Key Insights

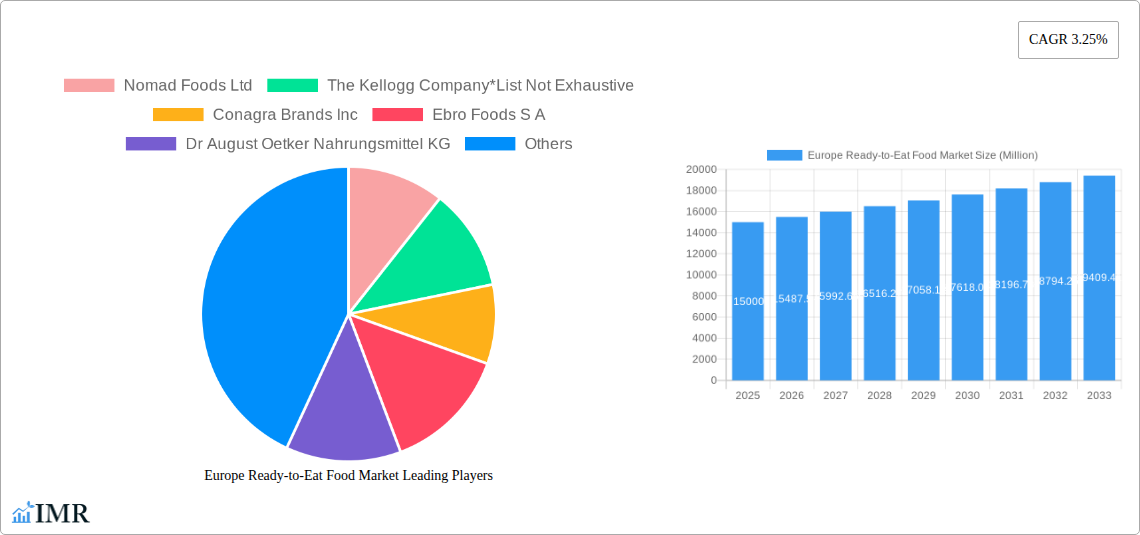

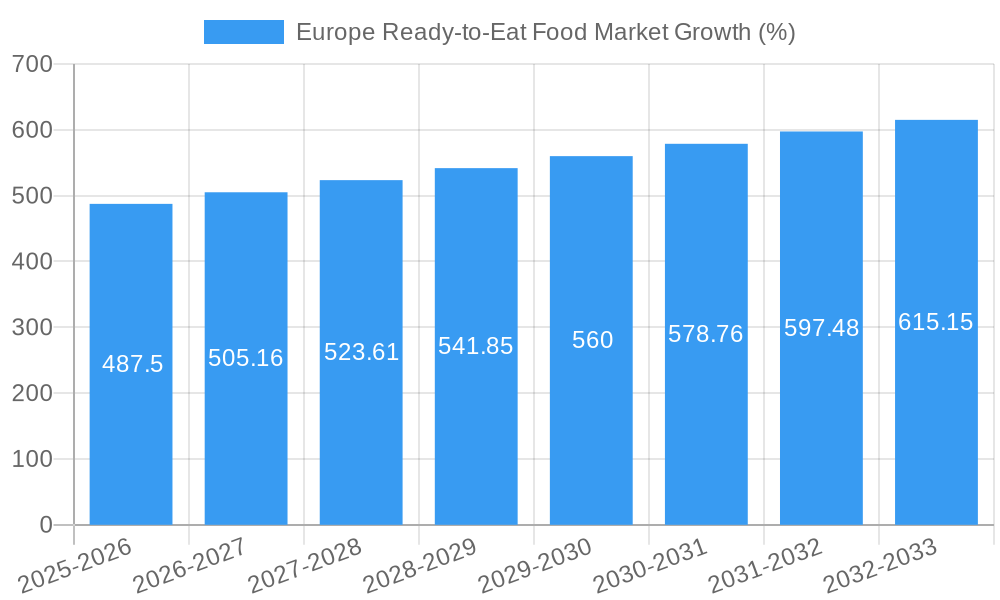

The European ready-to-eat (RTE) food market, valued at approximately €XX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.25% from 2025 to 2033. This growth is fueled by several key drivers. The increasing prevalence of busy lifestyles and the rising demand for convenient, time-saving meal options are significantly impacting consumer choices. Furthermore, the growing popularity of health-conscious food options, such as those with reduced sodium or added protein, is shaping product development and market segmentation. The market's segmentation, encompassing instant breakfast cereals, instant soups, frozen snacks, meat snacks, ready meals, and instant noodles, reflects this diverse consumer demand. Distribution channels are equally diversified, with hypermarkets/supermarkets maintaining a dominant share, complemented by the expanding presence of convenience stores and online retail platforms. Major players like Nestlé, Kellogg's, and Nomad Foods are strategically positioned to capitalize on this expanding market, investing in innovation and brand expansion to maintain competitiveness. However, challenges remain, including fluctuating raw material costs and increasing consumer awareness of processed food's impact on health, potentially influencing future growth trajectories.

The competitive landscape is marked by a mix of established multinational corporations and regional players. Intense competition necessitates continuous innovation, focusing on product diversification and appealing to evolving consumer preferences. While the European market is fragmented, with significant variations in consumption patterns across countries like Germany, France, the UK, and Italy, the overall market outlook remains positive. The projected growth trajectory hinges on sustained economic growth, evolving consumer preferences, and the ability of market players to successfully adapt to shifts in dietary habits and technological advancements within the food production and distribution sectors. The integration of sustainable practices and the increasing prominence of plant-based alternatives are also set to influence market dynamics over the forecast period.

Europe Ready-to-Eat Food Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Ready-to-Eat Food market, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is segmented by type (Instant Breakfast/Cereals, Instant Soups, Frozen snacks, Meat snacks, Ready Meals, Instant noodles) and distribution channel (Hypermarkets/Supermarkets, Convenience Stores/Grocery stores, Online Retail Stores, Other Distribution Channels). Key players analyzed include Nomad Foods Ltd, The Kellogg Company, Conagra Brands Inc, Ebro Foods S A, Dr August Oetker Nahrungsmittel KG, Frosta Aktiengesellschaft (FRoSTA AG), The Kraft Heinz Company, McCain Foods Limited, Premier Foods Group Limited, and Nestlé S A.

Europe Ready-to-Eat Food Market Dynamics & Structure

The European ready-to-eat food market is characterized by a moderately concentrated landscape, with a few large multinational corporations holding significant market share. However, the market also features numerous smaller players and regional brands, particularly within specific product categories. Technological innovation plays a crucial role, driving the development of healthier, more convenient, and sustainable products. Stringent food safety regulations and labeling requirements across the European Union shape the competitive landscape. The market faces competition from fresh food and home-cooked meals, but consumer demand for convenience and time-saving solutions remains a key driver. Mergers and acquisitions (M&A) activity has been notable, with larger companies strategically acquiring smaller, innovative brands to expand their product portfolios and enhance their market reach. The market witnessed xx M&A deals between 2019 and 2024, resulting in a xx% increase in market concentration.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share.

- Technological Innovation: Focus on healthier ingredients, extended shelf life, sustainable packaging, and innovative preparation methods.

- Regulatory Framework: Stringent EU food safety and labeling regulations influence product development and marketing.

- Competitive Substitutes: Fresh food, home-cooked meals, and other convenient food options.

- End-User Demographics: Increasing demand from busy professionals, single-person households, and aging populations.

- M&A Trends: Strategic acquisitions driving consolidation and expansion within the market.

Europe Ready-to-Eat Food Market Growth Trends & Insights

The Europe ready-to-eat food market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by several factors including increasing urbanization, changing lifestyles, rising disposable incomes, and a growing preference for convenience. Technological advancements, particularly in food processing and packaging, have played a significant role in enhancing the quality, shelf life, and appeal of ready-to-eat foods. Consumer behaviour shifts towards healthier options and sustainable packaging are influencing product innovation and market trends. The market penetration of ready-to-eat foods in the European Union reached xx% in 2024, with further expansion expected in the forecast period (2025-2033). The projected CAGR for the forecast period is xx%, indicating continued growth in market size. Specific consumer segments, such as millennials and Gen Z, exhibit high adoption rates.

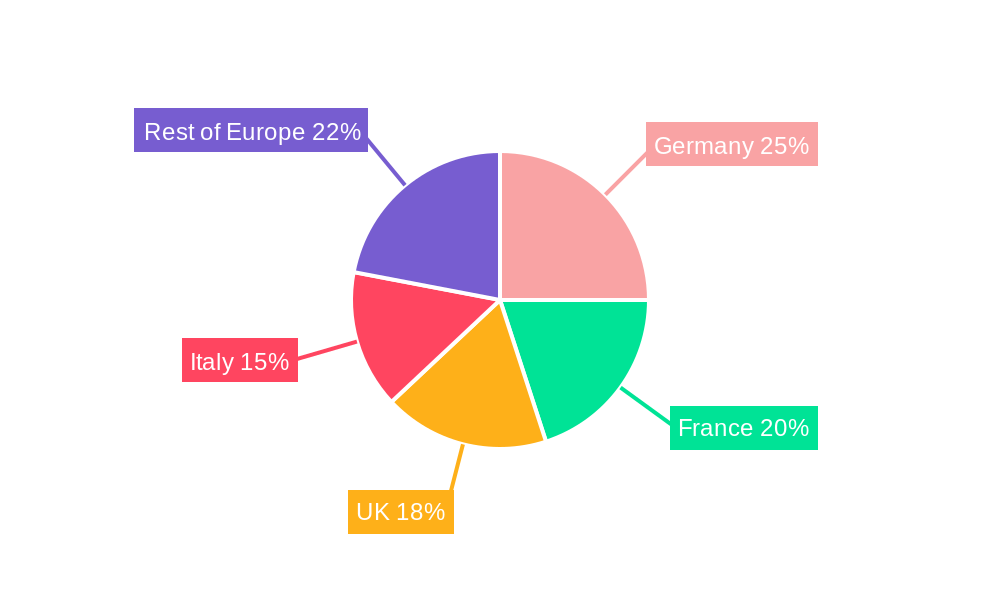

Dominant Regions, Countries, or Segments in Europe Ready-to-Eat Food Market

Western European countries, particularly Germany, the UK, and France, dominate the ready-to-eat food market in Europe, accounting for approximately xx% of the total market value in 2024. This dominance stems from high disposable incomes, strong retail infrastructure, and established consumer preferences for convenience foods. The ready meals segment is the largest product category, followed by frozen snacks and instant noodles. Within distribution channels, hypermarkets/supermarkets continue to be the primary sales channel, although online retail stores show substantial growth potential.

- Key Drivers:

- High disposable incomes in Western Europe.

- Well-developed retail infrastructure.

- Established consumer preference for convenience.

- Growth of online retail channels.

- Dominance Factors:

- Strong consumer demand.

- Established distribution networks.

- High per capita consumption.

Europe Ready-to-Eat Food Market Product Landscape

The ready-to-eat food market showcases a wide range of product innovations, focusing on enhanced convenience, healthier ingredients, and sustainable packaging. New product launches continuously incorporate more natural ingredients, reduced sodium, and organic certifications to cater to consumer health concerns. Technological advancements have resulted in improved preservation techniques and extended shelf life. Many products now feature unique selling propositions such as meal kits, portion-controlled packaging, and customized flavor profiles.

Key Drivers, Barriers & Challenges in Europe Ready-to-Eat Food Market

Key Drivers: The market is propelled by increasing urbanization, busy lifestyles, and the rising demand for convenient and time-saving meal solutions. Technological advancements in food processing and packaging also contribute to the market's growth, enhancing product quality and shelf life. Government initiatives promoting healthy eating and food safety further influence the market landscape.

Key Challenges: Supply chain disruptions, particularly regarding raw material availability and logistics, pose a significant challenge. Fluctuations in raw material prices impact production costs and profitability. Stringent food safety regulations and labeling requirements add to the complexity of product development and marketing. Intense competition from both established players and new entrants creates pressure on pricing and innovation.

Emerging Opportunities in Europe Ready-to-Eat Food Market

Untapped opportunities exist in expanding into Eastern European markets with rising disposable incomes and growing demand for convenience foods. Health-conscious consumers are driving demand for organic, plant-based, and gluten-free ready-to-eat options. Personalized nutrition and meal customization are emerging trends.

Growth Accelerators in the Europe Ready-to-Eat Food Market Industry

Long-term growth in the European ready-to-eat food market will be accelerated by technological breakthroughs in food processing and packaging, strategic partnerships between food companies and technology providers, and expansion into new and emerging markets. A greater focus on sustainable and ethical sourcing of ingredients will also play a pivotal role.

Key Players Shaping the Europe Ready-to-Eat Food Market Market

- Nomad Foods Ltd

- The Kellogg Company

- Conagra Brands Inc

- Ebro Foods S A

- Dr August Oetker Nahrungsmittel KG

- Frosta Aktiengesellschaft (FRoSTA AG)

- The Kraft Heinz Company

- McCain Foods Limited

- Premier Foods Group Limited

- Nestlé S A

Notable Milestones in Europe Ready-to-Eat Food Market Sector

- July 2021: Riviana Foods Inc., a subsidiary of Ebro Foods, launched Success Garden & Grains Blends, a new boil-in-bag rice product.

- February 2022: Nestlé SA acquired a majority stake in Orgain, expanding its organic plant-based product portfolio.

- April 2022: Nomad Foods launched an open innovation platform to foster collaborations for new product development.

In-Depth Europe Ready-to-Eat Food Market Market Outlook

The future of the European ready-to-eat food market is promising, driven by continued urbanization, evolving consumer preferences, and ongoing technological innovation. Strategic partnerships and mergers and acquisitions will reshape the market landscape. Expanding into underserved markets and focusing on sustainability and health will be key to long-term success. The market is poised for significant growth, offering considerable opportunities for both established players and new entrants.

Europe Ready-to-Eat Food Market Segmentation

-

1. Type

- 1.1. Instant Breakfast/Cereals

- 1.2. Instant Soups

- 1.3. Frozen snacks

- 1.4. Meat snacks

- 1.5. Ready Meals

- 1.6. Instant noodles

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores/Grocery stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Europe Ready-to-Eat Food Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Ready-to-Eat Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The numerous benefits offered by collagen in the food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Increasing vegan population in the region

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Pre-cooked Meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instant Breakfast/Cereals

- 5.1.2. Instant Soups

- 5.1.3. Frozen snacks

- 5.1.4. Meat snacks

- 5.1.5. Ready Meals

- 5.1.6. Instant noodles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores/Grocery stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instant Breakfast/Cereals

- 6.1.2. Instant Soups

- 6.1.3. Frozen snacks

- 6.1.4. Meat snacks

- 6.1.5. Ready Meals

- 6.1.6. Instant noodles

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores/Grocery stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instant Breakfast/Cereals

- 7.1.2. Instant Soups

- 7.1.3. Frozen snacks

- 7.1.4. Meat snacks

- 7.1.5. Ready Meals

- 7.1.6. Instant noodles

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores/Grocery stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instant Breakfast/Cereals

- 8.1.2. Instant Soups

- 8.1.3. Frozen snacks

- 8.1.4. Meat snacks

- 8.1.5. Ready Meals

- 8.1.6. Instant noodles

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores/Grocery stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Instant Breakfast/Cereals

- 9.1.2. Instant Soups

- 9.1.3. Frozen snacks

- 9.1.4. Meat snacks

- 9.1.5. Ready Meals

- 9.1.6. Instant noodles

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores/Grocery stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Instant Breakfast/Cereals

- 10.1.2. Instant Soups

- 10.1.3. Frozen snacks

- 10.1.4. Meat snacks

- 10.1.5. Ready Meals

- 10.1.6. Instant noodles

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores/Grocery stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Instant Breakfast/Cereals

- 11.1.2. Instant Soups

- 11.1.3. Frozen snacks

- 11.1.4. Meat snacks

- 11.1.5. Ready Meals

- 11.1.6. Instant noodles

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Hypermarkets/Supermarkets

- 11.2.2. Convenience Stores/Grocery stores

- 11.2.3. Online Retail Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Instant Breakfast/Cereals

- 12.1.2. Instant Soups

- 12.1.3. Frozen snacks

- 12.1.4. Meat snacks

- 12.1.5. Ready Meals

- 12.1.6. Instant noodles

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Hypermarkets/Supermarkets

- 12.2.2. Convenience Stores/Grocery stores

- 12.2.3. Online Retail Stores

- 12.2.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Ready-to-Eat Food Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Nomad Foods Ltd

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 The Kellogg Company*List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Conagra Brands Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Ebro Foods S A

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Dr August Oetker Nahrungsmittel KG

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Frosta Aktiengesellschaft (FRoSTA AG)

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 The Kraft Heinz Company

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 McCain Foods Limited

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Premier Foods Group Limited

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Nestlé S A

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Nomad Foods Ltd

List of Figures

- Figure 1: Europe Ready-to-Eat Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Ready-to-Eat Food Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Ready-to-Eat Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Ready-to-Eat Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ready-to-Eat Food Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Europe Ready-to-Eat Food Market?

Key companies in the market include Nomad Foods Ltd, The Kellogg Company*List Not Exhaustive, Conagra Brands Inc, Ebro Foods S A, Dr August Oetker Nahrungsmittel KG, Frosta Aktiengesellschaft (FRoSTA AG), The Kraft Heinz Company, McCain Foods Limited, Premier Foods Group Limited, Nestlé S A.

3. What are the main segments of the Europe Ready-to-Eat Food Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The numerous benefits offered by collagen in the food and beverage industry.

6. What are the notable trends driving market growth?

Increasing Demand for Pre-cooked Meals.

7. Are there any restraints impacting market growth?

Increasing vegan population in the region.

8. Can you provide examples of recent developments in the market?

April 2022: A platform for open innovation was launched by Nomad Foods in partnership with the international innovation network Innoget. It will be accessible to academics, subject matter experts, start-ups, and SMEs looking to form new collaborations from the ideation phase to product development and the eventual launch of new products in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ready-to-Eat Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ready-to-Eat Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ready-to-Eat Food Market?

To stay informed about further developments, trends, and reports in the Europe Ready-to-Eat Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence