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Industry.

6. What are the notable trends driving market growth?

ICE Engine is Expected to Hold the Highest Share.

7. Are there any restraints impacting market growth?

High Maintenance Cost of Construction Equipment.

8. Can you provide examples of recent developments in the market?

December 2023: The online crane rental service based in Dubai, MyCrane, started its own operation in the United States. The company stated that it chose to set up its own operations in the United States rather than appointing a franchisee, as it has done in other locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Equipment Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Equipment Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Equipment Rental Market?

To stay informed about further developments, trends, and reports in the Construction Equipment Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence