Key Insights

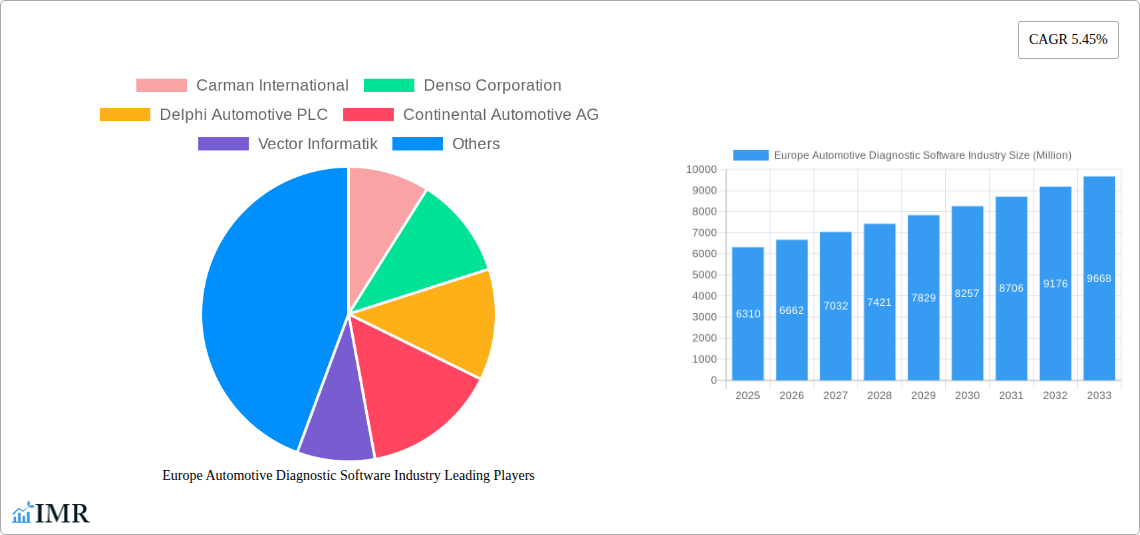

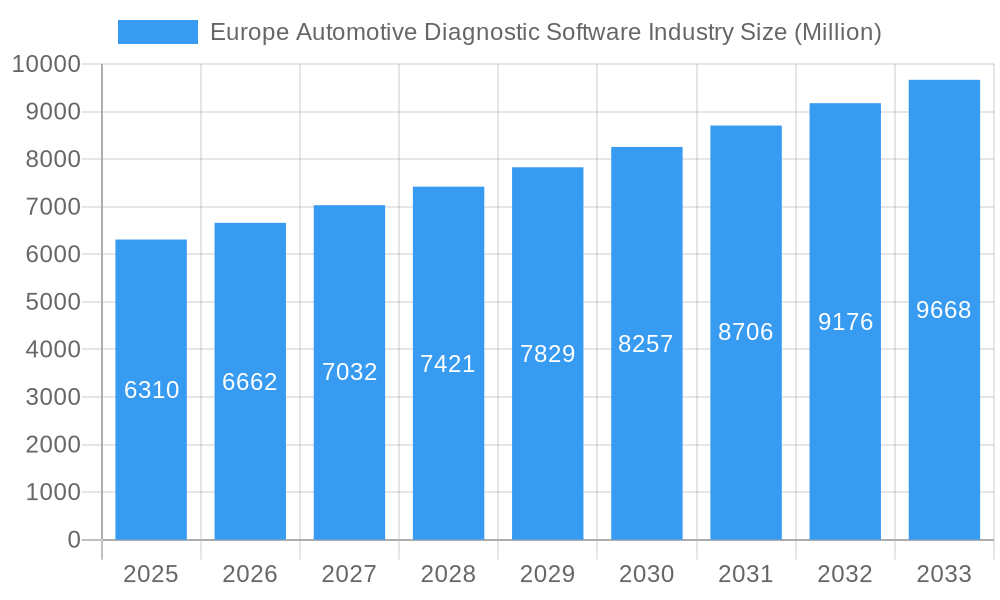

The European automotive diagnostic software market, valued at €6.31 billion in 2025, is projected to experience robust growth, driven by the increasing complexity of vehicles and the rising demand for efficient vehicle maintenance and repair. The market's Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The growing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) necessitates sophisticated diagnostic tools and software, boosting market demand. Furthermore, stringent emission regulations across Europe are pushing automakers and repair shops to adopt advanced diagnostic solutions for compliance and optimized performance. The market is segmented by software type (OBD, Electric System Analyzer, Scan Tool) and vehicle type (Passenger Cars, Commercial Vehicles), with passenger cars currently dominating the market share. Key players like Bosch, Denso, and Continental are investing heavily in research and development, constantly innovating and expanding their product portfolios to cater to the evolving market needs. The increasing integration of cloud-based diagnostic platforms and telematics further contributes to market growth, enabling remote diagnostics and predictive maintenance. Germany, France, and the UK represent significant regional markets within Europe, reflecting the strong automotive manufacturing and service sectors in these countries.

Europe Automotive Diagnostic Software Industry Market Size (In Billion)

The market's growth trajectory is expected to remain positive throughout the forecast period, although challenges such as high initial investment costs for advanced diagnostic software and the need for skilled technicians to operate these systems might present some restraints. However, the long-term benefits of improved vehicle maintenance, reduced downtime, and enhanced environmental compliance outweigh these challenges. The continuous technological advancements in software capabilities, such as artificial intelligence (AI)-powered diagnostics and augmented reality (AR) integration, will further propel the market's expansion, creating lucrative opportunities for established players and new entrants. The market is expected to witness a considerable increase in the adoption of cloud-based diagnostic systems and increased demand for specialized diagnostic solutions for EVs and hybrid vehicles, thereby significantly affecting the growth of the market in the future.

Europe Automotive Diagnostic Software Industry Company Market Share

Europe Automotive Diagnostic Software Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Automotive Diagnostic Software market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by type (OBD, Electric System Analyzer, Scan Tool) and vehicle type (Passenger Cars, Commercial Vehicles), offering granular insights into this dynamic sector. The report's value is presented in Million Units.

Europe Automotive Diagnostic Software Industry Market Dynamics & Structure

This section analyzes the market's competitive intensity, technological advancements, regulatory landscape, and strategic activities. The European automotive diagnostic software market is characterized by a moderately consolidated structure with key players such as Robert Bosch GmbH, Denso Corporation, and Continental Automotive AG holding significant market share. However, smaller, specialized companies also contribute significantly to innovation. The market is witnessing continuous technological innovation driven by the increasing complexity of vehicles, particularly electric vehicles (EVs). Stringent emission regulations and safety standards imposed by the European Union are shaping the industry's trajectory. The rise of connected cars and the Internet of Things (IoT) further fuels market growth. M&A activity is relatively moderate, with a focus on expanding capabilities and acquiring specialized technologies.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on AI, cloud computing, and data analytics for improved diagnostics and predictive maintenance.

- Regulatory Framework: EU emission standards and safety regulations drive demand for advanced diagnostic software.

- Competitive Substitutes: Limited direct substitutes, but competition exists from providers of other vehicle maintenance and repair services.

- End-User Demographics: Primarily automotive repair shops, dealerships, and fleet management companies.

- M&A Trends: Moderate activity, focused on technology acquisition and expansion into new segments. xx M&A deals were recorded between 2019 and 2024.

Europe Automotive Diagnostic Software Industry Growth Trends & Insights

The European automotive diagnostic software market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing vehicle complexity, the rising adoption of EVs, and the growing demand for efficient vehicle maintenance. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms, are further enhancing the capabilities of diagnostic software. Consumer preferences are shifting towards connected and autonomous vehicles, leading to increased demand for sophisticated diagnostic solutions. Market penetration is currently estimated at xx%, with significant potential for future growth.

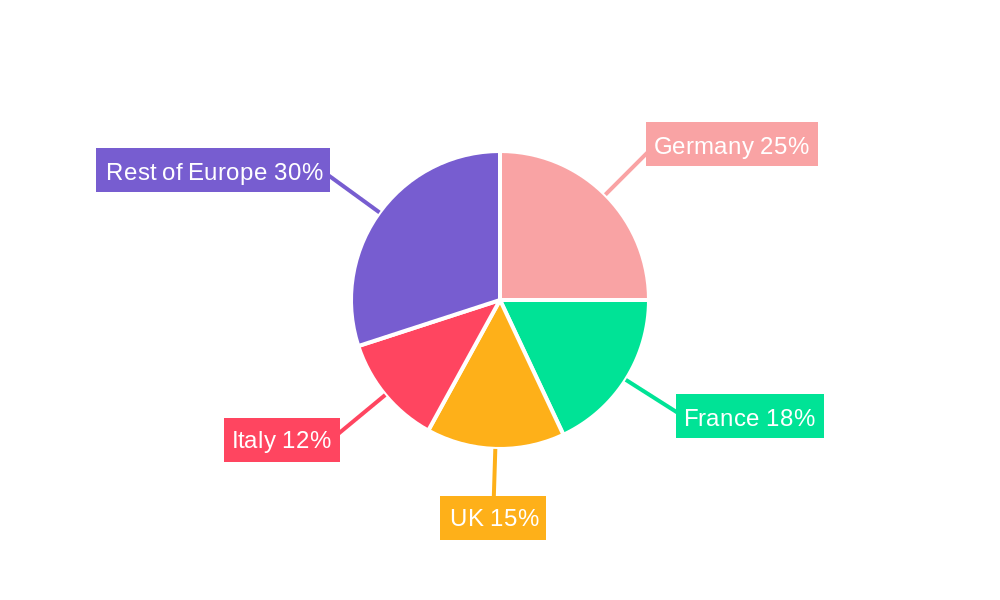

Dominant Regions, Countries, or Segments in Europe Automotive Diagnostic Software Industry

Germany, the UK, and France are currently the leading markets for automotive diagnostic software in Europe. This dominance is attributed to factors such as a large automotive manufacturing base, a well-developed automotive aftermarket, and strong regulatory frameworks. The passenger car segment is currently the largest, driven by the substantial number of vehicles on the road. However, the commercial vehicle segment is expected to experience faster growth due to increasing fleet management requirements and stricter regulations on commercial vehicle maintenance. The OBD segment holds the largest market share due to its widespread adoption and ease of use. The Electric System Analyzer segment is expected to witness significant growth in the coming years due to the increasing adoption of EVs.

- Germany: Strong automotive manufacturing and a highly developed aftermarket.

- UK: Large passenger car market and significant investments in vehicle technology.

- France: Growing adoption of EVs and increasing focus on vehicle maintenance.

- Passenger Cars: Largest segment due to high vehicle ownership.

- Commercial Vehicles: Fastest-growing segment driven by fleet management and regulations.

- OBD: Largest market share due to wide adoption.

- Electric System Analyzer: High growth potential due to EV adoption.

Europe Automotive Diagnostic Software Industry Product Landscape

The automotive diagnostic software market offers a diverse range of products, including OBD (On-Board Diagnostics) scanners, electric system analyzers, and specialized scan tools for various vehicle systems. These tools leverage advanced algorithms and data analysis techniques to provide comprehensive diagnostic information, facilitating efficient vehicle repair and maintenance. The integration of cloud connectivity enables remote diagnostics and data analysis, providing valuable insights for vehicle manufacturers and fleet operators. Recent innovations include AI-powered diagnostic systems that offer predictive maintenance capabilities, minimizing downtime and optimizing vehicle performance. Unique selling propositions frequently center on enhanced user interface design, extensive vehicle coverage, and efficient reporting capabilities.

Key Drivers, Barriers & Challenges in Europe Automotive Diagnostic Software Industry

Key Drivers:

- Increasing complexity of vehicles.

- Growing adoption of EVs and connected cars.

- Stringent emission and safety regulations.

- Demand for efficient vehicle maintenance and repair.

Challenges & Restraints:

- High initial investment costs for advanced diagnostic tools.

- Cybersecurity risks associated with connected diagnostic systems.

- Potential for incompatibility between different diagnostic systems.

- The need for skilled technicians to operate advanced diagnostic software.

Emerging Opportunities in Europe Automotive Diagnostic Software Industry

- Growing demand for telematics and remote diagnostics.

- Increased adoption of AI and machine learning in vehicle diagnostics.

- Expansion into emerging markets for electric vehicles.

- Development of specialized diagnostic solutions for autonomous vehicles.

Growth Accelerators in the Europe Automotive Diagnostic Software Industry Industry

Technological breakthroughs in AI, machine learning, and cloud computing are driving significant growth. Strategic partnerships between diagnostic software providers and vehicle manufacturers are creating integrated solutions. Expansion into the EV market, particularly through partnerships with EV manufacturers and service providers, is further accelerating market expansion. The growing adoption of predictive maintenance technology is also generating significant opportunities.

Key Players Shaping the Europe Automotive Diagnostic Software Market

- Carman International

- Denso Corporation

- Delphi Automotive PLC

- Continental Automotive AG

- Vector Informatik

- Snap-On Inc

- Actia Group

- General Technology Group

- Robert Bosch GmbH

- KPIT Technologies Lt

- Hella KGaA Hueck & Co

- Softing AG

Notable Milestones in Europe Automotive Diagnostic Software Industry Sector

- September 2022: Saietta Group PLC presented its Saietta Electric Drive Diagnostics (SEDD) software at IAA Transportation, showcasing advanced diagnostic and calibration capabilities for electric drives.

- December 2022: Otonomo Technologies Ltd. partnered with Groupe Renault to improve access to vehicle data insights for fleet customers.

- May 2023: MAHLE GmbH and Midtronics Inc. jointly developed service devices for EV Li-ion battery diagnostics and maintenance.

In-Depth Europe Automotive Diagnostic Software Industry Market Outlook

The future of the European automotive diagnostic software market is promising, with sustained growth driven by technological advancements, increasing vehicle complexity, and the widespread adoption of EVs. The continued integration of AI and data analytics will enhance diagnostic capabilities, enabling predictive maintenance and optimized vehicle performance. Strategic collaborations between software providers and automotive manufacturers will create integrated solutions. The expansion into new segments, such as autonomous vehicles and connected car technologies, presents lucrative opportunities for growth and innovation. The market is poised for substantial expansion over the forecast period, presenting significant opportunities for established players and new entrants.

Europe Automotive Diagnostic Software Industry Segmentation

-

1. Offering

- 1.1. Diagnostic Equipment/Hardware

- 1.2. Diagnostic Software

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Workshop Equipment

- 3.1. Exhaust Gas Analyzer

- 3.2. Wheel Alignment Equipment

- 3.3. Paint Scan Equipment

- 3.4. Dynamometer

- 3.5. Headlight Tester

- 3.6. Fuel Injection Diagnostic

- 3.7. Pressure Leak Detection

- 3.8. Engine Analyzer

-

4. End User

- 4.1. Automotive Repair and Maintenance Shops

- 4.2. OEM Dealerships

- 4.3. Fleet Management Companies

- 4.4. Other End Users

Europe Automotive Diagnostic Software Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Netherlands

- 7. Rest of Europe

Europe Automotive Diagnostic Software Industry Regional Market Share

Geographic Coverage of Europe Automotive Diagnostic Software Industry

Europe Automotive Diagnostic Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements In Vehicles Driving Demand; Others

- 3.3. Market Restrains

- 3.3.1. High Scan Tool Costs to Limit Growth; Others

- 3.4. Market Trends

- 3.4.1. Increasing Adoption in Passenger and Commercial Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Diagnostic Equipment/Hardware

- 5.1.2. Diagnostic Software

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 5.3.1. Exhaust Gas Analyzer

- 5.3.2. Wheel Alignment Equipment

- 5.3.3. Paint Scan Equipment

- 5.3.4. Dynamometer

- 5.3.5. Headlight Tester

- 5.3.6. Fuel Injection Diagnostic

- 5.3.7. Pressure Leak Detection

- 5.3.8. Engine Analyzer

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Automotive Repair and Maintenance Shops

- 5.4.2. OEM Dealerships

- 5.4.3. Fleet Management Companies

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Spain

- 5.5.5. Italy

- 5.5.6. Netherlands

- 5.5.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Germany Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Diagnostic Equipment/Hardware

- 6.1.2. Diagnostic Software

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 6.3.1. Exhaust Gas Analyzer

- 6.3.2. Wheel Alignment Equipment

- 6.3.3. Paint Scan Equipment

- 6.3.4. Dynamometer

- 6.3.5. Headlight Tester

- 6.3.6. Fuel Injection Diagnostic

- 6.3.7. Pressure Leak Detection

- 6.3.8. Engine Analyzer

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Automotive Repair and Maintenance Shops

- 6.4.2. OEM Dealerships

- 6.4.3. Fleet Management Companies

- 6.4.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. United Kingdom Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Diagnostic Equipment/Hardware

- 7.1.2. Diagnostic Software

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 7.3.1. Exhaust Gas Analyzer

- 7.3.2. Wheel Alignment Equipment

- 7.3.3. Paint Scan Equipment

- 7.3.4. Dynamometer

- 7.3.5. Headlight Tester

- 7.3.6. Fuel Injection Diagnostic

- 7.3.7. Pressure Leak Detection

- 7.3.8. Engine Analyzer

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Automotive Repair and Maintenance Shops

- 7.4.2. OEM Dealerships

- 7.4.3. Fleet Management Companies

- 7.4.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. France Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Diagnostic Equipment/Hardware

- 8.1.2. Diagnostic Software

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 8.3.1. Exhaust Gas Analyzer

- 8.3.2. Wheel Alignment Equipment

- 8.3.3. Paint Scan Equipment

- 8.3.4. Dynamometer

- 8.3.5. Headlight Tester

- 8.3.6. Fuel Injection Diagnostic

- 8.3.7. Pressure Leak Detection

- 8.3.8. Engine Analyzer

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Automotive Repair and Maintenance Shops

- 8.4.2. OEM Dealerships

- 8.4.3. Fleet Management Companies

- 8.4.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Spain Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Diagnostic Equipment/Hardware

- 9.1.2. Diagnostic Software

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 9.3.1. Exhaust Gas Analyzer

- 9.3.2. Wheel Alignment Equipment

- 9.3.3. Paint Scan Equipment

- 9.3.4. Dynamometer

- 9.3.5. Headlight Tester

- 9.3.6. Fuel Injection Diagnostic

- 9.3.7. Pressure Leak Detection

- 9.3.8. Engine Analyzer

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Automotive Repair and Maintenance Shops

- 9.4.2. OEM Dealerships

- 9.4.3. Fleet Management Companies

- 9.4.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Italy Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Diagnostic Equipment/Hardware

- 10.1.2. Diagnostic Software

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 10.3.1. Exhaust Gas Analyzer

- 10.3.2. Wheel Alignment Equipment

- 10.3.3. Paint Scan Equipment

- 10.3.4. Dynamometer

- 10.3.5. Headlight Tester

- 10.3.6. Fuel Injection Diagnostic

- 10.3.7. Pressure Leak Detection

- 10.3.8. Engine Analyzer

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Automotive Repair and Maintenance Shops

- 10.4.2. OEM Dealerships

- 10.4.3. Fleet Management Companies

- 10.4.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Netherlands Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 11.1.1. Diagnostic Equipment/Hardware

- 11.1.2. Diagnostic Software

- 11.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.2.1. Passenger Cars

- 11.2.2. Commercial Vehicles

- 11.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 11.3.1. Exhaust Gas Analyzer

- 11.3.2. Wheel Alignment Equipment

- 11.3.3. Paint Scan Equipment

- 11.3.4. Dynamometer

- 11.3.5. Headlight Tester

- 11.3.6. Fuel Injection Diagnostic

- 11.3.7. Pressure Leak Detection

- 11.3.8. Engine Analyzer

- 11.4. Market Analysis, Insights and Forecast - by End User

- 11.4.1. Automotive Repair and Maintenance Shops

- 11.4.2. OEM Dealerships

- 11.4.3. Fleet Management Companies

- 11.4.4. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 12. Rest of Europe Europe Automotive Diagnostic Software Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 12.1.1. Diagnostic Equipment/Hardware

- 12.1.2. Diagnostic Software

- 12.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 12.2.1. Passenger Cars

- 12.2.2. Commercial Vehicles

- 12.3. Market Analysis, Insights and Forecast - by Workshop Equipment

- 12.3.1. Exhaust Gas Analyzer

- 12.3.2. Wheel Alignment Equipment

- 12.3.3. Paint Scan Equipment

- 12.3.4. Dynamometer

- 12.3.5. Headlight Tester

- 12.3.6. Fuel Injection Diagnostic

- 12.3.7. Pressure Leak Detection

- 12.3.8. Engine Analyzer

- 12.4. Market Analysis, Insights and Forecast - by End User

- 12.4.1. Automotive Repair and Maintenance Shops

- 12.4.2. OEM Dealerships

- 12.4.3. Fleet Management Companies

- 12.4.4. Other End Users

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Carman International

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Delphi Automotive PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Continental Automotive AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Vector Informatik

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Snap-On Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Actia Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 General Technology Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Robert Bosch GmbH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 KPIT Technologies Lt

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Hella KGaA Hueck & Co

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Softing AG

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Carman International

List of Figures

- Figure 1: Europe Automotive Diagnostic Software Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Diagnostic Software Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 4: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 9: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 12: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 14: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 17: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 19: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 22: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 24: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 27: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 29: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 32: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 34: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 37: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Workshop Equipment 2020 & 2033

- Table 39: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Europe Automotive Diagnostic Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Diagnostic Software Industry?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Europe Automotive Diagnostic Software Industry?

Key companies in the market include Carman International, Denso Corporation, Delphi Automotive PLC, Continental Automotive AG, Vector Informatik, Snap-On Inc, Actia Group, General Technology Group, Robert Bosch GmbH, KPIT Technologies Lt, Hella KGaA Hueck & Co, Softing AG.

3. What are the main segments of the Europe Automotive Diagnostic Software Industry?

The market segments include Offering, Vehicle Type, Workshop Equipment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements In Vehicles Driving Demand; Others.

6. What are the notable trends driving market growth?

Increasing Adoption in Passenger and Commercial Vehicles.

7. Are there any restraints impacting market growth?

High Scan Tool Costs to Limit Growth; Others.

8. Can you provide examples of recent developments in the market?

May 2023: MAHLE GmbH and Midtronics Inc. jointly developed service devices for EVs from all manufacturers. The partnership aimed to offer safe, simple, and effective service for Li-ion battery diagnostics and maintenance, regardless of brand, over the entire life cycle of the batteries and vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Diagnostic Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Diagnostic Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Diagnostic Software Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Diagnostic Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence